Table of Contents

- Introduction

- Editor’s Choice

- Global Data Center Construction Market Statistics

- Leading Countries by Number of Data Centers

- Revenue of Leading Data Center Markets Worldwide

- Data Center Size Statistics

- Components Breakdown for Building a Data Center

- Useful Life of Data Center Equipment Components

- Data Center Project Statistics

- Data Center Project Contractors Statistics

- Sector Classification of Data Center Locations

- Power Usage and Its Effectiveness in Data Centers

- Data Center Construction Spending Statistics

- Data Center Construction Expenditure Statistics

- Economic Impacts of Data Center Construction Statistics

- Regulations for Data Center Construction Statistics

- Key Developments, Investments, and Strategies

- Recent Developments

- Conclusion

- FAQs

Introduction

Data Center Construction Statistics: Data center construction involves meticulous planning and execution to ensure optimal performance and reliability.

Key aspects include strategic site selection near essential infrastructure and consideration of environmental factors.

The design focuses on tier classification for system redundancy and efficient floor plans for space and scalability.

Critical systems like UPS and generators provide backup power, while precision cooling systems manage temperature.

Security measures encompass physical barriers and cybersecurity protocols. Connectivity features include carrier neutrality and network redundancy.

Sustainability, compliance with regulations, and scalability are also prioritized, ensuring efficient operation and future readiness. Maintenance and documentation further guarantee ongoing reliability and operational integrity.

Editor’s Choice

- The global data center construction market revenue is projected to reach USD 453.5 billion by 2033.

- The market share distribution within the global data center construction industry highlights a competitive landscape dominated by several key players. Dell EMC holds the largest share at 18%.

- The global data center construction market is characterized by regional disparities in market share, with North America leading significantly at 38.8%.

- Several prominent owner firms lead the landscape of data center projects and their valuations. DC BLOX stands out with 18 projects valued at USD 280 million.

- By 2030, co-location companies are projected to spend USD 36 billion, with hyperscaler investment reaching USD 13 billion.

- During the 18-24-month construction phase, the data center generates 1,688 local jobs, resulting in $77.7 million in wages and $243.5 million in local economic activities.

- In the United States, states like Virginia and Oregon are implementing stringent requirements focused on carbon reduction and sustainability. With proposed laws demanding significant cuts in carbon emissions from data centers by 2027.

Global Data Center Construction Market Statistics

Global Data Center Construction Market Size Statistics

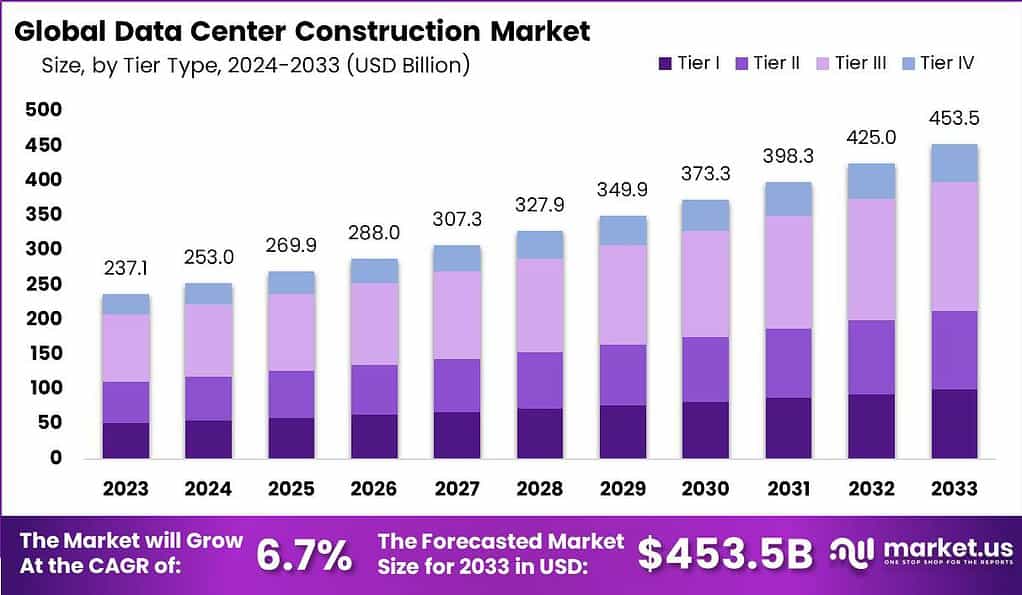

- The global data center construction market has demonstrated a steady growth trajectory over the past decade at a CAGR of 6.7%, with revenue figures reflecting a consistent upward trend.

- In 2023, the market revenue stood at USD 237.1 billion.

- This figure is projected to increase to USD 253.0 billion in 2024, indicating robust growth.

- The market is expected to continue its expansion, reaching USD 269.9 billion by 2025 and further rising to USD 288.0 billion in 2026.

- By 2027, the revenue is anticipated to climb to USD 307.3 billion. With a continued growth trend pushing it to USD 327.9 billion in 2028.

- The market is forecasted to achieve USD 349.9 billion in 2029 and by 2030. It is expected to reach USD 373.3 billion.

- The growth momentum is predicted to persist, with market revenue estimated at USD 398.3 billion by 2031, USD 425.0 billion by 2032, and USD 453.5 billion by 2033.

- This sustained growth underscores the increasing demand for data center construction. Driven by the expanding digital economy and the rising need for advanced data storage and processing facilities.

(Source: market.us)

Competitive Landscape of Global Data Center Construction Market Statistics

- The market share distribution within the global data center construction industry highlights a competitive landscape dominated by several key players.

- Dell EMC holds the largest share at 18%, followed closely by IBM with 17%.

- Hewlett Packard Enterprise and AECOM each account for 9% of the market, indicating their significant presence.

- Lenovo captures 10% of the market, surpassing Oracle and Equinix Inc., both of which hold an 8% share.

- Cisco and Fujitsu represent 7% and 6% of the market, respectively.

- The remaining 8% is distributed among other key players. Showcasing a diverse array of companies contributing to the industry’s growth and innovation.

(Source: market.us)

Regional Analysis of Global Data Center Construction Market Statistics

- The global data center construction market is characterized by regional disparities in market share, with North America leading significantly at 38.8%.

- This dominance is followed by the Asia-Pacific (APAC) region, which holds a substantial 27.4% share. Reflecting its rapid technological advancements and growing demand for data infrastructure.

- Europe accounts for 24.3% of the market, indicating its strong position in the global landscape.

- South America and the Middle East & Africa (MEA) regions, while smaller in comparison, contribute 6.8% and 2.7%, respectively.

- These figures underscore the varying degrees of market maturity and investment in data center construction across different regions.

Leading Countries by Number of Data Centers

- As of March 2024, the United States leads the global data center landscape with a staggering 5,381 data centers, significantly outpacing other countries.

- Germany ranks second with 521 data centers, closely followed by the United Kingdom with 514.

- China also plays a major role in the 449 data centers.

- Canada and France contribute notably with 336 and 315 data centers, respectively.

- Both Australia and the Netherlands host 307 data centers each.

- Russia has 297, while Japan maintains 251 data centers.

- Mexico, with 219 data centers, and Italy, with 170, show considerable presence in the market.

- Brazil and India also make significant contributions, with 168 and 163 data centers, respectively.

- Poland and Spain host 152 and 144 data centers, respectively.

- Hong Kong and Switzerland are notable, with 143 and 122 data centers each.

- Singapore and Sweden account for 120 and 99 data centers, respectively.

- New Zealand has 95 data centers, while Indonesia and Belgium each host 81. Highlighting the widespread distribution of data center infrastructure across these leading countries.

(Source: Statista)

Revenue of Leading Data Center Markets Worldwide

- The global data center market has shown significant growth from 2017 to 2028. With notable expansions in key regions such as the United States, China, Japan, Germany, and the United Kingdom.

- In 2017, the United States led the market with a revenue of $76.13 billion, followed by China at $51.78 billion, Japan at $13.96 billion, Germany at $12.08 billion, and the United Kingdom at $10.93 billion.

- By 2028, the revenue figures for these regions are projected to rise substantially. With the United States reaching $124.57 billion, China at $92.98 billion, Japan at $23.93 billion, Germany at $20.08 billion, and the United Kingdom at $19.36 billion.

- This growth trajectory highlights the increasing demand for data center services across these major markets.

- The period between 2020 and 2028 is marked by consistent revenue growth. Underscoring the robust expansion of the data center industry.

- Notably, the United States and China maintain their positions as dominant players.

- At the same time, Japan, Germany, and the United Kingdom also exhibit steady increases in market revenue, reflecting a global trend towards greater investment in data infrastructure.

(Source: Statista)

Data Center Size Statistics

- Data centers are classified based on their size metrics, which include rack yield and compute space.

- Mega data centers, the largest classification, have over 9,000 racks and more than 225,000 square feet of computing space.

- Massive data centers follow, with rack yields ranging from 3,001 to 9,000 and compute spaces between 75,001 and 225,000 square feet.

- Large data centers contain 801 to 3,000 racks and offer 20,001 to 75,000 square feet of computing space.

- Medium-sized data centers have 201 to 800 racks and compute spaces ranging from 5,001 to 20,000 square feet.

- Small data centers, with 11 to 200 racks, provide 251 to 5,000 square feet of computing space.

- The smallest classification, mini data centers, contain 1 to 10 racks and offer a computing space of 1 to 250 square feet.

- These classifications help in understanding the scale and capacity of data centers, guiding infrastructure planning and investment decisions.

(Source: U.S. Chamber of Commerce – Technology Engagement Center)

Components Breakdown for Building a Data Center

- The construction of a data center involves several critical components. Each contributes to the overall functionality and efficiency of the facility.

- The land and building shell, comprising elements such as the building structure and raised floors, account for 15% to 20% of the total construction cost.

- Electrical systems, which are essential for ensuring uninterrupted power supply and include backup generators, batteries, power distribution units (PDU), uninterruptible power supplies (UPS), and switchgear/transformers, represent the largest portion of the budget, ranging from 40% to 45%.

- HVAC, mechanical, and cooling systems, are vital for maintaining optimal operating conditions. Make up 15% to 20% of the cost and include components like computer room air conditioners (CRAC), computer room air handlers (CRAH), air-cooled chillers, and chilled water storage and piping.

- Finally, the building fit-out, encompassing areas such as the lobby, meet-me room (MMR), and shipping and receiving area, constitutes 20% to 25% of the total expenditure.

- These elements collectively ensure the efficient operation and sustainability of a data center.

(Source: Digital Infra)

Useful Life of Data Center Equipment Components

- The useful life of data center equipment varies by component and category, reflecting the durability and longevity of each element within the facility.

- In the electrical infrastructure category, power distribution units have a useful life of 20 years. While uninterruptible power supplies are designed to last 25 years.

- Switchgear and transformers, known for their robustness, have an expected lifespan of 30 years.

- Within the mechanical infrastructure, heating, ventilating, and air conditioning systems can operate effectively for 20 years.

- Chiller pumps and building automation systems have a useful life of 25 years, and chilled water storage and pipes are expected to last 30 years.

- Other critical components include fire protection systems, which have the longest useful life at 40 years, and security systems, designed to function for 20 years.

- These varying lifespans highlight the need for regular maintenance and periodic upgrades to ensure the continuous and efficient operation of data centers.

(Source: Digital Infra)

Data Center Project Statistics

Volume of Data Center Projects and Valuations by Leading Owner Firms

- Several prominent owner firms lead the landscape of data center projects and their valuations. DC BLOX stands out with 18 projects valued at USD 280 million.

- Microsoft Corp. follows with 11 projects, boasting a substantial valuation of USD 3.64 billion, reflecting its significant investment in data infrastructure.

- Facebook Inc., headquartered at its corporate offices, manages nine projects with an impressive total valuation of USD 5.01 billion.

- Google Inc., based in Mountain View, has five projects valued at USD 2.89 billion. Indicating its strong presence in the data center construction market.

- These figures underscore the extensive investments and the scale of operations managed by these leading firms in the industry.

(Source: AIM)

Value of Data Center Projects by Leading Owner Firms

- The value of data center projects undertaken by leading owner firms highlights significant investments in the sector.

- Facebook Inc., at its corporate headquarters, leads with nine projects valued at an impressive USD 5.01 billion.

- Microsoft Corp. follows with 11 projects totaling USD 3.64 billion, showcasing its extensive commitment to expanding its data infrastructure.

- Google Inc., based in Mountain View, has five projects with a valuation of USD 2.89 billion, underscoring its substantial presence in the market.

- Additionally, the North Colorado Medical Center, with a single project valued at USD 200 million. Reflects the growing diversification of data center investments across different industries.

- These figures illustrate the considerable financial commitments made by these leading firms to enhance their data center capabilities.

(Source: AIM)

Data Center Project Contractors Statistics

Volume of Data Center Projects by Leading General Contractor Firms

- The volume of data center projects managed by leading general contractor firms underscores their pivotal role in the industry.

- HITT Contracting, based at its corporate headquarters, leads with two projects valued at USD 207 million.

- M.A. Mortenson Co. also manages two projects, with a total valuation of USD 160 million. Reflecting significant involvement in data center construction.

- DPR Construction oversees a single project worth USD 80 million, while Holder Construction Co., operating out of Phoenix, handles one project valued at USD 35 million.

- These figures highlight the substantial contributions of these general contractor firms to the development of data center infrastructure.

(Source: AIM)

Value of Data Center Projects by Leading General Contractor Firms

- The value of data center projects managed by leading general contractor firms illustrates their significant contributions to the industry.

- DPR Construction Inc. in San Jose leads with three projects valued at USD 162.85 million.

- In comparison, its Dallas branch handles two projects worth USD 224.81 million, showcasing DPR Construction’s extensive involvement in data center construction across different locations.

- HITT Contracting, based at its corporate headquarters, oversees two projects with a substantial total valuation of USD 207 million.

- Additionally, HITT Contracting Inc. manages two projects valued at USD 38.9 million, further emphasizing the firm’s active role in the development of data center infrastructure.

- These figures highlight the substantial financial commitments and the critical role played by these general contractor firms in advancing data center projects.

(Source: AIM)

Sector Classification of Data Center Locations

- The sector classification of data center locations reveals a predominant concentration within office environments, accounting for 65% of the total.

- Combined, college, university, and office locations represent 6%, while those solely within college and university settings comprise 5%.

- Government-related data centers are distributed between miscellaneous buildings, which account for 3%, and government offices, representing 2%.

- Other sectors collectively make up 19% of the data center locations.

- This distribution underscores the primary reliance on office spaces for data center infrastructure while also highlighting the diverse range of environments that support these critical facilities.

(Source: AIM)

Power Usage and Its Effectiveness in Data Centers

- The average annual power usage effectiveness (PUE) for the largest data centers has demonstrated significant improvement over the years, reflecting ongoing efforts to enhance energy efficiency.

- In 2007, the PUE ratio was 2.5, indicating a relatively high level of energy consumption.

- By 2011, the PUE improved to 1.98, marking the beginning of a downward trend.

- This progress continued in 2013, with the PUE ratio further decreasing to 1.65.

- In 2018, the PUE reached 1.58, and despite a slight increase to 1.67 in 2019, the trend towards greater efficiency resumed.

- By 2020, the PUE was 1.59, followed by 1.57 in 2021.

- In 2022, the PUE reached its lowest point at 1.55 before slightly rising to 1.58 in 2023.

- These figures underscore the ongoing commitment to optimizing energy use and improving the sustainability of data center operations.

(Source: Statista)

Data Center Construction Spending Statistics

- Global data center construction spending by both co-location companies and hyperscalers has been steadily increasing from 2022 to 2030.

- In 2022, co-location companies spent USD 23 billion, while hyperscalers invested USD 9 billion.

- This spending rose to USD 25 billion and USD 10 billion, respectively, in 2023.

- By 2024, co-location companies are projected to spend USD 27 billion, with hyperscalers maintaining their investment at USD 10 billion.

- The trend continues, with co-location spending reaching USD 29 billion and hyperscaler spending remaining at USD 10 billion in 2025.

- In 2026, co-location companies are expected to spend USD 30 billion, while hyperscaler investment increases to USD 11 billion.

- This upward trajectory is anticipated to persist, with co-location companies spending USD 32 billion and hyper scalers USD 12 billion in 2027, rising to USD 34 billion and USD 12 billion in 2028.

- By 2029, co-location spending is forecasted to be USD 35 billion, with hyperscalers maintaining their investment at USD 12 billion.

- Finally, in 2030, co-location companies are projected to spend USD 36 billion, with hyperscaler investment reaching USD 13 billion.

- This consistent growth highlights the expanding demand for data center infrastructure across both sectors.

(Source: Mckinsey)

Data Center Construction Expenditure Statistics

- The initial capital and operating expenditures of a typical data center are substantial, reflecting the significant investments required for establishing and maintaining such facilities.

- With a net rentable square footage (NRSF) of 165,141, the capital expenditure per NRSF is $1,305, leading to initial capital expenditures totaling $215.5 million.

- This includes $13.4 million (6.2%) for land acquisition, $45.0 million (20.9%) for building construction, and a substantial $157.1 million (72.9%) for IT equipment. Annual operating expenditures, amounting to 8.6% of the capital expenditures, are $18.5 million.

- This includes $7.4 million (40.0%) for power, $2.8 million (15.0%) for staffing, $1.0 million (5.5%) for real estate taxes and insurance, and $7.3 million (39.5%) for maintenance, administration, and other expenses.

- These figures highlight the significant financial outlay involved in both the initial setup and ongoing operations of a data center, underscoring the importance of efficient management and strategic planning.

(Source: U.S. Chamber of Commerce – Technology Engagement Center)

Economic Impacts of Data Center Construction Statistics

- The economic impacts of a typical large data center on local communities are significant during both the construction and operation phases.

- During the 18-24-month construction phase, the data center generates 1,688 local jobs, resulting in $77.7 million in wages and $243.5 million in local economic activities.

- Additionally, it contributes $9.9 million in state and local taxes.

- Once operational, the data center continues to support the local economy by providing 157 local jobs annually, with associated wages of $7.8 million.

- The ongoing operations also generate $32.5 million in local economic activities and contribute $1.1 million in state and local taxes each year.

- These figures underscore the substantial and sustained economic benefits that a large data center brings to its surrounding community.

(Source: U.S. Chamber of Commerce – Technology Engagement Center)

Regulations for Data Center Construction Statistics

- The regulations governing data center construction vary significantly across different countries, emphasizing energy efficiency, sustainability, and environmental impact.

- In the European Union, data centers must adhere to the Energy Efficiency Directive, which mandates annual reporting on energy performance, data traffic, carbon usage, and the use of renewable energy sources.

- Countries like Ireland have introduced policies requiring data centers to utilize renewable energy and integrate decarbonization measures into their design to align with government preferences and reduce environmental impact.

- In the United States, states like Virginia and Oregon are implementing stringent requirements focused on carbon reduction and sustainability, with proposed laws demanding significant cuts in carbon emissions from data centers by 2027.

- These regulations reflect a global trend towards enhancing the sustainability and environmental responsibility of data center operations, compelling companies to adopt more efficient and eco-friendly practices.

(Source: Data Center Dynamics, Data Center Magazine, Data Center Knowledge)

Key Developments, Investments, and Strategies

- Secondary markets, traditionally playing a minor role with limited providers and retail co-location options, are undergoing significant changes.

- Hyperscale users, who previously concentrated their capacity in major metropolitan areas, are now decentralizing their deployments.

- Recent announcements indicate that providers are planning new facilities in Rio de Janeiro, adding 262 MW to support this growth alongside the existing capacity of 47 MW. Similar activity is also observed in Porto Alegre, Medellin, and Monterey.

- The new administration in Argentina plans to implement a transformative system aimed at reshaping the country’s approach to international investment and cooperation.

- Previous administrations are criticized for hindering economic growth through excessive borrowing, delayed loan repayments, overspending on government services, and imposing strict capital outflow restrictions.

- In 2023, Argentina received only $12 billion in Foreign Direct Investment (FDI), significantly lower compared to Brazil’s $91 billion and Mexico’s $50 billion.

- Buenos Aires presents an attractive opportunity for hyperscale companies and providers to expand beyond the current 45 MW capacity, fueled by Argentina’s competitive real estate and electricity costs ranging from $0.025 to $0.04 per kWh.

- Moreover, recent increases in submarine cable capacity in Buenos Aires have boosted connectivity by over sixfold.

(Source: Data Center Hawk)

Recent Developments

Acquisitions:

- KKR’s Acquisition of CyrusOne: In 2022, KKR acquired CyrusOne for $15 billion, highlighting the strong interest in data center assets. This acquisition is part of a broader trend where private equity firms are heavily investing in data centers due to their critical role in the digital economy.

- Carlyle’s Acquisition of Involta: Carlyle acquired Involta, further demonstrating the increasing consolidation within the data center industry. These acquisitions underscore the high demand for data center capacity driven by cloud computing and digital services.

New Product Launches:

- Hewlett Packard Enterprise (HPE) and Nvidia’s AI Data Center Solution: In June 2024, HPE introduced a ‘turnkey’ AI data center solution in collaboration with Nvidia. This new product is designed to streamline the deployment of AI workloads, offering integrated infrastructure optimized for performance and efficiency.

Funding:

- EdgeCore Digital Infrastructure’s Debt Refinancing: EdgeCore completed a $1.9 billion debt refinancing transaction in 2023 to fund the scalable development of its data center campus in Mesa, Arizona. This funding will support the expansion of their infrastructure to meet increasing demand from hyperscalers and cloud providers.

- Increased Investments by Private Equity Firms: The involvement of private equity (PE) in the data center sector continues to grow, with PE firms contributing significantly to mergers and acquisitions. In 2022 alone, PE firms accounted for more than 90% of the $48 billion in global data center M&A activity.

Market Growth:

- Global Market Expansion: The global data center construction market is experiencing robust growth, driven by the surge in demand for data-rich digital services. The market is projected to grow significantly as companies invest in new facilities to support the increasing use of cloud-based services and AI technologies.

- North American Trends: In North America, data center construction activity continues to rise, with new projects announced regularly. For example, QTS Realty Trust is planning a $180 million data center project in Irving, Texas, set to be completed by late 2025.

Innovation and Trends:

- Sustainability Initiatives: Data center operators are increasingly focusing on sustainability. For example, the integration of renewable energy sources and advanced cooling technologies is becoming more common to reduce the environmental impact of data centers.

- AI Integration: The adoption of AI in data center operations is accelerating. AI technologies are being used to optimize data center performance, improve energy efficiency, and support advanced computing requirements.

Conclusion

Data Center Construction Statistics – Data center construction is a complex process that involves substantial investments and strict regulatory compliance.

The construction timeline typically spans 18 to 24 months, encompassing site selection, building, and equipment installation.

Costs are driven by land acquisition, building, and IT infrastructure. Increasingly stringent regulations, especially in regions like the EU and the US, mandate energy efficiency and sustainability practices.

These regulations require data centers to adopt advanced cooling systems and renewable energy sources. The economic impact on local communities is significant, providing jobs and stimulating local economies.

As technology advances and regulations evolve, data centers must focus on sustainability and efficiency to meet growing global demand.

FAQs

The construction of a data center typically involves several key phases: planning and design, site selection, securing permits and approvals, building construction, installation of IT and electrical equipment, commissioning, and operational testing.

The cost of building a data center is influenced by several factors, including the size and scale of the facility, the level of redundancy and reliability required, the choice of location, the type of cooling and power systems used, and compliance with regulatory standards. Other considerations include land acquisition costs, labor expenses, and the quality of materials and technology deployed.

The time frame for constructing a data center can vary widely depending on the size and complexity of the project. On average, the construction phase can take between 18 to 24 months. This includes time for site preparation, construction, equipment installation, and thorough testing before the data center becomes operational.

Regulations affecting data center construction vary by country and region. In the European Union, the Energy Efficiency Directive mandates energy performance reporting for large data centers. In the United States, states like Virginia and Oregon are implementing stringent carbon reduction and sustainability requirements. Additionally, local building codes, environmental regulations, and industry standards such as Uptime Institute’s Tier Standards must be adhered to during construction.

Sustainability practices in data centers include the use of energy-efficient cooling systems, renewable energy sources, advanced power management techniques, and water conservation measures. Many data centers aim for green building certifications such as LEED (Leadership in Energy and Environmental Design) to demonstrate their commitment to environmental stewardship.