Table of Contents

- Introduction

- Editor’s Choice

- Global Data Center Construction Market Overview

- Leading Countries by Number of Data Centers

- Revenue of Leading Data Center Markets Worldwide

- Data Center Size Statistics

- Components Breakdown for Building a Data Center

- Data Center Project Statistics

- Data Center Project Contractors Statistics

- Sector Classification of Data Center Locations

- Data Center Construction Spending

- Data Center Construction Expenditure Statistics

- Economic Impacts of Data Center Construction

- Regulations for Center Construction

- Key Developments, Investments, and Strategies

Introduction

According to Data Center Construction Statistics, Data center construction involves meticulous planning and execution to ensure optimal performance and reliability.

Key aspects include strategic site selection near essential infrastructure and consideration of environmental factors.

The design focuses on tier classification for system redundancy and efficient floor plans for space and scalability.

Critical systems like UPS and generators provide backup power, while precision cooling systems manage temperature.

Security measures encompass physical barriers and cybersecurity protocols. Connectivity features include carrier neutrality and network redundancy.

Sustainability, compliance with regulations, and scalability are also prioritized, ensuring efficient operation and future readiness. Maintenance and documentation further guarantee ongoing reliability and operational integrity.

Editor’s Choice

- The global data center construction market revenue is projected to reach USD 453.5 billion by 2033.

- The market share distribution within the global data center construction industry highlights a competitive landscape dominated by several key players. Dell EMC holds the largest share at 18%.

- The global data center construction market is characterized by regional disparities in market share. With North America leading significantly at 38.8%.

- Several prominent owner firms lead the landscape of data center projects and their valuations. DC BLOX stands out with 18 projects valued at USD 280 million.

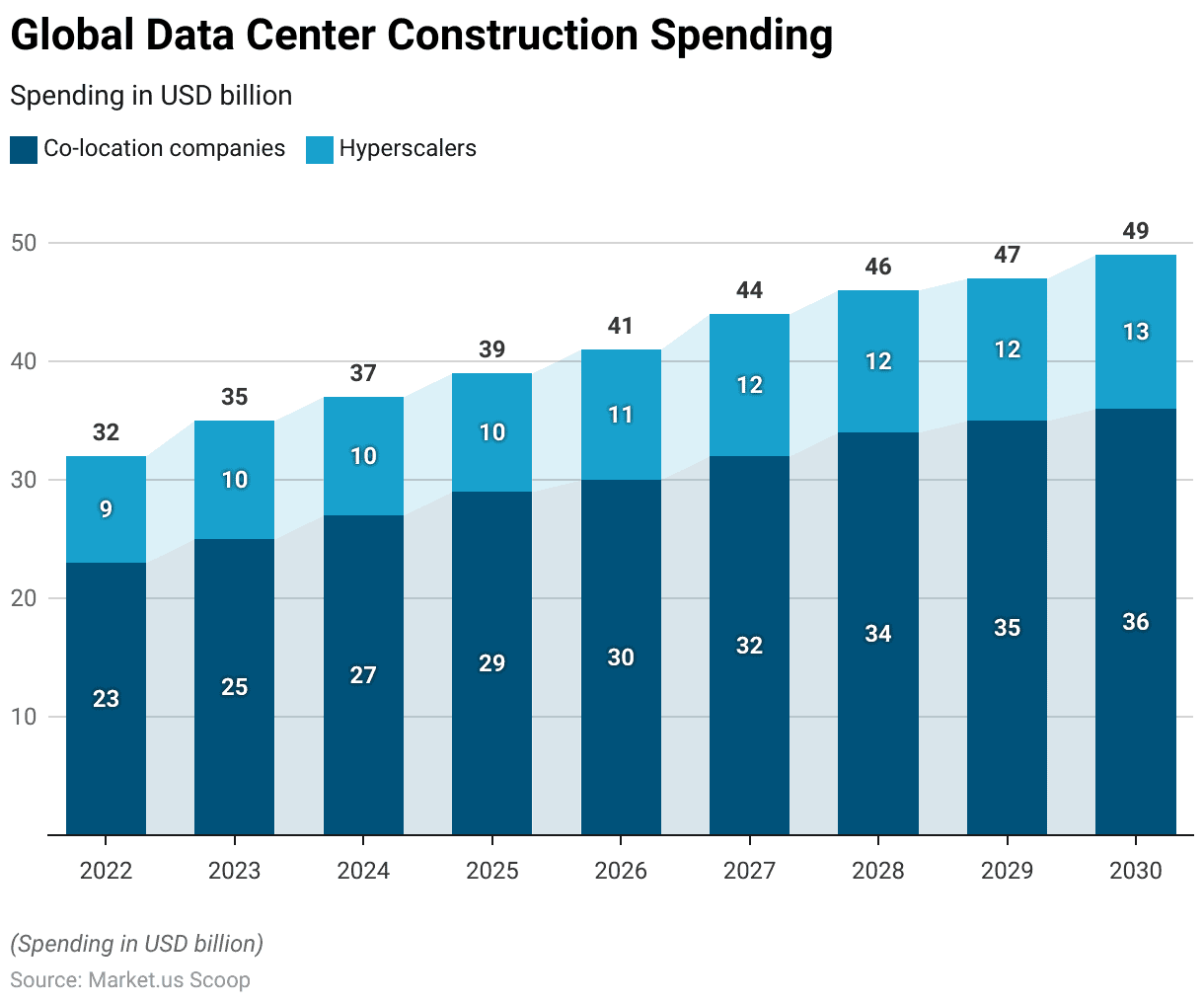

- By 2030, co-location companies are projected to spend USD 36 billion, with hyperscaler investment reaching USD 13 billion.

- During the 18-24-month construction phase, the data center generates 1,688 local jobs. Resulting in $77.7 million in wages and $243.5 million in local economic activities.

- In the United States, states like Virginia and Oregon are implementing stringent requirements focused on carbon reduction and sustainability. With proposed laws demanding significant cuts in carbon emissions from data centers by 2027.

Global Data Center Construction Market Overview

Global Data Center Construction Market Size

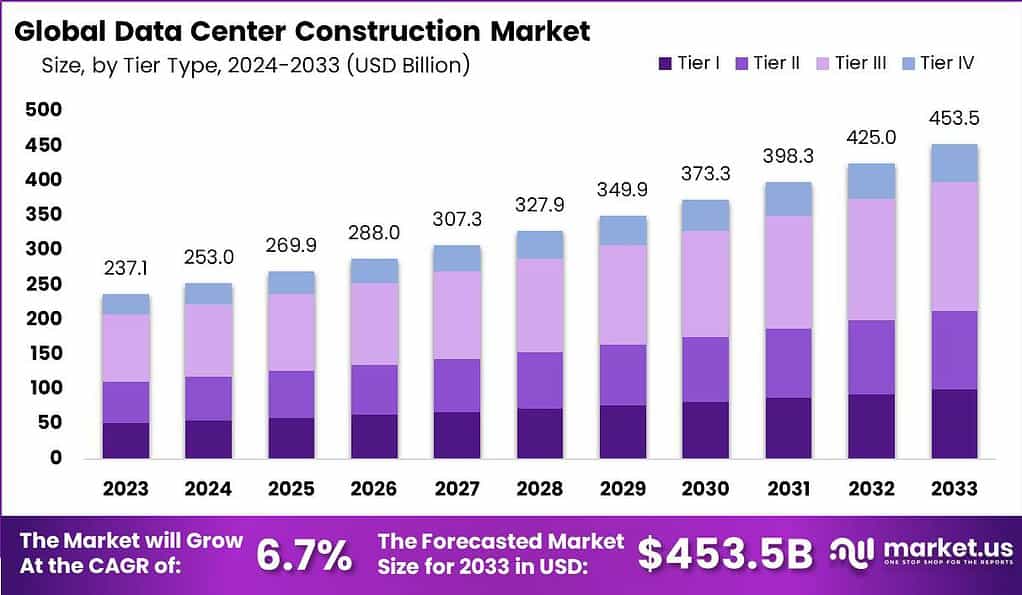

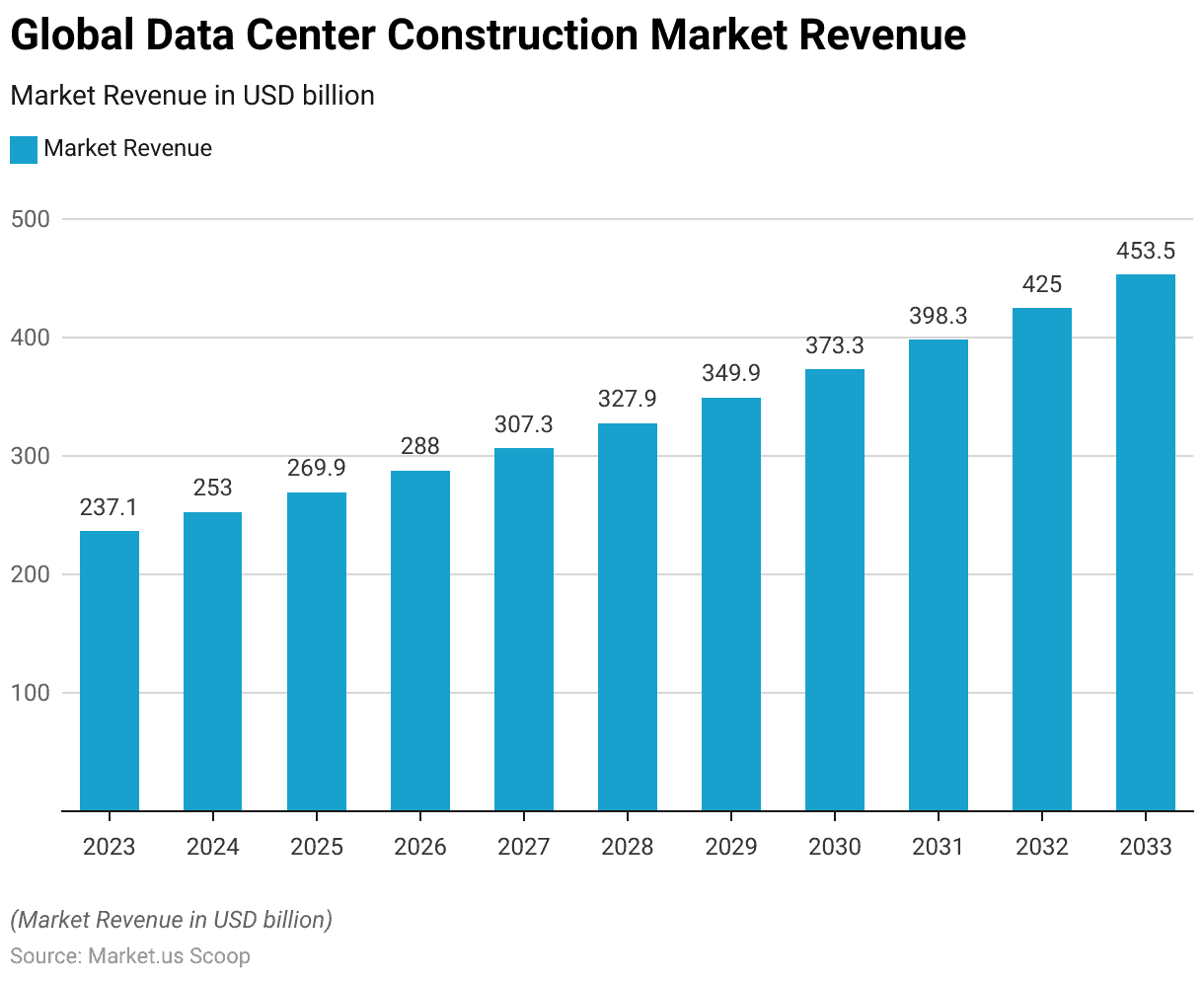

- The global data center construction market has demonstrated a steady growth trajectory over the past decade at a CAGR of 6.7%. With revenue figures reflecting a consistent upward trend.

- In 2023, the market revenue stood at USD 237.1 billion.

- The growth momentum is predicted to persist, with market revenue estimated at USD 398.3 billion by 2031, USD 425.0 billion by 2032, and USD 453.5 billion by 2033.

Competitive Landscape of the Global DCC Market

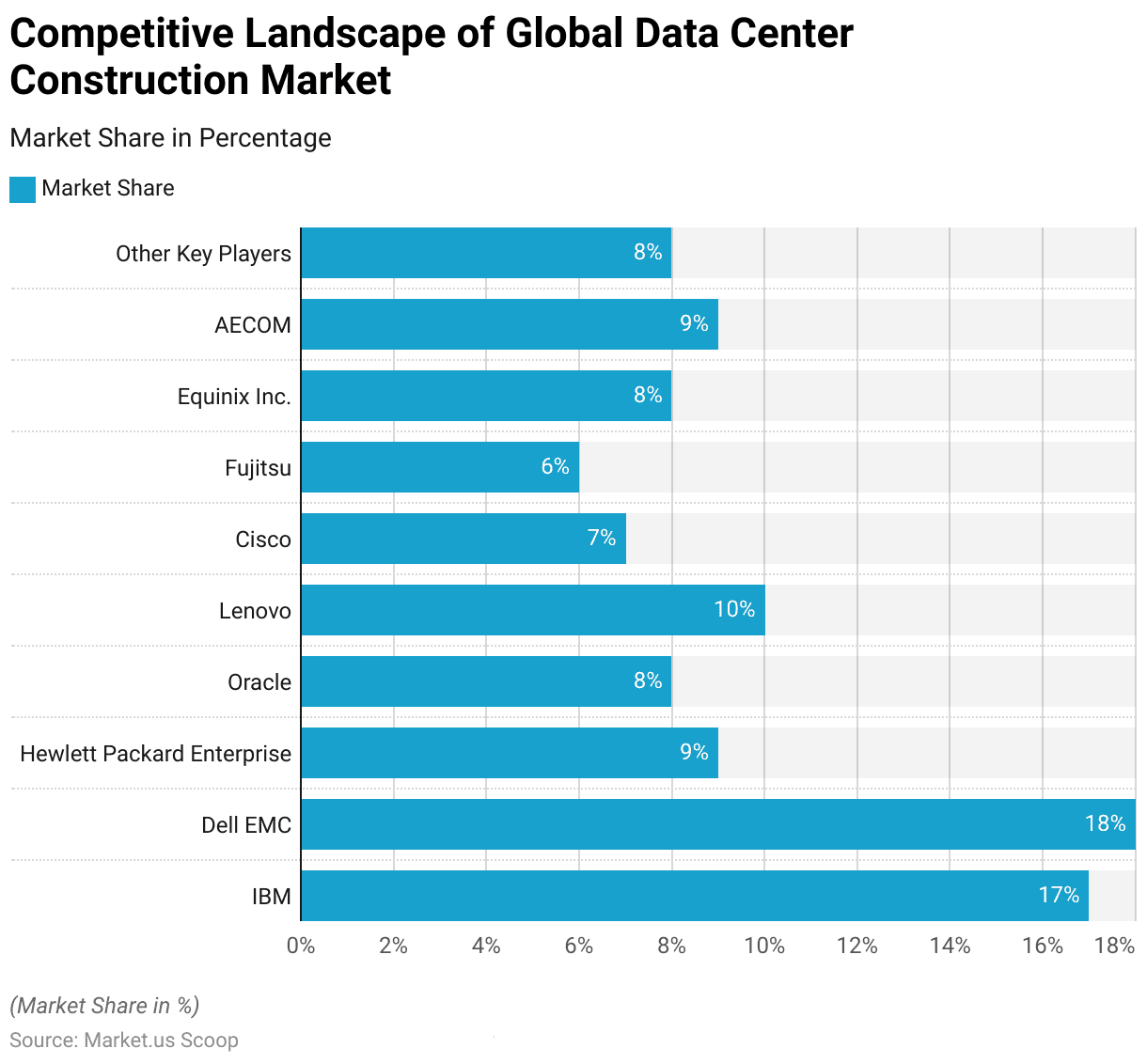

- The market share distribution within the global data center construction industry highlights a competitive landscape dominated by several key players.

- Dell EMC holds the largest share at 18%, followed closely by IBM with 17%.

- Hewlett Packard Enterprise and AECOM each account for 9% of the market. Indicating their significant presence.

- Lenovo captures 10% of the market, surpassing Oracle and Equinix Inc., both of which hold an 8% share.

- Cisco and Fujitsu represent 7% and 6% of the market, respectively.

Regional Analysis of Global Data Center Construction Market

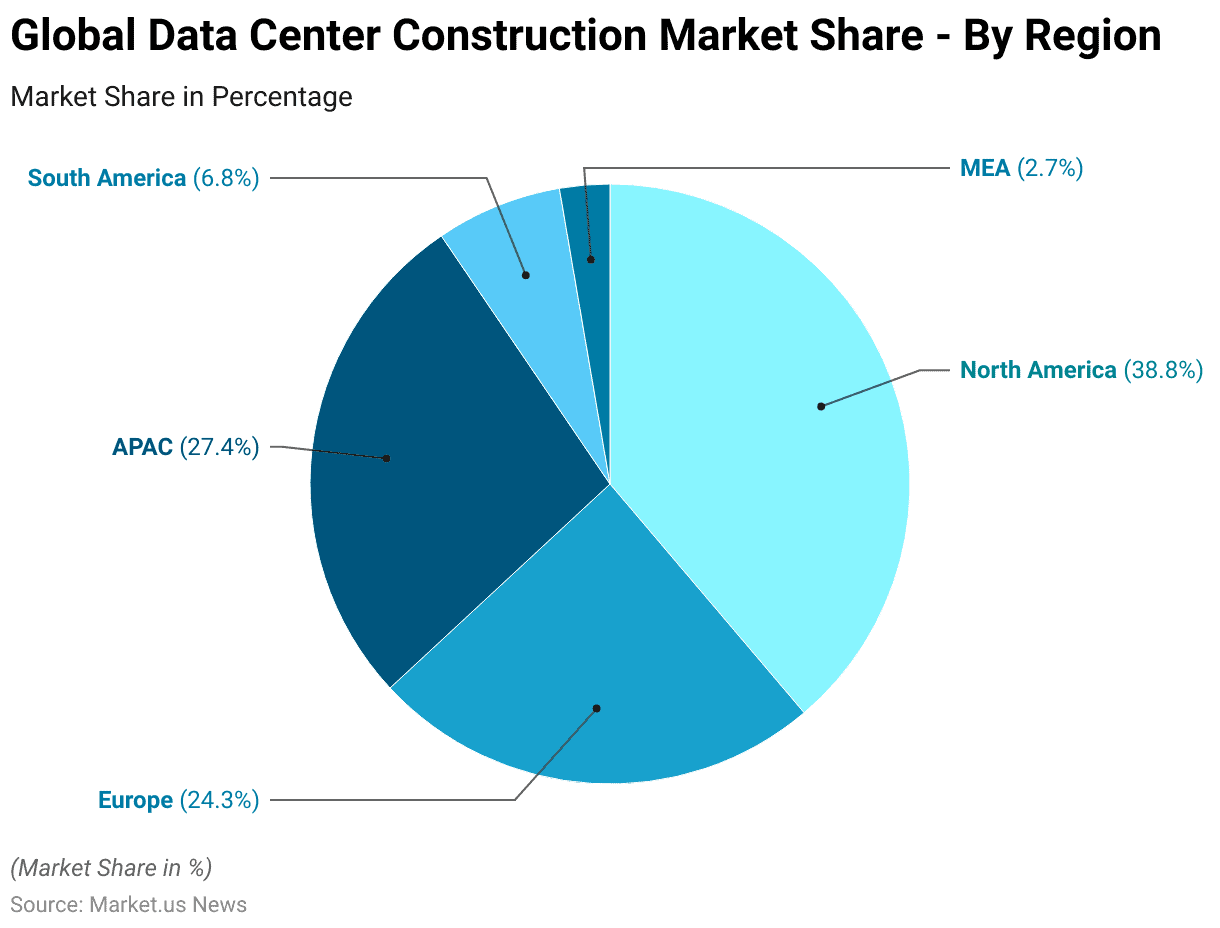

- The global data center construction market is characterized by regional disparities in market share, with North America leading significantly at 38.8%.

- This dominance is followed by the Asia-Pacific (APAC) region. Which holds a substantial 27.4% share, reflecting its rapid technological advancements and growing demand for data infrastructure.

- Europe accounts for 24.3% of the market, indicating its strong position in the global landscape.

- South America and the Middle East & Africa (MEA) regions, while smaller in comparison, contribute 6.8% and 2.7%, respectively.

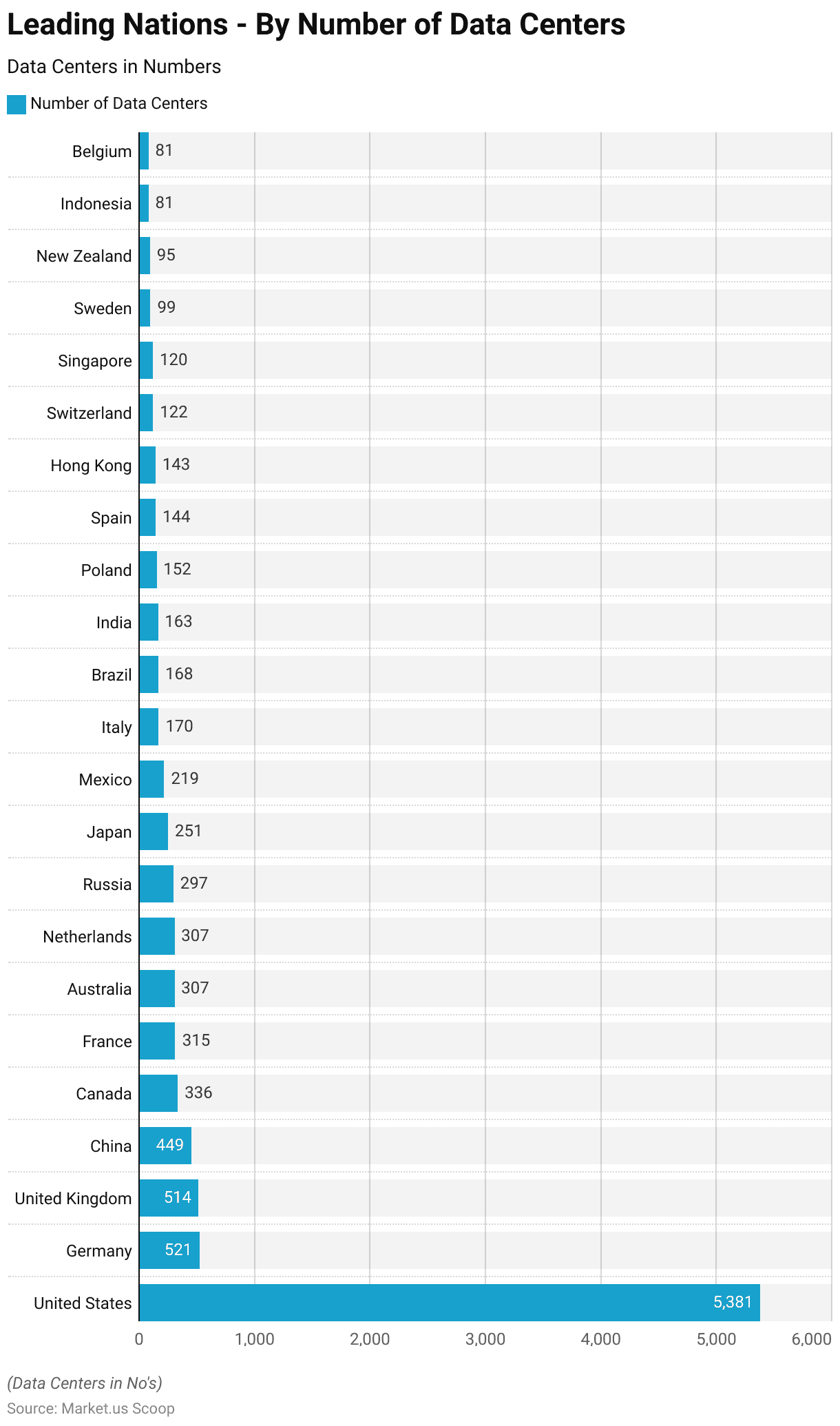

Leading Countries by Number of Data Centers

- As of March 2024, the United States leads the global data center landscape with a staggering 5,381 data centers, significantly outpacing other countries.

- Germany ranks second with 521 data centers, closely followed by the United Kingdom with 514.

- China also plays a major role in the 449 data centers.

- Canada and France contribute notably with 336 and 315 data centers, respectively.

- Both Australia and the Netherlands host 307 data centers each.

- Russia has 297, while Japan maintains 251 data centers.

- Mexico, with 219 data centers, and Italy, with 170, show considerable presence in the market.

- Brazil and India also make significant contributions, with 168 and 163 data centers, respectively.

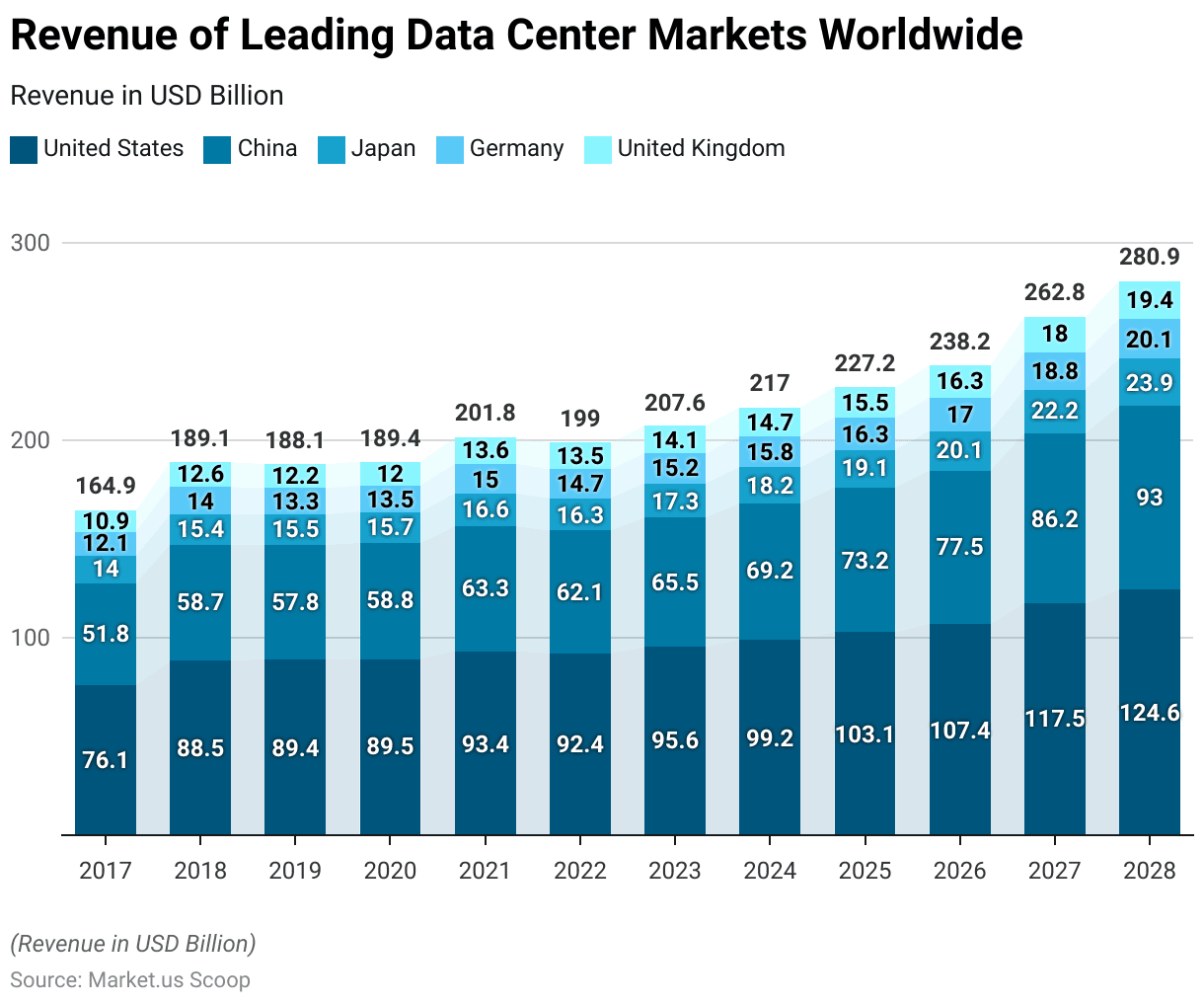

Revenue of Leading Data Center Markets Worldwide

- The global data center market has shown significant growth from 2017 to 2028. With notable expansions in key regions such as the United States, China, Japan, Germany, and the United Kingdom.

- In 2017, the United States led the market with a revenue of $76.13 billion, followed by China at $51.78 billion, Japan at $13.96 billion, Germany at $12.08 billion, and the United Kingdom at $10.93 billion.

- By 2028, the revenue figures for these regions are projected to rise substantially. With the United States reaching $124.57 billion, China at $92.98 billion, Japan at $23.93 billion, Germany at $20.08 billion, and the United Kingdom at $19.36 billion.

Data Center Size Statistics

- Data centers are classified based on their size metrics, which include rack yield and compute space.

- Mega data centers, the largest classification, have over 9,000 racks and more than 225,000 square feet of computing space.

- Massive data centers follow, with rack yields ranging from 3,001 to 9,000 and compute spaces between 75,001 and 225,000 square feet.

- Large data centers contain 801 to 3,000 racks and offer 20,001 to 75,000 square feet of computing space.

- Medium-sized data centers have 201 to 800 racks and compute spaces ranging from 5,001 to 20,000 square feet.

- Small data centers, with 11 to 200 racks, provide 251 to 5,000 square feet of computing space.

- The smallest classification, mini data centers, contain 1 to 10 racks and offer a computing space of 1 to 250 square feet.

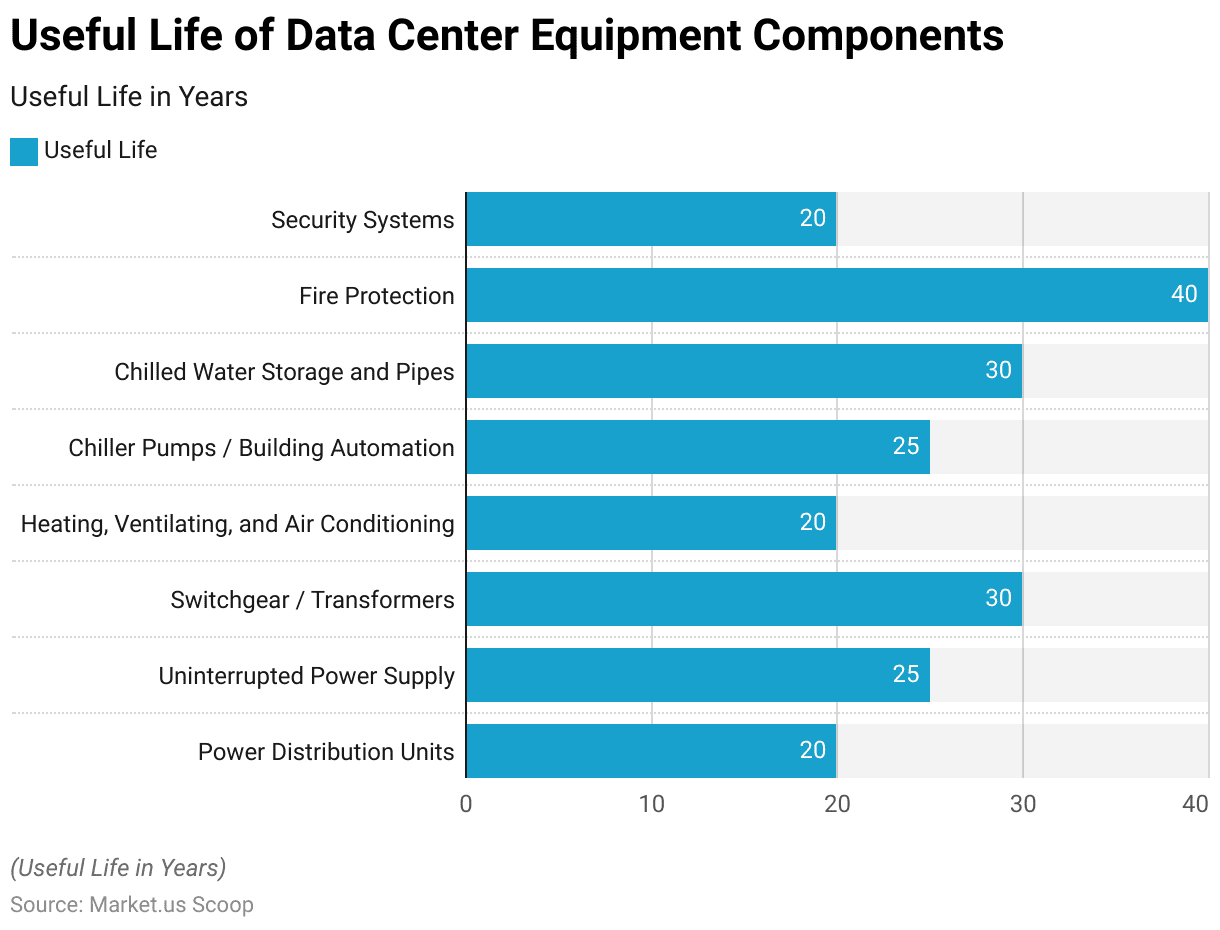

Components Breakdown for Building a Data Center

- The construction of a data center involves several critical components. Each contributes to the overall functionality and efficiency of the facility.

- The land and building shell, comprise elements such as the building structure and raised floors. Account for 15% to 20% of the total construction cost.

- Electrical systems, which are essential for ensuring uninterrupted power supply and include backup generators, batteries, power distribution units (PDU), uninterruptible power supplies (UPS), and switchgear/transformers, represent the largest portion of the budget, ranging from 40% to 45%.

- HVAC, mechanical, and cooling systems, are vital for maintaining optimal operating conditions. Make up 15% to 20% of the cost and include components like computer room air conditioners (CRAC), computer room air handlers (CRAH), air-cooled chillers, and chilled water storage and piping.

- Finally, the building fit-out, encompassing areas such as the lobby, meet-me room (MMR), and shipping and receiving area, constitutes 20% to 25% of the total expenditure.

Data Center Project Statistics

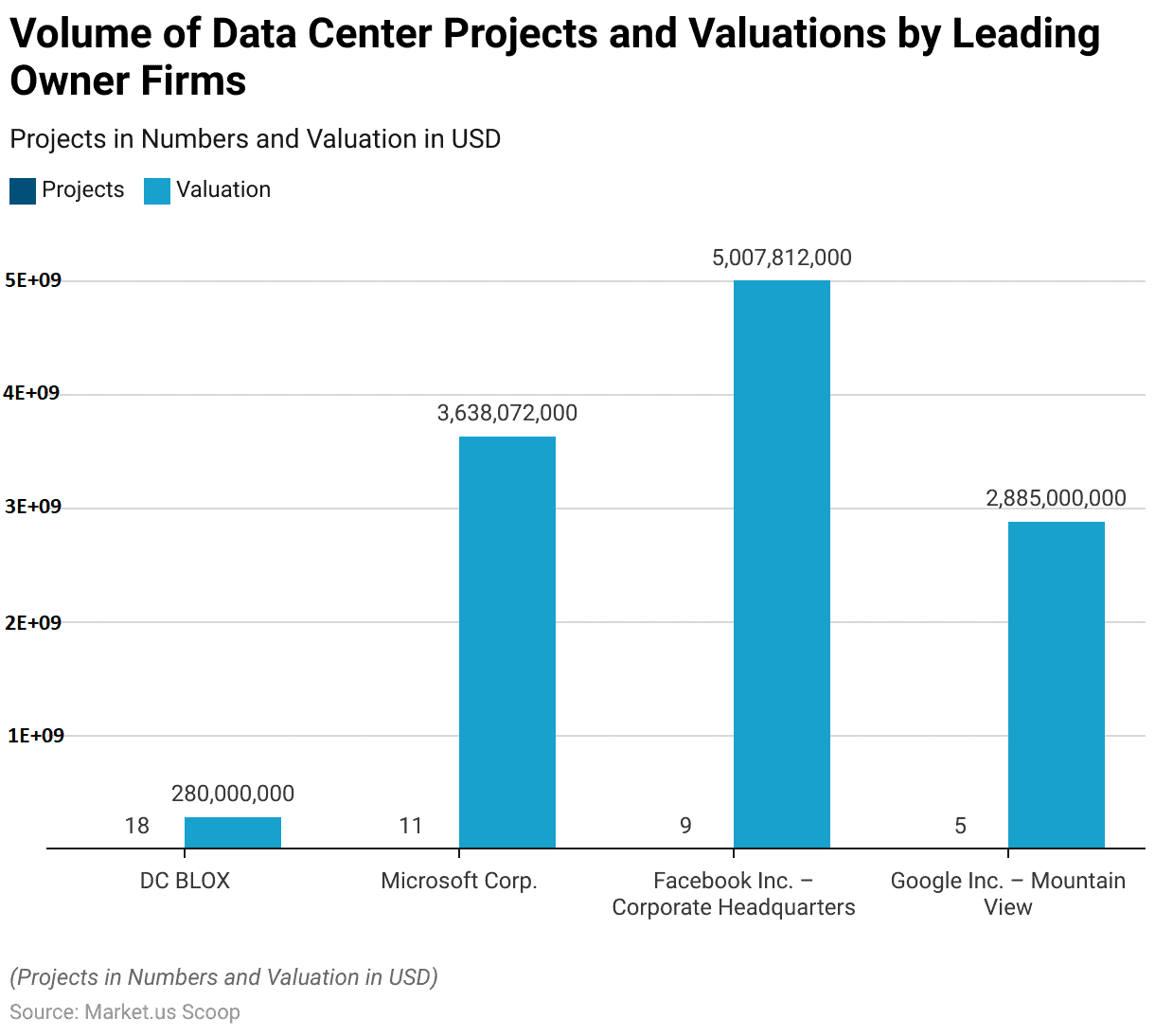

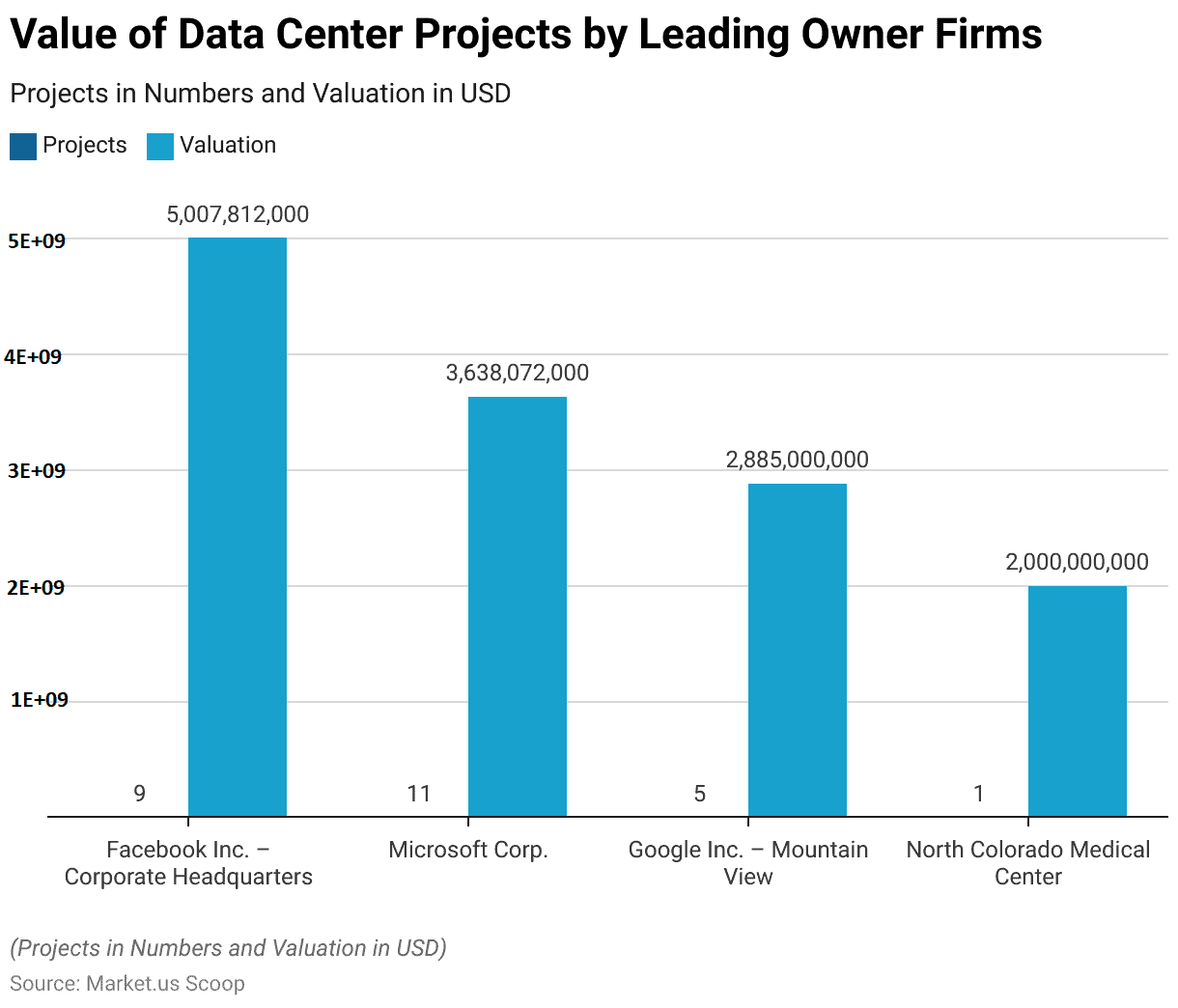

Volume of Data Center Projects and Valuations by Leading Owner Firms

- Several prominent owner firms lead the landscape of data center projects and their valuations. DC BLOX stands out with 18 projects valued at USD 280 million.

- Microsoft Corp. follows with 11 projects, boasting a substantial valuation of USD 3.64 billion, reflecting its significant investment in data infrastructure.

- Facebook Inc., headquartered at its corporate offices, manages nine projects with an impressive total valuation of USD 5.01 billion.

- Google Inc., based in Mountain View, has five projects valued at USD 2.89 billion. Indicating its strong presence in the data center construction market.

Data Center Project Contractors Statistics

Volume of Data Center Projects by Leading General Contractor Firms

- The volume of data center projects managed by leading general contractor firms underscores their pivotal role in the industry.

- HITT Contracting, based at its corporate headquarters, leads with two projects valued at USD 207 million.

- M.A. Mortenson Co. also manages two projects, with a total valuation of USD 160 million. Reflecting significant involvement in data center construction.

- DPR Construction oversees a single project worth USD 80 million. While Holder Construction Co., operating out of Phoenix, handles one project valued at USD 35 million.

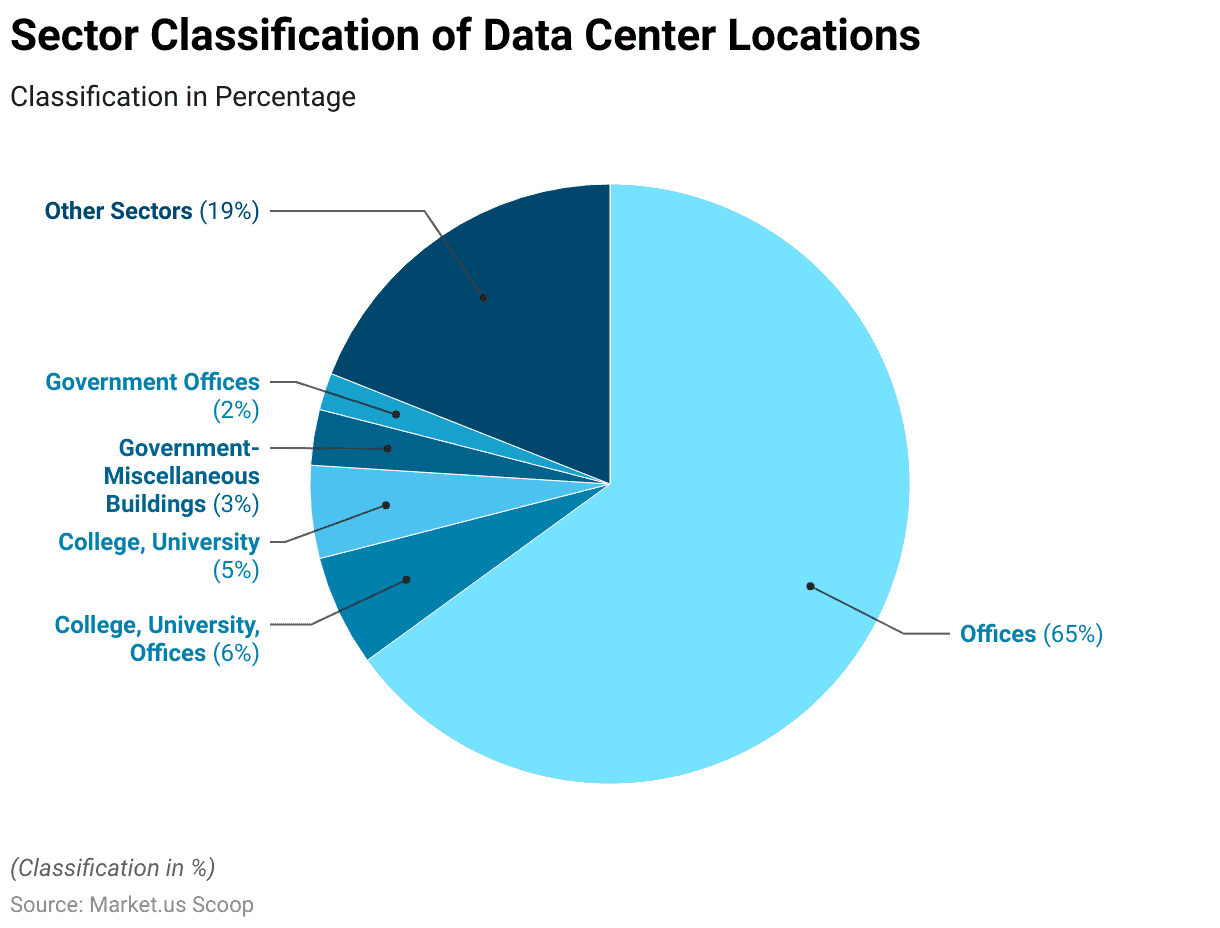

Sector Classification of Data Center Locations

- The sector classification of data center locations reveals a predominant concentration within office environments, accounting for 65% of the total.

- Combined, college, university, and office locations represent 6%. While those solely within college and university settings comprise 5%.

- Government-related data centers are distributed between miscellaneous buildings. Which account for 3%, and government offices, representing 2%.

- Other sectors collectively make up 19% of the data center locations.

Data Center Construction Spending

- Global data center construction spending by both co-location companies and hyperscalers has been steadily increasing from 2022 to 2030.

- In 2022, co-location companies spent USD 23 billion, while hyperscalers invested USD 9 billion.

- Finally, in 2030, co-location companies are projected to spend USD 36 billion. With hyperscaler investment reaching USD 13 billion.

Data Center Construction Expenditure Statistics

- The initial capital and operating expenditures of a typical data center are substantial. Reflecting the significant investments required for establishing and maintaining such facilities.

- With a net rentable square footage (NRSF) of 165,141, the capital expenditure per NRSF is $1,305, leading to initial capital expenditures totaling $215.5 million.

- This includes $13.4 million (6.2%) for land acquisition, $45.0 million (20.9%) for building construction, and a substantial $157.1 million (72.9%) for IT equipment. Annual operating expenditures, amounting to 8.6% of the capital expenditures, are $18.5 million.

- This includes $7.4 million (40.0%) for power, $2.8 million (15.0%) for staffing, $1.0 million (5.5%) for real estate taxes and insurance, and $7.3 million (39.5%) for maintenance, administration, and other expenses.

Economic Impacts of Data Center Construction

- The economic impacts of a typical large data center on local communities are significant during both the construction and operation phases.

- During the 18-24-month construction phase, the data center generates 1,688 local jobs. Resulting in $77.7 million in wages and $243.5 million in local economic activities.

- Additionally, it contributes $9.9 million in state and local taxes.

- Once operational, the data center continues to support the local economy by providing 157 local jobs annually, with associated wages of $7.8 million.

- The ongoing operations also generate $32.5 million in local economic activities and contribute $1.1 million in state and local taxes each year.

Regulations for Center Construction

- The regulations governing data center construction vary significantly across different countries, emphasizing energy efficiency, sustainability, and environmental impact.

- In the European Union, data centers must adhere to the Energy Efficiency Directive, which mandates annual reporting on energy performance, data traffic, carbon usage, and the use of renewable energy sources.

- Countries like Ireland have introduced policies requiring data centers to utilize renewable energy and integrate decarbonization measures into their design to align with government preferences and reduce environmental impact.

- In the United States, states like Virginia and Oregon are implementing stringent requirements focused on carbon reduction and sustainability, with proposed laws demanding significant cuts in carbon emissions from data centers by 2027.

Key Developments, Investments, and Strategies

- Secondary markets, traditionally playing a minor role with limited providers and retail co-location options, are undergoing significant changes.

- Hyperscale users, who previously concentrated their capacity in major metropolitan areas, are now decentralizing their deployments.

- Recent announcements indicate that providers are planning new facilities in Rio de Janeiro, adding 262 MW to support this growth alongside the existing capacity of 47 MW. Similar activity is also observed in Porto Alegre, Medellin, and Monterey.

- The new administration in Argentina plans to implement a transformative system aimed at reshaping the country’s approach to international investment and cooperation.

- Buenos Aires presents an attractive opportunity for hyperscale companies and providers to expand beyond the current 45 MW capacity, fueled by Argentina’s competitive real estate and electricity costs ranging from $0.025 to $0.04 per kWh.