Table of Contents

Introduction

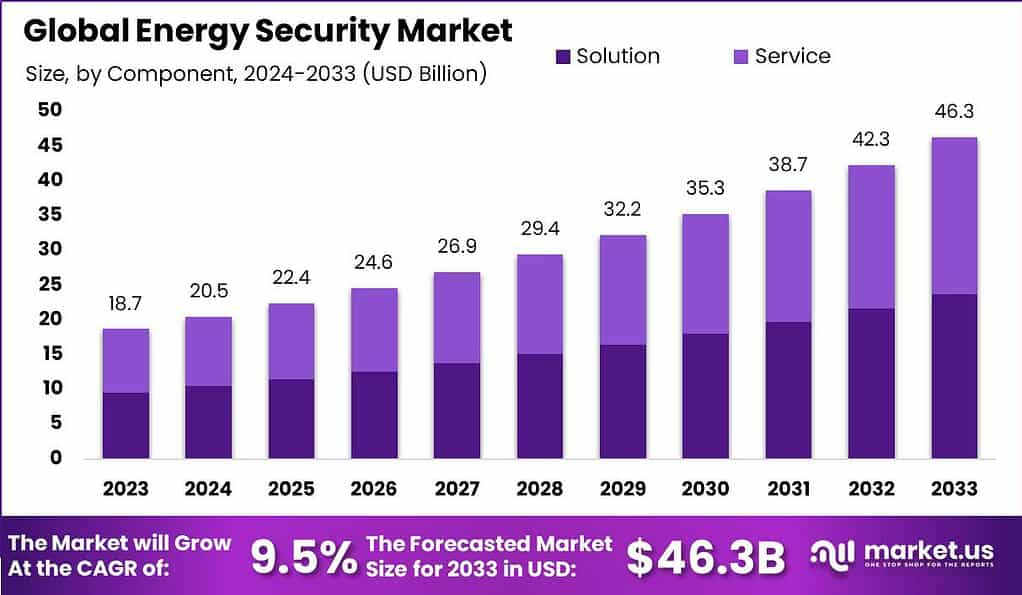

According to Market.us, The global market for energy security is projected to grow significantly in the coming decade. From a valuation of USD 18.7 billion in 2023, the market is anticipated to reach around USD 46.3 billion by 2033. This growth represents a compound annual growth rate (CAGR) of 9.5% from 2024 to 2033. This substantial increase highlights the increasing importance of and investment in ensuring a stable and secure energy supply worldwide, driven by rising energy demands and evolving technological advancements.

The energy security market is experiencing robust growth, driven by increasing global energy demands and heightened concerns over energy supply disruptions. Several factors contribute to this market expansion, including advancements in technology, heightened geopolitical risks, and the global shift towards renewable energy sources. These dynamics create a fertile environment for new entrants, who can innovate in areas such as cyber-physical security solutions, renewable energy technologies, and energy storage.

However, the market also presents significant challenges. New entrants must navigate complex regulatory environments, massive initial capital requirements, and fierce competition from established players with deep market penetrations. Additionally, the fluctuating nature of global politics and energy policies can impact market stability and predictability.

Various stakeholders are involved in the energy security market, including technology providers, energy companies, research institutions, and government agencies. These entities are investing in energy security solutions to mitigate risks associated with disruptions in energy supply, price volatility, and geopolitical tensions.

Click to learn, How data-driven insights can impact your market position, Request A Sample @ https://market.us/report/energy-security-market/request-sample/

Energy Security Statistics

- The global energy security market is estimated to reach USD 46.3 billion by the year 2033, demonstrating a compound annual growth rate (CAGR) of 9.5% during the forecast period. The market was valued at USD 18.7 billion in the year 2023.

- Based on components, the solutions segment has dominated the market, accounting for a share of 51.2% in the year 2023.

- In terms of technology, the network security segment has maintained a leading position, representing 57.6% of the market share in 2023.

- Regarding power plants, the Thermal and Hydro segment has been predominant, securing a market share of 28.1% in 2023.

- In 2023, North America held a dominant position in the energy security market, capturing more than 40.4% of the market share.

- According to a recent report from the United Nations Development Program, developed economies within the OECD contribute approximately 54% to global energy consumption.

- Transition economies, which are experiencing economic changes, account for 14% of the world’s energy demand. China, with its rapidly expanding economy, represents 11% of global energy consumption. The remaining countries collectively contribute 21% to the worldwide energy demand.

- Electricity is projected to become the primary energy carrier, accounting for over 50% of global energy consumption by 2050.

Emerging Trends in the Energy Security Market

- Accelerated Clean Energy Deployment: The recent years have seen significant acceleration in the deployment of clean energy technologies like solar PV and wind, due to supportive policies and cost declines, which are starting to have a substantial impact on emissions and reshaping energy markets.

- Corporate Renewable Procurement: There’s a growing trend of major corporations committing to renewable energy procurement, with initiatives like RE100 seeing increased membership. This trend is expected to expand further as companies use generative AI to meet carbon-neutral goals, significantly increasing their demand for clean electricity.

- Resiliency Through Renewables: As the share of renewables in power generation increases, there’s a notable shift towards recognizing renewable energy sources like solar and wind as key components of grid resilience, helping to manage grid constraints and enhancing supply chain robustness.

- Advancements in Energy Storage and Efficiency: Innovations in energy storage and the focus on energy efficiency are gaining momentum. Increased investment in utility-scale storage solutions and efforts to optimize energy use across different sectors are pivotal for ensuring energy security.

- Friendshoring for Energy Security: The strategy of friendshoring is gaining traction, especially in critical areas like lithium-ion battery supply chains. This approach is intended to stabilize supply chains by sourcing from and collaborating with allied countries, reducing dependence on geopolitical rivals.

Top Use Cases for Energy Security

- Grid Management and Optimization: Utilizing advanced technologies like generative AI for grid management can optimize load balancing, congestion management, and asset utilization, enhancing the reliability and efficiency of power distribution and transmission.

- Renewable Energy Integration: Corporations and governments are increasingly integrating renewable energy sources into their operations and national grids. This helps in reducing carbon footprints and dependency on fossil fuels, and supports commitments to carbon neutrality.

- Advanced Occupational Health and Safety (OHS) Training: Energy sectors are adopting personalized and immersive OHS training materials that expose trainees to realistic safety scenarios via virtual simulations, thereby enhancing safety standards and reducing incident rates.

- Energy Demand Forecasting with AI: Artificial intelligence is being increasingly deployed to generate accurate demand forecasts, which are crucial for efficient resource management and planning in energy sectors.

- Decarbonization of Supply Chains: Major corporations are not only switching to renewable energy but are also driving decarbonization throughout their supply chains, which is a critical step towards achieving broader energy security and sustainability goals.

Major Challenges

- Vulnerability to Cyber Threats: The increasing digitalization of energy systems, especially with the integration of renewable energy sources and smart grids, has heightened the risk of cyber attacks. Energy systems are becoming prime targets for such threats, which can lead to massive disruptions.

- Geopolitical Tensions: Regions like the Middle East and the involvement of major powers in energy-rich areas continue to pose significant risks to global energy security. Political instability can disrupt supply chains and affect global energy prices.

- Transition to Renewable Energy: While necessary for sustainability, the shift from fossil fuels to renewable energy sources presents challenges such as investment needs, technological integration, and the intermittency of renewable energy sources. This transition requires significant changes in infrastructure and market dynamics.

- Regulatory and Policy Barriers: Government policies and regulations can either support or hinder the development and integration of secure energy systems. Inconsistent policy environments across regions can complicate investments and operations in the energy sector.

- Infrastructure Resilience: Aging infrastructure, especially in developed economies, and the need for new infrastructure in developing regions pose challenges. Investments are required not only for upgrading existing systems but also for building resilient new systems that can handle evolving energy demands and extreme weather conditions due to climate change.

Market Opportunities

- Advancements in Technology: Innovations such as AI and smart grid technologies offer substantial opportunities for enhancing energy efficiency and grid management. These technologies can also help in balancing supply and demand, reducing wastage, and improving system responsiveness to changes in energy consumption patterns.

- Growth in Renewable Energy Sector: The surge in investments and the rapid deployment of renewable energy technologies provide significant opportunities for market players. Governments and private entities are increasingly supporting clean energy initiatives, which opens up new markets for energy solutions.

- Energy Storage Solutions: As the deployment of intermittent renewable energy sources like wind and solar increases, there is a growing need for energy storage solutions. This represents a considerable opportunity for companies specializing in battery technology and other storage methods.

- Decarbonization of Industries: With global commitments to reduce carbon emissions, there is a growing demand for technologies that can help decarbonize industrial processes. This includes carbon capture and storage (CCS) technologies and renewable energy solutions tailored for industrial applications.

- International Collaborations and Trade: Opportunities for establishing new partnerships and trade agreements are expanding as countries seek to diversify their energy sources and reduce dependence on single suppliers. This diversification can lead to more stable energy markets and open up new investment avenues.

Recent Developments

- Lockheed Martin Corporation has enhanced its cybersecurity offerings for the energy sector with new advancements. In January 2024, the company unveiled AI-powered threat detection systems, specifically engineered to safeguard energy infrastructure from advanced cyber-attacks.

- Honeywell International Inc. expanded its market presence through a strategic acquisition. In December 2023, Honeywell purchased Carrier’s Global Access Solutions for $4.95 billion, which includes the LenelS2, Onity, and Supra brands. This acquisition bolsters Honeywell’s capabilities in building automation and access control, solidifying its standing in the energy security market.

- Motorola Solutions took a significant step to broaden its security solutions portfolio. By acquiring IPVideo Corp., known for the HALO Smart Sensor, in late 2023, Motorola has integrated advanced threat detection technologies into its offerings, thereby enhancing its physical security solutions.

- ExxonMobil made a notable entry into the energy security sector with a substantial acquisition. In 2023, the company acquired Denbury Inc. for $5 billion, a move that expands its capabilities in carbon capture and storage, a critical component for protecting energy infrastructure against environmental threats.

- Siemens AG continued to focus on its strategic growth in smart grid technologies and cybersecurity. In 2023, Siemens introduced new digital solutions aimed at boosting grid security and resilience to cyber threats, targeting the specific needs of the energy sector.

- ABB Ltd. has concentrated on enhancing its offerings in smart grid and energy management solutions. In November 2023, ABB launched a new line of products designed to improve grid stability and security, addressing the increasing demand for resilient energy systems.

Conclusion

In conclusion, the global energy security market is expected to experience significant growth in the coming years. The market offers a range of solutions and technologies aimed at ensuring a stable and affordable energy supply. As the demand for energy continues to rise, and the need for sustainable and resilient energy systems becomes more prominent, the energy security market is poised for expansion, driven by investments in innovative solutions and technologies.