Table of Contents

Introduction

According to Interactive Kiosk Statistics, An Interactive Kiosks serves as a self-help terminal that enables user interaction through touchscreens or similar input means. It usually includes physical elements such as a screen, computer, and input tools, along with dedicated software for specific tasks.

These kiosks find common usage in offering information, facilitating self-checkout in retail, handling ticketing, and assisting with navigation. They enhance customer service, streamline operations, and reduce costs, although they necessitate regular maintenance and security measures.

Looking ahead, emerging trends encompass the integration of artificial intelligence, compatibility with mobile devices, and the implementation of touch-free interfaces, making them a versatile technology across various sectors.

Editor’s Choice

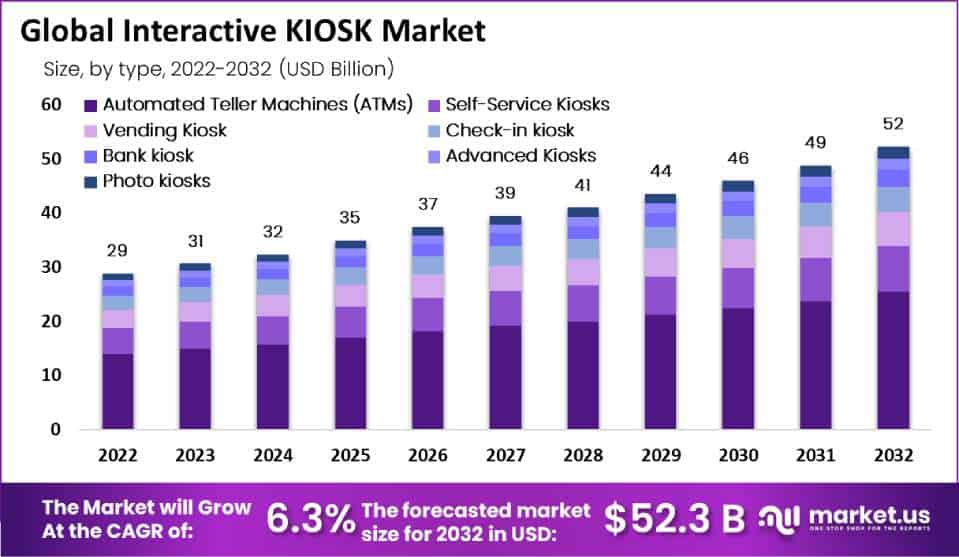

- The global Interactive Kiosk market is witnessing steady growth at a CAGR of 6.3%.

- In 2023, the Interactive Kiosk market was valued at USD 31 billion.

- Olea Kiosk Inc. and GLORY Ltd., have managed to establish a strong presence, each commanding a substantial 15% market share.

- The market distribution for Interactive Kiosks is regionally diverse, with North America commanding the largest share at 44.0%.

- By 2027, the Sel-service Kiosk is expected to reach an impressive revenue figure of USD 21,415.4 million, reflecting the increasing demand and adoption of self-service kiosk solutions across various sectors.

- Based on a research study, approximately 73% of surveyed shoppers have expressed a preference for retail self-service technologies like self-checkout, as opposed to interacting with in-store associates.

- A survey by PYMTS found that 49.4% of retail customers use self-service checkouts for speed, while 34.7% choose them for shorter lines. Hotel guests may also appreciate the flexibility to arrive or depart at their own pace.

Global Interactive KIOSK Market Overview

Global Interactive KIOSK Market Size

- The global Interactive Kiosk market is witnessing steady growth at a CAGR of 6.3%, with revenues projected to increase over the coming years.

- In 2022, the market was valued at USD 29 billion, and this value is expected to rise to USD 31 billion in 2023 and further to USD 32 billion in 2024.

- Looking ahead, the market is anticipated to expand even further, reaching USD 39 billion in 2027, USD 41 billion in 2028, and USD 44 billion in 2029.

- By 2030, the market is forecasted to achieve a value of USD 46 billion, with subsequent years showing continued growth, potentially reaching USD 49 billion in 2031 and USD 52 billion in 2032.

Key Players in the Global Interactive KIOSK Market

- Within the competitive landscape of the Interactive Kiosk industry, various companies are actively vying for their share of the market.

- Two companies, Olea Kiosk Inc. and GLORY Ltd., have managed to establish a strong presence, each commanding a substantial 15% market share. This indicates their significant market influence and competitive edge.

- Following closely behind, Meridian KIOSK holds a 12% market share, showcasing its position as a key player in the industry.

- NCR Corporation is not far behind with an 11% market share, underlining its competitive strength.

- Hitachi Ltd. and Frank Mayer both contribute significantly, each holding a 9% market share, which is noteworthy in the context of market dynamics.

- Diebold Nixdorf also holds a 9% share, emphasizing its presence in the market.

- Additionally, KIOSK Information System and REDYREF Interactive Kiosks play a significant role, accounting for 10% and 8% of the market, respectively.

Regional Analysis of the Global Interactive KIOSK Market

- The market distribution for Interactive Kiosks is regionally diverse, with North America commanding the largest share at 44.0%. This dominance highlights the significant adoption and utilization of Interactive Kiosks in North American markets.

- Europe follows as the second-largest market, holding a substantial 23.0% share, reflecting its significant presence and demand for these self-service terminals.

- The Asia-Pacific (APAC) region is also a notable player, contributing significantly with a market share of 22.5%, showcasing the growing popularity and adoption of Interactive Kiosks across various APAC countries.

- Latin America and the Middle East & Africa (MEA) regions account for smaller yet important shares, with Latin America at 5.3% and MEA at 5.2%.

Interactive Kiosk Market Revenue in the United States – By Component

- From 2014 to 2025, the Interactive Kiosk market in the United States exhibited consistent growth across its key components: Service Revenue, Software Revenue, and Hardware Revenue.

- In 2014, the Service Revenue stood at $2.31 billion, with Software Revenue at $1.5 billion and Hardware Revenue at $3.25 billion.

- Over the years, these figures steadily increased, reflecting the expanding adoption of Interactive Kiosks.

- By 2025, the Service Revenue is projected to reach $5.94 billion, Software Revenue to grow to $3.86 billion, and Hardware Revenue to reach $7.44 billion.

Global Self-service Kiosk Market Size

- The self-service kiosk market has demonstrated a consistent upward trajectory in terms of revenue over the past several years.

- Beginning in 2017 at USD 9,892.3 million, it exhibited steady growth, with revenue figures reaching USD 10,573.8 million in 2018 and USD 11,319.3 million in 2019.

- Looking ahead to 2024, the self-service kiosk market is forecasted to generate USD 16,414.4 million in revenue, with a promising outlook for subsequent years, showcasing the industry’s resilience and potential for sustained expansion.

- By 2027, it is expected to reach an impressive revenue figure of USD 21,415.4 million, reflecting the increasing demand and adoption of self-service kiosk solutions across various sectors.

Type of Kiosks in Operation

- Various types of kiosks operate across different sectors, each catering to specific needs.

- These kiosks include Wayfinding kiosks at 16%, Printing kiosks at 14%, Restaurant order and pay kiosks at 11%, as well as Retail order and pay kiosks also at 11%.

- Additionally, there are Photo processing, Bill payment, Wi-Fi, Pharmacy self-serve, Price checking, Parking, Phone charging, Gaming/entertainment, HR/employee self-service, Tourist information, and Coupon dispensing and/or redemption kiosks, each making up 9% of the kiosk landscape.

- Furthermore, there are specialized kiosks for Airport/transportation check-in, Hospital check-in, Gift dispensing at 5%, and even Vehicle license/registration renewal, DVD rental, Rental payment, and Locker pickup (“smart” lockers) at 2%.

Factors Driving the Demand for Interactive Kiosks

- As per the report findings, a significant 86% of customers express frustration when waiting for a refund, while 52% feel anger when faced with payment delays.

- Additionally, 49% of customers reach a point of extreme frustration when they can’t find what they’re looking for.

- The financial impact of these customer grievances is substantial, with an estimated loss of 38 billion dollars in sales attributed to customers leaving stores due to prolonged waiting times.

- In simple terms, it’s evident that long queues are universally disliked by customers, and they have a detrimental effect on sales.

- In August 2021, a historic milestone was reached with 10 million job vacancies available for the first time.

- Self-service kiosks offer a practical solution by automating routine tasks like check-ins, item pickups and returns, and price verifications. This automation not only improves the overall customer experience but also supports businesses in their quest to recruit skilled personnel.

Consumer Preferences for Interactive Kiosks

- Introducing automated passport control kiosks at JFK and Newark Airports in 2013 resulted in a remarkable 22% reduction in wait times by 2014.

- In contrast, other airports without these kiosks saw no improvement. This trend can be applied to the hotel industry, where self-service options enhance check-in efficiency and guest satisfaction.

- A 2019 study revealed that in fast-food restaurants, 30% of customers preferred kiosk orders when lines were equal in length. Similarly, hotel guests are likely to embrace self-service options.

- A survey by PYMTS found that 49.4% of retail customers use self-service checkouts for speed, while 34.7% choose them for shorter lines. Hotel guests may also appreciate the flexibility to arrive or depart at their own pace.

- When Dodger Stadium installed kiosks for concessions, the average order value increased by 20%. Implementing kiosks in hotels can boost average spending in F&B outlets and enhance add-on sales.