Table of Contents

- Introduction

- Editor’s Choice

- Global Printing and Writing Paper Demand

- Printers & Copiers Market Overview

- Commercial Printing Market Statistics

- Commercial Printing by Offset Printing Statistics

- Commercial Printing by Digital Printing Statistics

- Flexography Printing Statistics

- 3D Printing Statistics

- Commercial Printing Key Exports Statistics

- Key Commercial Printing Imports Statistics

- Commercial Printing Brand Metrics and Statistics

- Commercial Printing Cost Metrics and Statistics

- Advertising Spending in The Commercial Printing Industry Statistics

- Commercial Printing Key Benefits Statistics

- Commercial Printing Challenges and Concerns Statistics

- Regulations for Commercial Printing Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Commercial Printing Statistics: Commercial printing involves producing printed materials for businesses through various methods such as offset, digital, flexographic, gravure, and screen printing.

Key phases include pre-press (designing and proofing), press (actual printing), and post-press (finishing touches).

Factors affecting commercial printing include print quality, cost, turnaround time, and environmental impact.

Current trends highlight the growing demand for customization, digital integration, sustainability, and technological innovation in the industry.

This sector remains crucial for business operations and marketing, offering versatile solutions tailored to diverse needs.

Editor’s Choice

- The global printers and copiers market is projected to generate a revenue of USD 10.17 billion in 2029.

- In 2023, the global commercial printing market revenue reached USD 480.4 billion.

- The global commercial printing market is segmented by application. Packaging emerging as the dominant sector, accounting for 38% of the total market share.

- By 2025, global sheetfed offset lithographic printer sales are expected to reach USD 2.32 billion.

- The global 3D printing market revenue is estimated to reach USD 21 billion by 2021.

- In 2020, organizations in North America and Europe identified several key benefits of implementing digital document processes and tools. The most significant advantage, cited by 55% of respondents, was the acceleration of document processing.

- In 2021, respondents identified several barriers to the broader implementation of 3D printing, with cost being the most significant challenge. Specifically, 38% of respondents cited the technology as being too expensive, making it a primary obstacle to wider adoption.

Global Printing and Writing Paper Demand

- The global consumption of printing and writing paper has experienced fluctuations between 2021 and 2032.

- In 2021, the demand was recorded at 84 million tons. Which saw a slight increase to 85 million tons in 2022.

- However, by 2023, the demand had decreased to 83 million tons, continuing to decline to 82 million tons in 2024.

- The downward trend persisted, with consumption dropping to 79 million tons in 2025 before a modest rise to 80 million tons in 2026.

- The following years saw a slight fluctuation, with demand at 79 million tons in 2027 and 78 million tons in 2028, eventually falling to 77 million tons in 2029.

- The lowest demand in this period was projected for 2030, at 73 million tons.

- A small recovery was anticipated in the following years. With demand rising to 75 million tons in 2031 and then slightly decreasing again to 74 million tons by 2032.

- This data reflects a general decline in the consumption of printing and writing paper over the forecasted period. Likely influenced by the increasing digitization of communication and documentation.

(Source: Statista)

Printers & Copiers Market Overview

Global Printers & Copiers Market Revenue

- The global printers and copiers market has experienced fluctuations in revenue from 2019 to 2029.

- In 2019, the market generated USD 9.51 billion, which saw a significant increase to USD 10.61 billion in 2020.

- This upward trend continued into 2021, with revenue reaching USD 10.78 billion.

- However, in 2022, the market experienced a decline, with revenue falling to USD 9.49 billion.

- In 2023, the market showed a slight recovery, increasing to USD 9.69 billion. Followed by a continued modest growth to USD 9.76 billion in 2024.

- The revenue is projected to rise steadily over the subsequent years. Reaching USD 9.83 billion in 2025, USD 9.89 billion in 2026, and USD 9.99 billion in 2027.

- By 2028, the market is expected to surpass the USD 10 billion mark. Reaching USD 10.08 billion, with further growth anticipated in 2029. When the market is projected to generate USD 10.17 billion.

- This pattern reflects the market’s resilience and gradual recovery after the downturn in 2022. Driven by ongoing demand for printing and copying technologies.

(Source: Statista)

Printers & Copiers Market Revenue Growth

- The revenue growth of the global printers and copiers market from 2020 to 2029 shows a pattern of fluctuating performance.

- In 2020, the market experienced a significant growth of 11.58%, likely driven by increased demand during the COVID-19 pandemic.

- However, in 2021, the growth rate slowed considerably to 1.63%.

- A notable decline followed this in 2022 when the market contracted by 11.99%. Reflects a challenging period for the industry.

- In 2023, the market saw a modest recovery with a growth rate of 2.15%.

- However, the following years displayed a trend of minimal growth. With rates of 0.70% in 2024, 0.66% in 2025, and 0.65% in 2026.

- The market experienced slightly improved growth in 2027, reaching 1.04%. Followed by moderate growth rates of 0.89% in 2028 and 0.90% in 2029.

- Overall, the data indicates a period of instability with modest recovery and low growth. Suggesting a mature market facing various challenges and a shifting demand landscape.

(Source: Statista)

Global Printer Market Share – By Vendor

2015-2017

- The global printer market shares by vendor from 2015 to 2017 have shown notable shifts among key players.

- In 2015, Canon held 20.30% of the market, closely followed by HP with 20.40%. While Brother accounted for 7.90%.

- Epson and Kyocera had smaller shares at 5.50% each, with Ricoh at 6.20%, Xerox at 7.10%, and other vendors collectively dominating at 32.70%.

- By the year ending March 2016, Canon’s share had slightly decreased to 20.10%. While HP had also seen a slight decline to 19.70%.

- Brother’s share increased to 8.10%, while Epson and Kyocera remained stable at 5.50% and 5.70%, respectively. Xerox’s share increased slightly to 6.40%, while other vendors’ share reduced to 28.50%.

- In the year ending June 2017, both Canon and HP experienced further declines to 19.90% and 18.90%, respectively.

- Brother’s share also decreased to 7.10%, but Kyocera saw a significant increase to 11.90%. Other vendors’ market share grew to 31.60%.

2018-2021

- The year ending March 2018 marked a resurgence for Canon. Which saw its share rise to 24.10%, and HP increased to 21.40%.

- Brother also gained ground with 11.30%, while Epson’s share grew significantly to 9.80%. However, Ricoh’s share dropped to 2.50%, and the share of other vendors fell to 18.60%.

- By the year ending June 2018, Canon’s market shares slightly declined to 22.80%, while HP increased to 22.20%.

- Brother maintained its 11.30% share, and Epson’s share rose to 10.10%. Kyocera saw a small increase to 7.00%, and other vendors’ shares remained relatively stable at 18.50%.

- The year ending June 2019 saw HP leading the market with a significant increase to 26.60%, while Canon’s share declined to 20.20%.

- Brother’s share slightly increased to 11.50%, and Epson continued its growth to 10.70%. Kyocera’s share rose marginally to 7.30%, with other vendors holding 16.10% of the market.

- By the year ending March 2021, HP maintained a strong position with a 24.50% market share. Although, this was a slight decrease from 2019. Canon’s share further declined to 17.70%, while Brother and Epson held 10.70% and 9.90%, respectively.

- Kyocera’s share increased to 7.80%, and Ricoh saw a minor increase to 3.60%. Other vendors accounted for 20.20% of the market, reflecting a moderately consolidated landscape among the leading players.

(Source: Statista)

Commercial Printing Market Statistics

Global Commercial Printing Market Size Statistics

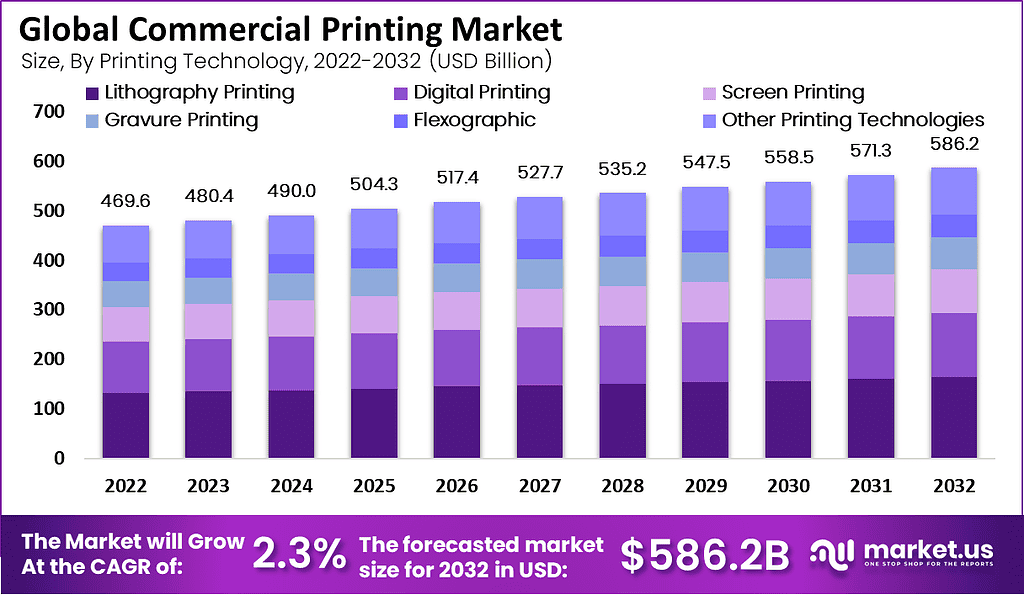

- The global commercial printing market has exhibited a steady growth trajectory from 2022 through 2032 at a CAGR of 2.3%. With revenue increasing from USD 469.6 billion in 2022 to an anticipated USD 586.2 billion by 2032.

- In 2023, the market revenue reached USD 480.4 billion, followed by a further increase to USD 490.0 billion in 2024.

- The market is projected to continue this upward trend. Reaching USD 504.3 billion in 2025 and USD 517.4 billion in 2026.

- By 2027, the market is expected to generate USD 527.7 billion, and this growth is forecasted to persist. With revenue climbing to USD 535.2 billion in 2028, USD 547.5 billion in 2029, and USD 558.5 billion in 2030.

- The market is anticipated to achieve a revenue of USD 571.3 billion in 2031. Culminating in a total market size of USD 586.2 billion by 2032.

- This consistent increase in revenue underscores the robust demand and sustained expansion within the commercial printing industry over the forecast period.

(Source: market.us)

Global Commercial Printing Market Size – By Printing Technology Statistics

2022-2027

- The global commercial printing market has demonstrated consistent growth from 2022 to 2027, with revenue expanding across various printing technologies.

- In 2022, the total market revenue was USD 469.6 billion, with lithography printing contributing USD 131.488 billion, digital printing USD 103.312 billion, and screen printing USD 70.44 billion.

- Gravure printing accounted for USD 51.656 billion, flexographic printing USD 37.568 billion, and other printing technologies USD 75.136 billion.

- By 2023, the market revenue increased to USD 480.4 billion, with growth observed across all segments. Lithography printing rose to USD 134.512 billion, digital printing to USD 105.688 billion, and screen printing to USD 72.06 billion.

- The gravure, flexographic, and other printing technologies segments also saw increases. Reaching USD 52.844 billion, USD 38.432 billion, and USD 76.864 billion, respectively.

- This upward trend continued, with the total market revenue reaching USD 504.3 billion in 2025. Driven by significant contributions from lithography (USD 141.204 billion), digital (USD 110.946 billion), and screen printing (USD 75.645 billion).

2028-2032

- By 2028, the market expanded to USD 535.2 billion, with lithography printing reaching USD 149.856 billion. Digital printing is USD 117.744 billion, and screen printing is USD 80.28 billion.

- In 2030, the market reached USD 558.5 billion, with lithography printing accounting for USD 156.38 billion. Digital printing is USD 122.87 billion, and screen printing is USD 83.775 billion. The market is projected to continue growing, culminating in a total revenue of USD 586.2 billion by 2032.

- During this year, lithography printing is expected to contribute USD 164.136 billion. Digital printing is USD 128.964 billion, and screen printing is USD 87.93 billion.

- Gravure, flexographic, and other printing technologies are also projected to grow. Contributing USD 64.482 billion, USD 46.896 billion, and USD 93.792 billion, respectively, to the total market revenue.

- This growth reflects the sustained demand and evolution within the commercial printing industry, driven by advances in various printing technologies.

(Source: market.us)

Global Commercial Printing Market Share – By Application Statistics

- The global commercial printing market is segmented by application. Packaging emerging as the dominant sector, accounting for 38% of the total market share.

- Advertising follows closely, representing 29% of the market, while publishing holds a 20% share.

- Other applications, encompassing various niche and specialized uses, contribute the remaining 13%.

- This distribution highlights the significant role of packaging in driving the commercial printing industry. Alongside substantial contributions from the advertising and publishing sectors.

(Source: market.us)

Commercial Printing Companies Market Share Statistics

- In 2016, the US commercial printing market was characterized by a highly fragmented landscape, with a few key players holding notable market shares.

- R.R. Donnelly & Sons emerged as the leading company, capturing 7.7% of the market.

- Quad/Graphics followed with a 4.3% market share, while Deluxe held 1.3%, and Canvey accounted for 0.6% of the market.

- The remaining 86.1% of the market was distributed among various other companies, reflecting the competitive and diverse nature of the commercial printing industry in the United States.

(Source: Statista)

Commercial Printing by Offset Printing Statistics

Global Sales of Sheetfed Offset Lithographic Printers

- The projected global sales of sheetfed offset lithographic printers are expected to experience a gradual decline from 2021 to 2026.

- In 2021, sales were estimated at USD 2.6 billion, which is anticipated to decrease to USD 2.53 billion in 2022.

- This downward trend is projected to continue in the following years, with sales declining to USD 2.45 billion in 2023 and further to USD 2.38 billion in 2024.

- By 2025, global sales are expected to reach USD 2.32 billion, and by 2026, the market is projected to decline to USD 2.25 billion.

- This steady decrease reflects potential shifts in demand and technological advancements within the printing industry.

(Source: Statista)

Sheetfed Offset Printing Machine Manufacturers – By Market Share

- In 2010, the global market for sheetfed offset printing machines was dominated by a few key manufacturers.

- Heidelberger Druckmaschinen led the market with a significant share of 42%, establishing its position as the dominant player.

- Koenig & Bauer followed with 16% of the market, while Komori held a 14% share.

- Manroland captured 9% of the global market, and Mitsubishi accounted for 6%.

- Ryobi contributed 5% to the market share, while the remaining 8% was distributed among other manufacturers.

- This distribution highlights the concentration of market power among the leading companies, with Heidelberger Druckmaschinen notably commanding a substantial portion of the market.

(Source: Statista)

Sheetfed Offset Printing Machines Producer Countries – By Market Share

- In 2011, Germany dominated the global market for sheetfed offset machine production, commanding a substantial market share of 57.2%.

- Japan followed as the second-largest producer, with 18.6% of the market.

- The United States and Austria each held a 3.3% share, while the United Kingdom accounted for 3% of the global market.

- France contributed 2.3% to the overall market share.

- This data underscores Germany’s leading role in the production of sheetfed offset machines, significantly outpacing other countries in this sector.

(Source: Statista)

Commercial Printing by Digital Printing Statistics

Global Digital Textile Printing Market Size

- The global digital textile printing market experienced significant growth between 2017 and 2020.

- In 2017, the market revenue was recorded at USD 19.17 billion.

- This figure increased substantially in 2018, reaching USD 24.41 billion, and continued its upward trajectory in 2019, with revenue climbing to USD 28.71 billion.

- By 2020, the market had expanded further, achieving a total revenue of USD 31.4 billion.

- This consistent growth reflects the increasing adoption of digital printing technologies in the textile industry. Driven by demand for faster production times, customization capabilities, and sustainable printing solutions.

(Source: Statista)

Digital and Print Advertising Revenue Generation Through Newspapers

- The advertising revenue of US newspapers from 2003 to 2014 reflects a notable shift from print to digital platforms.

- In 2003, print advertising dominated with USD 44.94 billion, while digital advertising generated a modest USD 1.22 billion.

- Over the following years, print revenue experienced a gradual decline, peaking in 2005 at USD 47.41 billion before beginning a steady downward trend.

- By 2008, print revenue had decreased significantly to USD 34.74 billion, and by 2014, it had fallen further to USD 16.4 billion.

- In contrast, digital advertising revenue steadily increased during this period.

- Starting from USD 1.22 billion in 2003, digital revenue grew to USD 2.66 billion by 2006 and surpassed the USD 3 billion mark in 2007, reaching USD 3.17 billion.

- This growth continued through the subsequent years, with digital revenue reaching USD 3.5 billion by 2014.

- The data illustrates the ongoing shift in the newspaper industry, where digital platforms have become increasingly significant as print advertising revenues have declined.

(Source: Statista)

Flexography Printing Statistics

Global Sales of Flexographic Printers

- The projected global sales of flexographic printers from 2021 to 2026 indicate a steady upward trend.

- In 2021, sales were expected to reach USD 1.23 billion, with a gradual increase projected for the following years.

- By 2022, sales are anticipated to grow to USD 1.29 billion, followed by USD 1.36 billion in 2023.

- This growth is forecasted to continue, with sales reaching USD 1.42 billion in 2024, USD 1.5 billion in 2025, and culminating at USD 1.57 billion in 2026.

- This consistent increase reflects the rising demand for flexographic printing technology, driven by its applications in various industries, particularly in packaging.

(Source: Statista)

Flexographic Printing Machines Producer Countries – By Market Share

- In 2011, the global market for flexographic press production was dominated by several key countries, with Germany leading the way with a substantial market share of 32.6%.

- Italy followed as the second-largest producer, accounting for 14.2% of the market.

- Switzerland held a 10.5% share, while the United States contributed 5.5%.

- France and Japan had smaller shares, with 4.4% and 2.5%, respectively.

- This distribution highlights the significant role of European countries, particularly Germany and Italy, in the production of flexographic presses during that period.

(Source: Statista)

3D Printing Statistics

Global 3D Printing Market Size

- The global 3D printing market experienced rapid growth between 2013 and 2021, reflecting the increasing adoption and advancement of 3D printing technologies.

- In 2013, the market revenue stood at USD 4.4 billion, and this figure grew significantly to USD 5.7 billion in 2014.

- The upward trajectory continued, with revenue reaching USD 6.9 billion in 2015 and USD 8.3 billion in 2016.

- By 2017, the market had expanded further to USD 10 billion, and this growth persisted over the following years, with revenue hitting USD 12 billion in 2018 and USD 14.5 billion in 2019.

- In 2020, the global 3D printing market generated USD 17.5 billion, and by 2021, the market had grown to USD 21 billion.

- This consistent growth underscores the increasing importance of 3D printing across various industries, driven by innovations and expanding applications.

(Source: Statista)

Most Used 3D Printing Technologies Worldwide

- The use of various 3D printing technologies varies significantly among respondents, with distinct preferences for in-house production, external services, or a combination of both.

- Fused Deposition Modeling/Fused Filament Fabrication (FDM/FFF) emerges as the most widely used in-house technology, with 71% of respondents utilizing it internally. In comparison, 15% rely on external services, and 9% use both.

- Selective Laser Sintering (SLS) is more commonly outsourced, with 42% of respondents using external services, compared to 20% in-house and 6% using both.

- Stereolithography (SLA) is employed in-house by 29% of respondents, while 27% opt for external services, and 6% utilize both.

- Multi Jet Fusion (MJF) is primarily outsourced, with 31% relying on external services, 10% using it in-house, and 3% combining both.

- Digital Light Processing/Liquid Crystal Display (DLP/LCD) technology is used in-house by 20% of respondents, with 21% outsourcing and 3% employing both methods.

- Other technologies, such as PolyJet, Direct Metal Laser Sintering/Selective Laser Melting (DMLS/SLM), Binder Jetting, and Digital Light Synthesis (DLS), are used by a smaller percentage of respondents, with a notable portion considering adding these technologies to their capabilities.

- Specifically, 26% of respondents use external services for PolyJet and Binder Jetting, while 30% outsource DMLS/SLM, and 24% use external services for DLS.

- Additionally, a significant portion of respondents are considering adding MJF (16%), Binder Jetting (15%), DLS (15%), and SLA (14%) to their 3D printing technology portfolio, indicating a growing interest in these methods.

(Source: Statista)

3D Printing & Additive Manufacturing Devices – By Context

2020-2024

- The number of 3D printing and additive manufacturing devices worldwide is projected to grow significantly from 2020 to 2025 across various contexts, including design, manufacturing, and field applications.

- In 2020, the number of devices in the design context was recorded at 550,000, with manufacturing applications accounting for 102,000 devices and field applications at 13,000 devices.

- This number increased in 2021 to 719,000 devices in design, 136,000 in manufacturing, and 16,000 in the field.

- By 2022, the number of devices had grown further, reaching 865,000 in design, 168,000 in manufacturing, and 19,000 in field applications.

- The upward trend continued in 2023, with the number of devices in design rising to 1.02 million, manufacturing to 206,000, and field applications to 22,000.

- In 2024, the number of devices is expected to reach 1.178 million in design, 249,000 in manufacturing, and 26,000 in the field.

2025-2030

- This growth is projected to continue over the subsequent years, with design devices reaching 1.337 million in 2025, 1.498 million in 2026, and 1.659 million in 2027.

- In the same years, the number of devices used in manufacturing is expected to grow to 298,000, 353,000, and 416,000, respectively, while field applications are projected to reach 30,000, 35,000, and 41,000 devices.

- By 2028, the number of 3D printing and additive manufacturing devices in design is anticipated to reach 1.82 million, with 485,000 devices in manufacturing and 47,000 in the field.

- The growth is expected to continue into 2029, with design devices reaching 1.978 million, manufacturing devices at 561,000, and field devices at 55,000.

- By 2030, the number of devices is projected to reach 2.13 million in design, 644,000 in manufacturing, and 63,000 in field applications, reflecting the broadening adoption of 3D printing technology across various sectors.

(Source: Statista)

Commercial Printing Key Exports Statistics

- In 2022, China led the global export market for industrial printers, with an export value of USD 10.4 billion, representing 21.1% of the total market share.

- Japan followed as the second-largest exporter, with exports valued at USD 8.44 billion, accounting for 17.1% of the market.

- Germany was the third-largest exporter, contributing USD 5.98 billion, or 12.1% of the global market share.

- Other significant exporters included Malaysia, with exports worth USD 3.77 billion (7.66%), and the Netherlands, close behind with USD 3.73 billion (7.57%).

- The United States also played a notable role, exporting industrial printers valued at USD 2.45 billion, or 4.96% of the market. Singapore followed with USD 1.95 billion in exports, representing 3.95% of the market share.

- The United Kingdom and Italy exported industrial printers worth USD 1.03 billion (2.09%) and USD 0.915 billion (1.86%), respectively.

- Vietnam, France, and Czechia also contributed to the global market with exports of USD 0.807 billion (1.64%), USD 0.788 billion (1.6%), and USD 0.672 billion (1.36%), respectively.

- Israel and Indonesia had export values of USD 0.626 billion (1.27%) and USD 0.538 billion (1.09%), respectively, while Chinese Taipei and Mexico rounded out the list with exports of USD 0.502 billion (1.02%) and USD 0.429 billion (0.87%), respectively.

- This distribution reflects the diverse global landscape of industrial printer exports, with a concentration of activity in Asia and Europe.

(Source: The Observatory of Economic Complexity)

Key Commercial Printing Imports Statistics

- In 2022, the United States emerged as the largest importer of industrial printers, with an import value of USD 8.21 billion, accounting for 16.7% of the global market.

- The Netherlands followed as the second-largest importer, with imports worth USD 4.02 billion, representing 8.15% of the market.

- Germany was close behind, importing industrial printers valued at USD 3.94 billion, or 8% of the global share. China also played a significant role, with imports totaling USD 3.85 billion, capturing 7.81% of the market.

- Other key importers included France, with an import value of USD 1.85 billion (3.75%), and Hong Kong, which imported USD 1.77 billion worth of industrial printers, accounting for 3.59% of the market.

- Japan imported USD 1.76 billion in industrial printers, representing 3.57% of the global market, while the United Kingdom imported USD 1.63 billion, or 3.31%.

- Singapore and Italy also contributed to the global demand, with imports valued at USD 1.45 billion (2.95%) and USD 1.4 billion (2.85%), respectively.

- Czechia imported industrial printers worth USD 1.09 billion, making up 2.21% of the market, and Canada followed with imports totaling USD 1.03 billion, or 2.1%. Mexico imported USD 0.97 billion in industrial printers, representing 1.97% of the market.

- Vietnam and Thailand both imported industrial printers valued at USD 0.892 billion, each accounting for 1.81% of the market.

- Spain rounded out the list of significant importers, with imports totaling USD 0.767 billion, or 1.56% of the global market.

- This data reflects the widespread global demand for industrial printers, with key markets spread across North America, Europe, and Asia.

(Source: The Observatory of Economic Complexity)

Commercial Printing Brand Metrics and Statistics

- In 2012, the brand equity ranking of printer brands in the United States placed HP Printing & Imaging at the top with a score of 66.69 on a scale of 1 to 100.

- Kodak Printing & Imaging followed in second place with a score of 61.16, while Canon Printing & Imaging secured the third position with a score of 60.27.

- Xerox Printing & Imaging was ranked fourth with a score of 59.52, closely followed by Epson Printing & Imaging, which scored 58.7.

- Brother Printing & Imaging and Samsung Printing & Imaging occupied the sixth and seventh spots, with scores of 57.25 and 56.52, respectively.

- The category average for brand equity among these brands was 56.16, indicating that most of the leading brands performed above this average, with HP leading the market in brand strength.

(Source: Statista)

Commercial Printing Cost Metrics and Statistics

- The average price of printers and copiers worldwide is projected to experience a gradual decline from 2019 to 2029.

- In 2019, the average price per unit was USD 98.39.

- This figure slightly decreased to USD 98.02 in 2020 and continued to decline to USD 97.69 in 2021.

- By 2022, the average price had further decreased to USD 97.51, and this downward trend persisted, with the price reaching USD 96.96 in 2023 and USD 96.44 in 2024.

- The average price is expected to continue its gradual decline, dropping to USD 95.92 in 2025, USD 95.42 in 2026, and USD 94.94 in 2027.

- By 2028, the average price is projected to fall to USD 94.46, with a further decrease to USD 93.47 by 2029.

- This steady reduction in price over the decade reflects ongoing advancements in technology, increased competition, and potential shifts in consumer demand, leading to more affordable pricing for printers and copiers worldwide.

(Source: Statista)

Advertising Spending in The Commercial Printing Industry Statistics

- Advertising spending in the commercial printing industry in the United States experienced significant fluctuations between 2010 and 2017.

- In 2010, the industry spent USD 5.99 million on advertising.

- This figure saw a sharp increase in 2011, reaching a peak of USD 19.52 million.

- However, by 2012, advertising spending had decreased to USD 12.02 million.

- The subsequent years witnessed a continued decline, with spending dropping to USD 4.27 million in 2013 and slightly decreasing further to USD 4.13 million in 2014.

- In 2015, there was a minor uptick in spending to USD 4.57 million, but a dramatic reduction followed this in the following years.

- By 2016, advertising spending plummeted to just USD 0.27 million, and in 2017, it decreased even further to USD 0.22 million.

- This trend reflects a significant contraction in advertising expenditures within the commercial printing industry over the analyzed period.

(Source: Statista)

Commercial Printing Key Benefits Statistics

- In 2020, organizations in North America and Europe identified several key benefits of implementing digital document processes and tools.

- The most significant advantage, cited by 55% of respondents, was the acceleration of document processing.

- This was closely followed by improving employee collaboration, which was highlighted by 54% of respondents.

- Increasing customer satisfaction was noted by 47% of respondents as a major benefit, while 45% recognized the improvement in employee productivity and time savings.

- Enabling document access, editing, and sharing while working remotely was seen as a critical benefit by 44% of respondents, reflecting the growing importance of remote work capabilities.

- Reducing printing and storage costs was another significant benefit identified by 37% of respondents.

- Ensuring document tracking and data security and compliance were each cited by 36% of respondents, underscoring the importance of maintaining control and security over digital documents.

- Additionally, 35% of respondents highlighted maintaining and increasing revenue as a benefit of digital document processes.

- Increasing document workflow flexibility was noted by 33% of respondents, while 32% pointed to increasing employee engagement.

- Finally, 31% of respondents recognized the value of leveraging data analytics and insights as a benefit of adopting digital document tools.

- These findings illustrate the diverse range of advantages that digital document processes offer to organizations, particularly in enhancing efficiency, collaboration, and security.

(Source: Statista)

Commercial Printing Challenges and Concerns Statistics

- In 2021, respondents identified several barriers to the broader implementation of 3D printing, with cost being the most significant challenge.

- Specifically, 38% of respondents cited the technology as being too expensive, making it a primary obstacle to wider adoption.

- Additionally, 29% of respondents expressed concerns about the quality of 3D-printed parts, indicating that the output quality was not yet sufficient for their needs.

- Another notable barrier was the lack of expertise, with 19% of respondents pointing to limited expertise in the field as a hindrance to implementation.

- Lastly, 14% of respondents felt that the limited choice of materials available for 3D printing restricted its broader use.

- These factors collectively highlight the key challenges that need to be addressed to facilitate the greater adoption of 3D printing technology.

(Source: Statista)

Regulations for Commercial Printing Statistics

- The commercial printing industry is subject to various regulations and legislations that vary significantly across regions.

- In the United States, regulations focus on environmental standards, including the use of sustainable materials and compliance with the Clean Air Act, which mandates the reduction of volatile organic compound (VOC) emissions from printing processes.

- In Europe, stringent environmental laws, particularly those related to waste management and recycling, govern the industry.

- For example, the EU’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation impacts the types of inks and chemicals that can be used in printing.

- In the UK, while most printed matter is exempt from customs duty and VAT, compliance with the UK Integrated Tariff is essential for imports, and adherence to intellectual property laws, such as the Copyright, Designs and Patents Act, is required.

- In Asia, countries like China and India are rapidly advancing in digital printing technologies, but they also face regulatory scrutiny, particularly in environmental compliance and waste management.

- These regulations collectively aim to promote sustainability, protect intellectual property, and ensure the safe and efficient operation of commercial printing services across different markets.

(Sources: Government of UK, HP)

Recent Developments

Acquisitions and Mergers:

- Cimpress acquires Printi: In mid-2023, Cimpress, a global leader in mass customization, acquired Printi, a leading online printing company in Brazil, for $70 million. This acquisition aims to strengthen Cimpress’s presence in the Latin American market and expand its digital printing capabilities.

- Quad/Graphics merges with LSC Communications: In late 2023, Quad/Graphics and LSC Communications, two major players in the commercial printing industry, completed a merger valued at $1.4 billion. This merger is expected to enhance operational efficiencies and broaden their service offerings, particularly in the book printing and publishing sectors.

New Product Launches:

- HP’s Indigo 100K Digital Press: In early 2024, HP launched the Indigo 100K Digital Press, designed for high-volume commercial printing. This new press offers enhanced speed, efficiency, and print quality. Targeting commercial printers looking to increase their production capacity while maintaining top-notch output.

- Canon’s imagePRESS V1000: Canon introduced the imagePRESS V1000 in mid-2023, a new digital color press that offers advanced color management and automation features. Aimed at improving productivity and reducing manual intervention in commercial printing operations.

Funding:

- Vistaprint raises $300 million: In 2023, Vistaprint, a leading online printing company, secured $300 million in funding to expand its product offerings. Invest in new technologies, and enhance its global distribution network. The funding will also support Vistaprint’s efforts to increase its market share in the commercial printing sector.

- Moo secures $150 million: Moo, an online printing company known for its premium business cards and stationery, raised $150 million in early 2024. This funding will be used to develop new products, improve customer experience, and expand its operations into new markets.

Technological Advancements:

- AI and Automation in Printing: The integration of AI and automation in commercial printing is becoming more prevalent. With printers adopt these technologies to optimize workflows, reduce waste, and enhance print quality. By 2024, it is estimated that over 40% of commercial printers will incorporate AI-driven solutions to improve efficiency and accuracy.

- Sustainable Printing Solutions: There is a growing demand for eco-friendly printing options, with an increasing number of companies offering sustainable printing solutions such as recycled paper, eco-friendly inks, and energy-efficient printing processes. As of 2023, approximately 30% of commercial printers offer sustainable printing services to meet the rising consumer demand for environmentally responsible practices.

Market Dynamics:

- Growth in Digital Printing: The global commercial printing market is experiencing a shift towards digital printing. Digital printing now accounts for 35% of the market in 2023. This trend is driven by the need for shorter print runs, customization, and quicker turnaround times. Making digital printing an attractive option for businesses.

- Increasing Demand for Packaging: The demand for commercial printing in the packaging industry is growing, particularly for customized and short-run packaging solutions. The packaging segment is expected to grow at a CAGR of 6.5% from 2023 to 2028. Driven by the rise of e-commerce and consumer demand for personalized packaging.

Conclusion

Commercial Printing Statistics – The commercial printing industry is undergoing significant transformation. Driven by advances in digital technologies and rising demand for customized, short-run products.

Moreover, As digital printing offers increased efficiency and flexibility and sustainability becomes a priority, companies are adapting to these trends.

Despite facing challenges such as intense competition and the need for ongoing technological investment.

The industry’s outlook remains positive, with growth opportunities arising from innovation and evolving consumer and business needs.

FAQs

Commercial printing refers to the process of producing printed materials for businesses and organizations, including items such as brochures, flyers, business cards, banners, and catalogs. It involves high-quality printing techniques and often requires large quantities to be cost-effective.

A print run refers to the number of copies produced in a single batch. The size of the print run can affect pricing and the type of printing method used.

Color matching ensures that the colors in the printed materials match those in the digital design. This process is crucial for brand consistency and involves using color management systems and proofs to align digital colors with print output.

Proofs are preliminary prints used to verify the accuracy of colors, layout, and design before the full print run. They help identify any potential issues and ensure that the final print meets expectations.

Bleed refers to the area of a design that extends beyond the edge of the final printed page. This ensures that there are no unprinted edges after trimming. A standard bleed area is typically 1/8 inch (3 mm).