Table of Contents

Introduction

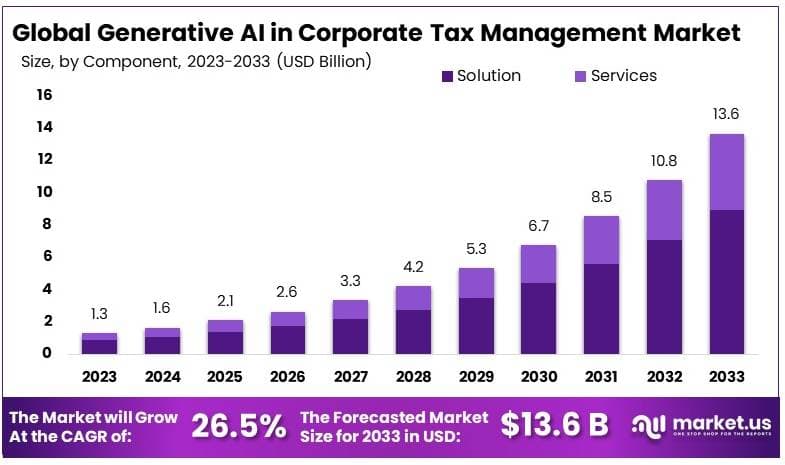

According to the Market.us, The Generative AI in Corporate Tax Management Market is projected to grow significantly, reaching approximately USD 13.6 billion by 2033, up from USD 1.3 billion in 2023, with an impressive CAGR of 26.5% from 2024 to 2033.

Generative AI in corporate tax management involves using sophisticated AI technologies to facilitate various tax-related operations within companies. This AI aids in automating intricate tax calculations, foreseeing tax obligations, enhancing tax strategies, and ensuring adherence to the continuously changing tax legislations. By automating data handling, analysis, and reporting, generative AI significantly refines the efficiency and accuracy of the tax filing process.

The market for generative AI in corporate tax management includes technologies and services that support the automation of corporate tax functions. This market is expanding as more companies and tax consultancy firms embrace these innovative solutions to improve the accuracy and efficiency of tax operations. The offerings in this market range from software and AI models to consultancy and integration services tailored for streamlined tax management.

The demand for generative AI in corporate tax management is primarily fueled by the growing complexity of tax regulations worldwide and the increasing need for efficient tax processing systems. Companies are seeking advanced solutions capable of managing the intricacies of taxes across multiple jurisdictions, enhancing the speed and accuracy of tax computations, and reducing compliance-related risks.

The expansion of this market is driven by several factors, including technological advancements in AI and machine learning, which enable more complex tax management systems. The need to navigate frequently changing regulations and the global expansion of businesses necessitate robust, adaptable tax management solutions. Furthermore, the imperative to cut operational costs and enhance financial reporting accuracy encourages companies to turn to AI-driven solutions.

Significant opportunities exist in the development of AI solutions that integrate seamlessly with existing financial systems, particularly in regions with intricate tax regimes and high compliance demands. Industry-specific solutions, especially for sectors like manufacturing and retail, also offer considerable growth prospects. With ongoing changes in tax laws, AI systems that can swiftly adapt to new rules present continuous opportunities for innovation and market expansion.

Key Takeaways

- The Generative AI in Corporate Tax Management Market was valued at USD 1.3 billion in 2023 and is projected to reach USD 13.6 billion by 2033, with a robust CAGR of 26.5%.

- The Solution segment dominated the market in 2023, accounting for 65.4% of the component segment, driven by the growing demand for automated tax solutions.

- Cloud-Based deployment led the market in 2023 with a 67.1% share, highlighting its scalability and accessibility for enterprises.

- Large Enterprises held the largest market share in 2023, at 64.8%, due to their complex tax management requirements.

- North America emerged as the leading region in 2023, capturing 39.0% of the market share, supported by its strong corporate sector.

Generative AI in Corporate Tax Management Statistics

- The Global Generative AI Market is poised for significant growth, anticipated to surge from USD 13.5 Billion in 2023 to USD 255.8 Billion by 2033, marking a robust CAGR of 34.2% from 2024 to 2033. In 2023, North America emerged as the frontrunner in this sector, commanding over 42.1% of the market share, equating to revenues of USD 5.6 Billion.

- Regarding adoption among tax professionals, data from 2023 showed a notable reluctance, with 73% expressing no immediate plans to utilize Generative AI. This sentiment experienced a dramatic shift by 2024, with the figure dropping to 48%. Concurrently, in the UK, 10% of tax practitioners utilize Generative AI daily, and approximately two-thirds are engaging with the technology either currently or imminently. The technology finds its primary applications in researching tax matters (91%) and drafting tax documents (87%).

- Frequent usage patterns reveal that 35% of professionals employ Generative AI at least monthly, and 32% are poised to adopt it, illustrating a growing inclination towards integrating this technology in tax practices.

- A Thomson Reuters survey highlights that 81% of tax professionals believe Generative AI can amplify the efficiency and accuracy of their work. While 47% of respondents from tax firms are optimistic about Generative AI, 36% remain hesitant, and 17% express concerns or fears.

- A significant majority, 73%, affirm that Generative AI can be deployed effectively in tax and accounting roles, though only 52% advocate for its adoption. These figures slightly lag behind those from corporate tax professionals, where 80% recognize the utility and 60% support the adoption of Generative AI.

- Utilization of open-source Generative AI tools, such as ChatGPT, is reported by 28% of tax firm respondents for personal use, with an additional 31% planning to start within the next three years. Meanwhile, proprietary tax-specific Generative AI tools are currently used by just 9%, although 44% plan to adopt these tools within the same timeframe.

- On an organizational scale, 10% of firms are leveraging Generative AI across their operations, with another 40% either planning or considering its implementation.

- The principal applications of Generative AI among these firms are accounting/bookkeeping (84%), tax research (84%), tax return preparation (69%), and tax advisory services (67%). This data underscores the transformative potential of Generative AI across the tax profession, reflecting both growing interest and varying levels of adoption readiness.

Emerging Trends

- AI-Driven Automation and Data Analytics: The integration of Generative AI (GenAI) in corporate tax departments significantly enhances automation and data analytics, allowing for real-time insights and more strategic decision-making.

- Predictive Capabilities and Risk Management: GenAI is transforming tax management from a traditionally reactive practice to a proactive and predictive one, with capabilities to forecast future trends and manage risks effectively.

- Increased Focus on Compliance and Accuracy: With its ability to process and analyze vast amounts of data, GenAI improves compliance and the accuracy of tax reporting and operations.

- Integration with Existing Systems: There is a growing trend of seamlessly integrating GenAI solutions with existing corporate systems to enhance functionality and operational efficiency.

- Custom AI Solutions for Tax Functions: Customizable AI tools are being developed to cater specifically to the nuanced needs of tax departments, ensuring more tailored and effective solutions.

Top Use Cases

- Automated Compliance and Reporting: GenAI significantly reduces the manual effort required in tax compliance and reporting by automating data extraction, validation, and processing tasks.

- Strategic Tax Planning: AI tools leverage historical data and predictive analytics to assist tax professionals in strategic planning and decision-making, ensuring optimal tax strategies are employed.

- Risk Assessment and Management: GenAI enhances the ability to perform detailed risk assessments and management, identifying potential compliance issues and tax liabilities before they become problematic.

- Fraud Detection and Security: AI-driven systems are equipped to detect discrepancies and potential fraud, thereby enhancing the security of tax processes and data.

- Resource Optimization and Cost Reduction: By automating routine tasks, GenAI frees up valuable resources, allowing tax departments to focus on higher-value strategic activities and reducing operational costs.

Major Challenges

- Data Security and Privacy Concerns: Ensuring the security and integrity of sensitive financial data remains a critical challenge as tax departments integrate GenAI technologies. The fear of data breaches or unauthorized access can hinder the adoption of these technologies.

- Accuracy and Compliance: As tax regulations are complex and frequently updated, maintaining accuracy in automated processes and ensuring compliance are significant challenges. Inaccurate outputs due to AI errors can lead to compliance risks and financial penalties.

- Integration with Existing Systems: Seamlessly integrating GenAI into existing corporate tax workflows without disrupting current processes poses a technological and logistical challenge. Ensuring compatibility and smooth function across different platforms is essential for effective implementation.

- Ethical and Legal Implications: As AI tools take on more decision-making roles, ethical concerns, such as bias in AI algorithms and the legal ramifications of AI-generated advice, become increasingly pertinent. Developing standards and practices to address these concerns is crucial.

- Skills Gap and Training Needs: The successful deployment of GenAI requires a workforce skilled in both tax expertise and AI technology. Bridging this skills gap through training and development programs is vital for maximizing the potential of GenAI.

Top Opportunities

- Enhanced Efficiency and Cost Reduction: GenAI can automate time-consuming tasks like data entry and tax calculations, freeing up professionals to focus on strategic and high-value activities. This shift not only improves operational efficiency but also reduces costs associated with manual processes.

- Improved Accuracy and Analytical Capabilities: AI-driven tools can process large volumes of data with greater accuracy than humans, reducing errors and enhancing the precision of tax reports and filings. This leads to better compliance and less risk of financial penalties.

- Strategic Decision Making and Planning: By analyzing past data and predicting future trends, GenAI enables more informed decision-making and strategic planning. Tax departments can leverage these insights to optimize tax strategies and enhance profitability.

- Innovative Tax Solutions and Services: The integration of GenAI in tax software, like embedding capabilities in tools such as Excel, allows tax professionals to customize solutions and automate routine tasks, leading to innovative practices and services in the tax field.

- Empowering Tax Professionals: Generative AI can transform the role of tax professionals from traditional taxologists to technologists, making tax careers more dynamic and appealing. This technological shift attracts a diverse range of professionals, enriching the talent pool.

Recent Developments

Vertex, Inc.

In June 2024, Vertex, Inc. made a significant acquisition of AI tax capabilities from Ryan, LLC. This acquisition is aimed at enhancing Vertex’s AI-driven tax categorization processes, which are crucial for managing tax compliance on a global scale. By integrating these capabilities, Vertex is focused on improving the accuracy and efficiency of tax management for high-volume businesses, leveraging AI to automate and streamline complex tax-related tasks. This move aligns with Vertex’s strategy to advance its AI innovation and support comprehensive cloud solutions for global tax processes.

Wolters Kluwer N.V.

Wolters Kluwer has been actively enhancing its AI offerings, particularly with the launch of new AI-enabled capabilities in May 2024. These enhancements are part of the company’s broader innovation strategy centered on firm intelligence. Notably, Wolters Kluwer introduced advanced AI functionalities within its tax and accounting solutions, designed to help professionals manage their tax obligations more efficiently. Additionally, in June 2024, they rolled out a new AI-powered virtual agent to improve customer support, which can understand and respond to inquiries in everyday language, significantly improving the user experience.

Avalara, Inc.

In January 2024, Avalara released its annual predictions, highlighting the growing role of AI in tax compliance. The company emphasized the increasing integration of AI assistants in the tax space, which are designed to analyze data, detect anomalies, and assist in tax research and filing. These developments underscore Avalara’s commitment to leveraging AI to automate tax processes and enhance the accuracy of compliance operations.

Thomson Reuters’ New AI-Enhanced Products

In November 2023, Thomson Reuters introduced several updates to its tax, accounting, and audit products, integrating generative AI capabilities. These updates include enhancements to their Checkpoint Edge and ONESOURCE Global Trade Management tools, aimed at automating tax workflows to improve efficiency for firms and corporate tax departments. This development is part of Thomson Reuters’ broader strategy to incorporate AI into their offerings to help professionals manage increasing complexities in tax regulations.

Thomson Reuters’ Acquisition of Casetext

In November 2023, As part of its $100 million annual investment in generative AI, Thomson Reuters acquired Casetext for $650 million. This acquisition is a strategic move to bolster their generative AI capabilities across their product lines, including those tailored for corporate tax management. The integration of Casetext’s technology is expected to enhance AI-driven legal and tax research capabilities, further automating and streamlining complex processes.

Deloitte’s AI Innovation Award for Omnia Platform

In August 2024, Deloitte’s Omnia platform, which now includes advanced generative AI capabilities, was recognized with the “AI Innovation Initiative of the Year” award at the 2024 International Accounting Forum and Awards. These capabilities are designed to improve audit workflows, making them more efficient while allowing professionals to focus on higher-value tasks. This platform is also applied in corporate tax management, where it helps streamline processes and provides deeper insights.

PwC’s $1 Billion Investment in AI

In 2024, PwC announced a significant investment of $1 billion over the next three years to expand and scale their AI capabilities, including generative AI. This investment is aimed at enhancing their tax services, with a focus on automating complex tax processes and improving accuracy and efficiency in tax compliance and planning. This initiative is part of a broader effort to integrate AI into PwC’s service offerings, providing clients with cutting-edge tools to manage their tax obligations.

Conclusion

In Conclusion, Generative AI in corporate tax management is poised to revolutionize how companies handle their tax obligations, offering substantial improvements in efficiency, accuracy, and compliance. As these AI systems become increasingly capable of handling complex tax scenarios across various jurisdictions, they present a significant opportunity for companies to streamline operations, reduce costs, and mitigate risks associated with tax compliance.

The market for these technologies is expanding rapidly, driven by the need for more sophisticated tax management solutions that can adapt to the ever-changing global tax landscape. This adaptation not only supports current operational needs but also positions companies to be more agile and competitive in a dynamic business environment. As such, the integration of generative AI into corporate tax functions is not just a trend but a critical investment in the future of financial management within organizations.