Table of Contents

Introduction

Cloud Kitchen Statistics: A cloud kitchen is a food delivery-focused concept that doesn’t include dine-in services. These kitchens, also called ghost or virtual kitchens, utilize technology and shared facilities to make their operations more efficient.

They’ve become increasingly popular due to the surge in food delivery apps and the demand for cost-effective, scalable food preparation solutions.

While they offer benefits like reduced expenses and scalability, they also encounter challenges tied to competition, maintaining food quality, and managing delivery logistics.

Looking ahead, cloud kitchens are expected to keep expanding by embracing technology and adapting to changing consumer tastes.

Editor’s Choice

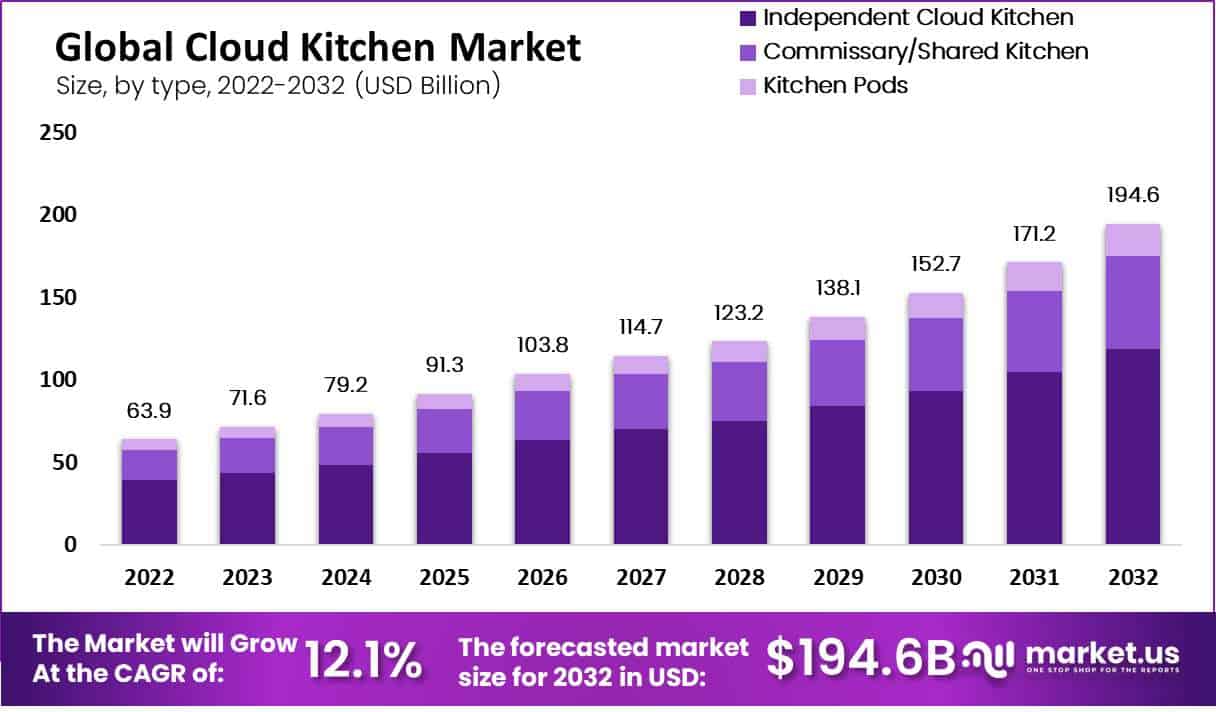

- The cloud kitchen market is experiencing impressive growth. Its revenue is projected to rise steadily over the next decade at a CAGR of 12.1%.

- In 2022, the market generated USD 63.9 billion in revenue and is expected to climb to USD 194.6 billion in 2032.

- In 2020, Karma Kitchen, a European ghost kitchen company. Stood out by securing an impressive 300 million euros in a single funding round.

- According to a study conducted by Technomic on behalf of Grubhub, 41% of independent restaurants are currently running virtual brands to meet the ongoing demand for food delivery.

- The global market for restaurant management software is poised for substantial expansion. With an expected value of approximately USD 16,254.45 million by 2032. A significant increase from its 2022 valuation of USD 4,088.40 million.

- The usage of apps for food and grocery orders in the U.S. is expected to rise from 27.9 million to 30.4 million in 2022.

- Over 80% of restaurants are adopting technology, including online ordering, reservation apps, and analytics, to enhance operational efficiency.

Global Cloud Kitchen Market Statistics

Cloud Kitchen Market Size Statistics

- The cloud kitchen market is experiencing impressive growth. Its revenue is projected to rise steadily over the next decade at a CAGR of 12.1%.

- In 2022, the market generated USD 63.9 billion in revenue, and this figure is expected to climb to USD 71.6 billion in 2023.

- The growth trajectory continues with anticipated revenues of USD 79.2 billion in 2024 and USD 91.3 billion in 2025, signifying a substantial increase.

- As we move into the late 2020s and early 2030s, the cloud kitchen market is set to expand even further. With projections reaching USD 103.8 billion in 2026, USD 114.7 billion in 2027, and USD 123.2 billion in 2028.

- By 2029, the market is forecasted to exceed USD 138.1 billion Crossing the USD 150 billion mark in 2030, and reaching an impressive USD 171.2 billion in 2031.

- The growth trend is expected to accelerate, culminating in a market revenue of USD 194.6 billion by 2032. Highlighting the increasing prominence of cloud kitchens in the global culinary landscape.

(Source: Market.us)

Cloud Kitchen Market Revenue – By Type Statistics

- The global cloud kitchen market is poised for significant growth over the next decade. The total market revenue is projected to increase steadily.

- In 2022, the market was valued at USD 63.9 billion, with a substantial portion coming from independent cloud kitchens at USD 39 billion. Followed by commissary/shared kitchens at USD 19 billion, and kitchen pods at USD 6 billion.

- The industry is expected to gain momentum in the coming years, with the total market revenue forecasted to reach USD 71.6 billion in 2023. Driven by independent cloud kitchens generating USD 44 billion, commissary/shared kitchens contributing USD 21 billion, and kitchen pods accounting for USD 7 billion.

- However, this upward trajectory is anticipated to continue, with the market reaching USD 194.6 billion in 2032, marked by substantial revenue streams from independent cloud kitchens, Commissary/shared kitchens, and kitchen pods, reflecting the evolving preferences of consumers and the increasing demand for food delivery services in the digital age.

(Source: Market.us)

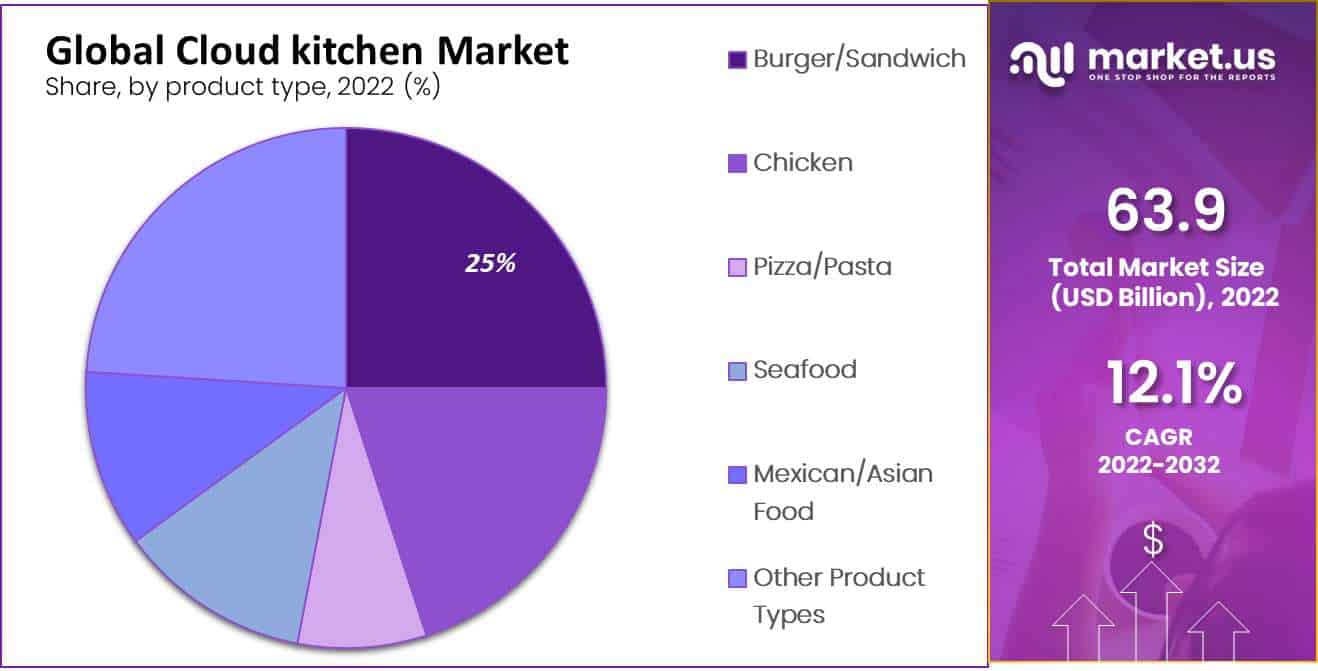

Cloud Kitchen Market Share – By Product Type Statistics

- The global cloud kitchen market is characterized by a diverse array of product types, each commanding a distinct market share.

- Among these, burgers and sandwiches stand out as the most popular category, constituting a significant 25% share of the market.

- Following closely behind are chicken-based offerings, which hold a substantial 20% market share.

- Meanwhile, the market also embraces the flavors of Italy with pizza and pasta products, making up 8% of the market.

- Seafood offerings account for a respectable 12% share. While the allure of Mexican and Asian cuisine captures an 11% slice of the market.

- Additionally, the cloud kitchen landscape accommodates a variety of other product types, collectively accounting for 24% of the market share.

- This diverse product portfolio reflects the dynamic and evolving nature of the global cloud kitchen industry. Catering to a wide range of culinary preferences and tastes.

(Source: Market.us)

Ghost Kitchen Statistics

- Projected for the year 2030 is the dominance of ghost kitchens in half of the global drive-thru and takeaway food service markets.

- In 2020, Karma Kitchen, a European ghost kitchen company. Stood out by securing an impressive 300 million euros in a single funding round.

- Simultaneously, in the United Kingdom, Deliveroo, a subsidiary of Roo Foods Limited, held the position of the third most utilized online food delivery provider in 2020.

- The year 2017 witnessed the inception of Deliveroo’s Editions program. Which streamlined the launch of virtual restaurants, eliminating the financial burdens and risks associated with establishing physical dining spaces.

- Travis Kalanick, co-founder of Uber Eats, is a significant player with a 25% market share in the U.S. food delivery industry. They made his foray into the ghost kitchen sector in 2018. He established CloudKitchens, a startup entirely dedicated to the ghost kitchen realm.

- As of the conclusion of 2020, there were 59 prominent companies in the ghost kitchen industry. DoorDash marked a significant milestone by inaugurating its initial ghost kitchen in Redwood City, California.

- Since 2016, there has been a noticeable surge in investments within the ghost kitchen sector, with the value of deals experiencing a remarkable 2.4-fold increase.

- Specifically, in the year 2019, ghost kitchens attracted a substantial investment of $1.9 billion through 16 different agreements.

(Source: MarketMan, Inc.)

Virtual Restaurant Statistics

- According to a study conducted by Technomic on behalf of Grubhub, 41% of independent restaurants are currently running virtual brands to meet the ongoing demand for food delivery.

- The survey, which involved 350 independent operators and took place from January 20 to 28, 2022, revealed that 68% of the respondents view their virtual restaurants as permanent additions and 46% intend to launch three or more virtual concepts within the next year.

- On average, these restaurants offering virtual brands provide customers with 5 distinct virtual concepts.

- The adoption of virtual brands aligns with the operators’ desire for customizable direct ordering channels, with 97% of independent restaurants considering such channels crucial.

- Additionally, 91% of these restaurants value access to customer data, while 88% prioritize commission-free ordering, and 92% emphasize the importance of creating branded experiences.

(Source: Restaurant Dive)

Food Delivery Apps Statistics

Food Delivery Users by App

- The landscape of food delivery apps is dynamic, with several key players catering to the needs of millions of users worldwide.

- At the forefront is Delivery Hero, boasting a substantial user base of 118 million.

- Just Eat closely follows with 90 million users, while Uber Eats is not far behind with 85 million.

- Dominos commands a significant presence with 51 million users, and Zomato and Swiggy each have 48 million and 45.5 million users, respectively.

- DoorDash serves 32 million users, while Grab and iFood have 25.5 million and 23 million users, respectively.

- Instacart has 13 million users, Rappi has 12 million, and Getir caters to 8 million users. Deliveroo, GoPuff, and Wolt round out the list with 7.4 million, 6 million, and 4 million users, respectively.

- This extensive user base across various food delivery apps illustrates the global appeal and growing demand for convenient food delivery services.

(Source: Business of Apps)

Food Delivery Downloads by App

- The realm of food delivery apps continues to thrive, as evidenced by the significant number of downloads across various platforms.

- Leading the pack is Delivery Hero with a remarkable 60.9 million app downloads.

- Zomato follows closely with 55.8 million downloads, while Uber Eats boasts 48.6 million downloads.

- DoorDash also commands a substantial user base with 36.8 million downloads, and Swiggy is not far behind at 34.9 million.

- Just Eat Takeaway is another noteworthy player with 24.9 million downloads, while iFood and Getir have garnered 18.6 million and 17.5 million downloads, respectively.

- Deliveroo and Instacart also maintain a strong presence with 11.6 million and 10 million downloads, respectively.

- GoPuff rounds out the list with 5.3 million downloads. These impressive download figures underscore the widespread popularity and continued growth of food delivery services facilitated by these apps.

(Source: Business of Apps)

Kitchen/Restaurant Management Software Statistics

Global Restaurant Management Software Market Overview

- The global market for restaurant management software is poised for substantial expansion, with an expected value of approximately USD 16,254.45 million by 2032, a significant increase from its 2022 valuation of USD 4,088.40 million.

- This growth is characterized by a noteworthy Compound Annual Growth Rate (CAGR) of 14.80% forecasted for the period spanning 2022 to 2032.

- Regarding various software categories, the ‘Front-End Software’ sector occupied the largest portion of market opportunities, surpassing 39% by 2021.

- Furthermore, the ‘Table & Delivery Management’ segment is projected to grow at a rate of 15.3% due to rising adoption among restaurant owners. Who seek to streamline operations by reducing wait times and automating food delivery processes.

- Concerning deployment methods, the On-Premise segment was predominant in 2021, while the ‘Cloud Kitchen’ segment is anticipated to witness significant growth, with an expected CAGR of 16% throughout the forecast period.

- Notably, the Full-Service Restaurant (FSR) segment made a substantial contribution to revenue in 2021, and the Quick Service Restaurant (QSR) segment is poised to experience a growth rate of 14.5% between 2023 and 2032.

- In terms of regional dominance, North America held the largest market share at 38.1% in 2021. The Asia Pacific region is forecasted to exhibit rapid growth, boasting a CAGR of 16% during the forecast period.

(Source: Market.us)

Cloud Kitchen Online Food Delivery Statistics

Global Online Food Delivery Market Overview

- The Online Food Delivery market is on the brink of significant growth, with a forecasted revenue of around US$1.04 trillion in 2023.

- This expansion is expected to continue with an estimated compound annual growth rate (CAGR) of 11.47% from 2023 to 2028. Potentially reaching a market size of approximately US$1.79 trillion by 2028.

- In the Grocery Delivery sector, there’s an exciting anticipation of a substantial 22.2% revenue increase in 2024, with the market volume projected to hit US$0.64 trillion in 2023.

- Globally, China is positioned to lead in revenue generation, with an impressive forecasted figure of US$395.90 billion in 2023.

- The Average Revenue Per User (ARPU) for Grocery Delivery is expected to hover around US$463.80 in 2023.

- Meanwhile, in the Meal Delivery market, the user base is set to expand significantly, reaching 2.5 billion users by 2028, with user penetration estimated to be approximately 25.2% in 2023.

- Notably, countries like the United States and China stand out in the global online food delivery market due to their large consumer base and robust delivery infrastructure.

(Source: Statista)

Customer Online Ordering and Delivery Preferences

- However, In 2022, there is a significant shift in consumer behavior towards online food ordering. Nearly 60% of diners anticipate ordering more online this year.

- Among these diners, 42% plan to increase their orders directly from restaurants. A threefold increase compared to the 14% who intend to use third-party apps more frequently.

- Mobile devices are gaining popularity, with 35% of customers now placing more orders through apps compared to three months ago, and they tend to spend more when using restaurant apps.

- The usage of apps for food and grocery orders in the U.S. is expected to rise from 27.9 million to 30.4 million in 2022.

- Moreover, successful restaurants are increasingly offering mobile order-ahead and loyalty rewards programs. Approximately 28% of people opt for online food ordering to save time on cooking and cleaning.

- Over 80% of restaurants are adopting technology, including online ordering, reservation apps, and analytics, to enhance operational efficiency.

- Approximately 56% of both customers and restaurant owners express a desire for online ordering within restaurant apps.

- The restaurant-to-consumer online food ordering segment has seen substantial growth, reaching 760 million users, a 20% year-over-year increase.

- Around 64% of consumers prefer digital on-premises ordering at Quick Service Restaurants (QSRs).

- Furthermore, as of mid-November, 45% of consumers surveyed indicated that the ability to order online would encourage them to spend more on food, up from 37% in October.

- Additionally, 35% expressed this sentiment for mobile app ordering, while 31% cited curbside pickup.

- Further, consumer demand for online food ordering has surged, with 62% ordering food online at least once a month before the pandemic, and 78% either maintaining or increasing their online food ordering frequency.

(Source: Mad Mobile)

Recent Developments

Acquisitions and Mergers:

- Reef acquires Boon Burger Café: In 2023, Reef Technology, a major player in the cloud kitchen industry. Acquired Boon Burger Café, a Canadian vegan restaurant chain, for an estimated $100 million. This acquisition is part of Reef’s strategy to expand its plant-based offerings through cloud kitchens across North America.

- DoorDash acquires Chowbotics: In 2023, DoorDash purchased Chowbotics, a robotic food prep company, for $70 million. This acquisition aims to improve automation in DoorDash’s cloud kitchen operations, speeding up food preparation and delivery.

New Product Launches:

- Uber Eats launches “Virtual Restaurants” in 2024: Uber Eats expanded its cloud kitchen platform by launching Virtual Restaurants in 2024. Enabling restaurants to operate additional brands from their existing kitchens. This new service helps restaurants increase revenue streams by creating delivery-only brands, without additional physical space requirements.

- Kitopi launches “Cloud Brands” in the Middle East: In late 2023, Kitopi, a leading cloud kitchen operator. Launched its Cloud Brands in the Middle East, focusing on creating unique, digital-first food brands. These brands are exclusive to delivery platforms and aim to capture the growing demand for convenient, online food options.

Funding:

- Taster raises $37 million for European expansion: In 2023, Taster, a European cloud kitchen operator, raised $37 million to expand its operations across Europe. The funding will help Taster grow its portfolio of virtual food brands and develop technology to enhance the efficiency of its delivery kitchens.

- Rebel Foods secures $175 million in Series F funding: In 2024, Rebel Foods, the world’s largest cloud kitchen operator, secured $175 million in Series F funding to grow its global presence and scale its technology platform. The company plans to expand into new markets like the U.S. and the Middle East.

Technological Advancements:

- AI-Driven Menu Personalization: AI is playing a key role in cloud kitchens by enabling menu personalization based on customer preferences and data analytics. By 2025, over 30% of cloud kitchens are expected to implement AI-driven tools to customize menus. Improve operational efficiency and enhance customer satisfaction.

- Automation and Robotics: Automation is becoming more common in cloud kitchens, with the use of robots for food preparation and packaging. By 2024, 25% of cloud kitchens are expected to adopt robotics technology to reduce labor costs and streamline operations.

Market Dynamics:

- Growth in Cloud Kitchen Market: This growth is driven by the increasing demand for food delivery services, the rise of virtual restaurants, and the shift towards online ordering.

- Increased Adoption of Virtual Brands: As food delivery continues to rise, 40% of restaurant operators are expected to launch virtual-only brands by 2025. Capitalizing on the low overhead costs and flexibility of cloud kitchens.

Conclusion

Cloud Kitchen Statistics – In summary, cloud kitchens are a game-changer in the food industry. Offering cost-effective, scalable solutions to meet the growing demand for online food orders.

Moreover, they face challenges in maintaining quality and regulatory compliance but hold great promise for the future. Technology integration and sustainability will be key drivers of their success.

As consumer behaviors evolve, cloud kitchens are set to redefine how we experience food. Presenting both opportunities and challenges for the industry.

FAQs

A cloud kitchen is also known as a ghost kitchen or virtual kitchen. It is a food service establishment that focuses solely on preparing and delivering food, without offering dine-in options.

Cloud kitchens operate by using shared kitchen spaces and technology to streamline food preparation and delivery processes. Multiple virtual restaurant brands may share the same kitchen facilities.

Cloud kitchens offer cost-efficiency, scalability, data-driven operations, and the ability to adapt quickly to market demands. They also eliminate the need for expensive dine-in spaces.

Challenges include competition among virtual restaurant brands, and maintaining food quality and consistency. Efficient last-mile delivery logistics, and compliance with local regulations.

COVID-19 accelerated the growth of cloud kitchens as dine-in restrictions increased the demand for food delivery, making them a more attractive option for restaurants.