Table of Contents

Introduction

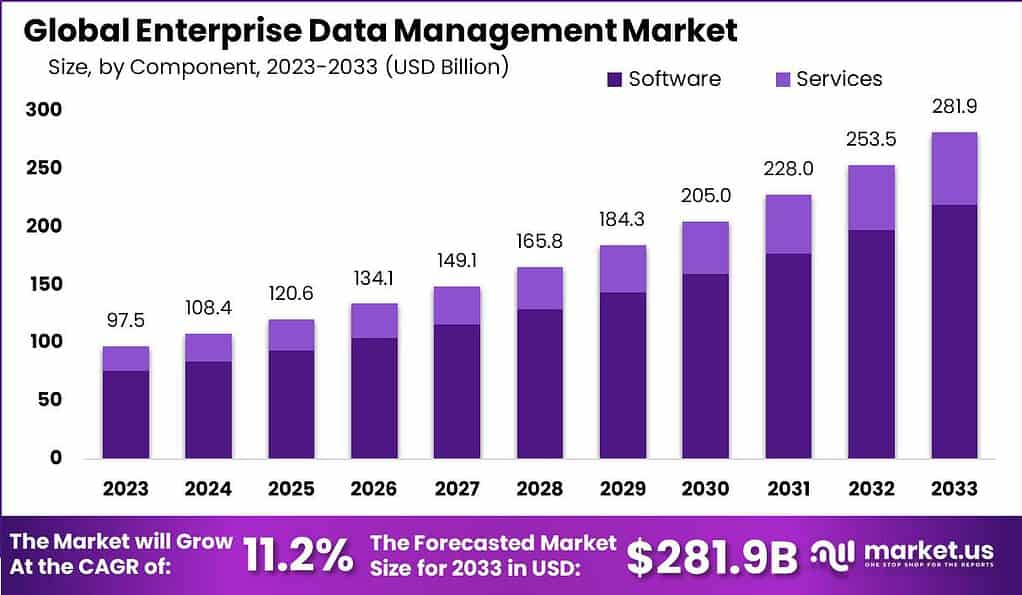

The Enterprise Data Management Market is a rapidly growing industry that is expected to expand significantly in the coming years. Initially valued at USD 97.5 billion in 2023, the market is anticipated to reach USD 108.4 billion by the end of 2024, with a CAGR of 11.2% during the forecast period, and an impressive size of USD 281.9 billion by 2033. This growth trajectory highlights the increasing importance of data management across enterprises for enhanced decision-making and operational efficiency.

The expansion of the Enterprise Data Management market is driven by several factors, including the adoption of cloud-based solutions. With over 58.4% of the market share in 2023 attributed to the cloud segment, the scalability, flexibility, and cost-efficiency benefits of cloud infrastructure are clear. This is especially relevant as organizations increasingly shift towards remote working models, necessitating seamless, secure access to data across various locations.

Large enterprises are at the forefront of the demand for comprehensive Enterprise Data Management solutions due to their complex data ecosystems, capturing more than 69.5% of the market share. These organizations prioritize data management to maintain efficient operations, comply with stringent regulations, and leverage advanced technologies like AI and machine learning for enhanced data analytics.

Recent mergers and acquisitions within the Enterprise Data Management sector have showcased the industry’s dynamic nature, emphasizing strategic growth and the enhancement of technological capabilities. For instance, IBM’s acquisition spree, including acquiring application modernization capabilities from Advanced, highlights their focus on bolstering IBM Consulting’s mainframe application and data modernization services. IBM also expanded its network IT automation capabilities by acquiring Pliant, and enhanced its data and AI governance through the acquisition of Manta Software Inc., underscoring its commitment to comprehensive data management and governance solutions.

Furthermore, the acquisition of Juniper Networks by Hewlett Packard Enterprise (HPE) and 1Password’s strategic move to acquire Kolide for boosting device security reflect the ongoing consolidation and technological advancements within the industry. These developments not only enhance the acquiring companies’ portfolios but also signal a broader industry trend towards integrated and secure data management solutions.

Key Takeaways

- The enterprise data management market is projected to experience a CAGR of 11.2%, reaching a size of USD 281.9 billion by 2033.

- In 2023, the global Enterprise Data Management Market was valued at USD 97.5 billion and is anticipated to reach USD 108.4 billion by the end of 2024.

- By 2023, the Software Segment held a dominant market position in the Enterprise Data Management Market, capturing over 77.9% share.

- Cloud-Based deployment accounted for more than 58.4% of the market share in 2023, while On-Premise solutions remained significant.

- Large Enterprises held over 69.5% of the market share in 2023, indicating their extensive investment in data management solutions.

- North America dominated the Enterprise Data Management market in 2023, accounting for over 34.7% share, followed by Europe, the Asia-Pacific (APAC), Latin America, and the Middle East & Africa.

- The IT & Telecommunications segment held a dominant market position in 2023, capturing over 27.2% share, followed by BFSI and Healthcare.

- The enterprise data management market is driven by factors such as increasing data volume and complexity, regulatory compliance, business intelligence, and cloud adoption.

- Key players in the market include IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., and Amazon Web Services, Inc.

Enterprise Data Management Statistics

- Internally managed data centers witnessed a significant increase in data volume from 297 terabytes in 2020 to 570 terabytes in 2022, demonstrating a doubling of data within just two years.

- The KPMG Real Estate Data Strategy Survey revealed that 57% of surveyed entities have implemented a coordinated data strategy, indicating a widespread recognition of the importance of structured data management.

- Enterprises have prioritized data governance, with 92% implementing this solution, followed by data stewardship and data quality management, both adopted by 67% of respondents, showcasing a focus on data integrity and consistency.

- On average, organizations take approximately 204 days to detect a data breach globally, with threat intelligence users detecting threats around 28 days faster than non-users, emphasizing the importance of proactive threat detection mechanisms.

- Data management platform (DMP) pricing typically ranges from $1,100 to $6,000 monthly, reflecting the significant investment marketers allocate towards data management solutions to enhance decision-making and drive sales.

- Legacy systems like enterprise resource planning (ERP) solutions continue to play a crucial role in data management, with many enterprises integrating master data management (MDM) capabilities from these systems into modern data governance frameworks.

- Adoption of artificial intelligence (AI) and machine learning (ML) in data management is on the rise, driven by the need to automate manual processes and improve data accuracy amidst a shortage of skilled data professionals.

- Blockchain technology enhances data security and authenticity, offering enterprises improved transaction record security and audit trails by storing data in an unalterable, decentralized format, thus bolstering data governance and integrity measures.

Use Cases

- Multicloud Data Integration: As organizations increasingly adopt multicloud strategies to avoid vendor lock-in and optimize data storage, integrating data across these diverse environments becomes crucial. Effective multicloud data integration ensures timely and accurate data delivery, enhancing data utilization for analysis and AI applications.

- Data Governance and Privacy: With the implementation of stringent data privacy laws globally, organizations are compelled to prioritize data governance and privacy. By automating metadata generation and governance, enterprises can significantly reduce manual errors, ensuring compliance with regulations while making data more accessible and useful.

- Customer 360 Views: The digital interaction expectations from customers have escalated, necessitating a comprehensive view of customer data. EDM strategies facilitate the unification of customer data across various touchpoints, providing a holistic view that enables personalized customer experiences and service delivery.

- MLOps and Trustworthy AI: In the age of AI, maintaining the integrity of data and models is paramount. EDM frameworks support the establishment of trust in data and AI models by providing high-quality, governed data for AI consumption, ensuring transparency and accountability in AI operations.

- Operational Efficiency and Strategic Decision Making: EDM enables organizations to streamline processes, ensuring that data is accurately and securely stored, easily accessible for analysis, and utilized to inform strategic decisions. This not only improves operational efficiency but also reinforces trust in data policies across the organization.

- Transforming Go-to-Market Strategies: For businesses aiming to align their go-to-market strategies with data, EDM can offer significant benefits. One instance involved a multinational manufacturer optimizing its go-to-market processes through data governance and quality tools, resulting in enhanced market speed and considerable annual savings.

- Business Analytics and Revenue Growth Management: A company specializing in home essentials achieved standardized pricing and revenue management data, overcoming challenges related to siloed data and disparate practices. This standardization was critical in generating reliable reports and analytics, ultimately optimizing data management processes.

Key Players Analysis

IBM Corporation

IBM Corporation plays a significant role in the Enterprise Data Management (EDM) sector, offering comprehensive solutions aimed at eliminating data silos, reducing complexity, and improving data quality for enhanced customer and employee experiences. The company’s data and AI solutions empower organizations to leverage enterprise data across various environments, including on-premises, public, and private clouds, to support analytics, applications, automation, and AI-powered products. IBM’s approach emphasizes the importance of resiliency, reliability, scalability, and cost-effectiveness, all while ensuring data security and quality. With a focus on flexible data management that integrates with existing technology, IBM helps businesses strengthen their data management strategies and unlock the value of their data wherever it resides.

Additionally, in January 2022, IBM demonstrated its commitment to enhancing customer and partner support by expanding its Client Engineering team in Central and Eastern Europe (CEE). This move is part of IBM’s broader strategy to provide targeted support and foster closer collaborations with customers and business partners in the EDM space, showcasing the company’s dedication to driving operational innovation and data management excellence on a global scale.

Oracle Corporation

Oracle Corporation significantly contributes to the enterprise data management (EDM) sector by offering solutions that manage master data across diverse scenarios such as cloud migration, mergers, and acquisitions, as well as reconciling metadata differences across business functions. Their platform improves productivity and change management efficiency for their customers, emphasizing the importance of connecting disparate enterprise applications and managing changes to enterprise master data elements.

SAP SE

SAP SE is at the forefront of the enterprise data management (EDM) sector, focusing on simplifying data landscapes through the business data fabric and SAP datasphere. This approach ensures that all organizational data—regardless of where it resides—is accessible, meaningful, and integrated with business context and logic intact. SAP’s solutions, including SAP Master Data Governance and SAP Extended Enterprise Content Management, are designed to consolidate, govern, and manage master data quality across the enterprise, thereby facilitating efficient and innovative end-to-end business processes.

Microsoft

Microsoft has teamed up with Schlumberger to bring advanced data management solutions to the energy sector. Their collaboration aims to accelerate new technologies for the industry, focusing on AI-enhanced, cloud-native solutions optimized for Microsoft Azure. This partnership marks a significant step towards digital transformation in the energy industry, leveraging Microsoft’s cloud, data, and AI innovations.

SAS Institute Inc.

SAS Institute Inc. plays a vital role in the Enterprise Data Management (EDM) sector by emphasizing the management of data as a crucial resource. Their approach enables organizations to unlock the potential of their data through a comprehensive strategy that includes access, integration, cleansing, governance, storage, and preparation for analytics. This holistic method ensures that data is not only collected from a multitude of sources but is also effectively managed to derive meaningful insights for organizational success.

Amazon Web Services, Inc.

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc., is recognized as a leading entity in cloud computing and enterprise data management. AWS provides an extensive array of cloud services, including data storage, processing, and analytics, which enables businesses to manage large volumes of data with scalability and security effectively. Catering to diverse enterprise needs across various sectors, AWS facilitates digital transformation by helping organizations leverage their data for strategic decision-making.

Conclusion

The Enterprise Data Management market is on a robust growth path, influenced by the increasing demand for cloud-based solutions, the necessity of managing vast data volumes, and the strategic moves by large enterprises to harness data for competitive advantage. Despite the challenges, the evolving technological landscape and strategic industry maneuvers are expected to drive the market towards substantial growth, reaching a valuation of USD 281.9 billion by 2033.