Table of Contents

- Introduction

- Editor’s Choice

- Smart Airport Market Overview Statistics

- Key Players in the Smart Airport Market Statistics

- Regional Analysis of the Smart Airport Market Statistics

- Smart Airport Passenger Processing Statistics

- Adoption of Technologies in Smart Airport

- Passenger Preferences and Priorities in Smart Airports

- Recent Developments

- Conclusion

- FAQs

Introduction

Smart Airport Statistics: Smart airports represent a notable progression in the aviation sector. Integrating modern technologies to enhance operational efficiency, passenger experiences, and safety.

They optimize procedures such as passenger check-in, luggage management, and security checks. Resulting in shorter wait times and improved traveler contentment.

Utilizing advanced surveillance and communication systems ensures safety and delivers up-to-the-minute information.

Additionally, smart airports support environmental sustainability by embracing eco-friendly technologies. The smart airport market is witnessing growth due to the advantages it delivers and regulatory encouragement. Indicating a promising evolution within the aviation industry.

Editor’s Choice

- The revenue of the Smart Airport market is projected to experience steady growth over the coming years at a CAGR of 8.8%.

- In 2022, the market generated USD 15.9 billion, and this figure is anticipated to increase to USD 36.2 billion in 2032.

- In terms of location breakdown, the Airside segment commands the largest share at 44.3%, emphasizing its significant role in the smart airport ecosystem.

- Amadeus IT Group SA secures a substantial 15% share, indicating its prominence in the industry.

- The global Smart Airport market exhibits a varied regional distribution. North America emerging as the dominant player, commanding a significant share of 35.9%.

- Notably, in 2021, approximately 52% of airports introduced self-service bag drop facilities. Which have the potential to reduce queues and lessen the reliance on airport personnel.

- During 2020, a significant majority of respondents worldwide, specifically 83%. Indicated that the implementation of thermal scanners at boarding gates and during the boarding process would greatly boost their confidence.

Smart Airport Market Overview Statistics

Global Smart Airport Market Size Statistics

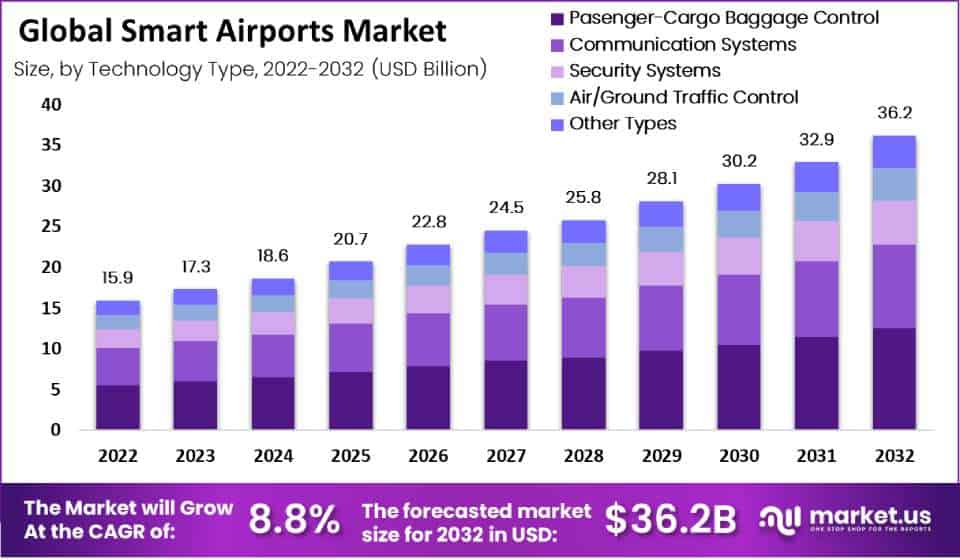

- The revenue of the Smart Airport market is projected to experience steady growth over the coming years at a CAGR of 8.8%.

- In 2022, the market generated USD 15.9 billion, and this figure is anticipated to increase to USD 17.3 billion in 2023.

- Moving forward, the market is expected to continue its upward trajectory. Reaching USD 18.6 billion in 2024, and further expanding to USD 20.7 billion in 2025.

- The growth of the market can be attributed to the increasing adoption of smart technologies and automation in airport operations.

- As we look ahead, the revenue is projected to reach USD 22.8 billion in 2026, USD 24.5 billion in 2027, and USD 25.8 billion in 2028.

- By 2030, the market is forecasted to surpass the USD 30 billion mark, specifically reaching USD 30.2 billion.

- Beyond that, the growth is expected to continue, with the market’s revenue estimated to reach USD 32.9 billion in 2031 and USD 36.2 billion in 2032.

- This positive trajectory underscores the significant opportunities and potential within the smart airport industry. Driven by advancements in technology and the increasing demand for efficient airport operations.

(Source: Market.us)

Smart Airport Market Size – By Technology Type Statistics

- The global Smart Airport market is characterized by its diversified technology segments, each contributing to the overall revenue.

- In 2022, the market recorded a total revenue of USD 15.9 billion, with the primary technology sectors being Passenger-Cargo Baggage Control at USD 6 billion, Communication Systems at USD 5 billion, Security Systems at USD 2 billion, Air/Ground Traffic Control at USD 2 billion, and Other Types at USD 2 billion.

- As we progress into the future, the market is set to expand consistently. By 2032, the total market revenue is expected to reach USD 36.2 billion.

- Notably, Passenger-Cargo Baggage Control is projected to grow to USD 13 billion, Communication Systems to USD 10 billion, Security Systems to USD 5 billion, Air/Ground Traffic Control to USD 4 billion, and Other Types to USD 4 billion.

- This growth trajectory signifies the rising importance of smart technologies in various facets of airport operations. Reflecting the industry’s commitment to enhancing passenger experience, security, and efficiency through technological advancements.

(Source: Market.us)

Global Smart Airport Market Share – By Location Statistics

- The global Smart Airport market is divided into various key locations, each holding a distinct market share percentage.

- In this breakdown, the Airside segment commands the largest share at 44.3%. Emphasizing its significant role in the smart airport ecosystem.

- The Landside sector holds a substantial market share as well. Accounting for 20.0%, while the Terminal Side segment accounts for 35.7% of the market share.

- This distribution highlights the critical areas within smart airports where technological advancements and innovations are implemented.

- Airside operations, which include activities on runways and taxiways, appear to dominate the market, closely followed by Terminal Side. Which encompasses passenger areas, and Landside, comprising access points and transportation connections.

- This allocation of market share underscores the comprehensive approach taken by the industry to implement smart technologies across all facets of airport operations to enhance efficiency and passenger experiences.

(Source: Market.us)

Key Players in the Smart Airport Market Statistics

- Within the Smart Airport market, several key players play significant roles. Each contributes to the overall landscape with their respective market shares.

- Amadeus IT Group SA secures a substantial 15% share, indicating its prominence in the industry.

- Following closely behind, CISCO Systems Inc. commands a notable 10% market share.

- Collins Aerospace and Daifuku Co. Ltd. both hold substantial positions, with 9% and 11% market shares, respectively.

- Ascent Technologies and Honeywell International Inc. each contribute 10% and 9% to the market. Huawei Technologies Co. Ltd. and IBM Corporation are also important players, holding 8% and 9% shares, respectively.

- Furthermore, the collective contribution of other key players accounts for 7% of the market share.

- This distribution underscores the competitive nature of the Smart Airport market. With a diverse group of companies making substantial contributions to its growth and development.

(Source: Market.us)

Regional Analysis of the Smart Airport Market Statistics

- The global Smart Airport market exhibits a varied regional distribution. North America emerging as the dominant player, commanding a significant share of 35.9%.

- Europe follows closely behind, contributing 21.0% to the market, showcasing its substantial presence. The Asia-Pacific (APAC) region plays a pivotal role as well, holding a substantial share of 23.7%.

- In Latin America, the Smart Airport market accounts for 14.2% of the overall distribution. While the Middle East and Africa (MEA) region represents 5.2%.

- This regional breakdown illustrates the global reach and adoption of smart airport technologies. With North America leading the way, followed by strong showings in Europe and APAC.

- These percentages reflect the evolving landscape of smart airports on a worldwide scale. As regions across the globe continue to invest in and embrace advanced technologies for enhanced airport operations.

(Source: Market.us)

Smart Airport Passenger Processing Statistics

- In 2021, the worldwide airline industry faced a significant challenge due to the COVID-19 pandemic. Resulting in just over 2.2 billion passengers flying.

- This marked a 50% drop in global air travel compared to 2019.

- Over the past decade, except for one year, there has been a consistent increase in the number of scheduled passengers handled by the global airline sector.

- Scheduled passengers refer to those who have booked flights with commercial airlines, excluding charter flights for private groups.

- Notably, in 2019, the Asia Pacific region led in terms of airline passenger traffic. Accounting for a third of the global total and hosting some of the busiest air routes.

- Three key factors driving this global growth in air travel are the rise of low-cost carriers. A growing global middle class, particularly in China, and increased investment in airport infrastructure. Mainly in the Asia Pacific region, expanding global travel capacity.

(Source: Statista)

Future Growth in Air Passenger Traffic

- In terms of future growth in air passenger traffic, there are notable shifts expected by 2040 compared to 2015.

- In North America, the percentage is projected to decrease from 24% in 2015 to 18% in 2040. Similarly, Europe is expected to see a decline from 27% to 20%.

- On the other hand, the Asia Pacific region is poised for substantial growth. With its share is projected to rise significantly from 34% in 2015 to 47% in 2040.

- The Middle East and Africa (MEA) are also expected to experience growth. Increasing from 5% in 2015 to 9% in 2040.

- Conversely, Africa’s share is projected to decrease slightly from 3% to 2%.

- Latin America is expected to maintain a relatively stable share. With a slight decrease from 8% in 2015 to 7% in 2040.

- These shifts in regional air passenger traffic reflect changing dynamics and economic developments in different parts of the world. With the Asia Pacific region emerging as a major player in the aviation industry.

(Source: OST)

Adoption of Technologies in Smart Airport

Technology Adoption During the COVID-19 Pandemic

- Amid the substantial financial losses faced by airlines and airports worldwide due to the COVID-19 pandemic, digitalization has emerged as a crucial solution.

- This approach has proven effective in mitigating the pandemic’s impact while sustaining the demand for air travel. In the “new normal” era, social distancing measures have become imperative, driving the need for operational enhancements.

- Various technologies, including Business Intelligence and Artificial Intelligence. Can be harnessed to efficiently manage terminal flow and implement social distancing measures.

- Additionally, the trend toward online booking and check-in is gaining momentum and is expected to continue growing.

- Notably, in 2021, approximately 52% of airports introduced self-service bag drop facilities. Which have the potential to reduce queues and lessen the reliance on airport personnel.

(Source: Statista)

Smart Touchpoint Installed Base at Airports

- The installation base of smart touchpoints at airports has seen a steady increase in recent years.

- In 2019, there were 46,658 smart touchpoint installations, which grew to 50,531 in 2020.

- Looking ahead to 2025, it is projected to significantly expand to 72,285 installations.

- This upward trend reflects the aviation industry’s commitment to enhancing passenger experiences and operational efficiency through the deployment of smart technology.

- These smart touchpoints encompass various aspects of airport services, including check-in kiosks, security checkpoints, and information displays. Contributing to a more seamless and technologically advanced airport environment.

(Source: Statista)

Passenger Preferences and Priorities in Smart Airports

- During 2020, a significant majority of respondents worldwide, specifically 83%. Indicated that the implementation of thermal scanners at boarding gates and during the boarding process would greatly boost their confidence.

- Furthermore, 85% of the surveyed individuals expressed the belief that implementing staggered boarding procedures would play a crucial role in increasing their confidence when approaching the boarding gate and during the boarding phase.

- In a survey conducted in 2020, approximately 88% of air travelers who participated expressed that they would feel more confident about flying in the post-COVID-19 era if airlines were to rearrange seating by leaving empty seats as a precautionary measure for social distancing.

- In the 2021 survey. A significant 94% of those surveyed emphasized that investing in cybersecurity measures was a top priority for airports.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Honeywell acquires Sine Group: In 2023, Honeywell, a global leader in smart technology, acquired Sine Group, a provider of visitor management and workplace systems, for $75 million. This acquisition enhances Honeywell’s smart airport solutions, specifically focusing on improving airport management and passenger flow with integrated technology.

- Siemens acquires AirIT: In 2023, Siemens acquired AirIT, a company specializing in airport management software, for $150 million. This move is aimed at boosting Siemens’ capabilities in offering digital solutions for airports, helping optimize operations, data analysis, and resource allocation.

New Product Launches:

- SITA launches Smart Path biometrics system: In early 2024, SITA, a global air transport IT company, introduced its Smart Path biometrics system, which allows passengers to check in, drop bags, and board flights using facial recognition. This system is aimed at enhancing passenger experience and increasing airport efficiency.

- Thales unveils AI-powered security systems: In February 2024, Thales launched an AI-powered airport security solution designed to streamline security checks with advanced threat detection capabilities. This technology reduces wait times by 30% and improves overall security at smart airports.

Funding:

- Skyports secures $100 million for smart airport technology: In 2024, Skyports, a leader in urban air mobility infrastructure, raised $100 million to develop drone-based cargo and passenger services at smart airports. The investment is aimed at expanding next-generation mobility solutions for smart airport hubs.

- Copenhagen Airport receives $50 million in government funding: In 2023, Copenhagen Airport secured $50 million from the Danish government to implement smart airport technologies, including automated baggage handling, AI-driven security systems, and sustainable energy solutions.

Technological Advancements:

- 5G integration in smart airports: By 2025, 45% of global airports are expected to integrate 5G technology into their infrastructure, enabling faster communication between systems and enhancing operational efficiency.

- Robotic Assistance at Airports: Smart airports are increasingly adopting robotic assistance for passenger services. By 2026, 25% of airports will deploy robots for tasks such as cleaning, luggage handling, and customer service, improving efficiency and reducing costs.

Conclusion

Smart Airport Statistics – In summary, smart airports are a significant advancement in aviation, driven by advanced technologies. They improve airport operations, enhance passenger experiences, and ensure safety.

The smart airport market is growing globally, fueled by factors like low-cost carriers, a rising global middle class, and increased airport infrastructure investment, particularly in the Asia Pacific region. Smart airports are poised to shape the future of aviation by offering efficiency, safety, and sustainability.

FAQs

Smart airports are airports that leverage advanced technologies such as IoT, AI, and data analytics to enhance various aspects of airport operations, including passenger services, security, and efficiency.

Smart airports provide benefits such as improved passenger experiences, reduced waiting times, enhanced safety and security, and more efficient airport operations.

Smart airports use technology for services like online booking, self-service check-in kiosks, and real-time flight information, making the passenger journey more convenient.

Data analytics in smart airports helps in optimizing operations, predicting passenger flows, and improving resource allocation.

The Asia Pacific region is a frontrunner in adopting smart airport technologies, with significant investment in airport infrastructure.