Table of Contents

Introduction

According to Network as a Service Statistics, Network as a Service (NaaS) revolutionizes networking by providing on-demand resource access without hefty infrastructure investments. Operating on a subscription model, NaaS adapts to diverse industry needs, offering flexibility and scalability.

Virtualized functions, software-defined networking, and cloud-based services are key components, providing organizations with enhanced control and agility. NaaS, with features like bandwidth management and security protocols, enables efficient navigation of modern networking complexities.

Positioned as a strategic enabler amid digital transformation, NaaS facilitates rapid application deployment. Cautious optimism surrounds NaaS, anticipating its potential to reshape networking infrastructures to meet the evolving demands of today’s interconnected business environment.

Editor’s Choice

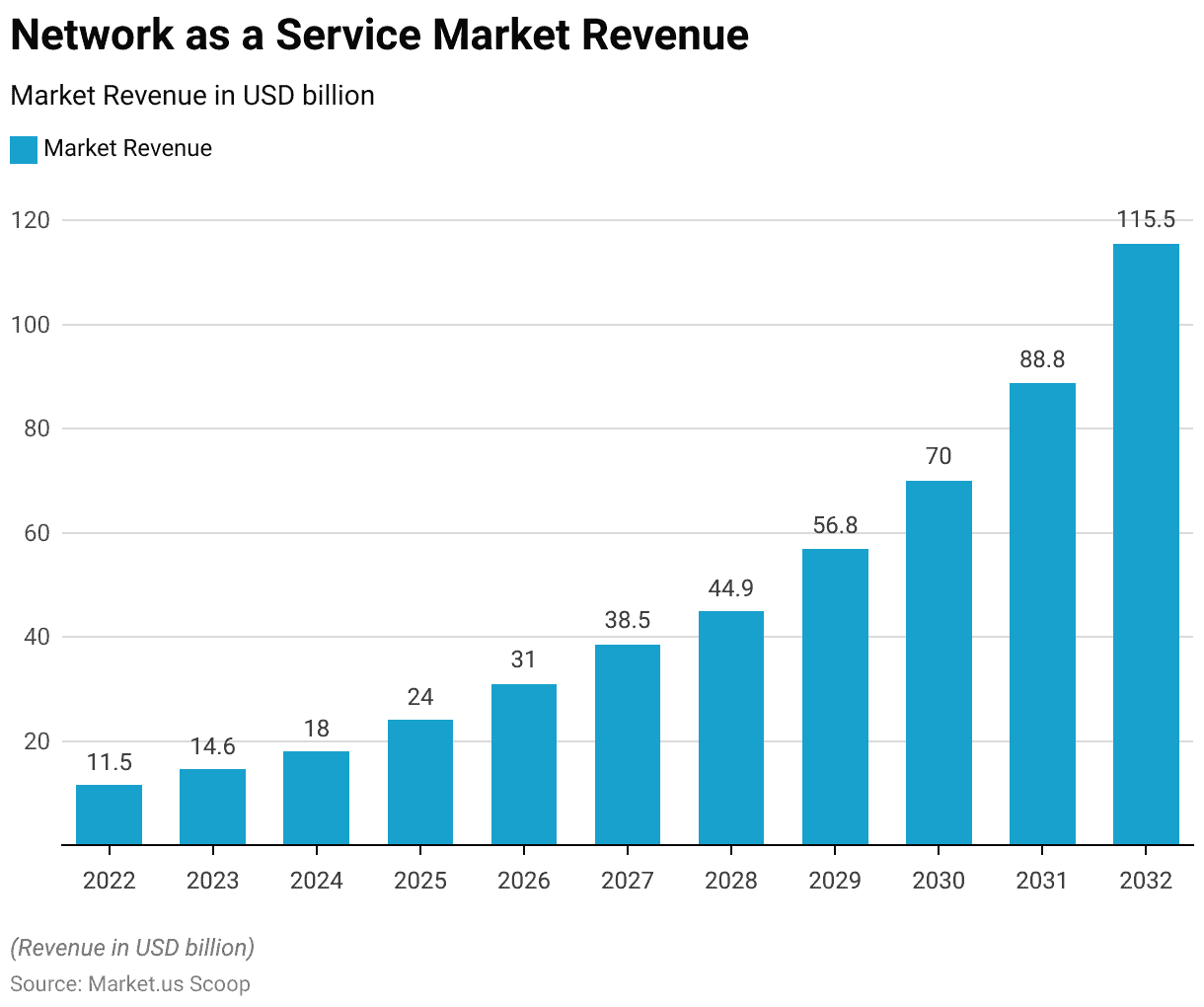

- The revenue trend within the Network as a Service (NaaS) market showcases a consistent and robust growth trajectory at a CAGR of 26.7%.

- The NaaS market reached a revenue of 14.6 billion USD in 2023.

- In 2022, the total NaaS market revenue stands at 11.5 billion USD, comprising WAN-as-a-service revenue of 7.6 billion USD and LAN-as-a-service revenue of 3.9 billion USD.

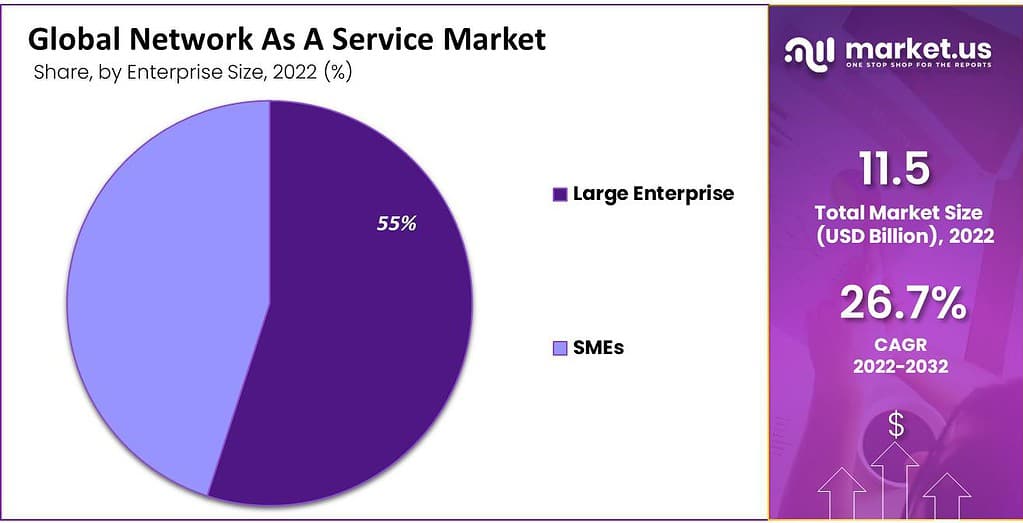

- As of the latest data, large enterprises claim a substantial majority, holding a commanding market share of 55%.

- Among the contributing factors, networking-related outages emerge as the primary driver, accounting for 29% of the responses.

- In 2020, Huawei led the pack with a substantial market share of 26.9%, solidifying its position as a key player in the networking landscape.

- Amazon Web Services (AWS) exhibited a consistent upward trajectory, starting at 67% adoption in 2019 and reaching 80% by 2022.

Network as a Service Market Overview

Global Network as a Service Market Size

- The revenue trend within the Network as a Service (NaaS) market showcases a consistent and robust growth trajectory at a CAGR of 26.7% over the forecasted period from 2022 to 2032.

- Commencing at 11.5 billion USD in 2022, the market exhibits a steady escalation, reaching 14.6 billion USD in 2023 and further expanding to 18.0 billion USD in 2024.

- As we progress into the latter part of the forecast, the NaaS market continues its upward trajectory, recording revenues of 88.8 billion USD in 2031 and a significant milestone of 115.5 billion USD in 2032.

Global Network as a Service Market Size – By Type

- The Global Network as a Service (NaaS) market demonstrates a substantial and progressive expansion, discerned by the evolving revenue figures across different types of services from 2022 to 2032.

- In 2022, the total NaaS market revenue stands at 11.5 billion USD, comprising WAN-as-a-service revenue of 7.6 billion USD and LAN-as-a-service revenue of 3.9 billion USD.

- As the market matures, substantial figures are evident, with total NaaS revenue reaching 56.8 billion USD in 2029, 70.0 billion USD in 2030, and 88.8 billion USD in 2031.

- The WAN-as-a-service and LAN-as-a-service segments similarly contribute to this upward trajectory.

- The pinnacle is achieved in 2032, with the total NaaS market soaring to 115.5 billion USD, driven by WAN-as-a-service revenue of 76.3 billion USD and LAN-as-a-service revenue of 39.3 billion USD.

Network as a Service Market Share – By Enterprise Size

- The Global Network as a Service (NaaS) market exhibits a distribution of market share delineated by enterprise size, with a discernible dominance by large enterprises.

- As of the latest data, large enterprises claim a substantial majority, holding a commanding market share of 55%.

- In tandem, small and medium-sized enterprises (SMEs) contribute significantly, securing 45% of the market share.

- This distribution underscores the prominence of large enterprises as key players in the NaaS landscape, emphasizing their substantial influence and market presence.

Factors Driving the Demand for NaaS

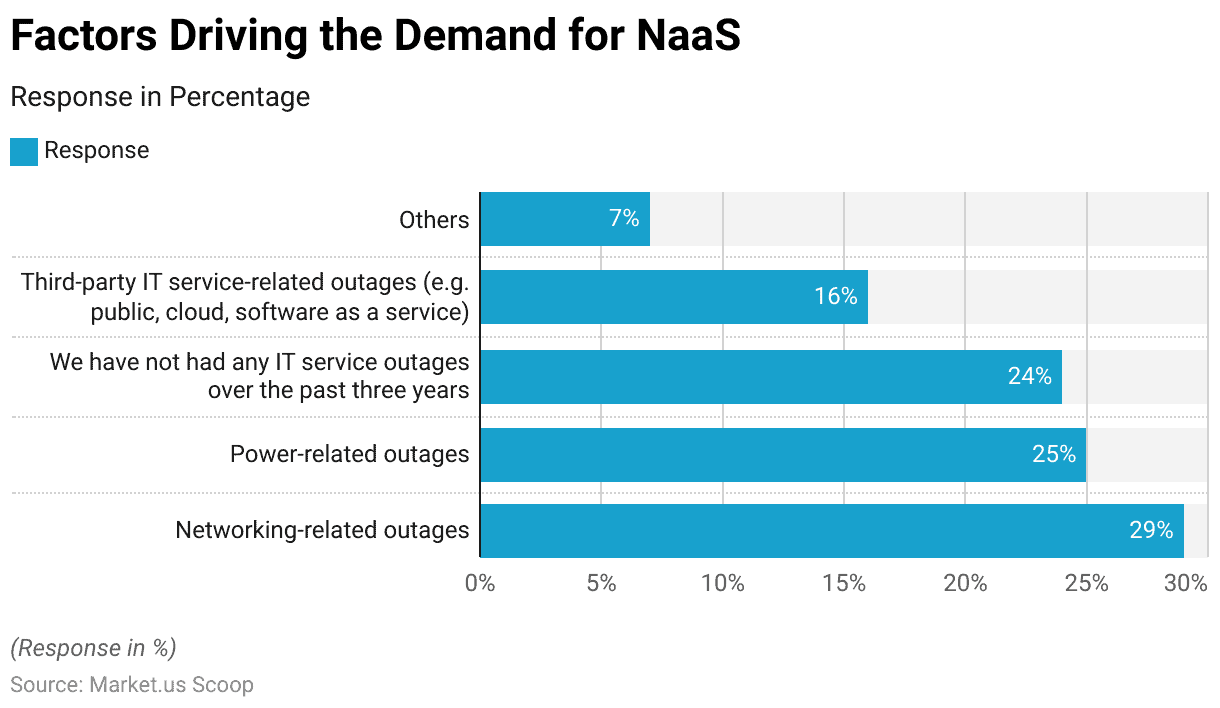

- The demand for Network as a Service (NaaS) is propelled by a variety of factors, with IT service outages playing a pivotal role in shaping this demand landscape.

- Among the contributing factors, networking-related outages emerge as the primary driver, accounting for 29% of the responses.

- Power-related outages closely follow, constituting 25% of the factors influencing the demand for NaaS.

- Notably, a significant portion of respondents, totaling 24%, attribute the impetus for NaaS adoption to a lack of IT service outages over the past three years, indicating a proactive approach to maintaining uninterrupted services.

- Third-party IT service-related outages, such as those associated with public cloud services or software as a service, contribute to 16% of the demand drivers.

Common Root Causes for Networking-related Outages

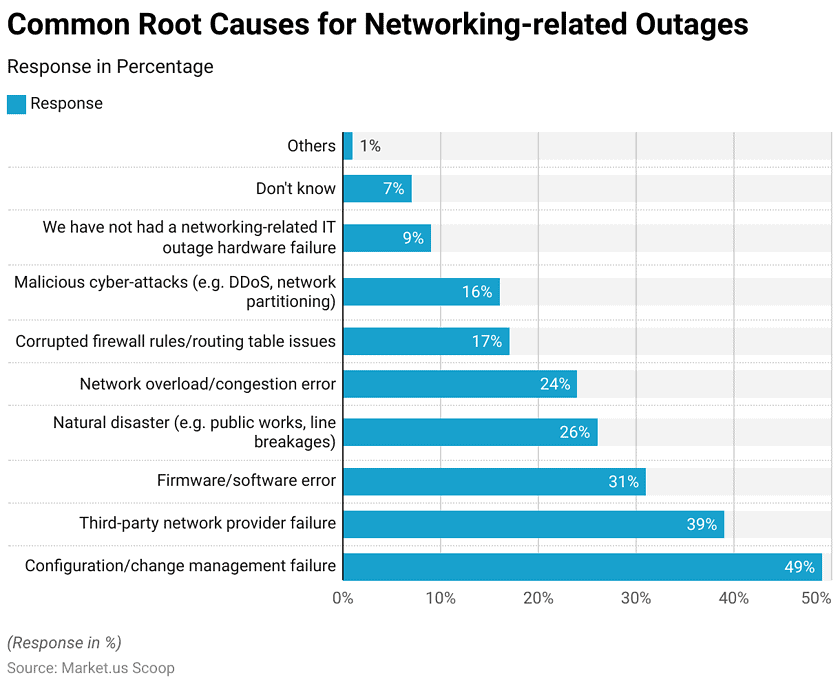

- Networking-related outages in the IT landscape can be attributed to various root causes, as identified by respondents.

- The most prevalent root cause, cited by 49% of respondents, is configuration/change management failure, underlining the critical importance of effective management in maintaining network stability.

- Third-party network provider failure follows closely, with 39% of responses indicating its impact on networking-related outages.

- Firmware/software errors contribute significantly, accounting for 31% of the root causes, emphasizing the need for robust software management practices.

- Natural disasters, such as public works or line breakages, are identified as a root cause by 26% of respondents, while network overload or congestion issues contribute to 24% of the responses. Corrupted firewall rules and routing table issues are noted as a cause by 17% of respondents.

- Malicious cyber-attacks, including Distributed Denial of Service (DDoS) and network partitioning, constitute 16% of the root causes, highlighting the persistent threat landscape.

- Interestingly, a notable 9% of respondents claim not to have experienced networking-related IT outages due to hardware failure.

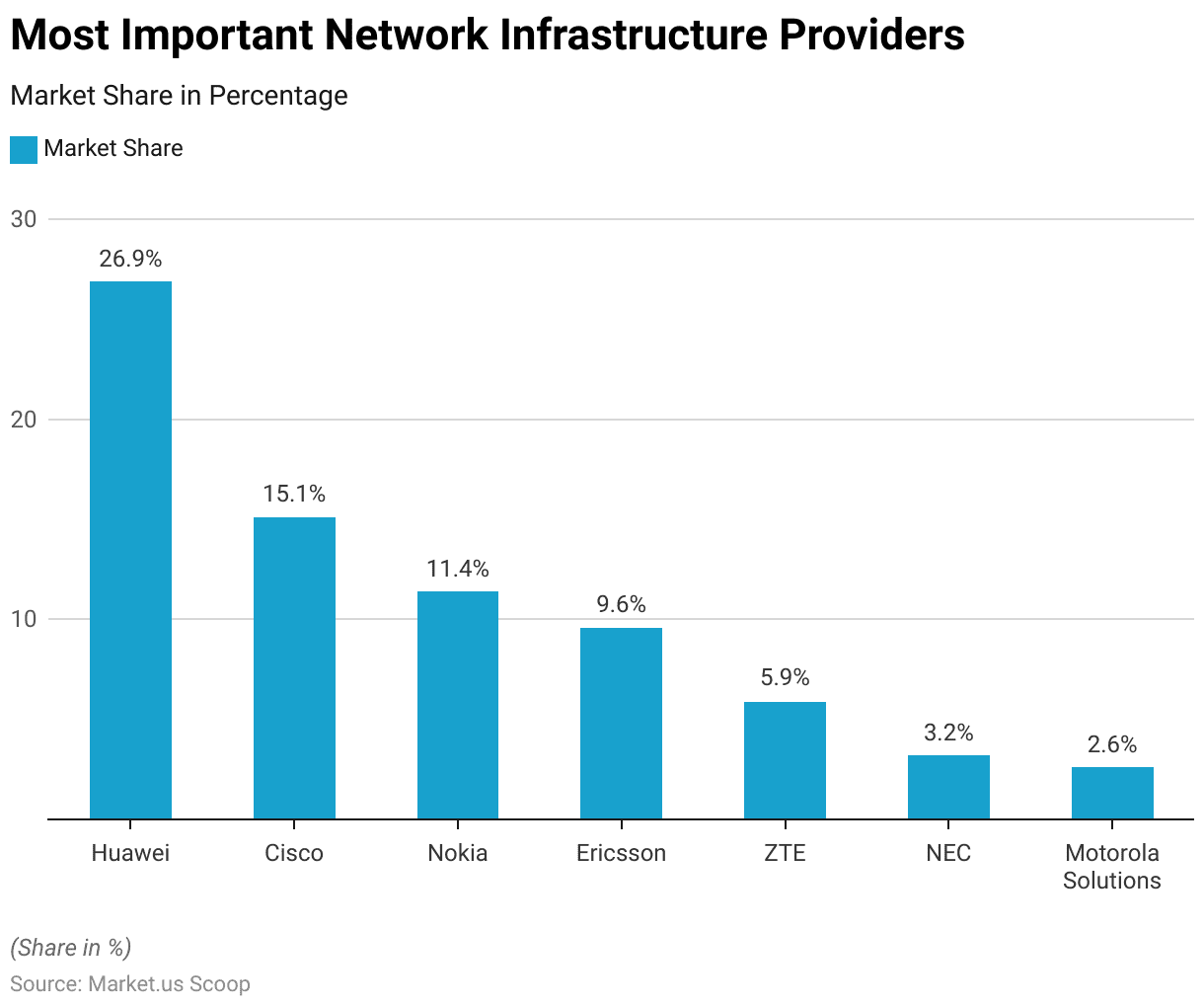

Most Important Network Infrastructure Providers

- In 2020, the market share among network providers was characterized by a prominent presence of industry leaders.

- Huawei led the pack with a substantial market share of 26.9%, solidifying its position as a key player in the networking landscape.

- Following closely behind, Cisco secured a notable 15.1% market share, showcasing its influence in the industry.

- Nokia and Ericsson, with market shares of 11.4% and 9.6%, respectively, maintained significant positions, contributing to the competitive dynamics of the market.

- ZTE, with a 5.9% market share, and NEC, with 3.2%, represented additional contributors to the network provider landscape.

- Motorola Solutions, holding a 2.6% market share, rounded out the key players in this competitive field.

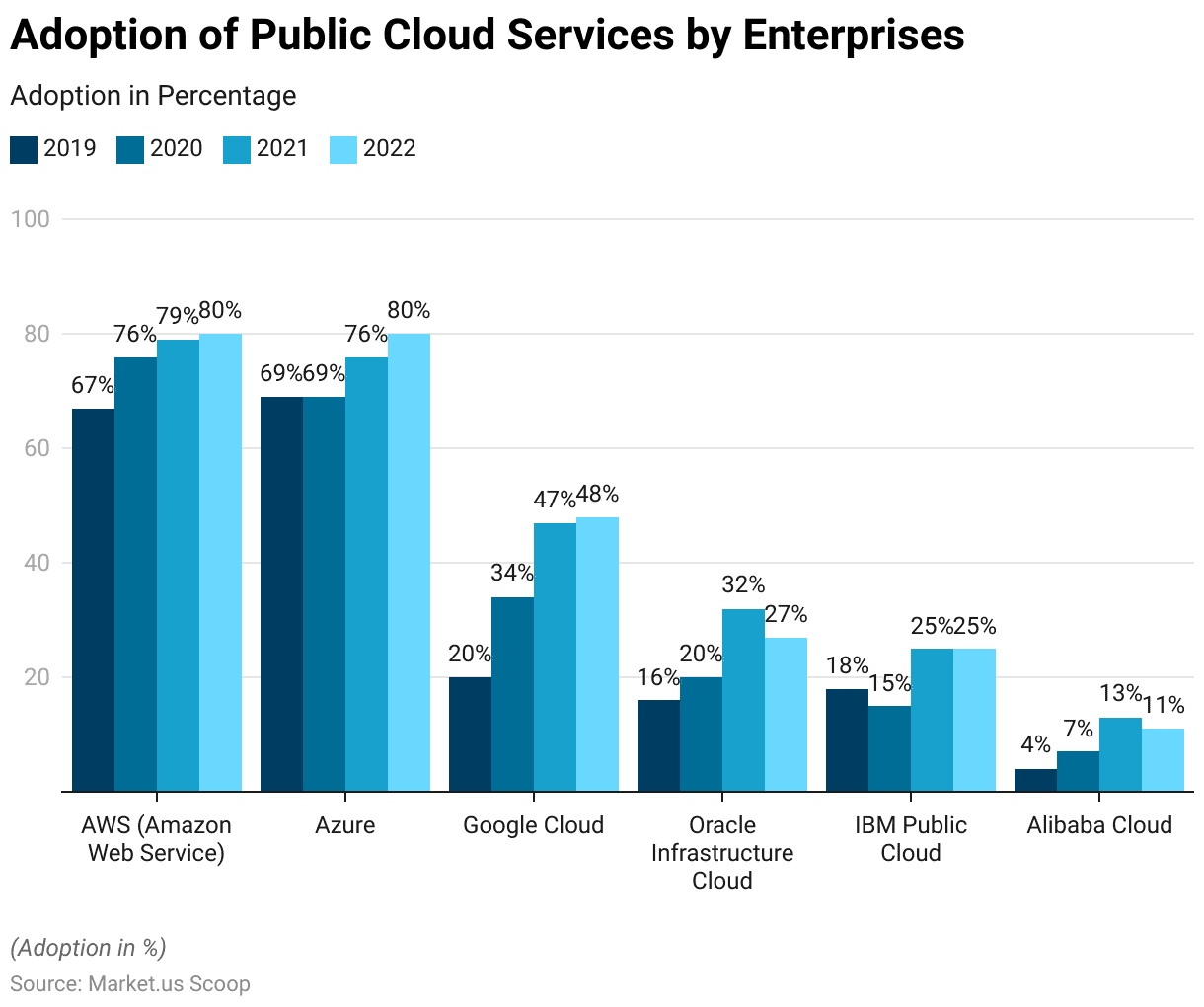

Adoption of Public Cloud Services by Enterprises

- The adoption of public cloud services by enterprise providers witnessed notable shifts from 2019 to 2022, reflecting the evolving dynamics in the cloud computing landscape.

- Amazon Web Services (AWS) exhibited a consistent upward trajectory, starting at 67% adoption in 2019 and reaching 80% by 2022.

- Microsoft’s Azure also demonstrated substantial growth, moving from 69% in 2019 to an equal 80% adoption rate in 2022.

- Google Cloud experienced remarkable expansion, jumping from 20% in 2019 to 48% in 2022, showcasing its increasing appeal among enterprises.

- Oracle Infrastructure Cloud saw fluctuations, with a peak adoption of 32% in 2021, while IBM Public Cloud maintained a steady presence, holding a 25% adoption rate in 2022.

- Alibaba Cloud, although starting at 4% in 2019, demonstrated consistent growth, reaching an 11% adoption rate in 2022.

Networking as a Service Challenges

- A mere 48% of professionals acknowledge regularly staying connected with their network, while 38% express the difficulty of maintaining such connections, primarily attributing it to a shortage of time.

- The desire to network more frequently is shared by 41% of individuals.

- Notably, the challenges in keeping in touch could be a factor in this aspiration, as reflected in the similar percentage of those wishing for more networking opportunities.

- The COVID-19 pandemic has contributed to a staggering 60% surge in cybercrime, posing a substantial drawback to online networking.

Post-pandemic NaaS Trends

- The demand for IT agility and efficient network procurement and management has intensified amid post-pandemic trends.

- IT procurement cycles have quickened, and investments have seen a more significant uptick compared to the pre-COVID era.

- As per an IDC InfoBrief, 71% of organizations note a reduction in their long-term planning cycles due to the impact of COVID-19.

- Furthermore, 82% of these organizations specify that their long-term planning cycles are now restricted to two years or less.

- Given the prevalence of hybrid work environments, there is a heightened emphasis on securing the enterprise both within and beyond its traditional boundaries in a manner that is both flexible and scalable.