Table of Contents

Introduction

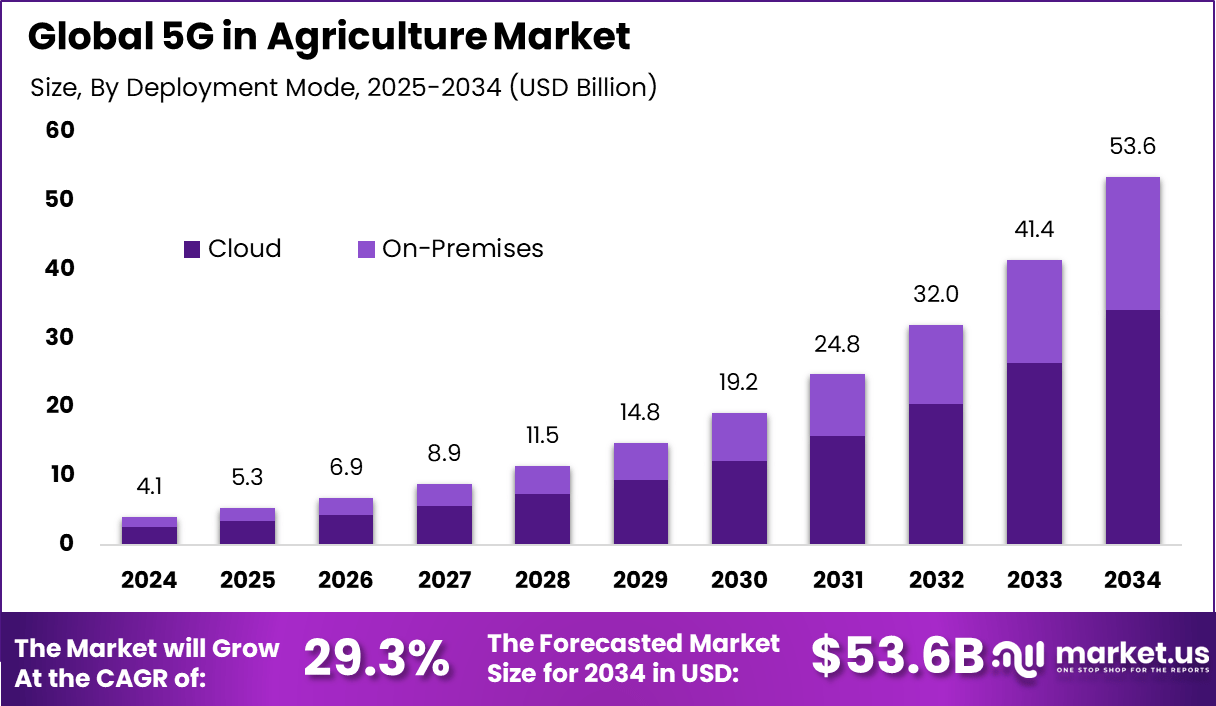

The global 5G in agriculture market generated USD 4.1 billion in 2024 and is projected to grow from USD 5.3 billion in 2025 to approximately USD 53.6 billion by 2034, reflecting a CAGR of 29.3%. In 2024 North America held a dominant share, with revenue of USD 1.7 billion representing more than 42.6% of the market. The use of 5G for precision farming, autonomous machinery, massive IoT sensor networks and real-time data analytics is driving this rapid expansion. Enhanced mobile broadband, ultra-low latency communications and massive machine-type connectivity are increasingly being applied to field sensing, livestock monitoring, drone operations and supply-chain traceability.

How Growth is Impacting the Economy

The growth of the 5G in agriculture market is creating wide-ranging economic impacts across macro- and micro-levels. The rapid expansion of connectivity and automation in farming stimulates capital investments in network infrastructure, IoT devices and smart-farm equipment, thereby accelerating rural development and technology-driven employment. Productivity gains from precision agriculture reduce input-costs and increase yields, which supports food-security objectives and dampens inflationary pressures on agricultural commodities.

As farms become more efficient, supply-chain bottlenecks may ease, supporting downstream agribusinesses and exporters. Governments that promote digital agriculture and 5G roll-out further amplify economic multiplier effects via public-private partnerships, subsidies and rural broadband initiatives. The ripple-effects extend into manufacturing of sensors, drones and connectivity devices, strengthening domestic technology ecosystems and enhancing global competitiveness in agri-tech.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/5g-in-agriculture-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The adoption of 5G in agriculture introduces new cost structures for agribusinesses and equipment providers: network deployment, sensor integration, data-management systems and training represent upfront expenditure. Agricultural supply chains are shifting as connectivity enables real-time tracking of produce, automated harvesting and remote monitoring, reducing reliance on manual labour and enabling just-in-time logistics models.

Sector-Specific Impacts

In crop-farming, 5G enables variable-rate fertilisation and automated harvesting, reducing input waste and labour dependence. In livestock operations, real-time monitoring of health, movement and environment allows for proactive interventions, impacting animal-husbandry business models. In supply-chain and export operations, enhanced traceability via connected sensors supports quality assurance and compliance, benefiting commodity traders and logistic firms. Each of these sectors must absorb infrastructure cost, data analytics investment and manage change-in operational processes.

Strategies for Businesses

Businesses leveraging 5G in agriculture should adopt a phased and data-driven approach. Start by identifying high-volume operations or resource-intensive tasks (such as irrigation or harvesting) that benefit most from connectivity and automation. Partner with telecom and agri-tech providers to pilot network-enabled solutions and build ROI metrics around yield improvement, input-cost reduction and labour efficiency.

Invest in digital skills for farmers and operators to ensure adoption and minimise resistance. Ensure that data-governance, cybersecurity and connectivity-reliability are embedded in the rollout plan, especially for remote sites. Monitor key performance indicators such as crop yield uplift, resource consumption reduction and operational uptime to drive scale-up decisions and refine business models.

Key Takeaways

- The 5G in agriculture market is poised for rapid expansion, from USD 4.1 billion in 2024 to around USD 53.6 billion by 2034.

- North America leads with over 42.6% market share in 2024.

- Growth is supporting productivity gains, rural infrastructure investment and agricultural value-chain efficiency.

- Businesses face new cost structures, infrastructure demands and changing supply-chain models as connectivity becomes embedded.

- Crop-farming, livestock operations and agri-supply-chain sectors each present distinct use-cases and regulatory/operational challenges.

- Strategic adoption—via pilots, partnerships, data-governance and digital-skills investment—is essential for realising value.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163518

Analyst Viewpoint

At present, the 5G in agriculture market presents a compelling opportunity for agribusinesses, network providers and technology solution vendors as farms digitise and automate at scale. The supportive macro-drivers—labour shortages, input-cost inflation, sustainability mandates and global food-security—underscore the positive momentum. Looking ahead, the future remains promising: as connectivity costs decline, edge-computing and AI integration mature, and ecosystem partnerships expand globally, widespread adoption of 5G-enabled smart farming is projected to become mainstream. Organisations that act early, build ecosystem alignment and emphasise outcomes will likely secure leadership in the next-generation ag-tech value chain.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Automated irrigation and variable-rate spraying | Rising demand for resource-efficient farming and input-cost reduction Market.us |

| Drone-based field monitoring and precision crop sensing | High-resolution imagery and real-time data enabled by 5G connectivity GSMA+1 |

| Autonomous tractors and farm machinery | Labour shortages and drive toward autonomous operations in agriculture Market.us+1 |

| Livestock health monitoring and real-time tracking | Increased focus on animal welfare, traceability and operational efficiency Telit Cinterion |

| Supply-chain traceability and real-time logistics in agriculture | Global demand for transparent, compliant agricultural supply-chains and quality assurance Market.us |

Regional Analysis

North America dominates the market in 2024 with USD 1.7 billion revenue and over 42.6% share, driven by advanced farm-tech adoption, strong network infrastructure and supportive regulatory environment. Europe and Asia Pacific are expected to register higher growth rates over the forecast period as governments invest in digital-agriculture and 5G rollout reaches rural zones. Regions such as Latin America, Middle East & Africa present emerging opportunities but may experience slower uptake due to infrastructure constraints, lower digital-agriculture maturity and funding limitations. Regional adoption will significantly depend on factors such as connectivity coverage, regulatory frameworks, farming practices, and local agritech ecosystems.

➤ More data, more decisions! see what’s next –

Business Opportunities

The rapid growth of the 5G in agriculture market presents numerous business opportunities across multiple stakeholder groups. Network operators and telecom infrastructure firms can expand rural 5G coverage and partner with agritech vendors to deliver connectivity-as-a-service for farms. Agritech hardware and software providers can develop specialised solutions—such as sensors, drones, autonomous vehicles—that leverage 5G’s low latency and high bandwidth.

Farm-management service providers may offer subscription-based analytics and automation solutions, enabling smaller farms to adopt smart farming without heavy-capex. There is also scope for value-chain players, such as logistic providers and commodity traders, to integrate traceability and connected-supply-chain models. Regional service providers in emerging markets can tailor localized solutions that meet small-farm size requirements and infrastructure constraints, opening underserved segments.

Key Segmentation

The market segmentation for 5G in agriculture can be structured across several key dimensions. By Component: hardware (sensors, drones, autonomous machines), software (analytics, farm-management platforms), and services (connectivity, integration, maintenance). By Application: precision farming (irrigation, nutrient management), livestock monitoring, supply-chain traceability and automation (machinery, drones).

By Farm Size/End-User: large-scale commercial farms, medium and small farms, agricultural service providers. By Region: North America, Europe, Asia Pacific, Rest of World. Each segment exhibits distinct growth dynamics—with hardware adoption driven by farm-automation investment; software and services growth supported by analytics, connectivity and integration; and application segments differentiated by farming practices and regional infrastructure maturity.

Key Player Analysis

Major players operating in the 5G in agriculture ecosystem are strengthening their market positions by building integrated platforms encompassing connectivity, IoT hardware, analytics and farm-management solutions. These firms are forming partnerships with telecom operators and agritech vendors to deliver end-to-end smart farming solutions, investing in R&D to optimise latency, reliability and scalability for agricultural applications.

Competitive advantage is achieved through robust connectivity coverage, domain-specific agritech expertise, regional regulatory compliance and service-oriented business models (e.g., subscription analytics, managed services). Firms that scale their offering globally, build ecosystem alliances and demonstrate measurable ROI for farmers are likely to lead market share and define future benchmarks.

- Huawei Technologies Co., Ltd.

- Ericsson AB

- Nokia Corporation

- Cisco Systems, Inc.

- Siemens AG

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Trimble Inc.

- AGCO Corporation

- Telit Communications PLC

- Vodafone Group Plc

- AT&T Inc.

- Verizon Communications Inc.

- China Mobile Communications Corporation

- Others

Recent Developments

- A technical review highlighted that 5G deployment in precision agriculture can deliver up to 10% yield increase and reduce water usage by approximately 40% via smart irrigation. GSMA

- A research study demonstrated that hybrid connectivity models combining 5G and satellite networks improve reliability in remote agricultural applications, particularly livestock monitoring and micro-climate sensing. arXiv

- A case study revealed autonomous farm-robotics using 5G edge-compute achieved more than 18-fold speed-increase in processing for selective-harvesting compared to embedded systems. arXiv

- Industry commentary emphasised that 5G will enable customised farm-management approaches (rather than one-size-fits-all) by enabling data-driven resource allocation and precision interventions in farming operations. amantyatech.com

- Market overview reports confirmed the dominant role of North America in 2024 and projected strong future growth as connectivity, automation and agri-tech converge. Market.us

Conclusion

The rapid expansion of 5G in agriculture is reshaping farming into a connected, data-centric ecosystem with broad implications for productivity, sustainability and rural economies. Businesses, agritech providers and network operators that align strategically around this growth path are well positioned to unlock value and drive the next generation of smart-agriculture innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)