Table of Contents

Introduction

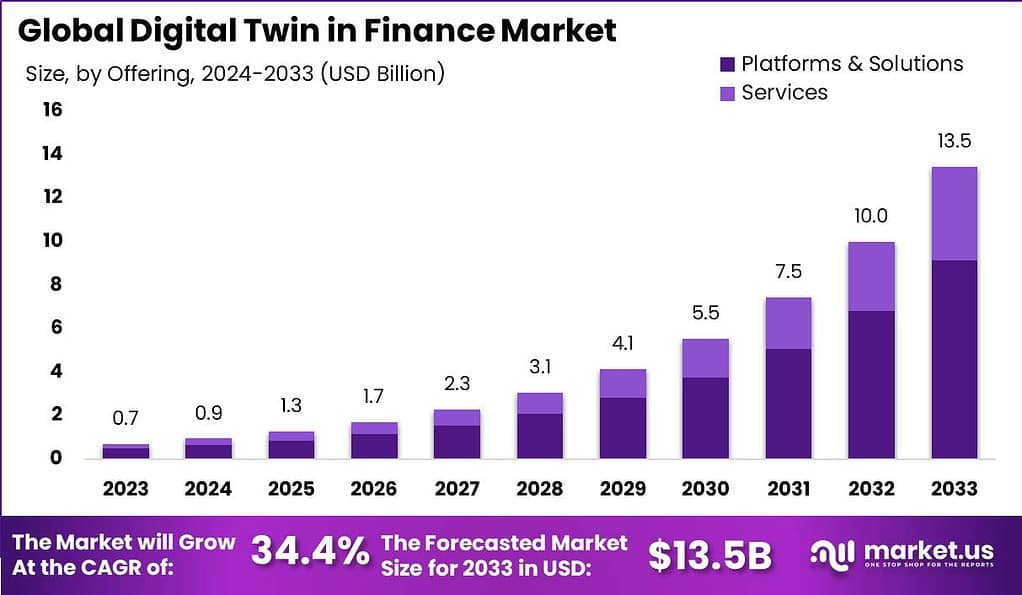

According to Market.us, The global Digital Twin in Finance Market is projected to reach approximately USD 13.5 Billion by 2033, up from USD 0.7 Billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 34.4% during the forecast period from 2024 to 2033. In 2023, North America held a dominant position in the market, capturing over 40% of the total market share, with revenues amounting to USD 0.2 Billion

A digital twin in finance refers to a virtual model designed to accurately reflect a financial system, asset, or process. This technology uses real-time data, machine learning, and advanced simulation algorithms to create dynamic representations of financial entities and operations. Digital twins allow financial institutions to experiment and predict outcomes without the risks associated with real-world changes..

The market for digital twins in finance is growing as institutions recognize the technology’s value in navigating complex financial landscapes. This market expansion can be attributed to the increasing demand for predictive analytics and real-time decision-making solutions. Financial service providers are leveraging digital twins to simulate market conditions, forecast economic impacts, and manage assets more effectively. Key market drivers include the rise in digital transformation initiatives, the need for enhanced data analytics capabilities, and growing regulatory compliance pressures.

Several factors are propelling the growth of the digital twin market within the financial industry. Technological advancements in AI and machine learning enable more detailed and accurate models of financial environments. The integration of IoT devices provides a continuous stream of operational data, which enhances the functionality and accuracy of digital twins. Furthermore, the increasing complexity of financial markets and the need for compliance with stringent regulatory requirements motivate financial institutions to adopt these sophisticated modeling tools.

The demand for digital twins in the finance sector is driven by the need for more sophisticated risk management tools and the ability to simulate financial outcomes under various scenarios without the inherent risks. As the volume and velocity of financial data increase, the necessity for models that can process and interpret this information in real-time becomes more critical. Financial institutions are using digital twins to optimize their operations, mitigate risks, and enhance customer service by predicting and adapting to changes more swiftly and accurately.

The digital twin technology in finance opens up numerous opportunities for innovation and efficiency. For financial institutions, the ability to test financial products and strategies in a virtual environment before actual implementation leads to lower costs and reduced risk. It also offers a competitive edge by enabling real-time responses to market changes. Additionally, there is a growing market for vendors who can provide tailored solutions for specific financial applications, such as asset management, fraud detection, and regulatory compliance. The ongoing digital transformation in finance suggests a sustained demand for digital twins, ensuring long-term growth and innovation in the sector.

Key Takeaways

- The Global Digital Twin in Finance Market is poised for substantial growth, with projections indicating an escalation from USD 0.7 Billion in 2023 to approximately USD 13.5 Billion by 2033, representing a robust compound annual growth rate (CAGR) of 4% over the forecast period from 2024 to 2033.

- In 2023, the platforms and solutions segment asserted a significant influence, securing a commanding 68% market share, underscoring its critical role in providing essential infrastructure and capabilities for the effective deployment of digital twins in financial environments.

- Simultaneously, the risk assessment and compliance segment emerged prominently, obtaining a substantial 38.7% share, reflecting the growing reliance on digital twin technologies for enhanced accuracy in risk evaluation and compliance with evolving financial regulations.

- The Banking, Financial Services, and Insurance (BFSI) sector dominated the market, capturing over 64% of the total market, indicating the deep integration of digital twin technologies in traditional financial institutions aiming to drive innovation and improve operational efficiencies.

- Regionally, North America led the market in 2023, holding more than 40% of the market share, attributed to the region’s advanced technological infrastructure and rapid adoption of innovative technologies by financial institutions.

Digital Twin in Finance Statistics

- The digital twin market is projected to witness substantial growth over the next decade. The Global Digital Twin Market size is forecasted to escalate from USD 11.8 billion in 2023 to an estimated USD 522.9 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 46.1% during the forecast period from 2024 to 2033.

- Parallel to this, the Digital Twins-as-a-Service (DTaS) market is anticipated to expand from USD 16.8 billion in 2023 to approximately USD 397.1 billion by 2033, growing at a CAGR of 37.2% during the same period.

- The adoption of digital twin technology is particularly pronounced in the Banking, Financial Services, and Insurance (BFSI) sector. According to a survey by Altair, 71% of respondents from the BFSI sector report their organizations currently utilize digital twin technology. This rate is notably high compared to other industries, positioning BFSI just behind the automotive and heavy equipment sectors in terms of adoption.

- The key applications of digital twins within the BFSI sector, as identified by respondents, include optimizing business processes (54%), digitally monitoring real-time behavior (51%), and employing predictive analytics to forecast future behavior (51%).

- In a broader digital context, Meta continues to lead the virtual reality headset market, holding a dominant 72% market share as of the fourth quarter of 2024. Meanwhile, digital advertising spending in the United States is projected to reach USD 452.4 billion by 2028, with Google capturing the largest share of digital ad revenue at USD 190.5 billion as of August 2024. In Europe, digital advertising expenditure attained a total of 48.3 billion Euros in 2023.

- The retail media sector shows significant growth, with 25% of respondents reporting a significant increase in digital media spending, and 35% noting a slight increase. A substantial 35% of brands plan to significantly ramp up their digital media expenditure in the near future.

- The BFSI sector exhibits a high level of engagement with digital twin technology, with 71% of BFSI respondents acknowledging its critical importance to their organization – a sentiment that matches the highest level of industry-specific significance recorded in the survey. Moreover, BFSI professionals display a relatively high level of understanding and confidence in digital twin technology, with 64% considering themselves highly knowledgeable – 14 points higher than the overall survey average.

- Despite the complex nature of digital twin technology, only 8% of BFSI respondents find it confusing, underlining the sector’s familiarity and comfort with this advanced technology. Looking ahead, 4% anticipate their organization will adopt digital twin technology within the next six months, while 58% foresee adoption within the next year or beyond.

- Additionally, 88% of non-management BFSI respondents believe that increased understanding of digital twin benefits among leadership could spur further investment in the technology, underscoring the need for enhanced knowledge dissemination at the managerial level. This perception is 3 points higher than the general survey response, indicating a specific opportunity for targeted educational efforts within the BFSI sector to enhance technology adoption and implementation.

Emerging Trends

- Regulatory Compliance: The integration of digital twins in finance is increasingly focused on ensuring compliance with evolving regulatory frameworks. This trend is particularly significant given the stringent regulations governing financial services.

- Fraud Detection Enhancement: By simulating financial transactions in a controlled virtual environment, digital twins can identify potential fraud patterns more effectively, helping institutions mitigate risks before they manifest in the real world.

- Risk Management Optimization: Digital twins allow financial organizations to model and predict various risk scenarios, enhancing their ability to manage and mitigate risks proactively.

- Personalization of Customer Experiences: There is a growing use of digital twins to tailor financial services to individual customer preferences and behaviors, improving customer satisfaction and loyalty.

- Streamlining Operations: Financial institutions are leveraging digital twins to optimize operations, reduce costs, and increase efficiency across their networks.

Top Use Cases for Digital Twins in Finance

- Credit Risk Analysis: Digital twins simulate various economic scenarios to predict their impact on credit portfolios, helping banks make more informed lending decisions.

- Asset Management: They are used to model investment portfolios under different market conditions to devise optimal investment strategies and improve asset management efficiencies.

- Operational Resilience Testing: Digital twins help financial institutions test their systems and processes against potential disruptions, ensuring operational resilience.

- Real-time Financial Monitoring: Utilizing digital twins for continuous monitoring of financial operations allows for the immediate detection of anomalies, helping to maintain financial integrity and stability.

- Customer Journey Optimization: By creating digital replicas of customer interactions, financial services can optimize the customer journey through personalized services and enhanced user experiences.

Top Benefits

- Enhanced Risk Management and Compliance: Digital twins offer improved monitoring and analysis of financial systems, which can lead to better risk management and adherence to regulatory requirements by predicting future challenges and enabling proactive responses.

- Improved Decision-Making: By providing a virtual representation of financial systems, digital twins facilitate detailed, real-time analytics which improves the precision and speed of financial decision-making processes.

- Operational Efficiency: Financial organizations can use digital twins to automate and optimize processes, significantly reducing the time and cost associated with manual interventions and increasing overall operational efficiency.

- Personalization of Financial Services: Digital twins can analyze customer data to offer personalized financial products and services, enhancing customer satisfaction and loyalty by catering to individual needs.

- Innovative Product Development and Testing: The technology allows financial institutions to simulate and test new financial products in a controlled virtual environment, reducing the risks and costs associated with new product launches.

Major Challenges

- High Implementation Costs: The initial setup and integration of digital twin technology can be costly and resource-intensive, posing a challenge for smaller organizations or those with limited budgets.

- Data Privacy and Security Concerns: Managing and protecting the vast amounts of data generated and used by digital twins is crucial, as breaches can lead to significant financial and reputational damage.

- Complexity in Integration: Integrating digital twin technology with existing financial systems can be complex and challenging, requiring substantial changes to legacy systems and processes.

- Skill Gap: There is a significant demand for skilled professionals who can design, implement, and manage digital twin solutions, and the current workforce may require extensive training and upskilling.

- Resistance to Change: Adoption can be hindered by organizational resistance to change, as stakeholders might be skeptical about the tangible benefits and wary of disrupting existing workflows.

Top Opportunities

- Autonomous Finance: With advanced analytics and simulation capabilities, digital twins can drive the automation of financial processes, reducing the need for human intervention and paving the way for autonomous financial operations.

- Advanced Scenario Planning: Digital twins enable financial institutions to simulate various economic and market conditions to better prepare and plan for potential future scenarios, thereby enhancing strategic planning.

- Cross-Functional Integration: There is an opportunity to use digital twins to bridge various functional areas within an organization, such as linking finance with operations and sales to optimize overall business performance.

- Sustainability and ESG Compliance: Digital twins can help institutions monitor and manage their environmental, social, and governance (ESG) goals by providing insights into the financial implications of sustainability practices.

- Enhanced Customer Experience: By utilizing real-time data and predictive analytics, financial services can deliver more engaging and responsive customer experiences, thereby increasing customer retention and satisfaction.

Recent Developments

- PTC Inc.: In January 2024, PTC introduced a new augmented reality feature for its digital twin platform aimed at improving financial forecasting and risk simulation in collaboration with major financial institutions.

- Siemens AG: In October 2023, Siemens expanded its partnership with IBM to integrate digital twin technology into financial sectors. This collaboration aims to leverage IBM’s AI capabilities alongside Siemens’ digital twin platforms to enhance predictive analytics for financial services.

- Microsoft Corporation: In August 2023, Microsoft launched an enhanced version of its Azure Digital Twins platform tailored for financial institutions. This new offering focuses on risk assessment and compliance, helping companies model complex financial environments for better decision-making.

- Oracle Corporation: In November 2023, Oracle announced its acquisition of a smaller AI-driven digital twin startup to strengthen its cloud-based digital twin solutions, particularly for the insurance industry. The move is expected to drive innovation in predictive modeling for financial services.

Conclusion

In conclusion, the adoption of digital twin technology in the finance sector signifies a transformative shift towards more dynamic and resilient financial management systems. By enabling real-time simulations and predictive analytics, digital twins help financial institutions not only to enhance operational efficiency but also to innovate in risk management and customer service.

As technology evolves and integrates deeper into financial operations, the market for digital twins in finance is expected to expand significantly. This growth offers substantial opportunities for both financial service providers and technology vendors to develop new solutions that address the ever-changing landscape of the financial industry. Thus, embracing digital twin technology is not only beneficial but essential for those aiming to stay competitive in the modern financial ecosystem.