Table of Contents

Introduction

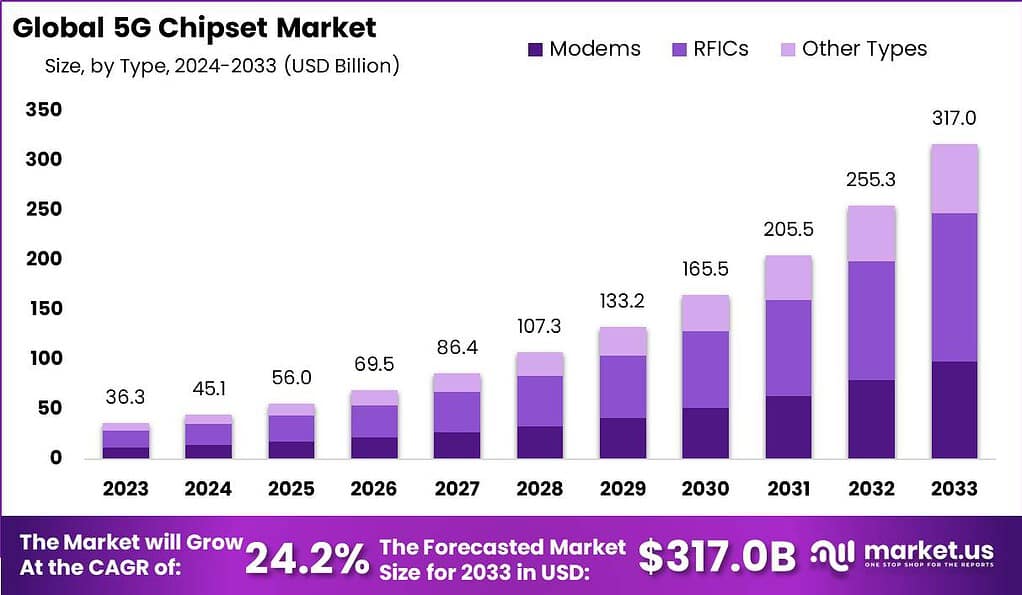

The 5G Chipset Market is poised for remarkable growth, with a projected worth of USD 317.0 billion by 2033, expanding at a notable CAGR of 24.2% from 2024 to 2033. A 5G chipset is a fundamental component of 5G technology that enables devices to connect to and utilize 5G networks. It serves as the core processing unit responsible for transmitting and receiving data at high speeds and low latency, facilitating the advanced features and capabilities offered by 5G networks. These chipsets are designed specifically to support the unique requirements of 5G, such as faster data transfer rates, improved network capacity, and enhanced network reliability.

The 5G chipset market has witnessed significant growth in recent years due to the widespread adoption of 5G technology across various industries and applications. As the demand for faster and more reliable connectivity increases, the need for efficient and powerful 5G chipsets has become paramount. Companies specializing in semiconductor manufacturing and telecommunications equipment have been actively developing and producing 5G chipsets to meet this demand.

To learn more about this report – request a sample report PDF

Key Takeaways

- The global 5G chipset market is projected to reach USD 317.0 billion by 2033, exhibiting a remarkable CAGR of 24.2% from 2024 to 2033.

- Qualcomm leads the market with a significant 44% share, generating ~USD 31.5 billion in revenue. It is followed by MediaTek, holding a 26% market share with revenues of ~USD 15.8 billion.

- RFICs Segment: Dominated the market in 2023 with over 47% share, due to their crucial role in handling complex radio frequency requirements of 5G networks.

- Sub-6 GHz Segment: Emerged as the dominant market segment in 2023, capturing more than 58% share, offering a balance between coverage and capacity.

- Smartphones/Tablets Segment: Commanded a significant market share of over 35% in 2023, driven by the proliferation of smartphones and tablets globally.

- IT & Telecom Segment: Emerged as the leader in 2023, capturing a significant market share of over 25%, owing to the industry’s forefront adoption of advanced technologies like 5G.

- North America: Emerged as the leader in 2023, capturing a significant market share of over 30%, attributed to early investments in infrastructure and proactive adoption of advanced technologies.

5G Chipset Statistics

- By 2023, the 5G chipset market is expected to reach a noteworthy revenue milestone of USD 36.3 billion.

- The growth trajectory continues with projected revenues of USD 45.1 billion in 2024 and USD 56 billion in 2025.

- The demand for 5G technology is surging, driving substantial gains in the market. Revenue estimates indicate USD 69.5 billion in 2026, USD 86.4 billion in 2027, and USD 107.3 billion in 2028.

- The trend continues with even more remarkable numbers, reaching USD 133.2 billion in 2029, USD 165.5 billion in 2030, and USD 205.5 billion in 2031.

- By 2032, the 5G chipset market is projected to reach a remarkable revenue milestone of USD 255.3 billion.

- The market is estimated to reach USD 317.0 billion by 2033.

- Samsung Electronics CO., Ltd. holds a substantial 16% market share, making it a frontrunner in the industry.

- Qualcomm Incorporated follows closely behind with a 10% share, known for its pioneering work in wireless technologies.

- Huawei Technologies Co., Ltd. and Infineon Technologies AG share 12% each, emphasizing their global presence and innovative contributions.

- Intel Corporation is also a prominent player with a 13% share, leveraging its expertise in semiconductor technology.

- MediaTek Inc. and Unisoc Communications, Inc. secure 9% and 8% market shares, respectively, showcasing their role in providing 5G solutions.

- North America holds the largest market share at 30.0%, driven by the rapid deployment of 5G networks and strong consumer demand for high-speed connectivity.

- Europe holds a market share of 10.0%, reflecting a somewhat slower adoption rate compared to North America.

- 5G chipsets offer substantially faster data speeds than 4G, boasting peak rates of up to 20 gigabits per second (Gbps).

- In the U.S., T-Mobile recorded an average 5G download speed of 186.3 Mbit/s, while South Korea leads globally with an average speed of 432 megabits per second (Mbps).

- The energy consumption of 5G is influenced by factors such as radio setup, hardware, and traffic load, with over 70% of energy consumption occurring within the Radio Access Network (RAN)

Emerging Trends

- Integration of Artificial Intelligence (AI): The 5G chipset market is witnessing a significant trend towards the integration of Artificial Intelligence. This allows for smarter and more efficient chipsets that can manage power consumption better and enhance data processing speeds. The AI integration aids in optimizing network traffic and improving user experiences by enabling advanced features such as real-time analytics and decision-making.

- Advancements in Semiconductor Technology: As the demand for higher speeds and more reliable connections increases, there is a push for advancements in semiconductor technology. The development of smaller, more efficient, and faster chipsets through techniques like EUV lithography is pivotal. This trend is crucial for meeting the performance requirements of 5G networks.

- Increased Focus on Energy Efficiency: Energy efficiency is becoming a paramount concern in the 5G chipset market. Manufacturers are focusing on creating chipsets that consume less power without compromising on performance. This is not only important for mobile devices to extend battery life but also essential for reducing the environmental impact of powering large-scale 5G networks.

- Enhancement of mmWave Technology: The millimeter wave (mmWave) technology is a cornerstone for 5G, enabling faster data speeds and increased bandwidth. The trend is towards enhancing mmWave chipsets to improve their range and reliability, especially in dense urban areas where 5G’s benefits are most needed. Overcoming the challenges of mmWave technology, such as signal attenuation, is crucial for the widespread adoption of 5G.

- Diversification of Supply Chains: The global 5G chipset market is experiencing a trend towards the diversification of supply chains. This is driven by the need to reduce dependency on single sources and to mitigate risks related to geopolitical tensions, trade disputes, and pandemic-related disruptions. Diversifying supply chains ensures a more stable and resilient production ecosystem for 5G chipsets.

Top Use Cases for 5G Chipsets

- Enhanced Mobile Broadband (eMBB): 5G chipsets are central to delivering enhanced mobile broadband services, offering higher data speeds and more reliable connections than ever before. This use case supports high-definition video streaming, virtual reality (VR) applications, and other bandwidth-intensive activities on mobile devices.

- Massive Machine Type Communications (mMTC): 5G chipsets enable mMTC, allowing the connection of a vast number of devices in the Internet of Things (IoT). This use case is essential for smart cities, industrial automation, and smart homes, where thousands of devices need to be interconnected efficiently and reliably.

- Ultra-Reliable Low Latency Communications (URLLC): URLLC is a critical use case for 5G chipsets, providing ultra-reliable and low-latency connections necessary for mission-critical applications such as remote surgery, autonomous driving, and emergency response services. The performance of 5G chipsets is key to enabling these time-sensitive and high-stakes applications.

- Fixed Wireless Access (FWA): FWA is a rapidly growing use case for 5G chipsets, offering an alternative to traditional wired broadband connections. By utilizing 5G networks, FWA provides high-speed internet access to homes and businesses, especially in areas where laying cables is challenging or not cost-effective.

- Cloud Gaming and AR/VR: The low latency and high data speeds of 5G chipsets unlock the potential for cloud gaming and augmented reality/virtual reality (AR/VR) experiences. These applications require quick data processing and transmission to deliver immersive and interactive experiences, making 5G chipsets foundational to their success.

Real Challenges

- High Costs of Development and Deployment: The creation and implementation of 5G chipsets involve substantial financial investment. Research, development, and the upgrading of existing infrastructure to support 5G technology can be expensive, making it a significant hurdle for companies.

- Technical Complexities: The design and manufacturing of 5G chipsets require advanced technical capabilities due to their complex nature. Ensuring compatibility with existing systems while pushing the boundaries of speed and efficiency presents a notable challenge.

- Spectrum Availability: For 5G technology to achieve its full potential, access to the right frequency bands is essential. However, the availability of these spectrum bands varies by region and is often limited, posing a logistical challenge.

- Security Concerns: As 5G technology facilitates greater connectivity, it also raises concerns about data security and privacy. Ensuring the security of 5G networks is a paramount challenge that demands innovative solutions.

- Regulatory and Standardization Issues: The global nature of the 5G market means companies must navigate a complex landscape of regulatory requirements and standards. Achieving compliance and ensuring interoperability across borders requires significant effort.

Market Opportunity

- Increased Demand for High-Speed Internet: The global appetite for high-speed internet and data services continues to grow, driven by trends like streaming services, online gaming, and remote work. This demand positions the 5G chipset market for substantial growth.

- Expansion in IoT and Smart Devices: The Internet of Things (IoT) and smart devices rely on fast, reliable internet connections. The deployment of 5G chipsets is critical in enabling the next generation of IoT applications, from smart homes to autonomous vehicles.

- Telecommunications Infrastructure Upgrade: As countries and companies worldwide work to upgrade their telecommunications infrastructure to 5G, significant opportunities arise for chipset manufacturers and related businesses.

- Innovation in Healthcare and Remote Services: 5G technology is set to revolutionize healthcare and remote services, offering low-latency connections that can support telemedicine, remote surgery, and real-time patient monitoring.

- Emerging Markets: Emerging economies present a vast opportunity for the expansion of 5G technology. As these markets develop their digital infrastructure, demand for 5G chipsets is expected to increase, offering a significant growth avenue for companies in the sector.

Top 12 Key Players

- Qualcomm Incorporated: A leader in wireless technology, Qualcomm develops and markets advanced communication technologies and chipsets for mobile devices and networks.

- MediaTek Inc.: MediaTek specializes in semiconductor design and provides innovative system-on-chip solutions for mobile devices, home entertainment, connectivity, and IoT applications.

- Samsung Electronics Co., Ltd.: Samsung is a global leader in consumer electronics, including smartphones, tablets, and semiconductor technology. It develops its own Exynos series of chipsets for mobile devices.

- Huawei Technologies Co., Ltd.: Huawei is a leading global provider of information and communications technology (ICT) infrastructure and smart devices. It develops Kirin chipsets for its smartphones and other devices.

- Intel Corporation: Intel is a multinational technology company known for its semiconductor manufacturing and innovation in computing and communications technology.

- NVIDIA Corporation: NVIDIA is a leading developer of graphics processing units (GPUs) and AI technology. It provides chipsets for gaming, professional visualization, data centers, and automotive applications.

- Ericsson: Ericsson is a Swedish multinational networking and telecommunications company. It provides infrastructure solutions for mobile and fixed networks, including 5G technology.

- Nokia Corporation: Nokia is a Finnish multinational telecommunications, information technology, and consumer electronics company. It offers networking equipment and solutions for mobile and fixed networks.

- Xilinx, Inc.: Xilinx is an American technology company known for its field-programmable gate arrays (FPGAs) and adaptive compute acceleration platforms for data centers, wireless communication, and other applications.

- Analog Devices, Inc.: Analog Devices designs and manufactures semiconductor products and solutions for signal processing, data conversion, and power management in various industries, including telecommunications.

- Marvell Technology Group Ltd.: Marvell is a semiconductor company that develops integrated circuits for storage, networking, and connectivity solutions in data centers, enterprise networks, and consumer electronics.

- Qorvo, Inc.: Qorvo is a provider of radio frequency (RF) solutions and semiconductor products for wireless communication, defense, and aerospace applications.

Conclusion

In conclusion, The 5G chipset market is experiencing rapid growth and significant demand as the global adoption of 5G technology continues to expand. The research findings indicate a strong market outlook with increasing deployment of 5G networks worldwide. The demand for high-speed and low-latency connectivity is driving the need for advanced 5G chipsets to power a wide range of devices and applications.

The 5G chipset market is characterized by intense competition among key players, including semiconductor manufacturers and technology companies. These players are focused on developing and commercializing highly efficient and powerful chipsets to meet the evolving requirements of 5G networks and devices. The market is witnessing continuous innovation in chip design, integration, and manufacturing processes, leading to improved performance, energy efficiency, and cost-effectiveness.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)