Table of Contents

Introduction

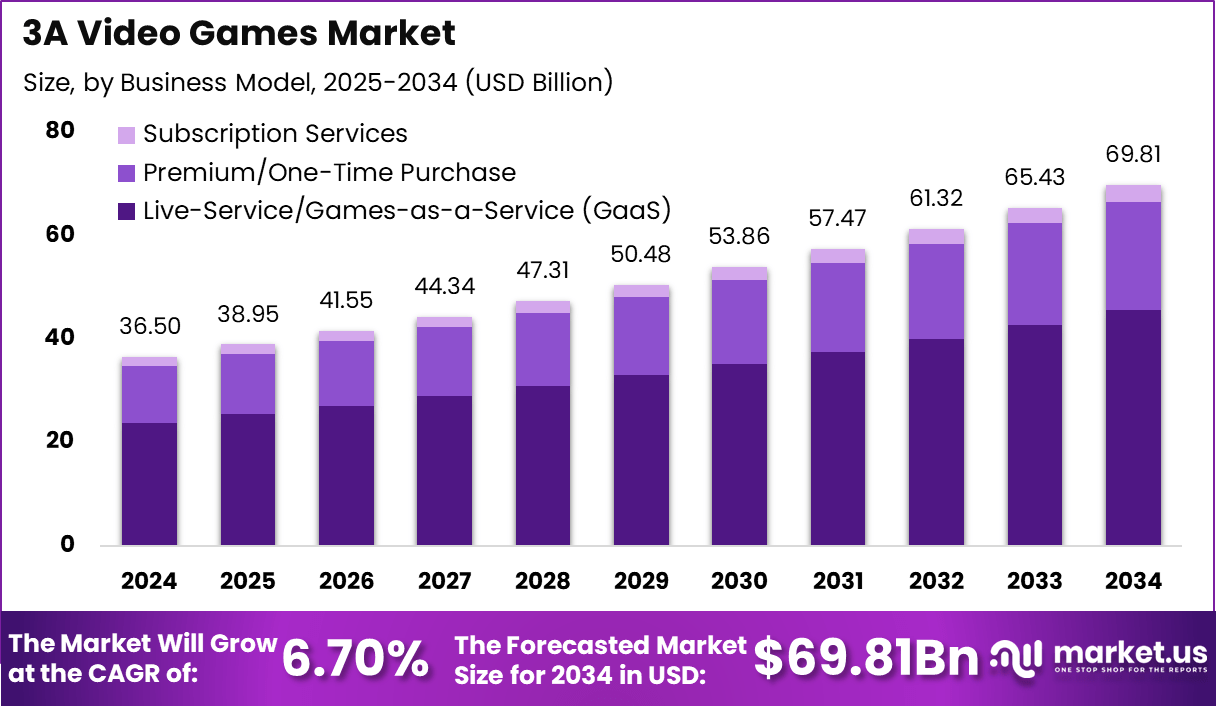

The global 3A video games market was valued at USD 36.5 billion in 2024 and is projected to reach approximately USD 69.81 billion by 2034, expanding at a CAGR of 6.7%. North America accounted for 35.4% of the global market, valued at USD 12.92 billion in 2024, due to strong consumer spending, high console ownership, and robust digital distribution networks. The US, valued at USD 11.78 billion in 2024, is expected to reach USD 18.29 billion by 2034, growing at a CAGR of 4.5%, driven by the adoption of next-generation consoles, 5G gaming infrastructure, and an expanding ecosystem of premium studios.

How Growth is Impacting the Economy

The growth of the 3A video games industry is significantly contributing to the digital economy through job creation, technological innovation, and rising consumer expenditure in entertainment. The industry fuels economic diversification by supporting hardware manufacturing, cloud gaming services, and cross-media collaborations such as film and esports. Increased investments in advanced game engines and motion capture technologies have boosted demand for skilled developers, 3D artists, and AI engineers.

The sector’s digital-first model promotes global trade via online distribution, reducing logistical costs while expanding revenue generation through subscription-based services. Furthermore, emerging markets are witnessing inflows of venture capital and government incentives for gaming startups, fostering economic resilience. The market’s expansion is also enhancing the creative economy, attracting tourism through gaming expos and boosting digital advertising revenue tied to esports and streaming platforms.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/3a-video-games-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Game studios are facing rising development and distribution costs due to high production quality expectations and dependence on advanced engines and motion capture tools. Global semiconductor shortages and hardware supply issues have prompted developers to adopt hybrid cloud infrastructures and cross-platform releases to minimize delays.

Sector-Specific Impacts

In entertainment, 3A games are merging with film and virtual reality ecosystems to drive immersive storytelling. The technology sector benefits from GPU and cloud-rendering innovation, while retail and e-commerce channels experience increased digital game sales. Education and simulation industries also leverage 3A design frameworks for training and research visualization.

Strategies for Businesses

Studios and publishers should diversify revenue through live-service models, digital expansions, and metaverse-ready gaming experiences. Collaboration with cloud providers can optimize content delivery and reduce server costs. Investing in modular game development pipelines allows faster updates and scalability. Businesses should also integrate AI for real-time rendering, testing, and performance optimization. Expanding into cross-platform ecosystems ensures higher player retention, while sustainable production practices and diversity in content creation appeal to a global audience. Strategic mergers, partnerships, and IP licensing are vital to strengthen market presence and reduce operational risk.

Key Takeaways

- Market to reach USD 69.81 billion by 2034 at a 6.7% CAGR

- North America held a 35.4% share in 2024 with USD 12.92 billion in revenue

- Rising next-gen console adoption and digital distribution are accelerating growth

- Hardware shortages are prompting a shift toward cloud-based gaming

- Cross-platform and live-service models driving profitability

- AI and real-time rendering technologies are revolutionizing game production

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163622

Analyst Viewpoint

The current 3A video games market is undergoing a transformation led by immersive technologies, cloud gaming, and AI-assisted production pipelines. With high consumer engagement and consistent console upgrades, the market outlook remains highly positive. Over the next decade, growth is expected to be reinforced by emerging markets, faster internet access, and affordable cloud gaming subscriptions. Analysts anticipate a convergence of AR/VR and blockchain-based digital ownership, enabling more interactive and profitable ecosystems. Continuous innovation and sustainability-focused operations will define the long-term competitiveness of the global 3A gaming sector.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Realistic open-world design | Demand for high-fidelity storytelling and graphics realism |

| Cross-platform gaming | Growing consumer preference for multi-device play |

| Cloud streaming integration | Expanding 5G networks and low-latency gameplay |

| Esports and online tournaments | Rising audience monetization and sponsorship investments |

| AI-driven NPC and world design | Need for dynamic gaming environments and personalization |

Regional Analysis

North America dominates with 35.4% share due to high consumer spending, early technology adoption, and major gaming studio concentration. Europe follows with strong console markets in the UK, Germany, and France, supported by favorable creative-industry incentives. Asia Pacific is the fastest-growing region, driven by high smartphone penetration, esports popularity, and government-supported game development hubs in China, Japan, and South Korea. Emerging regions like the Middle East and Latin America are witnessing growing digital infrastructure and player communities, creating lucrative opportunities for international publishers.

➤ More data, more decisions! see what’s next –

- AI-Powered Tutoring Bots Market

- Subscription-Based Drone Security Market

- AI Tablet Market

- AI Legal Drafting Tools Market

Business Opportunities

Rising investments in cross-platform development, immersive storytelling, and cloud-based streaming present strong business opportunities. Companies can capitalize on subscription-based gaming models, in-game advertising, and user-generated content platforms. The integration of metaverse environments and Web3 elements such as NFTs opens new monetization channels. Strategic collaboration with technology providers, film studios, and esports organizations will allow content diversification and broader audience reach. Furthermore, the demand for AI-based game testing and localization services in multilingual markets is set to expand business potential globally.

Key Segmentation

The 3A video games market is segmented by genre (action, adventure, role-playing, simulation, sports, others), by platform (console, PC, cloud, mobile), by distribution channel (online, offline), and by region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa). The action and adventure genres dominate the market due to cinematic storytelling and global franchise popularity. The console platform continues to lead in revenue share, while cloud gaming shows the fastest growth, driven by improved streaming technologies and digital accessibility.

Key Player Analysis

Leading market participants focus on developing open-world titles, enhancing player immersion, and integrating AI for adaptive gameplay. They are investing in proprietary engines, global studio acquisitions, and live-service models to maintain engagement. Cross-media collaborations with streaming services and film studios are expanding audience reach. Competitive strategies include leveraging data analytics for in-game monetization and community engagement. Emphasis on accessibility, sustainable operations, and cloud infrastructure partnerships is helping these players scale globally while enhancing profitability through digital ecosystems and direct-to-consumer models.

- Electronic Arts

- Take-Two Interactive

- Capcom

- Ubisoft

- Epic Games

- Bluehole

- Nexon

- Riot Games

- Tencent Holdings Ltd.

- Niantic

- Neowiz Games

- Activision Blizzard

- Nintendo

- PlayStation Studios

- Sony Interactive Entertainment

- 2K Games

- Warner Bros. Games

- Xbox Game Studios

- Sega

- Bandai Namco

- Krafton

- Rockstar

- Blizzard Entertainment

- Others

Recent Developments

- January 2025: A Major studio unveiled a next-gen open-world game with real-time physics rendering.

- April 2025: Cloud gaming platform launched cross-device compatibility for AAA titles.

- July 2024: Esports league signed multi-year sponsorship deals for major 3A franchises.

- October 2024: Global publisher expanded R&D center for AI-assisted game development.

- December 2024: Collaboration announced between a tech giant and a gaming studio for metaverse-ready content integration.

Conclusion

The global 3A video games market is entering a high-growth era powered by next-gen consoles, AI integration, and immersive storytelling. Sustainable innovation, cross-platform expansion, and advanced streaming infrastructure will continue to redefine gaming experiences and drive strong economic and creative contributions worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)