Table of Contents

Introduction

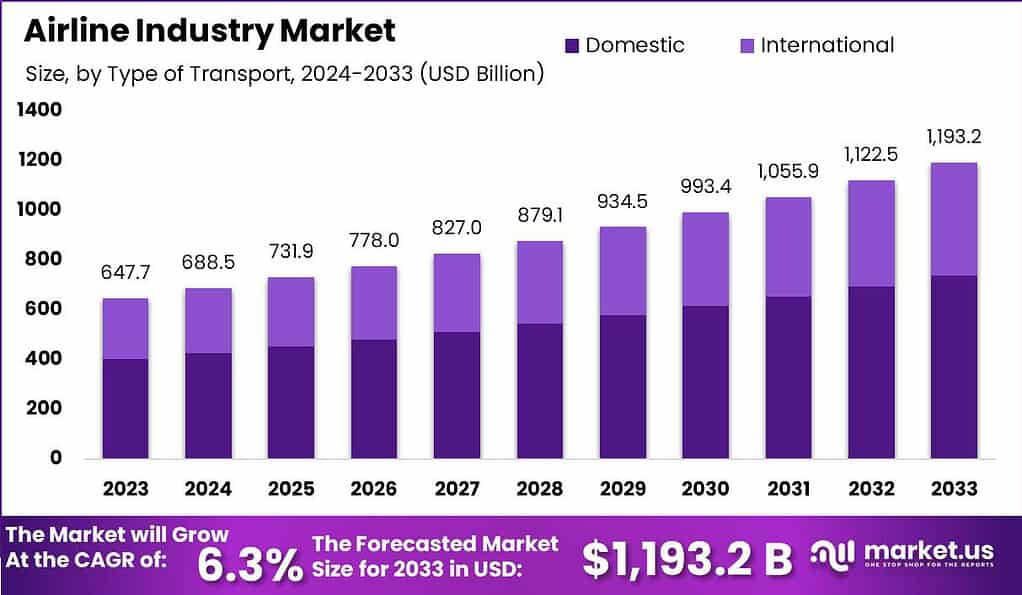

According to Market.us, The size of the Global Airline Industry Market is projected to reach USD 1,193.2 Billion by 2033, up from USD 647.7 Billion in 2023. This represents a Compound Annual Growth Rate (CAGR) of 6.3% over the forecast period from 2024 to 2033.

The airline industry comprises companies that provide air transport services for traveling passengers and freight. This industry relies on a complex array of operations that include flight operations, aircraft maintenance, baggage handling, and customer service. The industry is heavily regulated globally, and its revenue streams are closely tied to the economic conditions in various regions. Key players in this sector range from large international carriers to regional and low-cost airlines, each catering to different customer segments and geographic markets.

The market dynamics of the airline industry are influenced by factors such as fuel prices, technological advancements, regulatory changes, and macroeconomic trends like GDP growth and consumer spending patterns. The competition within the industry is intense, with carriers competing on routes, pricing, service quality, and frequent flyer programs. The rise of low-cost carriers has disrupted traditional business models, forcing legacy airlines to adapt with more efficient operations and diversified revenue streams such as ancillary services.

The demand for air travel is primarily driven by economic growth, as increased wealth leads to greater spending on travel for both business and leisure purposes. Growth factors also include globalization of business operations and tourism, technological improvements in aircraft efficiency, and liberalization of air transport markets. The industry has significant opportunities in digital transformation, such as the implementation of biometric technology for smoother security processes and personalized in-flight services using AI and data analytics to enhance passenger experience.

Key Takeaways

- The airline industry is projected to attain a market value of USD 1,193.2 billion by the year 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.3% throughout the forecast period. As of 2023, the market was appraised at USD 647.7 billion.

- When segmented by type of transport, the market is bifurcated into domestic and international segments. The domestic segment is predominant, capturing a market share of 62% in 2023.

- Further segmentation based on application reveals that the passenger segment commands the majority of the market, with a substantial share of 71.6% in 2023.

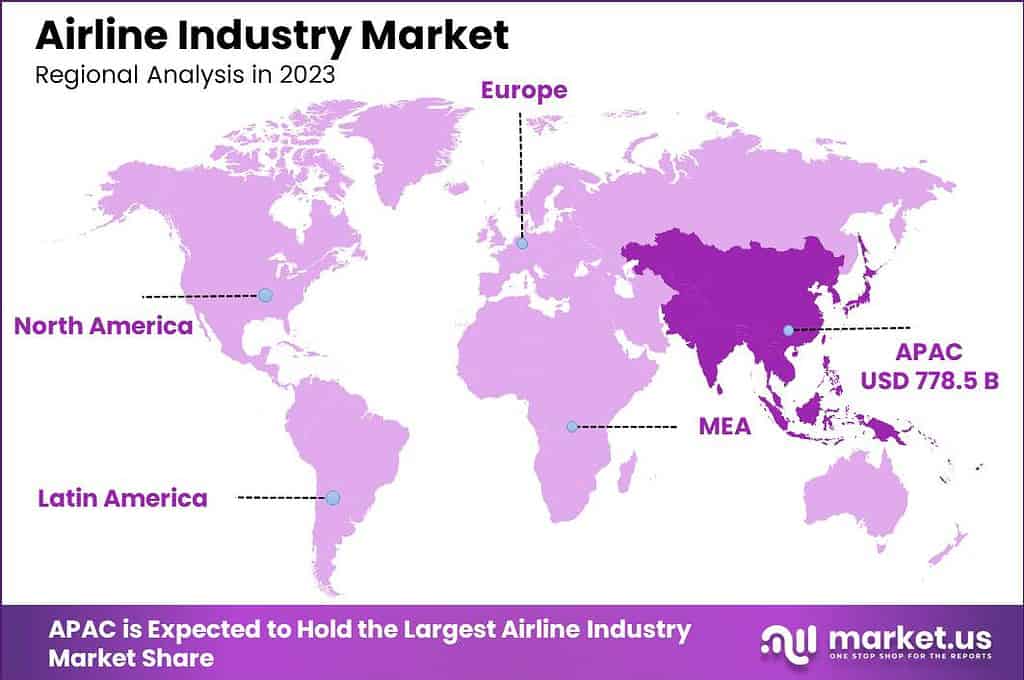

- Regionally, the Asia Pacific leads with the largest market share of 43% in 2023. This dominance is attributed to the region’s developing economy, enhanced infrastructure, and supportive governmental initiatives.

Airline Industry Statistics

- The global airline industry has experienced a robust recovery, with air traffic reaching 98.2% of pre-COVID-19 levels. This resurgence has been characterized by a strong rebound in passenger numbers, which are projected to approach 4.7 billion in 2024, nearing 5% below pre-pandemic figures. The increase in passenger demand, noted at 23% in 2023, has brought total passenger traffic to 4.3 billion.

- Airline operating profits are anticipated to surpass $49 billion in 2024, supported by strong demand and significant pricing power. This financial upswing is further underpinned by the operational capacity of jets, which are currently at 99% of levels seen before the pandemic.

- However, the industry faces ongoing challenges, particularly in the realms of supply chain management and production quality, which are expected to persist throughout 2024. Additionally, the sector requires substantial investment in aircraft delivery financing, estimated at $110 billion for the year 2024.

- The year 2023 marked a pivotal moment for aircraft lessors, with notable achievements in sector performance. Looking ahead, the industry is aligning towards sustainable aviation fuel (SAF) targets, aiming for 5-10% usage by 2030.

- Inflation in EU air fares has also seen a significant rise, currently at 28%, reflecting broader economic pressures.

- Ireland is poised to play a crucial role in advancing the aviation sector’s commitment to achieving net zero emissions by 2050, highlighting its strategic importance in the global efforts towards sustainability.

Source: startus-insights.com

Financial Performance

- Passenger Revenue: In 2024, passenger revenue in the global airline industry is projected to reach USD 744 billion, an increase from USD 646 billion in 2023.

- Net Profit: The industry is anticipated to achieve a net profit of ~USD 30.5 billion in 2024, marking a significant turnaround from a loss of USD 40.4 billion in 2021.

Traffic Volumes

- Passenger Traffic: Approximately 4.5 billion passengers were carried by the global airline industry in 2023, with forecasts suggesting an increase to 4.96 billion in 2024. This indicates a growth of 36.6% from 2022.

- Flight Operations: The total number of flights operated globally in April 2024 was 615,715, representing a 5.01% increase compared to the previous year.

Operational Metrics

- On-Time Performance: In April 2024, the on-time arrival rate for U.S. airlines improved to 80.4%, up from 75.7% in April 2023.

- Cancellation Rates: The cancellation rate for flights in April 2024 was reduced to 0.7%, a decrease from 1.7% in April 2023.

Economic Impact

- The airline industry is projected to significantly impact the global economy, with an expected contribution of approximately USD 1.5 trillion to global GDP by 2036. This robust economic input is anticipated to support around 15.5 million direct aviation jobs, underscoring the industry’s crucial role in global employment and economic stability.

- Fuel Consumption: Commercial airlines are projected to consume substantial quantities of fuel, emphasizing the integration of sustainable aviation fuel (SAF) to meet forthcoming environmental objectives. This shift towards sustainability is in response to global environmental targets and the increasing need for the aviation sector to reduce its carbon footprint.

Airline Industry in Asia Pacific

In 2023, the Asia-Pacific (APAC) region secured a prominent position in the global airline industry, accounting for over 43% of the market share. The valuation of the airline market in this region was estimated at USD 778.5 billion in 2023, with projections indicating substantial growth in the coming years.

The dominance of APAC in the airline industry can be attributed to several key factors:

- Economic Growth: APAC has been experiencing robust economic growth, leading to increased disposable incomes and a burgeoning middle class. This economic prosperity enables more individuals to travel for both leisure and business, fueling demand for airline services.

- Urbanization and Infrastructure Development: Rapid urbanization and significant investments in infrastructure, including airports and air services, have improved connectivity within the region. This development has made air travel more accessible and efficient, further boosting market growth.

- Increase in Tourism: APAC countries, notably China, India, Thailand, and Malaysia, have become popular tourist destinations. The rise in tourism has directly influenced the growth of the airline industry, as these destinations attract both international and domestic travelers.

- Expansion of Low-Cost Carriers (LCCs): The expansion of low-cost carriers in the region has made air travel affordable for a larger segment of the population. LCCs have been pivotal in democratizing air travel, making it a feasible option for cost-conscious consumers.

- Strategic Alliances and Partnerships: Airlines in the APAC region have been actively engaging in strategic alliances and partnerships. These collaborations have allowed for expanded service offerings, optimized operational costs, and enhanced market reach, contributing significantly to the dominance of the APAC market.

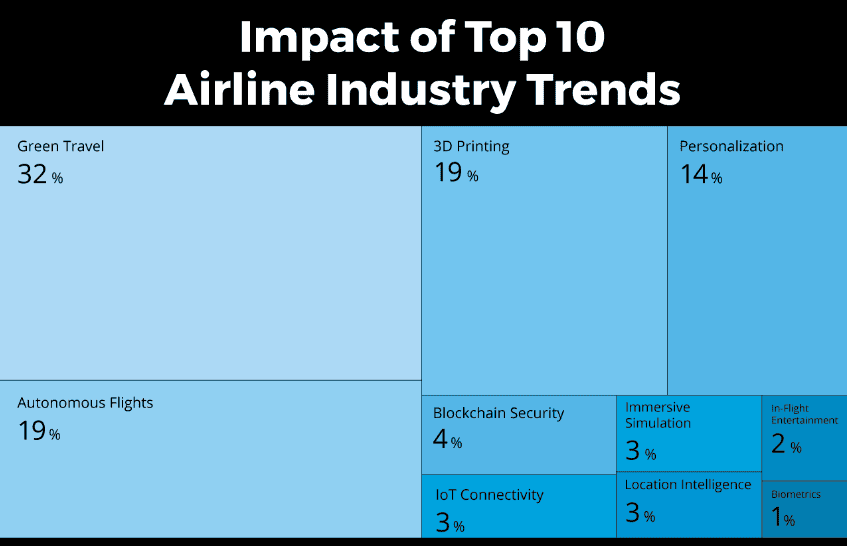

Emerging Trends

- Green Travel: Airlines are prioritizing sustainability, utilizing sustainable aviation fuels and integrating energy-efficient technologies to reduce carbon emissions and enhance environmental stewardship.

- Autonomous Flights: Advancements in autonomous flight technology are set to improve operational efficiency and safety, leveraging AI for tasks like automated takeoffs and landings.

- Supersonic Travel: After years of dormancy, supersonic travel is resurfacing with new developments aimed at reducing global travel times significantly.

- Biometric Enhancements: Airports are expanding the use of biometric technology to streamline passenger processing from check-in through boarding.

- Smart Airports: Transforming into smart hubs, airports are integrating digital technologies to improve efficiency and passenger satisfaction, mirroring the complexity of small cities.

Top Use Cases

- Hydrogen-Powered Aircraft: Companies are heavily investing in hydrogen fuel technology for aircraft, aiming to decrease carbon emissions and push toward a sustainable future.

- Personalized Passenger Experiences: Leveraging AI and data analytics, airlines are offering more tailored in-flight services, such as customized entertainment and meal options.

- Advanced Urban Air Mobility: As demand for efficient transport grows, new technologies like urban air mobility are emerging to provide alternative travel options.

- Emotional Loyalty Programs: Airlines are redefining loyalty programs to create deeper emotional connections with passengers, promoting brand loyalty beyond traditional rewards.

- SAF Supply Chain Planning: With a focus on sustainable aviation fuel, airlines are developing robust supply chains to support the production and integration of SAF, aligning with global carbon reduction goals.

Major Challenges

- Supply Chain and Production Issues: Airlines are facing delays in new aircraft deliveries and maintenance challenges due to ongoing supply chain disruptions, affecting their ability to meet increasing demand and maintain operational schedules.

- Labor Costs and Shortages: Elevated labor costs are expected to persist as the industry contends with renegotiations of union contracts and a tight labor market. Additionally, pilot shortages pose a significant challenge, limiting capacity growth and operational flexibility.

- Macroeconomic Sensitivity: The airline industry is highly sensitive to macroeconomic conditions. A potential slowdown or recession could significantly impact air travel demand, affecting overall sector profitability.

- Geopolitical Tensions: Ongoing geopolitical conflicts and potential new tensions could disrupt international travel routes and increase operational costs, particularly due to fluctuations in fuel prices and security considerations.

- Environmental and Regulatory Pressures: As environmental regulations tighten, airlines are compelled to invest in sustainable practices and technologies, including Sustainable Aviation Fuel (SAF). These initiatives, while necessary for long-term sustainability, present short-term financial and operational challenges.

Top Opportunities

- Sustainable Aviation Fuels (SAF): There’s a growing commitment within the industry to increase the use of SAF, which not only helps reduce carbon emissions but also aligns with global sustainability goals. This shift is expected to open up new markets and customer bases that prioritize environmental responsibility.

- Technological Innovations: Adoption of technologies such as autonomous flights, AI-driven operations, and improved in-flight entertainment systems presents opportunities to enhance operational efficiency and customer satisfaction. These technologies can also help reduce costs and improve safety.

- Digital Transformation: The integration of digital tools and platforms for better customer service, including personalized travel experiences through data analytics, offers a competitive edge and can lead to increased passenger loyalty and revenue.

- Expansion in Emerging Markets: Regions like Asia Pacific and certain markets in Africa and Latin America are anticipated to see significant growth. Airlines focusing on these regions can benefit from the increasing travel demand and developing infrastructure.

- Fleet Modernization and Diversification: Investing in newer, more fuel-efficient aircraft can reduce operational costs over time. Additionally, diversifying fleet sizes to meet different market demands allows airlines to adapt more flexibly to changing travel patterns and market conditions.

Recent Developments

- Air France-KLM Group: In August 2024, Air France-KLM completed the acquisition of a non-controlling stake in SAS AB, the parent company of Scandinavian Airlines. This acquisition marked the beginning of extensive commercial cooperation, which started in September 2024, aiming to strengthen Air France-KLM’s position in the European market.

- Delta Air Lines: Delta continues to expand its joint venture with Air France-KLM and Virgin Atlantic. This partnership, which began in 2009, now represents approximately 23% of total passenger and cargo transatlantic capacity, with combined annual revenues estimated at USD 13 billion. The joint venture offers significant customer benefits, including seamless connections and loyalty program integration across the partners.

- American Airlines: As part of its growth strategy, American Airlines has been focusing on expanding its transatlantic routes in collaboration with its Oneworld alliance partners. The airline is also investing heavily in upgrading its fleet and in-flight services to remain competitive in the international market.

- LATAM Airlines Group: LATAM, in which Delta Air Lines holds a 20% stake, has been focusing on strengthening its network in South America. The airline is actively expanding its route offerings within the region, leveraging its strategic partnerships to enhance connectivity.

- Alaska Airlines and Hawaiian Airlines: In 2023, Alaska Airlines announced an agreement to acquire Hawaiian Airlines. Despite the acquisition, Hawaiian Airlines will continue to operate under its brand, which allows Alaska Airlines to expand its presence in the Pacific region.

Conclusion

The airline industry is poised for recovery post-pandemic with expectations of a rebound in global travel demand. However, challenges such as fluctuating fuel prices, geopolitical tensions, and environmental regulations demand strategic adjustments from airlines. The successful exploitation of growth opportunities in technology and service innovation will be key for airlines to differentiate themselves and achieve sustainable growth in the competitive market landscape.