Table of Contents

- Introduction

- Editor’s Choice

- Global Esports Market Statistics

- Regional Analysis of Global Esports Market

- Leading Players in Esports Statistics

- Cumulative Cumulative Prize Pool of Different Esports

- Most Valuable Esports Organizations Statistics

- Demographics of Esports Users Statistics

- Esports Viewership Time Spending Statistics

- Esports Investment Statistics

- Esports Tournaments Statistics

- Top Esports Industry Growth Barriers Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Esports Statistics: Esports, short for electronic sports, are competitive video game events where professional players and teams compete in popular titles like League of Legends, Dota 2, and CS: GO.

Esports have grown rapidly, becoming a global sensation with massive prize pools and large-scale tournaments held in arenas.

Notable Esports organizations sign and support players, and events are streamed on platforms like Twitch and YouTube.

Esports offer diverse career opportunities, from players and coaches to commentators and content creators.

This industry encompasses sponsorships, merchandise, and advertising, attracting major companies. Challenges include player well-being and maintaining a fair and inclusive environment.

Esports is increasingly integrated into education and is poised for continued growth and innovation.

Editor’s Choice

- The esports market has witnessed remarkable growth at a CAGR of 20.9% in recent years.

- By 2032, the esports industry is expected to surpass all previous records. With a projected market revenue of USD 10,905.1 million.

- In 2021, Sponsorships took the lead with an estimated market revenue of $641 million.

- As of September 12, 2023, the leading esports player globally, based on earnings, is NOtail, also known as Johan Sundstein who has amassed an impressive $7.18 million in winnings.

- Among individuals aged 16 to 24, a substantial 32% actively engage in watching esports tournaments. Indicating a strong affinity for this form of competitive gaming.

- As expected, most esports enthusiasts in the United States are males, accounting for 72% of the fan base.

- In 2023, it’s anticipated that the annual prize money in Esports will surpass the impressive milestone of $500 million.

Global Esports Market Statistics

Global Esports Market Size

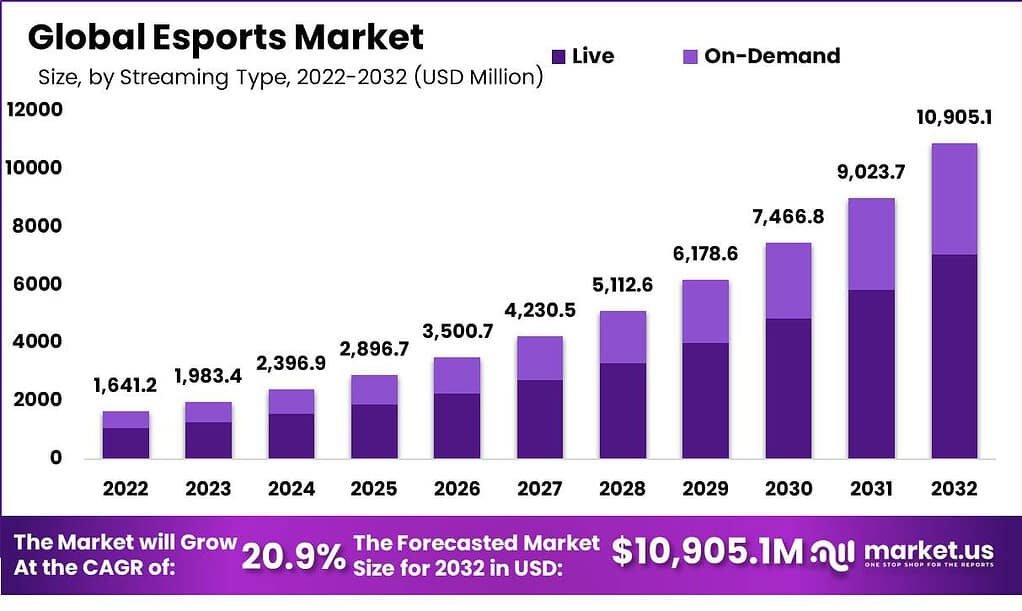

- The esports industry has witnessed remarkable growth at a CAGR of 20.9% in recent years.

- In 2022, the esports market generated a substantial revenue of USD 1,641.2 million.

- Building on this momentum, the industry’s revenue surged to USD 1,983.4 million in 2023, reflecting a promising trajectory.

- Projections for the years ahead are equally optimistic. The esports market is expected to reach USD 2,396.9 million in 2024 and USD 2,896.7 million in 2025, marking significant increases.

- The growth trend continues, with revenue expected to reach USD 3,500.7 million in 2026, USD 4,230.5 million in 2027, and a substantial USD 5,112.6 million in 2028.

- 2029 is forecasted to surge significantly, with esports market revenue hitting USD 6,178.6 million.

- The upward trajectory persists with projections of USD 7,466.8 million in 2030 and a substantial USD 9,023.7 million in 2031.

- By 2032, the esports industry is expected to surpass all previous records. With a projected market revenue of USD 10,905.1 million. Solidifying its position as a thriving and lucrative sector in the global entertainment landscape.

(Source: Market.us)

Esports Market Revenue- By Segment

- In 2021, the global esports market exhibited a diverse revenue landscape across various segments.

- Sponsorships took the lead with an estimated market revenue of $641 million. Reflecting the substantial investments made by companies to associate their brands with esports events and teams.

- Media rights contributed significantly with $192.6 million, highlighting the value of broadcasting rights for esports competitions.

- Publisher fees generated $126.6 million, showcasing the revenue stream from game developers’ involvement in esports.

- Merchandise and ticket sales amounted to $66.6 million, indicating the popularity of esports-related products and live events.

- The digital sector brought in $32.3 million, encompassing various digital content and in-game purchases, while streaming contributed $25.1 million. Underlining the importance of platforms like Twitch and YouTube Gaming in delivering esports content to a global audience.

- These revenue figures collectively illustrate the robust and multifaceted nature of the esports market in 2021.

(Source: Statista)

Regional Analysis of Global Esports Market

- The esports industry has been experiencing remarkable growth globally, with varying degrees of revenue generated in different countries.

- The United States leads the pack, where esports has become a billion-dollar industry, amassing a staggering $1,076 million in revenue.

- China closely follows, with an impressive $445.2 million, showcasing the immense popularity of esports in Asia.

- Canada and Germany also boast substantial esports revenue, with $121.8 million and $268.6 million, respectively. Underscoring their strong presence in the competitive gaming scene.

- Several other countries contribute significantly to the esports economy.

- France, with $150.4 million, and Japan, with $141.8 million, demonstrate their avid esports communities.

- Meanwhile, countries like Australia, Brazil, and Italy have firmly established themselves on the esports map, each generating revenue from $89.6 million to $116.2 million.

- Even smaller nations are making their mark, with Argentina, Austria, Belgium, and Ireland all seeing noteworthy esports revenue ranging from $16.25 million to $34.3 million.

- With $107.8 million, India showcases the burgeoning esports interest in South Asia.

- Additionally, Finland and Greece contributed $17.94 million and $24.63 million, respectively, highlighting the global reach of competitive gaming.

(Source: Statista)

Leading Players in Esports Statistics

- As of September 12, 2023, the leading esports player globally, based on earnings, is NOtail. Also known as Johan Sundstein, he has amassed an impressive $7.18 million in winnings.

- JerAx (Jesse Vainikka) and Ana (Anathan Pham) are closely behind, with earnings of $6.49 million each.

- These top players have made a significant mark in the world of esports.

- Additional notable figures in the esports earnings rankings include Ceb (Sebastien Debs) with $5.87 million, Topson (Topias Taavisainen) with $5.7 million, KuroKy (Kuro Takhasomi) with $5.29 million. Miposhka (Yaroslav Naidenov) with $5.26 million, Yatoro (Liya Mulyarchuk) and Collapse (Magomed Khalilov) both with earnings of $5.03 million, and Mira (Miroslav Kolpakov) with $5.02 million.

- These players represent the elite in competitive esports, showcasing their skills and earning substantial rewards.

(Source: Statista)

Cumulative Cumulative Prize Pool of Different Esports

- In the competitive world of esports in 2022, the cumulative prize pools for various games reached remarkable heights.

- Leading the pack was DOTA 2, with an astounding cumulative prize pool of $32.85 million. Making it the top esports title in terms of winnings.

- Arena of Valor followed with $32.73 million, securing the second spot.

- PlayerUnknown’s Battleground Mobile claimed the third position with an impressive $23.43 million in cumulative prizes.

- Other notable esports titles included Fortnite at $16.35 million, Counter-Strike: Global Offensive at $16.17 million, League of Legends: Wild Rift at $13.68 million, Rocket League at $9.42 million, PlayerUnknown’s Battleground at $8.42 million, Rainbow Six Siege with $8.04 million, and League of Legends with $7.71 million.

- These substantial prize pools reflect esports’ competitive fervor and growing popularity. Attracting top talent and avid fans from around the world.

(Source: Esports Earnings)

Most Valuable Esports Organizations Statistics

- In esports, the competition isn’t limited to players; organizations play a pivotal role, and the most valuable esports organizations of 2022 exemplify this.

- Topping the list is TSM (Team SoloMid), with a staggering valuation of $410 million. Followed closely by Cloud9 at $350 million and Team Liquid at $310 million.

- FaZe Clan and 100 Thieves also make a formidable presence with valuations of $305 million and $190 million, respectively.

- Gen.G, Enthusiast Gaming, G2 Esports, NRG Esports, and T1 further contribute to the robust esports ecosystem, each valued between $175 million and $150 million.

- These organizations invest in top-tier talent and actively engage with their fan base. Cementing their status as key players in the ever-expanding world of competitive gaming.

(Source: Forbes)

Demographics of Esports Users Statistics

By Age

- The viewership of esports tournaments among internet users exhibits distinct age-related trends.

- Among individuals aged 16 to 24, a substantial 32% actively engage in watching esports tournaments, indicating a strong affinity for this form of competitive gaming.

- The age group of 25 to 34 closely follows with 30%, demonstrating a significant presence of esports enthusiasts within this demographic.

- As age increases, the viewership gradually decreases, with 19% of those aged 35 to 44, 10% of those aged 45 to 54, and 6% of those aged 55 to 64 showing interest in esports tournaments.

- These statistics reveal that esports predominantly captivate the younger generations. The viewership gradually tapering off among older age groups, reflecting the generational divide in esports fandom.

(Source: GlobalWebIndex)

By Gender

- As expected, most esports enthusiasts in the United States are males, accounting for 72% of the fan base.

- Looking at the global perspective in 2019, the average proportion of female esports fans worldwide stood at 22%.

- In the United States, around 30% of male participants express some interest in Esports. While only 11% of female respondents indicated a similar interest in Esports.

- Additionally, 15% of male participants are unaware of Esports, which is 10% lower than the corresponding figure for female participants, where less than 1 in 4 have heard of Esports.

(Source: IDC-2020, Newzoo-2020)

Esports Viewership Time Spending Statistics

- During the third quarter of 2020, audiences collectively viewed a substantial 7.46 billion hours of esports and live-streaming gaming content. Marking an impressive 91.8% surge compared to the same period in 2019.

- Notably, YouTube Gaming experienced significant growth, witnessing an increase of 156 million hours in watch time from Q2 2020 to Q3 2020.

- In that timeframe, Facebook Gaming achieved a milestone by surpassing 1 billion watch hours for the first time.

- As the pandemic took hold in March 2020, Verizon reported a substantial 75% rise in internet traffic related to video games during peak hours. Highlighting the surge in gaming and esports engagement as people sought entertainment and connection during uncertain times.

(Source: Streamlabs, 2020, Foley & Lardner, 2020)

Esports Investment Statistics

- In 2019, the North American esports market primarily relied on prize pools, accounting for 38% of its revenue. Followed by over-the-top (OTT) advertising at 22%, direct brand sponsorship at 21%, media at 17%, and tickets and merchandise at 2%.

- However, globally, in 2020, the esports market’s revenue was predominantly driven by sponsorships, generating approximately $584 million. (Source: Newzoo, 2020)

- Other revenue sources included media rights ($163.3 million), publisher fees ($108.9 million), tickets and merchandise ($52.5 million), digital sales ($21.5 million), and streaming ($19.9 million).

- An impressive 73% of industry stakeholders believed the pandemic would increase investment and deal activity in esports.

- Additionally, nearly half, or 49%, expected traditional professional sports teams, athletes, and celebrities to boost their investments in esports in 2021.

- Furthermore, 40% anticipated increased investment from venture capital and private equity firms.

- Ultimately, global spending on sponsorship and advertising in esports is projected to reach $634.03 million by the year 2023.

(Source: Canaccord Genuity-2019, Foley & Lardner-2020)

Sponsorship in Esports Spending- According to Industry Statistics

- In 2019, esports sponsorship spending was distributed across various industries. With notable contributions from key sectors.

- Consumer goods led the way with a substantial sponsorship spending of $21.8 million, reflecting the interest of consumer brands in associating with esports events and teams.

- The technology sector followed closely, investing $15.9 million, emphasizing the tech industry’s engagement with the esports community.

- Clothing brands also significantly impacted, contributing $13.35 million in sponsorship spending.

- Meanwhile, the beverage and financial services industries allocated $4.75 million and $4.65 million, respectively, towards esports sponsorships.

- These figures underline the diverse array of industries that recognized the value of esports partnerships and actively participated in supporting this growing phenomenon.

(Source: Consultancy. UK 2019)

Esports Tournaments Statistics

- In 2023, it’s anticipated that the annual prize money in Esports will surpass the impressive milestone of $500 million.

- To provide some context 2017, the total prize pool for Esports competitions amounted to $115.51 million, showing substantial growth.

- By 2018, this figure had increased to $159.34 million, reflecting the industry’s expansion.

- Interestingly, predictions in 2019 foresaw the total global Esports prize pools reaching a substantial $543.69 million by 2023, underscoring the continued rise in Esports’ financial stakes.

- Regarding the biggest prize pools in Esports history, one standout event takes the crown.

- The International, an annual tournament, has consistently offered the largest Esports competition prize pools. In 2021, after a cancellation in 2020, The International returned with an astounding $40.02 million in prize money, setting a new record.

- In 2019, The International had a prize pool of $34.33 million, marking a notable year-over-year increase from 2015.

- During that year, The International’s prize pool was $18.43 million, surpassing the Fortnite World Cup 2019-Solo prize pool, which stood at $15.29 million.

- Completing the list of the top 8 Esports tournament prize pools is the Fortnite World Cup Finals 2019 – Duo, boasting a total prize pool of $15.1 million.

- These figures highlight the immense growth and competitiveness within the Esports industry, with The International consistently leading the way in prize money.

(Source: Enterprise Apps Today)

Top Esports Industry Growth Barriers Statistics

- A surprising survey revealed that 81% of respondents in the United States do not have any interest in esports whatsoever.

- Only 5% consider themselves passionate fans, while 14% fall into the category of casual enthusiasts.

- Additionally, another report indicated that merely 4% of American adults strongly desire to learn more about esports, with the majority (46%) displaying only moderate interest and a notable 32% showing no interest whatsoever.

- Furthermore, a striking 75% of industry stakeholders perceive match-fixing and cheating as formidable threats that jeopardize the credibility and expansion of esports.

- Moreover, 60% of these stakeholders view the influence exerted by a select group of game developers as a significant obstacle hindering the growth of esports.

- To add to these concerns, 77% of stakeholders anticipating a decline in esports investments attribute this decline primarily to the inability to host large in-person events.

- Respondents have also identified several other potential threats, including ongoing reductions in advertising and sponsorship expenditure (65%), reluctance to invest in esports teams due to continued market uncertainty (46%), and challenges in securing additional financial support from current sponsors (31%).

- These findings collectively underscore the multifaceted challenges and uncertainties surrounding the future of esports.

(Source: Foley & Lardner, 2020)

Recent Developments

Acquisitions and Mergers:

- Microsoft acquires Activision Blizzard: In 2023, Microsoft finalized its acquisition of Activision Blizzard, a major player in the esports industry, for $68.7 billion. This acquisition strengthens Microsoft’s presence in esports, particularly through popular titles like Call of Duty and Overwatch, which are central to the competitive gaming ecosystem.

- Enthusiast Gaming merges with Omnia Media: In 2023, Enthusiast Gaming, a major esports media platform, merged with Omnia Media in a deal valued at $150 million. This merger aimed to create one of the largest platforms for gaming content, increasing reach to esports fans and further enhancing content distribution across various channels.

New Product Launches:

- Riot Games introduces Wild Rift Esports: In 2023, Riot Games launched Wild Rift Esports, expanding its popular League of Legends franchise to mobile gaming. The new platform is designed to tap into the growing mobile gaming market and build competitive ecosystems for mobile players.

- ESL launches women’s esports league: In 2024, ESL introduced the ESL Impact League, a women-only esports competition aimed at fostering female participation in competitive gaming. This league aims to address gender imbalances in esports and attract more female gamers to the competitive scene.

Funding:

- FaZe Clan raises $40 million for growth: In 2023, FaZe Clan, a prominent esports organization, raised $40 million in a funding round to expand its esports teams, content creation, and international presence. The funding is also being used to increase partnerships with brands and enhance fan engagement.

- 100 Thieves secures $60 million for expansion: In early 2024, 100 Thieves, an esports organization and lifestyle brand, raised $60 million to fuel its global expansion and invest in more gaming content and team development. The organization aims to strengthen its position in the esports space through strategic partnerships and innovative content.

Technological Advancements:

- AI integration in esports analytics: AI is increasingly used to enhance player performance analytics and viewer experience. By 2025, over 30% of esports organizations are expected to use AI-driven tools to analyze game data, improve team performance, and engage fans with personalized content.

- Virtual Reality (VR) esports on the rise: VR is becoming a growing segment in esports, offering immersive gaming experiences. By 2026, VR esports is projected to account for 20% of the total esports market. Driven by advances in VR technology and increasing demand for immersive gaming experiences.

Conclusion

Over time, esports has transformed from a specialized subculture into a worldwide sensation, challenging conventional sports in both audience size and financial returns.

While the United States takes the lead in revenue, nations across the globe are eagerly engaging with and investing in this burgeoning field.

The role of data analytics has gained immense significance, providing vital insights into player performance and tactical approaches.

The COVID-19 pandemic expedited the industry’s expansion, drawing the attention of traditional sports teams and well-known personalities.

The horizon appears bright with ongoing innovations and an expanding fan base, cementing esports as a permanent fixture within the global entertainment landscape.

FAQs

Esports, short for electronic sports, refers to organized video game competitions where professional players and teams compete against each other in various video games.

Some of the most popular Esports games include League of Legends, Dota 2, Counter-Strike: Global Offensive (CS: GO), Fortnite, Overwatch, and Call of Duty, among others.

Esports players make money through various avenues, including tournament winnings, salaries from Esports organizations, streaming revenue, sponsorships, and merchandise sales.

The biggest Esports tournament prize pool ever was for The International 10 (Dota 2), which reached over $40 million in prize money.

Esports are not traditional physical sports but are recognized as a form of competitive gaming. They have gained legitimacy as a sport due to their organized nature, professional players, and massive global following.