Table of Contents

- Introduction

- Editor’s Choice

- Global Online Recruitment Market Overview

- Most Visited Jobs and Employment Websites

- Fastest-growing Job Search Sites

- Social Media Recruitment

- Demographic Insights of the Online Recruitment Process

- Impact of COVID-19 on Online Recruitment Process

- Recruiter Responses and Strategies

- Key Challenges Faced by The Industry

Introduction

According to Online Recruitment Statistics, Online recruitment, also referred to as e-recruitment or internet-based hiring, entails sourcing, enticing, scrutinizing, and ultimately picking candidates via digital platforms.

Vacancies are publicized on websites, social media, and professional networks to widen the pool of potential applicants.

Applicant Tracking Systems (ATS) streamline the hiring process by efficiently handling candidate data. Tools such as assessments and video interviews aid in assessing candidates.

The emphasis lies on constructing employer branding online to allure top-tier talent. Mobile-friendly interfaces and data analytics tools enhance recruitment efficiency while ensuring adherence to regulations and fostering inclusivity.

Remote hiring is increasingly prevalent and is facilitated by virtual interviews and onboarding methods. Regular adjustments to tactics are vital for maintaining competitiveness in recruitment endeavors.

Editor’s Choice

- The global online recruitment market revenue is projected to reach $58.0 billion in 2032.

- In the global online recruitment market, North America dominates with a significant market share of 43.0%, reflecting its advanced digital infrastructure and mature economy.

- In 2021, Recruit Holdings from Japan led the global online job portal market with a substantial market capitalization of $79.8 billion.

- Topping the most visited jobs and employment websites list is indeed.com, with an impressive average of 8.65 pages visited per user and a relatively low bounce rate of 34.87%.

- Collegerecruiter.com emerged as the fastest-growing platform, boasting an impressive traffic growth of 637.1% from January 2021 to March 2023.

- LinkedIn emerges as the most popular choice, with a staggering 90% of job seekers utilizing the professional networking platform for job search purposes.

- Marketing stands out as the industry most actively recruiting via social media, with an impressive 86% of companies utilizing platforms for talent acquisition and employer branding initiatives.

Global Online Recruitment Market Overview

Global Online Recruitment Market Size

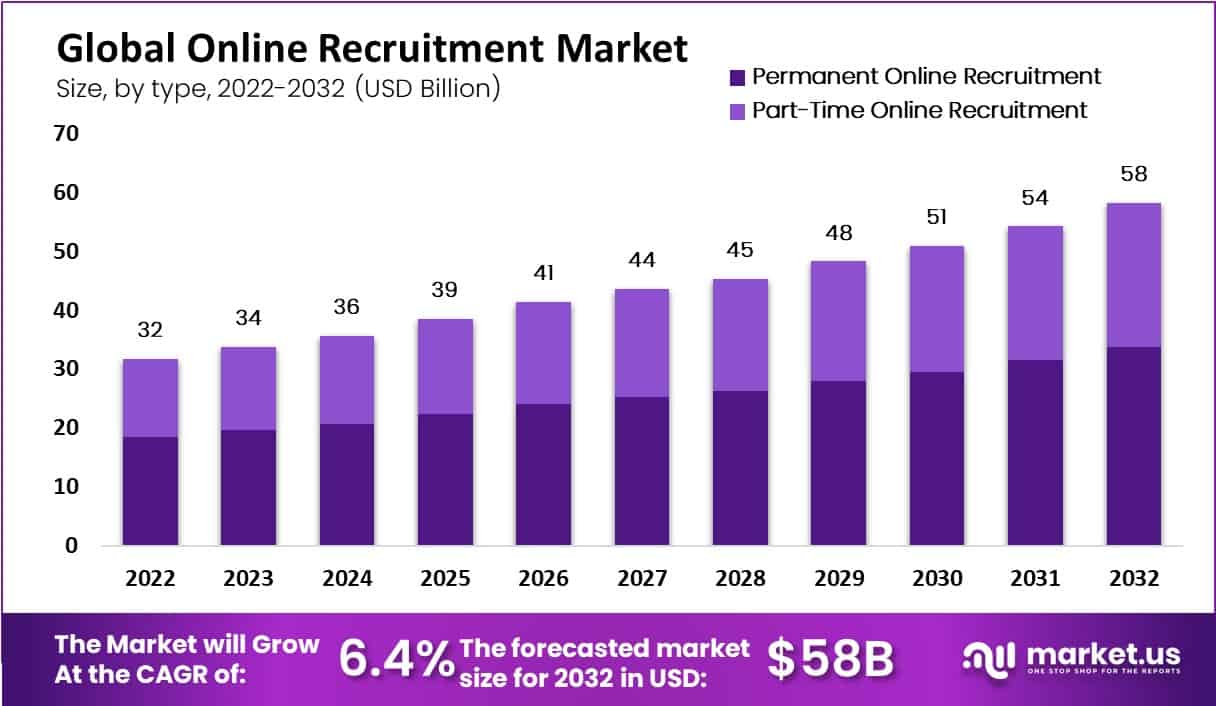

- The global online recruitment market has exhibited consistent growth over the past decade at a CAGR of 6.4%, with revenues increasing steadily from $32.0 billion in 2022 to $58.0 billion in 2032.

- In recent years, the market has experienced incremental gains, with revenues reaching $34.0 billion in 2023 and continuing to rise to $36.0 billion in 2024, $39.0 billion in 2025, and $41.0 billion in 2026.

- The market’s upward trajectory persisted into the early 2030s, with revenues climbing to $54.0 billion in 2031 and eventually peaking at $58.0 billion in 2032.

Regional Analysis of the Global Online Recruitment Market

- In the global online recruitment market, North America dominates with a significant market share of 43.0%, reflecting its advanced digital infrastructure and mature economy.

- Following closely behind is Europe, capturing 24.0% of the market share, driven by widespread internet penetration and a diverse talent pool.

- The Asia-Pacific (APAC) region holds a notable share of 22.5%, fueled by the region’s rapid economic growth, increasing internet connectivity, and burgeoning tech-savvy workforce.

- Latin America and the Middle East & Africa (MEA) regions account for more minor but still significant portions of the market, with shares of 5.3% and 5.2%, respectively.

Market Cap of Leading Online Job Portals

- In 2021, Recruit Holdings from Japan led the global online job portal market with a substantial market capitalization of $79.8 billion, followed by SEEK from Australia with $7.6 billion and 51job from China with $4.2 billion.

- ZIP Recruiter from the U.S. held a notable market cap of $741.1 million. In comparison, DHI Group from the U.S. and Freelancer from Australia had smaller market caps of $161 million and $219 million, respectively.

- JobNext from Malaysia trailed behind with a market cap of $41 million.

- By 2022, Recruit Holdings maintained its dominant position with a market cap of $72.9 billion, despite a slight decrease from the previous year.

- SEEK witnessed a slight increase in market cap to $7.9 billion, while 51job’s market cap decreased to $3.9 billion.

- ZIP Recruiter experienced significant growth, with its market cap soaring to $2.7 billion, showcasing its rising prominence in the industry.

Most Visited Jobs and Employment Websites

- Topping the list is indeed.com, with an impressive average of 8.65 pages visited per user and a relatively low bounce rate of 34.87%.

- Following closely behind is myworkdayjobs.com, offering a streamlined experience with an average of 4.22 pages per visit and a modest bounce rate of 38.03%.

- computrabajo.com stands out with a notably high average of 15.18 pages visited, indicating strong user engagement, while hh.ru boasts a respectable 7.1 pages per visit and a low bounce rate of 32.65%.

- Despite its prominence, glassdoor.com exhibits a higher bounce rate at 47.32%, with an average of 3.68 pages visited.

- Similarly, ziprecruiter.com and gupy.io demonstrate lower user engagement with average pages visited of 4.51 and 5.71, respectively, coupled with relatively higher bounce rates.

- Ultipro.com distinguishes itself with a notably low bounce rate of 29.14% and an average of 5.15 pages visited. Jooble.org follows suit with an average of 4.73 pages per visit and a modest bounce rate of 32.55%.

Fastest-growing Job Search Sites

- From January 2021 to March 2023, several job search sites worldwide experienced remarkable growth in traffic, indicative of evolving trends in employment-seeking behavior.

- Collegerecruiter.com emerged as the fastest-growing platform, boasting an impressive traffic growth of 637.1%.

- Justremote.co and nodesk.co closely followed with growth rates of 181.9% and 181.1%, respectively, reflecting the increasing popularity of Remote Work opportunities.

- Flexjobs.com and job.com also demonstrated substantial growth, with traffic increases of 167.1% and 157%, respectively, catering to the demand for flexible and remote employment options.

- Weworkremotely.com and indeed.com, though already established platforms, still exhibited significant growth rates at 143.7% and 116.2%, respectively, indicating sustained relevance and adaptation to evolving market dynamics.

- Joinhandshake.com and LinkedIn.com experienced notable growth as well, with traffic increases of 80.6% and 79.9%, respectively, highlighting the importance of professional networking and career development platforms.

Social Media Recruitment

Platforms Used by Job Seekers

- LinkedIn emerges as the most popular choice, with a staggering 90% of job seekers utilizing the professional networking platform for job search purposes.

- Twitter follows closely behind, with 57% of job seekers leveraging its real-time updates and networking capabilities.

- Glassdoor, known for its company reviews and salary insights, attracts 42% of job seekers.

- Facebook, despite being primarily a social networking platform, is utilized by 40% of job seekers for job search activities.

- Instagram, with its visual content focus, is used by 29% of job seekers, while YouTube, known for its video content, is used by 22% of job seekers.

Activities Job Seekers Are Engaged on Social Media

- Job seekers engage in a range of activities on social media platforms to facilitate their job search endeavors.

- A significant 77% of job seekers utilize social media to research prospective employers and leverage platforms to gather insights into company culture, values, and reputation.

- Additionally, 70% of job seekers actively use social media to apply for job vacancies, taking advantage of the convenience and accessibility offered by online application processes.

- Contacting recruiters or hiring managers directly is another common practice, with 51% of job seekers leveraging social media channels to establish connections and express their interest in employment opportunities.

Industries Recruiting via Social Media

- Marketing stands out as the industry most actively recruiting via social media, with an impressive 86% of companies utilizing platforms for talent acquisition and employer branding initiatives.

- Following closely behind is the hospitality industry, with 80% of companies leveraging social media for recruitment purposes, capitalizing on platforms to attract candidates for roles in hotels, restaurants, and tourism.

- Management consulting firms also demonstrate significant adoption, with 79% of companies utilizing social media to identify and engage top talent.

- In the retail sector, 75% of companies recruit via social media to fill positions in sales, customer service, and management.

- The IT industry, known for its digital savvy, embraces social media recruitment as well, with 71% of companies leveraging platforms to source candidates for technical and digital roles.

Demographic Insights of the Online Recruitment Process

By Age Group and Employment Status

- Among the unemployed population aged 16-24, 67% reported visiting such sites, while 61% of their employed counterparts within the same age bracket engaged in similar activity.

- In the 25-34 age group, 62% of the unemployed and 58% of the employed visited job or recruitment sites.

- Moving into older age brackets, the trend persists, albeit with slight declines in engagement. For individuals aged 35-44, 54% of the unemployed and 47% of the employed visited these sites.

- Similarly, in the 45-54 age group, 54% of the unemployed and 37% of the employed engaged with job or recruitment platforms.

- Among those aged 55-64, the percentage decreases further, with 39% of the unemployed and 29% of the employed accessing such sites.

By Gender

- In examining online job-seeking behaviors of 2,001 U.S. adults ages 18 and older, data reveals that 53% of males and 55% of females reported looking online for job information.

- Additionally, 44% of males and 46% of females applied for jobs online.

Impact of COVID-19 on Online Recruitment Process

- LinkedIn’s examination of talent market trends between April 2020 and June 2021 indicates a 24.5% increase in the importance candidates place on flexible work arrangements, a phenomenon LinkedIn has coined the Great Reshuffle.

- In 2021, during the peak of the pandemic, a report by Owl Labs on the State of Remote Work highlighted that 90% of surveyed employees reported being equally or more productive when working remotely compared to in-office work.

- Moreover, 46% expressed willingness to accept a salary reduction to continue remote work, and 1 in 3 indicated they would consider leaving their jobs if remote work opportunities were no longer available post-pandemic.

Recruiter Responses and Strategies

Usage of Online Recruiting for Recruiting Strategy by HR Practitioners Process

- In 2017, a survey of HR practitioners regarding their use of online recruiting as a recruiting strategy revealed various responses.

- The majority, comprising 79.2% of respondents, reported utilizing online recruiting as part of their strategy.

- Conversely, a smaller fraction, accounting for 9.4%, indicated that they did not use online recruiting.

- However, a notable portion, constituting 3.5% of respondents, expressed intentions to incorporate online recruiting into their strategy in the future.

- On the other hand, 2.2% reported having tried online recruiting but found it ineffective for their purposes.

Opinions of Recruiters by If Online Recruiting Is Faster at Employee Recruitment Process

- Among respondents, 47.3% believed that online recruiting facilitated faster recruitment processes in 2017.

- Conversely, a smaller proportion, representing 8.7% of respondents, disagreed with this notion.

- Approximately 13.5% of recruiters perceived online recruiting to be comparable in speed to traditional methods.

- Another notable segment, comprising 22.5% of respondents, indicated that the speed of online recruiting depended on the specific job being recruited for.

- Additionally, 8.1% of recruiters expressed uncertainty regarding whether online recruiting expedited the recruitment process.

Key Challenges Faced by The Industry

- In 2023, recruiters in the IT industry faced significant challenges, with finding qualified candidates being the foremost concern, followed by difficulty in identifying potential candidates lacking matching skills, as reported by over 27% of recruiters.

- While the percentage of tech organizations reporting skill shortages decreased compared to the previous year, it remained high at 54%.

- Despite the increasing demand for skilled IT professionals, 64% of global IT recruiters cited candidates’ lack of necessary skills or experience as the primary challenge in recruitment.

- Similarly, in the cybersecurity sector, cloud security and security operations positions posed significant recruitment difficulties in 2023.