Table of Contents

Introduction

Smart Card Statistics: Smart cards are compact devices featuring a microprocessor or memory chip designed for secure data storage and processing.

They are integral to sectors like identification, where they securely store certificates and cryptographic keys for access control and digital services.

In finance, smart cards, such as EMV cards, safeguard payment information with dynamic authentication, reducing fraud risk.

They also play key roles in telecommunications through SIM cards. Healthcare with electronic health records, and transportation for fare collection systems.

Smart cards can be either contact-based, requiring insertion into a reader, or contactless, utilizing RFID for wireless communication. Ensuring secure transactions and data integrity across diverse applications.

Editor’s Choice

- The global smart card market revenue is projected to reach USD 29.6 billion by 2033.

- The smart card market is characterized by a diverse range of key players. Each holds varying shares of the market. CPI Card Group Inc. leads with an 18% market share.

- In 2008, the smart card manufacturing market was led by Gemalto, which held a dominant 35% market share.

- The global smart card market is dominated by the Asia-Pacific (APAC) region. Which holds the largest share at 39.4%.

- In the Asia-Pacific region, the cashless transaction volume was USD 494 billion in 2020 and is projected to increase to USD 1,032 billion by 2025 and USD 1,818 billion by 2030.

- The history of smart cards is marked by significant milestones in technological advancement and widespread adoption across various sectors globally. It all began in the 1970s when patents were filed in Japan and France. Laying the groundwork for what would become the smart card.

- In the United States, the Federal Information Processing Standard (FIPS) 201-3 establishes guidelines for Personal Identity Verification (PIV) cards used by federal employees and contractors to access secure facilities and systems.

Smart Card Market Statistics

Global Smart Card Market Size Statistics

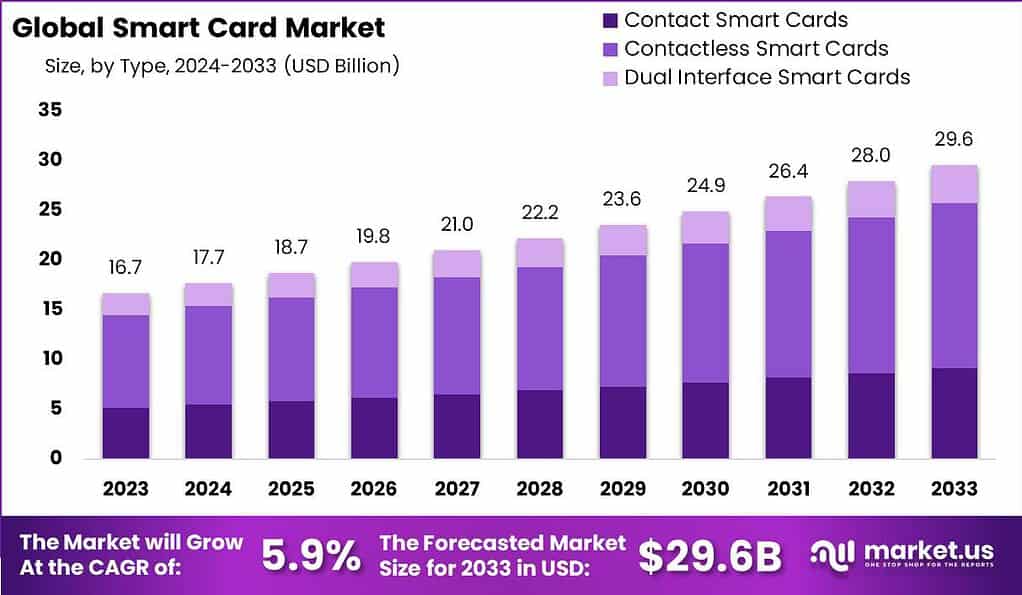

- The global smart card market revenue is projected to exhibit steady growth from 2023 to 2033 at a CAGR of 5.9%.

- In 2023, the further market revenue stood at USD 16.7 billion and is anticipated to increase incrementally each year.

- By 2024, the revenue is expected to reach USD 17.7 billion, followed by USD 18.7 billion in 2025.

- This upward trend continues, with revenues projected at USD 19.8 billion in 2026 and USD 21.0 billion in 2027.

- The market is forecasted to further expand to USD 22.2 billion in 2028 and USD 23.6 billion in 2029.

- Entering the next decade, the smart card market is anticipated to generate USD 24.9 billion in 2030 and USD 26.4 billion in 2031.

- The growth trajectory is expected to persist, culminating in market revenues of USD 28.0 billion in 2032 and reaching USD 29.6 billion by 2033.

- This consistent growth reflects the increasing adoption and integration of smart card technology across various sectors globally.

(Source: market.us)

Competitive Landscape of the Global Smart Card Market Statistics

- The smart card market is characterized by a diverse range of key players, each holding varying shares of the market.

- CPI Card Group Inc. leads with an 18% market share, followed closely by American Express Company at 17%.

- Atos SE and NXP Semiconductors NV each command a 9% share, while Inside Secure SA holds 10%.

- Giesecke & Devrient (G&D) GmbH and Infineon Technologies AG both account for 8% of the market.

- Gemalto NV has a 7% share, and Texas Instruments Inc. holds 6%.

- Additionally, other key players collectively contribute to 8% of the market share.

- This distribution underscores the competitive and fragmented nature of the smart card industry.

(Source: market.us)

Market Share of Smart Card Manufacturers Statistics

- In 2008, the smart card manufacturing market was led by Gemalto, which held a dominant 35% market share.

- Giesecke & Devrient and Oberthur Technologies each accounted for 14% of the market, reflecting a significant competitive presence.

- Sagem Orga contributed to 8% of the market share.

- The remaining 21% was divided among various other manufacturers. Indicating a diverse and competitive landscape within the smart card industry at that time.

(Source: Statista)

Regional Analysis of the Global Smart Card Market Statistics

- The global smart card market is dominated by the Asia-Pacific (APAC) region, which holds the largest share at 39.4%.

- North America follows with a market share of 26.5%, while Europe accounts for 23.0% of the market.

- South America, the Middle East, and Africa (MEA) regions have smaller shares, contributing 6.4% and 4.7%, respectively.

- This distribution highlights the significant influence of the APAC region in the smart card market. Which is driven by widespread adoption and technological advancements.

(Source: market.us)

Factors Driving the Demand for Smart Card Statistics

Rise in Cashless Transactions

- The volume of cashless transactions is expected to grow significantly across all regions from 2020 to 2030.

- In the Asia-Pacific region, the transaction volume was USD 494 billion in 2020 and is projected to increase to USD 1,032 billion by 2025 and USD 1,818 billion by 2030.

- Africa’s cashless transaction volume, starting at USD 59 billion in 2020, is expected to reach USD 105 billion by 2025 and USD 172 billion by 2030.

- Europe saw a transaction volume of USD 229 billion in 2020. Which is anticipated to grow to USD 375 billion by 2025 and USD 522 billion by 2030.

- In Latin America, the volume is projected to rise from USD 73 billion in 2020 to USD 111 billion in 2025 and USD 165 billion in 2030.

- The USA and Canada had a combined transaction volume of USD 180 billion in 2020. With forecasts predicting an increase to USD 258 billion by 2025 and USD 349 billion by 2030.

- This data highlights the global trend towards increased adoption of cashless transactions across all regions.

(Source: PwC)

Cashless Payment Adoption

- In 2020, preferences for cashless payment varied significantly across different countries.

- South Korea led with 77% of respondents favoring cashless transactions, followed by Sweden at 74% and Russia at 72%.

- The United Kingdom saw a preference rate of 70%, while both France and China reported 67%.

- In Spain, 61% of respondents preferred to pay without cash, and in Japan, this figure was 60%.

- The United States had a slightly lower rate at 58%, while India stood at 52%.

- Germany had 49% of respondents favoring cashless payments, and the Philippines reported the lowest preference at 33%.

- This data reflects the diverse adoption rates of cashless payment methods globally.

(Source: Global Web Index)

Adoption of Mobile Payments

- The adoption of mobile payments in the United States has shown a steady increase from 2016 to 2022.

- In 2016, there were 18.8 million users, representing a penetration rate of 5.8%.

- This number grew to 22.4 million users in 2017, with a penetration rate of 6.9%.

- By 2018, users reached 25.9 million, and the penetration rate increased to 7.9%.

- In 2019, the user base expanded to 29.1 million, with an 8.8% penetration rate.

- The growth continued in 2020, with 31.9 million users and a 9.6% penetration rate.

- By 2021, the number of mobile payment users rose to 34.3 million, reflecting a 10.3% penetration rate.

- In 2022, the adoption reached 36.3 million users, achieving a penetration rate of 10.8%.

- This consistent growth indicates a gradual but steady increase in the acceptance and use of mobile payment methods among U.S. consumers.

(Source: Electronic Transaction Association – The State of Mobile Payments in 2019)

Rise in E-commerce Sales

- Retail e-commerce sales worldwide have experienced remarkable growth from 2014 to 2023.

- In 2014, global e-commerce sales amounted to USD 1,336 billion.

- This figure increased to USD 1,548 billion in 2015 and further to USD 1,845 billion in 2016.

- The upward trend continued, with sales reaching USD 2,382 billion in 2017 and USD 2,982 billion in 2018.

- In 2019, retail e-commerce sales rose to USD 3,535 billion and saw a significant jump to USD 4,206 billion in 2020.

- This growth persisted in subsequent years, with sales hitting USD 4,927 billion in 2021 and USD 5,695 billion in 2022.

- By 2023, global retail e-commerce sales are projected to reach USD 6,542 billion.

- This substantial increase highlights the expanding influence and adoption of e-commerce in the global retail market.

(Source: Statista)

Rise in Mobile Transactions

- The volume of mobile payment transactions has shown substantial growth from 2016 to 2022.

- In 2016, the transaction volume was USD 230,365 million.

- This figure increased significantly to USD 357,736 million in 2017 and further to USD 527,661 million in 2018.

- The upward trajectory continued, with the transaction volume reaching USD 744,522 million in 2019 and USD 1,010,596 million in 2020.

- The growth further accelerated in 2021, with the volume rising to USD 1,326,790 million, and in 2022, it further expanded to USD 1,693,009 million.

- This consistent and rapid increase underscores the growing adoption and reliance on mobile payment solutions globally.

(Source: Electronic Transaction Association – The State of Mobile Payments in 2019)

History of Smart Card

- The history of smart cards is marked by significant milestones in technological advancement and widespread adoption across various sectors globally.

- It all began in the 1970s when patents were filed in Japan and France. laying the groundwork for what would become the smart card.

- By the early 1980s, field trials of IC cards in banking and telecommunications began in France. Leading to successful implementations of ATM cards and phone cards by mid-decade.

- However, the late 1980s saw pivotal developments with large-scale applications such as the U.S. Department of Agriculture’s smart card and the introduction of smart-card-based driver’s licenses in Turkey.

- The 1990s witnessed explosive growth, from electronic benefits transfer systems in the U.S. to nationwide prepaid card projects in Denmark.

- The establishment of EMV standards in 1994 by Europay, MasterCard, and Visa further standardized microchip-based bank cards globally.

- Into the 21st century, smart cards expanded into diverse applications, including telecommunications, military ID cards, and contactless payment systems.

- Initiatives like the Estonia citizen smart card in 2002 and the deployment of EMV cards worldwide by 2014 underscored their increasing ubiquity and security features.

- Today, smart cards continue to evolve, underpinning digital identity initiatives and serving as integral components of secure, multi-functional electronic systems globally.

(Source: Cardwerk, Giesecke+Devrient GmbH)

Technical Specification of Smart Card Statistics

- Smart cards are sophisticated portable storage devices that come in various types. Including contact, contactless, and dual-interface models, each with distinct technical specifications.

- Contact smart cards feature a physical contact pad that connects with a card reader.

- In contrast, contactless smart cards use an embedded antenna for radio frequency communication, enhancing convenience and hygiene, especially post-pandemic.

- Dual-interface cards combine both technologies for maximum versatility.

- The memory capacity of smart cards ranges from up to 256 KB of RAM for volatile storage to several megabytes of non-volatile flash memory.

- They utilize microprocessors varying from 8-bit to 32-bit, produced by companies like Infineon Technologies and NXP Semiconductors, running on operating systems such as Java Card and MULTOS.

- Encryption standards like AES, DES, and RSA ensure data security, making smart cards ideal for applications in banking, telecommunications, and secure identification.

(Sources: Secure Technology Alliance, Thales Group, Microsoft, Electrical Funda)

Smart Card Schemes Statistics

- Smart card schemes vary significantly by company, each offering unique specifications tailored to different applications.

- Thales, for instance, provides smart cards used in banking, loyalty programs, access control, and eID with features like advanced encryption (AES, RSA) and compliance with EMV standards for secure transactions.

- Banco Santander’s University Smart Card serves multiple functions, including student identification, access control, and payment capabilities, as well as integrating EMV and contactless technologies.

- In Bangladesh, the TakaPay card, developed by Fime, focuses on local transactions to minimize foreign exchange costs and enhance financial security, following similar initiatives in neighboring countries.

- SmartCitizen specializes in local government schemes, offering cards that facilitate electronic service delivery and improve citizen accessibility.

- However, these diverse schemes highlight the flexibility and security smart cards provide across various sectors.

(Sources: Digital Manhub, Smart Citizen, Thales Group, Cambridge University)

Key Smart Card Initiatives

- Several countries and organizations have initiated significant smart card projects to enhance security, efficiency, and user convenience.

- In the United Kingdom, the “Key” smartcard system by Go-Ahead Group allows seamless travel across various public transport modes, integrating rail and bus services with a single card.

- The European Union has broadly adopted the EMV standard for secure payments, ensuring interoperability of smart cards across member states and enhancing both security and convenience for transactions.

- In the United States, the Department of Defense’s Common Access Card (CAC) program integrates multiple identification and security functions for military personnel, improving access control and operational efficiency.

- The OECD’s Smart Cities initiative promotes the use of smart cards for urban services, aiming to boost citizen well-being and optimize public service delivery through advanced digital technologies.

(Source: Thales Group, OECD, Government Technology)

Regulations for Smart Cards

- Regulations for smart cards vary significantly by country, reflecting different security, usage, and compliance requirements.

- In the United States, the Federal Information Processing Standard (FIPS) 201-3 establishes guidelines for Personal Identity Verification (PIV) cards used by federal employees and contractors to access secure facilities and systems.

- Further, the Department of Defense uses Common Access Cards (CAC), which follow similar stringent standards for identification and access control.

- In the European Union, the EMV standard, developed by Europay, MasterCard, and Visa, governs the interoperability and security of smart payment cards, ensuring secure transactions across member states.

- In the Philippines, the SIM Registration Act mandates the registration of all SIM cards, including those embedded in smart cards, to combat fraud and enhance security.

- South Africa’s smart ID card system, introduced by the Department of Home Affairs, integrates biometric data to improve identity verification and reduce fraud.

- These regulations ensure that smart cards are used securely and efficiently across various applications, from financial transactions to identity verification.

(Sources: Interaksyon, U.S. Department of Defense – Common Access Card, Springer link, Cardwerk)

Recent Developments

Acquisitions and Mergers:

- Thales acquires Gemalto: In early 2023, Thales completed its $5.4 billion acquisition of Gemalto, a leading company in digital security and smart card technology. This merger aims to strengthen Thales’ position in the cybersecurity and smart card market.

- IDEMIA merges with Omoove: IDEMIA, a leader in augmented identity, merged with Omoove, a mobility solutions provider, in mid-2023. This merger is expected to enhance IDEMIA’s smart card offerings, particularly in the automotive and mobility sectors.

New Product Launches:

- Gemalto’s Bio-sourced Card: In late 2023, Gemalto launched a new bio-sourced smart card made from renewable materials. This eco-friendly card aims to reduce environmental impact and cater to the growing demand for sustainable products.

- Thales EMV Biometric Card: Thales introduced its EMV biometric card in early 2024. This card integrates fingerprint authentication, providing enhanced security for contactless payments without compromising convenience.

Funding:

- G+D raises $200 million: Giesecke+Devrient (G+D), a global security technology provider, secured $200 million in a funding round in 2023 to expand its smart card production capabilities and develop new digital security solutions.

- NXP Semiconductors secures $150 million: In early 2024, NXP Semiconductors raised $150 million to advance its smart card technology and enhance its applications in IoT and secure payments.

Technological Advancements:

- AI and Machine Learning Integration: Smart cards are increasingly incorporating AI and machine learning to enhance security features, such as real-time fraud detection and adaptive authentication mechanisms.

- Contactless Payment Innovations: Advances in contactless payment technology are making smart cards more efficient, with faster transaction times and improved security protocols, supporting the growth of cashless societies.

Market Dynamics:

- Growth in Smart Card Market: The global smart card market is projected to grow at a CAGR of 8.7% from 2023 to 2028, driven by increasing adoption in banking, healthcare, and transportation sectors, as well as the rising need for secure identification and authentication.

- Increased Adoption in Healthcare: Smart cards are seeing increased adoption in the healthcare sector for applications such as patient identification, electronic health records, and secure access to medical services, enhancing operational efficiency and patient care.

Regulatory and Strategic Developments:

- EU’s Digital Identity Framework: The European Union is implementing a new digital identity framework that includes smart card technology to provide secure and interoperable digital identities for citizens and businesses, promoting trust in online transactions.

- Enhanced Security Standards: Industry bodies are developing and updating security standards for smart cards, ensuring that they meet the latest requirements for data protection and fraud prevention, particularly in financial services.

Research and Development:

- Quantum-Resistant Smart Cards: While R&D efforts are focusing on developing quantum-resistant cryptographic algorithms for smart cards to ensure their security against future quantum computing threats, maintaining long-term data protection.

- Biometric Integration: Researchers are exploring new ways to integrate biometric authentication with smart cards, such as facial recognition and voice recognition, to enhance security and user convenience.

Conclusion

Smart Card Statistics – Smart cards are a major advancement in secure data storage and transaction processing, utilizing embedded microprocessors and advanced security features to protect against fraud and unauthorized access.

However, their versatility allows them to be used in banking, telecommunications, government ID, and public transportation.

The adoption of standards like ISO/IEC 7816 and ISO/IEC 14443 ensures global interoperability and security.

Future developments are expected to integrate biometrics, expand use in the Internet of Things (IoT), and improve mobile compatibility for seamless, contactless transactions.

As technology evolves, smart cards will remain vital for secure digital identification and payment systems, meeting the growing demand for secure and convenient solutions.

FAQs

A smart card is a plastic card with an embedded integrated circuit chip that can store, process, and communicate data. It is used for secure identification, authentication, data storage, and application processing.

Smart cards work by communicating with a reader through direct physical contact or via radio frequencies (contactless). The card’s microprocessor handles the data processing, which can include encryption and decryption for secure transactions.

Smart cards offer high levels of security through encryption, tamper-resistant hardware, and secure key management protocols. They are widely used in applications that require secure data handling and authentication.

While both use radio frequency for communication, RFID cards are generally used for identification and tracking without processing capabilities. In contrast, smart cards have an embedded microprocessor that can process and store data.

Smart cards are typically issued by institutions such as banks, governments, and corporations. The issuance process includes personalizing the card with user-specific data and ensuring secure initialization. Management involves lifecycle management, including activation, deactivation, and updates.