Table of Contents

Introduction

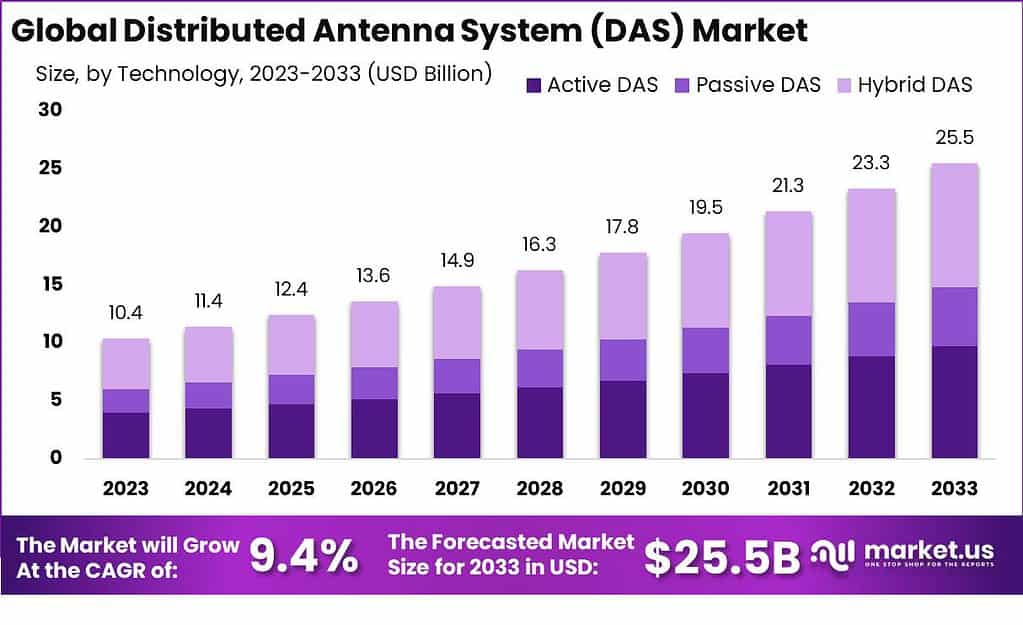

According to Market.us, The Distributed Antenna Systems (DAS) market is projected to expand from USD 10.4 billion in 2023 to approximately USD 25.5 billion by 2033. This represents a compound annual growth rate (CAGR) of 9.4% over the forecast period from 2024 to 2033. Distributed Antenna Systems (DAS) are a crucial component of modern wireless communication networks. They are designed to enhance cellular coverage and capacity in areas where the existing network infrastructure is insufficient. DAS technology distributes wireless signals through a network of antennas strategically placed throughout a building or a geographical area.

The Distributed Antenna Systems (DAS) market is witnessing significant growth due to the increasing demand for consistent and enhanced cellular coverage within large and complex structures like stadiums, hospitals, and high-rise buildings. This growth is further propelled by the rapid advancements in wireless communication technologies and the escalating number of mobile users globally. Moreover, the expansion of 5G networks is presenting substantial opportunities for the deployment of new DAS to handle the greater capacity and faster speeds required.

However, the DAS market faces challenges, primarily associated with the high initial investment and complexity involved in the installation of these systems. Each system must be customized to the specific architecture of a building, which can be both time-consuming and resource-intensive. Additionally, regulatory compliance and the need for coordination with multiple wireless carriers can complicate the deployment process.

Despite these challenges, opportunities abound as more organizations recognize the critical need for reliable mobile communication infrastructure to support various business operations and customer experiences. The ongoing technological innovations in DAS components and design are also making these systems more efficient and less obtrusive, which could drive further adoption in various sectors looking to upgrade their connectivity solutions

Key Takeaways

- The Distributed Antenna Systems (DAS) market is anticipated to reach a value of approximately USD 5.5 billion by 2033, with a projected compound annual growth rate (CAGR) of 7.6%.

- In 2023, the Hybrid DAS segment prominently distinguished itself, securing a significant market share of over 42%. This position underscores its dominant role within the market structure.

- In the same vein, Carrier Ownership emerged as a pivotal market player in 2023, achieving a robust market share of more than 38%. This indicates its central role in the deployment and management of DAS networks.

- The application segment of Public Venues & Safety also demonstrated substantial market influence, accounting for over 23% of the market share in 2023. This reflects its critical importance in ensuring communication reliability and safety in public spaces.

- Geographically, North America maintained a leading position in the DAS market, commanding a significant market share exceeding 40%. The region’s market value was estimated at USD 4.2 billion in 2023, illustrating strong demand and ongoing investment in DAS technologies.

Distributed Antenna Systems (DAS) Statistics

- According to market.us data, the Distributed Antenna Systems (DAS) market experienced steady growth in recent years. In 2023, the market size was estimated at $10.4 billion, indicating a positive trend. The following year, in 2024, the market witnessed further growth, reaching $11.4 billion.

- The positive trajectory continued, and in 2025, the DAS market expanded to $12.4 billion, showcasing a consistent increase in market size. Subsequently, in 2026, the market grew to $13.6 billion, indicating sustained upward momentum.

- As the demand for enhanced wireless connectivity persisted, the DAS market continued to thrive. In 2027, the market size reached $14.9 billion, demonstrating continued growth. The subsequent year, in 2028, the market expanded further to $16.3 billion, solidifying its upward trajectory.

- The positive trend persisted, and in 2029, the DAS market reached $17.8 billion, indicating a substantial increase in market size. By 2030, the market continued to flourish, reaching $19.5 billion, reflecting continued demand for DAS solutions.

- Looking ahead, market projections forecasted continued growth for the DAS market. In 2031, the market size is anticipated to reach $21.3 billion, indicating sustained expansion. The following year, in 2032, the market is projected to grow to $23.3 billion, highlighting the upward trajectory.

- The market research analysis concludes with a forecast for the DAS market to reach $25.5 billion in 2033, showcasing continued growth and strong market potential.

- According to the Centers for Disease Control and Prevention, 51% of American households solely use cell phones, indicating a decline in landline usage. This shift underscores the growing dependency on mobile connectivity.

- Active Distributed Antenna Systems (DAS) represent a significant investment, often costing millions of dollars and requiring over a year to implement. For a system covering a single carrier, the expense ranges from $2 to $4 per square foot.

- For solutions accommodating multiple carriers, the cost escalates to between $5 and $10 per square foot. Additionally, there may be ongoing fees associated with the necessary fiber optics and backhaul services.

- There are approximately 5.6 million commercial buildings across the United States.

- A vast majority, 94%, of U.S. commercial buildings are under 50,000 square feet, and 88% are less than 25,000 square feet.

- Only about 2% of these commercial structures are viable candidates for active DAS installations due to their larger size, specifically those exceeding 100,000 square feet.

- In contrast, the costs for hardware and installation of passive DAS are significantly lower, ranging from 30 cents to 70 cents per square foot.

Emerging Trends

- Integration with 5G Technology: As 5G networks continue to expand globally, the demand for DAS is increasing, particularly for indoor applications where 5G signals are weaker. DAS is becoming an essential component in delivering the dense network infrastructure required for 5G.

- IoT Connectivity: The proliferation of IoT devices across industries is driving the need for more robust wireless communication infrastructures. DAS is critical in environments that require a high density of connected devices, enhancing both coverage and capacity.

- Smart Buildings and Cities: With the rise of smart buildings and smart city initiatives, DAS is increasingly deployed to manage the complex network requirements of these technologically advanced environments, ensuring continuous and reliable wireless service.

- Higher Adoption in Public Safety: There is a growing emphasis on using DAS for public safety applications. In emergencies, reliable communication inside buildings can be crucial, making DAS a key component in public safety strategies.

- Neutral-host Models: This model is gaining popularity because it allows a single DAS to support multiple service providers. It’s particularly effective in large venues like stadiums or transportation hubs, where installing multiple infrastructures is impractical.

Top Use Cases for DAS

- Stadiums and Arenas: To manage the high volume of mobile traffic and enhance fan experience, DAS systems are extensively used in stadiums and arenas, ensuring robust connectivity even during high-demand events.

- Transportation Hubs: Airports, metro stations, and bus terminals utilize DAS to provide uninterrupted cellular coverage and support for public Wi-Fi networks, improving the traveler experience and operational efficiencies.

- Healthcare Facilities: Hospitals and clinics deploy DAS to support critical communication needs, mobile health technology applications, and IoT devices, which are vital for patient care and hospital operations.

- Educational Institutions: Universities and schools use DAS to support digital learning tools, enhance campus safety through improved emergency communication systems, and ensure connectivity across large campus areas.

- Commercial Real Estate: Office buildings and commercial complexes use DAS to attract and retain tenants by ensuring high-quality indoor wireless service, which is increasingly viewed as a utility rather than a luxury.

Major Challenges

- High Installation and Maintenance Costs: Deploying a DAS can be expensive due to the cost of equipment, labor, and ongoing maintenance. The complexity of designing a system that fits a specific building’s layout and requirements can also add to the costs.

- Integration with Existing Infrastructure: Integrating DAS with existing IT and communication infrastructures can be challenging. Ensuring compatibility with existing systems, minimizing disruptions, and adhering to building codes and regulations requires careful planning and technical expertise.

- Signal Interference and Optimization: DAS must manage various frequencies and signals from multiple carriers, which can lead to interference issues. Optimizing the system to provide clear and reliable signals across different areas of a building is a technical challenge.

- Scalability and Flexibility: As building needs and technologies evolve, DAS must be scalable and flexible to accommodate new requirements. This means planning for future upgrades and expansions without major overhauls, which can be difficult to achieve.

- Regulatory and Approval Processes: Deploying DAS often involves obtaining approvals from multiple stakeholders, including building owners, local authorities, and wireless carriers. Navigating these regulatory processes can be time-consuming and complicated.

Market Opportunities

- Growing Demand for In-Building Coverage: The increasing reliance on mobile devices and the need for reliable wireless coverage inside buildings, such as offices, hospitals, and shopping malls, is driving demand for DAS. Enhancing user experience by ensuring consistent connectivity is a significant opportunity.

- Support for IoT and Smart Buildings: DAS plays a crucial role in supporting Internet of Things (IoT) applications and smart building technologies. Efficient wireless coverage enables the seamless operation of IoT devices, optimizing building management and energy usage.

- Expansion of 5G Networks: The rollout of 5G technology offers significant opportunities for DAS. Upgrading existing DAS to support 5G can provide high-capacity, low-latency connections required for advanced applications like autonomous vehicles and augmented reality.

- Public Safety and Emergency Services: DAS is critical for supporting public safety communication systems. Ensuring reliable connectivity for emergency responders inside buildings and in large public venues is a key market driver.

- Growing Smart City Initiatives: The development of smart cities, with their focus on connected infrastructure and enhanced public services, presents a significant market opportunity for DAS. Integrating DAS into urban planning can support a wide range of applications, from traffic management to public safety.

Recent Developments

- January 2024: AFL, a global producer of fiber optic cable and accessories, acquired Forza Telecom, known as DAS Group Professionals (DGP). This acquisition enhances AFL’s capabilities in providing specialized indoor and outdoor DAS solutions, broadening its portfolio and service offerings in the DAS market.

- March 2024: American Tower Corporation acquired a significant portfolio of DAS assets in the United States. This acquisition is intended to expand their market presence and support the deployment of next-generation wireless networks.

- May 2024: SOLiD announced that Wireless Services selected their ALLIANCE 5G DAS to improve indoor wireless coverage. This selection underscores SOLiD’s capability to meet the growing demand for 5G infrastructure.

- June 2023: CommScope entered into a partnership with JTOWER, a neutral host service provider. This collaboration aims to maximize the use of broadband resources, improve network performance, and provide better connectivity for end users.

- January 2023: Anixter announced a strategic partnership with Wesco International, enhancing their supply chain solutions for DAS. This collaboration aims to streamline the deployment of DAS technologies across various sectors.

- July 2023: TE Connectivity introduced a new range of DAS components that are optimized for high-density environments like stadiums and large commercial buildings. These components are designed to improve signal strength and coverage in challenging environments

Conclusion

In conclusion, the Distributed Antenna Systems (DAS) market is witnessing significant growth driven by the increasing demand for seamless wireless connectivity. While challenges like deployment costs and coordination complexities exist, the opportunities for DAS vendors to provide innovative solutions and cater to the evolving needs of 5G networks are substantial. As technology continues to advance, the DAS market is poised for further expansion and development.