Table of Contents

3D Printing Statistics: 3D printing (also known as additive manufacturing) has revolutionized how we create and design objects.

Thanks to its ability to transform digital designs into tangible prototypes and functional products. 3D printing technology has gained considerable traction across numerous industries.

In this article, we will delve deeper into its statistical landscape. Exploring its market value, regional analysis, statistical graphs, future projections, and benefits of different types of 3D printing derived from reliable sources for an unbiased overview of this subject matter.

Editor’s Choice

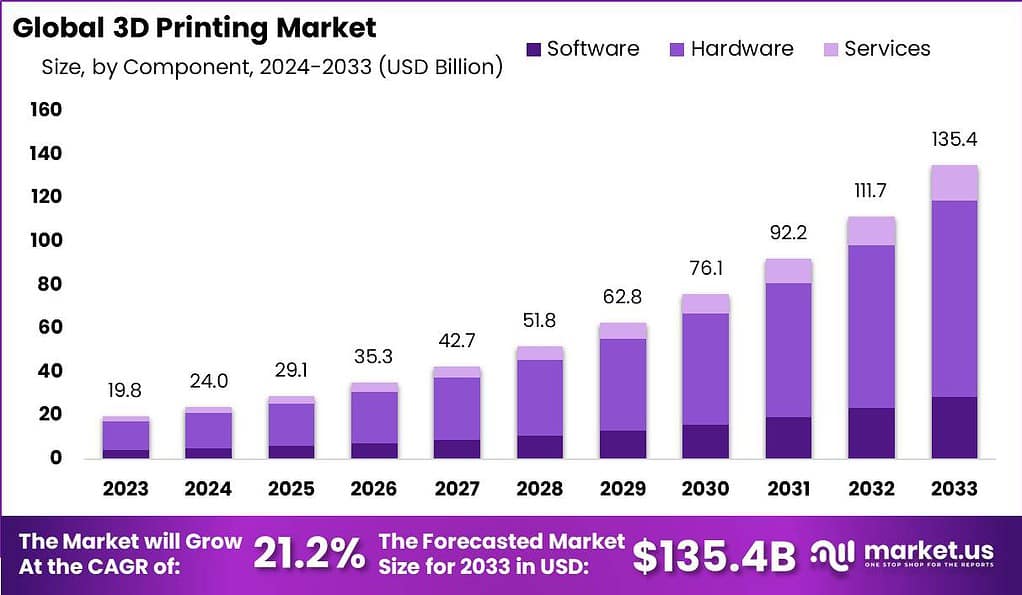

- The Global 3D Printing Market is projected to be worth USD 19.8 billion in 2023. The market is likely to reach USD 135.4 billion by 2033. The market is further expected to surge at a CAGR of 21.2% during the forecast period 2024 to 2033.

- Engineering sector firms increased their utilization of 3D-printed functional end-use components by 54% in 2020. 3D printing worldwide reached $13.8 billion by 2021 with North American sales amounting to $5.72 billion.

- Many analysts predict that the 3D printing industry will expand rapidly – anywhere between 18% to 27% annually. Approximately 2.2 million 3D printers will be shipped out by 2021.

- Equipment that prints 3D was estimated to cost an estimated total of 4.5 billion as of 2021. With materials accounting for an additional estimated market size of $1.7 billion.

- AutoDesk, HP Inc., 3D Systems, and Desktop Metal are among the top 3D printer manufacturers. Boasting market values exceeding $68.2 billion respectively. Investors recognize this buzz: in 2018, venture capital investments in 3D printing companies reached $300 million!

- Companies already employing 3D printing technology are also highly enthusiastic about it. 23% have indicated their plans to invest more than $100K in 3D printing technology by 2020.

- When asked about the advantages 3D printing offers over other production methods. 60% of respondents pointed to its remarkable ability to design complex geometric objects quickly and efficiently. 52% also enjoyed its speedy production rate while 41% highlighted its ability to mass customize products.

- 38% of businesses that utilize 3D printing consider it their main line of business. 18% have internal departments dedicated solely to it; while 16% employ it across various departments.

3D Printing Market Values Statistics

(Source: Statista)

3D Printing Statistics – Benefits

- The UK 3D printing market is projected to experience a compound annual growth rate of 10% over the coming years. Placing the UK at the fifth highest in terms of adoption worldwide. 3D printing was most commonly utilized for proof-of-concept and prototyping purposes.

- Most companies recognize 3D printing for its ability to speed up part delivery. 72% of aerospace industry prototyping requirements can be met through this technology. 55% of manufacturers favored this form of prototyping due to reduced costs.

- As of 2021, 3D printing makes up roughly 0.1% of the global manufacturing market. Within that context, in 2019 alone the global 3D printing market was worth over $10 billion while the materials market value stood at $1.5 billion – 82% of 3D printers use plastic as printing material!

- Other benefits of mass reduction (23%), assembly step reduction (22%), continuous improvement, and supply chain optimization (9%) are realized.

- According to over 40% of enterprises, rapid prototyping iterations and lead time reduction are among the primary advantages, followed by mass customization and cost savings.

Usage Statistics of 3D Printing

- 54% of engineering firms increased their 3D use of functional end-of-use components in 2020.

- Metal printing for 3D is becoming an increasingly popular practice as companies around the globe deal with concerns over plastic use. In 2018, 65% of 3D printers employed plastic filament, while 36% utilized metal.

- 7% of 3D printing service providers reported creating 1,001 to 10,000 parts annually. Another quarter stated they produced between 10,000 and 500.000 parts annually.

3D Printing Statistics – Market

- While 3D printing still accounts for only 1% of the world manufacturing market. This technology is poised to become an essential tool in manufacturing workflows.

- In 2019, the world’s additive manufacturing market increased to nearly $10.4 billion. Achieving the critical double-digit billion mark to the highest level in its 40-year history. (SmarTech Analysis of the Market for 2020 Additive Manufacturing Overview with a Summary of Opportunities Report)

- In the year 2018, VC investment surpassed $300 million for start-ups linked with 3D printers. The common thread in all investments is Industrial solutions as well as applications. (Hubs the 3D Printing Trends Report 2019)

- The market for 3D printing is expected to double every three years. With annual growth forecast by analysts ranging between 18.2 and 27.2%. (Hubs and The 3D Printing Trends Report 2019)

- 71% of companies believe that ignorance is the most significant factor influencing the decision-making process for projects to employ 3D printing or conventional methods. Likewise, 29% say they lack confidence regarding 3D printing as a solid. (Jabil An Assessment of 3D Printing Manufacturing Stakeholders, 2019)

- Based on the number of players in the industry the system manufacturers comprise the largest portion of the market for AM (38%) but the share of providers for services has grown significantly to 34%. (Ernst Young and Young 3D printing – the hype is it a game-changer? A Global EY Report 2019)

- The market for 3D printing is expected to grow by a factor of 2 every 3 years. The annual growth forecast by analysts ranges between 18.2 and 27.2%.

- HP’s Multi Jet Fusion has become one of the most rapidly growing polymer 3D printing processes. A total of 10 million pieces were made by using MJF 3D printers in the year 2018.

- Based on the number of players in the industry, systems manufacturers constitute the largest segment in the AM market. However, service providers have increased rapidly up to 34%.

- In the year 2019, 3D printing revenue accounted for around 0.3% of the world footwear market revenue as per SmarTech Analysis.

- The market for orthopedic 3D printing was worth $ 691 million as of 2018 and is forecast by SmarTech Analysis to grow into the $3.7 billion market in 2027.

- The market for medical 3D printing comprises products as well as services. Software as well as hardware is estimated to be valued at $1.25 billion, as per SmarTech Analysis.

- In 2019, 3D printing revenue was around 0.3% of world footwear market revenues as per SmarTech Analysis. (SmarTech Analyzes, Report on Markets for 3D Printed Footwear 2019 Report)

- The market for orthopedic 3D printing was worth $ 691 million as of 2018 and is forecast by SmarTech Analysis to grow into the $3.7 billion market in 2027.

- The market for medical 3D printing, which includes products as well as services, and software equipment, is estimated to be valued at $1.25 billion, as per SmarTech Analysis.

- Research company, CONTEXT, estimates that metal 3D printers will grow year-on-year at a unit-volume rate of 49% or more.

- A study by SmarTech Analysis suggests that revenues for 3D-printed dental implants will increase to $3.7 billion by 2021. Additionally, the technology will be the most popular manufacturing method for dental restorations as well as devices around the world by 2027.

- It is believed that the USA, UK, Germany, France, and China are the top five nations with the highest 3D printer use and rates of investment. (Ultimaker, 3D Printing Sentiment Index)

- The metal AM market was valued at EUR 1.51 billion as of 2018 and is projected to expand by a 25% CAGR.

- A 3D-printing ceramic market is predicted to grow from a 20 million-dollar revenue opportunity in 2020 to more than $400 million by 2029 according to a study by SmarTech Analysis.

- The market for 3D printing worldwide size was estimated at USD 13.84 billion as of 2021. It is predicted to grow by a compound annual growth rate of 20.8% from 2022 until 2030.

- The segment of industrial printers led the market and contributed to more than 70.0% of total revenue for 2021.

- Germany produced around EUR1 billion in revenue related to AM in the year 2019.

- The 3D printing market will be estimated the sum USD 13.84 billion by 2021. This is projected to grow to USD 16.75 billion by 2022.

- The 3D printing market is predicted to grow at an annual rate of growth of 20.8% between 2022 and 2030. It is expected to be USD 76.17 billion in 2028.

- The metal segment dominated the global market for 3D printing and contributed more than 50.6% of worldwide revenue in 2021.

- The stereolithography segment dominated the world 3D printing market and was responsible for more than an 8.9% share of total revenue for 2021.

- This trend is predicted to continue for the duration of the market for additive manufacturing in the world and is expected to expand by 24% between 2023 and 2025 The demand for 3D printing is projected to nearly triple in size between 2020 and 2026.

- The employment market for 3D printing companies isn’t particularly dynamic. Since 60% of companies didn’t plan on hiring employees in the year 2019.

- 63% of respondents think that the technology can have an impact and 89% of them believe that it will significantly cut down on lead times, ensuring that products less time to be available for sale.

- Automotive, medical aerospace, and medical sectors are predicted to be 51% of the global 3D printing industry by 2025.

- By 2021 3D printing accounts for approximately 0.1% of the global manufacturing market.

- The government hopes to boost its market share by 8% from 5%.

- In the year 2021, 3D printers accounted for about 0.1% of the world manufacturing market.

- According to a report from Ernst and Young, the 3D printing market is dominated mainly by system makers (consisting of 38%).

- The next step is service providers which make up about 34% of the total market.

- This market for am is expected to grow by a third and will reach $37.2 billion by 2026, according to HUBS Trend Report.

- When broken down into hardware, software, and other services. Hardware is the most dominant in the market with a major of more than 63%. It is followed by software, and finally services.

- The stereolithography sector in the 3D printer market was responsible for over 10% of the market’s total revenue in 2020. This segment holds the biggest share of revenue among the oldest and traditional printing techniques.

- It is estimated that the 3D printing market is projected to reach$9.4 billion by 2022 in the medical sector by itself.

- Comparatively to other markets such as the drone market 3D printing has a relatively large CAGR percentage and is expected to generate revenue running into the billions in the coming years.

- Prototyping is the most popular method of application. It will lead this segment of the market in terms of more than 50% of revenues worldwide by 2020 due to the growth of industries that are adopting 3D printing to create prototypes.

- Functional parts, a separate part of the application market are predicted to grow at a rate of 21.5% from 2021 until 2028. Alongside this, there will be a rising demand for designing and manufacturing functional components.

- In terms of verticals, the automotive sector holds the largest portion of the 3D printing for industrial use market, accounting for more than 23% of the sector’s global revenues.

- When it comes to the materials that are employed in 3D printing. Metal dominates the market with over 48% of global revenues and is expected to grow at a CAGR of 23.3% in six years.

- Between 2026 and 2018 Between 2018 and 2026, the 3D printing material market is expected to expand by 12% per year to just under $ 4 billion by 2026.

- Design software was the main reason behind greater than 36% of all global revenue from the 3D printing market in 2020, and is predicted to continue to dominate market share in the 3D printing market.

- The market for 3D printing in healthcare was estimated at $1,036.58 million in the year 2020. The market is projected to grow to $5,846.74 Million by 2030, at a CAGR registered of 20.10%.

- According to a SmartTech Analysis, 3D-printed prosthetics, and orthotics. As well as audiology market is projected to earn 509 million dollars in revenue in 2026 and will grow to $996 million by 2030.

- The market is predicted to expand at a rate of 32.4% and is expected to grow to USD 5167.9 Million in 2026.

- The growing demand for 3D printed parts in defense and aerospace is expected to drive the 3D printing market for metals.

- According to our first survey of primary respondents, the 3D printing market for metals is projected to grow each year by around 32.4%.

- The market for 3D printing is predicted to grow by a factor of 2 every three years. With annual growth forecast by experts ranging from 18.2 and 27.2%.

- Based on the number of players in the industry, systems manufacturers comprise the largest market for AM however, there are service companies too. The number has increased rapidly, increasing to 34%.

- In the year 2019, 3D printing revenue accounted for about 0.3% of worldwide footwear market revenue as per SmarTech Analysis.

- The market for 3D printing in orthopedics was worth $691 million in 2018. It is forecast by SmarTech Analysis to grow into the $3.7 billion market in 2027.8.

- The market for medical 3D printing includes products as well as services. Software as well as hardware is forecast to reach $1.25 billion, as per SmarTech Analysis.

- The market for metal AM in the world was valued at EUR 1.51 billion as of 2018 and is expected to expand at a rate of 25% CAGR.

- The ceramic 3D printer market is predicted to grow from a 20 million-dollar revenue opportunity in 2020 to more than $400 million by 2029 according to a report from SmarTech Analysis.

- The dimensions of the 3D Printer Manufacturing industry are anticipated to grow by 20.7% in 2022.

- The amount of 3D Printer Manufacturing industry in the US has increased by 13.9% per year in the period between 2017 and 2022.

3D Printing Statistics – Adoption

- AM adoption is rising all over the world as evidenced by over 70% of businesses discovering new applications for 3D printing by the year 2019. 60% of them use 3D printing, CAD, simulation on, ion, or reverse engineering internally.

- The scanner software segment is predicted to grow at the largest CAGR of 21.7% from 2022 until 2030. The segment is expected to generate significant revenue during the forecast timeframe due to the increasing use of scanners.

- AM adoption is rising across the globe as evidenced by over 70% of businesses discovering new applications for 3D printing by the year 2019. 60% of them using CAD, simulation, or reverse engineering in-house.

- The adoption of additive manufacturing is increasing across the globe and is evident by the fact that more than 70% of businesses discovering new applications for 3D printing by the year 2019. 60% of them using CAD, simulation, or reverse engineering in-house.

Latest Updates, Statistics of 3D Printing

- The share of companies that have AM systems in-house has nearly quadrupled over the three years preceding it, soaring from just 9% in 2016 up to 40% by the end of 2019.

- The amount of companies that use 3D printing for production on a full scale has risen by two-thirds between the years 2018 and 2019, with 21 40% and 21% respectively.

- 79% of companies surveyed believe that they will use 3D printing to produce items or products to increase by at least a third within the next three or five years.

- In the defense and aerospace industries, the most well-known use for 3D printing would be prototyping. This is then repaired as well as research and development as well as production components.

- The research firm CONTEXT predicts that 3D printers manufactured in metal will experience year-one-year volume increases of more than 49%.

- 62% of the worldwide deployed PBF steel AM equipment is via German suppliers.

- In the case of metal PBF processes, up or 40% to 60% of raw component costs are correlated with the material cost.

- For powder-based DED techniques, the powder could comprise up to 70% or more of the component cost, and for Wire Arc Deposition even up to 80%.

- The Powder Bed Fusion family plays the most important part in metal AM, making up 80% of metal AM systems installed worldwide.

- 72% of the companies that were surveyed by EY’s Global 3D Printing Report 2019 use AM systems made of polymer, as against 49% who employ metal AM systems.

- These trends together suggest an accelerated growth of the material industry which is projected to grow into a massive $4.5 billion market in the next five years.

- The majority of manufacturing executives believe that an open-minded ecosystem is crucial for advancing 3D printing on a large scale.

- The most widely used material used for 3D printing is still plastics, with 82%.

- Companies that use 3D printing also use carbon fiber and composites.

- The segment of polymer AM was estimated to be worth $5.5 billion in 2018.

- 94% of the companies that were surveyed claim that designers prefer traditional manufacturing due to the absence of additive material.

- According to a whitepaper written by RIZE.

- The Effects of Postprocessing) Postprocessing can add anywhere between 17% to 100% to the time spent printing in an entire batch.

- 66% of companies say they are having 2 or more issues regarding the current Post.

- 75% of companies identify the time it takes to finish the parts as a major issue for Their Post Printing, while for 51% of the respondents, the problem is an inconsistency.

- In the EY Report 2019, service providers account for 34% of the world’s AM market.

- In 2022, almost one-third of the 900 companies surveyed are planning to design and build AM components through service suppliers.

- Small and midsized companies account for more than 75% of 3D printing online services worldwide, making up over 75% of customers served with 3D printers in the consumer goods industry; industrial goods come second and automotive goods are third.

- 37% of 3D printing service providers reported producing between one and 10,000 parts per year in 2018. Since 2016, when companies used service providers at only 8%, that number has more than tripled to 26% by 2019.

- Nearly 81% of businesses are reluctant to invest in their systems as the primary reason to partner with service providers, while 48% do not understand AM procedures and standards, and 38% express confusion regarding AM design.

- The market for functional parts is projected to experience annual compound annual growth rates of about 17% between 2020-2023, with functional component design and construction increasing demand at an astounding compound annual growth rate of 21.4% from 2022-2030.

- At least 32% of the world’s population lived in America while only 13% was found in Asia.

- This study involved 1,000 participants from Europe (60%), America (25%), Asia & Oceania (9%) as well as Africa (1%).

- 2018’s top three 3D applications included production (43%), prototyping (55%), and Proof of Concept Models (41). 89% of firms that employed 3D printing found an advantage with shorter run sizes versus their competition.

- 36% of companies utilized metal 3D printing components during 2018, up from 28% in 2017. Small and Medium Enterprises (SMEs ) represent 75%+ of online 3D printing customers worldwide.

- Companies are rapidly turning to 3D printing as an expedient means for product development, with 39% more companies adopting this technique compared with only 29% doing so in 2017.

- 98% of power users of 3D printing identified distinct advantages over competitors using this technique, with 55% ranking speeding product development as their top priority. Businesses advertising themselves as being among the first to print 3D have seen their number grow from 15% in 2017 to 22% by 2018.

- Businesses are now more commonly using FDM 3D printing equipment than ever before – up from 11% reported last year!

- Polishing (48%), painting (27%), and cutting (23%). These finishes account for the most frequently printed items on 3D printers.

- Spending trends among companies with budgets exceeding $100K rose dramatically to 12% in 2018, up from only 4% the previous year.

- Manufacturers are increasingly turning to 3D printing as a competitive edge, using it to differentiate themselves on quality, customization, and speed – representing 21-30-30-29% respectively of manufacturers in each age bracket. Furthermore, 74% of companies indicated their competitors already utilize this form of 3D printing; 59% noted this in 2017.

- 3D printing has quickly become an effective means to gain competitive advantages, as evidenced by 93% of participants. 46% of businesses reported greater returns on investments in 2018 versus 2017 for 49% of businesses who experienced similar returns on investments.

- R&D design, production, and engineering departments have seen the highest adoption of 3D printing; their respective adoption rates being 46%, 43%, and 41%, respectively.

- Four out of ten firms surveyed use 3D printing for complex geometries. Plastic use for 3D printing decreased significantly from 2017 levels: only 65% of businesses utilized plastic materials as 3D printing material in 2018.

- In the 2017 survey 2017, 53% of participants did not own printing equipment, while only 28% of them had greater than one.

- 29% of the firms were using SLA and 15% had SLS 3D printers.

- Three-dimensional printers with DMLS technology are the most well-known, with metallic printing at 16%.

- 40% of users identified as being novices in 2017, as opposed to 15% who declared themselves to be beginners in 2018.

- 41% of professionals considered themselves to be intermediates and nearly 50% of them are experts in their area.

- Regarding how professionals develop their capabilities in 3D printing 41% of them prefer an internal approach 15% read 3D print blogs. and 14% are present at industry events, and 11% are online and in person.

- There is however a notable increase in the number of project managers, with 13% of firms planning to hire a few in 2018, there were only 3% who were looking to employ managers in 2017.

- 38% of companies did not observe any change in turnover, compared with 47% in 2017.

- Industries that manufacture industrial products in comparison to other consumers, utilize 3D printing primarily for production, not for standard samples, at a frequency of 50 to 43%.

- There are more 3D printing companies in this field (30%age as compared to. 22%age).

- Industrial product manufacturers also make use of more metals (46% as compared to. 36%) and use fewer plastics (56% as compared to. 56% vs.).

- The industry is also home to more professionals (50% against. 42%).

- There are a lot more novices in the consumer industry than in other industries (16%).

- This area makes greater use of the technology used throughout all phases of the life cycle that an item has than a typical model, as shown in the increase of 7% for prototyping as well as 7% more production plus 9% demonstration of the concept.

- 57% of the companies also reported higher ROI in 2018 compared to 2017.

- There are a few novices making use of 3D printing technologies within Aeronautics The majority of professionals working in Aeronautics were deemed experts with 38% of them being intermediates.

- 64% of those who use it use it in the production process which is much higher than that of other industries.

- 37% of these users also invested over $100K in 3D printing in the year 2018.

- 61% of professionals, for instance, utilize 3D printing with metal as compared to 30% of the average sample.

- 91% of this group consider 3D to be an avenue to boost creativity.

- 53% of people believe that the technology isn’t operating at its true potential and requires additional training and confidence.

- 20% of the world’s top 100 companies in the field of consumer goods are planning to implement 3D printing for the production of consumer products.

- 20% of companies are running internal initiatives to create innovative 3D printed products and services.

- The manufacturing industry that uses additives is expected to reach $20 billion in 2022, with an equivalent compound annual increase of 27% from 2016 to 2022.

- As of 2015, a giant of aviation Boeing was believed to have equipped its aircraft with over 22,000 3D-printed parts.

- The 3D printing industry in the UK is predicted to grow at a 10% CAGR.

- 72 72% of all prototyping requirements for the aerospace sector can be solved through 3D printing.

- 55% of manufacturers reported that they would prefer 3D printing because of the lower costs.

- 82% of 3D printing is made with plastics as the material for printing.

- The UK’s 3D printing market is expected to expand at a rate of 10% between 2021-2026.

- The principal reason for the rapid growth of Italy is that the Italian government provides an income tax cut of approximately 300% on any investment made in the industry.

- The share age of manufacturers that claimed they utilized 3D printing technology in their production was 40%.

- An analysis of the technology had the greatest use in prototyping, then studies and research (44%) repair (43%), and the manufacturing of components (39%).

- 66% of businesses said that the main advantage of 3D printing was the speedier part delivery.

- The speed may be due in part to the fact that 3D printers are digitalized instead of mechanically based.

- Every 3D printer can produce parts based on the inputs received.

- Other problems that the technology are higher costs (53%) the inability to obtain materials (33%) and time constraints (27.7%).

- In addition, as was stated earlier, although the market is in its infancy It is predicted to grow at a fast pace of 10% CAGR.

- The most widely used material for 3D printing is plastic. This is being followed by other types of materials, such as carbon fiber (24%) as well as composites (20%).

- The market for 3D printing expanded 7.5% in 2020, despite the pandemic reaching nearly $12.8 billion.

- This is in contrast to the average of 27.4% over the last 10 years.

- Industrial printers contribute over 76% of the worldwide revenue of printers and the rest are desktop 3D printers. They comprise mainly hobbyists and small companies.

- FDM 3D printers account for 48% of the total 3D printers currently in use.

- The segment of ceramic, although still relatively new, is predicted to expand at a rate of 23.3% during the forecasted time.

- In 2020, the established 3D printer makers saw an increase in sales, while independent service providers reported a 7.1% increase in their sales across the globe, resulting in $5.3 billion in revenues for the entire group.

- 65 percent of engineering companies utilized 3D printing in 2020, while traditional manufacturing methods were not available.

- 70% of engineering companies believe that they will produce or procure more 3D-printed parts by 2021.

- In the past three years, the company has designed 4D footwear as well as their signature 4D lattice midsoles that comprise 40% bio.

- According to Forbes, the technology of the future for 3D printing is largely in prototyping, both for industrial printers and desktop printers.

- In the [190+ pages research study, the worldwide 3D Printing Metals Market in 2019 was estimated at USD 724.6 million.

- “According to the study, the global 3D Printing Metals Market was valued at USD 724.6 million in 2019 and is expected to grow to USD 5167.9 million by 2026.

- The world 3D Printing Metals Market is anticipated to expand with a compound rate of 32.4% between 2019 and 2027″.

- Recommended Reading the demand for Global Online Language Learning Market Size and Share will surpass the USD 28.5 Billion mark and grow at 18.8% CAGR until 2028.

- Shares Worth US$ 7915.1 million by 2028. showing an annual CAGR of 4.1%. Industry Trends.

- 71% of businesses say that lack of understanding is the biggest factor that affects the decision to go with 3D printing or conventional methods. meanwhile, 29% believe there is a lack of trust regarding 3D printing as a reliable method.

- The number of organizations having AM systems within their facilities nearly quadrupled over the three years preceding it, soaring from 9% in 2016 to 40% by the end of 2019.

- The number of companies using 3D printing to produce full-scale production has increased from 2018 to 2019 by 21% and 40% respectively.

- 79% of companies surveyed believe that they will use 3D printing for manufacturing items or products to increase by at least a third in three to five years.

- In the defense and aerospace industries, the most used use for 3D printing would be prototyping. This is then repaired as well as research and development as well as production components.

- The research firm CONTEXT has estimated that 3D printers made of metal will be able to see a year-to-year volume increase of 49%.

- 62% of all globally installed PBF AM systems for metal originate via German suppliers.

- In the case of metal PBF processes, up or 40% to 60% of raw component costs are correlated with the material cost.

- When using powder in DED methods, the powder could comprise up to 70% or more of component cost, and when it comes to Wire Arc Deposition even up to 80%.

- The Powder Bed Fusion family is the most important in metal AM, accounting for 80% of metal AM systems.

- According to EY’s Global 3D Printing Report 2019, 72% of organizations use polymer AM systems, compared to 49% who use metal AM systems.

- These tendencies point to faster growth in the materials business, which is predicted to rise to a large $4.5 billion app market in the next five years.

- 91% of manufacturing executives are convinced. The

- Plastics are still the most commonly used material for 3D printing, accounting for 82% of all usage.

- Companies that use 3D printing have also experimented with composites and carbon fiber.

- In 2018, the polymer AM segment was anticipated to be worth roughly $5.5 billion.

- Due to a paucity of additive materials, 94% of surveyed companies claim designers prefer traditional manufacturing.

- According to a whitepaper byRIZE. The Impact of Postprocessing), postprocessing can add between 17% and 100% to the batch time of 3D printing.

- 66% of businesses report having two or more issues with their existing Post.

- The Length of Time to Finish Parts is cited by 75% of organizations as a critical difficulty in their Post Printing, while a lack of uniformity is cited by 51% of respondents.

- According to the 2019 EY Report, service providers account for 34% of the worldwide AM environment.

- By 2022, nearly one-third of the 900 organizations polled anticipate designing and manufacturing their AM parts through service providers.

- Small and medium-sized businesses account for more than 75% of the global consumer base for online 3D printing services.

- Consumer goods are the most prevalent industry supplied by 3D printing service bureaus.

- Automotive and industrial items are in second and third place, respectively.

- 37% of 3D printing service providers reported annual production of 1,000 to 10,000 components.

- The share of businesses that use service providers has more than tripled from 8% in 2016 to 26% in 2019.

- Around 81% of businesses say they will continue to deal with service providers since they are unwilling to invest in their systems.

- 48% are unfamiliar with AM procedures and standards, while 38% are unsure about AM design.

- According to 80% of businesses, 3D printing enables them to innovate more quickly.

- 51% of businesses are actively employing 3D printing in production.

- The methodology of the study is based on interviews with 1,300 respondents from Europe (64%), the United States (16.6%), and Asia (20.2%).

- The research design includes eight industries: industrial goods (13.6%), high technology (10.6%), services (9.9%), consumer goods (8.6%), health and medical (6.2%), automotive (5.7%), aerospace and defense (5.5%), and education (4.9%).

- Manufacturers are increasingly turning to 3D printing as part of their overall manufacturing strategies, with 51% of respondents opting for this form of additive manufacturing compared with 38.7% in 2018.

- Roughly 50% of businesses consider quality controls their primary concern when using 3D printers.

- When asked which area of 3D printing or additive manufacturing they most enjoy using, over 50% responded with “CAD design.”

- High-tech manufacturing companies depend on 3D printing to prototype their products – representing 47% of companies that belong to this category. This trend also serves to speed up the development time of new products.

- 3D Systems holds 5.68% and Stratasys 0.92% of market shares according to Wohlers Report 2015. Wohlers projects the 3D printing business will experience annual compound annual growth between 2014-20 of over 31% per year with revenues estimated to top $21 billion worldwide by then.

- Within this period, 3D Systems witnessed its revenues increase only 3.6% while Stratasys saw its drop by 2%; neither result is anywhere close to meeting their projected 31% growth forecasts. Both technologies could make some aspects of 3D Systems and Stratasy’s current portfolios appear inferior.

- Comparative to the $4.1 billion total revenue earned by the 3D printing industry in 2014, 3D Systems made up 15.9% and Stratasys made up 18.3%.

- HP believes several businesses could reap great advantages from 3D printing but have not purchased a 3D printer yet.

Recent Developments

Mergers and Acquisitions:

Stratasys and Desktop Metal: Stratasys and Desktop Metal announced plans to merge, in a significant consolidation move in the 3D printing industry, valued at $1.8 billion.

3D Systems and Xerox Elem Additive: 3D Systems is also active, having acquired Xerox Elem Additive to expand its capabilities in metal 3D printing.

New Product Launches:

HP: Introduced new 3D printing automation solutions and announced three new Direct Metal Printing (DMP) systems at the RAPID + TCT event.

Nexa3D: Launched the XiP Pro 3D printer, showcasing advancements in speed and precision.

KOKONI: Launched its AI-led SOTA system at CES 2023, notable for its innovative ‘upside-down’ design which enhances stability and reduces vibration during printing.

Funding and Financial Movements:

ARRIS Composites: Raised $34 million from investors including Bosch for its 3D printing technology focusing on composite materials.

Alloy Enterprises: Garnered $26 million to boost production of 3D-printed aluminum parts, emphasizing the growing interest in 3D printing for industrial applications.

Sector Growth and Trends:

The 3D printing market size reached $17 billion in 2022 with a revised growth projection for 2023 estimated at $19.9 billion, reflecting a compound annual growth rate of 17%.

Prototyping continues to dominate the application segment of 3D printing, especially valued in the automotive, aerospace, and defense industries for its precision and reliability

Conclusion

3D Printing Statistics – 3D printing technology has revolutionized various industries and holds immense potential for future developments.

It has proven to be a game-changer in manufacturing, design, healthcare, and even in space exploration. By allowing the creation of complex geometries and customized products, it has opened up new possibilities for innovation and creativity.

One of the key advantages of 3D printing is its ability to reduce production costs and time. Traditional manufacturing processes often involve expensive tooling and long lead times, whereas 3D printing enables on-demand production, eliminating the need for inventory and reducing waste. This makes it particularly advantageous for small-scale production, prototyping, and customization.

FAQ’s

3D printing, also known as additive manufacturing, is a process of creating three-dimensional objects by layering or adding materials in a controlled manner based on a digital model. It enables the production of complex and customized objects with intricate details.

The process begins with a 3D design created using computer-aided design (CAD) software or obtained from a 3D scanner. The design is then sliced into thin layers, and the 3D printer builds the object layer by layer using various materials, such as plastics, metals, ceramics, or even biological materials. The printer follows the instructions from the sliced design to deposit or solidify the material in the correct locations until the entire object is created.

There are several types of 3D printers available, including:

– Fused Deposition Modeling (FDM) or Fused Filament Fabrication (FFF)

– Stereolithography (SLA)

– Selective Laser Sintering (SLS)

– Digital Light Processing (DLP)

– MultiJet Printing (MJP)

3D printing has various applications across industries, including:

– Rapid prototyping

– Manufacturing

– Healthcare

– Aerospace

– Education

– Architecture

3D printing can use a wide range of materials, including plastics (such as PLA and ABS), metals (such as titanium and aluminum), ceramics, resins, composites, and even food-grade materials. The material options depend on the specific 3D printing technology and the printer’s capabilities.

Some advantages of 3D printing include:

– Customization

– Complexity

– Rapid prototyping

– Reduced waste

– On-demand production

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)