Table of Contents

Introduction

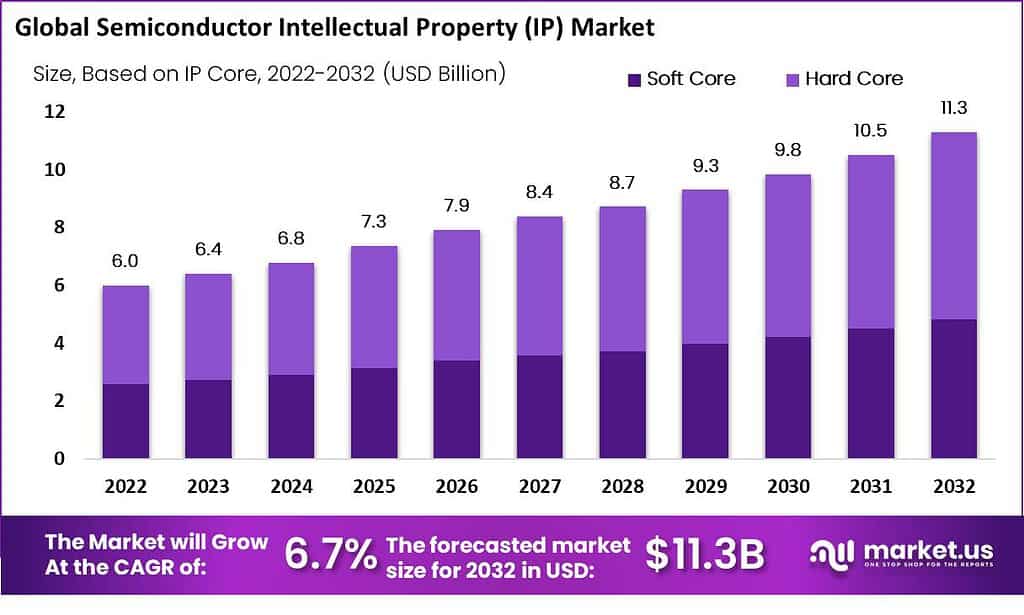

The Semiconductor Intellectual Property (IP) Market, which was valued at USD 6.4 billion in 2023, is expected to experience significant growth in the coming years. The market is projected to rise to USD 11.3 billion by 2032, at a compound annual growth rate (CAGR) of 6.7% during the forecast period. This growth can be attributed to various factors, including increasing demand for advanced semiconductor components in sectors such as telecommunications, data centers, and automotive, as well as the continuous development and integration of embedded digital signal processor IPs.

Recent advancements and collaborations in the market highlight the dynamic nature of the sector and the strategic moves by key players to address emerging needs and opportunities. For example, VeriSilicon’s adoption of a dual-channel Image Signal Processor IP by Inuitive for its vision AI processor in September 2023, eMemory Technology’s collaboration with United Microelectronics Corporation on Resistive Random Access Memory IPs in March 2023, and Rambus’s announcement in the same month about offering IP cores like Arm CryptoCell and CryptoIsland Root of Trust cores, demonstrate the industry’s focus on enhancing product offerings and expanding their reach across various domains.

The semiconductor IP market is witnessing notable growth in several segments, especially in the soft core segment, driven by the rising investments and development in technologies such as 5G, AI, and cloud-based solutions. Royalties from bulk purchases by electronics device manufacturers are expected to dominate the revenue sources due to the substantial procurement activities by leading electronics manufacturers. This segment’s growth is further fueled by the licensing segment’s anticipated high CAGR over the forecast period, reflecting the rising adoption of licensed semiconductor IP products.

Key Takeaways

- The Semiconductor IP Market was valued at USD 6.4 Billion in 2023.

- It’s estimated to grow at a CAGR of 6.7% from 2023 to 2032.

- By 2032, the market is projected to reach USD 11.3 Billion in size.

- Consumer electronics represent the industry with the highest market share and are projected to experience a compound annual growth rate of 7.2%.

- The automotive segment is predicted to have the highest CAGR of 7.4% during the forecast period due to the increasing adoption of electric vehicles.

- Asia Pacific dominates the market with about 34.6% market share and is expected to have a CAGR of 6.97% during the forecast period.

- Major players in the Semiconductor IP Market include Arm Holdings Ltd., Fujitsu Limited, Synopsys Inc., and Cadence Design Systems, Inc.

Semiconductor IP Statistics

- Arm Holdings Ltd. emerged as the frontrunner in the Semiconductor IP market, commanding an impressive 41% market share, consolidating its position as a key player.

- Soft Semiconductor Intellectual Property (SIP) is typically delivered in high-level languages like RTL, C++, Verilog, or VHDL, providing users with flexibility and adaptability.

- Connectivity SIP adheres to specific standards like USB, PCI, IEEE1394 (known as “Firewire”), IrDA, Bluetooth, or 802.11, catering to diverse connectivity needs.

- The semiconductor industry witnessed remarkable growth between 1996 and 2019, with total trade surging by 463% to reach a staggering $1.655 trillion.

- Cell phone subscriptions per 100 people experienced an exponential rise, increasing by 3,371% from 2 to 104.9.

- Internet users per 100 people displayed an even more impressive growth, soaring by 4,076% from 1.19 to 49.7.

- Transistor production witnessed an astonishing leap, growing by 900,343,543% from 29.1 quadrillion to 262 sextillion.

- The average number of transistors per semiconductor surged by an extraordinary 2,077,661% from 135,237 to 2,809,901,908.

- PC processor speeds experienced notable advancements, with single-core speeds increasing from 133 MHz to 2,300 MHz, and quad-core speeds demonstrating a remarkable 1,629% increase.

- IC wafer capacity expanded significantly by 344% from 51.9 million to 230.5 million, reflecting the industry’s capacity expansion.

- R&D spending in the semiconductor industry surged by 311% from $15.7 billion to $64.5 billion, indicating increased investment in innovation.

- Process technology node reduced drastically by -98% from 350 nanometers to 7 nanometers, reflecting advancements in semiconductor manufacturing.

- The semiconductor content per electronic system increased by 40% from 18.8% to 26.3%, indicating a growing reliance on semiconductor components.

Use Cases

- Automotive Applications: Processor IP is crucial in addressing the computational needs of vehicles for Advanced Driver-Assistance Systems (ADAS) and autonomous driving. The integration of AI for radar and sensor fusion applications is becoming prevalent, requiring high-performance processing for handling camera, radar, lidar, and sensor data.

- Aerospace and Defense: Semiconductor IPs find applications in aerospace and defense for navigation, communication, and surveillance systems, enhancing capabilities and security.

- Consumer Electronics: In the realm of consumer electronics, semiconductor IPs are utilized in the development of smartphones, PCs, and smart home devices, among others. The demand in this sector is significant, driving advancements in memory and processing technologies.

- Industrial and Medical: For industrial applications, semiconductor IP contributes to the automation and efficiency of manufacturing processes. In medical technology, it supports the development of diagnostic equipment, wearable health monitors, and other healthcare innovations.

- Data Centers and Cloud Computing: With the growth of cloud services and data centers, custom chips and generative AI accelerator chips are becoming increasingly important. Semiconductor IP plays a vital role in enhancing the performance and efficiency of data centers, addressing bandwidth and security challenges.

- Entertainment and Retail: IP is used in multimedia applications, including gaming, virtual reality, and retail analytics, providing enhanced graphics, user interface, and customer experience.

- Security: Semiconductor IP is critical for ensuring the security of devices and data, especially with the advent of quantum computing. Quantum Safe Cryptography IPs are being developed to protect against the potential future threat of quantum computers breaking current encryption methods.

- Robotics and AI: In robotics, semiconductor IP contributes to the functionality of robots in manufacturing, healthcare, and service industries. AI-powered cybersecurity IPs enhance protection against intrusions and cyber threats.

Recent Developments

- Arm Publicly Files for IPO: After years of speculation and a dropped acquisition by Nvidia, Arm has registered for an initial public offering. This move aims to solidify its position in the market and attract further investment.

- Intel Cancels Acquisition of Tower Semiconductor: Intel planned to acquire Tower Semiconductor to expand its manufacturing capabilities but ultimately canceled the deal. The termination was mutual, attributed to regulatory hurdles.

- Macom Acquires Wolfspeed’s RF Business: In a strategic expansion, Macom bought Wolfspeed’s RF portfolio for $125 million. This acquisition aims to bolster Macom’s GaN foundry services and semiconductor design.

- Synopsys, Inc. Partnership with WhiteHat Security: Synopsys entered a partnership with WhiteHat Security, enhancing its SaaS capabilities and dynamic application security testing technology. This collaboration is expected to advance the market’s growth for Semiconductor IP.

- AMD’s Acquisition of Xilinx: AMD expanded its product lineup in graphics and adaptive SoC products through the acquisition of Xilinx, marking a significant move towards becoming a leader in high-performance and adaptive computing.

- Notable Mergers and Acquisitions in 2022: The year witnessed several key M&As, including Allegro MicroSystems acquiring Heyday Integrated Circuits, Diodes Incorporated purchasing onsemi’s South Portland facility, and Navitas Semiconductor’s acquisition of GeneSiC, among others. These deals underline the strategic consolidations aimed at expanding product lines and market presence.

- CVS Health Co. Acquisition of Signify Health Inc.: CVS Health acquired Signify Health for $8 billion, indicating the growing interest in healthcare and value-based care, showing the expanding applications of semiconductor technologies in diverse sectors.

- Leap Therapeutics Acquisition of Flame Biosciences: Valued at $86 million, this acquisition underscores the biotechnology sector’s ongoing consolidation and the crucial role of semiconductor technologies in medical research and treatments.

Key Players Analysis

Arm Holdings Ltd.

Arm Holdings Ltd., originally named Advanced RISC Machines and later ARM, has become a cornerstone of the semiconductor intellectual property (IP) sector. Founded in 1990 as a joint venture between Acorn Computers, Apple Inc., and VLSI Technology, Arm has evolved from its roots in developing RISC processors for the Acorn Archimedes to a global leader in IP licensing. The company’s IP is central to a wide array of computing devices, from smartphones and tablets to digital TVs and embedded systems. Its technology is foundational for the processors used in virtually all smartphones today.

The company’s approach to IP licensing allows for significant customization by its partners, catering to specific performance, power, and cost requirements across all classes of computing devices. This business model has positioned Arm as a key player in the semiconductor industry, with its designs being fundamental to the development of energy-efficient, high-performance computing solutions.

Arm’s significance in the semiconductor IP market is underscored by its extensive range of processor IP, including the Cortex-A, Cortex-M, Cortex-R, Neoverse, Ethos, and SecurCore families. These offerings cater to a broad spectrum of applications, from mobile devices to infrastructure and IoT. In addition to processor IP, Arm provides a suite of development tools that accelerate product development, showcasing its comprehensive support for the semiconductor industry.

Fujitsu Limited

Fujitsu Limited, through its subsidiary Fujitsu Semiconductor Limited, plays a significant role in the semiconductor IP sector, with a particular emphasis on manufacturing and developing high-quality, high-performance LSI memory products. These efforts cater to the demands for miniaturization, improved performance, and lower power consumption in digital applications. Fujitsu’s innovations in this space are particularly notable in their work with Gallium Nitride (GaN) on Silicon chips, indicating a strong push towards advanced power devices that offer significant advantages in terms of efficiency and performance.

The company’s focus on semiconductor memory solutions is evident in its offering of non-volatile memory products like Ferroelectric RAM (FeRAM) and Resistive RAM (ReRAM), which are crucial for digital applications requiring enhanced performance and reliability. Fujitsu Semiconductor Memory Solution is dedicated to delivering these high-quality LSI memory products, leveraging years of manufacturing and development experience to meet the evolving needs of the industry.

A pivotal moment for Fujitsu Semiconductor came when Universal Microelectronics (UMC) acquired 100% ownership of Mie Fujitsu Semiconductor Limited (MIFS), a move that emphasized Fujitsu’s strengths in ultra-low power consumption process technology, non-volatile memory technology for embedded applications, and RF and mmWave technology. This acquisition was aimed at enhancing MIFS’s competitiveness and growth by leveraging UMC’s resources, including its expertise, cost competitiveness, and global business expansion capabilities.

Synopsys Inc.

Synopsys Inc. is a leading provider of semiconductor IP solutions for System on Chip (SoC) designs. They offer a wide range of high-quality, silicon-proven IP including logic libraries, embedded memories, analog IP, interface IP, security IP, and embedded processors. Synopsys focuses on accelerating IP integration and silicon bring-up through their IP Accelerated initiative, offering architecture design expertise, hardening, and signal/power integrity analysis. This commitment to IP quality and comprehensive support helps designers reduce integration risk and speed up time-to-market.

Cadence Design Systems Inc.

Cadence Design Systems Inc. is a major player in the semiconductor IP and electronic design automation (EDA) sectors. With a focus on computational software expertise for over 30 years, Cadence develops software, hardware, and IP that are pivotal in transforming design concepts into reality. The company’s customers include some of the world’s most innovative companies, highlighting its significance in the sector.

Cadence has made significant contributions to the semiconductor industry, particularly in areas such as artificial intelligence (AI), cloud computing, 3D technology, and AI-enabled big data analytics. Its products cater to a wide range of market applications including hyperscale computing, 5G communications, automotive, mobile, aerospace, consumer, industrial, and healthcare. This broad application spectrum underscores Cadence’s role in pushing the envelope in semiconductor design and system verification.

In 2021, Cadence had an annual revenue of $3 billion, with a workforce of 9,300 employees, emphasizing its scale and impact in the industry. Notably, around 40% of its revenue by 2022 came from systems-oriented customers, showcasing a shift towards designing customized chips for specific industry applications. This approach is increasingly relevant due to global chip shortages and shipping challenges. High-profile clients like Tesla and Apple Inc. are testament to Cadence’s importance in the semiconductor ecosystem.

The company’s product offerings include the Virtuoso Platform for designing full-custom integrated circuits, the Spectre X parallel circuit simulator, and AWR for designing 5G/wireless products. These tools are essential for the creation of advanced semiconductor devices. Additionally, Cadence’s digital implementation and signoff tools, system verification products, and formal verification tools play a critical role in ensuring the reliability and efficiency of semiconductor designs.

Cadence’s strategic acquisitions, such as OpenEye Scientific Software in September 2022 for $500 million, further demonstrate its commitment to expanding its technological capabilities and market reach.

Conclusion

The Semiconductor IP market is poised for substantial growth, driven by technological advancements, strategic corporate actions, and a strong focus on meeting the burgeoning demand for advanced semiconductor components across multiple sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)