Table of Contents

Introduction

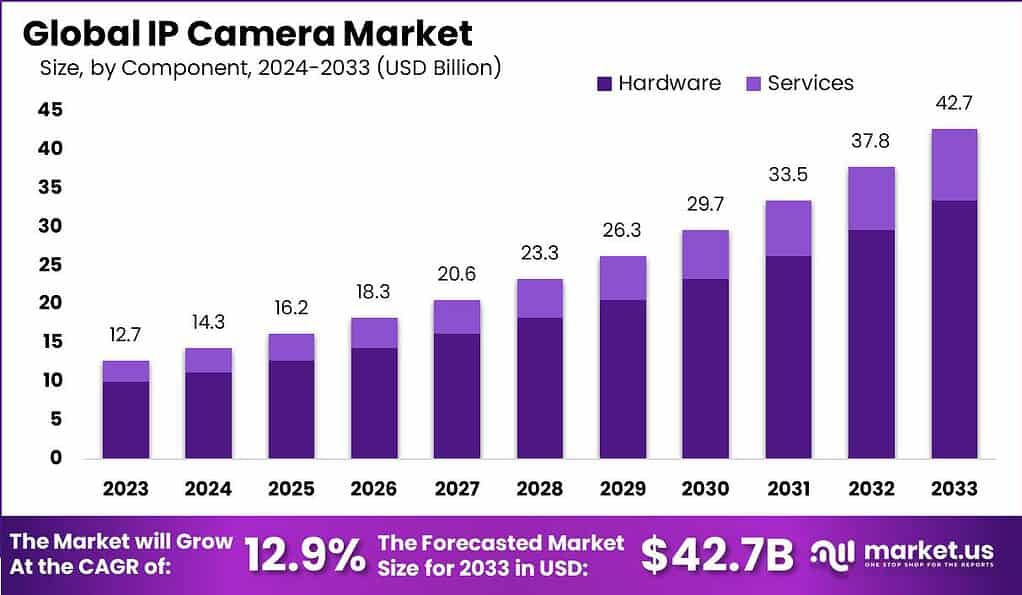

As per the Market.us report, the worldwide market for IP cameras is projected to grow from USD 12.7 billion in 2023 to approximately USD 42.7 billion by 2033. This represents a compound annual growth rate (CAGR) of 12.9% from 2024 to 2033. The IP Camera Market is experiencing a significant upswing, driven by growing security concerns and technological advancements in camera technology. These cameras, which use Internet Protocol to transmit image data and control signals over a network, offer more flexibility and higher quality images than traditional analog cameras.

One of the primary growth factors is the rising demand for safety and surveillance systems across various sectors, including retail, banking, and transportation. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in IP cameras is making them smarter, capable of performing tasks like facial recognition and motion detection, which further boosts their appeal. The market’s growth is further fueled by the increasing adoption of these cameras in both residential and commercial settings, where enhanced security is a priority.

Although, the IP Camera Market is navigating through significant growth , it also embraces some challenges. One of the main hurdles includes concerns about data privacy and security, as these cameras are connected to the internet, making them potential targets for hackers. Moreover, the complexity of IP camera installation and the need for substantial storage for high-quality video recordings are additional obstacles.

Despite these hurdles, there are significant opportunities in the IP Camera Market. The ongoing development of smarter, more connected cities and the increasing trend towards home automation provide expansive avenues for growth. Moreover, ongoing improvements in network infrastructure globally will likely enhance the performance and reliability of IP cameras, making them more appealing to a broader audience.

Key Takeaways

- The size of the global IP camera market is projected to reach approximately USD 42.7 billion by 2033. This represents a compound annual growth rate (CAGR) of 12.9% over the forecast period from 2024 to 2033.

- In 2023, the hardware segment led the IP camera market, accounting for over 78.4% of the market share.

- The fixed IP camera segment was the predominant category in 2023, comprising more than 44.7% of the market.

- In 2023, the consolidated IP camera segment was a major market leader, securing over 75.9% of the market share.

- Commercial usage dominated the IP camera market in 2023, holding more than 63% of the market.

- In 2023, the Asia-Pacific (APAC) region maintained a leading position in the IP camera market, holding over 48.9% of the market share. The region’s demand for IP cameras reached USD 6.3 billion, with forecasts indicating substantial growth in the coming years.

IP Camera Statistics

- 1 billion surveillance cameras are operational worldwide, demonstrating a widespread deployment across various sectors.

- In the domestic sphere, 98.8 million households globally have adopted smart home surveillance cameras, indicating significant consumer trust and reliance on this technology.

- China is recognized as the most surveilled country, with approximately 200 million CCTV cameras, highlighting its vast network of surveillance infrastructure.

- The United States boasts the highest number of CCTV cameras per capita, with 15.28 cameras per person, reflecting a substantial investment in surveillance technology at the individual level.

- The United Kingdom ranks as the third most surveilled country globally, with 628,975 cameras, showcasing its commitment to public safety and security.

- Dominating the global market, China accounts for 60% of the CCTV camera market, illustrating its leadership in manufacturing and deployment.

- The U.S. maintains the second largest video CCTV market, valued at approximately $8.29 billion, signaling robust industry activity and technological advancement.

- Japan’s CCTV camera market holds a value of around $403 million, indicating a significant but smaller scale operation compared to global leaders.

- Forecasts suggest that the security surveillance sector will escalate to over $21 billion by 2026, pointing to rapid growth and expanding applications.

- IP cameras make up 40% of the market shares, underlining their pivotal role in modern surveillance solutions.

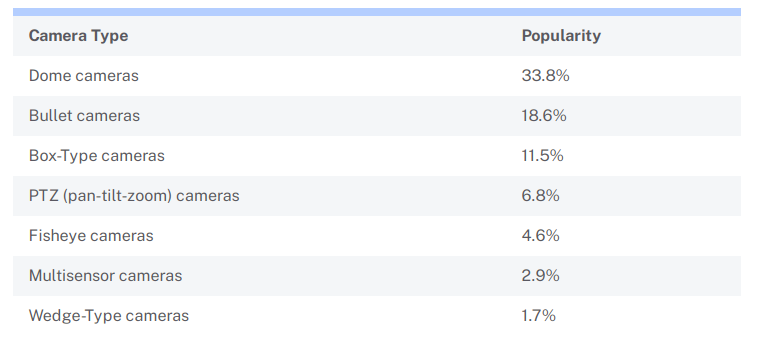

- Dome cameras, comprising 33.8% of the market, emerge as the most favored type of CCTV, while Wedge cameras, at just 1.7%, are the least popular.

- North America leads in CCTV usage with a market share of 28.5%, reflecting its extensive implementation across various industries.

- The broader American region accounts for 18% of all installed surveillance cameras, with Asia (excluding China) holding 15%, indicating significant regional variations in surveillance practices.

- The professional video surveillance market is poised for expansion, with an anticipated growth to $19.51 billion by 2026.

- The market for thermal cameras within the security industry is projected to attain a value of $7.8 billion by 2023, showcasing their increasing adoption for specialized applications.

- Lastly, the global smart camera market is expected to surge to $9.91 billion by 2025, reflecting the rising demand for intelligent and autonomous surveillance solutions.

Detailed representation of the market ranking for different types of CCTV cameras, highlighting their popularity and market share:

Source: dataprot.net

Top 5 IP Cameras

- Google Nest: Known for its high-quality cameras like the Google Nest Cam Outdoor, this brand offers robust ecosystems for home security solutions. These cameras are distinguished by their seamless integration with the Google ecosystem, offering smart home features and cloud storage options.

- Arlo: The Arlo Pro 2 is particularly noted for its excellent wireless capabilities, color night vision, and integrated spotlight. It supports a mobile app that provides comprehensive remote monitoring features, including cloud storage.

- Eufy: The Eufy Solo Pan and Tilt is recognized for its high resolution, affordability, and ability to integrate with Apple’s HomeKit, making it ideal for smart home environments. It offers features like on-board recording and two-way audio, although it lacks integration with Eufy’s own Homebase system.

- Lorex: Lorex cameras are appreciated for their ease of use, durability, and high-resolution capabilities up to 4K. They offer both local and cloud storage, and their setup is straightforward, appealing to both home and professional users.

- Ring: Ring’s cameras, including the Ring Indoor Cam, offer compact designs and affordable cloud storage options. These cameras integrate well with Amazon Alexa and are designed for easy DIY installation.

Emerging Trends

- AI-Driven Smart Cameras: IP cameras are increasingly incorporating AI to enhance functionalities like vehicle detection, people counting, and facial recognition, enabling more sophisticated and targeted surveillance capabilities.

- Edge Computing: By processing data closer to the source, IP cameras minimize latency and reduce bandwidth demands, making the systems more efficient and responsive to real-time security events.

- Cybersecurity Enhancements: As threats evolve, so do the cybersecurity measures in IP cameras. Enhanced security features are becoming standard to protect against hacking and unauthorized access.

- Integration with IoT and Smart Home Systems: The integration of IP cameras with IoT and smart home technologies is increasing. This integration enhances security and operational efficiency through automated systems and remote monitoring capabilities.

- Advancements in AI and Analytics: There’s a significant shift towards using artificial intelligence (AI) and advanced analytics in IP cameras. These technologies improve facial and license plate recognition accuracy, which is crucial for security applications.

Top Use Cases

- Home Security and Monitoring: IP cameras are widely used for residential security, allowing homeowners to monitor their property remotely in real-time. They can detect motion, record video, and send alerts to the homeowner’s smartphone. Some advanced models include features like night vision, two-way audio, and integration with smart home systems .

- Monitoring Children or Elderly: Families increasingly use IP cameras to keep an eye on young children or elderly family members. These cameras provide a way to ensure safety and respond quickly to any emergencies. They often include motion sensors and alarms to alert caregivers of any unusual activity .

- Public Safety and Traffic Monitoring: IP cameras are used by municipalities for monitoring public spaces and traffic. They help in managing traffic flow, detecting violations, and enhancing public safety by providing real-time surveillance data to law enforcement agencies.

- Remote Industrial Monitoring: In industrial settings, IP cameras are used to monitor equipment and processes remotely. They help in detecting malfunctions, ensuring safety compliance, and improving operational efficiency by providing real-time video feeds from different parts of a facility.

- Healthcare Monitoring: IP cameras play a crucial role in healthcare settings, particularly for patient monitoring. They are used in hospitals to monitor patients in critical care units, ensuring timely medical intervention. They can also be used in telehealth to provide remote consultations and continuous patient monitoring.

Major Challenges

- Higher Costs: IP cameras tend to be more expensive both in terms of initial costs and installation when compared to analog systems. This is due to their advanced features and the need for a robust network infrastructure to handle high-definition video, which can significantly increase the overall expense.

- Network Dependency and Bandwidth Requirements: IP cameras require a strong network connection to function effectively, as high-definition video consumes substantial bandwidth. This dependency on network quality can be a limitation in areas with poor connectivity.

- Complexity in Integration and Maintenance: Due to their advanced technology, IP cameras can be complex to integrate with existing systems and maintain. They often require ongoing technical support to manage software updates and network configurations.

- Legal and Regulatory Challenges: Regulations regarding surveillance vary widely by region and can be restrictive, impacting the deployment of IP cameras in certain areas.

- Data Privacy and Security Concerns: IP cameras are vulnerable to hacking, which can lead to significant privacy and security breaches. The inherent risks of cyber threats need to be addressed through robust security features.

Market Opportunities

- Integration of AI and IoT: The increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in IP cameras enhances their functionality, making them more efficient in real-time monitoring and event detection, which opens new avenues for market growth.

- Smart Home and City Applications: As smart homes and cities gain popularity, the demand for IP cameras to enhance security and connectivity within these ecosystems presents significant opportunities for market expansion.

- Advancements in 5G Technology: The rollout of 5G technology promises to enhance the capabilities of IP cameras, offering higher video quality and faster transmission speeds, which could revolutionize how surveillance is conducted.

- Cloud-Based Storage Solutions: The growing popularity of cloud storage for video surveillance offers flexibility and scalability in managing surveillance data, which is attractive to both residential and commercial users.

- Global Market Expansion: Expanding the reach of IP camera solutions into emerging markets, particularly in regions with increasing urbanization and infrastructural development, represents a substantial growth opportunity .

Recent Developments

- In April 2023, Honeywell introduced the 30 Series IP cameras, offering 2 MP and 5 MP resolutions, including a 5 MP fisheye camera. These cameras provide exceptional picture clarity and smart motion detection features, designed for flexible system integration and secure data transmission.

- Honeywell released the 70 Series AI cameras, including the HC70WZ5E30 indoor/outdoor speed dome camera in March 2024. These cameras come with advanced facial recognition capabilities and are designed for both indoor and outdoor applications.

- In June 2023, Axis Communications introduced the Q1961-TE thermal IP camera, designed for reliable detection and verification, even in challenging conditions. This thermal camera is ideal for perimeter security and industrial surveillance.

- In October 2023, Hikvision launched the second generation of their ColorVu cameras, which provide enhanced low-light performance and color imaging. These cameras are equipped with advanced algorithms for better image processing.

- In September 2023, Samsung introduced the Wisenet P series AI cameras, featuring deep learning algorithms for improved object detection and classification. These cameras are designed for high-security applications.

Conclusion

In summary, the IP camera market has demonstrated robust growth due to increasing demand for security solutions and advancements in technology. These cameras, integral to modern security setups, offer high-resolution video surveillance and are easily integrated with cloud and IoT-based systems, enabling remote monitoring and data analysis. The shift towards smart homes and cities has significantly propelled the demand, as IP cameras play a crucial role in these environments for real-time surveillance and incident response.

Additionally, the market is witnessing a surge in innovation, such as the introduction of AI-enabled cameras that can perform facial recognition and behavior analysis, further enhancing security measures and operational efficiency. The competitive landscape is dynamic, with key players investing heavily in R&D to innovate and improve product capabilities and ease of integration. Challenges such as concerns over data privacy and network security remain prevalent, but ongoing advancements in encryption and secure data transmission are helping to mitigate these issues.

Furthermore, regulatory changes and standards development are shaping market evolution, ensuring better product quality and system reliability. Overall, the IP camera market is expected to continue its growth trajectory, driven by technological advancements, increased security awareness, and the integration of AI and cloud technologies, which are opening new applications and opportunities across various sectors.