Table of Contents

Introduction

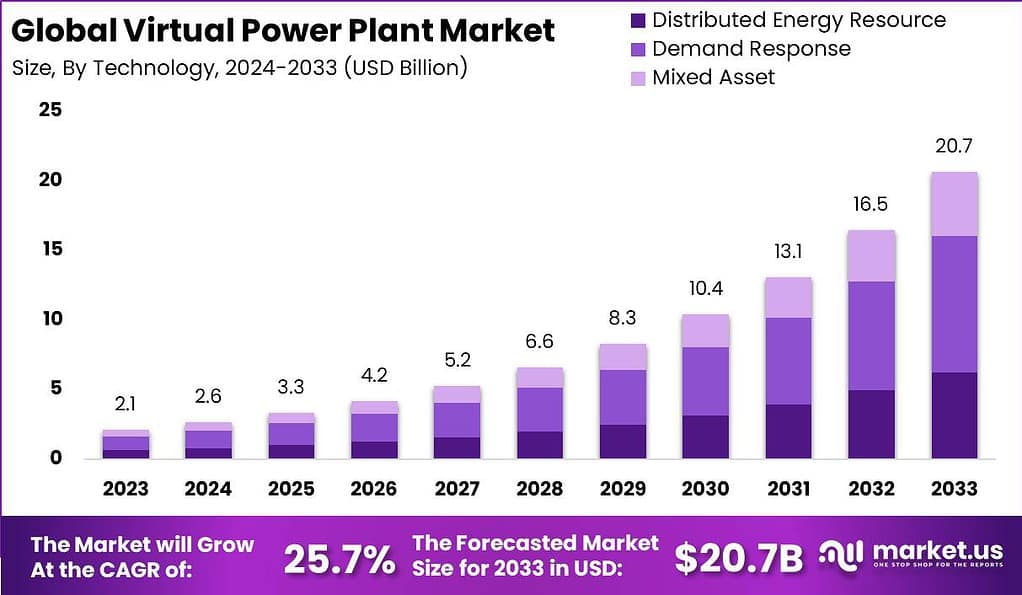

According to market.us, The Global Virtual Power Plant Market is projected to grow from USD 2.1 billion in 2023 to approximately USD 20.7 billion by 2033, with an impressive compound annual growth rate (CAGR) of 25.7% during the forecast period from 2024 to 2033.

A Virtual Power Plant (VPP) is a network of decentralized, small-scale power generating units (such as solar panels, wind turbines, and battery storage systems) and flexible power consumers (like electric vehicles and smart appliances) managed through a central control system. Unlike traditional power plants, which generate electricity from a single location, a VPP aggregates the capacity of various distributed energy resources (DERs) to optimize power generation, storage, and consumption across a region.

The Virtual Power Plant (VPP) market is a dynamic and rapidly growing sector that leverages advanced technology to manage and distribute electricity generated from various decentralized energy sources like solar panels, wind turbines, and battery storage systems. This market is experiencing growth due to several factors. Firstly, there’s a global push towards renewable energy, which fits perfectly with the flexible and sustainable nature of VPPs. Secondly, improvements in technology such as better battery storage and smarter software that can predict energy demand and optimize supply are also driving growth.

However, this market faces some challenges. Integrating different types of energy sources and technology while maintaining reliability and efficiency can be complex. Regulatory and market barriers also pose significant challenges as the energy sector is highly regulated and changes can be slow. Despite these challenges, the opportunities in the VPP market are significant.

There is a growing demand for more resilient and efficient energy systems, especially in areas prone to extreme weather or where energy infrastructure is old. Additionally, as more regions and countries commit to reducing carbon emissions, the role of VPPs in achieving these goals becomes even more critical. This makes the VPP market not only a necessary evolution in energy management but also a promising area for innovation and investment.

Key Takeaways

- The Virtual Power Plant (VPP) Market is set for substantial growth, with projections indicating an increase in market value from USD 2.1 billion in 2023 to USD 20.7 billion by 2033. This growth trajectory represents a Compound Annual Growth Rate (CAGR) of 25.7% from 2024 to 2033.

- In 2023, the Demand Response segment significantly led the VPP market, capturing over 47.5% of the total market share.

- Additionally, the Industrial segment played a pivotal role in the VPP landscape in 2023, accounting for more than 43% of the market share.

- Geographically, North America maintained its leadership in the VPP market in 2023, holding more than 37% of the market share, which translated into revenues of approximately USD 0.7 billion.

Virtual Power Plant Statistics

- Over the past decade, the US has invested over USD 120 billion in developing 100 GW of new generation capacity, primarily to enhance resource adequacy. According to a study by the Boston-based Brattle Group, utilities could potentially achieve cost savings of up to USD 35 billion by 2033 by adopting Virtual Power Plants (VPPs) for peaker capacity.

- Virtual Power Plants are projected to offer USD 15 billion to USD 35 billion in savings on capacity investments for US utilities over the next decade.

- Currently, the Department of Energy in the United States estimates the capacity of VPPs to be between 30 to 60 gigawatts, which constitutes approximately 4% to 8% of the peak electricity demand.

- The enhancement of smart grids and IoT technologies is significantly improving the efficiency and reliability of VPPs. Notably, Nokia launched a VPP Controller Software in 2024, designed to enable mobile operators to monetize backup batteries at base station sites.

- The Brattle Group’s Resource Adequacy Study analyzed a utility serving 1.7 million residential customers, facing a gross peak demand of 5.7 GW and a net peak demand of 3.6 GW, after accounting for contributions from solar and wind resources. The utility’s strategic goal is to produce 50% of its electricity from renewable sources by 2030.

- The study revealed that employing Virtual Power Plants (VPPs) as peaker resources would be economically advantageous, with costs 40% to 60% lower than those associated with traditional gas peakers and grid-scale battery solutions. This finding underscores the cost-effectiveness and potential of VPPs in enhancing grid reliability and efficiency in the face of increasing renewable integration.

Emerging Trends

- Grid Optimization and Resilience Virtual power plants (VPPs) are being increasingly adopted to enhance grid optimization and resilience. VPPs leverage distributed energy resources like solar panels and energy storage devices, using advanced software and control technologies to stabilize and improve grid reliability. This trend is particularly significant in regions prone to extreme weather events, where VPPs can aid in quick grid restoration and minimize disruptions.

- Integration of Renewable Energy Sources The growing use of renewable energy sources, particularly solar and wind, is a major driver for VPPs. These plants integrate diverse renewable energy sources into a cohesive network, which helps in balancing supply and demand, reducing reliance on fossil fuels, and lowering greenhouse gas emissions. This integration is crucial for transitioning to more sustainable and cleaner energy systems.

- Advancements in Mixed Asset VPPs Mixed asset virtual power plants, which combine different types of energy resources and storage, are gaining traction. These VPPs provide critical grid services such as frequency regulation, voltage support, and reactive power control. This capability enhances grid stability and reliability, making mixed asset VPPs an attractive solution for managing the variability of renewable energy sources and ensuring a consistent power supply.

- Government and Regulatory Support Governments and regulatory bodies worldwide are promoting the adoption of VPPs through supportive policies, incentives, and regulations. For example, North America has seen significant government initiatives aimed at clean energy promotion, which has created a favorable environment for VPP deployment. Similarly, Europe’s strong commitment to sustainability and advanced grid infrastructure has positioned it as a leader in the VPP market.

- Commercial and Residential Sector Adoption The adoption of VPPs is growing across both commercial and residential sectors. In the commercial sector, businesses are leveraging VPPs to optimize energy use, reduce costs, and participate in demand response programs. In the residential sector, the rising popularity of distributed energy resources like rooftop solar panels and home energy storage systems allows homeowners to generate, store, and sell excess energy back to the grid, promoting energy self-sufficiency and reducing electricity bills.

- Mixed Asset VPPs: These VPPs, which manage a mix of renewable energy sources and storage, are gaining traction for their ability to enhance grid stability and reliability by smoothing out the variability of renewables and ensuring a consistent power supply.

Top Use Cases

- Grid Balancing and Stability: VPPs aggregate distributed energy resources (DERs) such as solar panels, wind turbines, and battery storage to create a network that can balance electricity supply and demand. This helps to stabilize the grid, especially as more intermittent renewable energy sources are integrated.

- Residential Energy Management: In the residential sector, VPPs enable homeowners with solar panels and battery storage to manage their energy use more efficiently. They can store excess energy generated during the day and use it during peak demand periods, potentially selling surplus power back to the grid.

- Commercial and Industrial Optimization: VPPs are used by commercial and industrial facilities to optimize energy consumption and reduce costs. These facilities can participate in demand response programs, reducing their power usage during peak periods in exchange for financial incentives. This not only cuts costs but also supports grid stability.

- Electric Vehicle (EV) Integration: VPPs facilitate the integration of EVs into the energy grid. Through Vehicle-to-Grid (V2G) technology, EVs can act as mobile energy storage units, providing power back to the grid when needed. This integration helps manage load demand and enhances grid reliability.

- Peak Shaving and Load Management: VPPs help reduce peak demand on the grid by managing and distributing energy loads more efficiently. By controlling and optimizing the use of DERs, VPPs can minimize grid fees and reduce the need for additional infrastructure investments.

Major Challenges

- Regulatory and Policy Framework: One of the significant challenges for VPPs is the lack of a comprehensive regulatory and policy framework tailored to their unique needs. Current regulations often do not fully accommodate the integration and operation of VPPs, making it difficult for them to participate effectively in energy markets. This necessitates the development of policies that support the unique characteristics of VPPs.

- Interoperability and Standardization: Ensuring that various distributed energy resources (DERs) can communicate and operate seamlessly within a VPP is a significant hurdle. The lack of standardized protocols for devices and control systems creates barriers to the efficient integration of diverse energy sources and technologies. Achieving interoperability is crucial for the smooth functioning of VPPs.

- Data Management and Communication: VPPs rely heavily on real-time data from multiple sources to optimize operations and balance supply and demand. Effective data management and robust communication systems are essential. However, the complexity of managing vast amounts of data and ensuring reliable communication between grid operators, VPP operators, and DERs presents a formidable challenge.

- Market Participation and Economic Viability: Entering and competing in energy markets can be challenging for VPPs. The economic viability of VPPs depends on their ability to provide cost-effective services and generate revenue through participation in demand response programs and ancillary services markets. Achieving a favorable economic outcome requires navigating complex market dynamics and ensuring the profitability of VPP operations.

- Consumer Engagement and Trust: Engaging consumers and gaining their trust is critical for the success of VPPs. Consumers need to be willing to cede some control over their energy resources and participate in VPP programs. Building consumer confidence involves transparent communication about the benefits, potential risks, and operational protocols of VPPs. Overcoming consumer skepticism and encouraging widespread adoption remain significant challenges.

Market Opportunities

- Grid Resilience and Reliability: VPPs enhance grid stability by integrating and managing distributed energy resources (DERs) such as solar panels, wind turbines, and battery storage systems. This integration helps mitigate the impact of power outages and reduces the stress on the transmission and distribution systems, especially during peak demand periods.

- Decarbonization and Renewable Energy Integration: VPPs play a crucial role in the transition to a low-carbon energy system by facilitating the integration of renewable energy sources. They optimize the use of decentralized renewable energy, reducing reliance on fossil fuels and helping achieve climate goals. This shift supports the broader adoption of clean energy technologies and contributes to environmental sustainability.

- Economic Benefits and Cost Savings: VPPs can reduce operational costs for utilities and consumers by optimizing energy consumption and providing ancillary services. By participating in demand response programs and leveraging the flexibility of DERs, VPPs can lower electricity bills, defer costly grid infrastructure upgrades, and provide new revenue streams for participants.

- Enhanced Energy Flexibility and Management: VPPs offer improved energy management capabilities by allowing real-time monitoring and control of energy resources. This flexibility enables better load balancing, peak shaving, and efficient utilization of energy storage systems. Consumers can benefit from tailored energy solutions that align with their specific needs and usage patterns.

- Support for Electric Vehicle (EV) Integration: VPPs facilitate the integration of EVs into the energy grid through Vehicle-to-Grid (V2G) technology. EVs can act as mobile energy storage units, providing power back to the grid when needed and enhancing overall grid stability. This integration helps manage the increasing energy demand from the growing adoption of electric vehicles.

Recent Development

- In April 2024, Next Kraftwerke and Toshiba launched their joint venture, “Next Kraftwerke Toshiba Corporation,” aimed at providing VPP services in Japan. This venture will enable third parties to set up their own VPPs using Next Kraftwerke’s NEMOCS platform. This initiative supports the stabilization of the grid and enhances the efficiency of renewable energy resources

- Investment: In July 2023, Leap secured $12 million in equity financing to expand its VPP software solutions. This funding round was led by Standard Investments with participation from other investors like DNV Ventures and Sustainable Future Ventures. Leap’s platform integrates distributed energy resources (DERs) like batteries, EV chargers, and smart thermostats to balance the grid efficiently.

- Partnership: In April 2023, Leap joined the Virtual Power Plant Partnership (VP3) initiative to accelerate the growth of VPP solutions. This collaboration involves leading energy technology companies such as Google Nest and Sunrun.

- In June 2023, Toshiba Energy Systems & Solutions Corporation signed a long-term contract for renewable energy aggregation services, focusing on small-scale distributed solar power plants. This contract aims to optimize energy usage and enhance grid reliability in Japan.

- In 2023, ABB continued to expand its VPP offerings by integrating more renewable energy sources and storage systems into its existing platforms, aiming to enhance grid stability and support the energy transition in various markets.

Conclusion

In conclusion, Virtual Power Plants (VPPs) represent a transformative innovation in the energy sector, seamlessly integrating diverse, decentralized energy resources to create a more resilient and efficient power grid. By utilizing advanced software and communication technologies, VPPs can dynamically balance supply and demand, promoting grid stability and enhancing the incorporation of renewable energy sources.

This not only leads to significant economic benefits through optimized asset utilization and reduced infrastructure investments but also supports the global shift towards sustainable and decentralized energy systems. As smart grids evolve, VPPs will undoubtedly play a pivotal role in achieving energy efficiency, reliability, and sustainability, marking a critical advancement in the pursuit of modern, smart energy solutions.