Table of Contents

- Introduction

- Editor’s Choice

- Online Recruitment Market Statistics

- Most Visited Jobs and Employment Websites

- Fastest-growing Job Search Sites

- Social Media Recruitment

- Demographic Insights of Online Recruitment Statistics

- Impact of COVID-19 on Online Recruitment Statistics

- Recruiter Responses and Strategies

- Key Challenges Faced by The Industry

- Recent Developments

- Conclusion

- FAQs

Introduction

Online Recruitment Statistics: Online recruitment, also referred to as e-recruitment or internet-based hiring, entails sourcing, enticing, scrutinizing, and ultimately picking candidates via digital platforms.

Vacancies are publicized on websites, social media, and professional networks to widen the pool of potential applicants.

Applicant Tracking Systems (ATS) streamline the hiring process by efficiently handling candidate data. Tools such as assessments and video interviews aid in assessing candidates.

The emphasis lies on constructing employer branding online to allure top-tier talent. Mobile-friendly interfaces and data analytics tools enhance recruitment efficiency while ensuring adherence to regulations and fostering inclusivity.

Remote hiring is increasingly prevalent and is facilitated by virtual interviews and onboarding methods. Regular adjustments to tactics are vital for maintaining competitiveness in recruitment endeavors.

Editor’s Choice

- The global online recruitment market revenue is projected to reach $58.0 billion in 2032.

- In the global online recruitment market, North America dominates with a significant market share of 43.0%, reflecting its advanced digital infrastructure and mature economy.

- In 2021, Recruit Holdings from Japan led the global online job portal market with a substantial market capitalization of $79.8 billion.

- Topping the most visited jobs and employment websites list is indeed.com, with an impressive average of 8.65 pages visited per user and a relatively low bounce rate of 34.87%.

- Collegerecruiter.com emerged as the fastest-growing platform, boasting an impressive traffic growth of 637.1% from January 2021 to March 2023.

- LinkedIn emerges as the most popular choice, with a staggering 90% of job seekers utilizing the professional networking platform for job search purposes.

- Marketing stands out as the industry most actively recruiting via social media, with an impressive 86% of companies utilizing platforms for talent acquisition and employer branding initiatives.

Online Recruitment Market Statistics

Global Online Recruitment Market Size Statistics

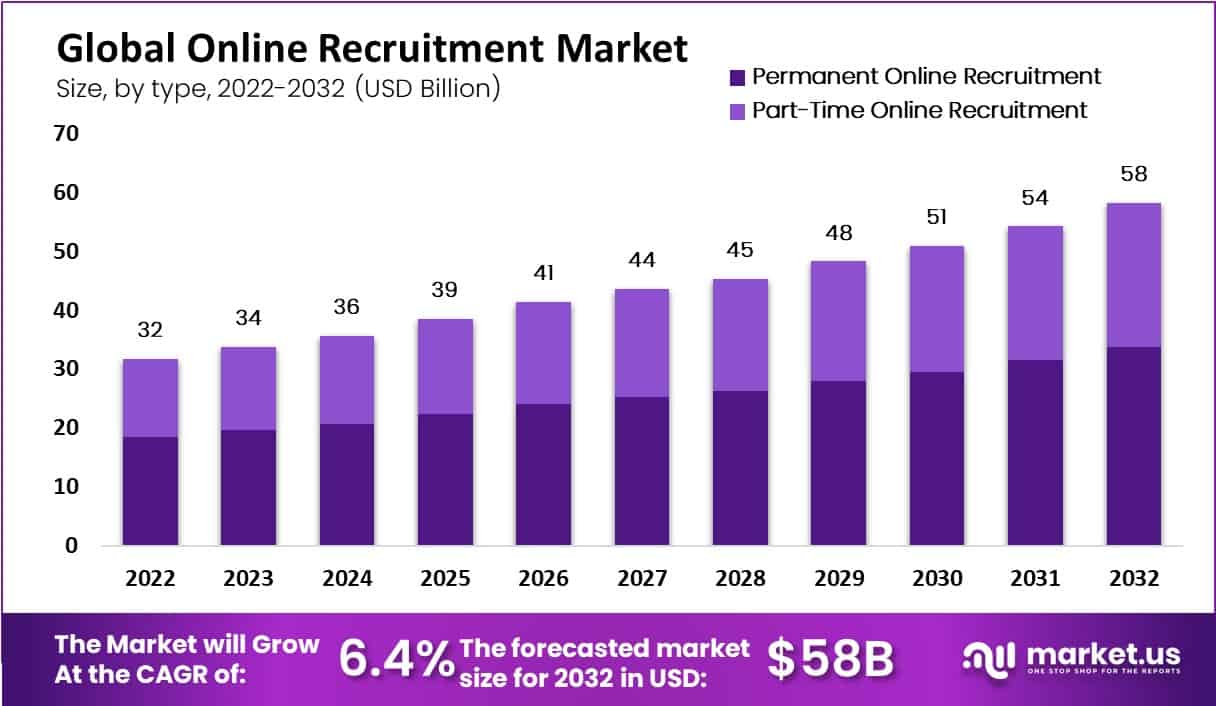

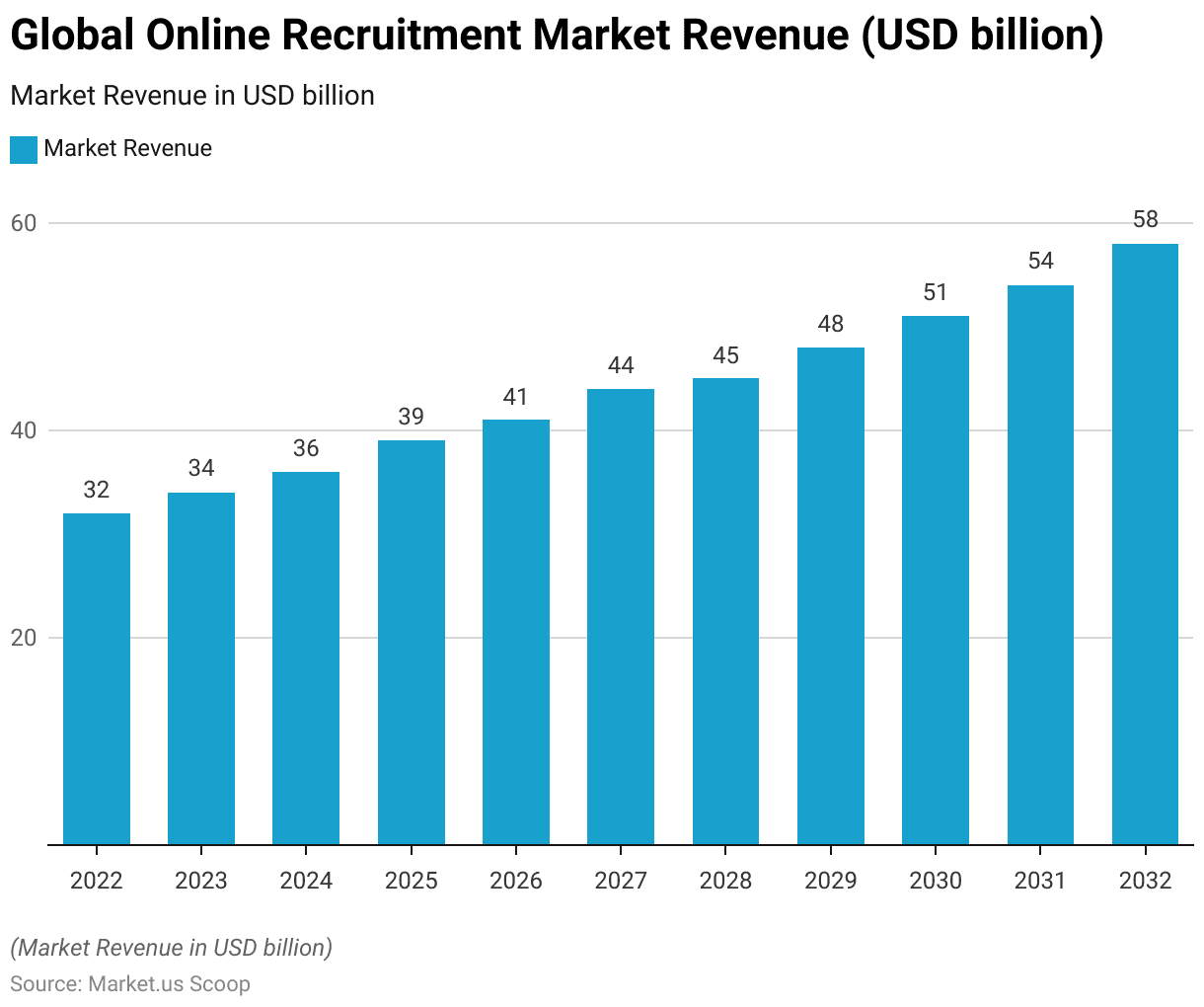

- The global online recruitment market has exhibited consistent growth over the past decade at a CAGR of 6.4%, with revenues increasing steadily from $32.0 billion in 2022 to $58.0 billion in 2032.

- This growth trajectory reflects the expanding role and significance of digital platforms in modern hiring practices.

- In recent years, the market has experienced incremental gains, with revenues reaching $34.0 billion in 2023 and continuing to rise to $36.0 billion in 2024, $39.0 billion in 2025, and $41.0 billion in 2026.

- By 2027, revenues surged to $44.0 billion, indicating a notable acceleration in growth.

- Subsequent years saw continued expansion, with revenues reaching $45.0 billion in 2028, $48.0 billion in 2029, and $51.0 billion in 2030.

- The market’s upward trajectory persisted into the early 2030s, with revenues climbing to $54.0 billion in 2031 and eventually peaking at $58.0 billion in 2032.

- This robust growth underscores the increasing reliance on online recruitment platforms by businesses worldwide, driven by factors such as globalization, technological advancements, and evolving workforce dynamics.

(Source: Market.us)

Regional Analysis of the Global Online Recruitment Market Statistics

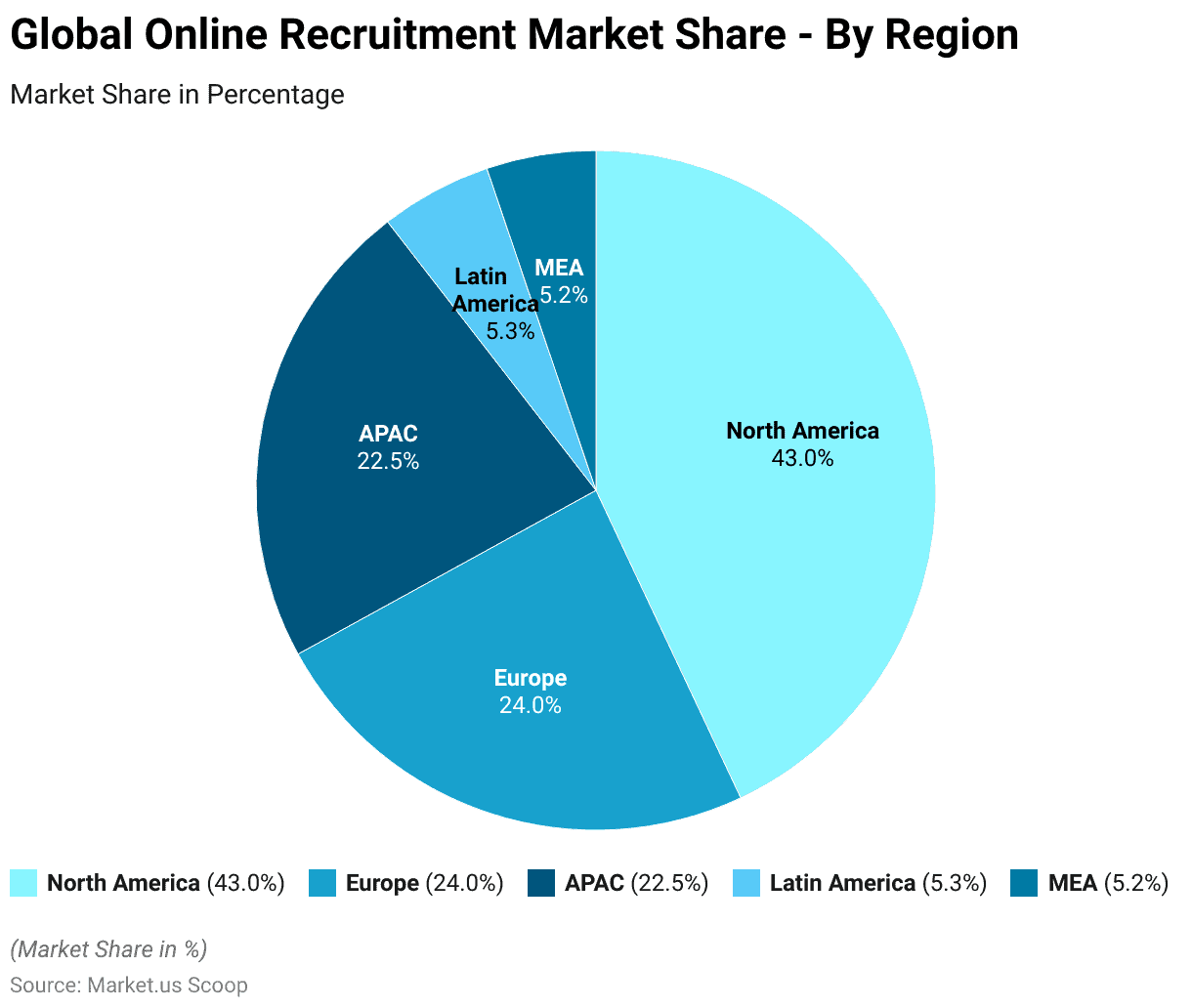

- In the global online recruitment market, North America dominates with a significant market share of 43.0%, reflecting its advanced digital infrastructure and mature economy.

- Following closely behind is Europe, capturing 24.0% of the market share, driven by widespread internet penetration and a diverse talent pool.

- The Asia-Pacific (APAC) region holds a notable share of 22.5%, fueled by the region’s rapid economic growth, increasing internet connectivity, and burgeoning tech-savvy workforce.

- Latin America and the Middle East & Africa (MEA) regions account for more minor but still significant portions of the market, with shares of 5.3% and 5.2%, respectively.

- These regions are witnessing steady growth in online recruitment adoption, propelled by factors such as rising internet penetration, urbanization, and the proliferation of smartphones.

- Overall, the distribution of market share across regions reflects the global nature of online recruitment, with each area contributing to the industry’s expansion and evolution in unique ways.

(Source: Market.us)

Market Cap of Leading Online Job Portals

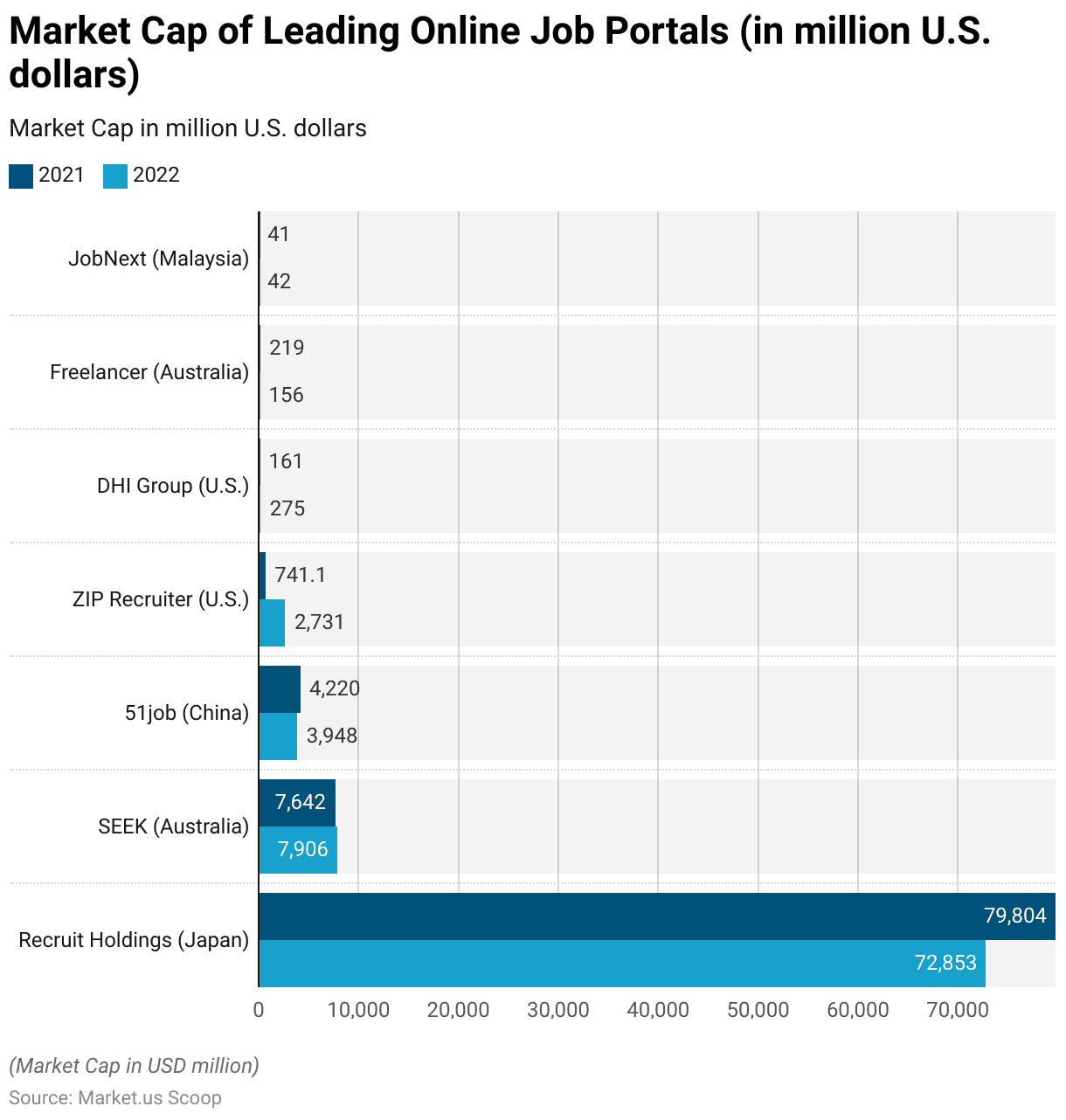

- In 2021, Recruit Holdings from Japan led the global online job portal market with a substantial market capitalization of $79.8 billion, followed by SEEK from Australia with $7.6 billion and 51jobs from China with $4.2 billion.

- ZIP Recruiter from the U.S. held a notable market cap of $741.1 million. In comparison, DHI Group from the U.S. and Freelancer from Australia had smaller market caps of $161 million and $219 million, respectively.

- JobNext from Malaysia trailed behind with a market cap of $41 million.

- By 2022, Recruit Holdings maintained its dominant position with a market cap of $72.9 billion, despite a slight decrease from the previous year.

- SEEK witnessed a slight increase in market cap to $7.9 billion, while 51job’s market cap decreased to $3.9 billion.

- ZIP Recruiter experienced significant growth, with its market cap soaring to $2.7 billion, showcasing its rising prominence in the industry.

- DHI Group’s market cap also increased to $275 million, while Freelancer’s decreased to $156 million. JobNext’s market cap remained relatively stable at $42 million.

- This data reflects the fluctuating market dynamics and competitive landscape of the global online job portal industry over two years.

(Source: Statista)

Most Visited Jobs and Employment Websites

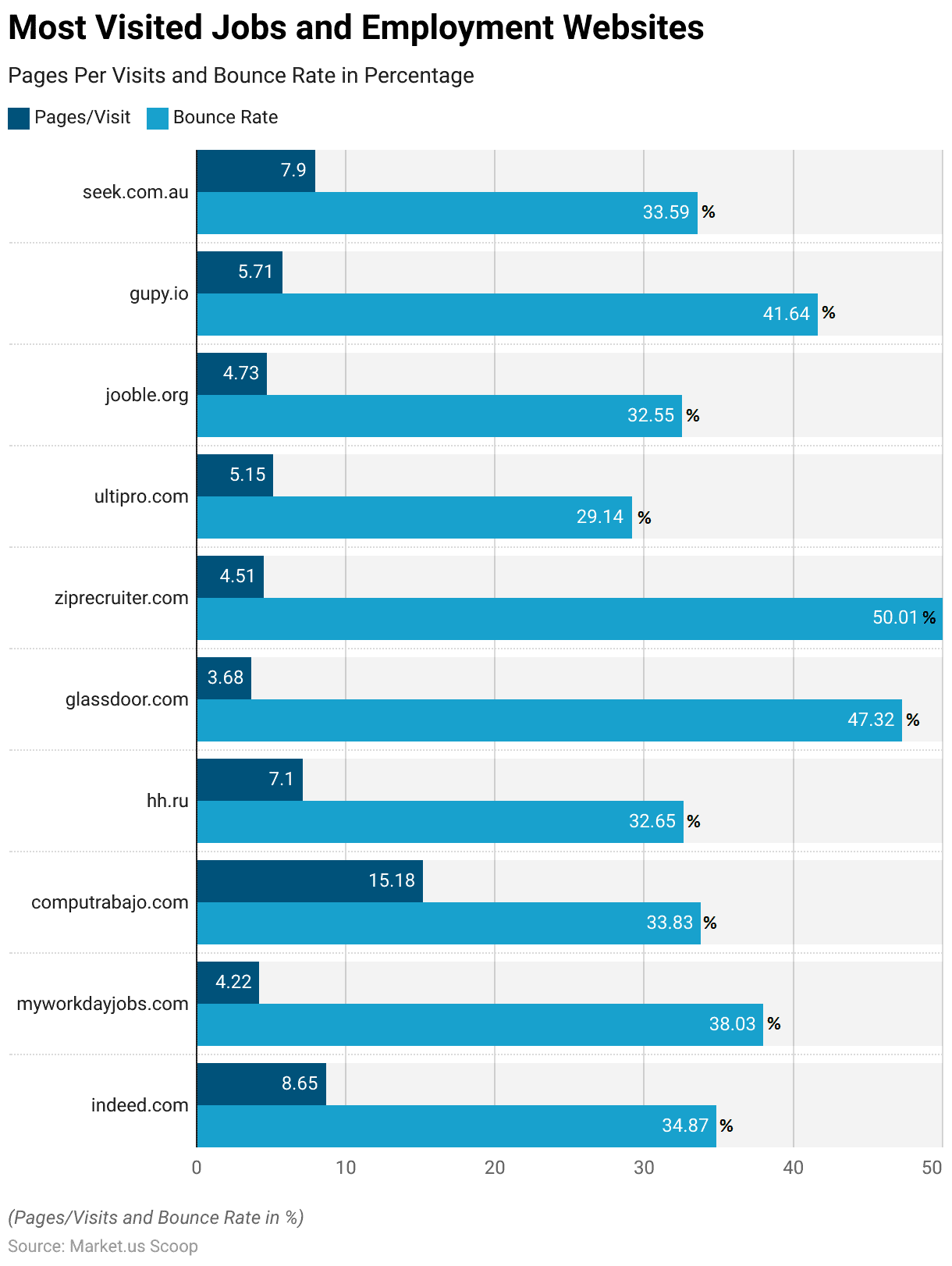

- The most visited jobs and employment websites reflect a diverse range of platforms catering to job seekers and employers alike. Topping the list is indeed.com, with an impressive average of 8.65 pages visited per user and a relatively low bounce rate of 34.87%.

- Following closely behind is myworkdayjobs.com, offering a streamlined experience with an average of 4.22 pages per visit and a modest bounce rate of 38.03%.

- computrabajo.com stands out with a notably high average of 15.18 pages visited, indicating strong user engagement, while hh.ru boasts a respectable 7.1 pages per visit and a low bounce rate of 32.65%.

- Despite its prominence, glassdoor.com exhibits a higher bounce rate at 47.32%, with an average of 3.68 pages visited.

- Similarly, ziprecruiter.com and gupy.io demonstrate lower user engagement with average pages visited of 4.51 and 5.71, respectively, coupled with relatively higher bounce rates.

- Ultipro.com distinguishes itself with a notably low bounce rate of 29.14% and an average of 5.15 pages visited. Jooble.org follows suit with an average of 4.73 pages per visit and a modest bounce rate of 32.55%.

- Rounding off the list, seek.com.au showcases solid engagement with an average of 7.9 pages visited and a bounce rate of 33.59%.

- Overall, these statistics offer insights into the preferences and behaviors of users navigating the competitive landscape of online job and employment platforms.

(Source: Similar web)

Fastest-growing Job Search Sites

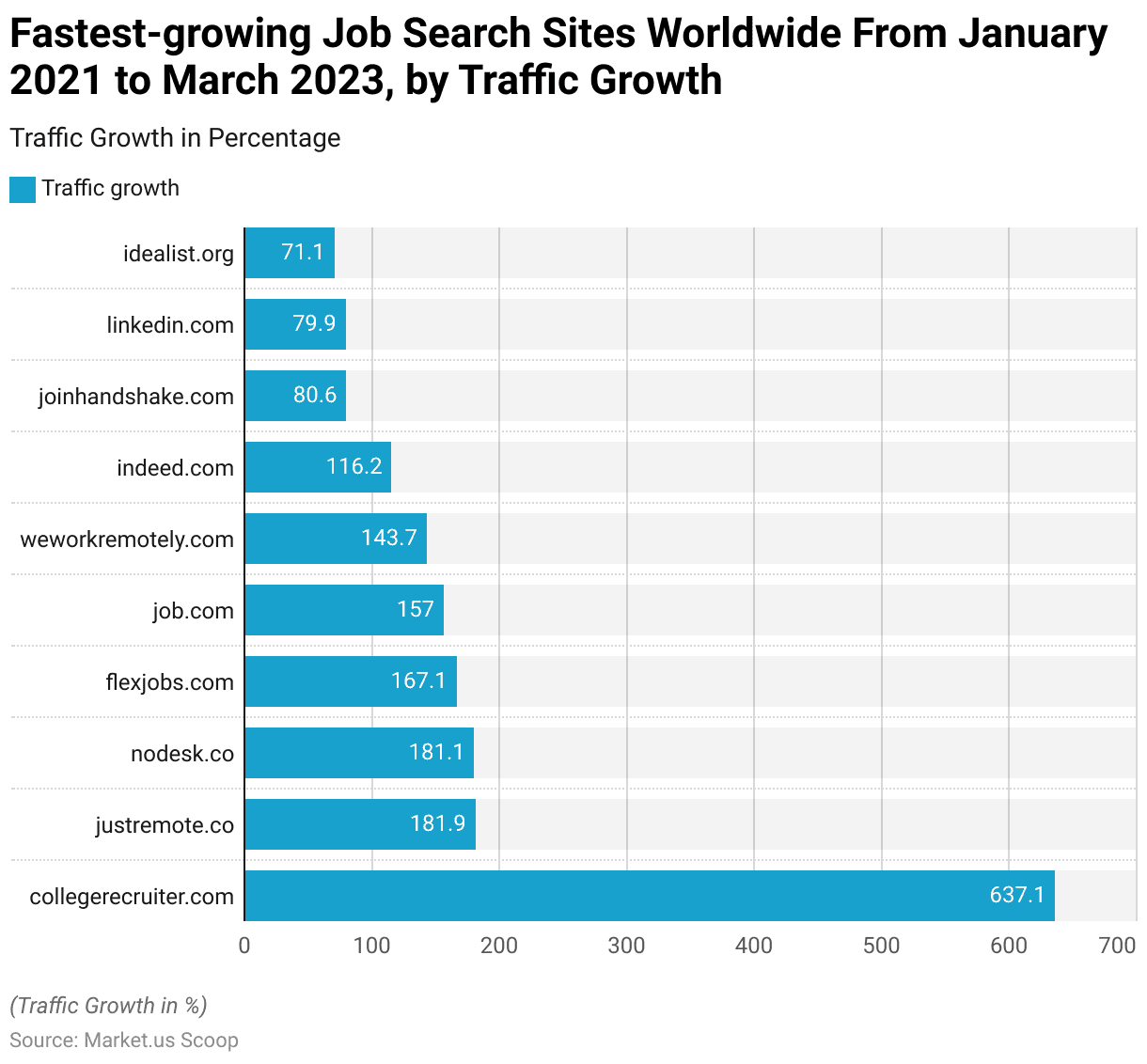

- From January 2021 to March 2023, several job search sites worldwide experienced remarkable growth in traffic, indicative of evolving trends in employment-seeking behavior.

- Collegerecruiter.com emerged as the fastest-growing platform, boasting an impressive traffic growth of 637.1%.

- www.justremote.co and www.nodesk.co closely followed with growth rates of 181.9% and 181.1%, respectively, reflecting the increasing popularity of remote work opportunities.

- Flexjobs.com and job.com also demonstrated substantial growth, with traffic increases of 167.1% and 157%, respectively, catering to the demand for flexible and remote employment options.

- Weworkremotely.com and indeed.com, though already established platforms, still exhibited significant growth rates at 143.7% and 116.2%, respectively, indicating sustained relevance and adaptation to evolving market dynamics.

- Joinhandshake.com and LinkedIn.com experienced notable growth as well, with traffic increases of 80.6% and 79.9%, respectively, highlighting the importance of professional networking and career development platforms.

- Finally, idealist.org rounded off the list with a respectable growth rate of 71.1%, underscoring the increasing interest in opportunities within the non-profit sector.

- Overall, these statistics underscore the shifting landscape of job search platforms, with a notable emphasis on remote work and diverse career pathways.

(Source: Statista)

Social Media Recruitment

Platforms Used by Job Seekers

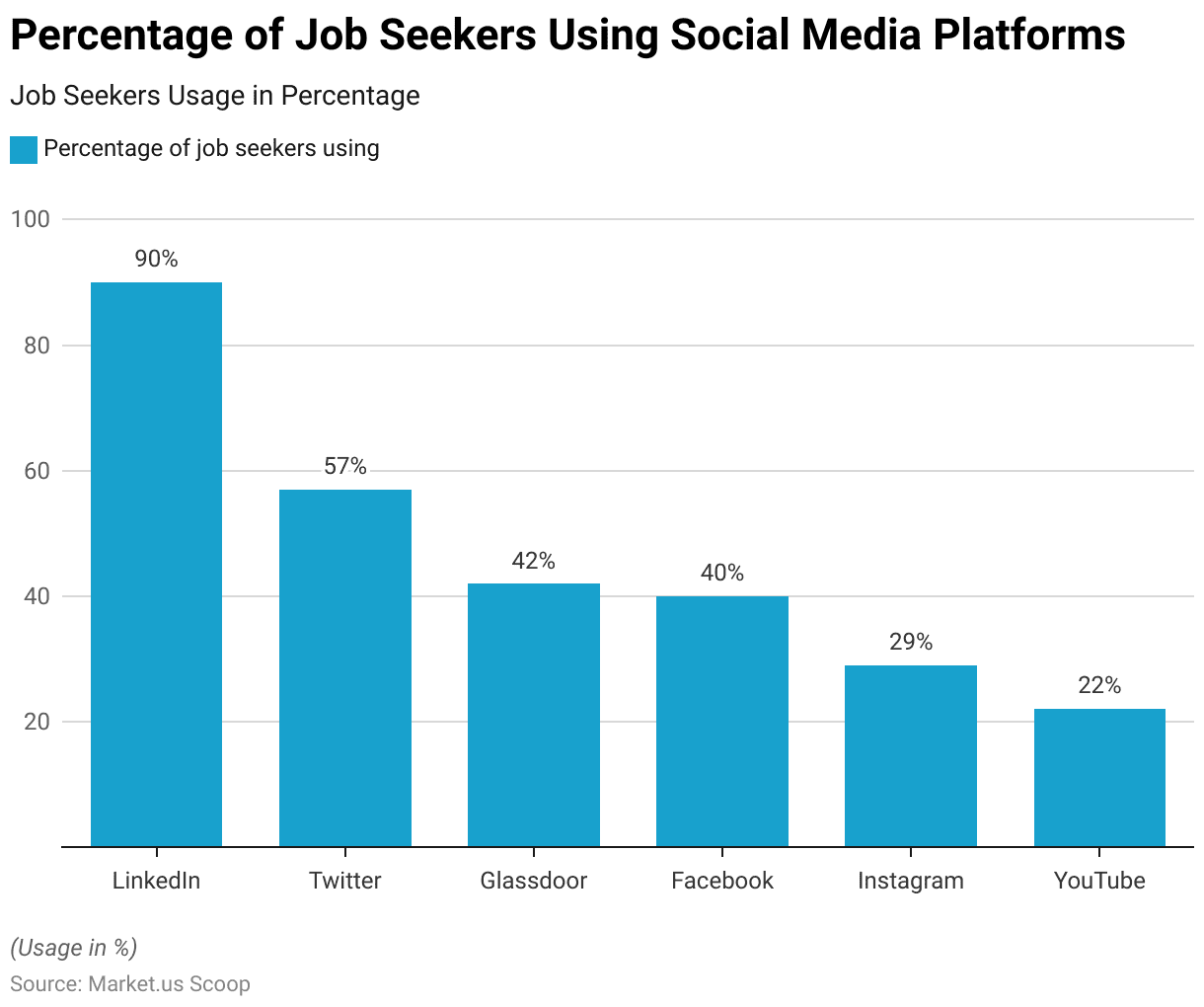

- Job seekers utilize a variety of social media platforms in their search for employment opportunities.

- LinkedIn emerges as the most popular choice, with a staggering 90% of job seekers utilizing the professional networking platform for job search purposes.

- Twitter follows closely behind, with 57% of job seekers leveraging its real-time updates and networking capabilities.

- Glassdoor, known for its company reviews and salary insights, attracts 42% of job seekers.

- Facebook, despite being primarily a social networking platform, is utilized by 40% of job seekers for job search activities.

- Instagram, with its visual content focus, is used by 29% of job seekers, while YouTube, known for its video content, is used by 22% of job seekers.

- This data underscores the diverse preferences of job seekers in utilizing social media platforms to explore career opportunities and network with potential employers.

(Source: StandOut-CV)

Activities Job Seekers Are Engaged on Social Media

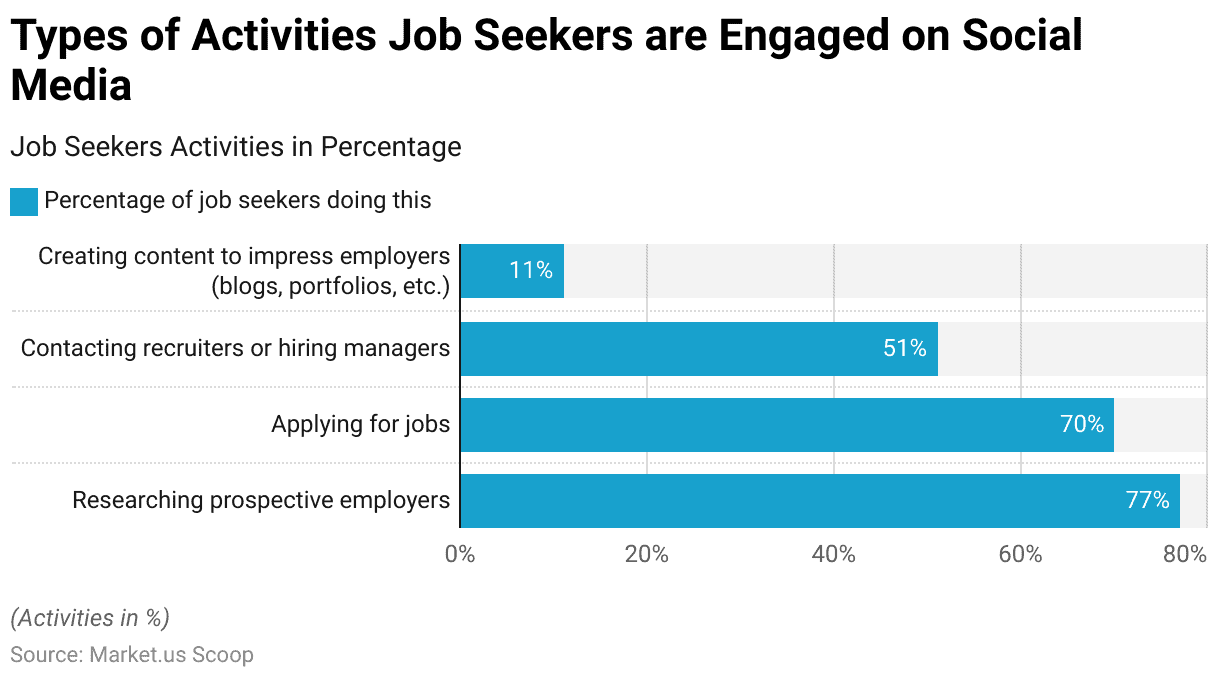

- Job seekers engage in a range of activities on social media platforms to facilitate their job search endeavors.

- A significant 77% of job seekers utilize social media to research prospective employers and leverage platforms to gather insights into company culture, values, and reputation.

- Additionally, 70% of job seekers actively use social media to apply for job vacancies, taking advantage of the convenience and accessibility offered by online application processes.

- Contacting recruiters or hiring managers directly is another common practice, with 51% of job seekers leveraging social media channels to establish connections and express their interest in employment opportunities.

- While a smaller proportion, 11% of job seekers create content such as blogs or portfolios to showcase their skills and impress potential employers, demonstrating the creative approaches individuals employ to stand out in competitive job markets.

- These activities collectively reflect the multifaceted role of social media in modern job search strategies, serving as a valuable tool for research, networking, and self-promotion.

(Source: StandOut-CV)

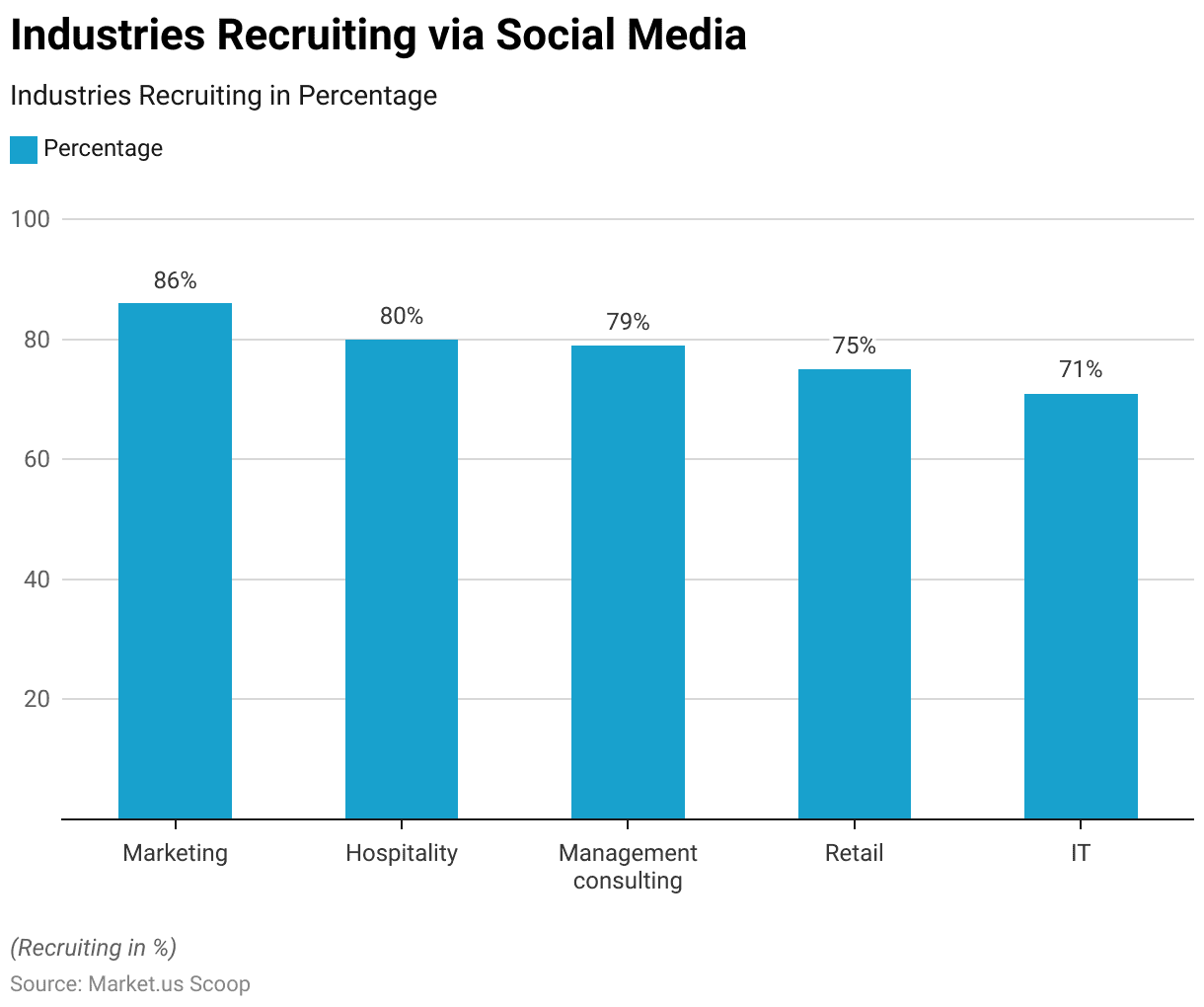

Industries Online Recruitment via Social Media Statistics

- Social media has become a prevalent recruitment tool across various industries, with specific sectors exhibiting higher levels of engagement than others.

- Marketing stands out as the industry most actively recruiting via social media, with an impressive 86% of companies utilizing platforms for talent acquisition and employer branding initiatives.

- Following closely behind is the hospitality industry, with 80% of companies leveraging social media for recruitment purposes, capitalizing on platforms to attract candidates for roles in hotels, restaurants, and tourism.

- Management consulting firms also demonstrate significant adoption, with 79% of companies utilizing social media to identify and engage top talent.

- In the retail sector, 75% of companies recruit via social media to fill positions in sales, customer service, and management.

- The IT industry, known for its digital savvy, embraces social media recruitment as well, with 71% of companies leveraging platforms to source candidates for technical and digital roles.

- These findings highlight the widespread adoption of social media recruitment practices across industries, reflecting its effectiveness in reaching and engaging with diverse talent pools.

(Source: StandOut-CV)

Demographic Insights of Online Recruitment Statistics

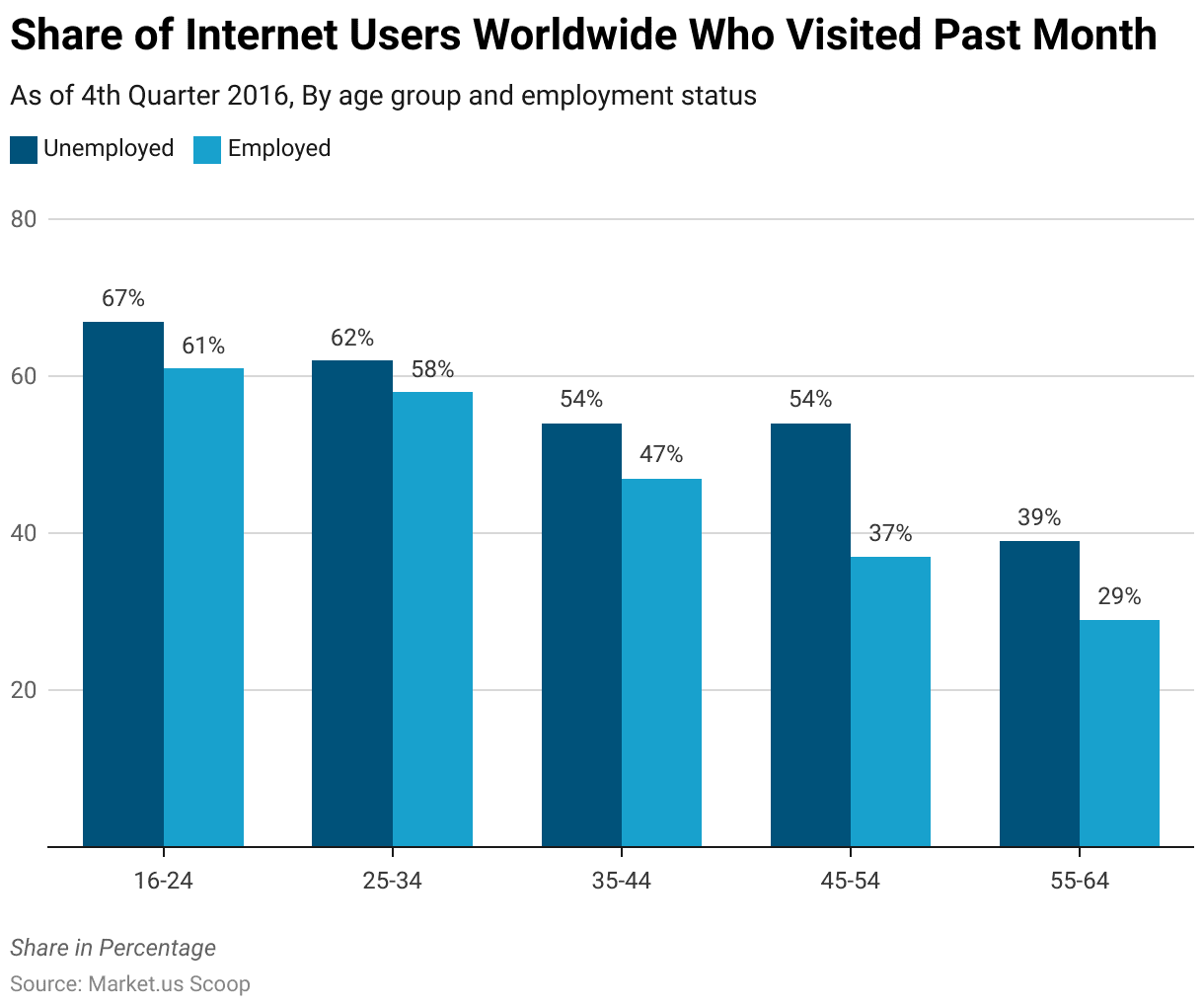

By Age Group and Employment Status

- As of the fourth quarter of 2016, data indicates the share of internet users worldwide who visited a job or recruitment site in the past month, segmented by age group and employment status.

- Among the unemployed population aged 16-24, 67% reported visiting such sites, while 61% of their employed counterparts within the same age bracket engaged in similar activity.

- In the 25-34 age group, 62% of the unemployed and 58% of the employed visited job or recruitment sites.

- Moving into older age brackets, the trend persists, albeit with slight declines in engagement. For individuals aged 35-44, 54% of the unemployed and 47% of the employed visited these sites.

- Similarly, in the 45-54 age group, 54% of the unemployed and 37% of the employed engaged with job or recruitment platforms.

- Among those aged 55-64, the percentage decreases further, with 39% of the unemployed and 29% of the employed accessing such sites.

- These statistics provide insights into the varying levels of engagement with job-seeking platforms across different age groups and employment statuses during the specified period.

(Source: Statista)

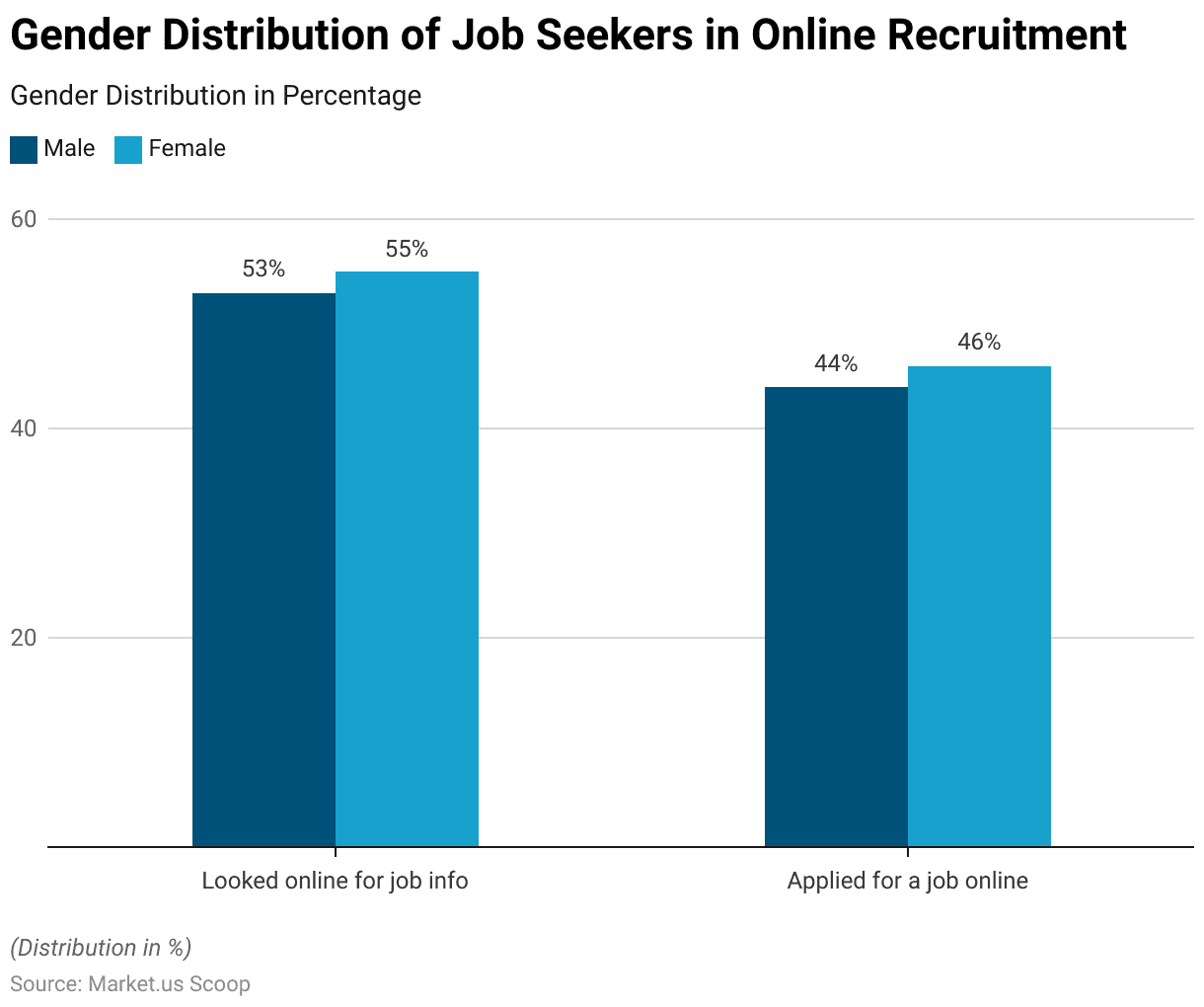

By Gender

- In examining online job-seeking behaviors of 2,001 U.S. adults ages 18 and older, data reveals that 53% of males and 55% of females reported looking online for job information.

- Additionally, 44% of males and 46% of females applied for jobs online.

- These statistics illustrate a slightly higher propensity among females to both seek job information and actively apply for positions online compared to their male counterparts.

- Such insights into gender-specific online job-seeking behaviors offer valuable considerations for recruitment strategies and platforms aiming to reach diverse audiences effectively.

(Source: Pew Research)

Impact of COVID-19 on Online Recruitment Statistics

- Research conducted by Harvard and Stanford suggests that businesses transitioning to a hybrid work model could potentially save up to $11,000 annually.

- LinkedIn’s examination of talent market trends between April 2020 and June 2021 indicates a 24.5% increase in the importance candidates place on flexible work arrangements, a phenomenon LinkedIn has coined the Great Reshuffle.

- According to LinkedIn, Glint’s findings reveal that employees who are content with their organization’s flexibility in terms of work schedules and locations are significantly more likely to be satisfied with their jobs and recommend their employer, with satisfaction rates being 2.6 times higher and likelihood to recommend being 2.1 times higher.

- In 2021, during the peak of the pandemic, a report by Owl Labs on the State of Remote Work highlighted that 90% of surveyed employees reported being equally or more productive when working remotely compared to in-office work.

- Moreover, 46% expressed willingness to accept a salary reduction to continue remote work, and 1 in 3 indicated they would consider leaving their jobs if remote work opportunities were no longer available post-pandemic.

(Source: Harvard and Stanford, LinkedIn, Owl Labs State of Remote Work Report)

Recruiter Responses and Strategies

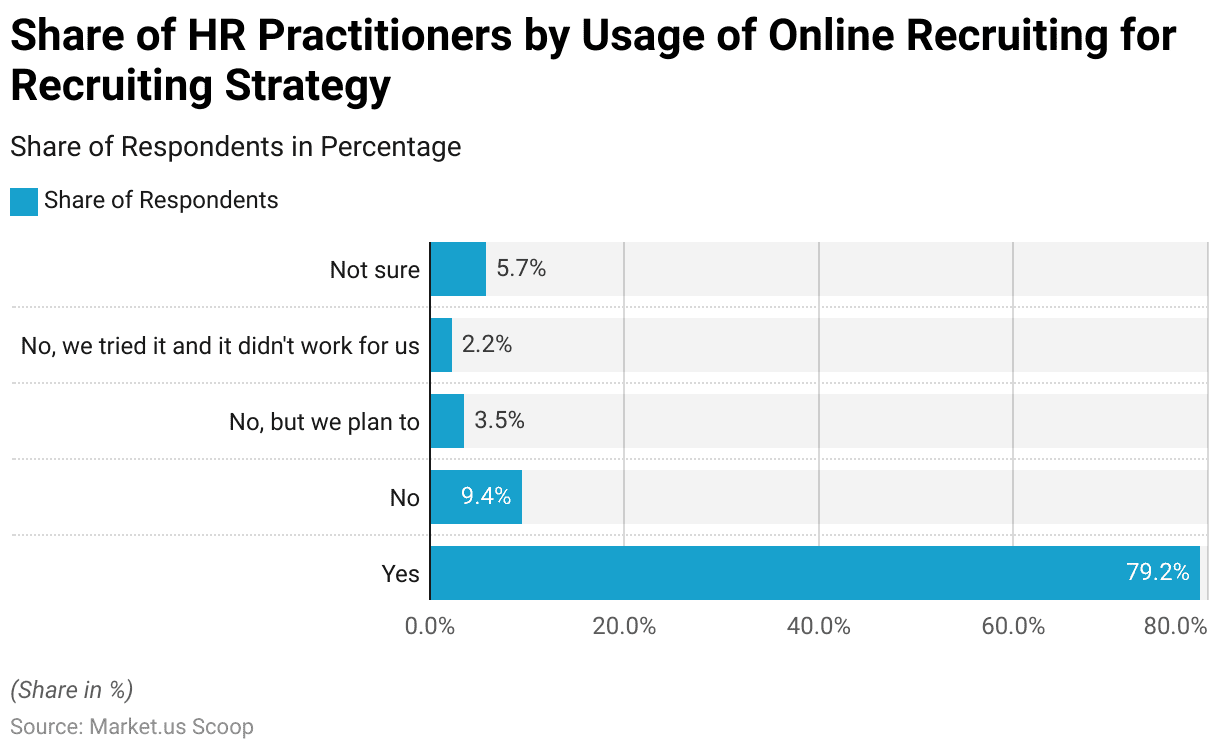

Usage of Online Recruiting for Recruitment Strategy by HR Practitioners Statistics

- In 2017, a survey of HR practitioners regarding their use of online recruiting as a recruiting strategy revealed various responses.

- The majority, comprising 79.2% of respondents, reported utilizing online recruiting as part of their strategy.

- Conversely, a smaller fraction, accounting for 9.4%, indicated that they did not use online recruiting.

- However, a notable portion, constituting 3.5% of respondents, expressed intentions to incorporate online recruiting into their strategy in the future.

- On the other hand, 2.2% reported having tried online recruiting but found it ineffective for their purposes.

- Additionally, 5.7% of respondents were uncertain about their organization’s stance on online recruiting.

- These findings illuminate the varying degrees of adoption and perceptions surrounding online recruiting among HR practitioners during the specified period.

(Source: Statista)

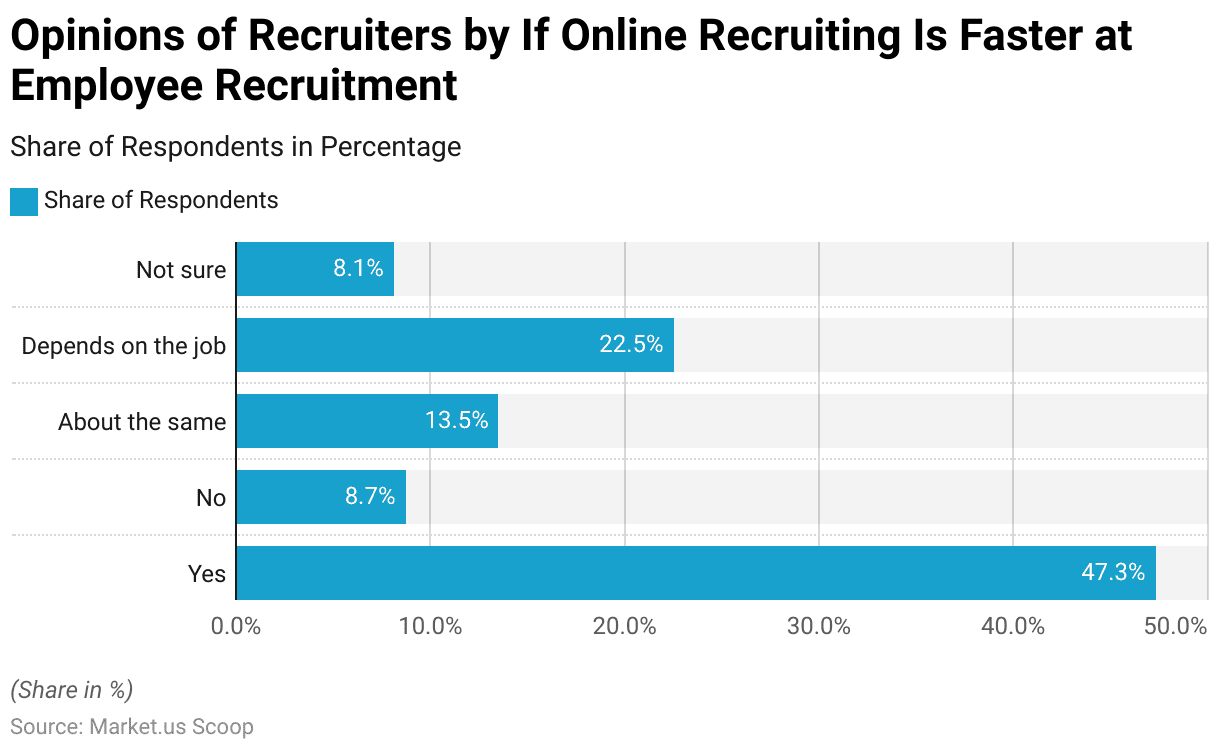

Opinions of Recruiters by If Online Recruiting Is Faster at Employee Recruitment Statistics

- In 2017, opinions among recruiters regarding the speed of employee recruitment through online methods varied.

- Among respondents, 47.3% believed that online recruiting facilitated faster recruitment processes. Conversely, a smaller proportion, representing 8.7% of respondents, disagreed with this notion.

- Approximately 13.5% of recruiters perceived online recruiting to be comparable in speed to traditional methods.

- Another notable segment, comprising 22.5% of respondents, indicated that the speed of online recruiting depended on the specific job being recruited for.

- Additionally, 8.1% of recruiters expressed uncertainty regarding whether online recruiting expedited the recruitment process.

- These findings highlight the diversity of perspectives within the recruitment industry regarding the efficiency of online recruiting methods in expediting employee recruitment.

(Source: Statista)

Key Challenges Faced by The Industry

- In 2023, recruiters in the IT industry faced significant challenges, with finding qualified candidates being the foremost concern, followed by difficulty in identifying potential candidates lacking matching skills, as reported by over 27% of recruiters.

- While the percentage of tech organizations reporting skill shortages decreased compared to the previous year, it remained high at 54%.

- Despite the increasing demand for skilled IT professionals, 64% of global IT recruiters cited candidates’ lack of necessary skills or experience as the primary challenge in recruitment.

- Web development, DevOps, and database software were among the most sought-after technical skills, with JavaScript/Java and Python being the most in-demand programming languages. Recruiters noted back-end and full-stack developers as particularly challenging roles to fill, aligning with their high demand.

- Similarly, in the cybersecurity sector, cloud security and security operations positions posed significant recruitment difficulties in 2023.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Monster and CareerBuilder merger: In a strategic move to enhance their digital recruitment platforms, Monster and CareerBuilder, two pioneering U.S.-based job board companies, announced their intention to merge. This merger aims to consolidate resources and expand its reach in the online recruitment market.

New Product Launches:

- SmartRecruiters’ new product features: In January 2023, SmartRecruiters unveiled new enhancements to its recruitment platform, including Zoom integration, the ability to edit onboarding start dates, and various other updates aimed at streamlining the recruitment process for both recruiters and candidates.

Funding:

- Investment in technology upgrades: Several major online recruitment platforms have received substantial investments aimed at integrating advanced analytics and AI technologies. These enhancements focus on improving the efficiency of matching candidates with job opportunities and optimizing the recruitment process.

Technological Advancements:

- AI in Recruiting: Artificial intelligence is increasingly being integrated into online recruitment platforms. AI technologies are being used to speed up volume screening, especially for roles with straightforward resume requirements or where large numbers of applicants are typical. This technology helps recruiters by pre-screening candidates to fast-track the hiring process.

- Remote and Virtual Recruiting Tools: With the continuation of remote work trends, online recruitment platforms have significantly invested in virtual recruiting tools that allow for comprehensive remote interviewing and onboarding processes.

Conclusion

Online Recruitment Statistics – Online recruitment is now a crucial component of modern hiring strategies, offering benefits for both employers and job seekers.

Despite challenges like identifying qualified candidates and addressing skill shortages, it provides opportunities to reach a wider talent pool and streamline hiring processes.

The demand for skilled IT professionals remains high, with recruiters facing the ongoing challenge of aligning candidates’ skills with organizational needs.

However, advancements in online recruitment tools facilitate faster and more efficient candidate sourcing and screening.

Overall, online recruitment enhances employer branding and provides valuable insights for optimizing recruitment strategies, ensuring organizations remain competitive in the evolving digital economy.

FAQs

Online recruitment refers to the process of using internet-based platforms and tools to attract, source, screen, and hire candidates for job openings. It encompasses various strategies, including job posting websites, social media platforms, applicant tracking systems, and virtual interviewing tools.

Online recruitment offers several advantages for employers, including access to a larger pool of candidates, cost-effectiveness compared to traditional methods, faster hiring processes, and the ability to reach passive job seekers who may not actively be searching for opportunities.

Some challenges of online recruitment include ensuring the quality and authenticity of candidate profiles, managing large volumes of applications efficiently, addressing potential biases in the screening process, and keeping up with rapidly evolving technology and recruitment trends.

Employers can employ various strategies to enhance their online recruitment efforts, such as optimizing job postings for search engines, leveraging social media and professional networking platforms, building and maintaining a strong employer brand, utilizing data analytics to track recruitment metrics, and providing a positive candidate experience throughout the hiring process.

Job seekers can improve their chances of success in online recruitment by creating a professional and complete online profile, customizing their applications to align with job requirements, utilizing keywords relevant to their industry and desired roles, networking with professionals in their field, and staying updated on industry trends and job market demands.