Table of Contents

- Introduction

- Editor’s Choice

- Enterprise IoT Market Overview

- IoT Revenue

- Internet of Things (IoT) Connections Over the Globe

- Share of Enterprises Internet of Things (IoT) Projects Worldwide – By Area

- Number of Edge-Enabled Internet of Things (IoT) Devices Worldwide – By Market

- Enterprises & Entire IoT Adoption

- Importance of and Investment Plan for Enterprises IoT in Business Worldwide – By Industry

- Enterprises IoT Spending Across Different Industries

- Challenges Around IoT Enterprises Integration

Introduction

According to Enterprise IoT Statistics, Enterprise IoT entails connecting devices, sensors, and software within an organization’s infrastructure to optimize operations and decision-making.

Components include sensors, connectivity, cloud platforms, analytics, and integration with existing systems. Use cases range from asset tracking to predictive maintenance and smart buildings.

Benefits include improved efficiency, decision-making, customer experience, and innovation. Challenges include security, interoperability, scalability, and data management.

Overall, enterprise IoT offers opportunities for organizations to enhance efficiency, innovation, and customer satisfaction, but successful implementation requires addressing challenges such as security and interoperability.

Editor’s Choice

- The global enterprise IoT market revenue rose to USD 600.8 billion in 2023.

- In 2032, the market is projected to reach USD 1,819.2 billion, with hardware revenues at USD 844.11 billion, software and solutions at USD 611.25 billion, and services at USD 363.84 billion.

- In the global enterprise IoT market, small and medium-sized enterprises (SMEs) hold a significant majority, with 64% of the market share, underscoring their pivotal role in adopting IoT technologies.

- By the end of the decade, in 2030, IoT revenues are expected to surpass $621.6 billion.

- By 2021, consumer IoT connections rose to 8 billion, while enterprise IoT jumped to 7.5 billion.

- The healthcare industry leads with a significant 14.5% increase in IoT spending, underscoring its growing reliance on connected technologies for enhanced patient care and operational efficiency.

- The most prevalent issue experienced by 53% of organizations was integrating IoT solutions with existing technology, highlighting the complexity of meshing new systems with legacy infrastructures.

Enterprise IoT Market Overview

Global Enterprise IoT Market Size

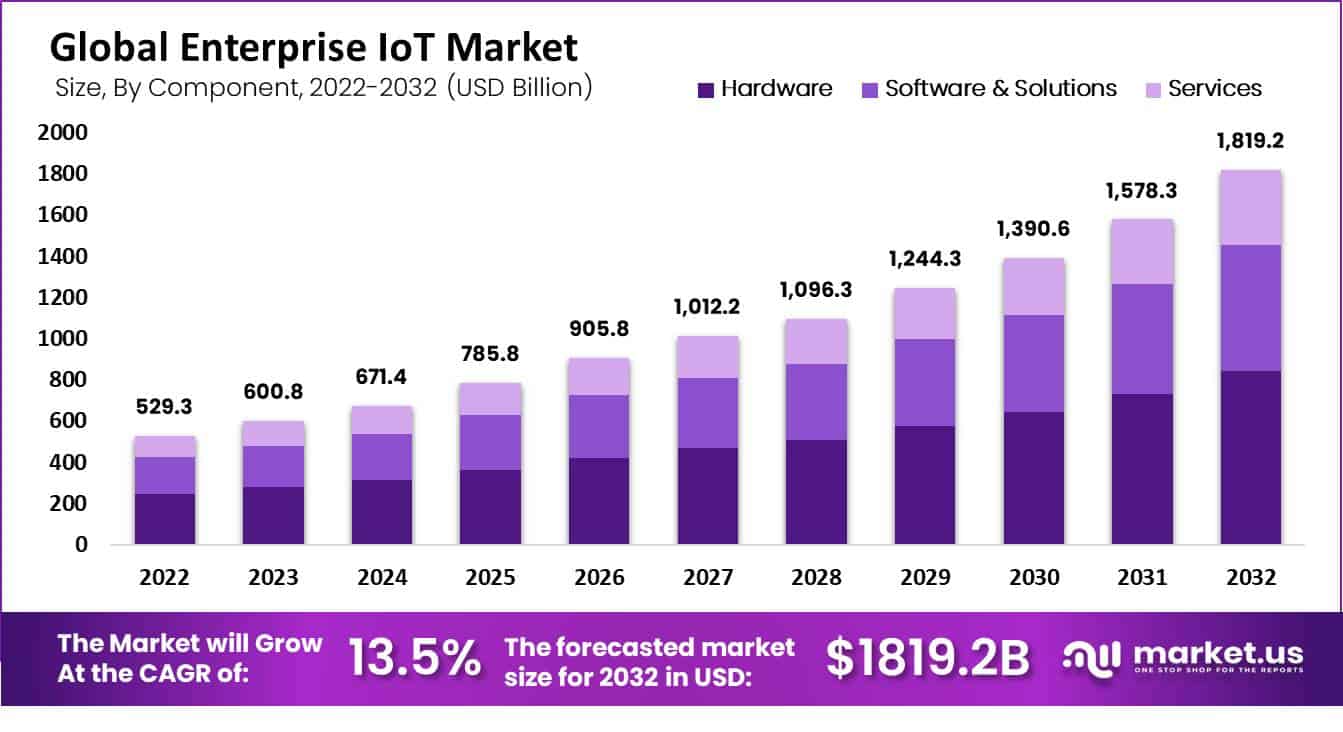

- The global enterprise IoT market has shown substantial growth over the past decade, as evidenced by increasing revenue figures at a CAGR of 13.5%.

- In 2022, the market generated USD 529.3 billion. The following year, revenue rose to USD 600.8 billion, marking a significant year-on-year increase.

- This growth trajectory is expected to continue, with projections estimating the market to reach USD 671.4 billion in 2024.

- By 2032, the global enterprise IoT market is expected to attain USD 1,819.2 billion, reflecting a sustained and robust growth pattern over the decade.

Enterprise IoT Market Size – By Component

- The global enterprise IoT market’s revenue segmentation by component from 2022 to 2032 highlights notable growth across hardware, software solutions, and services.

- In 2022, the total market revenue stood at USD 529.3 billion, distributed among hardware (USD 245.6 billion), software and solutions (USD 177.84 billion), and services (USD 105.86 billion).

- The upward trend continued into 2023, with total revenues increasing to USD 600.8 billion, comprising USD 278.77 billion from hardware, USD 201.87 billion from software and solutions, and USD 120.16 billion from services.

- In 2032, the market is projected to reach USD 1,819.2 billion, with hardware revenues at USD 844.11 billion, software and solutions at USD 611.25 billion, and services at USD 363.84 billion.

Global Enterprise IoT Market Share – By Component

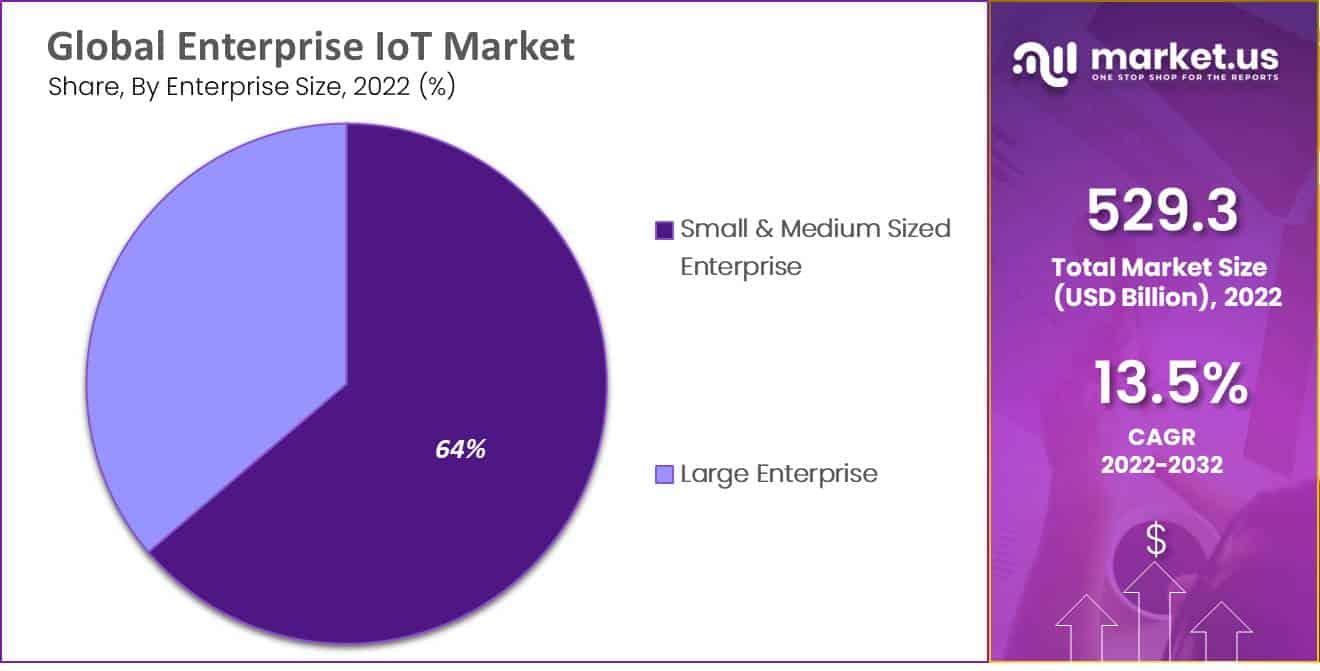

- In the global enterprise IoT market, small and medium-sized enterprises (SMEs) hold a significant majority, with 64% of the market share, underscoring their pivotal role in adopting IoT technologies.

- In contrast, large enterprises account for 36% of the market share.

IoT Revenue

Internet of Things (IoT) Total Annual Revenue Worldwide

- From 2020 to 2030, the worldwide revenue generated from the Internet of Things (IoT) demonstrates a consistent upward trajectory.

- In 2020, the total annual revenue was recorded at $181.5 billion.

- This figure increased steadily, reaching $213.1 billion in 2021 and further rising to $251.6 billion in 2022.

- By 2023, IoT revenues climbed to $293.2 billion, and the growth continued, with revenues projected to hit $336 billion in 2024.

- The trend persisted, with revenues reaching $520.6 billion by 2028 and $570.6 billion by 2029. By the end of the decade, in 2030, IoT revenues are expected to surpass $621.6 billion.

IoT Annual Revenue – By Region

- In 2020, North America led with $38.1 billion, followed by Greater China at $64.8 billion and Europe with $34.7 billion.

- Over the decade, these regions continued to show substantial revenue increases. North America is projected to reach $138.7 billion by 2030, Greater China is expected to hit $184 billion, and Europe is anticipated to grow to $122.7 billion.

- Other regions also demonstrated significant growth trajectories. For instance, Latin America’s IoT revenue, which started at $7.7 billion in 2020, is forecasted to rise to $33.3 billion by 2030.

- Similarly, India and South Asia began at $3.6 billion in 2020 and are predicted to be more than quintuple to $21.4 billion by the end of the decade. IoT revenues in Japan and South Korea are also on the rise, expected to reach $44.7 billion and $14.7 billion, respectively, by 2030.

- Smaller markets showed notable percentage increases as well. Australasia’s revenue is set to nearly quadruple from $2.2 billion in 2020 to $8.5 billion in 2030.

Internet of Things (IoT) Connections Over the Globe

Number of Internet of Things (IoT) Connected Devices Worldwide

- From 2019 to 2023, the number of Internet of Things (IoT) connected devices worldwide has experienced significant growth, increasing from 8.6 billion devices in 2019 to 15.14 billion by 2023.

- This upward trend is forecasted to continue through the end of the decade. In 2024, the total is expected to rise to 17.08 billion devices.

- By 2025, the number will further grow to 19.08 billion, and projections show a steady annual increase, reaching 21.09 billion by 2026.

- By the end of the decade, in 2029 and 2030, the numbers are projected to reach 27.31 billion and 29.42 billion, respectively.

Worldwide Internet of Things (IoT) Connections – By Application

- In 2020, there were 7.5 billion connections in the consumer segment and 5.5 billion in the enterprise sector.

- Over the years, these numbers have steadily increased. By 2021, consumer IoT connections rose to 8 billion, while enterprise IoT jumped to 7.5 billion.

- This upward trajectory continued, with consumer connections reaching 9 billion and enterprise connections growing to 9.5 billion by 2023.

- The gap between the two widened significantly by 2024, with enterprise IoT connections overtaking consumer IoT at 11 billion to 10.5 billion, respectively.

- By 2025, enterprise IoT connections expanded to 13 billion compared to 11 billion in consumer IoT.

- The trend accelerated, with enterprise IoT connections projected to reach 24 billion by 2030, significantly outpacing consumer IoT connections, which are expected to hit 14 billion.

Number of Internet of Things (IoT) Connected Devices Worldwide – By Vertical

- In agriculture, forestry, and fishing, the number of devices is set to increase significantly from 28.6 million in 2022 to 194.7 million by 2030.

- The mining and quarrying sector sees a more modest rise, from 15.6 million to 24.2 million devices over the same period.

- Manufacturing devices will grow from 103 million in 2022 to 200.5 million by 2030.

- The most substantial increase is observed in the electricity, gas, steam, and air conditioning supply sectors, where connected devices soar from 1,395.8 million in 2022 to 2,774.1 million in 2030.

- Water supply and waste management also experience significant growth, with numbers escalating from 257.2 million to 705.2 million devices.

- In the construction sector, IoT-connected devices are expected to increase from 12.7 million in 2022 to a substantial 94.6 million by 2030.

- The retail and wholesale sector shows robust growth, with the number of devices expanding from 906.4 million to 2,518.5 million.

- In January 2018 and July 2020, the distribution of enterprise Internet of Things (IoT) projects across various sectors showed notable shifts.

- In the manufacturing and industrial sectors, the share of IoT projects increased from 17% in 2018 to 22% in 2020, reflecting growing adoption in these areas.

- Transportation and mobility also saw a rise, from 11% to 15%, while energy sector projects increased from 10% to 14%.

- Retail experienced a significant jump in IoT project share, going from 4% to 12%. Conversely, projects in cities decreased from a leading 23% in 2018 to 12% in 2020.

- Healthcare IoT projects grew modestly from 6% to 9%, and supply chain projects increased from 5% to 7%.

- Agriculture maintained a steady share of 4% across both years.

- However, IoT projects in buildings and other sectors saw a notable decline, with buildings dropping from 12% to 3% and other categories from 8% to 3%.

Number of Edge-Enabled Internet of Things (IoT) Devices Worldwide – By Market

- The number of edge-enabled Internet of Things (IoT) devices globally, spanning from 2020 to 2030, displays significant growth within both consumer and enterprise markets.

- Starting in 2020, the count was 2,303 million devices in the consumer segment and 401 million in the enterprise segment.

- This upward trend continued, with consumer devices reaching 2,625 million and enterprise devices 473 million by 2021.

- The growth accelerated through the following years, with consumer numbers increasing to 3,005 million and enterprise to 554 million by 2022, and then to 3,415 million and 638 million, respectively, in 2023.

- Similarly, enterprise devices also saw steady increases, reaching 807 million in 2025 and culminating at 1,233 million by 2030.

Enterprises & Entire IoT Adoption

- In 2016, the total number of IoT units installed worldwide stood at approximately 6,382 million. This figure grew to 8,381 million in 2017 and further expanded to 11,197 million by 2018. By 2030, the installed base is expected to skyrocket to 125,000 million units.

- Consumer devices have consistently formed a significant portion of this total, increasing from 3,963 million units in 2016 to 5,244 million in 2017 and 7,036 million in 2018, with a projection of reaching 75,000 million by 2030. Throughout this period, consumer devices have represented about 60% to 63% of total IoT devices.

- Notably, the IoT adoption rate has shown dramatic increases, starting at 11% in 2016, rising to 14% in 2017, and reaching 18% in 2018.

- By 2030, the adoption rate is projected to reach an unprecedented 176%, reflecting the anticipated deep penetration and ubiquity of IoT technologies in daily life and across various sectors by the end of the period.

Importance of and Investment Plan for Enterprises IoT in Business Worldwide – By Industry

- In the technology, media, and telecommunications industries, a high 90% of organizations viewed IoT as critical to some or all business lines, with 54% expressing strong confidence in their digital trust controls for IoT and 37% planning to invest in IoT security over the next 12 months.

- In the consumer market, 80% of entities recognized the critical nature of IoT, but only 33% were very confident about their digital trust controls, and 32% planned to invest in security.

- The financial services sector reported that 86% considered IoT essential, with 43% very confident in their digital trust controls, although only 26% intended to invest in IoT security soon.

- Health services showed that 83% of organizations saw IoT as critical, but just 37% had high confidence in their digital trust frameworks, and 24% planned on investing in security enhancements.

- In the industrial products sector, 79% found IoT critical, 39% had high confidence in their controls, and 35% were planning security investments.

- Energy utilities and mining also valued IoT highly at 86%, with 37% very confident in their controls and 28% planning to invest in security.

Enterprises IoT Spending Across Different Industries

- The healthcare industry leads with a significant 14.5% increase in IoT spending, underscoring its growing reliance on connected technologies for enhanced patient care and operational efficiency.

- Following closely, the insurance industry shows a 12.3% growth rate, leveraging IoT for risk assessment and management.

- The education industry also sees a notable increase, with an 11.9% rise in spending, reflecting its adoption of IoT for smarter, more connected educational environments.

- Conversely, the transportation industry, oil and gas industry, and discrete manufacturing industry are experiencing more modest growth rates in their IoT investments. The transportation industry’s spending is growing by 5.7%, potentially for advancements in logistics and fleet management.

- The oil and gas industry sees a 5% increase, likely focusing on IoT for operational efficiency and safety enhancements.

- Lastly, the discrete manufacturing industry is growing at a rate of 4.3%, indicating a steady, albeit slower, uptake of IoT technologies in manufacturing processes.

Challenges Around IoT Enterprises Integration

- In 2020, enterprises faced several significant challenges when integrating Internet of Things (IoT) technologies.

- The most prevalent issue experienced by 53% of organizations was integrating IoT solutions with existing technology, highlighting the complexity of meshing new systems with legacy infrastructures.

- Close behind, security and data privacy concerns were cited by 50% of the respondents, underscoring the critical importance of safeguarding data in increasingly connected environments.

- The cost of implementation was also a major hurdle for 47% of enterprises, indicating substantial financial implications associated with deploying IoT solutions.

- Additionally, 40% of organizations encountered resistance from employees or internal stakeholders, which could stem from concerns over changes to workflows or job roles.

- A lack of in-house skills was another significant barrier, mentioned by 38% of enterprises, reflecting a gap in IoT-related expertise necessary for effective implementation.

- Finally, unclear return on investment (RoI) troubled 27% of the companies, suggesting challenges in justifying IoT projects financially.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)