Table of Contents

- Introduction

- Editor’s Choice

- Global Speech and Voice Recognition Market Statistics

- Speech Signal for Recognition

- Number of Voice Search Users Around the Globe

- Voice Recognition Usage in Different Applications

- Adoption of Voice Recognition Across Various Departments

- Demographics of Speech and Voice Recognition Users

- Use of Voice Technology by Professionals in Industries

- Voice Assistants Mostly Used by Users

- Accuracy of Voice Assistants

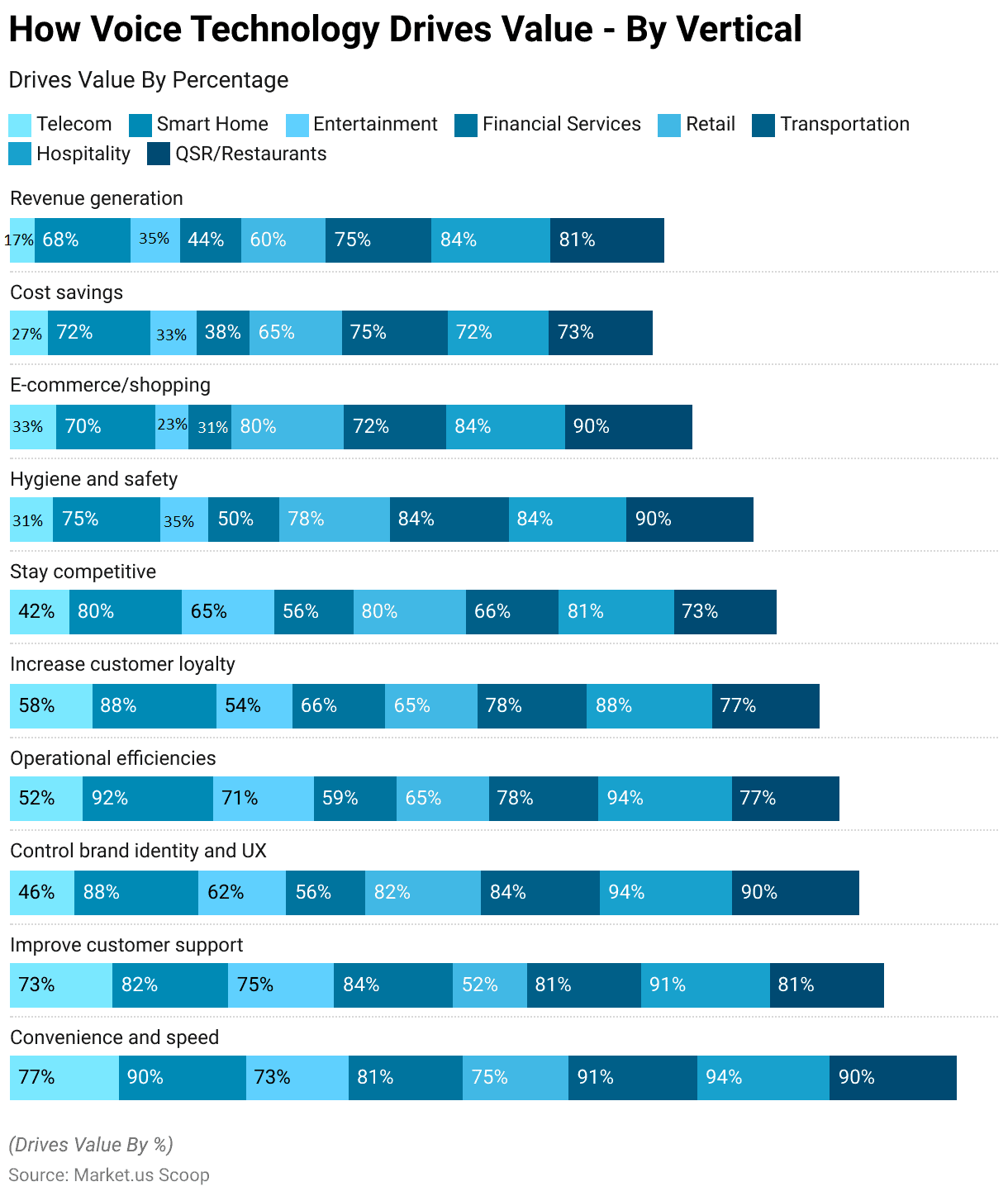

- How Voice Technology Drives Value (By Vertical)

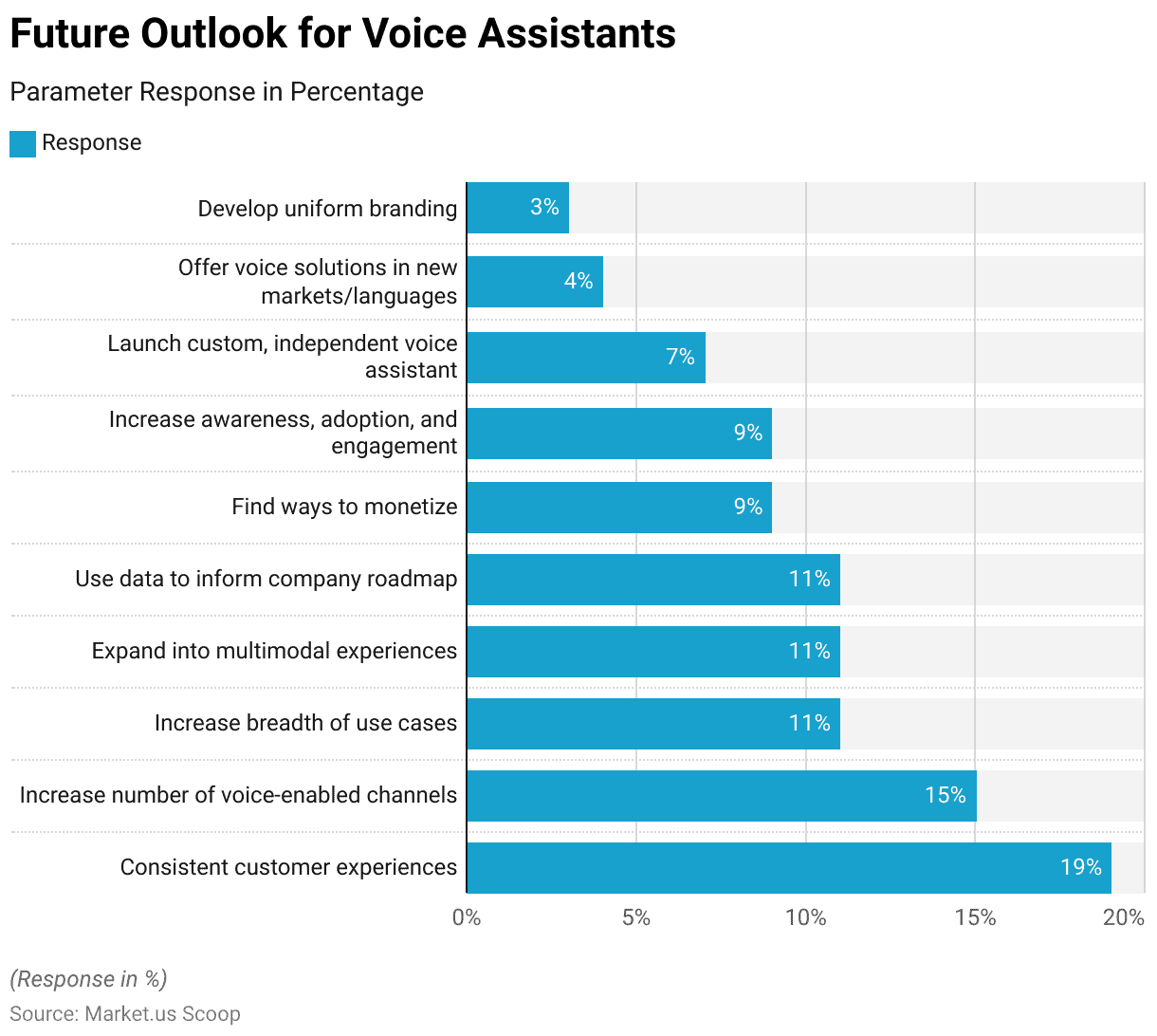

- Future Outlook for Voice Assistants

- Recent Developments

- Conclusion

- FAQs

Introduction

Speech and Voice Recognition Statistics: Speech and voice recognition technology enables computers to understand human speech by converting spoken words into text or instructions.

This involves capturing audio through microphones, processing it digitally, and analyzing sound patterns to recognize individual sounds, words, and phrases.

It has diverse applications in virtual assistants, transcription services, accessibility tools, security systems, and automotive interfaces, facilitating hands-free operation and improving accessibility.

However, challenges like ensuring accuracy, addressing privacy concerns, and integrating with existing systems persist.

Advances such as refined learning methods and cloud-based solutions improve accuracy and scalability. While personalized features customize systems to users’ distinct speech patterns.

Editor’s Choice

- By 2032, the global speech and voice recognition market revenue will reach USD 83.0 billion.

- In 2023, the market expanded to USD 17.0 billion, with speech recognition generating USD 11.1 billion, voice recognition USD 4.8 billion, and other technologies USD 1.1 billion.

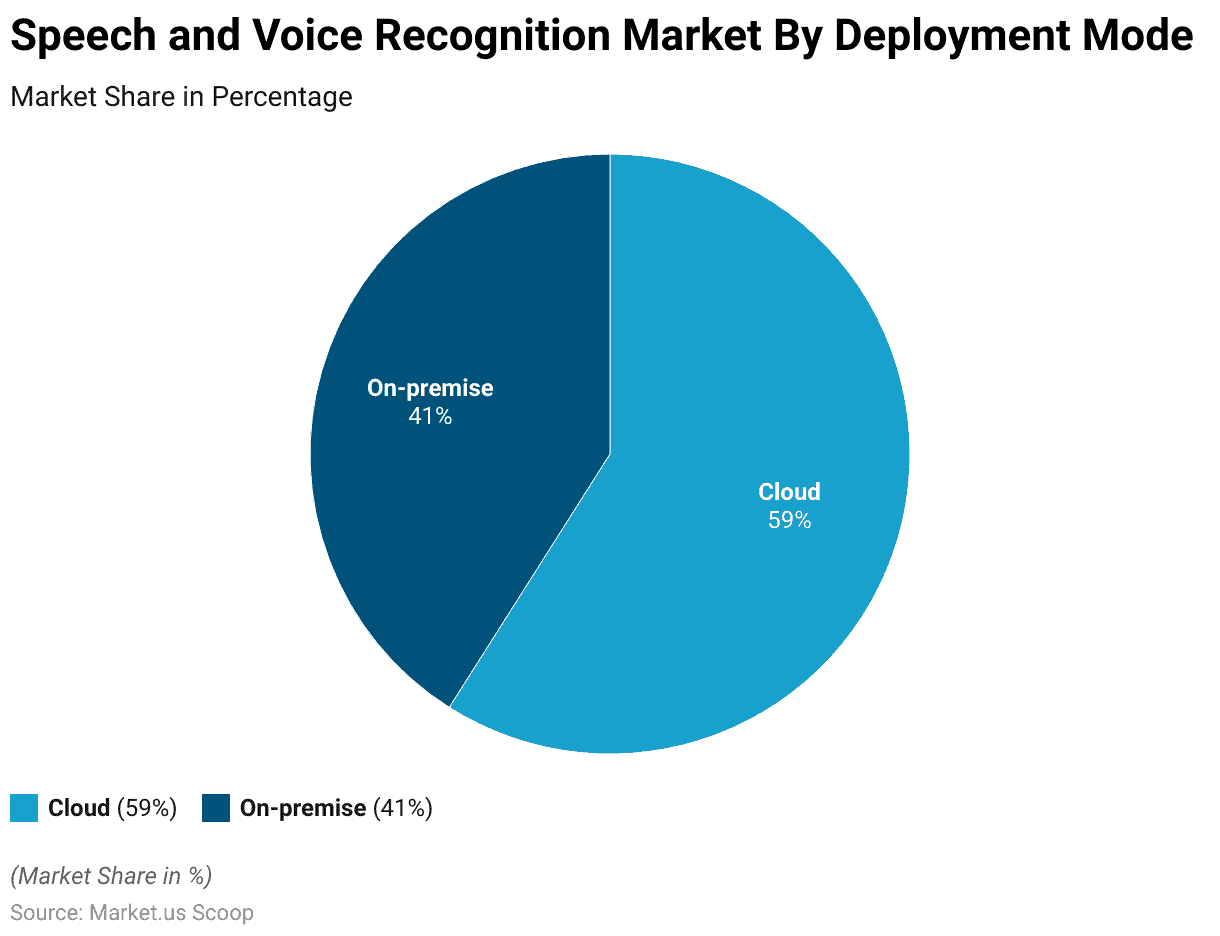

- The global speech and voice recognition market is segmented by deployment mode. Cloud-based solutions hold 59% of the market share.

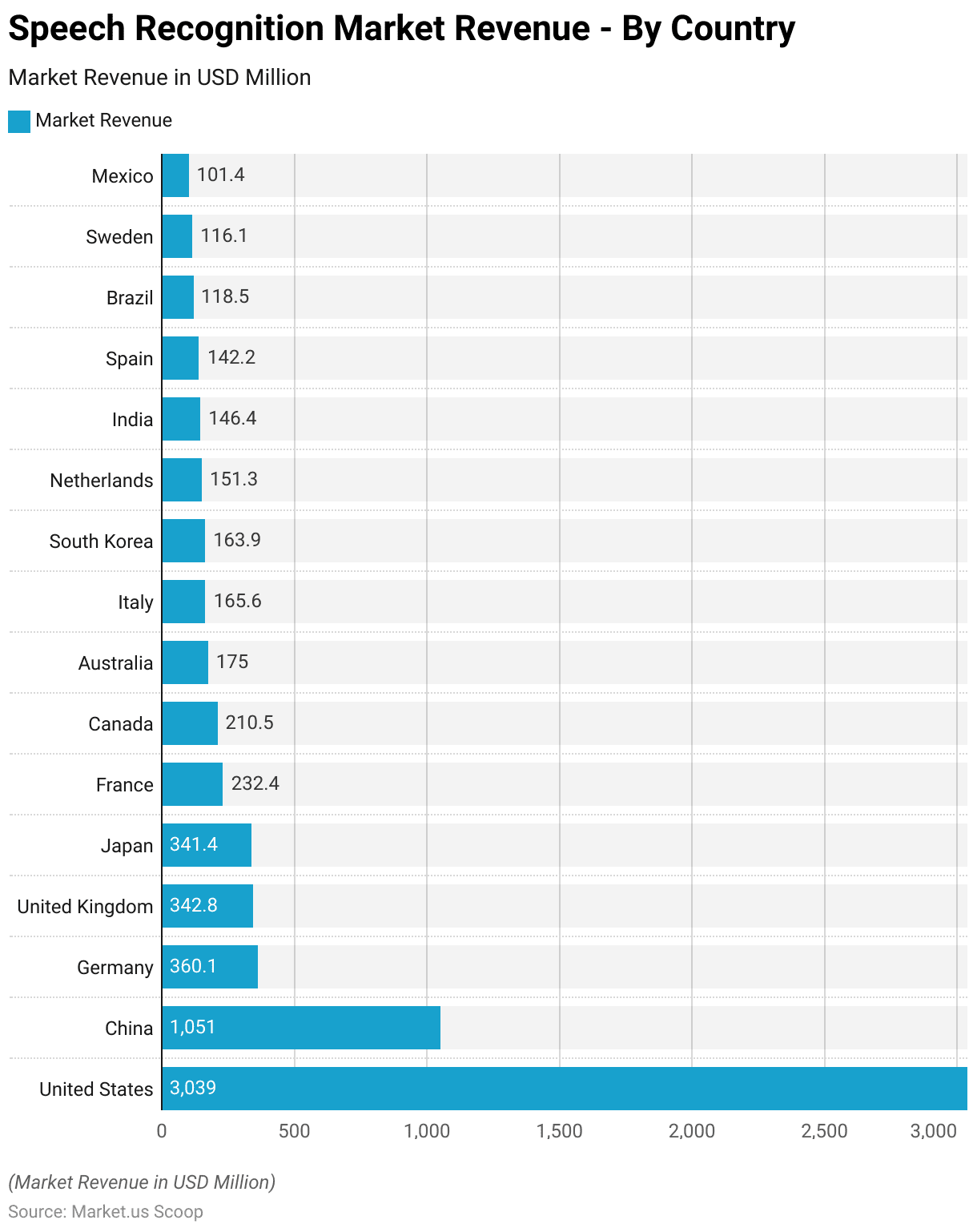

- As of the latest data, the global speech recognition market revenue showcases a notable dominance by the United States, with revenues reaching USD 3039 million.

- 31% of voice users view cleanliness as a notable advantage of voice technology.

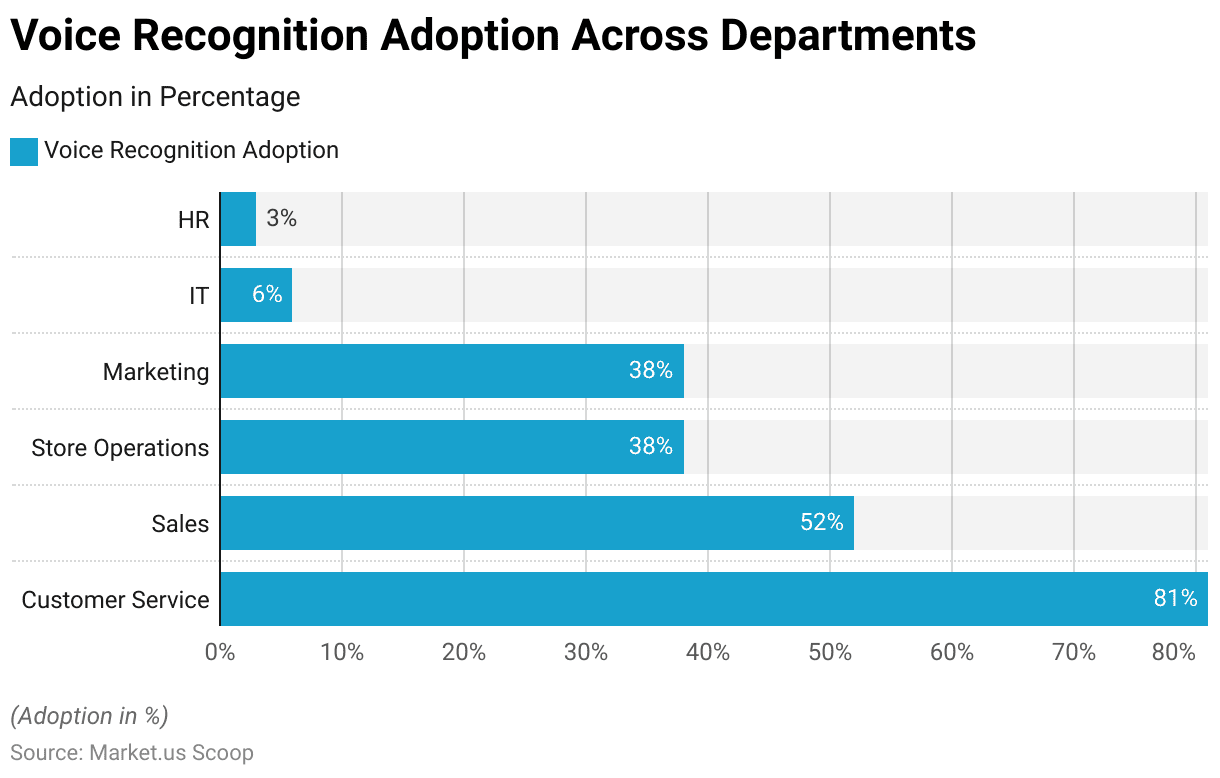

- Customer service leads the way with a high adoption rate of 81%. Indicating its widespread integration to enhance customer interactions and support services.

- In subtitling and closed captioning, 14% of professionals utilize voice technology, followed by 12% in customer experience and analytics.

Global Speech and Voice Recognition Market Statistics

Global Speech and Voice Recognition Market Size Statistics

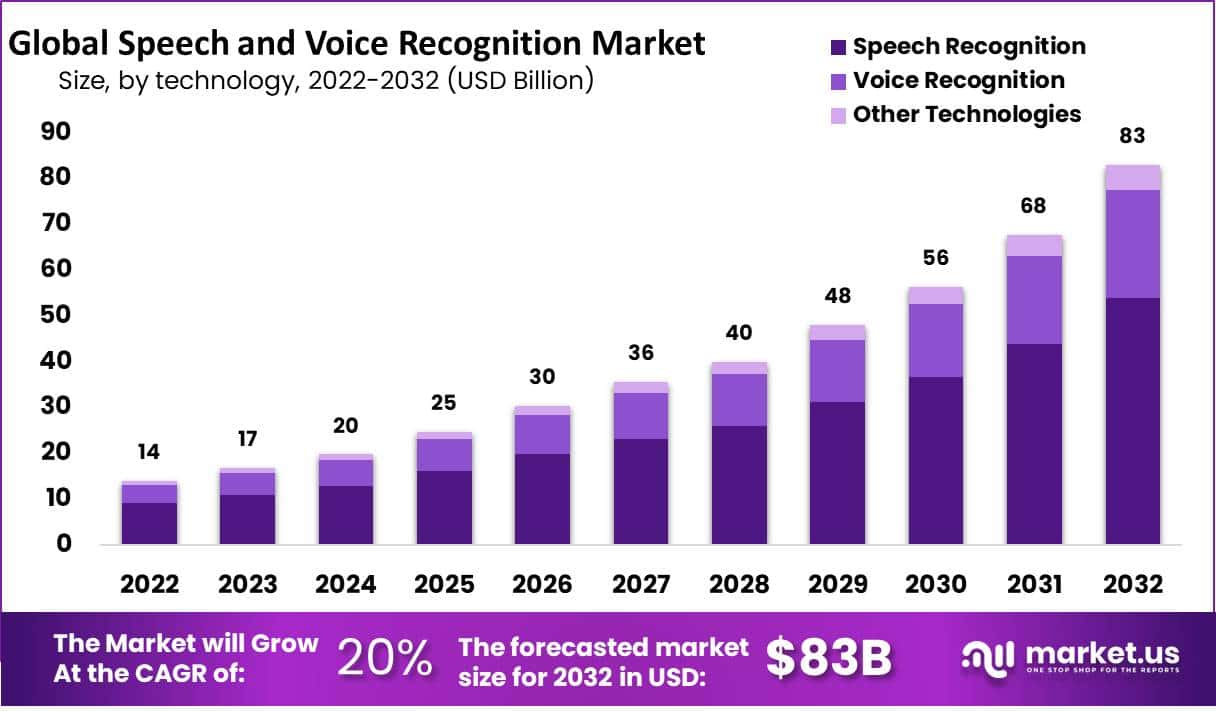

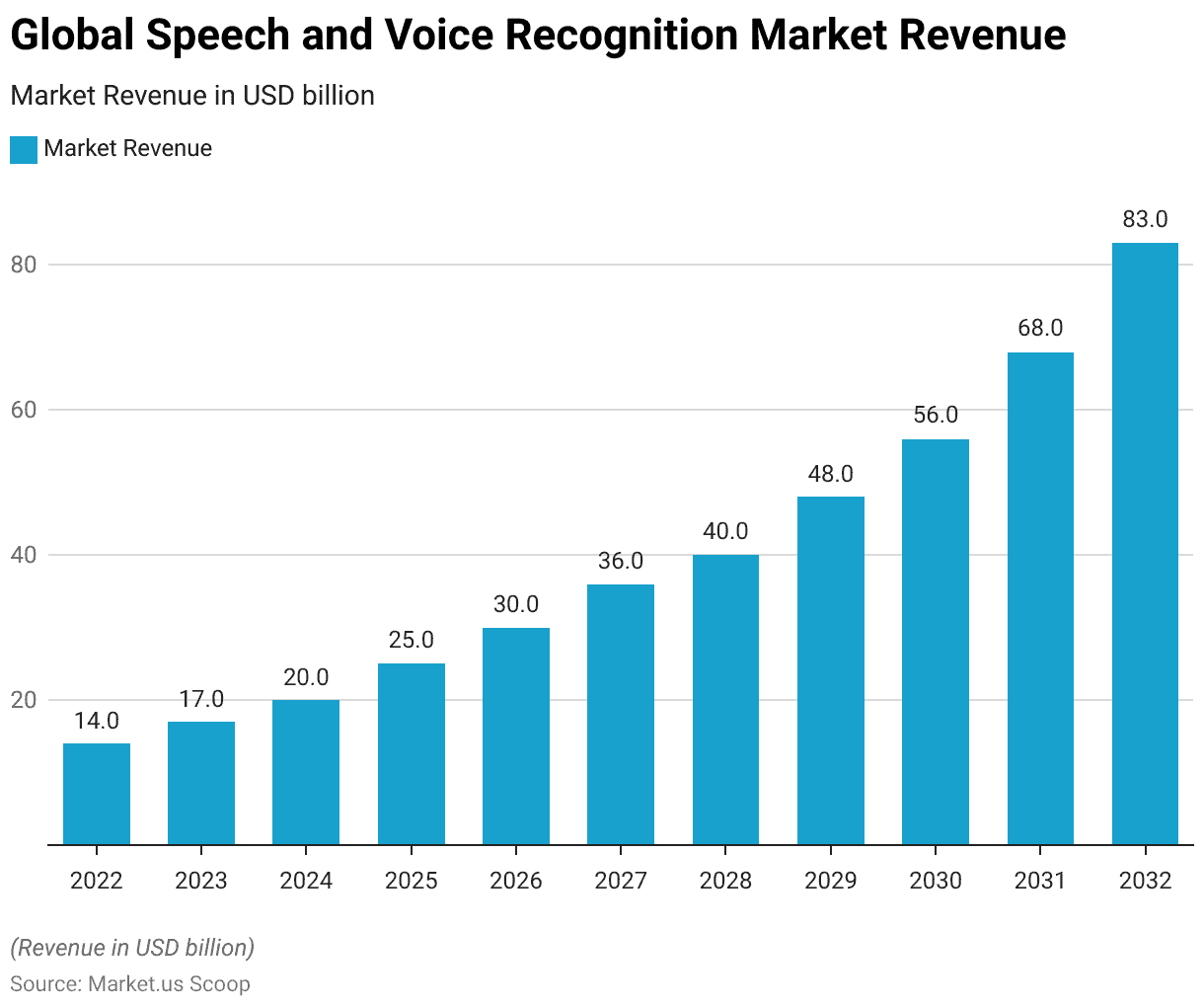

- The global speech and voice recognition market has experienced steady growth in revenue over the past decade at a CAGR of 20%.

- Starting at USD 14.0 billion in 2022, the market saw a significant increase to USD 17.0 billion in 2023, followed by continued expansion to USD 20.0 billion in 2024.

- Projections indicate continued robust growth, with revenues reaching USD 25.0 billion in 2025, USD 30.0 billion in 2026, and USD 36.0 billion in 2027.

- The market is expected to maintain this upward trajectory, surpassing USD 40.0 billion in 2028, USD 48.0 billion in 2029, and USD 56.0 billion in 2030.

- By 2031, revenue is forecasted to reach USD 68.0 billion, further climbing to USD 83.0 billion by 2032.

- This growth reflects the increasing adoption of speech and voice recognition technology across various industries. Driven by advancements in artificial intelligence, natural language processing, and improved user interfaces.

(Source: Market.us)

Speech and Voice Recognition Market Size – By Technology Statistics

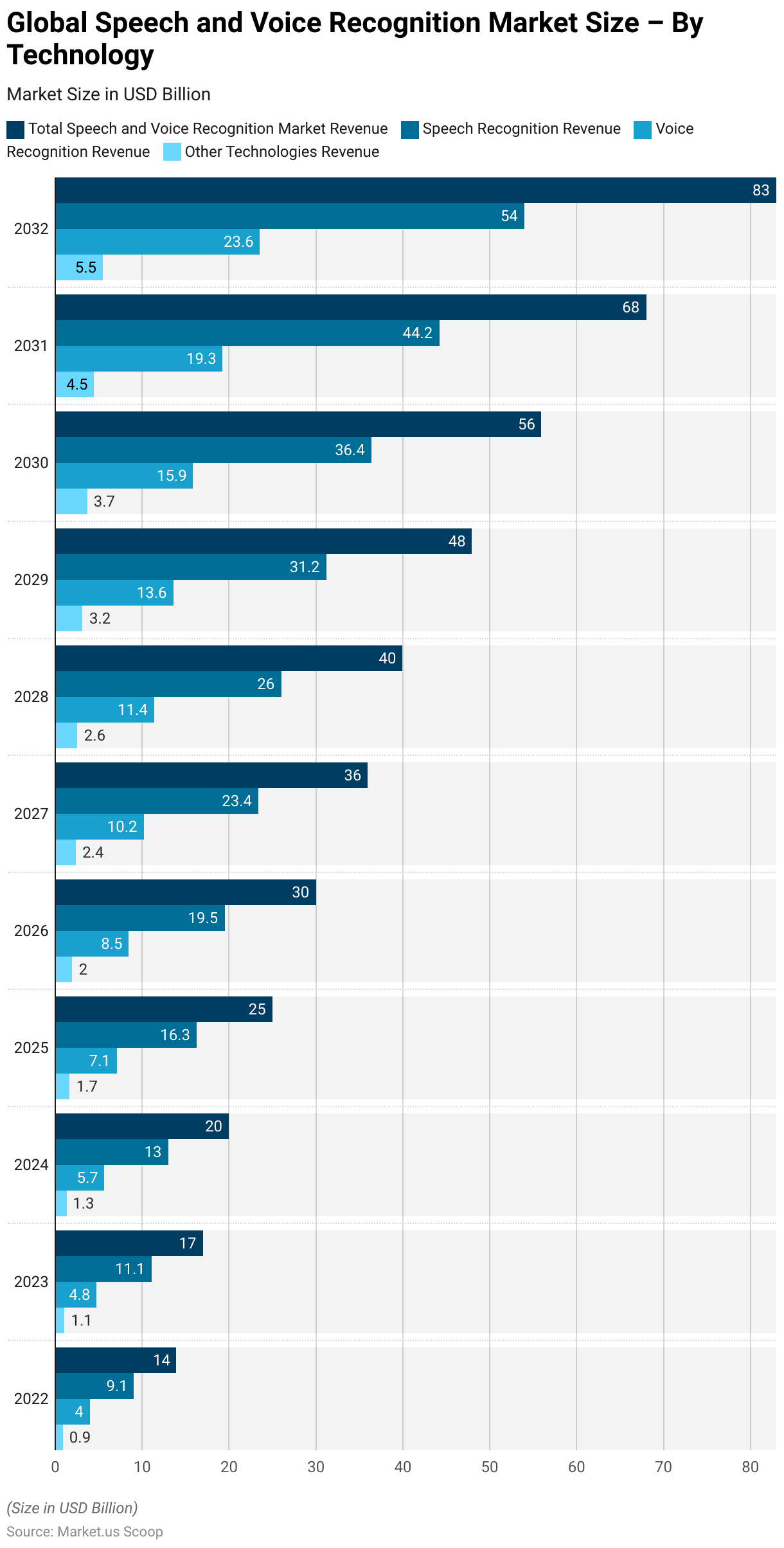

- The global speech and voice recognition market has steadily grown, with revenues increasing consistently.

- In 2022, the total market revenue reached USD 14.0 billion, with speech recognition accounting for USD 9.1 billion, voice recognition for USD 4.0 billion, and other technologies contributing USD 0.9 billion.

- Subsequently, in 2023, the market expanded to USD 17.0 billion, with speech recognition generating USD 11.1 billion, voice recognition USD 4.8 billion, and other technologies USD 1.1 billion.

- This growth trajectory continued into 2024, when the market surged to USD 20.0 billion, with speech recognition leading at USD 13.0 billion, voice recognition at USD 5.7 billion, and other technologies at USD 1.3 billion.

- Projections indicate further growth in the coming years, with revenues reaching USD 25.0 billion in 2025, USD 30.0 billion in 2026, and USD 36.0 billion in 2027.

- By 2032, the market is expected to exceed USD 83.0 billion. Driven by increasing adoption and advancements in speech and voice recognition technologies across various industries.

(Source: Market.us)

Global Speech and Voice Recognition Market Share – By Deployment Mode Statistics

- The global speech and voice recognition market is segmented by deployment mode. Cloud-based solutions hold 59% of the market share.

- Cloud deployment offers flexibility, scalability, and accessibility, making it a preferred choice for many businesses seeking efficient and cost-effective solutions.

- On-premise deployment, comprising a smaller portion of the market at 41%, remains significant. Particularly for organizations requiring greater control over their data and infrastructure.

- This division in deployment modes reflects businesses’ diverse needs and preferences across industries. Driving competition and innovation within the speech and voice recognition market.

(Source: Market.us)

Regional Analysis of Speech Recognition Market

- As of the latest data, the global speech recognition market revenue showcases a notable dominance by the United States, with revenues reaching USD 3039 million.

- Following behind, China emerges as a significant player, albeit with a considerable gap, recording revenues of USD 1051 million.

- Germany and the United Kingdom exhibit substantial contributions, with revenues of USD 360.1 million and USD 342.8 million, respectively.

- Japan closely trails, with revenue figures totaling USD 341.4 million.

- France, Canada, and Australia each demonstrate notable involvement in the market, with revenues standing at USD 232.4 million, USD 210.5 million, and USD 175 million, respectively.

- Italy, South Korea, and the Netherlands exhibit similar revenue figures, ranging from USD 163.9 million to USD 165.6 million.

- Though slightly less, India, Spain, Brazil, Sweden, and Mexico contribute to the market, with revenues ranging from USD 101.4 million to USD 146.4 million.

- These figures underline speech recognition technology’s widespread adoption and growing significance across various global markets.

(Source: Statista)

Speech Signal for Recognition

- Humans generate acoustic wave speech signals, which are captured by microphones and converted into analog signals.

- These analog signals are then conditioned using an anti-aliasing filter and further filtered to compensate for channel impairments.

- The anti-aliasing filter restricts the speech signal to approximately half the sampling rate (the Nyquist rate) before sampling. Subsequently, the conditioned analog signal is sampled by an analog-to-digital (A/D) converter to produce a digital signal.

- A/D converters commonly used for speech signal applications typically have a resolution ranging from 12 to 16 bits and sample rates between 8000 to 20,000 samples per second.

- Oversampling of the analog speech signal is employed to ensure precise fidelity control of the sampled speech signal and simplify the anti-aliasing filter.

(Source: IIT Bombay)

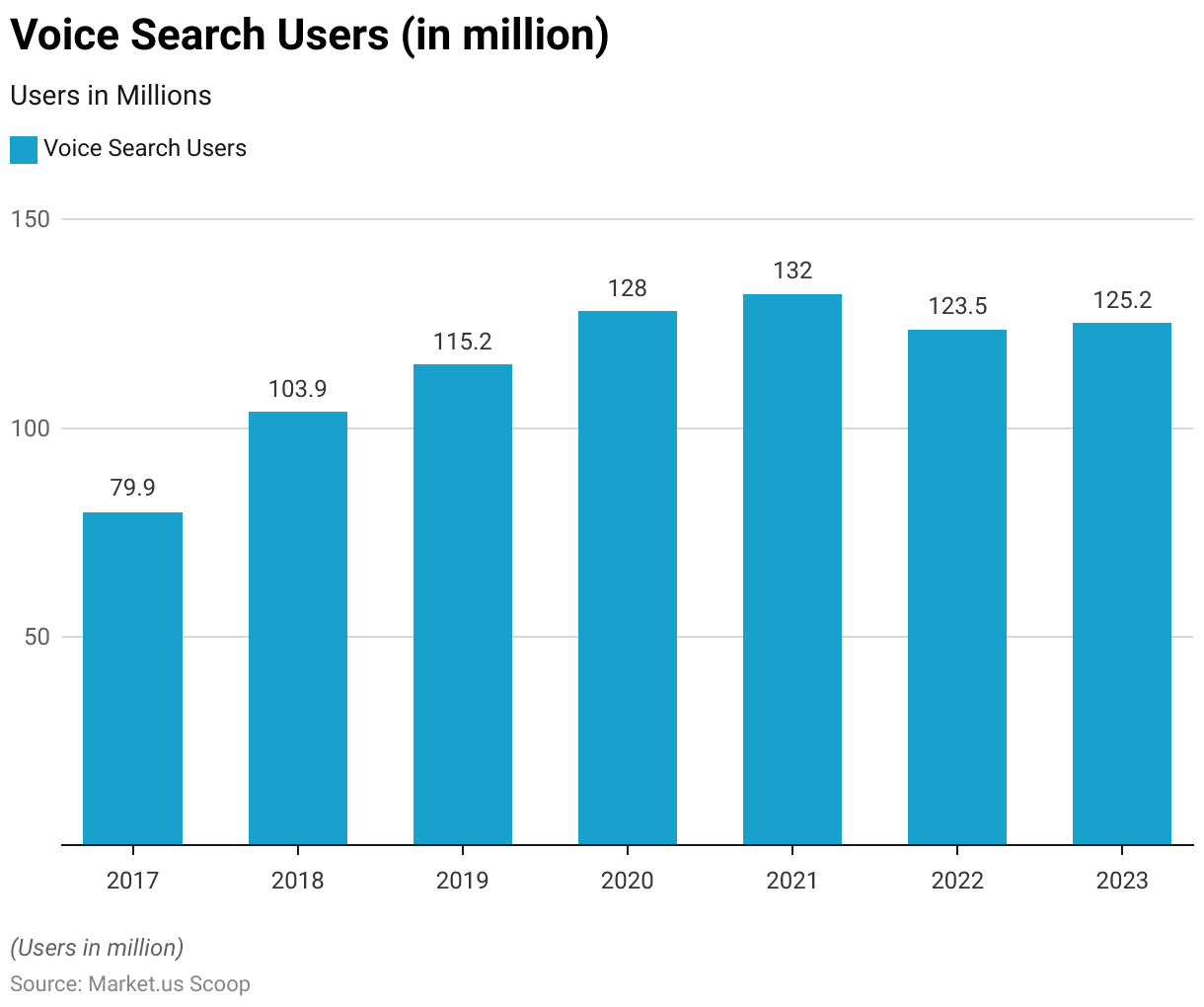

Number of Voice Search Users Around the Globe

- The utilization of voice search technology has experienced a notable upward trajectory over recent years, as evidenced by a steady increase in user numbers.

- In 2017, there were approximately 79.9 million voice search users, which grew substantially to 103.9 million in 2018.

- This trend continued with even more significant momentum, reaching 115.2 million users in 2019.

- Despite fluctuations, likely influenced by technological advancements and user adoption rates, 2020 saw a peak of 128 million users engaging with voice search functionalities.

- In the subsequent years, they maintained this upward trajectory, with 132 million users in 2021, 123.5 million users in 2022, and further growth to 125.2 million users in 2023.

- These statistics underscore the increasing integration of voice searches into daily routines. Reflecting a shift towards more seamless and intuitive digital interactions.

(Source: Demandsage)

Voice Recognition Usage in Different Applications

- 31% of voice users view cleanliness as a notable advantage of voice technology.

- Additionally, 37% express interest in utilizing voice interfaces to check their bank balances. While 29% indicate a willingness to schedule doctor’s appointments using voice commands.

- Another 28% would opt for voice-enabled grocery, and food delivery services.

- Regarding health and fitness apps, only 18% of users currently employ voice technology.

- Moreover, a substantial 86% believe that voice technology has the potential to enhance hygiene measures in business and event settings, a sentiment amplified by the impact of the pandemic.

- Home automation emerges as a prevalent application for voice, with 56% of users open to using voice commands to open doors, 55% for elevator controls, and 49% for vending machine operations.

- However, only one in four users extend their use of voice beyond basic searches, with limited availability of voice search functionality in many applications and websites likely contributing to this trend.

(Source: Adobe 2020 Voice Survey)

Adoption of Voice Recognition Across Various Departments

- Voice recognition technology adoption varies significantly across different departments within organizations.

- Customer service leads the way with a high adoption rate of 81%, indicating its widespread integration to enhance customer interactions and support services.

- Sales departments also show significant uptake, with 52% adopting voice recognition technology to streamline sales processes and improve efficiency.

- In-store operations and marketing adoption rates stand at 38%, reflecting the utilization of voice technology to optimize operational workflows and enhance marketing strategies.

- However, adoption rates are considerably lower in IT and HR departments, with only 6% and 3%, respectively.

- This suggests a slower uptake of voice recognition technology in these areas, possibly due to specific technical requirements or alternative solutions currently in place.

(Source: SoundHound)

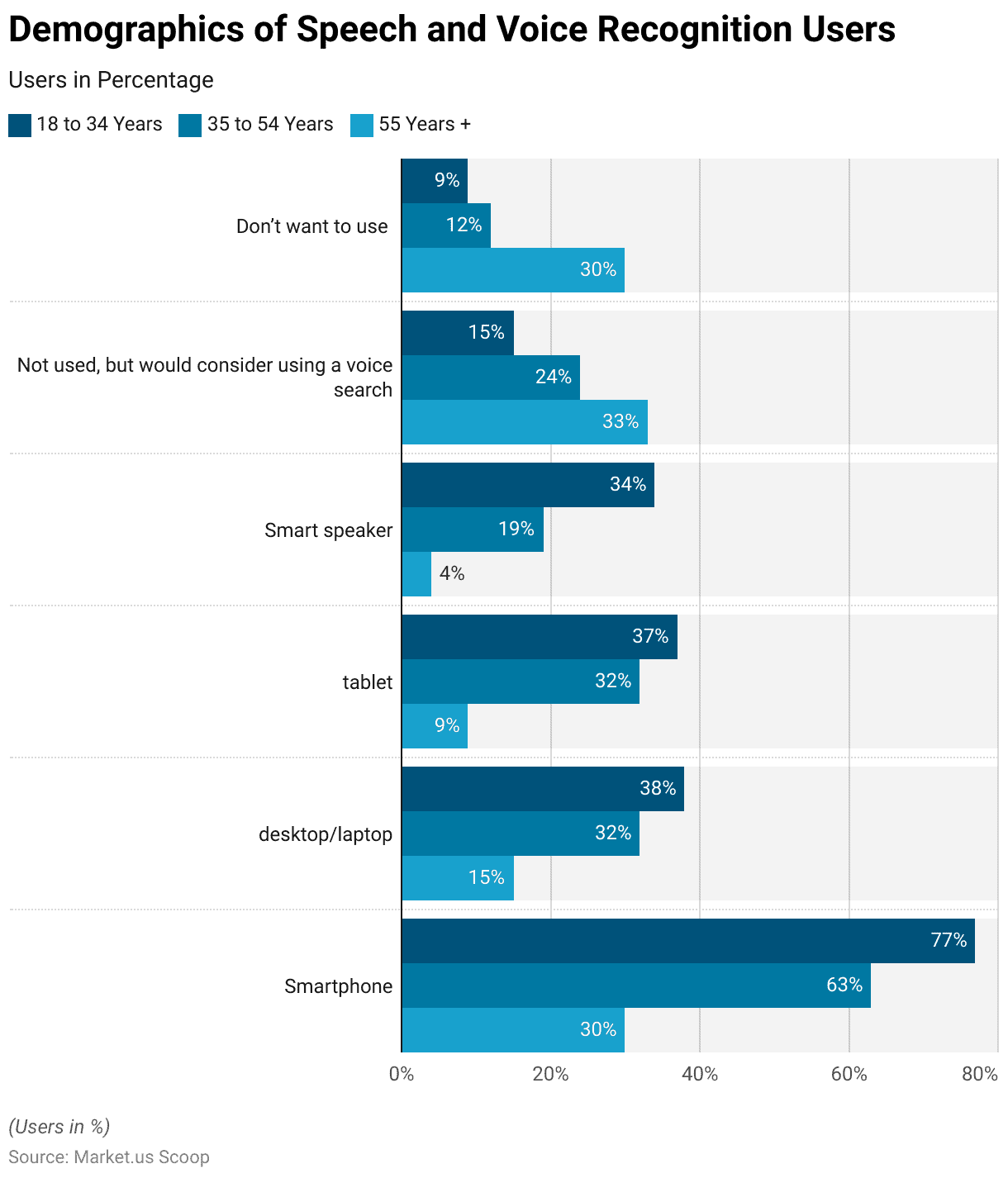

Demographics of Speech and Voice Recognition Users

- The demographics of speech and voice recognition users vary across different devices. Among smartphone users, the highest adoption rates are observed in the 18 to 34 age group, with 77%, followed by 63% in the 35 to 54 age bracket, and 30% among those aged 55 and above.

- Similarly, desktop/laptop usage is more prevalent among younger demographics, with 38% in the 18 to 34 age group, decreasing to 32% and 15% in the 35 to 54 and 55+ age groups, respectively.

- Tablet usage follows a similar trend, with 37% among the 18 to 34 age group, 32% among the 35 to 54 age group, and 9% among those aged 55 and above.

- Smart speaker adoption, however, is highest among the younger demographic, with 34% in the 18 to 34 age group, declining to 19% and 4% in the 35 to 54 and 55+ age groups, respectively.

- Moreover, there is a notable proportion of users across all age groups who have not yet utilized voice search but are open to considering it, ranging from 15% to 33%.

- Conversely, some individuals express reluctance to use voice technology, with percentages ranging from 9% to 30% across the different age groups.

(Source: Demandsage)

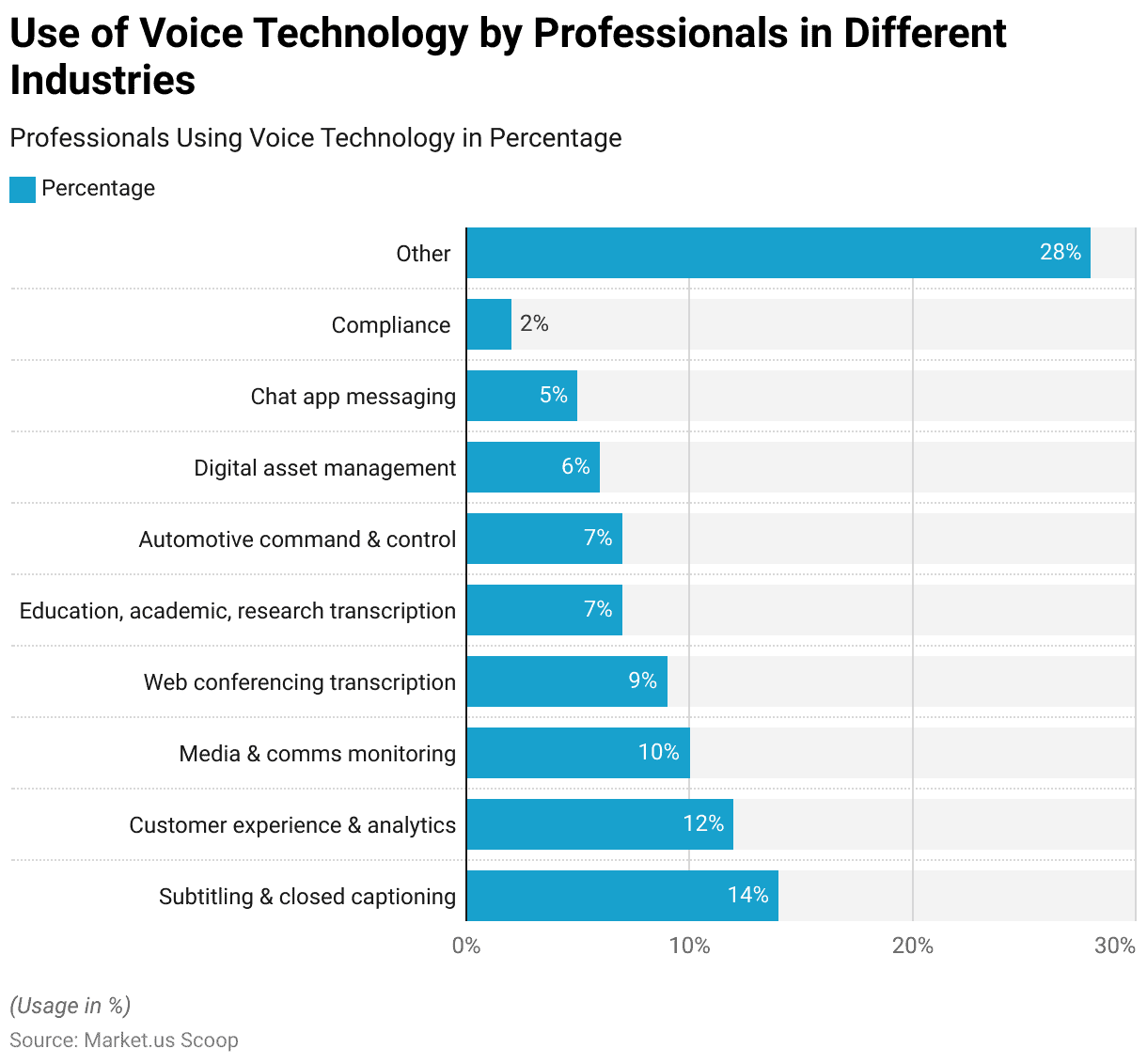

Use of Voice Technology by Professionals in Industries

- Voice technology adoption among professionals varies across different industries.

- In subtitling and closed captioning, 14% of professionals utilize voice technology, followed by 12% in customer experience and analytics.

- Media and communications monitoring see a 10% adoption rate, while web conferencing transcription and education, academic, and research transcription stand at 9% and 7%, respectively.

- In the automotive sector, voice technology is employed for command and control purposes by 7% of professionals.

- Digital asset management and chat app messaging industries show relatively lower adoption rates, with 6% and 5%, respectively.

- Compliance-focused applications have the lowest adoption, with only 2% of professionals using voice technology.

- Other industries collectively account for 28% of voice technology adoption, reflecting various applications and usage scenarios across the professional landscape.

(Source: Statista)

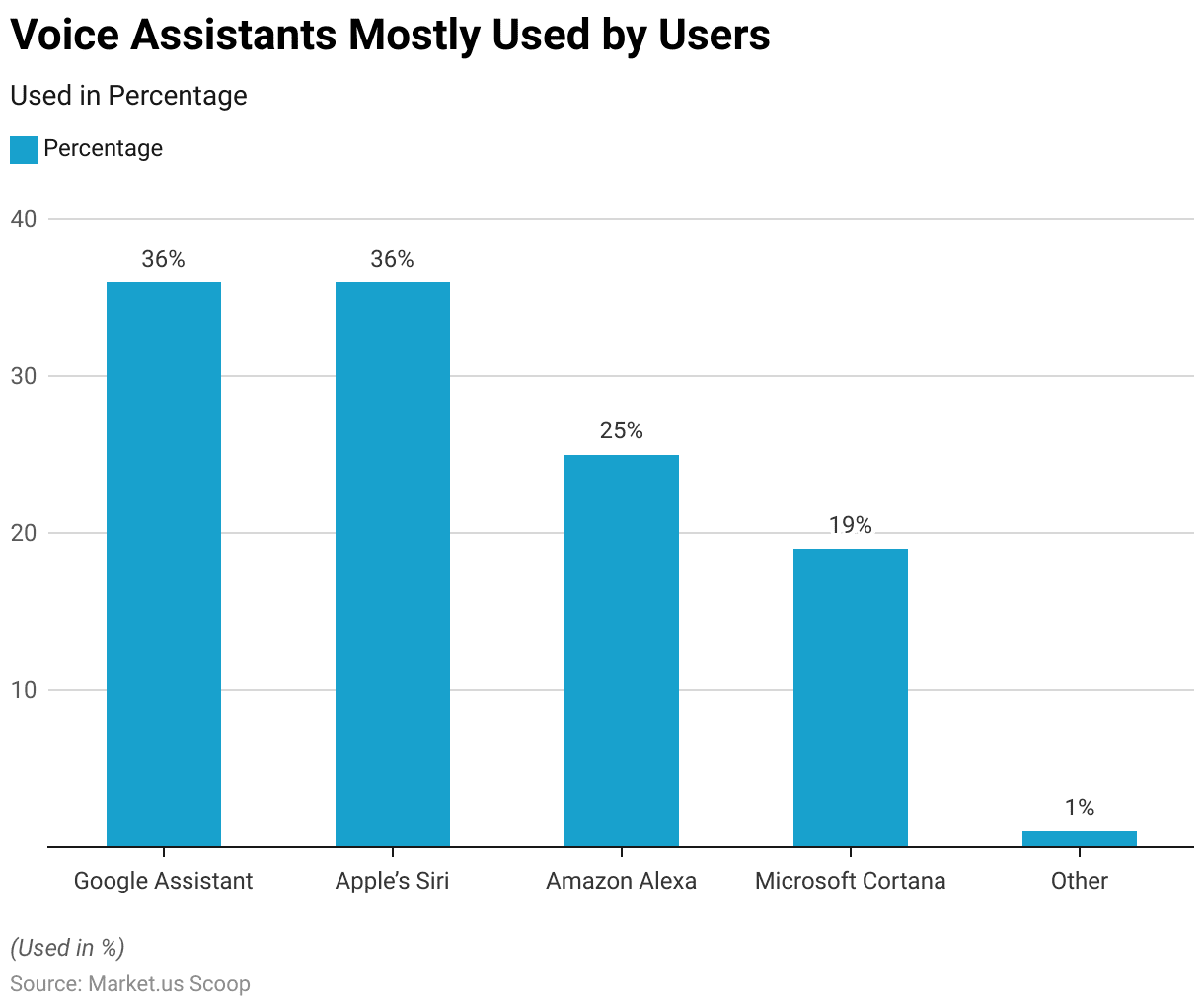

Voice Assistants Mostly Used by Users

- According to recent data, Google Assistant and Apple’s Siri dominate the market share of digital assistants, each holding a substantial 36% of users.

- Following closely behind is Amazon Alexa, capturing 25% of the market.

- Microsoft Cortana trails with 19%, while other digital assistants collectively represent a marginal 1%.

- This distribution underscores the fierce competition among tech giants vying for supremacy in the digital assistant landscape.

- The market is dynamic and highly contested, with Google and Apple neck and neck and Amazon maintaining a significant presence.

- These figures reflect consumers’ preferences and highlight the importance of user experience and functionality in driving adoption rates.

(Source: Statista)

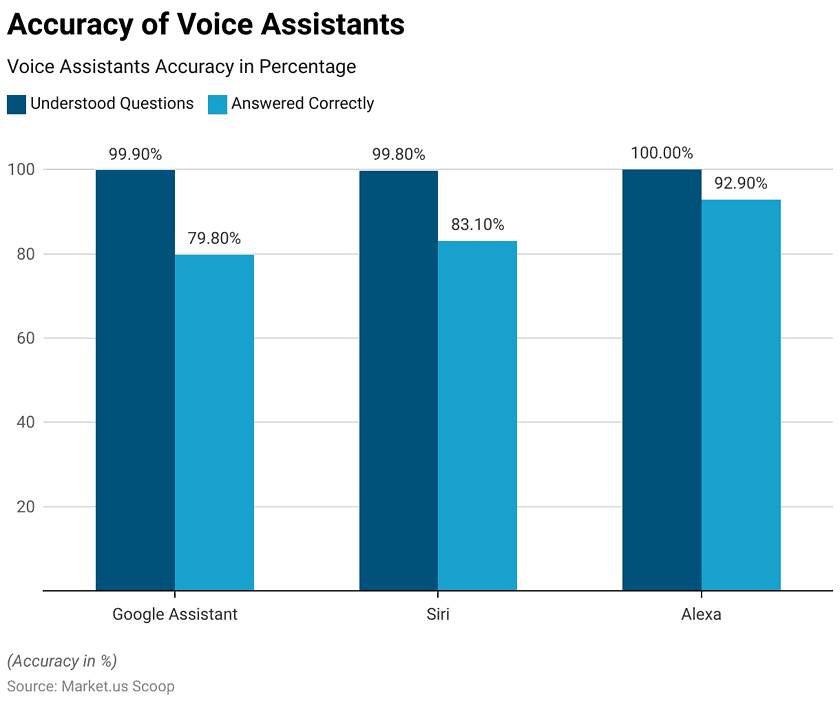

Accuracy of Voice Assistants

- When assessing the accuracy of digital assistants in understanding questions and providing correct answers, Alexa emerges as the top performer, achieving a perfect score of 100% in understanding questions and delivering correct responses 92.90% of the time.

- Siri follows closely, with a 99.80% understanding rate and an 83.10% accuracy in providing correct answers.

- While exhibiting a high understanding rate of 99.90%, Google Assistant lags in accuracy, answering questions correctly 79.80% of the time.

- These metrics offer insights into the comparative performance of popular digital assistants, highlighting their strengths and areas for improvement in effectively interpreting and responding to user queries.

(Source: Statista)

How Voice Technology Drives Value (By Vertical)

- Voice technology drives value across various verticals by addressing key parameters tailored to each industry’s needs.

- In the telecom sector, convenience and speed are paramount, with 77% of respondents highlighting the importance of streamlined interactions.

- Smart home applications prioritize convenience even further, with 90% emphasizing its significance.

- Entertainment platforms benefit from voice technology by enhancing customer support (75%) and controlling brand identity and user experience (62%).

- Financial services leverage voice technology to improve customer support (84%) and drive revenue generation (44%).

- Retailers capitalize on voice technology to control brand identity and enhance customer loyalty (66%).

- In transportation, operational efficiencies (78%) and hygiene and safety measures (84%) are prioritized. While the hospitality industry places a strong emphasis on convenience (94%) and customer loyalty (88%).

- Quick-service restaurants (QSRs) prioritize customer support (81%) and hygiene and safety (90%) to enhance the overall dining experience.

- These insights underscore how voice technology is a versatile tool. Enabling organizations to optimize operations. Enhance customer experiences, and maintain competitiveness within their respective industries.

(Source: Opus Research Survey – February 2021)

Barriers to Adoption of Speech and Voice Recognition Assistants Statistics

- In 2020, most survey participants, accounting for 73%, identified accuracy as a primary obstacle to the widespread adoption of voice technology.

- Additionally, 66% of respondents expressed concerns about recognition issues stemming from accents or dialects, further hindering the adoption of voice technology.

(Source: Statista)

Future Outlook for Voice Assistants

- Looking ahead, the future outlook for voice assistants entails several key strategies and priorities.

- Consistent customer experiences are a top consideration, cited by 19% of respondents. Highlighting the importance of delivering seamless interactions across various touchpoints.

- To broaden their reach, companies aim to increase the number of voice-enabled channels (15%) and expand the breadth of use cases (11%).

- Additionally, there’s a focus on evolving into multimodal experiences (11%) and leveraging data to inform company roadmaps (11%).

- Monetization opportunities are also being explored (9%) alongside efforts to raise awareness, adoption, and engagement (9%).

- A smaller percentage of respondents (7%) plan to launch custom, independent voice assistants. While others aim to offer voice solutions in new markets or languages (4%) and develop uniform branding (3%).

- These initiatives underscore the evolving voice technology landscape. Driven by a desire to enhance user experiences and capitalize on emerging opportunities.

Recent Developments

Acquisitions and Mergers:

- Microsoft’s Acquisition of Nuance Communications: In April 2021, Microsoft announced its acquisition of Nuance Communications. A leader in speech recognition technology, for $19.7 billion. This strategic move aims to enhance Microsoft’s healthcare AI and cloud services capabilities.

- SoundHound’s Acquisition of Allset: In June 2024, SoundHound AI acquired key assets from Allset. A company specializing in voice AI solutions for the restaurant industry. This acquisition underscores SoundHound’s strategy to expand its offerings in the voice AI market.

Funding:

- Speechmatics’ Series B Funding: In November 2021, Speechmatics, a speech recognition technology company, raised $62 million in Series B funding. The investment, led by Susquehanna Growth Equity, aims to support Speechmatics’ vision of understanding every voice with human-level accuracy.

- PolyAI’s Funding Round: In May 2024, PolyAI, a London-based AI startup specializing in voice assistants for call centers, secured a valuation near $500 million following a $50 million funding round. The investment was led by Hedosophia and NVentures, with contributions from Nvidia, Khosla Ventures, and Point72 Ventures.

Product Launches:

- Character.AI’s Voice Conversation Feature: In June 2024, Character.AI, an AI chatbot startup, introduced a new feature enabling voice conversations between users and their AI characters. This development enhances user interaction and positions Character.AI competitively in the AI chatbot market.

Conclusion

Speech and Voice Recognition Statistics: In summary, speech and voice recognition technology has rapidly transformed our daily interactions with devices, offering various applications from virtual assistants to automotive interfaces.

Fueled by advancements in AI, natural language processing, and cloud computing, this market continues to expand.

Challenges such as accuracy and privacy concerns persist, yet the future outlook remains promising. Ongoing innovation is expected to improve user experiences and adoption rates across industries.

As businesses and consumers increasingly depend on voice tech for convenience and efficiency, it is poised to redefine human-computer interaction.

FAQs

Speech and voice recognition technology enables computers to interpret and understand human speech, converting spoken words into text or commands.

Speech recognition involves capturing audio input, digitally processing it, and analyzing sound patterns to identify individual sounds, words, and phrases.

Typical applications include virtual assistants, transcription services, accessibility tools, security systems, automotive interfaces, and more.

Challenges include maintaining accuracy, addressing privacy concerns, integrating with existing systems, and ensuring compatibility with different accents and dialects.

Advancements in deep learning, cloud computing, and natural language processing are driving accuracy, scalability, and user experience improvements.