Table of Contents

Introduction

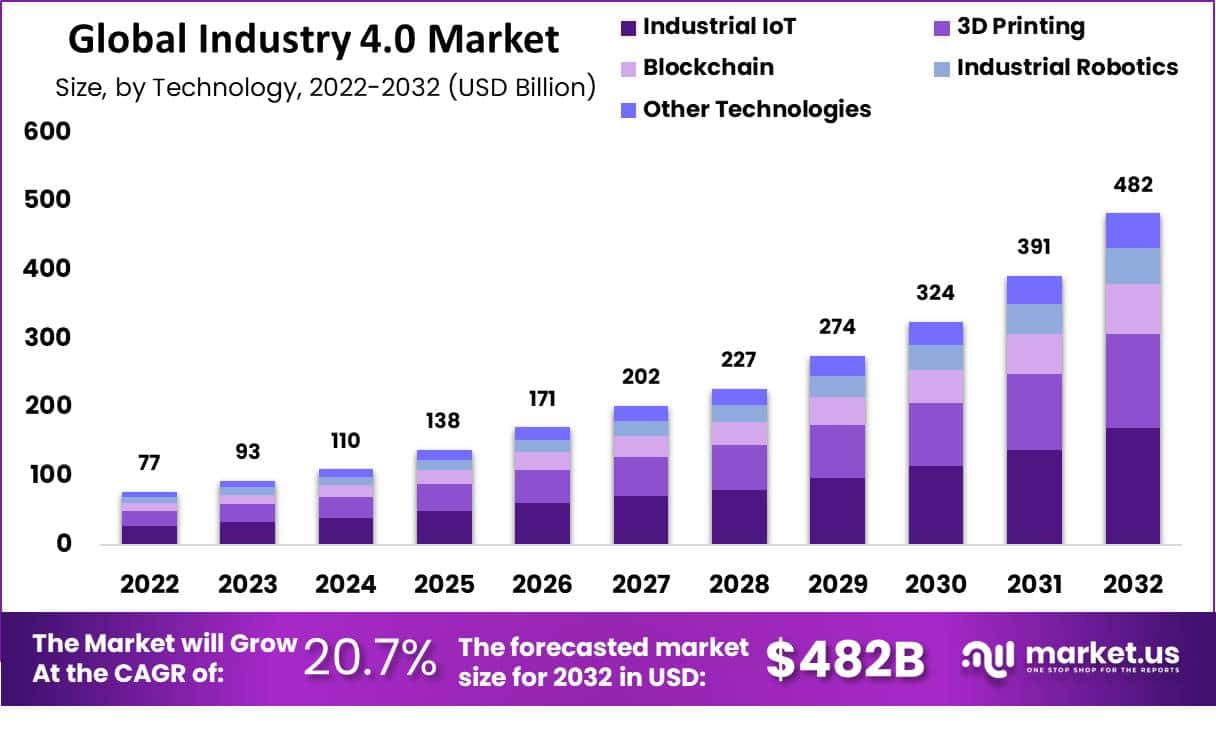

The Industry 4.0 market is expected to grow significantly in the coming years. It is characterized by the integration of cutting-edge technologies such as artificial intelligence (AI), the Internet of Things (IoT), and advanced robotics into manufacturing processes. Forecasts suggest that the market will expand from USD 93 billion in 2023 to an impressive USD 482 billion by 2032, driven by a compound annual growth rate (CAGR) of 20.7%. This growth is due to various factors, including the increasing adoption of smart technologies that improve manufacturing efficiency, reduce downtime, and enhance product quality.

Recent developments in the Industry 4.0 market have highlighted its dynamic nature. For example, in June 2023, Siemens invested EUR 2 billion to establish new manufacturing facilities and innovation labs, showing a strong commitment to fostering growth and innovation. Similarly, in February 2023, Johnson Controls International and Willow began a global collaboration to transform buildings and facilities using digital twin technologies digitally. Additionally, in August 2023, the collaboration between Telefonaktiebolaget LM Ericsson and RMIT University aimed to educate Vietnamese students on 5G and emerging technologies, demonstrating the global reach and interdisciplinary impact of Industry 4.0 initiatives.

Challenges remain, such as the need for increased awareness of the return on investment (ROI) associated with adopting Industry 4.0 technologies and overcoming workforce and standardization issues. Nonetheless, the benefits, including improved operational efficiency, reduced costs, and enhanced product quality, are compelling industries worldwide to embrace this fourth industrial revolution. With significant investments in technology and collaborations fostering innovation and adoption across various sectors, the Industry 4.0 market’s future appears robust, promising transformative effects on global manufacturing landscapes.

Key Takeaways

- The Industry 4.0 market is expected to grow from USD 93 billion in 2023 to approximately USD 482 billion by 2032, representing a remarkable compound annual growth rate (CAGR) of 20.7%.

- The adoption of advanced technologies such as Industrial IoT, 3D printing, blockchain, and industrial robotics is driving the expansion of the Industry 4.0 market.

- Industrial IoT, one of the key technologies in Industry 4.0, holds the largest market share, accounting for 39% of the total market.

- Manufacturing emerges as the leading industrial vertical, expected to hold the largest market share, followed by automotive, energy & utilities, oil and gas, aerospace and defense, and other industrial verticals.

- North America dominates the global Industry 4.0 market, contributing the largest revenue share of 42%.

- Key players in the Industry 4.0 market, including Robert Bosch GmbH, ABB Ltd, Honeywell International Inc., and others, are implementing various strategies to enhance market growth.

Industry 4.0 Statistics

- From 2011 to 2022, public interest in Industry 4.0 and terms like “Industrial IoT” and “Smart Manufacturing” surged, showing a 140 times increase. This indicates a growing curiosity and engagement with the concept.

- Between 2020 and 2021, over 50,000 research papers were published on Industry 4.0, contributing to more than 200,000 papers over the last ten years. This marks a deepening exploration of the topic by scholars.

- Startup funding for Industry 4.0 technologies jumped by 319% from 2011 to 2021, with $2.2 billion invested in 2021 across 2,513 deals, highlighting increasing investor confidence and interest in this area.

- Mergers and acquisitions (M&A) in the Industry 4.0 sector doubled from 2011 to 2021, with 132 acquisitions recorded in 2021, showing a 116% increase from ten years ago. This indicates strong industry consolidation and strategic partnerships.

- The automotive sector saw a $28 billion cost reduction from 2016 to 2020 due to Industry 4.0 technologies, equating to a 3.9% annual decrease in costs across the industry.

- Industry 4.0 adoption is expected to lead to a 2.6% annual reduction in inventory levels, highlighting the efficiency of connected systems in optimizing inventory management.

- Early adopters of Industrial Internet of Things (IIoT) technologies could see a 30% increase in productivity and a 30% reduction in maintenance costs, partly due to predictive maintenance.

- Companies investing in Industry 4.0 technologies could see a return on investment within just 2 years, underscoring the rapid benefits of these innovations compared to traditional IT projects.

- By 2020, the share of highly digitized manufacturers was expected to more than double from 33% in 2016 to 72%, indicating a significant move toward integrated and digitized supply chains.

Use Cases Of Industry 4.0

- Asset Tracking: This involves the precise location and tracking of equipment, tools, and work-in-progress materials using technologies like QR codes, RFID, and Ultra-Wideband (UWB). One German automotive factory achieved operational cost savings of $60.1 million over five years, enhancing overall equipment effectiveness and optimizing resource deployment.

- Augmented Reality (AR): AR technologies are leveraged for troubleshooting and support, notably reducing downtime, service trips, and training time significantly. The adoption of AR in a German automotive factory led to operational cost savings of $37 million, demonstrating its impact on productivity and efficiency.

- Condition-Based Monitoring (CBM): CBM utilizes predictive maintenance to monitor the status of assets (like temperature, vibration, pressure) for proactive maintenance. This approach contributed to $90.5 million in operational cost savings for a German automotive factory, attributed mainly to reduced downtime and IT maintenance costs.

- Mobile Robots: The use of autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) introduces flexibility and efficiency, enabling $136 million in savings for a German automotive factory. These robots optimize pathfinding and task execution, reducing operational expenditure.

- Provisioning Connected Products: Addressing the complexity of modern products, this use case involves the wireless installation of software and firmware in products like vehicles, facilitating streamlined production and minimizing stoppages. This resulted in $33.6 million in operational cost savings for an automotive plant.

- Simulation/Digital Twins: This technology involves creating a virtual replica of physical assets for analysis and simulation, allowing companies to predict maintenance needs, optimize equipment usage, and train employees safely. It serves as a cornerstone for reducing manufacturing bottlenecks and enhancing operational planning.

- Horizontal and Vertical System Integration: Ensuring seamless data sharing and communication across different levels and departments within an organization, this integration fosters a more collaborative, efficient, and transparent operation, breaking down silos for improved decision-making.

- Industrial IoT (IIoT): Deploying sensors across machinery and equipment for real-time data monitoring, IIoT aids in identifying and addressing production inefficiencies, supporting massive increases in production throughput and operational efficiency.

Recent Developments

- Trends and Innovations: A deep dive into the Industry 4.0 landscape reveals key trends like Artificial Intelligence, Human Augmentation & Extended Reality, Edge, Fog & Cloud Computing, and Network & Connectivity shaping the sector in 2024. These trends underscore a significant shift towards more connected, intelligent, and flexible manufacturing environments.

- Strategic Acquisitions: Stryker, a leader in the medical technology field, made significant moves with the acquisition of Wright Medical, enhancing its market position in orthopaedics. This acquisition is a part of Stryker’s strategy to expand its product lines and development capabilities, marking it as the largest in their history. They also acquired OrthoSensor, Inc., integrating advanced sensor technology into their offerings to advance orthopaedic care.

- Innovative Product Launches and Expansions:

- Solvay moved its headquarters to a new facility in Brussels, designed to foster research, innovation, and administration activities. This move signifies the company’s commitment to leading in the specialty materials and chemical sectors.

- Gujarat Fluorochemicals Limited (GFL) announced a breakthrough in using non-fluorinated polymerization aid technology for manufacturing PTFE fine powder and PFA, showcasing innovation in sustainable manufacturing processes. Additionally, GFL is expanding its PTFE & PVDF capacities to meet global demand.

- Daikin Industries, Ltd. completed its Kashima Integrated Production Center, enhancing its fluorochemical production capabilities and asserting its commitment to innovation and sustainable manufacturing.

- Dongyue Group outlined strategic plans to expand capacities for PTFE products, indicating growth and development in response to increasing market demand.

- KUKA Launches KR CYBERTECH Series: In May 2023, KUKA introduced its KR CYBERTECH series, tailored for cost-effective automation of handling and basic machining tasks. The robot is designed for flexibility across various industries, including metal and electronics.

- FANUC Corp Introduces High-Payload Collaborative Robots: FANUC Corp unveiled two new collaborative robots with high payload capacities at Automate 2023, showcasing their commitment to enhancing automation solutions.

- Strategic Partnership between KION Group and Li-Cycle Holdings Corp.: KION Group entered into a strategic partnership with Li-Cycle, focusing on the environmentally friendly recycling of lithium-ion batteries, underscoring the industry’s push towards sustainability.

- Emergence of AI and IoT in Manufacturing: The industry is witnessing a high adoption rate of AI and IoT technologies, aiming to optimize manufacturing processes. Innovations such as AI-specific hardware and novel algorithms are enhancing existing systems.

- Growth in Human Augmentation & Extended Reality: Wearables and exoskeletons are augmenting human capabilities in industrial settings, while XR technologies like MR, AR, and VR are transforming industrial manufacturing systems.

Conclusion

In conclusion, the Industry 4.0 market is poised for significant expansion, with projections indicating a robust CAGR of 20.7%. This forecast underscore the increasing adoption of digital technologies across the production sector, driving automation and efficiency improvements in industrial facilities. As Industry 4.0 continues to evolve, the integration of advanced technologies such as IoT, AI, and automated equipment is set to redefine manufacturing processes, heralding a new era of productivity and innovation in the industrial landscape.