Table of Contents

Buy Now Pay Later Market Overview

Buy Now Pay Later companies (BNPL) provide a financial arrangement that allows consumers to purchase goods or services immediately and defer payment over a specified period, typically in interest-free installments.

This model has gained popularity, particularly among younger consumers, due to its simplicity and flexibility.

While BNPL offers advantages such as improved budgeting and instant product access, it poses risks, including potential debt accumulation and late fees.

The global BNPL market has experienced significant growth. Projected to reach approximately $125 billion by 2023 as it increasingly integrates into e-commerce platforms.

Consumers are advised to approach BNPL cautiously to avoid overspending and ensure responsible financial management.

Market Drivers

The global Buy Now Pay Later (BNPL) market is rapidly expanding due to several key factors. Growing consumer demand for flexible payment options, particularly among millennials and Generation Z, drives this trend.

The acceleration of e-commerce during the COVID-19 pandemic has also increased BNPL adoption as retailers incorporate these services to improve customer experience and conversion rates.

Technological advancements allow for quicker approvals and reduced default rates, enhancing the appeal of BNPL.

Additionally, rising awareness and the need for effective budgeting solutions further support market growth.

Evolving regulatory frameworks are likely to bolster consumer trust, promoting the continued expansion of this payment model.

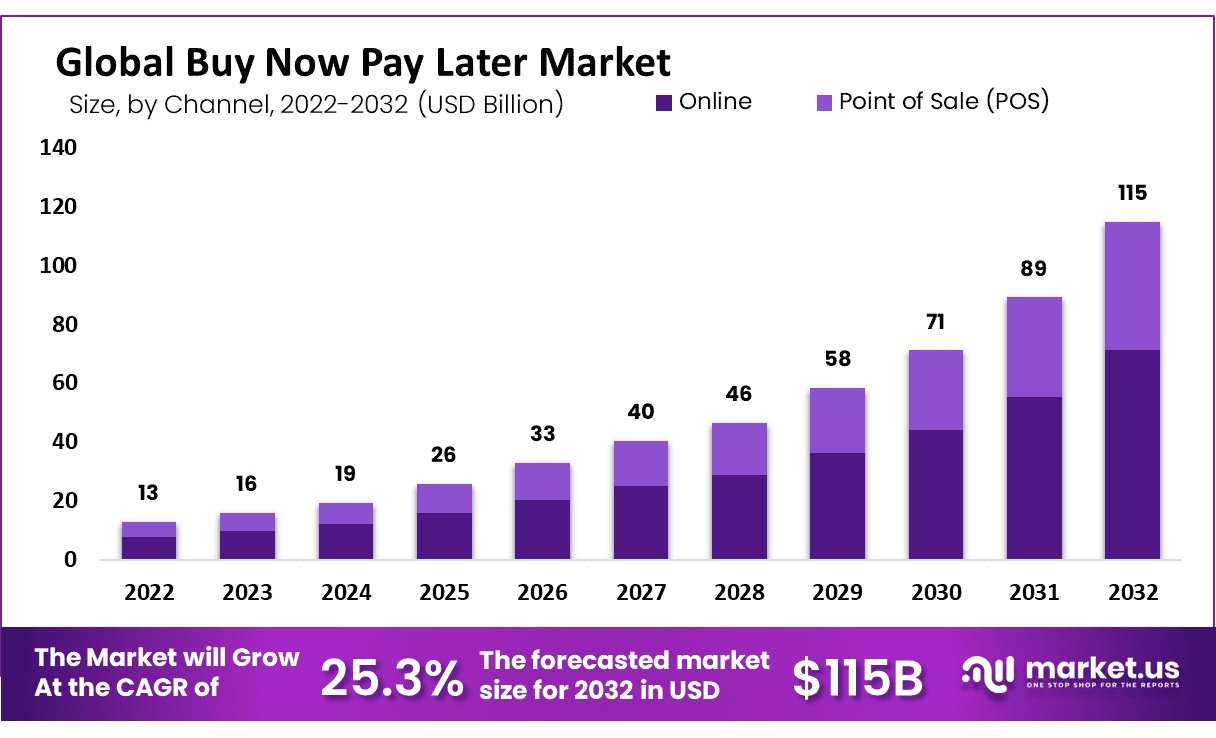

Market Size

The Global Buy Now Pay Later market is projected to reach approximately USD 115 billion by 2032, up from USD 16 billion in 2023. Representing a compound annual growth rate (CAGR) of 25.3% from 2023 to 2032.

List of Major Companies

These are the top ten companies operating in the Buy Now Pay Later Market:

Visa

Company Overview

| Establishment Year | 1958 |

| Headquarter | San Francisco, California, U.S. |

| Key Management | Ryan McInerney (CEO) |

| Revenue (US$ Bn) | $ 32.7 Billion (2023) |

| Headcount | ~ 28,800 (2023) |

| Website | https://visa.com/ |

About Visa

Visa Inc. has made notable advancements in the Buy Now Pay Later (BNPL) companies/sector. Leveraging its extensive global network to position itself as a key player.

With its “Visa Installment Solutions,” consumers can use their existing Visa cards for installment payments without needing additional merchant integration.

Currently available in the U.S., Canada, and Malaysia, Visa’s BNPL services are set for further global expansion.

The company has partnered with major financial institutions, including HSBC and CIBC, to enhance these offerings.

By integrating BNPL options into its network, Visa ensures secure and scalable solutions for merchants and consumers.

Additionally, it supports leading BNPL fintechs like Klarna, Afterpay, and Zip, further solidifying its influence in this growing payment sector.

Geographical Presence

Visa Inc. is a leading player in digital payments with a broad geographical footprint across North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

It holds a significant market share in the United States and is expanding in Canada, Brazil, Mexico, and several European nations, including the UK and Germany.

The company is particularly focused on growth in Asia-Pacific, especially in China and India, promoting digital payment solutions.

Furthermore, Visa is improving payment access in South Africa and the UAE. Its key strategies include enhancing financial inclusion, investing in innovative technologies, and collaborating with local financial institutions and fintech firms to meet regional market demands.

Recent Developments

- In October 2024, Visa partnered with Cardlay to enhance spend management solutions for commercial card issuers.

- In October 2024, Visa partnered with BBVA and introduced the Visa Tokenized Asset Platform.

MasterCard

Company Overview

| Establishment Year | 1966 |

| Headquarter | New York, U.S. |

| Key Management | Michael Miebach (CEO) |

| Revenue (US$ Bn) | $ 25.1 B (2023) |

| Headcount | ~ 33,400 (2023) |

| Website | https://mastercard.com/ |

About MasterCard

MasterCard Inc. has expanded into the Buy Now, Pay Later (BNPL) companies/sector with its “Mastercard Installments” program, launched in key markets such as the U.S., Australia, and the U.K.

This service allows consumers to split payments into installments, including a popular zero-percent interest, pay-in-four option.

Leveraging MasterCard’s extensive acceptance network, the program integrates easily without requiring additional merchant onboarding.

Recent partnerships with financial institutions like Barclays and Fifth Third Bancorp, as well as collaborations with fintech firms such as Marqeta and SoFi, have enhanced MasterCard’s BNPL reach.

Additionally, a commercial BNPL card has been introduced in the Asia-Pacific region. Aimed at small businesses to help manage cash flow and access financing.

Geographical Presence

MasterCard Inc. is a global leader in payment technology, operating in over 210 countries and territories. The company has a significant presence in North America, particularly in the United States.

While also expanding in Latin America, Europe, the Middle East, Africa, and Asia-Pacific. Key markets include Brazil, the UK, South Africa, and China.

Where MasterCard focuses on partnerships with local banks and fintech companies to enhance digital payment solutions and promote financial inclusion.

With a commitment to innovation, MasterCard invests in technologies such as AI and blockchain. Aligning with global sustainability goals and adapting to regional market dynamics to drive future growth in the payment landscape.

Recent Developments

- In October 2024, Mastercard partnered with Paysend to introduce the Paysend Libre remittance solution in Mexico.

- In May 2024, Mastercard NetsUnion started handling transactions made in China using Mastercard cards issued by local banks.

PayPal

Company Overview

| Establishment Year | 1998 |

| Headquarter | San Jose, California, U.S. |

| Key Management | John Donahoe (Chairman) |

| Revenue (US$ Bn) | $ 29.7 Billion (2023) |

| Headcount | ~ 27,200 (2023) |

| Website | http://paypal.com/ |

About PayPal

PayPal has increased its presence in the Buy Now, Pay Later companies/sector, starting with its “Pay in 4” service in 2020, which allows users to divide purchases into four interest-free installments.

This offering has been complemented by “Pay Monthly,” launched in 2022, enabling U.S. consumers to spread payments over 6 to 24 months for purchases between $199 and $10,000, with no late fees.

In 2021, PayPal acquired the Japanese BNPL platform Paidy for $2.7 billion, marking a strategic move to enter the Japanese market and expand its global BNPL capabilities.

The company continues to innovate with new AI-driven tools like Smart Receipts and personalized offers, further enhancing its digital payment solutions to cater to consumers and merchants alike.

Geographical Presence

PayPal Holdings, Inc. is a prominent digital payments company that enables secure online transactions for consumers and merchants globally.

It has a significant presence in North America (mainly the U.S. and Canada), Europe (including the UK, Germany, France, Italy, and Spain), Asia-Pacific (notably Australia, China, and India), Latin America (Mexico and Brazil), and the Middle East and Africa (UAE and South Africa).

By leveraging strategic partnerships, acquisitions, and localized services, PayPal is poised to meet growing demand in the digital payments market, reinforcing its leadership in the financial technology sector.

Recent Development

- In September 2024, PayPal launched PayPal Complete Payments, a safe and efficient all-in-one platform.

- In June 2022, PayPal introduced PayPal Pay Monthly, its latest buy now, pay later service, issued by WebBank, allowing U.S. consumers to extend their payment periods.

Block

Company Overview

| Establishment Year | 2009 |

| Headquarter | San Francisco, California, U.S. |

| Key Management | Jim McKelvey (Director) |

| Revenue (US$ Bn) | $ 21.9 Billion (2023) |

| Headcount | ~ 12,985 (2023) |

| Website | https://block.xyz/ |

About Block

Block, Inc. (formerly Square) significantly strengthened its position in the Buy Now, Pay Later (BNPL) companies/sector by acquiring Afterpay in January 2022 for $29 billion.

This acquisition allows Block to integrate Afterpay’s BNPL services into its broader ecosystem, including Cash App and Square.

Through this integration, sellers using Square can offer BNPL options to customers, while Afterpay users can manage their installment payments directly through the Cash App.

This move enhances Block’s capabilities in both consumer and merchant sectors, aligning with its goal to create more accessible financial solutions.

Recent developments also include expanding Afterpay’s reach across the U.S. and Australia, which supports Block’s broader vision of a two-sided financial ecosystem that benefits both consumers and merchants.

Geographical Presence

Block, Inc., headquartered in San Francisco, is a leading financial services and mobile payment company known for its platforms like Square, Cash App, TIDAL, and Afterpay.

The company operates primarily in North America, with a significant market presence in the United States and Canada, and it is expanding into Europe (notably the UK and Ireland), Australia, and Mexico.

Block employs a multi-faceted strategy focusing on localized solutions, partnerships, and continuous innovation to meet the diverse needs of its customer base.

This strategic approach positions Block, Inc. as a frontrunner in the evolving digital payments landscape, driving growth and enhancing its competitive edge globally.

Recent Development

- In July 2022, Block partnered with US Foods to improve the adoption of technology in restaurants.

- In May 2024, Block launched a new machine learning-powered app.

Stripe

Company Overview

| Establishment Year | 2010 |

| Headquarter | San Francisco, California, U.S., and Dublin, Ireland |

| Key Management | Patrick Collison (CEO) |

| Revenue (US$ Bn) | $ 14.4 B (2022) |

| Headcount | ~ 8,000 (2022) |

| Website | https://stripe.com/ |

About Stripe

Stripe, Inc. has made moves in the Buy Now, Pay Later (BNPL) companies space by partnering with key players such as Affirm, Afterpay, and Klarna.

These collaborations allow businesses using Stripe to offer flexible payment options like pay-in-4 installments or monthly payments, improving customer checkout experiences.

Through partnerships with firms like Zip and Sunbit, Stripe has expanded BNPL capabilities to sectors like automotive services and healthcare, enabling merchants to offer payment plans directly at the point of sale.

Stripe’s integration of BNPL options into its payment infrastructure enhances its appeal for merchants looking to increase average cart sizes and conversion rates.

Geographical Presence

Headquartered in San Francisco, Stripe, Inc. has significantly expanded its operations. In North America, Stripe serves the U.S. and Canada with tailored services for various businesses.

In Europe, it operates in major markets like the UK, Ireland, Germany, France, Spain, Italy, and the Netherlands, complying with local regulations.

The Asia-Pacific region includes Australia, Japan, and Singapore, while Latin America features Brazil and Mexico.

Recently, Stripe entered the African market in South Africa to support local e-commerce startups, demonstrating its commitment to providing efficient global payment solutions for businesses of all sizes.

Recent Developments

- In September 2024, Sunbit, a fintech specializing in everyday expenses, partnered with Stripe to enhance embedded finance and broaden its solutions for in-person service businesses.

- In July 2024, Stripe acquired Lemon Squeezy, a payments processing startup.

Amex

Company Overview

| Establishment Year | 1850 |

| Headquarter | New York City, United States |

| Key Management | Stephen J. Squeri (CEO) |

| Revenue (US$ Bn) | $ 60.5 Billion (2023) |

| Headcount | ~ 74,600 (2023) |

| Website | https://americanexpress.com/ |

About Amex

American Express has expanded its presence in the BNPL sector through its “Plan It” feature, which allows cardholders to split purchases of $100 or more into monthly installments with a fixed fee rather than interest.

Launched as part of Amex’s broader credit offerings, this feature provides flexibility for customers while ensuring transparency about payment costs.

Cardholders can choose repayment terms of 3, 6, or 12 months, helping them manage larger expenses like travel or major purchases.

In recent developments, American Express has strengthened its BNPL offerings by integrating Plan It into services like Delta’s booking platform, allowing travelers to spread out payments for flights and hotels.

Geographical Presence

American Express Company (Amex), headquartered in New York City, is a global financial services firm known for its credit and charge cards.

It has a strong presence in North America, especially the U.S. and Canada, and operates in Latin America, including Mexico, Brazil, and Argentina.

In Europe, Amex is established in the UK, Germany, France, and Spain, while in the Asia-Pacific region, it is active in Japan, Australia, and China. The company also serves markets in the Middle East and Africa, particularly the UAE and South Africa.

By customizing its services for local markets and leveraging its strong brand, American Express is well-positioned to capitalize on the growing demand for digital payment solutions and premium financial products.

Recent Developments

- In October 2024, American Express partnered with Boost Payment Solutions to enhance virtual card payments for US-based suppliers.

- In March 2024, American Express opened a campus in Gurugram, Haryana, India.

Discover

Company Overview

| Establishment Year | 1985 |

| Headquarter | Riverwoods, Illinois, U.S. |

| Key Management | Michael Rhodes (CEO) |

| Revenue (US$ Bn) | $ 20.6 Billion (2023) |

| Headcount | ~ 21,100 (2023) |

| Website | http://discover.com/ |

About Discover Financial

Discover Financial Services has made strides in the Buy Now, Pay Later (BNPL) companies/sector through partnerships that expand its offerings.

One key development is its collaboration with Sezzle, a prominent BNPL platform, allowing merchants in the U.S. to offer interest-free installment plans through the Discover Global Network.

This partnership enhances payment flexibility for consumers while leveraging Discover’s vast merchant network, which spans over 48 million locations globally.

Additionally, Discover has focused on integrating BNPL with its broader payment solutions to cater to evolving consumer preferences for more convenient and flexible payment methods.

Geographical Presence

Discover Financial Services, based in Riverwoods, Illinois, is a prominent financial services firm recognized for its credit cards and banking solutions.

Primarily active in the United States, the company has a significant presence in states such as California, Texas, Florida, and New York, bolstered by various retail partnerships.

Although its operations are mainly domestic, Discover is expanding internationally through collaborations, notably with Diners Club International, to enhance global service acceptance.

Its commitment to customer service and financial technology innovation strengthens its competitive position in the market.

Recent Developments

- In July 2024, Discover opened its Shine Bright Community Center in Whitehall, Ohio, the US.

- In February 2021, Discover reached an agreement with Sezzle to partner with select merchants on the Discover Global Network, offering consumers more payment options.

Ant

Company Overview

| Establishment Year | 2014 |

| Headquarter | Xihu District, Hangzhou, China |

| Key Management | Eric Jing (CEO) |

| Revenue (US$ Bn) | $ 0.3 Billion (2023) |

| Headcount | ~ 16,660 (2023) |

| Website | https://www.antgroup.com/ |

About Ant

Ant Group is actively expanding its presence in the Buy Now, Pay Later (BNPL) companies/sector as part of its strategy to enhance its global financial services.

Known for its Alipay platform, the company acquired Dutch payments firm MultiSafepay for $200 million in early 2024, strengthening its position in Europe and enabling BNPL services for small and medium-sized enterprises (SMEs).

Additionally, Ant has invested in BNPL leader Klarna to integrate BNPL options on platforms like AliExpress.

These initiatives support Ant Group’s objectives of boosting cross-border payment capabilities and promoting financial inclusion through innovative digital solutions.

Geographical Presence

Ant Group, based in Hangzhou, China, is a prominent technology firm recognized for its Alipay digital payment platform.

It dominates the Chinese digital payments market and has expanded into Asia-Pacific, Europe, North America, Africa, and Latin America.

Significant operations in Hong Kong and Southeast Asia, along with strategic partnerships in Europe and the U.S., highlight its global ambitions.

The company is also investing in African fintech to improve mobile payment services and is exploring opportunities in Latin America.

Ant Group aims to promote financial inclusion and leverage technology to meet diverse market demands, positioning itself for ongoing growth in the global landscape.

Recent Development

- In January 2024, Ant Group acquired Dutch payments firm MultiSafepay for $200 million as part of its strategy to expand into Western markets.

Adyen

Company Overview

| Establishment Year | 2006 |

| Headquarter | Amsterdam, Netherlands |

| Key Management | Pieter van der Does (CEO) |

| Revenue (US$ Bn) | $ 2.0 Billion (2022) |

| Headcount | ~ 3,883 (2023) |

| Website | http://www.adyen.com/ |

About Adyen

Adyen has been enhancing its role in the Buy Now, Pay Later (BNPL) companies/sector through strategic partnerships and product innovations.

A key development is its collaboration with Klarna, enabling Klarna’s BNPL options to be integrated into Adyen’s physical payment terminals across Europe, North America, and Australia.

This move allows retailers to offer flexible payment options in-store, enhancing the checkout experience for consumers.

Additionally, Adyen partnered with Billie, a B2B payments innovator, to bring BNPL solutions to businesses.

This partnership allows merchants to offer “pay later by invoice” options, improving cash flow management and reducing credit risks for business buyers.

Geographical Presence

Adyen NV, based in Amsterdam, Netherlands, is a prominent global payment provider with a strong presence across multiple continents.

The company has a significant footprint in Europe, especially in the UK, Germany, and France, where demand for digital payment solutions is high.

In North America, particularly the United States, Adyen supports various sectors amid the e-commerce boom.

The Asia-Pacific region, including Australia and Japan, is also a key growth area due to rising digital payment usage.

Adyen is expanding in Latin America, focusing on Brazil and Mexico, while also targeting emerging markets in the Middle East and Africa.

The company’s strategy emphasizes local partnerships and regulatory compliance to enhance its offerings and leverage growth opportunities.

Recent Development

- In September 2024, Adyen partnered with RMS Cloud to ease the user experience and drive operational efficiencies.

- In February 2024, Adyen partnered with Billie, a B2B payments innovator, to allow its customers to offer B2B Buy Now, Pay Later (BNPL) payment services.

Apple

Company Overview

| Establishment Year | 1976 |

| Headquarter | Cupertino, California, U.S. |

| Key Management | Tim Cook (CEO) |

| Revenue (US$ Bn) | $ 383.2 Billion (2023) |

| Headcount | ~ 161,000 (2023) |

| Website | http://thalesgroup.com/ |

About Apple

Apple Inc. entered the Buy Now, Pay Later (BNPL) market with Apple Pay Later, launched in March 2023. This service allowed U.S. users to split purchases into four payments over six weeks without fees or interest.

However, by mid-2024, Apple decided to discontinue the service, likely due to challenges posed by rising interest rates and economic pressures.

Instead, Apple transitioned to offering BNPL options via third-party providers, like Affirm, which integrated into the Apple Wallet starting in iOS 18.

This shift allows users to access installment loans directly through Apple Pay with enhanced flexibility, maintaining Apple’s focus on seamless digital payment solutions.

Geographical Presence

Apple Inc., based in Cupertino, California, maintains a strong global presence. In North America, it leads the U.S. market with extensive retail and operational facilities and is expanding in Canada.

In Europe, it has a significant presence in the UK, Germany, France, Italy, and Spain. The Asia-Pacific region is vital, particularly in China, which has a robust retail and supply chain, along with emerging markets in Japan and India.

In Latin America, Brazil and Mexico are priorities, while growth is also noted in the UAE and South Africa. This strategic diversification enables Apple to meet regional consumer demands effectively.

Recent Developments

- In October 2024, Apple announced its plans to introduce the Apple Intelligence generative AI suite.

- In March 2023, Apple launched its “buy now, pay later” (BNPL) service in the United States.