Table of Contents

Introduction

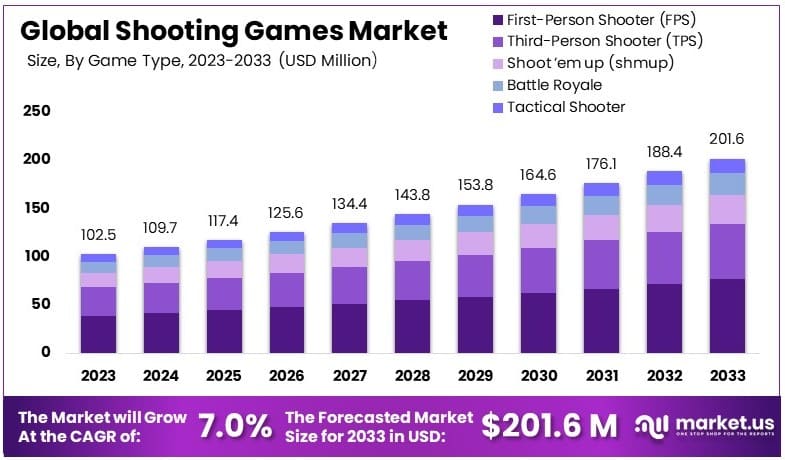

According to Market.us, The Shooting Games Market exhibited a valuation of USD 102.5 million in 2023. It is anticipated to ascend to USD 201.6 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. This growth trajectory highlights the increasing popularity and consumer engagement with shooting games, reflecting broader trends in digital entertainment and interactive media. Such a robust growth rate underscores the market’s potential for substantial expansion and profitability over the next decade.

Shooting games, often referred to as “shooters,” encompass a genre of video games where the focus is primarily on the defeat of characters or targets using ranged weaponry. This genre is diverse, ranging from first-person shooters (FPS) where the game is experienced from the perspective of the character, to third-person shooters that provide a viewpoint slightly behind and above the character. Popular for their fast-paced action and competitive gameplay, shooting games often emphasize hand-eye coordination, reaction times, and strategic planning. They remain one of the most popular and enduring genres in the gaming industry, appealing to a broad demographic of gamers.

The market for shooting games has seen robust growth and is a significant segment of the global video gaming industry. Factors driving this market include technological advancements in gaming technology, increased accessibility through mobile platforms, and the rising popularity of e-sports tournaments featuring shooting games. Major gaming platforms like PC, consoles, and mobile devices all support this genre, with various titles topping sales charts regularly. The market dynamics are also influenced by the strong community engagement and the frequent updates and expansions provided by developers which help maintain a high level of player interest over time.

There are several promising opportunities in the shooting games market. The integration of virtual and augmented reality technologies is enhancing the immersive experience of games, providing new ways for developers to engage players and monetize premium game modes. The market also benefits from the potential for in-game purchases and customization options that create additional revenue streams. Moreover, indie developers are bringing innovative gameplay concepts to the market, capturing niche audiences and diversifying the gaming landscape. Expanding into untapped regions with high gaming potential, such as Asia-Pacific and Latin America, offers further growth avenues.

Key Takeaways

- The Shooting Games Market was valued at USD 102.5 million in 2023 and is projected to reach USD 201.6 million by 2033, growing at a CAGR of 7.0%.

- In 2023, First-Person Shooter (FPS) games led the game type segment with 38% of the market share, mainly because of their engaging and immersive gameplay.

- For gaming platforms, consoles were the most popular in 2023, holding a 40% market share. This dominance is attributed to their large user base and advanced gaming features.

- Geographically, North America was the largest market in 2023, contributing 31% or USD 31.78 million. This leadership is due to the region’s strong gaming culture and high levels of consumer spending on games.

Shooting Games Statistics

- In 2024, about one-third of the FPS (First Person Shooter) gaming audience in the US are people aged 30-39. This shows that shooting games are popular among a wide range of ages, not just the young.

- Call of Duty, a well-known gaming franchise, has been extremely successful. It has sold around 425 million copies and made about $30 billion in revenue by 2022. Its mobile version also performed well, with 270 million downloads in its first year, proving its wide appeal across different gaming platforms.

- In terms of revenue, the shooter game sector made $4.6 billion in 2022, which was a 27% drop from the previous year. Shooter game apps were downloaded 1.8 billion times last year, a decrease from 2.8 billion in 2020.

- PUBG Mobile leads in popularity, with 120 million average monthly users.

- When looking at regional earnings, North America generates about 40% of the global revenue, Europe follows with over 30%, and the Asia Pacific region accounts for around 23%.

- Significant investments are also shaping the industry. For example, Sony bought Bungie for USD 3.6 billion, showing the intense competition among companies to expand their presence in the multiplayer shooting game market.

Emerging Trends in Shooting Games

- Hybrid Gameplay Mechanics: Current trends in shooting games include the integration of diverse gameplay mechanics, such as combining shooting elements with rhythm-based gaming. This fusion creates a unique challenge of timing actions to the beat of music, enhancing engagement through a multi-sensory experience.

- Advanced Immersive Technologies: Shooting games are increasingly incorporating advanced VR and AR technologies, pushing towards more immersive experiences. This integration allows players to experience games in a more engaging and realistic manner, blurring the lines between virtual and real-world interactions .

- Interactive and Dynamic Environments: The settings within shooting games are becoming more dynamic and interactive, influenced heavily by player actions. This trend emphasizes games that adapt to decisions and strategies, offering a more personalized gaming experience.

- Narrative Depth: There is a significant push towards incorporating rich narratives and complex storylines in shooting games, moving beyond traditional gameplay to involve players emotionally and intellectually.

- Eco-conscious Gaming: Environmental considerations are becoming increasingly important, with developments focused on reducing energy consumption associated with gaming. This trend is part of a broader movement towards sustainability within the industry.

Top Use Cases for Shooting Games

- Training and Simulation: Shooting games are used extensively in training and simulation environments, particularly in military and law enforcement scenarios. These applications benefit from realistic, high-stakes game design that mimics real-world tactics and scenarios.

- Competitive Gaming and Esports: Shooting games remain staples in the competitive gaming and esports arenas. The fast-paced and skill-based nature of these games makes them popular among players and spectators, driving large-scale tournaments and events.

- Social Interaction: Multiplayer formats in shooting games facilitate social interaction and teamwork. Players collaborate and compete in real-time, fostering community and shared gaming experiences.

- Cognitive and Reflex Training: These games are often used for cognitive and reflex training, as they require quick decision-making, precision, and adaptability. This can enhance hand-eye coordination and problem-solving skills.

- Entertainment and Recreation: At their core, shooting games provide entertainment and recreational value to a wide demographic. Their ability to deliver thrilling and engaging content keeps players returning for more, driving the genre’s popularity.

Major Challenges

- Inclusivity Issues: The gaming industry continues to face significant challenges in inclusivity, particularly regarding diversity in gender, ethnicity, and accessibility for players with disabilities. There’s a need for greater representation within games and the workforce, and addressing this could enhance the gaming experience for a broader audience.

- Cultural Sensitivity in Global Markets: As gaming companies expand globally, understanding and integrating diverse cultural perspectives become crucial. Missteps in cultural representation can affect market reception and user engagement.

- Technological Advancements and Adaptation: Keeping up with rapid technological changes and integrating them into new gaming titles without alienating existing audiences can be challenging. This includes the adoption of emerging technologies like VR and AR.

- Regulatory and Ethical Concerns: Issues such as game addiction, violence, and data privacy are increasingly under scrutiny, posing regulatory challenges for game developers and publishers.

- Economic Pressures: The competition for investment and the need for substantial initial funding make financial sustainability a critical challenge. Ensuring profitability while innovating and expanding in competitive markets requires astute financial strategies.

Top Opportunities

- Expansion into Emerging Markets: There are significant growth opportunities in untapped markets, especially in regions like Asia and the Middle East, where mobile gaming is on the rise.

- Technological Integration: Leveraging technologies such as AI, cloud computing, and advanced graphics can create more immersive and engaging gaming experiences, opening up new possibilities for gameplay innovation.

- Cross-platform Gaming: Developing games that can be played across various platforms can increase market reach and user engagement, catering to a broader audience.

- Esports and Competitive Gaming: The rising popularity of esports provides a lucrative opportunity for shooting games to be featured in tournaments, attracting sponsorships and a larger viewer base.

- Community and Social Features: Integrating more social features and community engagement tools can enhance player retention and attract new users by building a more connected gaming environment.

Recent Developments

- Ubisoft: In August 2023, Ubisoft announced that it had secured cloud streaming rights to Activision Blizzard’s extensive game catalog, including Call of Duty, following Microsoft’s acquisition of Activision. This deal grants Ubisoft the ability to stream Activision’s games on their Ubisoft+ service for the next 15 years. This move solidifies Ubisoft’s position in the cloud gaming sector.

- Activision Blizzard: Activision was in the news due to Microsoft’s acquisition, finalized in 2023. The acquisition, valued at approximately $69 billion, is one of the largest in the gaming industry and affects popular shooter franchises like Call of Duty. With this acquisition, Microsoft aims to expand its influence in both console and cloud gaming.

- Krafton: Known for PUBG, Krafton has continued to innovate in the battle royale genre. In late 2023, they launched PUBG: New State, a futuristic version of their popular game, aiming to capture new audiences and refresh the established PUBG brand. This launch is seen as a strategic move to stay competitive in the rapidly evolving shooting games landscape.

- Nexon: The South Korean publisher is expanding its presence in the global shooting games market, particularly through partnerships and game launches focused on mobile and console platforms. Nexon is positioning itself to capitalize on the growing demand for cross-platform shooters.

Conclusion

The market for shooting games is undergoing rapid evolution, influenced by technological advancements, shifts in player preferences, and a growing emphasis on multiplayer functionalities. Key drivers shaping this dynamic sector include the integration of immersive technologies, the predominance of the free-to-play model, and the surging popularity of battle royale formats.

These elements collectively contribute to the robust expansion of the market. As it progresses, the industry is poised to offer increasingly innovative and engaging experiences to a global audience. This trend underscores the significant potential for growth and innovation within the realm of shooting games, reflecting both the technological advancements at play and the changing landscape of consumer entertainment preferences.