Table of Contents

Introduction

According to Autonomous Ships Statistics, Autonomous ships are cutting-edge maritime vessels capable of operating independently without direct human control. Using a combination of advanced sensors, navigation systems, and artificial intelligence.

Depending on the situation, these ships can function in various operational modes, including fully autonomous, remotely operated, and hybrid.

They promise benefits such as reduced operational costs and increased safety by minimizing human error. However, they face challenges like technical reliability, Cybersecurity risks, and the need for evolving regulations.

As technology advances, integrating ships into the maritime industry is expected to progress. Aiming to enhance efficiency and safety while addressing regulatory and safety concerns.

Editor’s Choice

- The launch of Yara Birkeland, the world’s first fully electric and autonomous container ship, in 2020, represented a significant milestone.

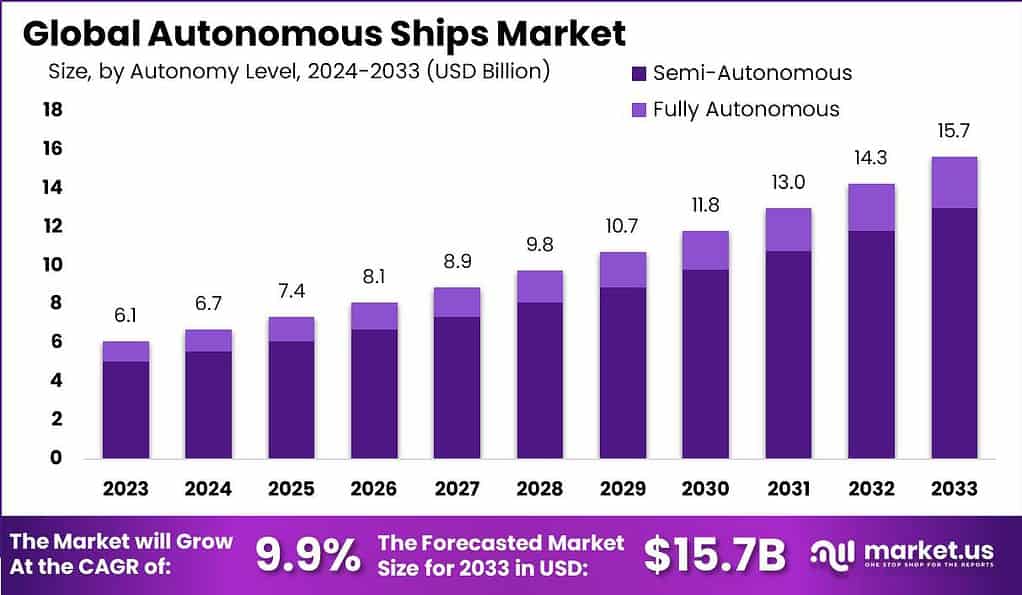

- The global autonomous ships market revenue reached USD 6.1 billion in 2023.

- Meanwhile, fully autonomous ships are projected to contribute USD 2.22 billion in 2031, USD 2.45 billion in 2032, and USD 2.68 billion by 2033.

- In the global autonomous ships market, the hardware component holds a dominant position, accounting for 77.5% of the total market share.

- In the autonomous ships market, the commercial sector emerges as the predominant end-use segment, commanding 64.2% of the market share.

- In the autonomous ships market, ABB leads with a market share of 15%. Reflecting its strong position in providing advanced maritime automation solutions.

- The regional distribution of the autonomous ships market reveals a leading share held by the Asia-Pacific (APAC) region, which commands 31.4% of the market.

- The majority of respondents believe that the presence of crew onboard vessels will remain crucial for shipboard operations in the future, with 84% affirming this view.

History of Autonomous Ships

- The history of autonomous ships has evolved significantly since the 1970s, when the first concepts of unmanned vessels emerged.

- In the 1980s and 1990s, advancements were primarily theoretical. With research focused on the potential benefits and technological feasibility of autonomous navigation systems.

- By the early 2000s, practical developments began, marked by the launch of various prototypes and pilot projects.

- One of the earliest notable projects was the European Union’s MUNIN (Maritime Unmanned Navigation through Intelligence in Networks). Which in 2016 demonstrated the potential of ships for long-distance maritime transport.

- The 2010s saw major strides, with companies like Rolls-Royce and Kongsberg unveiling plans for commercial autonomous vessels.

- The launch of Yara Birkeland, the world’s first fully electric and autonomous container ship, in 2020, represented a significant milestone.

Autonomous Ships Market Overview

Global Autonomous Ships Market Size

- The global autonomous ships market has exhibited a steady upward trajectory in recent years at a CAGR of 9.9%, with revenue amounting to USD 6.1 billion in 2023.

- The trend of growth is projected to persist into the next decade, with the market anticipated to generate USD 11.8 billion in 2030, USD 13.0 billion in 2031, USD 14.3 billion in 2032, and culminating at USD 15.7 billion by 2033.

Global Autonomous Ships Market Size – By Autonomy Level

- The global autonomous ships market is poised for significant growth. Total revenue is projected to rise from USD 6.1 billion in 2023 to USD 15.7 billion by 2033.

- In 2023, semi-autonomous ships accounted for USD 5.06 billion, while fully autonomous ships contributed USD 1.04 billion.

- Meanwhile, fully autonomous ships are projected to contribute USD 2.22 billion in 2031, USD 2.45 billion in 2032, and USD 2.68 billion by 2033.

Competitive Landscape of Global Autonomous Ships Market

- In the autonomous ships market, ABB leads with a market share of 15%. Reflecting its strong position in providing advanced maritime automation solutions.

- Following closely, Wartsila holds 14% of the market, emphasizing its significant contribution to the industry’s technological advancements.

- Rolls-Royce accounts for 13% of the market share, showcasing its prominent role in developing innovative autonomous ship systems.

- Kongsberg Gruppen has a 12% market share, underscoring its expertise in integrated maritime automation.

- L3 ASV captures 11% of the market, indicating its substantial involvement in the autonomous maritime sector.

- Rh Marine follows with a 10% market share, highlighting its contributions to maritime automation technologies.

- Siemens holds 9% of the market, reflecting its pivotal role in integrating autonomous solutions within the maritime industry.

- Other key players collectively account for 16% of the market share. Demonstrating the diverse and competitive nature of the autonomous ships market.

Regional Analysis of Global Autonomous Ships Market

- The regional distribution of the autonomous ships market reveals a leading share held by the Asia-Pacific (APAC) region, which commands 31.4% of the market. This dominance is attributed to the region’s rapid technological advancements, extensive maritime activities, and significant investments in autonomous maritime technologies.

- North America follows with a 28.0% market share. Reflecting its strong focus on innovation and the early adoption of autonomous shipping solutions.

- Europe holds a close 27.7% share, driven by its robust maritime industry and supportive regulatory frameworks.

- South America accounts for 8.0% of the market, indicating a growing interest in ships, albeit at a slower pace compared to the leading regions.

- The Middle East and Africa (MEA) region holds a 4.9% market share. Highlighting emerging opportunities and gradual advancements in autonomous maritime technologies within these regions.

Global Container Shipping Statistics

Global Container Shipping Market Volume – Growth Rate

- The global container shipping market has experienced fluctuating growth rates from 2015 to 2022.

- In 2015, the market saw a slight decline with a growth rate of -0.4%.

- By 2022, the growth rate stabilized at 3.7%, indicating steady progress and resilience in the global container shipping market amidst varying economic conditions.

Specifications of Autonomous Ships

- Autonomous ships, such as the Yara Birkeland and those developed under the AUTOSHIP project, are equipped with advanced technologies that allow for efficient, safe, and environmentally friendly maritime operations.

- Key specifications include extensive sensor arrays capable of detecting and classifying objects up to several kilometers away. Ensuring effective situational awareness and collision avoidance.

- The Yara Birkeland, for instance, uses a fully electric propulsion system. Contributing to zero emissions and reducing diesel truck journeys by 40,000 annually. Its dimensions are approximately 80 meters in length and 15 meters in width.

- Kongsberg Maritime’s systems, utilized in many ships, feature robust radar and GPS integration, supporting autonomous navigation over long distances. With operational ranges often exceeding 500 nautical miles (NM).

- These ships are also designed with substantial data storage and processing capabilities to handle complex navigational tasks and remote operations from control centers like Kongsberg’s Remote Operating Centre (ROC), which can control and monitor multiple vessels simultaneously.

Benefits of Autonomous Ships

Sectors Benefiting from Autonomous Ships

- The adoption of autonomous operations is anticipated to benefit several sectors within the shipping industry significantly.

- According to respondents, the container ships—deep sea sector shows the highest potential, with 57.58% recognizing its benefits.

- Container ships—short sea also stand to gain, with 46.19% of respondents in favor.

- The tanker sector is similarly poised for an advantage. With 45.03% acknowledging its potential, closely followed by general cargo ships at 44.87%.

- Car carriers could benefit as well, with 42.05% of respondents indicating a positive impact.

- Offshore operations, recognized by 31.79% of respondents, and inland waterways, with 32.28%, also present significant opportunities for autonomous technology integration.

- Other sectors that could see benefits include specialist vessels (30.3%), ferries—short sea (30.13%), and ferries—coastal (26.66%).

- Dredging and hydraulic operations (26.32%) and ferries—international (14.07%) show more moderate potential.

- The passenger liners/cruise sector (9.93%) and yachts (10.1%) appear less likely to benefit substantially from autonomous operations. Reflecting lower respondent endorsement.

Challenges and Concerns

- The majority of respondents believe that the presence of crew onboard vessels will remain crucial for shipboard operations in the future, with 84% affirming this view.

- A smaller segment, comprising 10% of respondents, considers crew presence to be unessential. Indicating a minority belief in the feasibility of fully autonomous operations without a crew.

- Additionally, 6% of respondents believe that crew will be essential only in crowded areas. Suggesting a conditional need for crew depending on the operational environment.

Regulations for Autonomous Ships

- The regulations for autonomous ships are evolving globally, with significant progress made in Europe and specific advancements in countries like Norway, the UK, Belgium, Denmark, and the Netherlands.

- Moreover, these nations have signed an agreement to facilitate the operation of ships in the North Sea, establishing common technical standards and solutions pending international regulations by the International Maritime Organization (IMO) expected by 2025.

- The IMO has also categorized different levels of ship autonomy. Ranging from remote control with crew on board to fully autonomous vessels. National regulations currently govern most autonomous shipping projects, with international guidelines still under development.