Table of Contents

Introduction

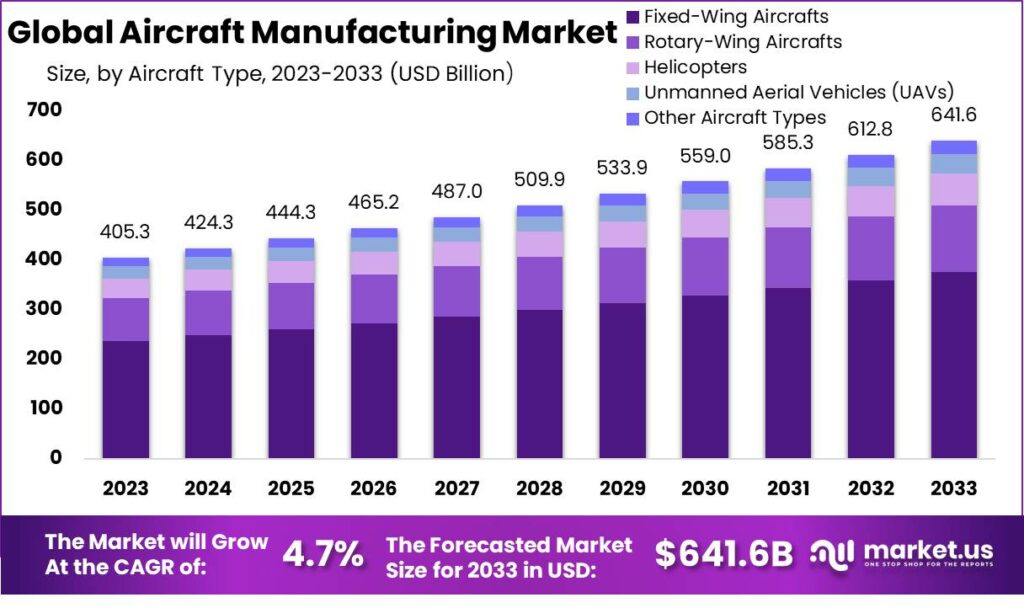

According to Market.us, Aircraft Manufacturing Market recorded a valuation of USD 405.3 billion in 2023 and is expected to reach USD 641.6 billion by the end of 2033, expanding at a CAGR of 4.7% over the decade.

The aircraft manufacturing industry represents a dynamic and technologically advanced sector critical to global transportation and defense. This sector encompasses the design, development, and production of a wide range of aircraft, from commercial airliners to military jets, reflecting its importance in facilitating global connectivity and defense capabilities.

The market for aircraft manufacturing has witnessed significant growth, driven by a combination of factors. Key among these is the resurgence of commercial air travel, pushing airlines to update and expand their fleets with more fuel-efficient and environmentally friendly aircraft. This demand is further amplified by the rise of low-cost carriers (LCCs), which have revolutionized the aviation industry by offering competitive pricing, thereby increasing air travel accessibility. The introduction of new business models by various airlines to ensure sustainability amidst growing competition highlights the industry’s adaptability and growth potential.

Technological advancements play a pivotal role in shaping the industry. The development of lighter, more fuel-efficient aircraft through the use of advanced materials like carbon fiber composites, alongside enhancements in avionics and communication systems, has significantly increased aircraft efficiency and safety. These technological strides not only meet the growing demand for advanced and efficient aircraft but also foster competitive dynamics in the market, encouraging innovation among manufacturers.

The military and defense segment of the market is experiencing rapid growth, driven by the need to replace aging aircraft and enhance national defense capabilities. This segment benefits from substantial investments by governments worldwide, aimed at acquiring advanced military aircraft equipped with the latest technology for precision and stealth operations.

Opportunities abound for both new entrants and established players in the aircraft manufacturing industry, thanks in part to government initiatives that support the sector. These initiatives include financial subsidies, tax incentives, and investments in infrastructure, all of which serve to lower manufacturing costs and foster industry growth. Such support underscores the strategic importance of the aircraft manufacturing industry to national and global security and economic well-being.

The competitive landscape of the global aircraft manufacturing market features prominent players who lead through innovation, strategic partnerships, and continuous research and development. These efforts are crucial for staying ahead in a market characterized by intense competition and rapid technological evolution.

Key Takeaways

- The Aircraft Manufacturing Market is poised to surpass USD 641.6 billion by 2033, reflecting a steady CAGR of 4.7% from 2024 to 2033.

- Fixed-Wing Aircrafts lead the market, commanding a robust share exceeding 58.7%, driven by their stability, efficiency, and versatility across commercial, military, and private sectors.

- Commercial Aviation dominates with a robust 45.2% market share, fueled by increasing air travel demand and modernization efforts for enhanced fuel efficiency and passenger comfort.

- Helicopters, within the Rotary-Wing Aircrafts category, play pivotal roles in emergency services, search and rescue, and military operations, underscoring their importance with a significant market share.

- Unmanned Aerial Vehicles (UAVs), or drones, are experiencing growing demand, attributed to their utility in surveillance, agriculture, and package delivery applications, with a notable market share.

- The Military and Defense sector secures a substantial portion of the market, driven by investments in advanced fighter jets, surveillance aircraft, and strategic bombers, reflecting its strategic importance.

- North America commands a formidable position with a substantial revenue share of 43.6%, attributed to industry giants like Boeing and Lockheed Martin, robust R&D, and sustained demand in both commercial and military sectors.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights!

Aircraft Manufacturing Statistics

- Over the next 20 years, the world needs about 19,575 new commercial airplanes. This huge demand is valued at around ~$3.2 trillion.

- By 2042, the total number of airplanes flying around the world is expected to reach 46,720. To meet this, 39,490 new passenger and cargo planes will be needed over the next two decades.

- In the United States, there’s a 25% jump expected in the demand for new commercial planes in 2023 and 2024. This increase is mainly because airlines want newer, more modern planes.

- Around the globe, there’s a need for 2,850 new turboprop aircraft in the coming years, with a total value estimated at about ~$95 billion.

- The market for new business jets is set to grow by 20% in 2023 and 2024. This growth is thanks to the private aviation sector getting back on its feet.

- New technologies in making airplanes, like 3D printing and using robots, could make planes up to 30% cheaper to produce.

- Europe is also seeing a higher demand for new airplanes, expected to increase by 18% in 2023 and 2024. This is because airlines there want to update their fleets and be more eco-friendly.

- Across the world, the demand for new aircraft is anticipated to rise by 15% in 2023 and 2024. This is mainly due to the aviation sector growing quickly in developing countries.

- In the United States, there’s a 25% increase expected in the demand for new unmanned aerial vehicles (UAVs) in 2023 and 2024. This surge is mainly because of a growing need for better surveillance and scouting capabilities.

- Worldwide, the demand for new regional airplanes is set to grow by 20% in 2023 and 2024. This growth is fueled by the desire for air travel options that are both more efficient and environmentally friendly.

- The introduction of cutting-edge avionics and flight control systems is predicted to boost aircraft safety and efficiency by as much as 30%. This advancement is likely to encourage the development of new aircraft models.

- In Europe, the need for new airplanes is expected to go up by 20% in 2023 and 2024. This increase is driven by airlines’ efforts to modernize their fleets and achieve sustainability objectives.

- Globally, the demand for new aircraft is anticipated to rise by 22% in 2023 and 2024. This boost is largely due to the expansion of the aviation industry in emerging markets.

Emerging Trends

- Sustainability and Eco-friendly Designs: Aircraft manufacturers are focusing on developing planes that are more fuel-efficient and produce fewer emissions. This includes the use of lightweight materials and the exploration of alternative fuels, such as biofuels and electric power, to reduce the carbon footprint of air travel.

- Advanced Materials and Manufacturing Techniques: The adoption of composite materials, such as carbon fiber, is on the rise. These materials make aircraft lighter, more fuel-efficient, and easier to maintain. Additionally, 3D printing is gaining traction for producing complex aircraft parts at a lower cost and with reduced waste.

- Autonomous and Unmanned Aircraft: The development of autonomous flight technologies is progressing, with potential applications ranging from cargo delivery to passenger aircraft. Unmanned Aerial Vehicles (UAVs) are also becoming more prevalent in both civilian and military sectors for surveillance, reconnaissance, and targeted missions.

- Connectivity and In-flight Entertainment: Enhancing passenger experience through better connectivity and in-flight entertainment options is a growing trend. This includes high-speed internet access, streaming services, and personalized content delivery.

- Digitalization and Data Analytics: The use of Big Data and analytics is transforming aircraft maintenance and operations. Predictive maintenance, powered by data analysis, can foresee potential issues before they occur, improving safety and reducing downtime.

Top Use Cases

- Cargo Delivery: Especially with the rise in e-commerce, there’s an increased need for efficient cargo delivery. Aircraft are being designed to accommodate this, with larger cargo doors and reinforced floors for heavy loads.

- Humanitarian Aid and Disaster Relief: Aircraft are crucial for delivering aid to areas affected by natural disasters. Versatile aircraft that can operate in various terrains and conditions are particularly valuable for these missions.

- Medical Evacuations: Aircraft equipped for medical evacuations can transport patients quickly and efficiently, offering life-saving support in critical situations.

- Surveillance and Security: UAVs are extensively used for border surveillance, anti-poaching efforts, and security operations, offering real-time data and imagery without risking human lives.

- Space Exploration: The development of aircraft-like spaceplanes is opening new avenues for space exploration and tourism, with the potential for reusable vehicles that can significantly lower the cost of space access.

Real Challenges

- High Development Costs: The cost of developing new aircraft, especially those incorporating new technologies, is extremely high. This can limit market entry to only well-established players.

- Regulatory Hurdles: The aviation industry is heavily regulated. Meeting safety and environmental standards can delay the introduction of new technologies and designs.

- Skilled Labor Shortage: There is a growing shortage of skilled labor in the aerospace industry, from pilots to engineers and technicians, which can hamper growth and innovation.

- Cybersecurity Risks: With increased digitalization, aircraft and aviation systems are becoming more vulnerable to cyber attacks, posing a challenge to ensuring safety and confidentiality.

- Global Supply Chain Vulnerabilities: The aerospace industry relies on a complex, global supply chain. Disruptions, such as those caused by the COVID-19 pandemic, can have widespread impacts on production and delivery schedules.

Market Opportunity

- Emerging Markets: Rapid economic growth in regions like Asia Pacific is fueling a surge in air travel demand, representing a significant opportunity for aircraft manufacturers.

- Retrofitting and Upgrades: There’s a substantial market for upgrading and retrofitting existing aircraft with new technologies to extend their service life and improve performance.

- Defense Spending: Increasing defense budgets worldwide are driving demand for military aircraft, including advanced fighter jets and UAVs.

- Sustainable Aviation: Innovations in sustainable aviation technologies open up new market opportunities for manufacturers focused on eco-friendly solutions.

- Urban Air Mobility (UAM): The development of UAM systems, including electric vertical takeoff and landing (eVTOL) aircraft, presents a growing market for short-distance air transportation solutions in urban areas.

Recent Developments

- In October 2023, Beta Technologies opened a new place for making electric airplanes in Vermont. They plan to make 300 planes a year. They hope to get the okay from FAA in 2025 for a special electric plane called CX300. This plane can take off and land like normal planes. They also have another electric plane that can take off and land vertically. They hope it gets approved in 2026.

- L3Harris bought Aerojet Rocketdyne for about $4.7 billion in December 2022. This big buy helps L3Harris do more in aerospace and defense.

- In September 2023, Japan Industrial Partners, Suzuki Motor Corp., and ROHM Co. Ltd. bought Toshiba Corporation for about $16.23 billion. This deal brought together companies from different fields, showing they are all interested in technology and defense things.

Conclusion

The aircraft manufacturing industry is at a pivotal point, with sustainability, technological advancements, and digitalization shaping its future. Despite the challenges, including high costs and regulatory barriers, the sector is poised for significant growth, driven by global demand for air travel, defense needs, and the push for greener aviation. Opportunities in emerging markets, retrofitting, and new technologies like autonomous flight and urban air mobility highlight the industry’s potential for innovation and expansion. As the industry continues to evolve, focusing on sustainability, efficiency, and passenger experience will be key to capturing market opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)