Table of Contents

- Introduction

- Editor’s Choice

- History of 3D Cameras

- 3D Camera Market Statistics

- Digital Cameras Market Statistics

- Digital Camera Brand Equity Statistics

- Digital Camera Sales Value Statistics

- Specifications of Some 3D Camera Statistics

- Key Export 3D Camera Statistics

- Key Import 3D Camera Statistics

- 3D Camera Ownership in Households Statistics

- 3D Imaging Systems Camera Applications Statistics

- Technological Developments in 3D Camera Statistics

- Regulations for 3D Camera Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

3D Camera Statistics: A 3D camera captures three-dimensional images or video by employing technologies like stereoscopic vision, time-of-flight (ToF), structured light, and Lidar.

Stereoscopic vision uses multiple lenses to simulate human depth perception, while ToF measures light travel time to create depth maps.

Structured light projects patterns to infer depth, and Lidar uses laser pulses for detailed 3D mapping. These cameras find applications in 3D imaging, scanning, and depth sensing, enabling realistic visuals, precise measurements, and enhanced interactions.

Despite their benefits, challenges include high computational demands and limitations in resolution and accuracy under certain conditions.

Editor’s Choice

- In the digital era, Fuji introduced the first consumer digital 3D camera in 2010. Followed by advancements like Lytro’s light field camera in 2011, allowing post-capture focus adjustments.

- In 2023, the global 3D camera market revenue stood at USD 16.9 billion.

- The market for 3D cameras is characterized by several key players holding significant shares. Intel Corporation and Canon Inc. each hold a market share of 13%, making them prominent leaders in the industry.

- The global 3D camera market exhibits varying market shares across different regions. The Asia-Pacific (APAC) region leads with a substantial 35.6% share, reflecting its dominance in the market.

- The global digital cameras market revenue is projected to reach USD 26.8 billion by 2032.

- In 2012, the ranking of digital camera brands in the United States based on brand equity scores revealed Canon as the leading brand with a score of 68.59 out of 100.

- In 2022, China led the global export market for cameras. With an export value of USD 809 million, accounting for 26.7% of the market.

- The share of households in Denmark owning digital video cameras dropped to 16% in 2019, 15% in 2020, and slightly recovering to 16% in 2021.

- A recent notable innovation is the collaboration between Jabil, AMS OSRAM, and Artilux. Resulting in a 3D camera that operates in short-wavelength infrared (SWIR) at 1130 nm. Suitable for both indoor and outdoor environments.

History of 3D Cameras

- The history of 3D cameras traces its origins back to the early 20th century.

- In 1922, “The Power of Love” became the first 3D feature film. Using anaglyph glasses with red and green lenses to create the 3D effect.

- Edwin H. Land’s development of polarized lenses in the 1930s marked a significant advancement in 3D technology. It was utilized in the first polarized 3D film, “Beggars of Life,” in 1936.

- The 1950s witnessed the first golden age of 3D movies, with films like “Bwana Devil” pioneering the use of color and 3D.

- The format experienced a resurgence in the 1960s and 70s. With the development of Space Vision and Stereovision, which improved the viewing experience.

- In the digital era, Fuji introduced the first consumer digital 3D camera in 2010. Followed by advancements like Lytro’s light field camera in 2011, allowing post-capture focus adjustments.

- These milestones reflect the continuous evolution and growing interest in 3D imaging technology over the decades.

(Sources: Beyond Photo Tips, Iphotography, American Paper Optics)

3D Camera Market Statistics

Global 3D Camera Market Size Statistics

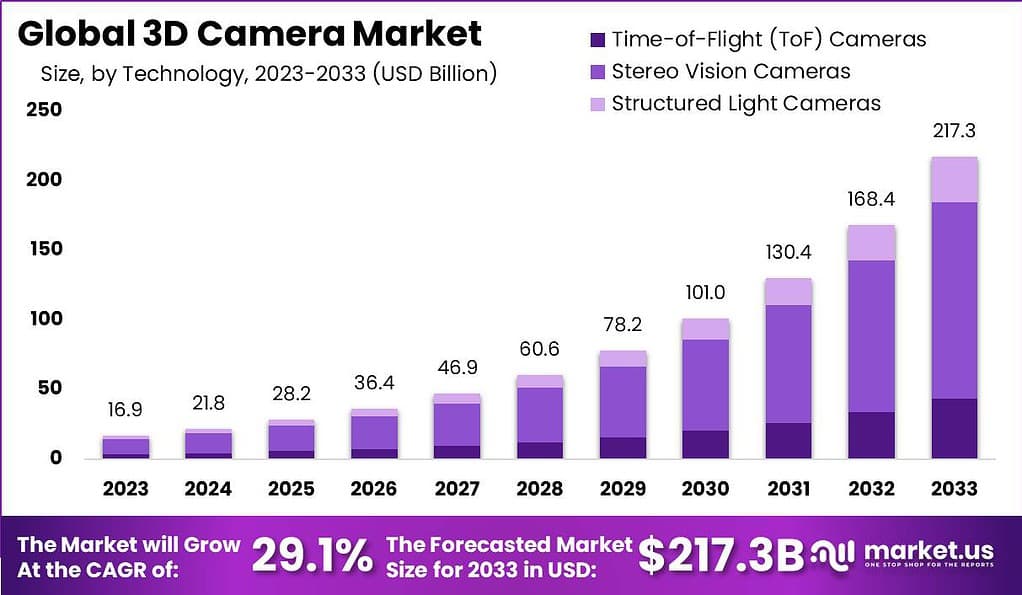

- The global 3D camera market has shown significant growth over the past decade and is projected to continue its upward trajectory at a CAGR of 29.1%.

- In 2023, the market revenue stood at USD 16.9 billion.

- This figure is expected to increase to USD 21.8 billion in 2024, reaching USD 28.2 billion by 2025.

- The market is anticipated to grow further. With revenues projected to be USD 36.4 billion in 2026 and USD 46.9 billion in 2027.

- By 2028, the market is forecasted to generate USD 60.6 billion, and in 2029. It is expected to reach USD 78.2 billion.

- The growth trend is set to continue into the next decade. Market revenues are predicted to be USD 101.0 billion in 2030, and USD 130.4 billion in 2031. USD 168.4 billion in 2032, and a substantial USD 217.3 billion by 2033.

- This consistent growth underscores the increasing demand and advancements in 3D camera technology across various applications.

(Source: market.us)

Competitive Landscape of the Global 3D Camera Market Statistics

- The market for 3D cameras is characterized by several key players holding significant shares.

- Intel Corporation and Canon Inc. each hold a market share of 13%, making them prominent leaders in the industry.

- Both Fujifilm and Hewlett-Packard account for 12% of the market. Closely followed by Panasonic Holdings Corporation, which also commands a 12% share.

- Nikon holds an 11% market share, while Faro Technologies accounts for 10%.

- GoPro, Inc. contributes 5% to the market.

- The remaining 12% is distributed among other key players. Highlighting a competitive landscape with a few dominant companies and several smaller contributors.

(Source: market.us)

Regional Analysis of the Global 3D Camera Market Statistics

- The global 3D camera market exhibits varying market shares across different regions.

- The Asia-Pacific (APAC) region leads with a substantial 35.6% share, reflecting its dominance in the market.

- North America follows with a 31.2% share, indicating significant market activity.

- Europe holds a 28.6% share, showcasing its strong presence in the industry.

- In contrast, South America, the Middle East, and Africa (MEA) regions have smaller shares, with 3.2% and 1.4% respectively.

- This distribution highlights the concentrated market power in APAC, North America, and Europe, with relatively limited penetration in South America and MEA.

(Source: market.us)

Digital Cameras Market Statistics

Global Digital Cameras Market Size Statistics

- The global digital cameras market has demonstrated steady growth at a CAGR of 4.0%. With revenue figures reflecting a consistent upward trend.

- In 2022, the market revenue was recorded at USD 18.3 billion.

- This increased to USD 19.0 billion in 2023 and is projected to reach USD 19.7 billion in 2024.

- The market is expected to continue expanding, with revenues anticipated to be USD 20.7 billion in 2025 and USD 21.6 billion in 2026.

- By 2027, the market is forecasted to generate USD 22.4 billion. Increasing slightly to USD 22.9 billion in 2028.

- The growth trajectory is expected to persist. With projected revenues of USD 23.8 billion in 2029, USD 24.7 billion in 2030, USD 25.7 billion in 2031, and USD 26.8 billion by 2032.

- This steady growth indicates a robust demand for digital cameras globally.

Market Share of Leading 3D Digital Camera Manufacturers Statistics

- As of December 2023, the market shares of leading digital camera manufacturers worldwide. By sales volume is dominated by Canon, which holds a substantial 46.5% share.

- Sony follows with a significant 26.1% market share.

- Nikon ranks third with 11.7%, while Fujifilm and Panasonic hold smaller shares of 5.8% and 4.3%, respectively.

- Other manufacturers occupy the remaining 5.6% of the market.

- This distribution highlights Canon’s leading position in the digital camera market. Followed by strong performances from Sony and Nikon, with other companies maintaining modest shares.

(Source: Statista)

Digital Camera Brand Equity Statistics

- In 2012, the ranking of digital camera brands in the United States based on brand equity scores revealed Canon as the leading brand with a score of 68.59 out of 100.

- Nikon closely followed with a score of 67.26, while Sony secured the third position with a score of 67.12.

- Kodak and Olympus were further down the list, scoring 62.18 and 61.44, respectively.

- The category average for digital camera brand equity stood at 60.3, indicating that Canon, Nikon, and Sony all performed above average in terms of brand equity among U.S. consumers.

(Source: Statista)

Digital Camera Sales Value Statistics

- The global revenue from digital camera sales experienced a steady decline from 2011 to 2016.

- In 2011, the revenue was at its peak, reaching 33 billion euros.

- This figure decreased to 31 billion euros in 2012.

- The downward trend continued, with revenues falling to 26 billion euros in 2013 and further dropping to 21 billion euros in 2014.

- By 2015, the sales had decreased to 19 billion euros, and the decline persisted into 2016, with revenue reaching 17 billion euros.

- This consistent decrease over the six years highlights a significant contraction in the global digital camera market.

(Source: Statista)

Specifications of Some 3D Camera Statistics

3D-A5000

- The 3D-A5000 boasts a compact and robust design with dimensions of 324 x 137 x 97 mm and a weight of 3.0 kg.

- It operates efficiently within a temperature range of 0–40 °C (32–104 °F) and can be stored in temperatures ranging from -10 to 60 °C (14–140 °F).

- The device functions optimally in environments with humidity levels below 85% (non-condensing) and is protected with an IP65 rating, ensuring resistance to dust and water.

- It can withstand shocks up to 50 gs (11 ms half-sine pulse) and vibrations of 4 gs (10–120 Hz for 30 minutes).

- The trigger input voltage ranges from –24 VDC to +24 VDC. With an input ON requirement of more than 10 VDC (> six mA) and an input OFF requirement of less than 2 VDC (<1.5 mA). The power specifications include a voltage of +24 VDC (22–26 VDC) and a maximum current of 6.0 A.

- The device features a swift acquisition time of 200 milliseconds and is compatible with VisionPro software. It includes a 10 Gigabit Ethernet interface for high-speed data transmission.

- The 3D-A5000 is certified by CE, FCC, KCC, TUV SUD NRTL, and RoHS standards. Ensuring compliance with global safety and environmental regulations. Additionally, an optional fan accessory is available for enhanced cooling.

(Source: Cognex)

EOS 5D Mark IV Kit (EF 24 – 105 IS II USM)

- The Canon EOS 5D Mark IV Kit (EF 24-105 IS II USM) is a high-end DSLR offering a range of features for professional use.

- It has a 61-point AF system with up to 41 cross-type points and supports various autofocus modes, including One-Shot, AI Servo, AI Focus, and Manual.

- The camera provides a 30.4-megapixel sensor, an ISO range of 100-32,000 (expandable to 102,400), and a 3.2-inch LCD with 1,620,000 dots. It lacks a built-in flash but has a 24-105 mm lens with 4.3x optical zoom.

- It supports CF Type I, SD, SDHC, and SDXC UHS-I cards and features metering with a 150,000-pixel RGB+IR sensor and 252-zone TTL.

- The camera records in MOV and MP4 formats and includes an optical image stabilizer. Connectivity options include SuperSpeed USB 3.0, an external microphone input, HDMI mini out, and wireless remote control.

- Powered by the DIGIC 6+ processor, it offers shooting modes such as Program AE, Shutter-priority AE, Aperture-priority AE, Manual, and Bulb, with a shutter speed range of 30 seconds to 1/8000 seconds.

- Weighing about 1,685 grams with a battery and memory card, it supports JPEG, RAW, and RAW + JPEG formats. With white balance settings of Auto, Preset, and Custom and an X-sync speed of 1/200.

(Source: Canon)

3D Handycam Camcorder – Sony HDR-TD10

- The Sony HDR-TD10 3D Handycam Camcorder features dual “Exmor R” CMOS sensors and BIONZ® processors. Providing a pixel count of about 4200K and an effective resolution of 3540K pixels (4:3).

- It includes 64GB of internal memory and supports Memory Stick PRO Duo™, Memory Stick PRO-HG Duo™, and SD/SDHC/SDXC cards.

- The camcorder captures still images at 7.1 megapixels and records video in 3D HD, HD, and STD formats with resolutions up to 1920×1080/60i.

- It offers Dolby® Digital 5.1ch audio, built-in zoom microphones, and Clear Phase Stereo Speakers. Along with optical image stabilization, a 10x optical zoom for 3D, and a 12x zoom for 2D.

- The 3.5-inch Xtra Fine LCD™ 3D display features TruBlack™ technology. Additional features include Auto/Manual focus, AE Shift, face detection, and smile shutter.

- Connectivity options include HDMI out, USB ports, and memory card slots. Measuring 54.5mm x 64.5mm x 128mm and weighing approximately 640g (excluding battery). The camcorder operates on an InfoLITHIUM® battery with a power consumption of 5.8W in 3D HD and 3.9W in HD mode.

- The package includes various cables, a remote, and a software CD-ROM.

(Source: Sony)

Nikon D3 FX DSLR Camera

- The Nikon D3 FX DSLR Camera is designed to deliver high-performance imaging with its 12.1-megapixel FX-format (23.9 x 36mm) CMOS sensor.

- It features a fast and accurate 51-point autofocus system with 3D Focus Tracking, ensuring precise focus on subjects.

- The camera is capable of continuous shooting at up to 9 frames per second at full FX resolution, making it ideal for capturing fast-paced action. Images are captured to CF I/II cards, providing ample storage and flexibility.

- The 3.0-inch super-density VGA color monitor, with 920,000 dots, offers a clear and detailed display with 170-degree wide-angle viewing and tempered glass protection for durability.

- This combination of advanced features makes the Nikon D3 a robust and reliable choice for professional photographers.

(Source: Detec)

GoPro MAX Waterproof 360 Action Camera

- The GoPro MAX Waterproof 360 Action Camera is a versatile and robust device designed for capturing high-quality action footage.

- The package includes the GoPro MAX camera, a camera case, a rechargeable battery, a curved adhesive mount, two protective lenses with lens caps, a microfiber bag, a mounting buckle with a thumb screw, and a USB-C cable.

- Users can choose between the HERO mode or the 360 mode to capture stunning 6K footage.

- The camera features Max HyperSmooth for unbreakable stabilization, making it ideal for high-intensity activities. It is waterproof up to 16 feet and built to withstand tough conditions.

- The camera offers premium 360-degree stereo audio from six microphones and supports 1080p live streaming for vlogging. Additional features include Max TimeWarp, PowerPano, and four digital lenses, ensuring users can nail any shot.

- The GoPro MAX is compatible with the Quik app and over 30 mounts and accessories, enhancing its versatility and functionality.

(Source: GoPro)

Key Export 3D Camera Statistics

- In 2022, China led the global export market for cameras with an export value of USD 809 million, accounting for 26.7% of the market.

- Hong Kong followed with exports worth USD 404 million, representing 13.4%.

- Malaysia held the third position with USD 281 million in exports, making up 9.31% of the market share.

- Thailand exported cameras worth USD 194 million, contributing 6.41% to the market. While the Netherlands and Japan exported USD 130 million and USD 124 million worth of cameras, respectively, accounting for 4.29% and 4.1%.

- The United States recorded an export value of USD 114 million, representing 3.78%, and Germany followed with USD 87.7 million, making up 2.9%.

- Vietnam’s exports stood at USD 78.8 million (2.61%), Sweden at USD 73.8 million (2.44%), and South Africa at USD 70.4 million (2.33%).

- Italy exported cameras worth USD 58.9 million, holding a 1.95% share. While the Philippines exported USD 55.9 million, making up 1.85%.

- The United Kingdom and the United Arab Emirates had export values of USD 51.4 million and USD 45.6 million, respectively, accounting for 1.7% and 1.51% of the market.

- This data highlights the prominent role of Asian countries in the global camera export market. With China and Hong Kong being the top exporters.

(Source: The Observatory of Economic Complexity)

Key Import 3D Camera Statistics

- In 2022, China emerged as the leading importer of cameras, with an import value of USD 682 million, accounting for 22.6% of the global market.

- The United States followed with imports worth USD 369 million, representing 12.2%.

- Hong Kong imported cameras valued at USD 182 million, making up 6% of the market share.

- The Netherlands and Japan recorded import values of USD 156 million and USD 148 million, respectively, contributing 5.15% and 4.88% to the market.

- Germany’s imports stood at USD 128 million, representing 4.23%. While the United Kingdom imported cameras worth USD 92.4 million, accounting for 3.06%.

- Other notable importers include Turkey with USD 79.5 million (2.63%), Singapore with USD 58.6 million (1.94%), and India with USD 56.7 million (1.87%).

- France imported cameras valued at USD 54.9 million (1.82%), and Canada followed closely with USD 52.1 million (1.72%).

- Chinese Taipei’s imports amounted to USD 51.1 million, representing 1.69%. While the Philippines imported USD 50.5 million worth of cameras (1.67%).

- Thailand rounded out the list with imports valued at USD 47.9 million, accounting for 1.58% of the global market.

- This data highlights the significant demand for cameras in these countries, with China and the United States leading the market.

(Source: The Observatory of Economic Complexity)

3D Camera Ownership in Households Statistics

- The share of households in Denmark owning digital video cameras experienced fluctuations from 2008 to 2021.

- In 2008, 20% of households owned digital video cameras, and this figure increased to 24% in 2009.

- The ownership rate continued to rise, reaching 26% in 2010, before dipping slightly to 22% in 2011.

- A significant increase occurred in 2012, with ownership peaking at 31%.

- However, this was followed by a decline to 25% in 2013 and 24% in 2014.

- In 2015, the ownership rate rose again to 26%, only to decrease to 23% in 2016 and 21% in 2017.

- By 2018, the share had fallen back to 20%.

- The declining trend persisted, with ownership dropping to 16% in 2019, 15% in 2020, and slightly recovering to 16% in 2021.

- This data indicates varying levels of adoption of digital video cameras among Danish households over the years, with a notable peak in 2012 followed by a general downward trend.

(Source: Statista)

3D Imaging Systems Camera Applications Statistics

Manufacturing Applications

- 3D imaging systems in manufacturing utilize various methods tailored to specific needs and conditions.

- Triangulation methods, which offer 2D and 3D illumination with a depth of field (DOF) under 4 meters and measurement rates from 1 to 1000 kHz, are cost-effective and suitable for reverse engineering, quality assurance, CAD modeling, and inspection, though they may experience shadowing.

- Pulsed Time-of-Flight (TOF) scanning methods, with a DOF over 10 meters and measurement rates of 1 to 250 kHz, excel in bright conditions and are ideal for outdoor modeling and documentation, typically with uncertainty between 5 mm and 50 mm.

- Amplitude Modulated (AM) TOF scanning methods, offering a DOF of 1 to 100 meters and measurement rates from 50 to 1000 kHz, are used indoors for tooling, reverse engineering, and metrology of larger parts, with uncertainty ranging from 0.05 mm to 5.00 mm.

- Frequency Modulated (FM) TOF scanning methods, characterized by a DOF under 10 meters and slower scanning rates of 0.01 to 2.0 kHz, provide the highest sensitivity and dynamic range but are the most expensive, primarily used for large-scale dimensional metrology with uncertainties between 0.01 mm and 0.25 mm.

(Source: National Institute of Standards and Technology – U.S. Department of Commerce)

Autonomous Mobility Applications

- 3D imaging systems play a crucial role in autonomous mobility, utilizing various methods to enhance navigation and safety.

- Pulsed Time-of-Flight (TOF) scanning methods, with light beam illumination and multiple scanning planes, offer a wide field of view (FOV) and a depth of field (DOF) greater than 100 meters.

- They provide high measurement rates exceeding 1 million pixels per second and perform well in bright conditions, making them suitable for military unmanned ground vehicle (UGV) navigation, terrain mapping, and automotive collision avoidance, with uncertainties ranging from 5 mm to 50 mm.

- Pulsed TOF non-scanning methods, featuring high-power 3D illumination and a variable narrow FOV, support DOF over 10 meters and array sizes up to 256 x 256, operating at rates above 30 Hz.

- They are used for robotic vehicle navigation and security, with uncertainties between 2 cm and 5 cm.

- Focal Plane Array (AM TOF) methods, with non-scanning operation and a narrow FOV of 40° x 40°, offer the largest array sizes up to 200 x 200 and real-time operation up to 100 frames per second.

- They have a typical DOF of 0.5 to 30 meters, are cost-effective, and are used for real-time perception in industrial robots and safety systems, with uncertainties around ±1 cm.

(Source: National Institute of Standards and Technology – U.S. Department of Commerce)

Construction Applications

- 3D imaging (3DI) systems utilized in construction applications are characterized by horizontal fields-of-view (FOVs) of 360° and vertical FOVs of 80° or better, with measurement uncertainties in millimeter order.

- These systems have maximum ranges extending from approximately 50 meters to over a kilometer.

- Various state Departments of Transportation (DOTs) employ 3DI systems for land and highway surveys, typically utilizing those with maximum ranges between 100 meters and 200 meters.

- For applications such as volume determination in mining and excavations, as well as topographic mapping, systems with longer maximum ranges are more efficient.

- In contrast, 3DI systems used for clash detection and the creation of as-built models generally have maximum ranges of 50 meters to 200 meters.

- For tolerance checking, systems with ranges of 50 meters or greater and measurement uncertainties on the order of millimeters or better are commonly employed.

(Source: National Institute of Standards and Technology – U.S. Department of Commerce)

Technological Developments in 3D Camera Statistics

- Technological advancements in 3D cameras have significantly enhanced their capabilities and applications.

- Recent developments include the introduction of the Persee N1 by Orbbec, leveraging the Nvidia Jetson platform to provide a robust, ready-to-use solution for developers, and streamlining the integration of 3D vision into various projects.

- Another notable innovation is the collaboration between Jabil, AMS OSRAM, and Artilux, resulting in a 3D camera that operates in short-wavelength infrared (SWIR) at 1130 nm, suitable for both indoor and outdoor environments.

- This camera enhances automation by improving obstacle identification, collision avoidance, and route planning.

- The market for 3D cameras is projected to grow significantly, driven by applications in robotics, industrial automation, and smart city technologies.

- These advancements highlight the expanding role of 3D cameras in various industries, offering precise and comprehensive 3D data critical for the advancement of AI and autonomous systems.

(Sources: Electronics 360, Printed Electronics Now)

Regulations for 3D Camera Statistics

- Regulations for 3D cameras vary significantly by country, reflecting different security, privacy, and technological considerations.

- In the United States, the Federal Communications Commission (FCC) governs wireless communications for 3D cameras, ensuring devices comply with standards to prevent interference.

- In the European Union, the General Data Protection Regulation (GDPR) impacts the use of 3D cameras, particularly concerning the collection and storage of personal data.

- Germany enforces strict privacy laws that mandate clear signage and consent when using 3D cameras in public spaces.

- In China, regulations by the Ministry of Industry and Information Technology (MIIT) require manufacturers to adhere to cybersecurity laws, ensuring data security and local storage.

- India‘s Directorate General of Civil Aviation (DGCA) regulates the commercial use of 3D cameras in drones, necessitating licenses and insurance.

- In contrast, Japan‘s Ministry of Internal Affairs and Communications (MIC) sets guidelines for electromagnetic compatibility and interference, with additional privacy safeguards under the Act on the Protection of Personal Information (APPI).

- These regulations collectively ensure that 3D cameras are used responsibly and ethically across different regions.

(Sources: Drone Made, UAV Coach, Dronegenuity)

Recent Developments

Acquisitions and Mergers:

- Apple acquires LinX Imaging: In early 2023, Apple completed its acquisition of LinX Imaging, an Israeli company specializing in 3D camera technology, for $345 million. This acquisition aims to enhance Apple’s imaging capabilities in its iPhone and iPad product lines. Providing superior depth-sensing and augmented reality (AR) features.

- Intel acquires Itseez: Intel acquired Itseez, a company known for its computer vision technology, for $50 million in mid-2023. This merger is expected to strengthen Intel’s RealSense 3D camera offerings by integrating Itseez’s advanced algorithms and vision processing software.

New Product Launches:

- Sony’s DepthSense Camera: In early 2024, Sony launched the DepthSense camera, a new line of 3D cameras designed for use in smartphones, gaming consoles, and AR/VR devices. These cameras offer high-precision depth sensing, faster processing, and improved low-light performance.

- Intel RealSense D455: Intel introduced the RealSense D455 in mid-2023, an advanced 3D camera with a wider field of view and enhanced depth perception capabilities. This product targets applications in robotics, drones, and industrial automation.

Funding:

- Occipital raises $80 million: In 2023, Occipital, a company specializing in 3D sensing and computer vision, raised $80 million to expand its product line. Enhance its Structure Sensor technology and accelerate market expansion efforts.

- Vayyar Imaging secures $109 million: Vayyar Imaging, a leader in 4D imaging radar technology, secured $109 million in early 2024 to develop new 3D imaging solutions for healthcare, automotive, and smart home applications.

Technological Advancements:

- AI and Machine Learning Integration: Advances in AI and machine learning are being integrated into 3D cameras to improve object recognition, scene understanding, and real-time data processing, enhancing their utility in various applications.

- Miniaturization and Integration: The development of smaller, more integrated 3D camera modules is enabling their use in compact devices. Such as smartphones, wearables, and IoT devices, expanding the market reach of 3D imaging technology.

Market Dynamics:

- Growth in 3D Camera Market: The global 3D camera market is projected to grow at a CAGR of 14.2% from 2023 to 2028. Driven by increasing demand in smartphones, automotive, and industrial applications, as well as advancements in AR/VR technologies.

- Rising Adoption in Automotive Industry: 3D cameras are seeing increased adoption in the automotive industry for applications. Such as autonomous driving, driver assistance systems, and in-cabin monitoring, contributing to market growth.

Regulatory and Strategic Developments:

- EU GDPR Compliance for 3D Cameras: Manufacturers are enhancing their 3D camera systems to comply with the General Data Protection Regulation (GDPR) in the European Union. Focusing on data privacy, secure storage, and transparent processing of visual data.

- US FCC Guidelines on 3D Imaging Devices: The US Federal Communications Commission (FCC) issued new guidelines in early 2024. To regulate the use of 3D imaging devices, ensuring their safe and effective operation in consumer and industrial applications.

Research and Development:

- Advanced Depth-Sensing Technologies: R&D efforts are focusing on developing advanced depth-sensing technologies. Such as time-of-flight (ToF) and structured light to improve the accuracy and resolution of 3D cameras, enabling more precise and reliable imaging.

- Multi-Camera Systems: Researchers are exploring the use of multi-camera systems to provide comprehensive 3D mapping and enhanced depth perception. Supporting applications in robotics, virtual reality, and augmented reality.

Conclusion

3D Camera Statistics – The global 3D camera market is experiencing significant growth, driven by technological advancements, diverse applications, and rising consumer demand.

Key players such as Intel, Fujifilm, Nikon, Hewlett-Packard, Canon, and Panasonic are leading this expansion.

The Asia-Pacific region dominates the market, followed by North America and Europe. 3D cameras are essential in various fields. Including autonomous mobility, construction, and manufacturing, each utilizing specific imaging methods.

Despite challenges like high costs and regional adoption rates, ongoing research and development are expected to address these issues. Overall, the 3D camera market is poised for continued growth and innovation.

FAQs

The 3D camera captures three-dimensional images by using multiple lenses or sensors to mimic the depth perception of human eyes. Creating a more immersive and realistic viewing experience.

3D cameras work by capturing multiple images from different angles simultaneously. These images are then combined using software to create a single 3D image that can be viewed from different perspectives.

3D cameras are used in various applications, including virtual reality, augmented reality, film and entertainment, industrial inspections, construction, autonomous vehicles, and medical imaging.

Benefits include enhanced depth perception and improved accuracy in measurements. Better quality control in manufacturing, realistic virtual simulations, and advanced capabilities in autonomous navigation.

Common 3D imaging methods include Triangulation (active), Pulsed Time-of-Flight (TOF), Amplitude Modulated (AM) TOF, and Frequency Modulated (FM) TOF.

Typical characteristics include horizontal fields-of-view of 360°, and vertical FOVs of 80° or better. Measurement uncertainties in millimeters, and maximum ranges from about 50 meters to over a kilometer.

Challenges include high costs, technological limitations, and varying regional adoption rates. Ongoing research and development efforts are expected to mitigate these issues.