Table of Contents

IP Camera Market Overview

IP camera companies provide digital video cameras that transmit data over a network, enabling remote viewing and recording.

They come in various types, including fixed, PTZ (Pan-Tilt-Zoom), dome, bullet, and wireless models, each suited for different surveillance needs.

Key features include varying resolutions, network connectivity options, video compression technologies, and built-in analytics capabilities like motion detection.

The benefits of IP cameras include remote access, scalability, and enhanced security features. Considerations such as bandwidth requirements, power supply, and cybersecurity vulnerabilities are essential.

Their increasing adoption across residential, commercial, and industrial sectors highlights their effectiveness in modern surveillance.

Market Drivers

The global IP camera market is driven by several factors, including heightened security concerns stemming from increased crime rates. Technological advancements in video analytics and connectivity, and the integration of IP cameras with smart home systems.

Cost reductions have made these cameras more accessible, while remote monitoring capabilities have enhanced their appeal.

Additionally, government investments in public safety and the globalization of retail and logistics sectors further propel demand.

Rising awareness of the benefits of advanced surveillance solutions also contributes to the market’s robust growth, reflecting a significant shift towards modern security technologies.

Market Size

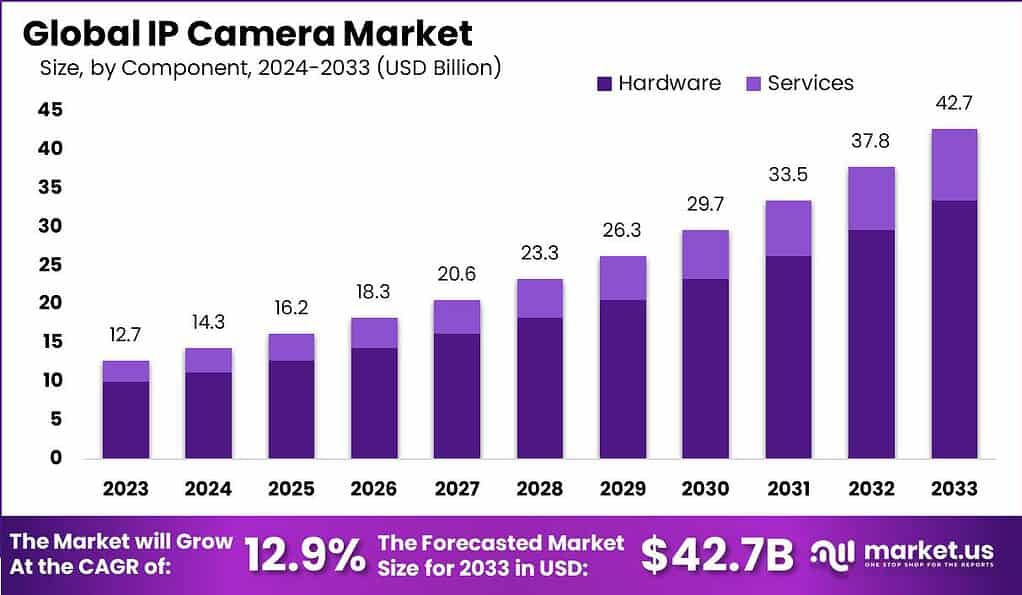

The global IP camera market is projected to reach approximately USD 42.7 billion by 2033, up from USD 12.7 billion in 2023, with a CAGR of 12.9% from 2024 to 2033.

List of Major Companies

These are the top 10 companies operating in the IP Camera Market:

Canon

Company Overview

| Establishment Year | 1937 |

| Headquarter | Tokyo, Japan |

| Key Management | Fujio Mitarai (Chairman) |

| Revenue (US$ Bn) | $ 30.3 B (2022) |

| Headcount | ~ 184,034 (2021) |

| Website | https://global.canon/en/ |

About Canon

Canon has been significantly strengthening its position in the IP camera companies/sector, particularly through strategic acquisitions and innovative product development.

The company’s key moves include acquiring BriefCam, a provider of video content analysis software. Which enhances its capabilities in video surveillance and deep learning technologies.

This acquisition complements its earlier purchases of Axis Communications and Milestone Systems. Positioning Canon as a leader in the network video solutions market.

These acquisitions allow Canon to expand its portfolio of advanced video analytics, traffic monitoring, and city surveillance solutions, integrating AI and deep learning for enhanced functionality.

Recent developments, such as the continued innovation in video analytics with BriefCam and the potential for synergies across its acquired companies. Demonstrate Canon’s commitment to leading the global video surveillance market.

Geographical Presence

Canon Inc., headquartered in Tokyo, Japan, operates globally across several key regions, including Asia-Pacific, the Americas, and EMEA.

In Asia, Japan serves as its main hub, while China and Southeast Asian markets are experiencing significant growth.

North America, particularly the U.S., is a major revenue source, complemented by emerging markets in Latin America.

In Europe, Canon maintains a strong presence in Western and Eastern Europe. With an increasing focus on the Middle East and Africa.

The company is adapting to digital transformation and sustainability trends. Positioning itself to meet diverse customer needs and drive innovation across its product lines.

Recent Developments

- In July 2024, Canon introduced the EOS R1 and EOS R5 Mark II full-frame mirrorless cameras.

- In June 2024, Canon Inc. launched the CINE-SERVO Lenses.

Hikvision

Company Overview

| Establishment Year | 2001 |

| Headquarter | Hangzhou, Zhejiang, China |

| Key Management | Chen Zongnian (Chairman) |

| Revenue (US$ Bn) | $ 12.6 B (2022) |

| Headcount | ~ 58,544 (2022) |

| Website | http://www.hikvision.com/ |

About Hikvision

Hikvision, a major player in the IP camera companies/sector, continues to expand its product range and market reach. In 2023, the company launched over a dozen new products.

Including advanced AI-powered solutions such as the 7 Series ColorVu Dual Light Cameras and new DeepinView Dome Cameras. Designed to enhance low-light performance and data analytics for security systems.

These innovations reflect Hikvision’s ongoing focus on integrating artificial intelligence and improving video surveillance technology.

The company also introduced new PoE switches and eco-friendly camera systems. Like the ColorVu Solar-Powered Security Camera, to meet evolving market demands.

These product launches are part of Hikvision’s strategy to maintain its leading position in the global surveillance market, where it has significantly increased its market share.

Geographical Presence

Hikvision, a prominent video surveillance provider, has a strong global presence and operations across multiple regions.

Its headquarters in China serves as the main market, while Southeast Asia is experiencing growth due to smart city initiatives.

In North America, particularly the U.S. and Canada, the focus is on innovative security solutions. Europe shows high demand driven by regulations and public safety. While the Middle East and Africa are seeing increased adoption linked to urbanization.

Latin America, especially Brazil and Mexico, is also emerging as a key market. Overall, Hikvision’s strategic partnerships and localized approaches enhance its competitive edge and market adaptability.

Recent Developments

- In September 2024, HIKMICRO launched the STELLAR 3.0 and THUNDER 3.0 models.

- In September 2024, Hikvision launched upgraded wireless access points aimed at lowering costs and streamlining network management for small and micro-sized businesses.

Hitachi

Company Overview

| Establishment Year | 1910 |

| Headquarter | Tokyo, Japan |

| Key Management | Keiji Kojima (CEO) |

| Revenue (US$ Bn) | $ 71.9 B (2023) |

| Headcount | ~ 268,655 (2024) |

| Website | https://www.hitachi.com/ |

About Hitachi

Hitachi is actively leveraging its expertise in digital solutions and robotic systems to make a mark in the IP camera companies and broader security sectors.

Although it is more focused on its Lumada digital infrastructure and AI-driven solutions, Hitachi’s recent acquisitions and developments in vision systems are noteworthy.

For example, the company acquired Kyoto Robotics, which specializes in intelligent robotic vision systems, and has integrated these technologies into its broader digital transformation initiatives.

This acquisition enhances Hitachi’s capabilities in sectors like manufacturing and logistics by utilizing advanced AI and vision technologies for automation and monitoring.

Furthermore, Hitachi’s focus on operational technology (OT) and digital innovation is being strengthened through reorganizations, such as its partnership with Hitachi Vantara to offer data and IoT solutions, including infrastructure for surveillance and security applications.

Geographical Presence

Hitachi, Ltd., headquartered in Tokyo, Japan, operates across diverse sectors globally, including IT services, social infrastructure, and high-functional materials.

In Asia-Pacific, the company has a strong presence in Japan and China, with significant investments in technology and infrastructure. In North America, particularly the United States, Hitachi focuses on IT services and consulting.

Its European operations, notably in the UK and Germany, emphasize smart city solutions and industrial automation.

Additionally, the company is expanding its footprint in the Middle East, Africa, and Latin America, targeting infrastructure and energy projects.

This broad geographical presence enables Hitachi to effectively address regional market demands while aligning with global trends in sustainability and innovation.

Recent Development

- In September 2024, Transport for Wales selected Hitachi to implement a digital booking system for public transport in Wales.

- In August 2024, Hitachi partnered with Gencurix to create advanced cancer diagnostics, combining Hitachi’s R&D and digital expertise with Gencurix’s biomarker testing technology.

Bosch

Company Overview

| Establishment Year | 1886 |

| Headquarter | Stuttgart, Germany |

| Key Management | Stefan Hartung (CEO) |

| Revenue (US$ Bn) | $ 99.1 B (2023) |

| Headcount | ~ 429,416 (2023) |

| Website | https://www.bosch.com/ |

About Bosch

Robert Bosch GmbH, a key player in the IP camera companies/sector, has been actively expanding its portfolio through both innovation and acquisitions.

In recent years, Bosch has strengthened its video surveillance capabilities, particularly through its Security Systems division, which offers a wide range of video cameras, management systems, and access control solutions.

In 2023, Bosch completed a significant acquisition of U.S.-based TSI Semiconductors, allowing it to boost production in cutting-edge semiconductor technology, which is vital for modern IP camera systems and video analytics.

Additionally, Bosch has been focusing on integrating AI and IoT technologies into its security products, reflecting its strategic aim to lead in connected security solutions.

This combination of innovation and strategic acquisitions ensures that Bosch continues to grow in the rapidly evolving IP camera and surveillance market.

Geographical Presence

Robert Bosch GmbH, headquartered in Stuttgart, Germany, is a global leader in technology and services, with a significant geographical presence across multiple regions.

In Europe, it operates extensively in Germany, France, Italy, and the UK, focusing on automotive components and consumer goods.

In North America, the U.S. is a key hub for manufacturing and R&D, complemented by operations in Canada and Mexico.

The Asia-Pacific region features a strong presence in China and India, emphasizing mobility solutions and consumer appliances.

Latin America includes manufacturing facilities in Brazil and Argentina, while operations in South Africa and the UAE support the Middle East and Africa. This strategic distribution enhances Bosch’s competitiveness across various sectors and markets.

Recent Development

- In July 2024, Robert Bosch introduced the new Eyes Outdoor Camera II.

- In September 2023, Bosch acquired U.S. chipmaker TSI Semiconductors, enhancing its manufacturing capacity in a key market.

Sony

Company Overview

| Establishment Year | 1946 |

| Headquarter | Tokyo, Japan |

| Key Management | Kenichiro Yoshida (CEO) |

| Revenue (US$ Bn) | $ 90.1 B (2023) |

| Headcount | ~ 113,000 (2023) |

| Website | http://www.sony.com/ |

About Sony

Sony Corporation has been actively advancing its position in the IP camera companies/sector, focusing on cutting-edge image sensor technology and innovative video solutions.

A key development was Sony’s acquisition of Nevion, which enhanced its portfolio of cloud-based IP production solutions catering to industries such as broadcasting and security.

Sony’s image sensor division continues to dominate the market, with the company expecting to control 60% of the global image sensor market by 2025.

This growth is driven by heavy investments in R&D, particularly in larger, more advanced image sensors that improve video quality for both security applications and consumer devices.

Additionally, Sony’s innovations in AI-enhanced cameras and 4K resolution technologies are shaping the future of IP cameras for high-precision surveillance.

Geographical Presence

Sony Corporation has a significant global presence across various sectors, including electronics, gaming, and entertainment.

In North America, the U.S. is its largest market, supported by robust operations in consumer electronics and gaming.

Europe features strong markets in the U.K., Germany, and France, particularly for the PlayStation brand. In the Asia-Pacific region, Japan remains the home base for R&D, while China and Southeast Asia show growing potential.

Latin America, especially Brazil and Mexico, is emerging with a focus on consumer electronics. In the Middle East and Africa, Sony is expanding its footprint in entertainment and gaming.

This strategic geographical diversification allows Sony to leverage regional strengths and respond effectively to local market demands.

Recent Developments

- In September 2024, Sony Corporation partnered with TVN LIVE PRODUCTION to enhance its outside broadcast fleet with the addition of the U8 truck.

- In September 2020, Sony acquired Nevion, a leader in virtualized media production, to strengthen its portfolio with IP and cloud-based broadcasting solutions.

Panasonic

Company Overview

| Establishment Year | 1918 |

| Headquarter | Osaka, Japan |

| Key Management | Kazuhiro Tsuga (Chairman) |

| Revenue (US$ Bn) | $ 62.8 Billion (2023) |

| Headcount | ~ 233,391 (2023) |

| Website | http://holdings.panasonic/ |

About Panasonic

Panasonic Corporation is enhancing its position in the IP camera companies/sector by focusing on advanced imaging technologies for broadcasting and security.

In 2023, it launched new 4K IP camera systems, including the AK-UCU700 camera control unit, which supports high-quality 4K HDR and advanced IP migration.

This initiative is part of Panasonic’s strategy to lead in IP-based live production. The company has also strengthened its portfolio through partnerships, such as integrating JPEG XS technology in its PTZ and studio cameras for low-latency video transmission.

In 2022, Panasonic sold an 80% stake in its surveillance camera business to Polaris Capital, creating Panasonic i-Pro Sensing Solutions to concentrate on advanced security solutions and streamline operations.

Geographical Presence

Panasonic Corporation has a strong global presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Its North American headquarters in Newark, New Jersey, focuses on automotive batteries and consumer electronics.

Europe hosts key manufacturing facilities in Germany, the UK, and France, while Japan is the R&D hub. Manufacturing operations are crucial in China and Southeast Asia, and in Latin America, primarily in Brazil and Argentina, Panasonic addresses local market needs.

In the Middle East and Africa, the company is expanding through strategic partnerships, reinforcing its commitment to delivering innovative technology solutions worldwide.

Recent Developments

- In October 2023, Panasonic Connect Europe launched a new camera control unit (CCU) to facilitate IP migration for its 4K studio camera systems.

- In April 2023, Panasonic partnered with intoPIX to integrate JPEG XS technology into its PTZ and studio cameras.

LG

Company Overview

| Establishment Year | 1958 |

| Headquarter | Seoul, South Korea |

| Key Management | Kwang-Mo Koo (Chairman) |

| Revenue (US$ Bn) | $ 64.5 Billion (2022) |

| Headcount | ~ 75,000 (2022) |

| Website | https://www.lg.com/ |

About LG

LG Electronics has been expanding its presence in the IP camera and smart home ecosystem with recent innovations and strategic moves.

In 2023, LG launched its Smart Cam (model VC23GA), a Full HD camera integrated with its webOS-powered smart TVs.

It allows for enhanced video conferencing, home fitness tracking, and interactive applications such as dance tutorials and AI-driven fitness feedback.

This aligns with LG’s broader push into AI and smart home solutions, as evidenced by its acquisition of an 80% stake in Athom, a smart home platform company.

The acquisition aims to enhance LG’s AI-enabled home automation solutions, integrating third-party devices through the LG ThinQ platform, thus broadening LG’s ecosystem in the IoT and home automation sectors.

Geographical Presence

LG Electronics has established a significant geographical presence across North America, Europe, Asia, Latin America, and the Middle East and Africa.

In North America, it focuses on consumer electronics and appliances, with a headquarters in New Jersey. In Europe, the company capitalizes on demand for premium products from its London headquarters.

Originating in South Korea, LG maintains a strong position in Asia, particularly in South Korea and China, through robust R&D investments. In Latin America, LG targets growth in Brazil and Mexico with affordable technology.

In the Middle East and Africa, it emphasizes sustainability and energy efficiency to capture emerging market opportunities, positioning itself as a leader in the electronics and home appliance sectors globally.

Recent Developments

- In September 2024, LG Electronics launched the LG NOVA Partner Alliance Program.

- In June 2023, LG launched its Smart Cam (model VC23GA), a Full HD video camera with dual microphones and a multi-view feature.

Samsung

Company Overview

| Establishment Year | 1969 |

| Headquarter | Suwon, South Korea |

| Key Management | Kye-Hyun Kyung (CEO) |

| Revenue (US$ Bn) | $ 198.2 Billion (2023) |

| Headcount | ~ 270,372 (2023) |

| Website | https://www.samsung.com/ |

About Samsung

Samsung Electronics is enhancing its position in the IP camera companies/sector through strategic partnerships and product innovations, particularly by expanding its image sensor portfolio to improve video quality and AI capabilities.

The company is focused on integrating AI and connectivity features into its cameras, responding to the rising demand for smart devices.

In 2024, Samsung plans to pursue significant mergers and acquisitions in AI, robotics, and digital health to bolster its security and surveillance capabilities.

By leveraging its expertise in semiconductors and image sensors, Samsung aims to lead in AI-powered surveillance solutions, offering advanced video analytics and real-time monitoring for commercial and residential markets.

Geographical Presence

Samsung Electronics operates globally, with a strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

In North America, significant markets include the U.S., Canada, and Mexico, focusing on smartphones and consumer electronics. Europe sees a robust foothold in Western countries, while Eastern Europe is targeted for growth.

In Asia, South Korea serves as its base, with China and Southeast Asia critical for smartphone and home appliance sales.

Latin America, particularly Brazil and Argentina, and the Middle East and Africa are key growth areas, with localized product offerings tailored to regional demands. This strategic geographical diversification reinforces Samsung’s position as a global technology leader.

Recent Development

- In September 2024, Samsung Electronics introduced the Music Frame WICKED Edition, a customizable wireless speaker.

- In April 2023, Samsung Electronics renewed a multi-year agreement to integrate various generations of high-performance, ultra-low-power AMD Radeon graphics into its Exynos SoCs.

Dahua

Company Overview

| Establishment Year | 2001 |

| Headquarter | Hangzhou, Zhejiang, China |

| Key Management | Fu Liquan (Founder) |

| Revenue (US$ Bn) | $ 4.6 Billion (2022) |

| Headcount | ~ 23,452 (2022) |

| Website | http://www.dahuasecurity.com/ |

About Dahua

Dahua Technology is enhancing its presence in the IP camera companies/sector by integrating AI and IoT technologies.

In 2023, the company launched the HDCVI 2023 series, featuring AI-driven over-coax technology for high-definition video and intelligent functions like Smart Dual Illuminators that adjust lighting based on detected targets.

Upgraded WizSense and WizMind solutions employ deep-learning algorithms for improved accuracy in tracking people and vehicles.

The Full-Color camera series excels in low-light conditions, delivering vibrant images. Additionally, Dahua is committed to sustainability through its ESG initiatives, focusing on energy efficiency and recycling and aligning technological innovation with environmental responsibility.

Geographical Presence

Dahua Technology, a leading provider of video surveillance solutions, has established a significant geographical presence across several regions.

Its headquarters in China drives extensive manufacturing and R&D, while strong market penetration is evident in Southeast Asia, North America, and Europe, where tailored solutions meet local regulatory needs.

In Latin America, rising investments in public safety, particularly in Brazil and Mexico, present growth opportunities.

Meanwhile, the Middle East and Africa, especially the UAE and Saudi Arabia, are key markets for smart city projects.

Overall, Dahua’s strategic focus on emerging and established markets positions it well to address the global demand for advanced surveillance technologies.

Recent Developments

- In September 2024, Dahua Technology announced an investment of over 35 million baht to establish a showroom in Thailand.

- In July 2024, Dahua Technology introduced MultiVision series cameras.

Honeywell

Company Overview

| Establishment Year | 1906 |

| Headquarter | Charlotte, North Carolina, U.S. |

| Key Management | Vimal Kapur (CEO) |

| Revenue (US$ Bn) | $ 36.6 Billion (2023) |

| Headcount | ~ 95,000 (2023) |

| Website | http://honeywell.com/ |

About Honeywell

Honeywell International is actively expanding its footprint in the IP camera companies/sector with a strong focus on AI-powered video surveillance and security solutions.

A key development in 2023 was the expansion of Honeywell’s 60 Series AI IP cameras, designed to offer high-quality imaging with advanced built-in AI analytics for enhanced situational awareness and reduced false alarms.

These cameras are optimized for various applications, from government to commercial spaces, and feature low-light capabilities, smart motion detection, and compliance with industry standards.

Additionally, Honeywell acquired Carrier’s Global Access Solutions business for $4.95 billion, adding brands like LenelS2 to its portfolio.

This acquisition strengthens Honeywell’s capabilities in building automation and security by integrating access solutions with cloud-based services, further enhancing its leadership in the global security market.

Geographical Presence

Honeywell International Inc., headquartered in Charlotte, North Carolina, operates across diverse sectors, including aerospace, building technologies, and safety solutions.

Its geographical presence is robust, with significant operations in North America, particularly the U.S., and strong footholds in Western Europe, especially Germany and the UK.

China and India are key growth markets in the Asia-Pacific region, while Brazil and Mexico drive expansion in Latin America.

Additionally, Honeywell targets energy and petrochemical sectors in the Middle East and Africa, leveraging its technologies to enhance operational efficiencies. This strategic diversification enhances Honeywell’s resilience and positions it for sustained growth globally.

Recent Developments

- In September 2024, Honeywell International partnered with Samsung E&A to provide carbon capture solutions for power plants.

- In September 2024, Honeywell International and Samsung announced plans to provide carbon capture solutions for power plants.