Table of Contents

Introduction

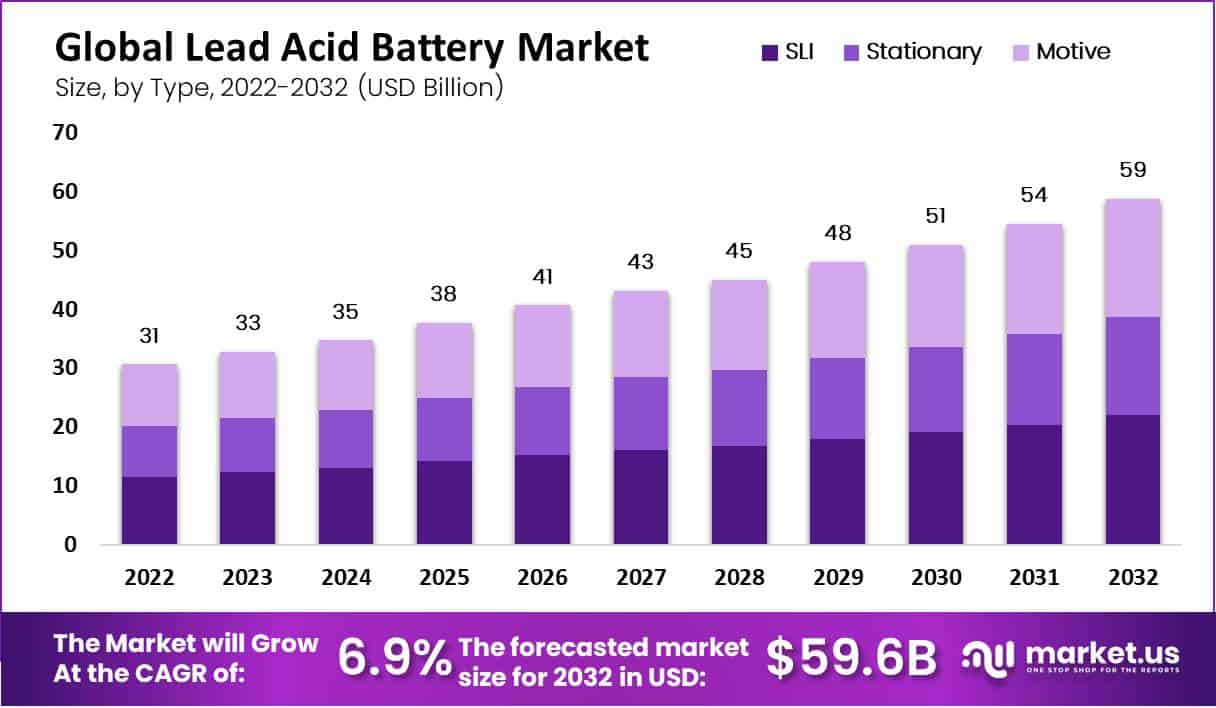

The Lead Acid Battery Market is poised for substantial growth, anticipated to reach USD 59 billion by 2032, with a steady Compound Annual Growth Rate (CAGR) of 6.9% throughout the forecast period. Lead-acid batteries, known for their reliability and cost-effectiveness, are extensively utilized across various sectors, including automotive, telecommunications, and renewable energy storage.

Lead-acid batteries are rechargeable and composed of lead plates immersed in sulfuric acid electrolyte solution. Despite facing challenges such as relatively low energy density compared to newer technologies, they boast a high recycling rate of over 97%, emphasizing their sustainability. These batteries typically deliver a nominal voltage of 2.0V per cell and require a series configuration of six cells to achieve a total voltage of 12.0V, suitable for automotive and backup power applications.

The global demand for lead-acid batteries varies across different applications and regions. Electric mobility and consumer electronics are experiencing notable growth in demand, while energy storage demand stabilizes. China has historically demonstrated the highest demand for lead-acid batteries, with other regions showing varying trends.

The SLI (Starting, Lighting, and Ignition) batteries segment holds a dominant position in the lead-acid battery market, driven by their essential role in the automotive industry. SLI batteries are crucial for starting vehicle engines and powering lighting and ignition systems. Automotive applications remain a leading segment within the market, reflecting the enduring preference for lead-acid batteries due to their reliability and cost-effectiveness.

The Asia-Pacific (APAC) emerges as a key region in the lead-acid battery market, showcasing significant growth in both production and consumption. Countries like China, India, Japan, and South Korea lead the market, leveraging their manufacturing capabilities and technological advancements. The region’s commitment to expanding renewable energy infrastructure further boosts the demand for lead-acid batteries.

Key Takeaways

- The Lead Acid Battery Market is expected to reach USD 59 billion by 2032, with a steady Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period.

- Lead-acid batteries typically have a nominal voltage of 2.0V per cell, requiring a series configuration of 6 cells to achieve a total voltage of 12.0V.

- Ni-MH batteries, although having a lower nominal voltage of 1.25V per cell, require a 10-cell series to reach 12.5V, slightly exceeding the voltage output of lead-acid batteries.

- Lead-acid batteries provide 1,200Wh of energy capacity, whereas Ni-MH batteries offer a slightly higher 1,250Wh due to differences in voltage.

- Lead-acid batteries are notably heavier at 34.3 kilograms and occupy a volume of 13.4 liters, while Ni-MH batteries weigh 15.6 kilograms and have a smaller volume of 5.2 liters, indicating higher energy density and efficiency in space utilization.

- Deep-cycle batteries, including specific types of lead-acid and Ni-MH batteries, can sustain a DoD greater than 50%, with some models capable of reaching up to 80%, crucial for long-lasting power on a single charge.

- In 2022, the SLI (Starting, Lighting, and Ignition) batteries segment dominated the lead-acid battery market, driven by their essential role in the automotive industry and continuous growth in vehicle production and sales.

- The Automotive segment held a leading position in 2022, reflecting the indispensable role of lead-acid batteries in powering various automotive applications due to their reliability, cost-effectiveness, and durability.

Lead Acid Battery Statistics

- Lead-acid batteries are typically characterized by a colombic efficiency of 85% and an energy efficiency of approximately 70%.

- As of 2018, lead-acid batteries accounted for 70% of the global energy storage market, generating revenues of USD 80 billion and a production capacity of 600 GWh.

- The 12-volt advanced lead-acid battery is integral to developments in modern vehicle technologies, particularly with the increase in vehicle electrification and autonomy.

- In 2023, the renewable energy sector witnessed a substantial growth, particularly driven by China’s solar PV market, with global annual renewable capacity increasing by nearly 50% to 510 GW.

- Manufacturers generally claim a cycle life for lead-acid batteries ranging from 400 to 550 cycles.

- The efficiency of charge and discharge can vary significantly, from 50% to 95%, influenced by factors such as battery design and the specific use case.

- These batteries exhibit a self-discharge rate of 3% to 20% per month, necessitating periodic recharging.

- Lead-acid batteries are capable of being charged within a temperature range of –35°C to 45°C, enhancing their adaptability to various environmental conditions.

- Ni-MH batteries have a lower nominal voltage of 1.25V per cell, requiring a series of ten cells to achieve 12.5V.

- By 2025, demand for lead-acid batteries in China is expected to decrease to 93 GWh but is projected to rebound to 114 GWh by 2030.

- In contrast, in the United States, the demand which increased from 65 GWh in 2018 to 75 GWh in 2020, is expected to stabilize around 72 GWh by 2025 and 2030.

Drive Your Growth Strategy! Purchase the Report to Uncover Key Insights: https://market.us/purchase-report/?report_id=15986

Emerging Trends

- Increased Demand in Emerging Economies: The lead acid battery market is witnessing significant growth in emerging economies, particularly in the Asia Pacific region, due to the expansion of the automotive sector and the rising demand for backup power solutions.

- Advancements in Battery Recycling: There’s a growing trend towards the recycling of lead acid batteries, with new facilities aiming to enhance the recycling capacity significantly. This not only supports environmental sustainability but also helps in meeting the material demand for new batteries.

- Expansion in Data Center Applications: The proliferation of data centers globally is driving the demand for Uninterrupted Power Supply (UPS) systems, which predominantly use lead acid batteries to ensure power reliability and manage peak loads efficiently.

- Integration with Renewable Energy Systems: With an increased focus on renewable energy, lead acid batteries are increasingly being integrated into renewable energy systems for energy storage. This helps in stabilizing the grid and managing the intermittent nature of renewable energy sources.

- Technological Innovations: The market is seeing continuous product innovation, such as the development of advanced lead acid batteries that offer better performance, longer life cycles, and enhanced efficiency, catering to a broader range of applications from automotive to industrial uses.

Top 5 Use Cases for Lead Acid Batteries

- Automotive Applications: Lead acid batteries are extensively used in the automotive industry for Starting, Lighting, and Ignition (SLI) applications, dominating the market due to the continuous growth in vehicle production and demand for cost-effective energy storage solutions.

- Uninterrupted Power Supplies (UPS): They are critical in settings where power reliability is essential, such as data centers, hospitals, and telecommunications, providing emergency power during outages and ensuring operational continuity.

- Renewable Energy Storage: Lead acid batteries are employed in renewable energy systems to store excess energy generated from sources like solar and wind, which is essential for managing supply fluctuations and ensuring a steady power supply.

- Backup Power for Critical Infrastructure: They provide backup power solutions across various industries including healthcare, education, and corporate sectors, ensuring safety and continuity in the event of power disruptions.

- Material Handling Equipment: In industrial applications, lead acid batteries are used in material handling equipment such as forklifts due to their cost-effectiveness and reliability, which is crucial in operations that require consistent power for heavy lifting and mobility.

Major Challenges

- Competition from Alternatives: The lead acid battery market is challenged by alternative technologies like lithium-ion batteries, which offer longer lifespans and lower maintenance requirements.

- Environmental Regulations: Increasingly stringent global environmental regulations present challenges, particularly concerning lead pollution and battery disposal practices.

- Technological Advancements: There is a pressing need for ongoing technological improvements to meet modern demands for higher efficiency and performance in lead acid batteries.

- Market Penetration: The rise of alternative energy storage solutions in traditional applications, such as automotive and renewable energy sectors, is reducing the market share for lead acid batteries.

- Supply Chain Disruptions: The COVID-19 pandemic highlighted vulnerabilities in the global supply chain, affecting the production and distribution of lead acid batteries, which could have long-term impacts on supply and cost.

Market Opportunity

- Expanding Automotive Sector: The expanding automotive sector, especially in emerging economies, continues to drive demand for SLI (starting, lighting, and ignition) batteries.

- Renewable Energy Storage: As the use of renewable energy sources increases, there is a significant opportunity for lead acid batteries in energy storage, especially in regions with unstable power supplies.

- Telecommunication Expansion: The rapid growth of the telecommunications sector, including the rollout of 5G and the expansion of data centers, creates a growing demand for reliable energy storage that lead acid batteries can provide.

- Cost-Effective Energy Storage: Lead acid batteries remain a cost-effective solution for various applications, including UPS systems and backup power supplies, appealing to cost-sensitive markets.

- Technological Innovations: Continuous innovations in lead acid battery technology, such as the development of more durable and efficient systems, open up new markets and applications, enhancing their competitiveness against newer technologies.

Recent Developments

- June 2023 – EnerSys & Verkor SAS: EnerSys announced a non-binding Memorandum of Understanding (MoU) with Verkor SAS, a leading entity in the European battery technology sector. This agreement aims to explore the development of a lithium battery gigafactory within the United States, leveraging Verkor SAS’s expertise to meet the growing demand for lithium batteries.

- May 2023 – EnerSys® and ODYSSEY® Connect: EnerSys unveiled the ODYSSEY® Connect battery monitoring system, introducing a groundbreaking solution in battery health and performance management. This system actively monitors and tracks battery health and performance indicators, communicating critical information via Bluetooth® to compatible smart devices.

Top 10 Lead Acid Battery Companies

- Exide Industries Limited Headquarters (India) – Exide Industries Limited stands as a global leader in lead acid battery manufacturing, renowned for its robust product portfolio and unwavering quality standards. With a rich history spanning decades, Exide continues to innovate, catering to diverse industrial and automotive applications.

- Johnson Controls (Headquarters: United States) – Johnson Controls commands a significant presence in the lead acid battery market, leveraging advanced technologies to deliver high-performance energy storage solutions. The company’s commitment to sustainability and innovation reinforces its position as a frontrunner in the industry.

- EnerSys (Headquarters: United States): EnerSys emerges as a key player in the lead acid battery segment, offering a comprehensive suite of products tailored to meet the evolving needs of various sectors. With a global footprint and a focus on customer-centric solutions, EnerSys continues to drive advancements in energy storage technology.

- East Penn Manufacturing Company (Headquarters: United States): East Penn Manufacturing Company has established itself as a prominent player in the lead acid battery market, renowned for its dedication to quality, innovation, and sustainability. With a diverse product portfolio catering to a myriad of applications, East Penn remains at the forefront of the industry.

- C&D Technologies (Headquarters: United States): C&D Technologies stands as a leading provider of energy storage solutions, specializing in the design and manufacture of high-performance lead acid batteries. With a focus on reliability and efficiency, C&D Technologies continues to meet the demands of critical power applications worldwide.

- GS Yuasa Corporation (Headquarters: Japan) Overview: GS Yuasa Corporation boasts a strong presence in the lead acid battery market, leveraging advanced technologies and extensive industry experience to deliver cutting-edge energy storage solutions. The company’s commitment to innovation and sustainability underscores its status as a market leader.

- NorthStar Battery Company (Headquarters: United States): NorthStar Battery Company distinguishes itself through its focus on premium quality lead acid batteries, renowned for their exceptional performance and reliability. With a customer-centric approach and a dedication to technological advancement, NorthStar continues to thrive in the competitive landscape.

- Leoch International Technology Limited (Headquarters: China) Leoch International Technology Limited emerges as a prominent player in the lead acid battery segment, offering a diverse range of products tailored to meet the needs of various industries. With a global presence and a commitment to innovation, Leoch remains a trusted choice for cost-effective energy solutions.

- FIAMM Energy Technology S.p.A. (Headquarters: Italy) FIAMM Energy Technology S.p.A. is a leading provider of lead acid batteries, known for its emphasis on quality, reliability, and sustainability. With a focus on technological innovation and customer satisfaction, FIAMM continues to make significant strides in the energy storage market.

- Camel Group Co., Ltd. (Headquarters: China): Camel Group Co., Ltd. emerges as a key player in the lead acid battery industry, offering a diverse portfolio of high-quality products at competitive prices. With a focus on research and development, Camel Group remains committed to delivering innovative energy storage solutions globally.

Conclusion

In conclusion, while the lead-acid battery market has faced challenges due to environmental concerns and competition from alternative technologies, it continues to hold a significant market share in certain sectors. The market’s future will depend on factors such as ongoing technological advancements, evolving regulations, and the demand for cost-effective energy storage solutions. It is essential to consult up-to-date market research and industry reports to obtain the most accurate and current information on the lead-acid battery market.