Table of Contents

- Introduction

- Editor’s Choice

- Physical Security Market Statistics

- Physical Security Services Market – By Regional Statistics

- Key Reasons for Causing Security Incidents

- Widely Used Physical Security Solutions Statistics

- Impact Of Security Incidents On Business

- Statistics by Businesses in Improving Physical Security

- Use of RVM Solutions for Physical Security Statistics

- Consumer and Business Response to Physical Security

- Recent Developments

- Conclusion

- FAQs

Introduction

Physical Security Statistics: Physical security constitutes a crucial element of comprehensive security strategies.

Encompassing measures to protect physical assets, individuals, and information from unauthorized access, theft, harm, and damage.

This encompasses access control, perimeter protection, surveillance, security personnel, intrusion detection, alarm systems, locks, and secure storage.

All are designed to counteract threats like break-ins, vandalism, workplace aggression, and natural disasters.

Physical security often aligns with other security domains, such as cybersecurity, and necessitates adherence to applicable regulations.

Assessing risks plays a central role in customizing security measures to specific requirements. At the same time, continuous maintenance and assessment are imperative to adapt to evolving threats and ensure the efficacy of safeguarding mechanisms.

Editor’s Choice

- In 2022, the Physical Security market revenue stood at USD 132.5 billion, and it is expected to increase to USD 278.1 billion in 2032.

- A significant 75% of companies place physical security as one of their foremost priorities.

- Over the past 5 years, 60% of companies have encountered breaches in their physical security measures.

- The estimated average cost of addressing a physical security breach is approximately $100,000.

- Security measures such as surveillance systems, including security cameras, have been adopted by 40% of companies to enhance physical security.

- Access control systems, such as biometric scanners and keycard systems, have been deployed for physical security by 30% of companies.

- Security enhancements in fencing, gates, and barriers have been implemented by 25% of companies to bolster physical security.

- A notable 20% of companies have invested in educating their employees about best practices in physical security.

- Visitor management systems have been integrated for physical security purposes by 15% of companies.

Physical Security Market Statistics

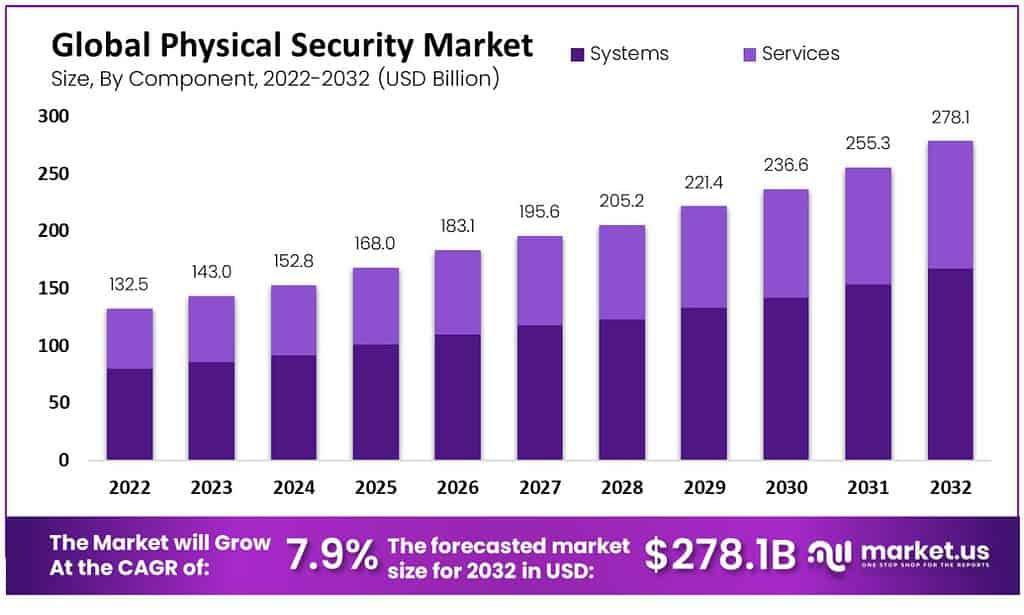

Global Physical Security Market Size

- The physical security market is showing steady growth in terms of revenue. The figures are projected to rise consistently in the coming years at a CAGR of 7.9%.

- In 2022, the market revenue stood at USD 132.5 billion, expected to increase to USD 143.0 billion in 2023.

- The growth trend continues with estimated revenues of USD 152.8 billion in 2024 and USD 168.0 billion in 2025.

- The market is anticipated to gain momentum, reaching USD 183.1 billion in 2026 and USD 195.6 billion in 2027.

- As we look ahead, the projections suggest revenues of USD 205.2 billion in 2028 and USD 221.4 billion in 2029.

- The market is poised to exceed USD 236.6 billion in 2030 and continue its upward trajectory. Reaching USD 255.3 billion in 2031 and USD 278.1 billion in 2032.

- These figures reflect a positive outlook for the physical security market, indicating its importance in an increasingly interconnected world.

(Source: Market.us)

Physical Security Market Revenue – By Component Statistics

- The global physical security market has witnessed significant growth in recent years. With the total revenue reaching USD 132.5 billion in 2022.

- This revenue is primarily driven by two key components: systems and services. Which contributed USD 79.5 billion and USD 53 billion, respectively, to the overall market.

- The market is expected to continue its upward trajectory. Total revenue is projected to reach USD 143.0 billion in 2023, representing a steady increase.

- Systems are anticipated to generate USD 85.8 billion, while services are expected to contribute USD 57.2 billion in 2023.

- Over the next decade, the market is forecasted to experience substantial growth. With total revenue reaching USD 255.3 billion by 2031.

- Systems and services will play integral roles, with estimated contributions of USD 153.2 billion and USD 102.1 billion that year.

- This data reflects the increasing importance of physical security in a rapidly evolving global landscape. Highlighting the demand for cutting-edge systems and specialized services to safeguard people and assets.

(Source: Market.us)

Global Physical Security Market – By End-Use Statistics

- The global physical security market in various end-use industries exhibited a market share distribution in 2022.

- Government entities held a significant portion of the market at 20%, emphasizing the importance of security measures in public sectors.

- Transportation followed closely, representing 18% of the market. Highlighting the need for safeguarding critical infrastructure in the travel and logistics sector.

- With a 15% market share, retail recognized the significance of security in protecting stores and merchandise.

- Residential areas accounted for 7% of the market, emphasizing the relevance of security solutions for home safety.

- The industrial sector contributed 9% of the market share. Underscoring the importance of security measures in safeguarding manufacturing facilities and critical infrastructure.

- The banking, financial services, and insurance (BFSI) sector constituted 14% of the market, acknowledging financial institutions’ critical need for security.

- Lastly, other end-user verticals collectively held 17% of the market share. Indicating a diverse range of industries investing in physical security solutions to protect their assets and interests.

- This distribution reflects the wide-ranging applications and importance of physical security across various sectors globally.

(Source: Market.us)

Physical Security Services Market – By Regional Statistics

- Managed Security Services Market size is expected to be worth around USD 74.2 Billion by 2032

- The data represents the market size of security services in various regions from 2015 to 2020, measured in USD billions.

- In Europe, the market size was 29 billion USD in 2015. Which decreased to 20 billion USD in 2017 and further declined to 19 billion USD in 2018.

- It decreased to 15 billion USD in 2019 and remained stable at 15 billion USD in 2020.

- Asia (excluding Japan) started at 30 billion USD in 2015 and experienced fluctuations over the years, reaching 28 billion USD in 2018. Then dropping significantly to 11 billion USD in 2019 before recovering to 19 billion USD in 2020.

- North America had a market size of 36 billion USD in 2015. Declining to 32 billion USD in 2017 and 29 billion USD in 2018.

- In 2019, it saw a significant drop to 12 billion USD but rebounded to 19 billion USD in 2020.

- The Middle East & Africa region maintained a relatively stable market size. Hovering around 36 to 31 billion USD from 2015 to 2018. With a drop to 12 billion USD in 2019 and a subsequent recovery to 19 billion USD in 2020.

- Latin America started at 36 billion USD in 2015 and remained relatively stable through 2018 at around 32 billion USD.

- However, it experienced a decline to 12 billion USD in 2019 and a slight recovery to 15 billion USD in 2020.

- Top 10 Managed Security Services Companies offered by specialized third-party providers.

(Source: Statista)

Key Reasons for Causing Security Incidents

- In 2022, various companies identified factors that contributed to increased security incidents.

- A negligible percentage, less than 1%, attributed the rise to reduced business hours, possibly indicating a minor impact.

- Insider problems, such as internal security breaches, were cited by 5% of companies as a contributing factor.

- A slightly larger proportion, 6%, pointed to security guard shortages as a challenge affecting security levels.

- Surprisingly, 11% of respondents admitted uncertainty about the exact causes of increased security incidents.

- However, % of companies, 26%, attributed the rise to supply chain issues, highlighting the vulnerabilities exposed by disruptions in global supply chains.

- Furthermore, a substantial 39% attributed the increase in security incidents to the state of the economy, suggesting a correlation between economic conditions and security challenges.

- Strikingly, 46% of companies reported that they had not experienced increased security incidents, suggesting a notable level of stability or effective security measures in place for this segment.

- These diverse perspectives underscore the multifaceted nature of security incidents and the various factors companies associated with their occurrence in 2022.

(Source: Pro-Vigil’s “The State of Physical Security Entering 2022” Report)

Widely Used Physical Security Solutions Statistics

- Access control dominates the widely used physical security solutions, commanding a substantial market share of 50%.

- Access control systems are pivotal in regulating and managing entry to secured areas, making them a fundamental component of security strategies across various sectors.

- Video surveillance follows closely, holding a significant 30% market share.

- The prevalence of video surveillance underscores its role in monitoring and recording activities in both public and private spaces, contributing to enhanced security and incident deterrence.

- Perimeter security solutions, with a 20% market share, also play a crucial role in safeguarding the boundaries of properties and facilities, preventing unauthorized access and potential threats.

- Together, these physical security solutions form a comprehensive defense against a wide range of security risks and are integral to protecting assets, people, and information in today’s security landscape.

(Source: Abdalslam)

Impact Of Security Incidents On Business

- Security incidents can have a significant impact on businesses across various dimensions. When assessing the effects of security incidents, several factors come into play.

- For instance, incidents may lead to changes in business hours, with approximately 2% of cases necessitating such adjustments.

- Additionally, brand damage can occur in 6% of instances, affecting a company’s reputation and credibility.

- Furthermore, customer service can be notably impacted, with around 18% of incidents influencing the quality of service provided to clients.

- The financial aspects of a business are also vulnerable, with cash flow suffering in 25% of cases due to security incidents.

- Project delays are another significant concern, with approximately 40% of incidents causing disruptions in project timelines.

- Surprisingly, in 44% of instances, security incidents may not have any discernible impact on the business.

- These findings underscore the diverse and potentially severe consequences of security incidents on various aspects of business operations.

(Source: Pro-Vigil’s “The State of Physical Security Entering 2022” Report)

Statistics by Businesses in Improving Physical Security

- In 2022, businesses implemented various changes to their physical security strategies to enhance their protection measures.

- Notably, 47% of businesses installed security video cameras, utilizing advanced surveillance technology to monitor and safeguard their premises.

- Furthermore, 22% of businesses opted to strengthen their security by installing fencing fortifying their perimeters to deter potential threats.

- A significant portion, 14%, adopted remote video monitoring (RVM) systems, allowing for real-time surveillance from remote locations.

- Alarm systems also gained prominence, with another 14% of businesses choosing to install them, providing immediate alerts in case of security breaches.

- In addition, 7% of businesses deployed access control systems to regulate and restrict entry to specific areas. At the same time, an equal percentage increased their security personnel by adding security guards to their teams.

- Remarkably, 42% of businesses reported that their security strategy remained unchanged, possibly reflecting their existing robust security measures or a cautious approach to alterations in their security protocols.

- These adaptations illustrate the diverse ways in which businesses in 2022 responded to the evolving landscape of physical security concerns.

(Source: Pro-Vigil’s “The State of Physical Security Entering 2022” Report)

Use of RVM Solutions for Physical Security Statistics

- Businesses employ various approaches to video surveillance as part of their security strategies.

- A significant portion, 41%, utilize remote video monitoring, which allows for real-time surveillance and proactive response to security events.

- In contrast, 27% of businesses reported not using video surveillance as security measures.

- Meanwhile, 32% of businesses employ a more straightforward approach, opting for simple video recording and storage without real-time monitoring.

- These choices reflect the diversity of strategies businesses employ in managing video surveillance as an integral component of their security solutions, with some prioritizing real-time monitoring for immediate threat detection. In contrast, others opt for more passive recording and storage options.

- Among those currently implementing remote video monitoring (RVM) as part of their security measures, nearly half (45%) have extended its applications beyond security-related functions, thus enhancing the value it brings to their business operations.

- For instance, respondents have indicated that they utilize RVM to oversee worksite conditions (28%) and monitor foot traffic flow (17%), among other diverse applications.

- Nevertheless, most businesses (55%) have yet to explore the potential of RVM for purposes beyond security, representing a missed opportunity to enhance their overall business operations and maximize the return on investment from their existing video technology infrastructure.

(Source: Pro-Vigil’s “The State of Physical Security Entering 2022” Report)

Consumer and Business Response to Physical Security

- 81% of the respondents heavily rely on mobile applications, whereas only 25% have embraced mobile credentials for security management.

- According to a recent survey conducted by ProVigil, a provider of remote video monitoring services, nearly 20% of the 124 business operations leaders who participated in the survey reported an increase in physical security incidents compared to the previous year.

- Concerns surrounding physical security have prompted 40% of the surveyed organizations to revise their security strategies, including a heightened use of video cameras and security personnel since the onset of the pandemic.

- The survey commissioned by Ontic also revealed that 43% of respondents found it challenging to ensure the safety of remote employees, while 36% faced difficulties securing physical access to corporate data.

- Furthermore, 35% expressed apprehension about reduced physical security staffing due to economic factors, 33% cited challenges in managing physical threat data, and 32% expressed concerns about physical security threats targeting company leadership and C-suite members.

- Additionally, a separate study found that almost 60% of Americans are worried about the safety of their loved ones in hospitals and medical facilities.

- The security industry newcomer, Fred Nelson, brings time-tested and proven sales and leadership methods, offering a fresh perspective on security practices.

(Source: Webinarcare)

Recent Developments

Acquisitions and Mergers:

- Allied Universal acquires G4S: In early 2023, Allied Universal completed its acquisition of G4S, a leading global security company, for $5.3 billion. This acquisition aims to enhance Allied Universal’s capabilities in providing comprehensive physical security solutions and expand its global footprint.

- Johnson Controls acquires Silent-Aire: Johnson Controls acquired Silent-Aire, a provider of custom HVAC and data center solutions, for $870 million in mid-2023. This merger is expected to strengthen Johnson Controls’ position in the physical security market by integrating advanced cooling solutions for data centers.

New Product Launches:

- Hikvision’s AI-Powered Cameras: In early 2024, Hikvision launched a new line of AI-powered security cameras designed for enhanced surveillance. These cameras feature advanced facial recognition, real-time threat detection, and improved video analytics capabilities, aiming to provide more effective physical security.

- Honeywell’s Pro-Watch Integrated Security Suite: Honeywell introduced the Pro-Watch Integrated Security Suite in mid-2023, a comprehensive security management platform that integrates access control, video surveillance, and intrusion detection systems. This suite is designed to streamline security operations and improve incident response.

Funding:

- Rhombus Systems secures $40 million: In 2023, Rhombus Systems, a provider of cloud-managed physical security solutions, raised $40 million to expand its product line, enhance its AI capabilities, and accelerate market expansion efforts.

- Evolv Technology raises $60 million: Evolv Technology, a leader in AI-based weapons detection, secured $60 million in early 2024 to develop new security screening solutions and expand its global reach, aiming to improve safety in public venues and workplaces.

Technological Advancements:

- AI and Machine Learning in Security: Advances in AI and machine learning are being integrated into physical security systems to improve threat detection, automate monitoring processes, and enhance decision-making capabilities, resulting in more effective and efficient security operations.

- IoT Integration: Development of IoT-enabled physical security devices is enhancing the connectivity and interoperability of security systems, allowing for real-time data collection, remote monitoring, and improved situational awareness.

Market Dynamics:

- Growth in Physical Security Market: The global physical security market is projected to grow at a CAGR of 8.2% from 2023 to 2028, driven by increasing concerns over safety and security, advancements in surveillance technology, and the rising adoption of integrated security solutions.

- Increased Demand for Cloud-Based Solutions: There is a significant increase in demand for cloud-based physical security solutions due to their scalability, cost-effectiveness, and ability to provide remote access and real-time updates, contributing to market growth.

Regulatory and Strategic Developments:

- GDPR Compliance for Security Systems: Physical security providers in the European Union are enhancing their systems to ensure compliance with the General Data Protection Regulation (GDPR), focusing on data privacy, secure storage, and transparent processing of surveillance data.

- US Department of Homeland Security (DHS) Guidelines: The DHS issued updated guidelines in early 2024 for physical security measures in critical infrastructure sectors, emphasizing the importance of advanced surveillance, access control, and emergency response systems.

Research and Development:

- Smart Access Control Systems: R&D efforts are focusing on developing smart access control systems that use biometrics, mobile credentials, and AI to enhance security and convenience, providing more accurate and secure access management.

- Advanced Surveillance Analytics: Researchers are working on advanced video analytics technologies that leverage deep learning algorithms to improve the accuracy and speed of threat detection, enabling proactive security measures.

Conclusion

Physical Security Statistics – Physical security is the bedrock of comprehensive protection strategies, shielding assets, people, and data from diverse threats.

It spans access control, surveillance, and more, serving various sectors like government, transportation, and retail.

Businesses adapt to challenges, including supply chain disruptions and economic shifts, while embracing technology for enhanced security and operational benefits.

However, there’s room for improvement, with potential in mobile solutions, remote employee safety, and threat data management.

As threats evolve, a proactive approach remains crucial to safeguarding assets and people in a dynamic security landscape.

FAQs

Physical security refers to the measures and strategies to protect physical assets, individuals, and information from unauthorized access, theft, damage, or harm.

The key components of physical security include access control, surveillance, security personnel, intrusion detection, alarm systems, perimeter security, and more, depending on specific needs.

Physical security is vital for safeguarding assets, people, and sensitive information, reducing the risk of theft, vandalism, workplace violence, and other security threats.

Common security incidents include break-ins, theft, vandalism, unauthorized access, workplace violence, and natural disasters like fires and floods.

Businesses can conduct risk assessments to identify vulnerabilities, assess the potential impact of security incidents, and tailor security measures to specific requirements.