Table of Contents

Introduction

Combat System Management Statistics: A Combat Management System (CMS) is a complex military tool that centralizes data from sensors, like radar and sonar, for commanders to make informed decisions.

It identifies and tracks targets, controls weapon systems, and ensures secure communication among units. CMS aids navigation, resource management, and command hierarchy.

It analyzes data for post-mission insights and cybersecurity is a top concern. It integrates with other military systems, emphasizes user-friendliness, and monitors its health.

CMS adapts to future tech upgrades and legal compliance and includes training and documentation for operators and maintainers. Its versatility makes it pivotal in modern military operations.

Editor’s Choice

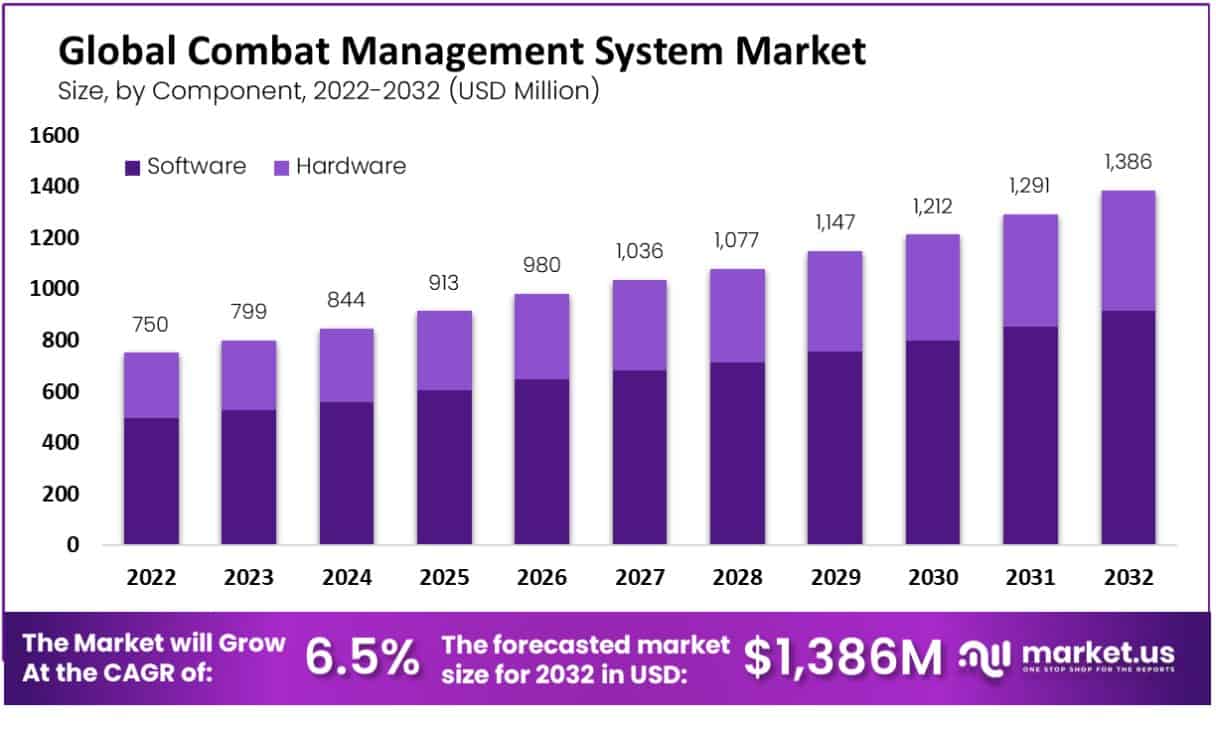

- The Combat Management System market is projected to exhibit substantial growth at a CAGR of 6.5% from 2022 to 2032.

- In 2032, the Combat Management System market is expected to achieve a substantial revenue of USD 1,386.0 million.

- In the global combat management system market and various sub-systems, the Unmanned Vehicle Control System takes the lead with a substantial market share of 23%.

- Tacticos technology has been deployed on more than 160 vessels, encompassing a broad range from small patrol craft to substantial frigates and destroyers, serving the needs of 20 different navies across the globe.

- Saab’s 9LV CMS system delivers extensive operational functionality and has already been implemented in over 200 systems worldwide.

- Lockheed Martin’s COMBATSS-21, serving as a ships’ battle management system, draws its foundation from the latest Aegis surface combatants employed by the US Navy and takes a central role within the Freedom-variant self-defense suite.

- In October 2023, the U.K. Ministry of Defence granted BAE Systems contracts worth $4.95 billion to construct a new class of nuclear attack submarines for the Royal Navy and, eventually, for Australia.

Global Combat Management System Market Overview

Global Combat Management System Market Size Statistics

- The Combat Management System market is projected to exhibit substantial growth at a CAGR of 6.5% over the forecast period from 2022 to 2032.

- Starting at USD 750.0 million in 2022, the market is expected to witness a steady upward trajectory.

- In 2023, it is anticipated to reach USD 799.0 million, reflecting a positive trend.

- The subsequent years continue to show robust growth, with market revenues reaching USD 844.0 million in 2024, USD 913.0 million in 2025, and USD 980.0 million in 2026.

- The momentum persists with revenues of USD 1,036.0 million in 2027 and USD 1,077.0 million in 2028.

- As we progress towards 2030, the market is predicted to reach USD 1,147.0 million and then further escalate to USD 1,212.0 million in 2031.

- Finally, in 2032, the Combat Management System market is expected to achieve a substantial milestone with revenues of USD 1,386.0 million, showcasing the sector’s robust growth potential over the next decade.

(Source: Market.us)

Global Combat Management System Market Size – By Component Statistics

- The global Combat Management System (CMS) market is characterized by robust growth in both software and hardware components.

- In 2022, the total market revenue stood at USD 750.0 million, with software accounting for USD 495.0 million and hardware contributing USD 255.0 million. As we move into the future, this growth trend continues.

- In 2023, the total market revenue will increase to USD 799.0 million, with software and hardware revenues reaching USD 527.0 million and USD 272.0 million, respectively.

- This pattern persists through the years, with the total market revenue projected to reach USD 1,386.0 million in 2032, driven by software revenue of USD 915.0 million and hardware revenue of USD 471.0 million.

- This data highlights the increasing importance of both software and hardware components within the global CMS market, reflecting the vital role these systems play in enhancing military capabilities and command and control functions worldwide.

(Source: Market.us)

Global Combat Management System Market Share – By Sub-system Statistics

- In the global combat management system market, various sub-systems collectively shape the landscape of modern military operations.

- Notably, the Unmanned Vehicle Control System takes the lead with a substantial market share of 23%, reflecting the increasing importance of unmanned vehicles in contemporary warfare scenarios.

- Following closely behind is the Self Defense Management System, commanding a significant share of 19%, highlighting the emphasis on self-protection mechanisms within combat management.

- Additionally, the Situational Awareness System, at 15%, plays a crucial role in providing real-time information to military personnel, while the Weapon Management System, at 16%, ensures precise control and deployment of weaponry.

- Complementing these core sub-systems, the Track Management System, with a 14% market share, facilitates the monitoring and tracking of targets and assets on the battlefield.

- Beyond these key sub-systems, the remaining sub-systems and components collectively contribute 13% to the market share, underlining the multifaceted nature of combat management systems and the diverse components that work in synergy to ensure operational success on the modern battlefield.

- This distribution underscores the importance of a comprehensive and integrated approach to combat management, where each sub-system plays a vital role in achieving mission objectives.

(Source: Market.us)

Thales

- Thales has introduced the Tacticos naval combat management system, a comprehensive solution tailored for both combat and maritime security operations.

- This system has been intricately crafted with a strong emphasis on certified openness and scalability in its design.

- It employs a modular approach, enabling it to adapt to a variety of mission requirements and vessel types.

- Tacticos assumes a central role in mission solutions, leveraging open standards technology and an extensive array of subsystem interfaces.

- Operators have the flexibility to manage it from either the Combat Information Center (CIC) or the OpsRoom, with Thales offering valuable assistance in designing efficient room layouts.

- Thales also provides specialized mission packages, which encompass anti-air warfare clusters, Fire Control clusters, and Tactical datalink solutions.

- Tacticos technology has been deployed on more than 160 vessels, encompassing a broad range from small patrol craft to substantial frigates and destroyers, serving the needs of 20 different navies across the globe.

- These navies include the US Navy and several others from regions such as Asia, Europe, the Gulf, Latin America, the Middle East, and North Africa.

(Source: SP’s Naval Forces)

SAAB

- The Saab 9LV CMS system is tailored to meet the operational requirements of a ship’s command and is versatile enough to be used on a wide range of vessels, spanning from small patrol boats to large frigates.

- Saab provides customers with the option to integrate various subsystems according to their preferences.

- Thanks to its efficient situational awareness and swift, precise tactical response capabilities across all domains of warfare, the 9LV system significantly enhances operational effectiveness for diverse mission scenarios, whether they occur in the open sea or coastal areas.

- It is well-equipped to handle unconventional threats and can adapt to both current and foreseeable future challenges.

- The system offers a variety of choices for integrating user interfaces for equipment and subsystems, including hosted vendor clients, web services, thin clients, or fully integrated human-machine interfaces with touch-input displays and soft keys.

- Additionally, it seamlessly integrates with other subsystems like weapon systems.

- Saab’s 9LV CMS system delivers extensive operational functionality and has already been implemented in over 200 systems worldwide.

(Source: SP’s Naval Forces)

Lockheed Martin

- Lockheed Martin’s COMBATSS-21, serving as a ships’ battle management system, draws its foundation from the latest Aegis surface combatants employed by the US Navy and takes a central role within the Freedom-variant self-defense suite.

- It seamlessly combines electro-optical infrared cameras, radar, gun fire control systems, countermeasures, and short-range anti-air missiles into a unified system.

- This adaptable platform offers advanced defense capabilities for the LCS, spanning missions like intelligence, surveillance, reconnaissance, mine warfare, surface warfare, and anti-submarine warfare.

- Its modern design permits tailored configurations across a spectrum of ship sizes, ranging from compact patrol vessels to expansive deck ships, ensuring versatility and cost-effectiveness.

- The well-established software provides a dependable, low-risk solution that can be readily upgraded to address evolving threats and changing operational environments throughout the ship’s service life.

(Source: SP’s Naval Forces)

DCNS

- POLARIS® is a compact and proven solution designed to meet the requirements of navies and coast guards, focusing on surveillance and protection in littoral and exclusive economic zones.

- It suits various vessels, including offshore patrol vessels, fast attack craft, fast patrol boats, and landing platform dock/helicopter dock operations.

- Its key features encompass efficient intelligence data handling, simplified identification procedures, and improved coordination for sea policing and countering unconventional threats.

- POLARIS® is a robust and adaptable CMS, readily suitable for ship upgrade programs. It can manage both surface-to-surface and defense missile systems and, when used with MATRICS, automatically detects irregular behavior patterns.

- Additionally, it offers enhanced connectivity and interoperability with multiple elements, including helicopters, special forces, unmanned systems, search sensors, electronic warfare capabilities, and weapon systems.

(Source: SP’s Naval Forces)

Elbit

- The ENTCS 2000 Naval Combat Management Systems have the objective of achieving “knowledge superiority” over potential foes by accelerating decision-making processes and executing accurate weapon engagements within task forces.

- Additionally, it guarantees swift adjustment to changing circumstances. This system is built upon an openly accessible and widely distributed architecture, making use of commercially accessible components.

- It offers increased redundancy, removing the risk of a single point of failure.

- Its modular structure and adaptability ensure it is compatible with a variety of existing systems and platforms, ranging from small patrol boats to frigates, and from command centers to maritime patrol aircraft and helicopters.

(Source: SP’s Naval Forces)

- Back in November 2018, BAE Systems unveiled a £20 million investment in augmented reality and artificial intelligence technologies intended for future use in the essential systems that empower warships with their combat capabilities.

- These advancements are intended to assist naval personnel in enhancing their decision-making abilities within future combat scenarios, enabling them to respond more swiftly to potential threats.

- In June 2023, the European Commission disclosed the outcomes of the 2022 proposals for the European Defence Fund (EDF), providing €832 million in EU funding for 41 collaborative defense research and development initiatives throughout the EU.

- These chosen projects aim to advance the EU’s top-tier defense capabilities in crucial domains like naval, ground, and air combat, space-based early warning, and cybersecurity.

- In November 2023, Lockheed Martin Corp.’s Rotary and Mission Systems unit secured a $30.5 million contract modification related to the AEGIS combat system. The contract was granted by the Naval Sea Systems Command in Washington, D.C.

Furthermore Investments in Naval Combat Management Systems Statistics

- Austal, an Australian firm with shipyards in Western Australia and Alabama, USA, offers an attractive investment opportunity. With an expected $3.2 billion contract for surveillance ship construction and a market capitalization of less than $1 billion, it stands out as a compelling choice compared to other defense industry companies.

- The increasing competition with China has spurred the US Navy’s interest in expanding its shipbuilding endeavors, adding to Australia’s appeal to investors.

- In October 2023, the U.K. Ministry of Defence granted BAE Systems contracts worth $4.95 billion to construct a new class of nuclear attack submarines for the Royal Navy and, eventually, for Australia.

- This contract, named SSN-AUKUS, enables BAE Systems to initiate detailed design work and procure long lead materials for the submarines. Construction is set to commence in the late 2020s, with the first submarine scheduled for delivery in the 2030s.

(Source: BAE Systems, European Commission, Yahoo Finance, gCaptain, USNI News)

Recent Developments

Acquisitions and Mergers:

- BAE Systems acquires Bohemia Interactive Simulations: In 2023, BAE Systems acquired Bohemia Interactive Simulations, a leading developer of military training and simulation software, for $200 million. This acquisition aims to enhance BAE’s combat system management solutions by integrating advanced simulation technologies for training and operational planning.

- Northrop Grumman acquires Firebird Systems: In 2024, Northrop Grumman acquired Firebird Systems, a company specializing in sensor integration and real-time data management for combat systems, in a deal worth $150 million. This acquisition strengthens Northrop Grumman’s capabilities in delivering more efficient combat system management solutions with improved data processing capabilities.

New Product Launches:

- Lockheed Martin introduces C2BMC upgrade: In late 2023, Lockheed Martin launched an upgraded version of its Command and Control, Battle Management, and Communications (C2BMC) system. The new version offers enhanced real-time data processing and advanced threat detection for improved situational awareness in combat scenarios.

- Saab launches 9LV CMS for naval operations: In 2023, Saab introduced its next-generation 9LV Combat Management System (CMS), designed specifically for naval combat operations. The system provides enhanced multi-domain situational awareness and integrates advanced sensors and weapon systems to improve combat decision-making.

Funding:

- Raytheon Technologies secures $500 million for R&D: In 2023, Raytheon Technologies announced a $500 million investment in research and development for combat system management solutions. The funding is aimed at advancing AI integration, improving sensor fusion technologies, and enhancing decision-making speed in real-time combat environments.

- General Dynamics invests $300 million in AI-driven combat systems: In early 2024, General Dynamics secured $300 million to enhance its AI-driven combat system management technologies. The company aims to develop systems that can autonomously process vast amounts of combat data, enabling faster and more accurate responses.

Technological Advancements:

- AI integration in combat management systems: AI is playing a critical role in modernizing combat systems by improving data analysis and decision-making capabilities. By 2025, 45% of combat management systems are expected to incorporate AI technologies to enhance real-time situational awareness and autonomous threat identification.

- Advanced sensor fusion technologies: Sensor fusion, which combines data from multiple sensors to create a unified view of the battlefield, is becoming essential for combat system management. By 2026, sensor fusion will account for 35% of new combat system deployments, allowing for more accurate targeting and threat detection.

Conclusion

Combat Management System Statistics – In summary, Combat Management Systems (CMS) are crucial for modern naval operations, enhancing decision-making and situational awareness.

The global CMS market is growing steadily, driven by defense investments and the need for naval modernization.

Leading companies like Thales, Lockheed Martin, and Saab provide adaptable and scalable solutions for various naval platforms.

Initiatives like the European Defence Fund emphasize the importance of CMS in responding to evolving threats.

As technology advances, CMS will continue to play a vital role in naval warfare, ensuring naval forces’ readiness and effectiveness.

FAQs

A Combat Management System is a software and hardware suite used on naval vessels to collect, process, and display information critical for decision-making during combat operations. It integrates various sensors, weapons systems, and communication devices to enhance situational awareness and control.

CMS primarily performs functions such as threat detection, tracking, weapon control, communication management, surveillance, and data fusion to help naval crews effectively respond to threats and manage combat operations.

A CMS enhances naval operations by providing real-time information, automating processes, and assisting in rapid decision-making. It improves response times, reduces the risk of errors, and optimizes the utilization of onboard resources.

Prominent companies in CMS development include Thales, Lockheed Martin, Saab, and BAE Systems, among others. These companies offer a range of CMS solutions tailored to different naval platforms.

Open architecture in CMS allows for easier integration with other ship systems, facilitates upgrades, and ensures interoperability. It enables navies to adapt to changing technologies and requirements more effectively.