Table of Contents

Introduction

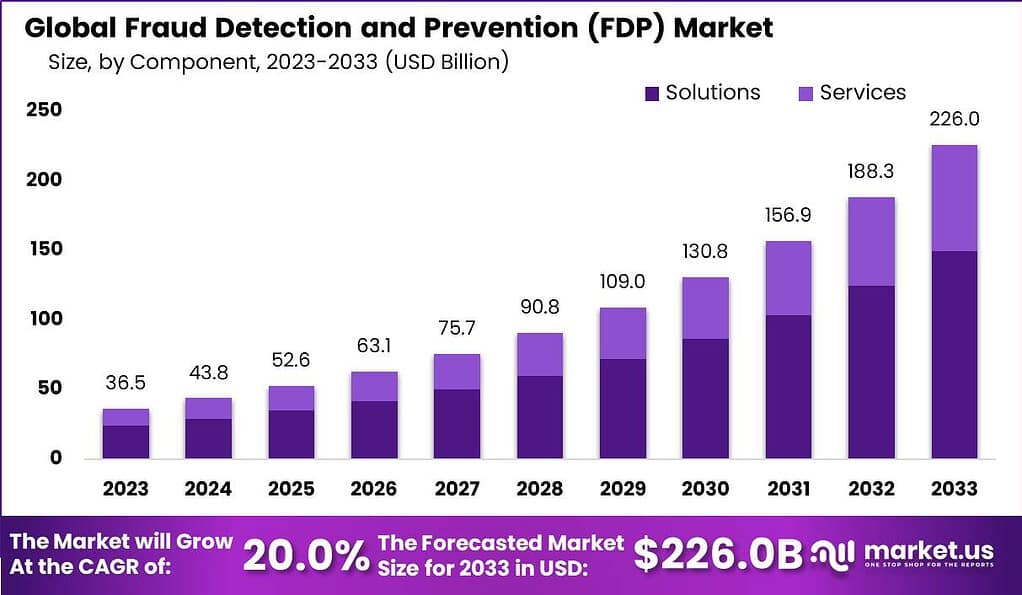

According to the Market.us, The global market for Fraud Detection and Prevention Market is projected to expand significantly, increasing from USD 36.5 billion in 2023 to an estimated USD 226.0 billion by 2033. This growth represents a Compound Annual Growth Rate (CAGR) of 20.0% from 2024 to 2033.

The Fraud Detection and Prevention (FDP) market is a critical area in today’s business landscape, aimed at identifying and mitigating unauthorized or fraudulent activities that can lead to financial losses and reputational damage. As businesses increasingly move their operations online, the need for robust FDP solutions has grown significantly.

This market is driven by several growth factors and one of the main growth factors in the FDP market is the sharp increase in online activities, which unfortunately includes fraudulent activities. This rise in fraud has driven the demand for advanced FDP solutions that can keep up with sophisticated fraudsters. Additionally, advancements in technology like artificial intelligence and machine learning have transformed FDP systems, making them smarter and more efficient at spotting potential threats.

One of the primary challenges in the FDP market is the constantly evolving nature of fraud tactics. Fraudsters continually adapt their strategies to bypass traditional detection methods, requiring FDP systems to be highly adaptive and updated regularly. Additionally, integrating these systems seamlessly into existing frameworks without disrupting user experience poses a significant technical challenge.

Despite these challenges, the FDP market presents numerous opportunities. The integration of artificial intelligence and machine learning technologies has greatly enhanced the effectiveness of fraud detection systems, enabling them to learn from new patterns of fraud and predict potential threats with greater accuracy. Furthermore, the global expansion of digital payments and e-commerce platforms has broadened the scope for FDP solutions, making it an indispensable tool for businesses looking to secure their operations. These technologies not only improve the speed and accuracy of fraud detection but also help in building trust with customers who feel safer conducting transactions online.

Key Takeaways

- The Fraud Detection and Prevention (FDP) Market is anticipated to reach USD 226.0 billion by 2033, growing at a robust CAGR of 20.0% from 2024 to 2033, up from USD 36.5 billion in 2023.

- Solutions such as fraud analytics, governance, risk and compliance (GRC), and authentication systems are leading the market, commanding over 66.1% market share in 2023. This dominance underscores the increasing reliance on sophisticated tools to combat fraud effectively.

- Payment Fraud is at the forefront, holding more than 47.5% of the market share in 2023. This surge is attributed to the exponential rise in online banking, e-commerce, and digital wallet usage, necessitating stringent fraud prevention measures.

- Large Enterprises represent a significant portion of the market, with a share of 72.8% in 2023. These organizations require comprehensive FDP solutions due to their complex structures and high susceptibility to fraudulent activities.

- The Banking, Financial Services, and Insurance (BFSI) sector accounted for over 27.6% of the market share in 2023. The high volume of monetary assets managed within this sector makes it a prime target for fraud, thereby driving the demand for advanced FDP solutions.

- North America led the market in 2023, with a substantial share of 43.1%. This is driven by the region’s technological advancements, robust regulatory framework, and widespread digitalization efforts, positioning it as a pivotal player in the FDP market.

Fraud Detection and Prevention Statistics

- The Association of Certified Fraud Examiners (ACFE) estimates that US businesses lose an average of 5% of their gross annual revenues to fraud. In India, 52% of organizations experienced some form of fraud or economic crime within the last 24 months, with 12% encountering ESG reporting fraud.

- Nearly 67% of fraud incidents in Indian organizations stemmed from external attacks or collusion between external and internal sources. External fraudsters, often immune to traditional fraud prevention measures like codes of conduct and training, are significant perpetrators. Among these external actors, 49% were hackers, 41% were customers, and 31% involved organized crime.

- During the COVID-19 pandemic, US federal regulators fined the Bank of America USD 225 million for a faulty fraud detection system. The 2024 report indicates that 53% of fraud cases had pandemic-related factors, marking an increase in median losses for the first time since 2016.

- In government organizations, the median loss per fraud case was $150,000, with corruption more prevalent at the national level. Although only 4% of fraud cases involved cryptocurrency, this number is expected to rise. 47% of these cases included the conversion of stolen assets into cryptocurrency, and 33% involved bribery or kickback payments in cryptocurrency.

- The Latin America and Caribbean region had the highest median loss per fraud case at $250,000. The Asia-Pacific and Eastern Europe/Western-Central Asia regions followed, each with a median loss of $200,000. Southern Asia and Eastern Europe/Western-Central Asia had the highest percentages of corruption cases, at 74% and 71%, respectively.

- A typical fraud case lasted about 12 months before detection, with 43% of frauds discovered through tips, more than half of which came from employees. Perpetrators were predominantly male (74%) and aged between 31 and 50 years (69%), with 87% having no prior fraud-related charges or convictions.

Emerging Trends

- AI and Machine Learning Integration: The integration of AI and machine learning technologies is a key trend, enhancing the efficiency and accuracy of fraud detection systems. These technologies enable real-time decision-making and predictive analytics, which help in identifying potential fraud before it occurs.

- Rise of Synthetic Identity Fraud: There’s a notable rise in synthetic identity fraud, where fraudsters combine real and fake information to create new identities. This type of fraud is becoming more common and difficult to detect, pushing organizations to innovate more sophisticated detection mechanisms.

- Fraud-as-a-Service (FaaS): The emergence of FaaS, where fraud capabilities are offered as a service, is enabling even non-tech-savvy criminals to carry out sophisticated fraud schemes. This has made fraud more accessible and increased the overall volume of attacks.

- Regulatory Pressure and Compliance: Increased regulatory requirements across the globe are pushing businesses to adopt robust fraud prevention measures. This includes complying with stringent data protection laws and financial regulations, which in turn drives the adoption of advanced FDP solutions.

- Open Banking and API-Driven Integration: Leveraging open banking frameworks and APIs for improved fraud detection through enhanced data sharing and interoperability .

- Cross-Functional Fraud Management Teams: Establishment of dedicated, cross-functional teams to develop comprehensive fraud prevention strategies utilizing diverse expertise.

- Cross-Border and Multi-Channel Fraud: As businesses expand globally and online transactions increase, fraud attempts are also becoming more international and diversified across multiple channels. This compels businesses to implement comprehensive fraud prevention strategies that cover various operational areas and geographies.

Top Use Cases

- Payment Fraud Prevention: One of the most critical use cases is in the prevention of payment fraud, which includes credit card fraud, wire transfer fraud, and new account fraud. FDP systems are used to monitor and analyze transaction behaviors in real-time to detect anomalies that may indicate fraudulent activities.

- Identity Verification: Solutions like Prove Identity use mobile authentication to secure transactions, preventing unauthorized access and enhancing user verification processes.

- Account Takeover Prevention: This involves detecting and preventing unauthorized access to user accounts. FDP systems monitor login patterns and verify user credentials to detect anomalies that may suggest an account takeover attempt.

- AML and KYC Compliance: Financial institutions employ these systems to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, effectively reducing legal risks and potential fines.

- Internal Fraud Management: Especially within financial institutions, fraud detection systems are crucial for monitoring employee actions and preventing internal fraud, which can lead to significant losses.

- Advanced Analytics for Fraud Detection: Leveraging data analytics and machine learning, these systems can detect complex fraud patterns, often in real time, thus significantly improving the effectiveness of fraud prevention strategies.

- Identity Verification: Solutions like Prove Identity use mobile authentication to secure transactions, preventing unauthorized access and enhancing user verification processes.

- Healthcare Fraud Management: In healthcare, these systems detect fraudulent activities such as billing for services not rendered or upcoding, which can lead to substantial financial savings.

Major Challenges

- Rapid Technological Advancements: The FDP market is pressured to continuously adapt to rapidly evolving technologies, especially as fraudsters leverage sophisticated methods to bypass security measures.

- Integration Complexity: Integrating FDP solutions with existing systems can be complex and challenging, requiring substantial time and technical expertise.

- Data Privacy Concerns: Ensuring compliance with data protection regulations (like GDPR in Europe) is critical and challenging as it requires that FDP solutions manage and protect sensitive data without compromising privacy.

- Skill Shortages: There is a significant gap in the availability of skilled professionals who are adept at managing modern FDP tools, which hampers the effectiveness of fraud prevention initiatives.

- High Costs: Implementing and maintaining effective FDP systems can be costly, especially for small to medium enterprises (SMEs) that may lack the financial resources for advanced solutions.

Market Opportunities

- Biometric Technologies: The use of biometric technologies for fraud prevention, such as fingerprint and facial recognition, is gaining traction. These technologies offer a reliable method for user identification and are crucial in preventing identity-related frauds.

- Big Data Analytics: The capability to process and analyze vast amounts of transaction data in real-time is increasingly important. Big Data analytics plays a critical role in identifying fraudulent patterns and enhancing decision-making processes within FDP systems.

- Diverse End-user Applications: Beyond traditional banking and financial services, sectors such as healthcare, retail, and e-commerce are rapidly adopting FDP solutions to protect sensitive data and prevent fraud in transactions.

- Innovative Product Offerings: Companies are continuously innovating and expanding their product portfolios to include more advanced and comprehensive FDP solutions. This not only helps in staying ahead of fraudsters but also caters to a broader market, including small and medium-sized enterprises (SMEs) which are now able to afford such technologies due to cloud solutions and as-a-service models.

- Cloud-Based Solutions: There is a rising demand for cloud-based FDP solutions, which offer scalability, flexibility, and cost-effectiveness. These systems facilitate real-time updates and seamless access to advanced analytics, making them ideal for organizations looking to quickly adapt to new fraud patterns.

- Expansion in Emerging Markets: Regions like Asia-Pacific, Latin America, and Africa are experiencing rapid digital transformation, increasing the demand for effective FDP solutions. As these markets continue to grow, the opportunity for FDP providers to expand their presence is significant.

Recent Developments

- January 2024: SAP announced a partnership with a leading cybersecurity firm to enhance its fraud detection capabilities using advanced AI and machine learning technologies

- June 2024: SAS unveiled a collaboration with a fintech company to integrate its fraud detection solutions with blockchain technology, aiming to enhance transaction security.

- April 2024: FICO partnered with several major banks to deploy its enhanced fraud prevention solutions across their digital banking platforms .

- April 2023: IBM launched the latest version of its X-Force Threat Intelligence Index, featuring enhanced capabilities for fraud detection and prevention, with insights into attacker tactics and strategies to safeguard identities.

- May 2023: IBM introduced new features in its IBM Security Trusteer, aimed at improving real-time fraud detection and identity authentication across multiple channels.

- February 2023: SAS launched a new version of its Fraud Management and Detection Software, which now supports multiple channels and lines of business, allowing for enterprise-wide monitoring from a single platform.

- November 2023: Experian introduced a new fraud detection platform that leverages big data analytics to provide real-time alerts and reduce false positives.

- July 2023: FICO updated its Falcon Fraud Manager, incorporating new machine learning algorithms to improve the speed and accuracy of fraud detection in credit card transactions.

Conclusion

In conclusion, the Fraud Detection and Prevention market is a dynamic field that plays a crucial role in safeguarding business assets and maintaining consumer trust. The FDP market is vital for protecting businesses and their customers from financial loss and maintaining trust in digital platforms. While it faces challenges such as rapidly advancing fraud techniques and integration issues, the continued technological advancements and growing digital landscape provide substantial opportunities for growth and improvement in this sector.

As technology evolves, so does the sophistication of fraud schemes, underscoring the importance of advanced FDP systems. These systems leverage machine learning, artificial intelligence, and big data analytics to detect and prevent fraudulent activities in real time, offering robust solutions that adapt to the dynamic landscape of threats.

The market is expected to continue its growth trajectory, fueled by technological advancements and the increasing necessity for security in digital and financial interactions. Looking ahead, the integration of FDP systems with emerging technologies like blockchain and predictive analytics presents new opportunities for market expansion. However, challenges such as data privacy concerns and the need for high-cost investments in advanced systems remain. Nevertheless, as long as the digital economy continues to expand, the FDP market will remain a critical and ever-evolving field, essential for safeguarding assets and building trust in modern economic structures.