Table of Contents

Introduction

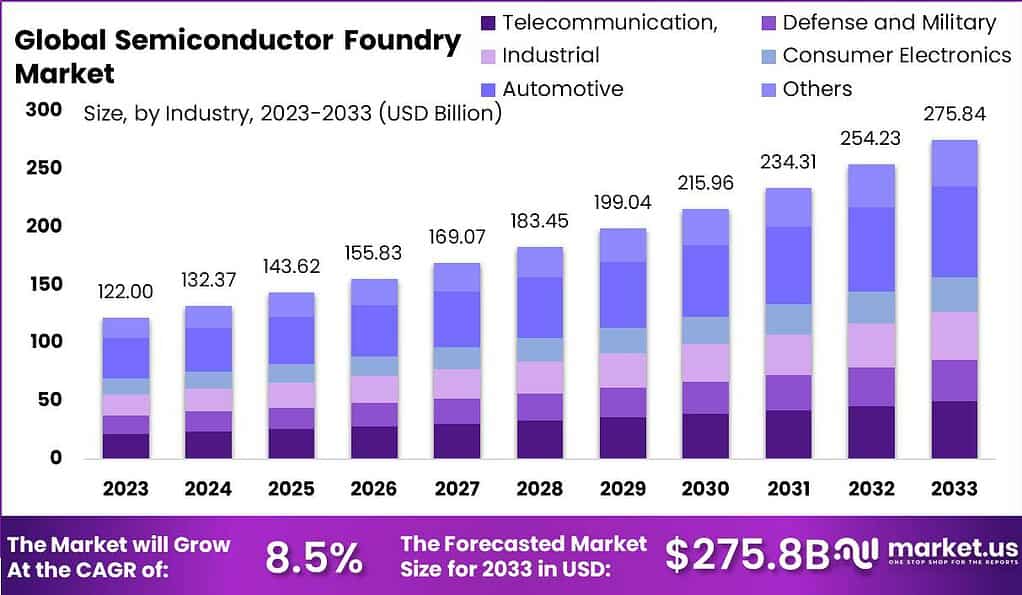

According to Market.us, The global semiconductor foundry market is projected to reach a valuation of approximately USD 275.84 billion by 2033, up from USD 122 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 8.5% over the forecast period from 2024 to 2033.

A semiconductor foundry, also known as a fabrication plant or fab, is a specialized facility where semiconductor devices, such as integrated circuits (ICs), are manufactured. Unlike integrated device manufacturers (IDMs) that design and produce their chips in-house, foundries focus solely on the manufacturing aspect, serving as contract manufacturers for other companies. These companies, known as fabless semiconductor companies, design the chips but rely on foundries to fabricate them.

Foundries play a crucial role in the semiconductor supply chain, enabling innovation and production at scale by providing advanced manufacturing capabilities. The Semiconductor Foundry Market refers to the global industry and business environment in which foundries operate. This market encompasses the production, sales, and distribution of semiconductor devices manufactured by foundries on behalf of fabless semiconductor companies. It is a vital segment of the broader semiconductor industry, with a few key players dominating the market, providing manufacturing services ranging from simple, low-cost chips to complex, cutting-edge semiconductor technologies.

The growth of the Semiconductor Foundry Market is driven by several key factors. The increasing demand for advanced electronics and consumer devices, such as smartphones, tablets, and wearables, is a significant driver. The rise of new technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT) is also boosting demand for semiconductors, requiring more advanced manufacturing processes.

Additionally, the shift towards electric vehicles (EVs) and autonomous driving systems is propelling the need for high-performance chips, further expanding the market. Moreover, the trend of outsourcing manufacturing to foundries by fabless companies continues to grow as companies seek to minimize capital expenditure and focus on core competencies like design and innovation.

The Semiconductor Foundry Market presents numerous opportunities, particularly as demand for semiconductors grows across various sectors. One significant opportunity lies in the development of advanced manufacturing processes, such as 3nm and 2nm nodes, which offer higher performance and energy efficiency. Foundries investing in these cutting-edge technologies can capitalize on the growing demand for high-performance computing, AI, and other emerging applications.

Another opportunity is the geographic diversification of foundry operations to reduce supply chain vulnerabilities. With recent global disruptions, there is increasing interest in establishing foundry capabilities in regions like North America and Europe, presenting a strategic opportunity for market expansion. Lastly, the growing demand for chips in automotive, healthcare, and industrial sectors opens new avenues for specialized semiconductor foundries to cater to these niche markets.

Key Takeaways

- The Semiconductor Foundry Market is poised for significant growth, with its market size projected to reach USD 275.8 Billion by 2033, up from USD 122 Billion in 2023. This growth trajectory represents a robust CAGR of 8.5% during the forecast period from 2024 to 2033.

- In 2023, the 16/14 nm technology segment emerged as a key player, capturing a substantial market share of over 20.4%. This highlights the increasing demand for advanced semiconductor technologies.

- The Automotive segment played a pivotal role in driving the market in 2023, securing a commanding market share of over 28.4%. The growth in this segment underscores the rising integration of semiconductors in automotive applications, especially with the advent of electric and autonomous vehicles.

- Regionally, North America asserted its dominance in the Semiconductor Foundry Market in 2023, commanding a significant market share of over 38.6%. This dominance is attributed to the region’s strong technological infrastructure and the presence of major industry players.

Semiconductor Foundry Statistics

- The global semiconductor market is projected to reach USD 996 billion by 2033, growing from USD 530 billion in 2023.

- This growth reflects a CAGR of 6.5% during the forecast period from 2024 to 2033.

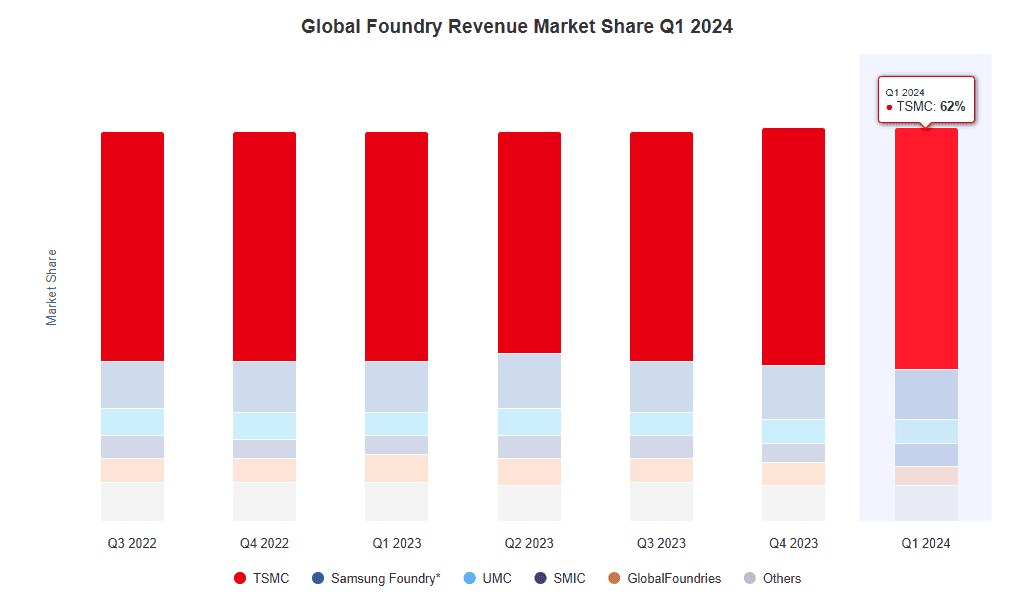

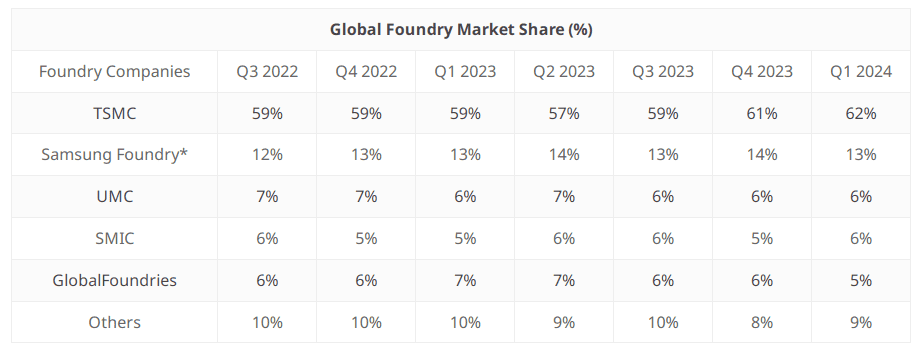

- TSMC remains a dominant force in the semiconductor manufacturing industry, holding a 61.7% market share in the global semiconductor foundry market as of Q1 2024.

- The top ten semiconductor foundries globally generated a combined revenue of USD 29.2 billion in Q1 2024.

- Samsung is TSMC’s closest competitor, with a 17% market share.

- UMC, operating 12 fabs across Asia, manages a monthly capacity exceeding 750,000 8-inch equivalent wafers, and holds a market share similar to GlobalFoundries at 7%.

- SMIC Group, with services spanning process nodes from 0.35 microns to 14 nm, captures 4% market share.

- Foundries account for approximately 60% of the semiconductor device value added, underscoring their crucial role in the supply chain.

- The 5/4nm nodes lead the foundry revenue share with 26%, driven by strong demand from AI applications.

- The 3nm node experienced a decline to a 6% market share, primarily due to seasonal production impacts.

- The open-foundry model is expected to dominate, capturing 69% of the market by 2029, signaling a shift towards more flexible manufacturing partnerships.

Emerging Trends

- IoT and Advanced Technologies: The demand for IoT applications is driving significant growth in the semiconductor foundry market. Foundries are increasingly involved in manufacturing chips that facilitate advanced connectivity and data processing capabilities essential for IoT devices and systems.

- 3D Printing in Manufacturing: The integration of 3D printing technology is transforming semiconductor manufacturing by enabling faster prototyping and customization. This trend is enhancing the efficiency and flexibility of production processes in the foundry sector.

- FinFET Technology Adoption: The semiconductor industry is witnessing a shift towards the adoption of 14-nm/16-nm FinFET technology, which is known for its energy efficiency and high performance. This technology is critical for meeting the sophisticated demands of modern computing and communication systems.

- Advanced Analytics and Big Data: Foundries are increasingly using advanced analytics and big data to optimize their operations. This involves leveraging data collected through sensors in fabrication facilities to implement predictive maintenance, advanced process controls, and intelligent scheduling.

- High-Performance Computing (HPC) Demand: There is a growing demand for high-performance computing capabilities due to the increasing complexities of computational tasks in various sectors, including automotive and telecommunications. This is pushing foundries to innovate and produce more advanced semiconductor components.

Top Use Cases for Semiconductor Foundries

- Smartphone and PC Components: Semiconductor foundries play a crucial role in the production of components for smartphones and PCs. The demand for these components spikes particularly during new product releases and technological upgrades, as seen with the recent surge in orders for new iPhone and Android devices.

- Automotive Electronics: The automotive sector is rapidly adopting semiconductor technologies for smart factories and connected vehicles. Foundries are essential in producing specialized chips for automotive electronics, including advanced driver-assistance systems and electric vehicle powertrains.

- Consumer Electronics: Foundries manufacture critical components for a wide range of consumer electronics, from gaming consoles to smart home devices. This segment is driven by continuous consumer demand for newer, more advanced gadgets.

- Communication Infrastructure: The expansion of telecommunications infrastructure, especially with the rollout of 5G, requires high-speed, high-capacity semiconductor components. Foundries are pivotal in meeting these demands, ensuring the functionality and efficiency of communication systems.

- Healthcare Devices: Semiconductor foundries also support the healthcare sector by manufacturing chips used in medical devices. These components are essential for various medical applications, including diagnostic and monitoring devices, where reliability and precision are critical.

Major Challenges

- Technological Obsolescence and Rapid Innovation Cycles: The rapid pace of technological advancements often makes existing technologies obsolete, pushing foundries to continually update their processes and invest heavily in R&D, which can strain resources and reduce profitability.

- Geopolitical Tensions and Supply Chain Vulnerabilities: Geopolitical issues, such as tensions between major countries involved in semiconductor manufacturing and trade disputes, can disrupt supply chains and impact production.

- Economic Fluctuations and Market Volatility: The semiconductor industry is sensitive to economic downturns, which can lead to rapid changes in demand. This volatility requires foundries to be highly adaptive but also poses significant financial risks.

- Overcapacity and Competition from Legacy Nodes: Particularly in regions like China, there’s a concern about overcapacity, which can drive down prices and reduce margins, especially among players focusing on legacy technology nodes.

- Environmental Regulations and Sustainability Challenges: Increasing environmental regulations pose challenges for foundries in managing their production practices and maintaining sustainability, especially concerning water usage and energy consumption.

Top Opportunities

- Growth in Advanced Automotive and Industrial Applications: The demand for sophisticated semiconductor solutions in automotive and industrial applications is rising, driven by advancements in electric vehicles and automation technologies.

- Expansion into New Markets and Regions: Opportunities for growth are present in new geographic markets, especially where local manufacturing is being incentivized by governmental policies, such as in the United States under initiatives like the CHIPS Act.

- Development of Cutting-edge Technologies: There is significant potential in developing and refining advanced process nodes (like 5nm and 3nm technologies), which are crucial for next-generation computing and AI applications.

- Strategic Partnerships and Collaborations: Collaborations between foundries and technology companies can help in diversifying product portfolios and stabilizing supply chains, reducing dependencies on specific markets or geopolitical areas.

- Increasing Demand for Consumer Electronics: As consumer electronics continue to evolve with new features and capabilities, there is a steady demand for high-performance semiconductor chips, which foundries can capitalize on.

Recent Developments

Intel Corporation

February 2024: Intel launched its Intel Foundry Services (IFS), designed to meet the growing demand for sustainable AI-driven systems. This initiative includes an extended process roadmap to strengthen its position in the foundry market. The company also emphasized partnerships with ecosystem leaders like Synopsys, Cadence, Siemens, and Ansys to support its foundry operations.

GlobalFoundries

March 2024: GlobalFoundries, in collaboration with STMicroelectronics, announced the launch of a new 300mm fab dedicated to the production of semiconductors for automotive and industrial applications. This new facility aims to address the increasing demand in these sectors.

Samsung Electronics

Technological Advances: Samsung is advancing its 3nm and 2nm Gate-All-Around (GAA) process technologies, aiming to capitalize on the expected revival in demand for smartphones and PCs in 2024. Despite a challenging 2023, Samsung is positioning itself to regain momentum in the foundry market.

Taiwan Semiconductor Manufacturing Company Limited (TSMC)

August 2023: TSMC, along with Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors N.V., formed a joint venture to invest in European Semiconductor Manufacturing Company (ESMC) GmbH. This collaboration aims to establish a new fabrication facility in Europe, demonstrating TSMC’s commitment to expanding its global footprint.

Conclusion

The semiconductor foundry market is navigating a complex landscape characterized by significant challenges such as geopolitical tensions, supply chain disruptions, and technological hurdles. However, these challenges are accompanied by substantial opportunities, particularly in areas like AI, IoT, and smart manufacturing. As the industry evolves, foundries that can adapt to these changes and leverage new technologies are likely to thrive. The ongoing global realignment of manufacturing capabilities, driven by both geopolitical factors and technological advancements, will shape the future of the semiconductor industry, providing both risks and rewards for market participants.