Table of Contents

Introduction

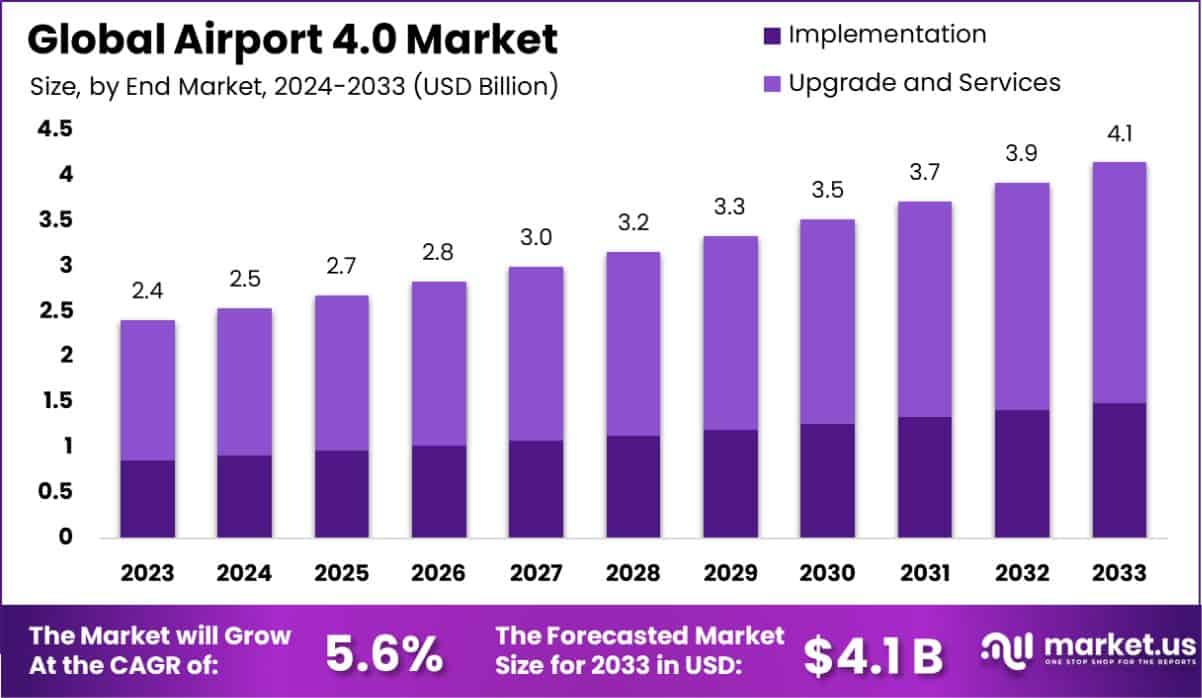

The Global Airport 4.0 Market is projected to reach a valuation of approximately USD 4.1 billion by 2033, up from USD 2.4 billion in 2023. This represents a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2033. This growth trajectory underscores the increasing integration of Industry 4.0 technologies in airport operations, fueled by the escalating demand for enhanced operational efficiency and improved passenger experiences.

Airport 4.0 refers to the integration of the Fourth Industrial Revolution’s technologies, such as the Internet of Things (IoT), artificial intelligence (AI), big data, and automation, into airport operations. This transformation aligns with the broader concept of Industry 4.0, which emphasizes digitalization and interconnectivity. In the context of airports, Airport 4.0 initiatives focus on enhancing operational efficiency, passenger experience, and security. By leveraging smart technologies, airports can optimize everything from baggage handling and security screenings to facility management and customer service.

The Airport 4.0 market is rapidly expanding as airports worldwide invest in technology to meet the increasing demands of modern air travel and heightened security requirements. The market includes a wide range of solutions such as biometric identification systems, automated immigration controls, smart baggage tracking, and predictive maintenance for airport infrastructure. As the adoption of these technologies increases, the market is expected to witness significant growth, driven by the need to enhance passenger satisfaction and operational efficiency. Additionally, government regulations promoting enhanced security measures and investments in smart airport initiatives fuel the expansion of this market.

Demand

The demand for Airport 4.0 technologies is driven by the increasing need for more efficient and secure airport operations. As global air traffic continues to grow, airports are seeking innovative solutions to manage greater passenger volumes without compromising the traveler experience. This demand is further propelled by heightened security threats, which necessitate advanced surveillance and screening technologies. Moreover, the COVID-19 pandemic has accelerated the need for contactless technologies and improved health screening procedures at airports, leading to a surge in demand for integrated, automated systems that can manage these requirements effectively.

Growth Factors

Several key growth factors are stimulating the expansion of the Airport 4.0 market. Firstly, technological advancements in AI, IoT, and robotics are making it feasible and cost-effective for airports to implement smart technologies. Secondly, there is a growing emphasis on enhancing passenger experience, which drives airports to adopt smart systems for a smoother and more personalized journey. Additionally, environmental concerns are pushing airports to adopt green technologies that optimize energy use and reduce carbon footprints. Government initiatives and funding in upgrading aviation infrastructure also significantly contribute to the market growth, as they provide the necessary support for integrating advanced technologies.

Key Takeaways

- The Airport 4.0 Market is projected to reach USD 4.1 Billion by 2033, up from USD 2.4 Billion in 2023, with a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2033.

- In the segmentation by end market, Upgrade and Services maintained a dominant position, capturing over 64.3% of the market share in 2023.

- In terms of applications, the Airside segment held a commanding market position, representing 27.5% of the market in 2023.

- By size, the Large segment dominated, accounting for 42.5% of the market in 2023.

- In the operation category, Non-aeronautical activities dominated the market, with a share exceeding 53.5% in 2023.

- Geographically, the Asia Pacific region led with a market share of 36.8%, translating to revenues of approximately USD 0.88 Billion in 2023.

Airport 4.0 Statistics

- The Global Smart Airport Market is projected to expand from USD 17.3 Billion in 2023 to USD 36.2 Billion by 2032, achieving a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2024 to 2033.

- The recovery to “pre-COVID-19” figures is anticipated at an annual growth rate of 3.7% extending through 2040.

- Air cargo activities are forecasted to increase at an annual rate of 2.3%, necessitating a corresponding rise in flight movements to accommodate this growth. In terms of passenger travel, a monthly increase of 10% is anticipated for June, as reported by the TSA.

- Since the introduction of Generative AI in 2023, this technology has swiftly risen to prominence on both airport and airline agendas, with 97% of airlines actively planning to develop this technology further.

- A significant 86% of airlines are engaging with innovation partners to advance their capabilities in AI, machine learning (ML), and computer vision technologies.

- Approximately 16% of airports currently employ AI and ML to enhance decision-making processes, with an additional 51% planning to integrate these technologies by the end of 2026.

- A substantial majority, 75%, of passengers show a preference for utilizing biometric data over traditional methods such as passports and boarding passes.

- 33% of airlines are investing in vertical take-off and landing (VTOL) integration technologies to optimize airline operations.

- The implementation of facial recognition systems, biometric scans, and AI-driven security checks is expected to reduce passenger queuing times by 30-40%.

Emerging Trends in Airport 4.0

- Sustainability Initiatives: Airports are increasingly adopting eco-friendly practices to mitigate environmental impacts. This includes the integration of renewable energy sources like solar panels and wind turbines, as well as the implementation of smart building management systems to optimize energy use.

- Advanced Passenger Experience: Digital and transparent displays are enhancing the way information is conveyed to travelers, improving both navigation through terminals and the overall airport experience. This trend is complemented by immersive digital installations that transform waiting areas into engaging environments.

- Biometric and Digital Identity Solutions: The adoption of biometric technology is accelerating, offering a more seamless travel experience. Airports are implementing systems that allow passengers to use facial recognition for various processes, reducing the need for physical boarding passes and enhancing security.

- Urban Air Mobility (UAM): Airports are preparing for the future of urban air mobility, including the integration of eVTOL (electric vertical takeoff and landing) platforms. These advancements aim to reduce congestion and streamline short-distance air travel.

- Personalization Through Data Analytics: Leveraging big data and AI, airports are offering personalized travel experiences, tailoring everything from check-in to in-flight services to individual traveler preferences. This includes personalized retail and dining experiences based on past behavior and preferences

Top Use Cases for Airport 4.0

- Efficient Resource Management: AI and IoT technologies are crucial in optimizing resource allocation, including gate assignments and staff scheduling, based on real-time data and predictive analytics.

- Enhanced Security Protocols: Implementation of advanced screening technologies using AI and machine learning improves security while minimizing delays, enhancing the ability to identify and mitigate potential threats.

- Seamless Passenger Flow Management: From check-in through boarding, airports are using digital systems to streamline processes, reducing wait times and improving the passenger experience through automated systems and smart queue management.

- Maintenance and Operations Efficiency: IoT devices and smart sensors are used extensively for the real-time monitoring and maintenance of airport facilities, ensuring operational continuity and safety.

- Non-Aeronautical Revenue Generation: Digital integration allows airports to enhance non-aeronautical revenue streams, such as retail, dining, and parking services, by providing personalized advertisements and promotions to passengers based on their travel profiles and current location within the airport.

Major Challenges in Airport 4.0

- Integration of Advanced Technologies: Airports face significant challenges in adopting and integrating new technologies like IoT, AI, and private 5G networks necessary for Airport 4.0. These technologies are essential for enhancing operational efficiency and passenger experiences but require substantial investment and expertise.

- Legacy Systems: The transition from old technology systems to advanced digital solutions is slow and complex. Many airports still rely on outdated technology that cannot support the demands of modern airport operations, making the phasing out of such legacy systems a major hurdle

- Security and Privacy Concerns: With the increasing use of digital technologies and data analytics, airports need to manage and protect vast amounts of sensitive data. Ensuring cybersecurity and privacy amid growing threats remains a persistent challenge.

- Scalability and Flexibility: Airports need to develop infrastructure that can adapt to rapidly changing technologies and passenger demands. This includes scalable solutions that can handle increasing amounts of data and connectivity requirements.

- Financial and Operational Stability: Achieving financial and operational stability while investing in smart technologies is challenging, especially given the high costs associated with digital transformations and the need for continuous innovation.

Top Opportunities in Airport 4.0

- Enhanced Passenger Experience: Airport 4.0 offers significant opportunities to enhance the passenger experience through technologies like biometric check-ins, augmented reality for navigation, and personalized services, leading to faster processing and improved satisfactionOperational Efficiency: The integration of IoT and AI can significantly improve operational efficiencies, from optimized asset tracking and management to predictive maintenance and automated airside operations.

- Revenue Generation: Digital transformation opens up new avenues for non-aeronautical revenue generation through enhanced retail experiences, targeted advertising, and value-added services for passengers.

- Sustainability Initiatives: Airport 4.0 technologies enable airports to better manage their energy consumption, reduce carbon footprints, and implement sustainable practices, aligning with global environmental goals.

- Safety and Security Enhancements: Advanced digital solutions can significantly improve security measures at airports, including automated surveillance, behavior analysis, and enhanced screening processes, ensuring a safer environment for passengers and staff.

Recent Developments

- Cisco Systems – In June 2024, Cisco launched a $1 billion AI investment fund aimed at accelerating innovation in AI-driven technologies, including those applicable to Airport 4.0. This investment is expected to fuel the development of next-generation smart airport solutions that leverage AI for enhanced security, passenger experience, and operational efficiency.

- Siemens AG – In March 2023, Siemens announced the acquisition of Senseye, a UK-based company specializing in AI-powered predictive maintenance solutions for industrial machines. This acquisition is part of Siemens’ strategy to enhance its digital services portfolio, particularly for the aviation sector, where predictive maintenance is crucial for minimizing downtime and optimizing operations in smart airports.

- IBM Corporation – In January 2023, IBM acquired Octo, a US-based IT modernization and digital transformation services provider, to strengthen its offerings in the public and federal sectors, which include airport security and management systems. This move is expected to enhance IBM’s capabilities in delivering advanced, AI-driven solutions to smart airport.

Conclusion

In conclusion, the adoption of Airport 4.0 technologies signifies a transformative leap in how airport operations are conducted, emphasizing efficiency, security, and enhanced passenger experiences through the integration of advanced digital technologies. The Airport 4.0 market is poised for significant growth, driven by increasing investments from airports seeking to modernize their infrastructure and meet the evolving expectations of travelers. As this sector continues to evolve, it will likely offer substantial opportunities for innovation, collaboration, and investment, making it a critical area for stakeholders in the aviation industry to focus on.