Table of Contents

Introduction

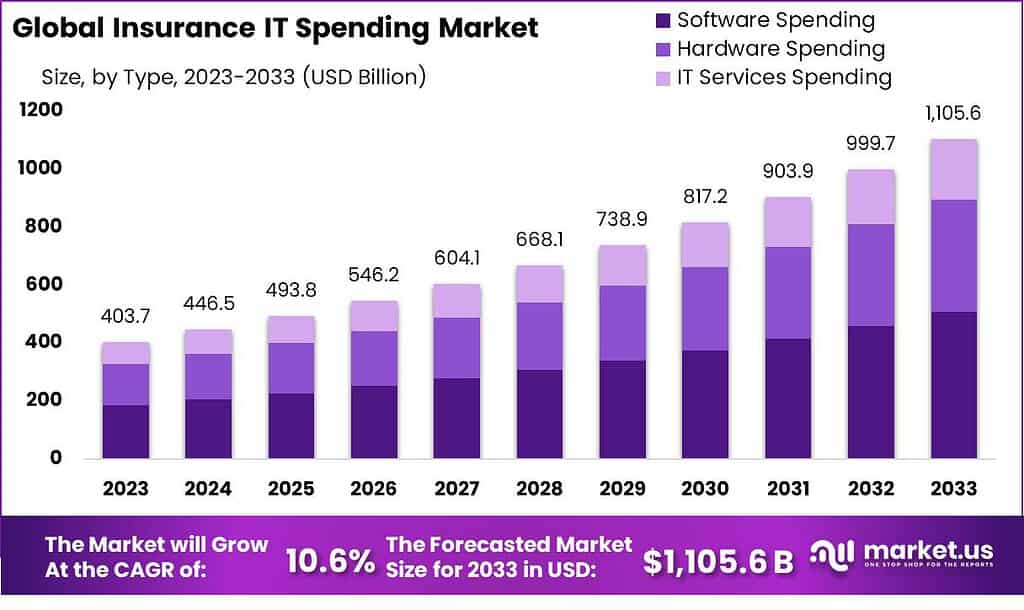

According to Market.us, The global Insurance IT Spending Market is expected to reach a substantial value of USD 974.8 billion by 2032, exhibiting a steady Compound Annual Growth Rate (CAGR) of 10.6%.

The Insurance IT Spending Market is experiencing significant growth, driven by the increasing demand for digital transformation within the insurance sector. This growth is primarily attributed to the need for insurance companies to enhance their operational efficiency, improve customer experience, and offer innovative insurance products tailored to the digital age. The adoption of advanced technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) is playing a crucial role in reshaping the insurance industry, leading to increased IT investments.

One of the key factors fueling this market’s expansion is the rising awareness among insurance firms about the benefits of integrating digital technologies into their operations. These technologies not only streamline processes but also enable the development of more personalized insurance solutions, thereby attracting a larger customer base. Furthermore, regulatory compliance requirements are pushing insurance companies to upgrade their IT infrastructure, thus contributing to market growth.

To learn more about this report – request a sample report PDF

However, the Insurance IT Spending Market also faces several challenges. Cybersecurity threats and data privacy concerns are significant hurdles, as insurance companies deal with sensitive personal and financial information. Additionally, the high cost of implementing new technologies and the lack of skilled IT professionals in the insurance sector pose challenges to market growth.

The market’s dynamic nature, driven by technological innovations, opens doors for startups and tech companies to offer novel solutions that address the current gaps in the insurance IT landscape. New entrants can differentiate themselves by providing cutting-edge technologies and services that enhance data security, improve customer engagement, and streamline insurance processes.

Insurance IT Spending Statistics

- The global insurance IT spending market is expected to reach a substantial value of USD 974.8 billion by 2032, exhibiting a steady Compound Annual Growth Rate (CAGR) of 10.6%.

- Insurers are setting aside 27% of their IT budgets for digital transformation initiatives in 2023. This reflects a strong commitment to embracing digital advancements to stay competitive and meet evolving customer expectations.

- A significant 68% of insurers view the modernization of their core systems as a crucial IT goal for 2023 and 2024. This priority underscores the industry’s focus on updating and enhancing foundational technologies for better efficiency and service delivery.

- The demand for cloud-based solutions within the insurance sector is anticipated to surge by 35% in 2024. This growth is fueled by the benefits of scalability and cost-efficiency that cloud technologies offer, enabling insurers to adapt more swiftly to market changes.

- According to Deloitte, 54% of insurance companies are planning to up their investment in cybersecurity by at least 10% in 2023. This move is a response to the increasing cyber threats and the critical need to protect sensitive data and maintain customer trust.

- The Insurance Information Institute has highlighted that spending on data analytics and business intelligence by insurers is projected to rise by 28% in 2024. This investment reflects the industry’s growing recognition of the value of data-driven insights for decision-making and strategic planning.

- Capgemini’s research points out that 62% of insurers place a high priority on modernizing their policy administration systems for 2023 and 2024. This focus is aimed at enhancing operational efficiency and providing more flexible and responsive services to policyholders.

- Accenture’s findings reveal that 71% of insurance companies are set to invest in customer experience and engagement platforms in 2023 and 2024. This investment demonstrates the industry’s shift towards putting the customer at the center of business strategies to foster loyalty and satisfaction.

- The Insurance Technology Association (ITA) predicts a 25% growth in demand for InsurTech solutions in 2023. This increase is driven by the industry’s need for innovation and to offer services that are more aligned with the modern customer’s expectations.

- Nearly half of the insurers, 48%, plan to boost their investment in Robotic Process Automation (RPA) solutions in 2024. This technology is sought after for its potential to streamline operations and reduce manual efforts in processes.

- The adoption of blockchain technology in the insurance industry is expected to climb by 30% in 2024. Blockchain’s promise of enhancing transparency, security, and efficiency in transactions is driving its increased uptake in the sector.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights

Emerging Trends

- AI and Advanced Analytics: The integration of artificial intelligence and advanced analytics is revolutionizing risk assessment, customer service, and fraud detection processes.

- Cloud Computing Adoption: Insurers are increasingly migrating to cloud platforms to enhance flexibility, scalability, and security of their IT infrastructure.

- Blockchain for Transparency and Efficiency: Blockchain technology is being adopted for its ability to enhance transparency, reduce fraud, and streamline operations.

- Telematics and IoT: The use of telematics and IoT devices is growing, enabling insurers to collect real-time data for personalized policies and proactive risk management.

- Cybersecurity Measures: As digital transformation accelerates, insurers are investing more in cybersecurity measures to protect sensitive data and comply with regulations.

Top Use Cases

- Automated Claims Processing: Utilizing AI and ML for automating claims verification and processing to improve efficiency and accuracy.

- Personalized Insurance Products: Leveraging data analytics and AI to create customized insurance products based on individual risk profiles and preferences.

- Fraud Detection and Prevention: Employing AI and blockchain to enhance the ability to detect and prevent insurance fraud.

- Risk Assessment and Management: Using IoT devices and telematics for real-time monitoring and risk assessment to adjust policies dynamically.

- Customer Engagement Platforms: Developing digital platforms for enhancing customer engagement and providing seamless digital experiences.

Impact

- Enhanced Operational Efficiency: Automation and digitization lead to reduced processing times and lower operational costs.

- Improved Customer Satisfaction: Digital tools and platforms enable insurers to offer personalized services, enhancing customer experience and loyalty.

- Data-driven Decision Making: Access to big data and analytics empowers insurers with insights for better risk management and product development.

- Increased Market Competitiveness: Adoption of emerging technologies allows insurers to stay competitive in a rapidly evolving industry.

- Risk Reduction: Advanced technologies contribute to more accurate risk assessments and fraud detection, reducing losses.

Real Challenges

- Data Security and Privacy: Protecting customer data amidst increasing cyber threats and regulatory requirements.

- Integration with Legacy Systems: Updating or replacing outdated systems with modern technology solutions without disrupting operations.

- Regulatory Compliance: Keeping up with changing regulations in different markets while adopting new technologies.

- Talent Acquisition and Training: Finding and training skilled professionals to manage and leverage new technologies effectively.

- Cost Management: Balancing the investment in new technologies with the need to maintain profitability.

Market Opportunity

- Emerging Markets: Expanding into new geographical areas with digital insurance products tailored to local needs.

- Product Innovation: Developing new insurance products that cater to the changing lifestyles and needs of consumers.

- Partnerships with FinTechs: Collaborating with FinTech and InsurTech startups to drive innovation and expand service offerings.

- Sustainability and ESG: Integrating sustainability and ESG (Environmental, Social, and Governance) factors into product offerings and operations.

- Digital Health and Wellness Programs: Offering health and wellness programs that utilize wearable devices for real-time health monitoring.

Recent Developments

- In June 2023, Accenture announced a substantial investment, allocating ~$3 billion over three years into its Data & AI practice. This investment aims to aid clients across various industries, including insurance, to rapidly and responsibly utilize AI for growth, efficiency, and resilience. The initiative includes doubling AI talent to 80,000 through hiring, acquisitions, and training, underscoring the importance of AI in transforming the insurance industry

- In November 2023, Guidewire introduced the Innsbruck cloud release during its Connections Conference. This release, set to be generally available on December 1, 2023, aims to empower insurers with advancements in customized digital experiences, risk insights, and claims automation.

Conclusion

The insurance IT spending market is navigating through a period of significant transformation, propelled by technological advancements and shifting consumer demands. Emerging trends such as AI, blockchain, and cloud computing are reshaping the industry, offering unprecedented opportunities for innovation and customer engagement. However, these advancements also introduce challenges, particularly concerning data security, regulatory compliance, and integration with legacy systems. Despite these hurdles, the market presents ample opportunities for growth, especially for those willing to embrace digital transformation, innovate, and expand into untapped markets. As the industry continues to evolve, insurers that successfully leverage these technologies while addressing associated challenges are poised to lead the market.