Table of Contents

Introduction

Buy Now Pay Later Statistics: Buy Now, Pay Later (BNPL) is a contemporary payment method gaining popularity for its ability to let consumers purchase items and delay payments, usually in installments, without incurring traditional credit card interest charges.

It offers an easy application process, low to no interest rates, and flexibility in payment schedule. Making it convenient for online and offline shopping.

Users select BNPL at checkout, undergo a quick approval process, choose a suitable payment plan, and receive automatic payment schedules.

While BNPL provides affordability and budgeting advantages, it also presents challenges. Such as the potential for overspending and late fees, which have attracted regulatory scrutiny.

Editor’s Choice

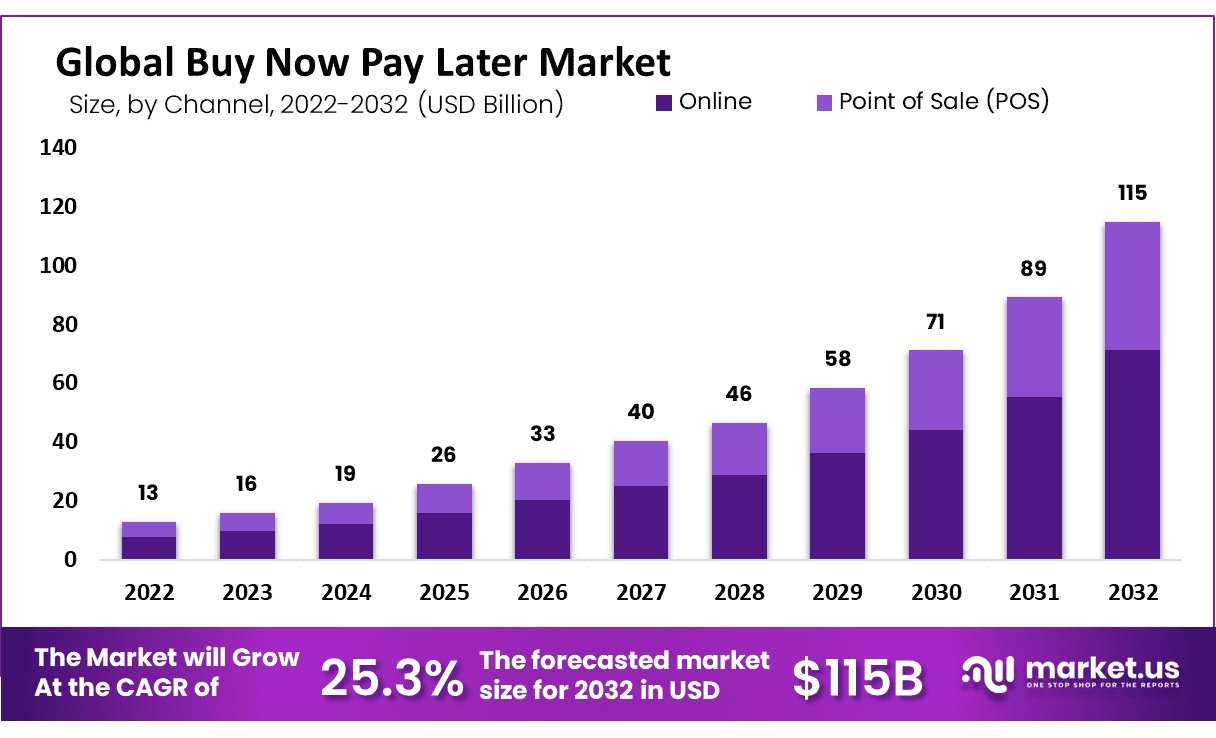

- The Buy Now Pay Later (BNPL) market has demonstrated substantial growth over the forecasted years at a CAGR of 25.3%.

- In 2022, the BNPL market recorded a revenue of 13 billion, which marked the beginning of its upward trajectory.

- In 2021, approximately 17% of consumers with a credit history opted to utilize a Buy Now, Pay Later (BNPL) service for at least one purchase.

- The typical amount financed by BNPL users within a year amounted to $1,000.

- Notably, individuals with higher annual incomes exceeding $200,000 were less inclined to utilize BNPL platforms, with only 9% having used such services.

- Furthermore, BNPL usage appeared to be more prevalent among renters. As 22% of BNPL users identified as renters compared to 15% who were homeowners.

- Additionally, it was observed that women were somewhat more likely to embrace BNPL platforms. With 22.7% of women having used them, while the figure stood at 14.3% for men.

Global BNPL Market Overview

Market Size and Growth Trends

- The Buy Now Pay Later (BNPL) market has demonstrated substantial growth over the forecasted years at a CAGR of 25.3%.

- In 2022, it recorded a revenue of 13 billion, which marked the beginning of its upward trajectory.

- This trend continued, with revenue reaching 16 billion in 2023, followed by 19 billion in 2024.

- The BNPL market’s growth remained robust, climbing to 26 billion in 2025, 33 billion in 2026, and 40 billion in 2027.

- This expansion continued steadily, with revenues of 46 billion in 2028, 58 billion in 2029, and 71 billion in 2030.

- The market’s remarkable ascent culminated in impressive figures of 89 billion in 2031 and a staggering 115 billion in 2032.

- This consistent growth can be attributed to the growing popularity of BNPL services. Offering consumers a flexible and convenient way to make purchases and manage their finances.

- As the BNPL market thrives, it is poised to play a significant role in the evolving landscape of payment methods and consumer spending habits.

(Source: Market.us)

Global Buy Now Pay Later (BNPL) Market Revenue- By Channel

- The Global Buy Now Pay Later (BNPL) market has grown remarkably across different channels over the forecasted years.

- In 2022, the total revenue reached 13 billion, with 8 billion generated online and 5 billion at point-of-sale locations.

- This upward trend continued into 2023, with total revenue hitting 16 billion. Comprising 10 billion online and 6 billion at point-of-sale.

- In 2024, the BNPL market expanded further, with total revenue reaching 19 billion. 12 billion of which came from online transactions and 7 billion from point-of-sale.

- The growth pattern persisted through subsequent years, culminating in an impressive total revenue of 115 billion in 2032.

- During this period, online and point-of-sale revenue also grew substantially. Reflecting the increasing adoption of BNPL services in online and physical retail environments.

- This trend underscores the growing consumer preference for the flexibility and convenience offered by BNPL across various purchasing channels.

(Source: Market.us)

Regional Analysis of the Global Buy Now Pay Later (BNPL) Market Statistics

- Regarding Buy Now, Pay Later (BNPL) services’ domestic e-commerce market share. Sweden takes the top spot with a commanding 23%, followed closely by Germany at 19%.

- Norway secures the third position with a 15% market share, while Finland and Australia share the fourth and fifth spots, each contributing 12% and 10% to the market, respectively.

- New Zealand joins Australia in fifth place, holding a 10% market share.

- Moving down the rankings, the Netherlands follows with a 9% market share, and Denmark is not far behind with 8%.

- Belgium claims the ninth position with 7% of the domestic e-commerce market. While the United Kingdom rounds out the top 10 with a 5% market share.

- France and Japan share the 11th position, each with a 4% market share.

- Several countries, including India, Indonesia, Singapore, and the Philippines, hold a 3% market share, placing them in the 12th position.

- Finally, Italy, Spain, the United States, and Poland find themselves in the 17th position. Each contributes 2% to their respective domestic e-commerce markets.

- This data highlights the varying adoption rates of BNPL services in different countries. Sweden leading the way in this payment trend.

(Source: Worldpay)

Different BNPL Services

- Different Buy Now, Pay Later (BNPL) services come with varying terms regarding interest rates and late fees, which are crucial considerations for users.

- Affirm offers an interest rate of up to 36%, though it does not impose late fees.

- Afterpay, known for its 0% interest rate, charges late fees of up to 25% of the initial order value per purchase.

- FuturePay adopts a unique approach, levying $1.25 for every $50 in unpaid balance and late fees of up to $38 per payment.

- Klarna, another 0% interest rate provider, imposes late fees of up to $7 per payment.

- On the other hand, PayPal Credit carries a variable interest rate of 28.09% and can charge late fees of up to $41 per payment.

- Pay In 4 offers 0% interest and does not have late fees. Like Pay In 4, Zip has a 0% interest rate but may charge up to $10 per purchase in late fees.

- Sezzle also operates with 0% interest and imposes a flat $10 late fee per payment.

- Splitit offers 0% interest but no late fees. However, users should be aware that their credit card may charge late fees independently.

- These varying terms among BNPL services highlight the importance of understanding each provider’s specific terms and fees to make informed financial decisions.

(Source: The Ascent)

Most Popular BNPL Providers

- Among Buy Now, Pay Later (BNPL) users, certain providers have garnered more significant popularity, according to the percentage of respondents.

- Afterpay emerges as the frontrunner, with half of the BNPL users, or 50% of respondents, choosing this service for their payment needs.

- Klarna closely follows, with 45% of users opting for its offerings. Affirm secures the third spot, with 41% of respondents choosing it as their BNPL provider.

- PayPal Credit and Pay In 4 collectively garnered 35% of BNPL users’ preferences. Zip/Quad Pay and Sezzle share the spotlight with 11% each, reflecting a portion of the user base.

- Meanwhile, FuturePay and Splitit have a smaller but notable presence, capturing 4% and 2% of respondents, respectively.

- These statistics underscore the diversity in BNPL provider choices among users, with Afterpay, Klarna, and Affirm emerging as the top contenders in this competitive space.

(Source: The Ascent)

Demographic Analysis of BNPL Users

Age Distribution of Buy Now Pay LaterUsers Statistics

- The age distribution of Buy Now Pay Later (BNPL) users has seen notable shifts over the years, reflecting changing consumer preferences.

- In 2021, most BNPL users belonged to Generation Z, accounting for 36.80% of the user base, followed by Millennials at 30.30%.

- Fast forward to 2023, and Gen Z’s representation grew to 46.50%, while Millennials increased to 39.50%.

- This trend continued into 2025, with Gen Z comprising 47.40% of BNPL users and Millennials at 40.60%.

- These figures indicate a significant shift towards younger generations embracing BNPL services. Gen Z and Millennials show the most substantial growth, experiencing an increase of approximately 10.6% and 10.3%, respectively, from 2021 to 2025.

- Meanwhile, Gen X and Baby Boomers also saw their adoption rates rise, with Gen X increasing by 13.7% and Baby Boomers by 8.6% during the same period. However, their overall representation remains smaller compared to the younger generations.

- This evolving age distribution highlights the widespread appeal of BNPL, particularly among the younger demographic.

Buy Now Pay Later Usage by Gender Statistics

- The usage of Buy Now Pay Later (BNPL) services varies by gender, with distinct patterns emerging.

- As of the latest data, females have demonstrated a higher utilization rate of BNPL, accounting for 22.7% of users, while males make up 14.3%.

- This indicates a notable disparity in adoption, with more females embracing BNPL as a payment option than their male counterparts.

- The reasons behind this gender-based divergence in BNPL usage may include factors such as shopping habits, financial preferences, and marketing strategies employed by BNPL service providers.

- Nonetheless, these statistics underscore the importance of gender-specific insights in understanding consumer behavior within the BNPL market.

(Source: Federal Reserve Bank of New York, 2023)

Buy Now Pay Later Use by Household Income Statistics

- Household income levels significantly influence Buy Now Pay Later (BNPL) usage patterns.

- The data reveals a substantial discrepancy in BNPL adoption based on income brackets.

- Among households with an income of less than $75,000, a significant majority, representing 72.60%, utilize BNPL services.

- In contrast, households with an income of $75,000 and over have a notably lower adoption rate, accounting for 17.60% of BNPL users.

- This divergence in adoption rates underscores the appeal of BNPL as a financial tool for those with lower income levels, as it provides flexibility in managing payments and budgeting for essential and non-essential expenses.

- Conversely, higher-income households may rely on other financial instruments or prefer alternative payment methods. Leading to a lower utilization rate in the BNPL market among this demographic.

- Understanding these income-based distinctions is crucial for BNPL providers and policymakers in tailoring their offerings and regulations to meet the diverse needs of consumers across different income groups.

(Source: Federal Reserve Bank of Philadelphia)

Consumer Adoption and Behavior

Frequency of Buy Now Pay Later Use Statistics

- The frequency of Buy Now, Pay Later (BNPL) usage has exhibited varying patterns over the past four years, from 2020 to 2023.

- In 2020, 19% of users reported using BNPL at least once a week, and this percentage remained consistent in 2021.

- However, by 2022, there was a substantial drop to 19% from the previous year’s 19%.

- In 2023, the frequency of BNPL usage at least once a week decreased to 5%. Conversely, BNPL usage once a month increased from 19% in 2020 to 26% in 2023.

- Using BNPL once every three months also witnessed growth, rising from 19% in 2020 to 25% in 2023.

- Usage once every six months remained relatively stable, hovering around 17% throughout the four years.

- Lastly, the least frequent usage category, once a year or less frequently, declined from 25% in 2020 to 16% in 2023.

- These trends highlight changes in consumer behavior regarding BNPL, with some users opting for more frequent usage. In contrast, others have reduced their usage or shifted to less frequent intervals.

(Source: The Ascent)

Main Reasons People Use Buy Now Pay Later Statistics

- People opt for Buy Now, Pay Later (BNPL) for various reasons, and the data illustrates the motivations behind its usage.

- A significant portion, representing 45% of users, choose BNPL because it simplifies the payment process, making it more convenient.

- Additionally, 44% of users value its flexibility, allowing them to manage their finances more efficiently.

- Another substantial group, comprising 36% of users, is attracted to BNPL due to its lower interest rates than traditional credit cards.

- Furthermore, the easy approval process appeals to 33% of users, offering accessibility to those who may have faced challenges with traditional credit.

- Notably, 33% also turn to BNPL when their credit cards are maxed out.

- For 22% of users, the absence of interest on BNPL transactions is a key factor, while an equal percentage finds it beneficial when dealing with low credit card limits.

- These reasons collectively highlight the diverse motivations that drive individuals to embrace BNPL as a payment method, reflecting its adaptability to various financial situations and needs.

(Source: Federal Reserve Bank of Philadelphia)

The Most Common Use Categories of Buy Now Pay Later Statistics

- The most common use categories for Buy Now, Pay Later (BNPL) services encompass a range of consumer needs and preferences.

- Among these categories, clothing and fashion emerge as the top choices. With 43% of BNPL users utilizing this payment method for apparel purchases.

- Following closely behind is furniture and appliances, representing 31% of users, indicating a preference for financing larger household items.

- Personal care items and cosmetics rank third, with 28% of users opting for BNPL for their beauty and grooming products.

- Meanwhile, household essentials, including everyday items, garner 27% usage. While groceries secure a substantial 24% share, reflecting BNPL’s versatility in covering everyday needs.

- Further down the list, 22% of users turn to BNPL for books, movies, music, and games, indicating its appeal in the entertainment sector.

- Lastly, fitness equipment rounds out the list, with 15% of users utilizing BNPL for their health and fitness-related purchases.

- These usage categories illustrate the broad spectrum of consumer spending that BNPL accommodates. Catering to essential and discretionary purchases across various market segments.

(Source: The Ascent)

Buy Now Pay Later in Retail Sector Statistics

- The Buy Now, Pay Later (BNPL) usage in the retail sector is projected to experience robust growth. With an estimated Compound Annual Growth Rate (CAGR) of 25.6% expected through 2030.

- In 2019, apparel and beauty products dominated BNPL’s Gross Merchandise Value (GMV), accounting for a substantial 80.1% share.

- However, this figure decreased to 58.6% in 2021, indicating a shift in consumer preferences.

- The fashion sector significantly contributes to global BNPL revenue, making up more than 43% of the total.

- Notably, the fashion and garments category is expected to lead in CAGR at 27.2%, surpassing other spending categories.

- Home and furniture purchases are the most popular among BNPL users, with 42% of consumers choosing this category.

- Electronics follow closely, constituting 30% of BNPL purchases and ranking as the second most common category.

- Among 18 to 24-year-old consumers, 62% have utilized BNPL for purchasing video gaming consoles.

- In comparison, those aged 25 to 34 are 29.7% more likely than the average to use BNPL for home appliance purchases, making up 48% of shoppers in this category.

(Source: Consumer Financial Protection Bureau)

Buy Now Pay Later in E-Commerce Statistics

- The global transaction value of Buy Now, Pay Later (BNPL) in the e-commerce sector has experienced remarkable growth.

- In 2019, it stood at 34 billion USD, signaling its emergence as a popular payment method.

- This figure saw a significant leap to 60 billion USD in 2020, indicative of its rapid consumer adoption.

- By 2021, the BNPL transaction value in e-commerce doubled, reaching an impressive 120 billion USD.

- The growth trajectory continued into the forecasted years, with estimates of 214 billion USD in 2022, 309.2 billion USD in 2023, 386 billion USD in 2024, 481 billion USD in 2025, and 565.8 billion USD in 2026.

- These forecasts underline the sustained upward trend in using BNPL in e-commerce, making it an integral part of the global digital shopping landscape.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Square acquires Afterpay: In early 2023, Square completed its $29 billion acquisition of Afterpay, a leading BNPL provider. This acquisition aims to integrate Afterpay’s BNPL services into Square’s Seller and Cash App ecosystems, enhancing the payment flexibility for merchants and consumers.

- PayPal acquires Paidy: PayPal acquired Paidy, a Japanese BNPL firm, for $2.7 billion in late 2023. This merger is expected to strengthen PayPal’s presence in the Asian market and expand its global BNPL offerings.

New Product Launches:

- Apple Pay Later: In mid-2023, Apple introduced Apple Pay Later, a BNPL service integrated into Apple Pay. This service allows users to split their purchases into four interest-free payments, providing a convenient and flexible payment option for Apple users.

- Amazon’s BNPL Partnership with Affirm: Amazon launched a BNPL option in partnership with Affirm in early 2024, allowing customers to pay for purchases over time with no hidden fees or interest, enhancing the shopping experience on Amazon’s platform.

Funding:

- Klarna raises $1 billion: In 2023, Klarna, a leading BNPL provider, secured $1 billion in a funding round to expand its services globally and invest in new technologies to improve user experience and payment processing.

- Affirm secures $500 million: Affirm raised $500 million in early 2024 to enhance its BNPL offerings, develop new financial products, and expand its merchant partnerships, aiming to capture a larger share of the growing BNPL market.

Technological Advancements:

- AI and Machine Learning Integration: BNPL providers are integrating AI and machine learning to enhance credit risk assessment, personalize payment plans, and detect fraudulent activities, improving the overall efficiency and security of BNPL services.

- Seamless Integration with E-commerce Platforms: Advances in technology are enabling BNPL services to be more seamlessly integrated into e-commerce platforms, offering a smoother checkout experience and increasing conversion rates for online retailers.

Market Dynamics:

- Growth in BNPL Market: The global BNPL market is projected to grow at a CAGR of 23.6% from 2023 to 2028, driven by increasing consumer demand for flexible payment options, the rise of online shopping, and the expansion of BNPL services across various retail sectors.

- Increased Adoption Among Millennials and Gen Z: BNPL services are seeing high adoption rates among Millennials and Gen Z consumers, who prefer flexible payment options and are more likely to use digital payment solutions for their purchases.

Regulatory and Strategic Developments:

- Regulatory Oversight in the UK: The Financial Conduct Authority (FCA) in the UK introduced new regulations in early 2024 to oversee BNPL providers, ensuring transparency, consumer protection, and responsible lending practices within the industry.

- US CFPB Inquiry: The Consumer Financial Protection Bureau (CFPB) in the US launched an inquiry in 2023 to examine the practices of major BNPL providers, focusing on consumer impact, data privacy, and the potential for increased debt among users.

Research and Development:

- Sustainable BNPL Practices: R&D efforts are focusing on developing sustainable BNPL practices that promote responsible spending and financial literacy among consumers, aiming to mitigate the risk of over-indebtedness.

- Enhanced User Experience: Researchers are working on improving the user experience of BNPL services by developing more intuitive interfaces, faster approval processes, and better customer support systems.

Conclusion

Buy Now Pay Later Statistics – In summary, the Buy Now, Pay Later (BNPL) industry has experienced significant growth globally, driven by its convenience and flexibility.

This report covered market statistics, regional trends, key player strategies, consumer behaviors, and industry challenges.

The BNPL market has expanded in various regions, with key players employing diverse strategies to stay competitive.

Consumer preferences, especially among younger demographics, have shifted toward BNPL, but managing the financial responsibilities and risks is crucial.

Challenges such as credit risk, regulatory changes, security, and customer concerns must be addressed.

The industry’s future looks promising, with continued growth, innovation, and increased regulatory scrutiny.

In conclusion, the BNPL industry is reshaping retail and finance, requiring stakeholders to adapt responsibly for long-term success.

FAQs

BNPL is a payment method that allows consumers to make purchases and defer payment for a later date, often in installments, without incurring interest or fees if paid within the agreed-upon time frame.

When you choose BNPL at checkout, you can split your purchase into equal installments. You typically make the first payment at the time of purchase and the remaining payments over a specified period, usually every two weeks or monthly.

Most BNPL services offer zero or low-interest options if you make timely payments. However, late payments may result in fees or interest charges, so it’s essential to understand the terms and conditions.

BNPL is widely accepted by online and in-store retailers, making it available for various purchases, from fashion and electronics to travel and everyday items.

Benefits of BNPL include flexibility in managing payments, interest-free options, easy approval processes, and the ability to budget for larger purchases over time.

Drawbacks can include late payment fees, interest charges if not paid on time, the risk of overspending, and potential impacts on credit scores.

BNPL providers typically earn revenue through transaction fees paid by merchants and, in some cases, interest charges or late fees from consumers who miss payments.