Table of Contents

Introduction

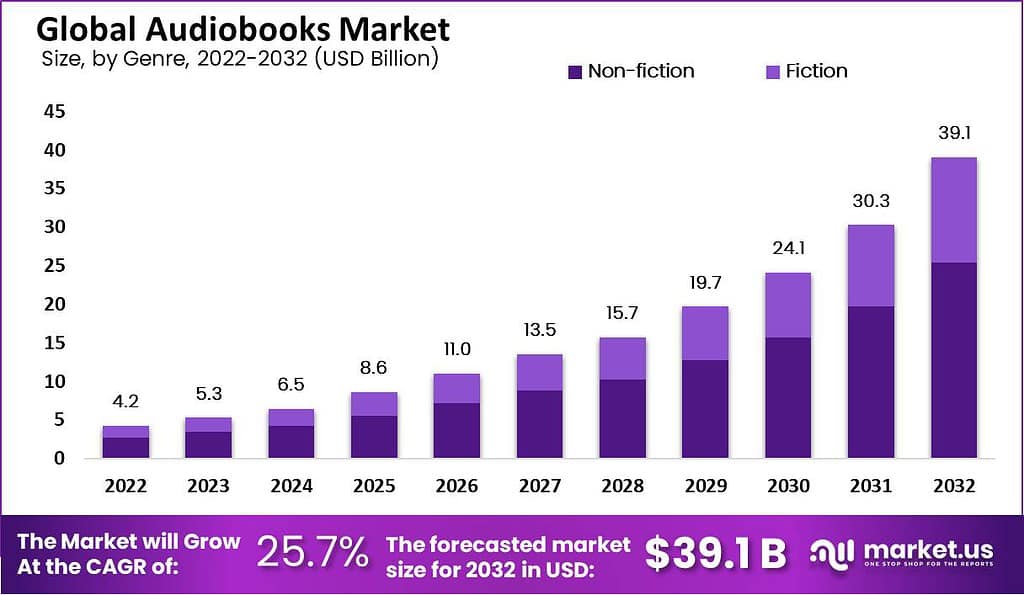

The global audiobooks market is projected to witness substantial growth, with a forecasted value of approximately USD 39.1 billion by 2032, reflecting a robust CAGR of 25.7% from 2023 to 2033. Audiobooks, audio recordings of book content, offer a convenient alternative for readers, particularly those with busy schedules or visual impairments. They are accessible through various devices like smartphones, tablets, and dedicated audiobook players, facilitating easy consumption on-the-go.

The market for audiobooks has seen significant growth in recent years. This expansion can be attributed to the increasing use of smartphones and portable devices, making it easier for consumers to access and enjoy audiobooks on-the-go. Additionally, busy lifestyles have prompted many to opt for audiobooks as a convenient alternative to traditional reading. The market is further driven by a wide range of genres and titles available, appealing to diverse audience preferences. Major platforms like Audible, Google Play Books, and Apple Books dominate the market, offering extensive libraries and subscription models that cater to varying user needs.

The market’s expansion is fueled by increasing demand for portable and accessible reading options, supported by technological advancements enabling easy download and access across multiple devices. Major industry players such as Audible and Apple Books dominate the market, providing extensive libraries across various genres. Additionally, trends like multitasking lifestyles and the growing popularity of digital media contribute to market growth.

Key Takeaways

- Market Size and Growth: The global Audiobooks Market is projected to achieve a substantial size of approximately USD 39.1 billion by 2032, with a robust compound annual growth rate (CAGR) of 25.7% during the forecast period from 2022 to 2032.

- Non-fiction Segment Dominance: In 2022, the Non-fiction segment maintained a leading position in the audiobooks industry, securing a significant market share of over 65%.

- Smartphones as Primary Access Devices: The Smartphones segment dominated the audiobooks market in 2022, capturing more than 44% of the industry share, underscoring the pivotal role of mobile devices in content consumption.

- Adults as Key Consumers: The Adults demographic segment was the predominant consumer base in the audiobooks market in 2022, holding a dominant share of more than 78%.

- One-time Download Popularity: In 2022, the One-time Download purchase model held a dominant market position, representing over 65% of the market, indicating a strong preference for outright content ownership over subscription models.

- Regional Market Leaders and Growth Opportunities: North America led the audiobooks market in 2022, driven by the widespread availability of digital devices and the popularity of subscription-based services. The Asia Pacific region is anticipated to be the fastest-growing market, fueled by increasing smartphone adoption and a growing interest in English-language content.

Audiobooks Statistics

- Future Market Share: By 2027, audiobooks are projected to represent over 10% of the global publishing market, marking a significant milestone as they surpass this threshold for the first time.

- Revenue Growth: Projections for 2030 indicate that audiobooks will account for over 21.3% of the total global book publishing revenue, illustrating robust growth in this segment.

- Market Peak: By 2032, the audiobook market is anticipated to reach its zenith with an estimated revenue of $39.1 billion.

- Recent Growth Trends in the U.S.: Over the past five years, audiobook sales revenue in the United States has surged by more than 50%, reflecting increasing consumer demand.

- Dominance of Fiction: Currently, fiction dominates the audiobook format, constituting more than 65% of sales, whereas nonfiction genres are witnessing a growth rate of 27.5% annually.

- Average Length and Content: The typical audiobook lasts about one hour and consists of roughly 9,300 words.

- Core Demographic: The primary consumer base for audiobooks is the 25-34 years age group, highlighting its popularity among younger adults.

- Gender Preferences: Women show a higher propensity to engage with audiobooks, with 54% of female listeners compared to 46% of male listeners.

- Age Distribution: Another significant demographic segment for audiobooks includes individuals aged 35-44 years, comprising 30% of listeners.

- Listening Habits: The majority of audiobook consumption occurs at home, with 57% of listening happening in this setting.

- Increased Reading Capacity: Over 55% of audiobook listeners believe that this format helps them read more books annually.

- Market Dominance by Audible: Audible, an Amazon subsidiary, currently holds a 41% market share in the audiobook industry, showcasing its leading position.

- Listening Duration: On average, individuals spend 41 minutes daily listening to audiobooks, enabling them to complete approximately two audiobooks monthly.

- Platform Preference: Audible is the preferred service for up to 49% of audiobook listeners.

- Listening Contexts: Audiobooks are frequently enjoyed during commutes (63%), while performing household chores (54%), and during relaxation times like baths or sleep (44%).

- Royalty Structures: Audible: Authors face a 75% royalty fee, which decreases to 60% if they opt for exclusive distribution through Audible. Apple Books: Maintains a consistent 70% royalty rate across all book categories. Kobo: Offers variable royalty rates ranging from 55% to 68%, depending on the book’s price and the use of Kobo tokens.

Emerging Trends in the Audiobooks Market

- Advancements in Voice Technology and AI: There’s an increasing focus on developing natural-sounding text-to-speech systems, which are now often AI-driven. This technology enhances the production efficiency and affordability of audiobooks, broadening their appeal and accessibility.

- Growth of Subscription-Based Models: Subscription services are becoming a dominant model in the audiobooks industry, offering users unlimited access to vast libraries for a monthly fee, thus encouraging continuous consumption and loyalty among users.

- Increased Focus on Original Content: Audiobook platforms are investing significantly in original content and exclusive partnerships with authors and publishers to differentiate themselves in a competitive market.

- Expanding Accessibility Features: Improved streaming capabilities and better audio quality are key technological advancements. Enhancements in accessibility features are making audiobooks more user-friendly, particularly for people with disabilities.

- Emphasis on Diversity and Inclusion: There’s a concerted effort to ensure that audiobook content reflects a diverse range of perspectives and experiences. This trend is seen as crucial for capturing a broader audience and fostering inclusivity in the industry.

Top Use Cases for Audiobooks

- Multitasking During Commutes and Chores: Audiobooks offer a convenient solution for people looking to engage in literature while commuting, exercising, or performing household tasks, allowing them to make efficient use of their time.

- Educational Tools: Many students and educators are turning to audiobooks as educational resources. They are used to aid learning, especially for auditory learners, and to provide access to literature in classroom settings.

- Accessibility for the Visually Impaired: Audiobooks serve as an essential tool for individuals who are visually impaired, offering them a way to access literature and information that might otherwise be unavailable.

- Entertainment and Relaxation: Providing entertainment is a fundamental use case of audiobooks, with many users listening to unwind or enjoy a good story without the need to visually engage with text.

- Professional Development: Professionals often use audiobooks for personal and career development, accessing a wide range of content from business insights to technical knowledge, which helps them stay updated in their fields.

Major Challenges

- Technological Dependencies: The market’s growth is closely tied to technological advancements in smartphones and voice technology. Any slowdown in these sectors could impact audiobook accessibility and user experience.

- Narration Quality: High-quality narration is crucial for user satisfaction. Poor narration, characterized by inadequate voice modulation or pacing, can lead to customer dissatisfaction and impact market growth negatively.

- Copyright and Piracy Issues: Intellectual property rights are a persistent concern, with piracy posing a significant threat to revenue.

- Market Saturation: As more players enter the market, differentiation becomes challenging, and companies may struggle to maintain a unique value proposition.

Market Opportunities

- Emerging Markets: There’s significant growth potential in emerging markets where smartphone penetration is increasing.

- Language and Localization: Expanding the range of languages offered can tap into new demographic segments, enhancing reach and relevance.

- Partnerships with Publishers: Collaborations with book publishers can provide exclusive content, attracting more users.

- Customized Listening Experiences: Innovations that allow personalized listening experiences, like adjustable playback speeds and tailored content recommendations, can enhance user engagement.

- Educational Applications: Audiobooks have substantial potential in educational settings, where they can be used to support diverse learning styles and needs.

Recent Developments

- Acquisition of Berrett-Koehler Audiobook Publishing: In January 2024, RBmedia, a prominent player in the audiobook industry, announced the acquisition of the audiobook publishing company of Berrett-Koehler. This strategic move involved expanding RBmedia’s catalog of audiobooks by taking over previously published titles by Berrett-Koehler.

- Spotify’s Entry into Audiobook Market: In October 2023, Spotify, a well-known music streaming platform, made a significant move into the audiobook market by offering over 150,000 audiobooks to its premium subscription members. This expansion of content allowed Spotify users to access personalized music, podcasts, and audiobooks all within the same platform.

- AI-Narrated Audiobooks on Apple Books: In January 2023, Apple introduced a new feature for selected titles on Apple Books – AI-narrated audiobooks. Alongside traditional human narrators, artificial intelligence technology was used to narrate certain audiobooks. This development suggests a potential trend towards incorporating AI-powered narration alongside human narrators in the audiobook industry.

Conclusion

In conclusion, the audiobooks market has experienced significant growth and transformation in recent years. Audiobooks have become a popular alternative for individuals who prefer to listen rather than read, offering convenience and flexibility. The market has witnessed notable developments, such as RBmedia’s acquisition of Berrett-Koehler’s audiobook publishing company, Spotify’s expansion into audiobooks, and Apple’s introduction of AI-narrated audiobooks. These events highlight the continuous efforts to enhance the accessibility and enjoyment of audiobooks for a diverse audience. As technology advances and consumer preferences evolve, the audiobooks market is poised for further expansion and innovation in the years to come.