Table of Contents

Introduction

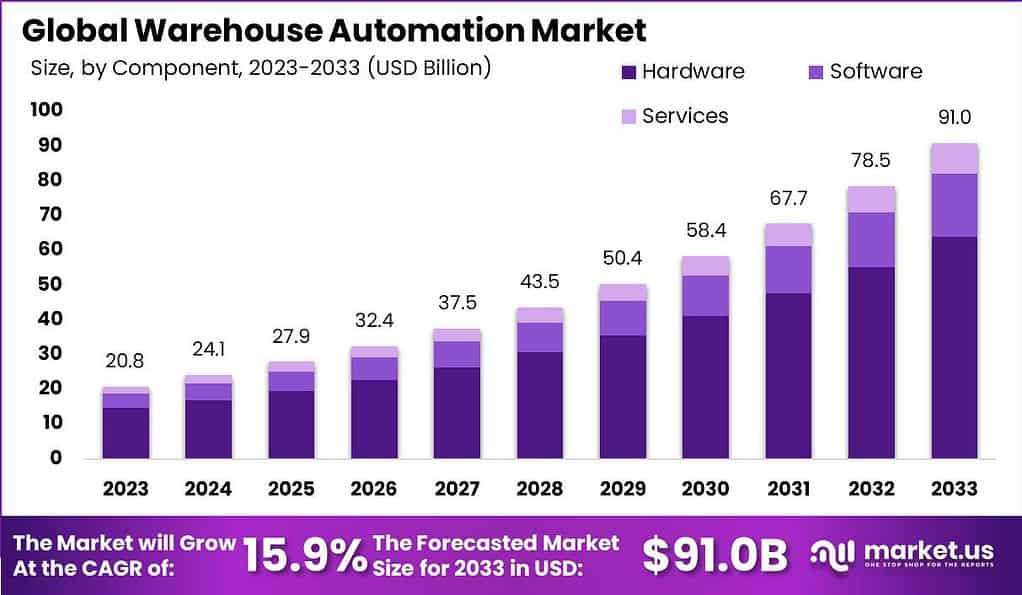

The global Warehouse Automation Market is projected to witness substantial growth, with an estimated value reaching USD 91.0 billion by 2033. This significant expansion reflects a robust Compound Annual Growth Rate (CAGR) of 15.9% from 2024 to 2033. Warehouse automation involves deploying advanced technologies like robotics, artificial intelligence, and machine learning to streamline various processes within warehouses. These technologies aim to enhance efficiency, accuracy, and productivity in tasks such as inventory management, order fulfillment, and logistics operations.

One of the primary drivers behind the growth of the warehouse automation market is the exponential expansion of the e-commerce industry. With the increasing preference for online shopping, businesses face mounting pressure to fulfill orders rapidly and accurately. To meet these demands, warehouse automation solutions, including Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS), and robotic picking systems, are essential. These technologies enable companies to optimize their operational efficiency, reduce order processing times, and improve customer satisfaction in a fiercely competitive market landscape.

Despite the evident benefits, high capital investment poses a significant challenge to the widespread adoption of warehouse automation. Establishing automated warehouses requires substantial financial resources to procure advanced machinery, software systems, and integrate these technologies into existing operations. Particularly, small and medium-sized enterprises (SMEs) may find it challenging to allocate the necessary funds for large-scale automation projects. Additionally, the complexity involved in designing and implementing these systems further escalates initial investments, deterring some companies from embracing automation despite its potential long-term advantages.

To learn more about this report – request a sample report PDF

Key Takeaways

- The warehouse automation market is anticipated to grow substantially, reaching USD 91.0 billion by 2033, with a strong Compound Annual Growth Rate (CAGR) of 15.9% throughout the forecast period.

- In 2023, the Hardware segment dominated the Warehouse Automation Market, holding over 70.4% of the market share.

- Similarly, the Retail & E-commerce segment held a prominent position, capturing more than 33.5% of the market share.

- North America led the warehouse automation sector in 2023, with a market share exceeding 36.7%. This leadership is attributed to factors such as the presence of major e-commerce players and significant investments in automation technologies.

Warehouse Automation Statistics

- 15% reduction in inventory costs has been achieved in 2023 due to the implementation of AI-driven warehouse management systems.

- 87% of industry decision-makers are either expanding or planning to expand their warehouse facilities by 2024.

- 80% of warehouse activities are currently outsourced, with 20% remaining in-house as companies grow geographically.

- 70% of supply chain professionals view automation as beneficial for warehouse operations as of 2024.

- 79% of high-performing supply chain companies report revenue growth above their industry average.

- Up to 12% of companies find their distribution costs not effective.

- The total number of warehouses is expected to see significant growth, estimated to reach approximately 7.91 billion by 2025.

- A growth of 15% to 20% in cross-border e-commerce is anticipated, which will increase demand for modern warehouses and automated systems.

- 89% of organizations are expected to use modernized Warehouse Management Systems for labor planning and management by 2024.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights

Emerging Trends

- Increased Use of Robots and Automation: The adoption of mobile robots and drones is escalating. These robots handle tasks such as material handling, order picking, and inventory management with increasing efficiency.

- Integration of IoT Technology: IoT devices are becoming essential for real-time tracking and monitoring of inventory and equipment performance, enhancing the synchronization of warehouse operations.

- Predictive Analytics: Using predictive analytics for demand forecasting and inventory management is growing. This trend involves analyzing data to proactively manage market demands.

- Collaborative Robots (Cobots): Cobots are increasingly used in warehouses to assist humans with repetitive tasks, improving both productivity and workplace safety.

- Cloud-based Warehouse Management Systems (WMS): Warehouses are moving towards cloud-based management systems that offer scalability, flexibility, and reduced operational costs.

Top 5 Use Cases

- Improved Inventory Management: Automated systems enhance inventory visibility and control, reducing errors and optimizing stock levels.

- Efficient Order Fulfillment: Automation improves the speed and accuracy of the order fulfillment process, from picking and sorting to packing.

- Enhanced Safety: Automation minimizes human involvement in risky tasks, significantly reducing workplace accidents.

- Cost Reduction: Automation allows warehouses to operate with fewer workers and less space, leading to substantial cost savings.

- Scalability and Flexibility: Automation enables warehouses to adjust operations based on demand without heavy investments in infrastructure or manpower.

Major Challenges

- High Initial Costs: Significant upfront investments are required for automation technology, including the cost of equipment and system integration.

- Infrastructure Compatibility: Adapting existing warehouse infrastructure to accommodate new automated technologies can require extensive modifications.

- Workforce Displacement: Automation can lead to job displacement, necessitating a shift in workforce skills to manage and maintain new systems.

- Complex Technology Integration: Integrating various automated systems to communicate seamlessly presents considerable technical challenges.

- Ongoing Maintenance Needs: Automated systems need regular maintenance and technical support, adding to the complexity and operational costs.

Market Opportunity

- Growing E-commerce Industry: The booming e-commerce sector is driving the need for efficient warehouse operations. As online shopping continues to gain popularity, businesses are looking for warehouse automation solutions to meet the increasing demand for fast and accurate order fulfillment.

- Labor Shortages and Rising Labor Costs: The availability of skilled labor in the warehouse industry is becoming scarce, and labor costs are rising. Warehouse automation presents an opportunity to reduce reliance on manual labor, improve productivity, and mitigate the impact of labor shortages and rising costs.

- Increasing Focus on Operational Efficiency: Companies are increasingly prioritizing operational efficiency in their supply chain management. Warehouse automation technologies, such as automated picking systems, conveyor systems, and inventory management software, optimize processes and reduce errors, leading to improved efficiency and cost savings.

- Advancements in Robotics and AI Technologies: The rapid advancements in robotics, artificial intelligence (AI), and machine learning have opened up new possibilities for warehouse automation. Advanced robotic systems and AI-powered algorithms enable intelligent automation, enhancing accuracy, speed, and adaptability in warehouse operations.

- Global Expansion of Retail and Logistics Networks: The expansion of retail and logistics networks on a global scale presents a significant market opportunity for warehouse automation. As businesses expand their operations across regions, they require scalable and flexible automation solutions to efficiently manage their warehouse networks.

Recent Developments

- Pilot Program by Maersk and BionicHIVE: In March 2023, Maersk and BionicHIVE initiated a pilot program in Mira Loma, California, United States, to evaluate automation processes at a Maersk warehouse. The pilot involved sorting, selecting, and storing packages using automated systems equipped with cameras and sensors.

- Introduction of SOFTBOT Platform Connector by SVT Robotics: In April 2023, SVT Robotics introduced the SOFTBOT Platform Connector for Tecsys Inc., facilitating seamless integration between SVT’s SOFTBOT Platform and Tecsys WMS. This pre-built connector accelerates deployment and reduces complexity for Tecsys Elite clients, eliminating the need for custom code in robotics deployments and multi-system automation.

- Launch of Pio by AutoStore: In January 2023, AutoStore launched Pio, a plug-and-play version of their renowned cube storage technology, specifically designed for small and medium-sized businesses (SMBs). Pio offers an affordable automation solution for SMBs in various industries like sporting goods, crafts, cosmetics, and apparel, enabling them to access advanced automation technology.

Top Market Leaders

- Honeywell International Inc.

- Oracle Corporation

- Daifuku Co. Ltd.

- Dematic

- Swisslog Holding AG

- KNAPP AG

- BEUMER Group

- ABB Ltd.

- Fanuc Corporation

- Vanderlande

- SSI Schaefer

- KION Group

- Softeon

- Manhattan Associates

- Other Key Players

Conclusion

The warehouse automation market presents substantial growth opportunities driven by technological advancements, the expanding reach of e-commerce, and the increasing demand for faster and more efficient logistics solutions. As companies continue to innovate and integrate advanced technologies such as AI, robotics, and big data analytics, the efficiency of warehouse operations is expected to increase, thereby enhancing the overall supply chain. However, stakeholders must carefully navigate the challenges, particularly the high costs associated with deploying these technologies. The potential for significant returns on investment through improved operational efficiencies and the expansion of service-based revenue streams provides a compelling case for continued investment in warehouse automation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)