Table of Contents

- Introduction

- Editor’s Choice

- Data Center Traffic Statistics

- Data Center Market Overview

- Edge Data Center Market Statistics

- Key Drivers for Deploying Edge Data Center Worldwide Statistics

- Use of Edge Data Center Infrastructure Solutions Worldwide Statistics

- Edge Data Center Computing Adoption and Deployment Statistics

- Deployment of Edge-enabled Internet of Things (IoT) Devices Worldwide

- Key Spending Statistics

- Operational Priorities and Challenges in Edge Computing Facilities and Data Centers

- Strategies to Prevent Unplanned Outages: Edge Facilities vs. Data Centers

- Sustainability Concerns in Deploying Edge Data Center Worldwide Statistics

- Regulations for Edge Data Center Statistics

- Innovations and Developments in Edge Data Center Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Edge Data Center Statistics: Edge data centers are small facilities strategically located closer to end-users and data sources to minimize latency and optimize bandwidth.

These centers enhance user experiences for real-time applications, such as IoT devices and content delivery, by processing data locally.

They enable faster response times, reduce the load on centralized data centers, and offer scalability and cost efficiency. However, they also present challenges, including security vulnerabilities and management complexities.

The edge data center market is experiencing rapid growth, driven by increasing demand for real-time data processing and advancements in technologies. Like AI, machine learning, and 5G, making them essential for modern digital infrastructure.

Editor’s Choice

- By 2033, the revenue for the global edge data center market is forecasted to reach $60.2 billion.

- In the global edge data center market, the distribution of market share by enterprise size demonstrates a significant dominance by large enterprises, which hold 79.70% of the market.

- In 2023, a survey on the key drivers for deploying edge data centers worldwide highlighted several critical factors influencing the expansion of this technology. The predominant driver, as identified by 41.10% of respondents, is the requirement for low latency and high bandwidth. Essential for enhancing user experiences and handling data-intensive applications.

- In a survey comparing operational attributes between edge computing facilities and traditional data centers. Several key differences and similarities were highlighted. Approximately 62% of respondents from edge computing facilities reported that the risk of an unplanned outage increased due to cost constraints.

- In an analysis of strategies to prevent unplanned outages. Different approaches between edge facilities and data centers reveal varied preferences and practices. Investment in improved equipment is a priority in 61% of edge facilities.

- In a 2023 survey assessing the impact of sustainability concerns on decision-making for deploying edge data centers globally. A varied degree of influence was reported among respondents. Approximately 30.5% indicated that sustainability concerns impacted their decisions to a large extent. Highlighting a significant commitment to environmentally responsible practices in their deployment strategies.

- In Europe, the European Energy Efficiency Directive mandates data centers larger than 500 kW to report their energy use and emissions annually, effective May 2024. This directive is part of a broader effort to cut carbon emissions across the EU by 55% by 2030. Highlighting the increasing alignment of data infrastructure with sustainable practices.

Data Center Traffic Statistics

Global Data Center Traffic Vs Useable Data Created

- From 2017 to 2021, a significant growth trajectory was observed in both global data center traffic and the volume of usable data created annually, measured in zettabytes.

- In 2017, global data center traffic was reported at nine zettabytes per year. While usable data created was considerably higher at 31 zettabytes.

- By 2018, data center traffic increased to 12 zettabytes, and usable data grew to 40 zettabytes.

- The trend continued in 2019, with data center traffic reaching 14 zettabytes and usable data expanding to 52 zettabytes.

- The year 2020 saw further growth, with traffic climbing to 17 zettabytes and usable data surging to 67 zettabytes.

- By 2021, global data center traffic reached 21 zettabytes, and the creation of usable data peaked at 85 zettabytes.

- This progression highlights the expanding scale of data management and utilization. Reflecting the intensifying demand for data processing and storage capabilities across global industries.

(Source: PwC)

Global Data Center IP Traffic – By Data Center Type

2012-2016

- Between 2012 and 2016, the global data center IP traffic exhibited distinct trends for cloud-based and traditional data centers, with the data measured in exabytes per year.

- Starting in 2012, traditional data centers accounted for more traffic at 1,389 exabytes compared to cloud data centers at 1,177 exabytes. However, this pattern shifted over the subsequent years.

- By 2013, cloud data centers saw an increase to 1,647 exabytes. Surpassing traditional data centers, which posted slightly higher traffic at 1,417 exabytes.

- The growth in cloud data center traffic accelerated significantly. Reaching 2,110 exabytes in 2014, while traditional data centers experienced a decline to 1,339 exabytes.

- This trend became more pronounced from 2015 onwards, as cloud data centers continued their robust growth. Tripling their traffic to 3,581 exabytes, whereas traditional data centers dropped to 827 exabytes.

- By 2016, cloud data center traffic nearly doubled again to 5,991 exabytes, and traditional data centers remained relatively flat at 828 exabytes.

2017-2021

- The expansion in cloud infrastructure continued, with cloud data center traffic reaching 8,190 exabytes in 2017 and traditional rising modestly to 897 exabytes.

- By 2018, cloud data center traffic hit 10,606 exabytes, and traditional data centers moved slightly to 952 exabytes.

- The gap widened further in 2019, with cloud data centers reaching 13,127 exabytes and traditional data centers under 1,000 exabytes at 997.

- The progression into 2020 and 2021 saw cloud data centers achieving 16,086 and 19,509 exabytes, respectively, with traditional data centers maintaining a slower growth to 1,030 and 1,046 exabytes.

- This data underscores the transformative shift towards cloud data centers. Reflecting broader adoption and reliance on cloud solutions over traditional data center models.

(Source: Statista)

Data Center Market Overview

Global Data Center Market Size

- The global data center market has shown fluctuating yet overall upward revenue trends from 2017 to 2029, with earnings measured in billions of US dollars.

- In 2017, the market started with a revenue of $272.95 billion, experiencing a steady increase to $306.44 billion by 2018.

- Despite a slight decrease to $301.39 billion in 2019, followed by a further dip to $298.30 billion in 2020, the market rebounded to $319.32 billion in 2021.

- A minor contraction occurred in 2022, bringing the revenue down to $312.31 billion.

- However, from 2023 onwards, a significant growth phase began, starting with $372.79 billion in 2023 and escalating to $416.10 billion in 2024.

- The growth trajectory continued robustly, reaching $452.48 billion in 2025, $483.23 billion in 2026, and peaking at $572.01 billion by 2027.

- The revenue remained relatively stable, with a slight increase to $575.29 billion in 2028, before rising again to reach $624.00 billion in 2029.

- This trend underscores a resilient expansion in the data center market, driven by escalating demands for data processing and storage solutions globally.

(Source: Statista)

Competitive Landscape of Global Data Center Market

- In the competitive landscape of the global data center market in 2022. Dell led the market with a 13% share, highlighting its significant presence in the industry.

- Huawei followed with an 8% market share, and HPE was close behind at 7%.

- IBM held a 5% share, demonstrating its continued relevance in the data center space.

- Both Ericsson and NVIDIA captured 4% each, reflecting their strong positions in specific segments of the market.

- Hitachi, Inspur, and Nokia each maintained a 3% market share, indicating their competitive but smaller-scale operations within the broader market. Broadcom held a smaller portion of the market at 2%.

- The remaining market share, constituting 48%, was distributed among various other players. Illustrating a highly fragmented market where numerous companies compete, offering diverse technologies and services.

- This distribution underscores the dynamic and competitive nature of the global data center market, with multiple established companies and emerging players striving for growth and innovation.

(Source: Statista)

Data Center Market Revenue – By Country

- In 2024, the distribution of data center market revenue by country showcases the United States as the leader with a substantial $123.20 billion. Reflecting its dominant position in the global market.

- China follows with significant revenue of $95.74 billion, underlining its role as a major player in the data center industry.

- Japan and Germany also show notable market sizes. Generating $20.60 billion and $18.70 billion, respectively.

- The United Kingdom contributes $17.18 billion, positioning itself as a key market in Europe alongside France with $11.75 billion.

- Further down the list, India shows a growing data center market presence, with revenues reaching $8.65 billion, while Canada reports $8.08 billion.

- Italy and South Korea also make notable contributions, with $7.04 billion and $6.79 billion, respectively.

- Australia, Brazil, and the Netherlands have revenues of $5.40 billion, $5.32 billion, and $5.25 billion, indicating significant activity in their regional markets.

- Russia and Spain, while smaller, still maintain considerable market activity with $4.84 billion and $4.48 billion in data center revenues, respectively.

- This revenue distribution underscores the global nature of the data center market, with widespread investment and development across various countries.

(Source: Statista)

Edge Data Center Market Statistics

Global Edge Data Center Market Size Statistics

- The projected revenue for the global edge data center market is set to experience substantial growth from 2023 to 2033 at a CAGR of 19.5%.

- In 2023, the market revenue is expected to be approximately $10.6 billion.

- This figure is anticipated to increase to $12.7 billion in 2024. Followed by a steady rise to $14.8 billion in 2025.

- The upward trend continues, with the revenue reaching $18.5 billion by 2026 and further to $22.5 billion in 2027.

- A consistent increase is projected for the following years, with the revenue expanding to $26.4 billion in 2028 and $29.5 billion in 2029.

- The growth momentum is expected to accelerate. Leading to revenues of $35.3 billion in 2030, $41.3 billion in 2031, and $49.3 billion in 2032.

- By 2033, the revenue for the global edge data center market is forecasted to reach a significant peak of $60.2 billion.

- This trajectory indicates a robust expansion of the market over the decade. Reflecting increasing investments and the evolving demand for edge-computing solutions.

(Source: market.us)

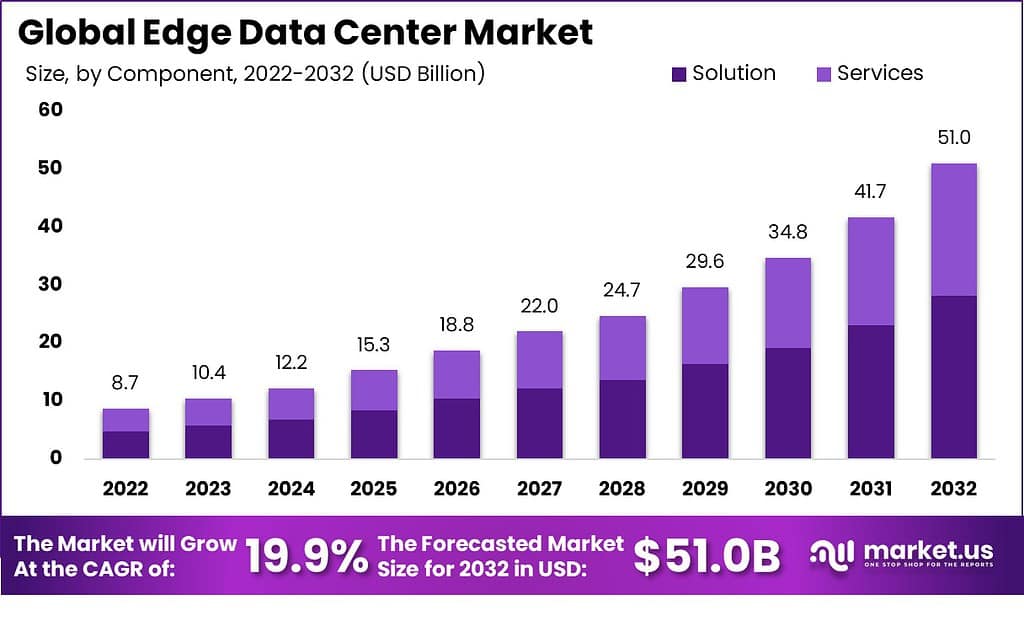

Global Edge Data Center Market Size – By Component Statistics

2023-2028

- The global edge data center market is segmented into solutions and services, with both components poised for growth from 2023 to 2028.

- In 2023, the market is divided into solutions valued at $8.72 billion and services at $1.88 billion, contributing to a total revenue of $10.6 billion.

- This pattern of growth continues, with solutions reaching $10.45 billion and services $2.25 billion in 2024, progressing to $12.18 billion and $2.62 billion respectively, in 2025.

- By 2026, solutions are expected to generate $15.23 billion, alongside services at $3.27 billion.

- The upward trajectory is evident as solutions rise to $18.52 billion and services to $3.98 billion by 2027, with further increases to $21.73 billion and $4.67 billion in 2028.

2029-2033

- The market will grow significantly in the following years, with solutions reaching $24.28 billion and services $5.22 billion by 2029, followed by $29.05 billion and $6.25 billion in 2030.

- By 2031, solutions are forecasted at $33.99 billion and services at $7.31 billion. Culminating in solutions reaching $40.57 billion and services at $8.73 billion in 2032.

- The peak will be achieved in 2033, with solutions valued at $49.54 billion and services at $10.66 billion. Leading to a robust total market size of $60.2 billion.

- This demonstrates a dynamic expansion within the edge data center market. Emphasizing the increasing demand and diversification of both solutions and services over the decade.

(Source: market.us)

Global Edge Data Center Market Share – By Enterprise Size Statistics

- In the global edge data center market, the distribution of market share by enterprise size demonstrates a significant dominance by large enterprises, which hold 79.70% of the market.

- In contrast, small and medium-sized enterprises (SMEs) account for 20.30% of the market share.

- This distribution underscores the substantial role that large enterprises play in driving demand and investment within the edge data center sector. Reflecting their extensive resources and scalability requirements.

- Meanwhile, SMEs, though smaller in market share, also contribute to the sector. Likely driven by their growing need for advanced data processing capabilities close to the source of data generation.

(Source: market.us)

Key Drivers for Deploying Edge Data Center Worldwide Statistics

- In 2023, a survey on the key drivers for deploying edge data centers worldwide highlighted several critical factors influencing the expansion of this technology.

- The predominant driver, as identified by 41.10% of respondents, is the requirement for low latency and high bandwidth. Essential for enhancing user experiences and handling data-intensive applications.

- Close behind, the need for better data security and privacy is a concern for 38.30% of respondents. Reflecting the increasing emphasis on protecting data against breaches and unauthorized access.

- Additionally, the a growing number of Internet of Things (IoT) devices and applications. Which necessitates robust and localized data processing capabilities, and motivates 35.50% of participants.

- The increasing demand for real-time and streaming applications also plays a significant role, with 33.30% of respondents identifying it as a key driver. Highlighting the shift towards more dynamic and interactive digital experiences.

- Moreover, the need for faster and more efficient data processing is crucial for 30.50% of the surveyed, emphasizing the push for improved operational efficiencies.

- Compliance and regulatory adherence, necessary for meeting strict data handling and privacy standards, are also significant, influencing 18.40% of respondents.

- Other factors account for a smaller share of 2.80%. Indicating a broad consensus on the primary motivations behind the adoption of edge data centers.

(Source: Statista)

Use of Edge Data Center Infrastructure Solutions Worldwide Statistics

- In 2022, a survey examining the use of integrated and modular edge infrastructure solutions worldwide revealed a diverse adoption pattern among respondents.

- Conventional IT equipment racks led the preferences, accounting for 39% of the share. Underscoring their continued relevance and widespread use in traditional data center setups.

- Close behind, integrated, single-rack micro data centers garnered 37% of the respondent share. Indicating a strong preference for compact, self-contained solutions that offer simplicity and rapid deployment benefits.

- Additionally, prefabricated modular data centers. Which are known for their scalability and ease of deployment, were chosen by 20% of respondents.

- This distribution highlights the evolving landscape of data center infrastructure. Where both traditional and innovative modular solutions play pivotal roles in addressing the diverse needs of modern digital operations.

(Source: Statista)

Edge Data Center Computing Adoption and Deployment Statistics

Edge Computing Infrastructure IT Power Footprint Worldwide

- In examining the projections for the IT power footprint of edge computing infrastructure worldwide. Two different estimates—conservative and optimistic—provide distinct outlooks for 2019 and 2028, measured in megawatts.

- In 2019, both estimates agreed on a conservative figure of 1,078 megawatts. Representing a baseline scenario for the industry’s energy use.

- However, the optimistic estimate for the same year suggested a much higher usage of 40,380 megawatts. Indicating expectations for significant growth in edge-computing activities.

- Looking ahead to 2028, the conservative estimate remains unchanged at 1,078 megawatts. Suggesting a scenario where growth in IT power consumption is minimal or well-managed despite potential increases in computing activities.

- In stark contrast, the optimistic estimate for 2028 escalates dramatically to 120,840 megawatts. This figure reflects an anticipated surge in edge computing infrastructure deployment, driven by advancements in technology. Increased adoption of IoT devices, and greater data processing needs at the edge.

- These estimates highlight the potential variability in the industry’s future energy demands. Ranging from stable to extremely high growth depending on technological adoption and efficiency improvements over the coming decade.

(Source: Statista)

Global Power Footprint of Edge Computing Infrastructure – By Region

- By 2028, the distribution of the IT power footprint for edge computing infrastructure is expected to vary significantly across regions worldwide.

- The Asia-Pacific region is projected to have the largest share, accounting for 37.70%. Indicative of its rapid technological adoption and expansive digital transformation initiatives.

- Europe follows with a substantial 29% of the distribution. Reflecting its strong infrastructure and robust data regulations.

- North America is set to hold 20.50% of the share, demonstrating its ongoing investment in edge computing to support real-time data processing and IoT applications.

- Latin America, the Middle East, and Africa are projected to have smaller shares of 7% and 5.80%, respectively. Pointing to emerging growth in these regions as they continue to develop their digital capabilities.

- This regional distribution underscores the global interest in and the strategic importance of edge computing solutions to cater to localized data needs and enhanced connectivity demands.

(Source: Statista)

Global Power Footprint Share of Edge Computing Infrastructure – By Vertical

- By 2028, the IT power footprint share for edge computing infrastructure worldwide is expected to be distributed across various sectors. Each differs in its reliance on edge computing technologies.

- The mobile consumer segment is anticipated to lead with a significant 21.70% share. Driven by the increasing consumption of mobile data and the expansion of mobile network capabilities.

- The residential sector is also expected to command a substantial footprint. Accounting for 14.80%, likely reflecting the growth in smart home devices and residential IoT applications.

- Enterprise IT follows with an 11.90% share, emphasizing the adoption of edge computing in corporate settings to enhance operational efficiency and data management.

- Communication service providers are projected to hold a 10.40% share. Which is crucial for supporting the vast data traffic and connectivity demands of modern telecommunications.

- The automotive sector will represent 9.70% of the footprint. Likely due to the rise in connected vehicles and autonomous driving technologies.

- Healthcare, with an 8.60% share, indicates the growing integration of edge computing to manage real-time data processing for medical devices and patient monitoring systems.

- Manufacturing and smart cities are set to have shares of 6.20% and 6.10%, respectively. Highlighting the use of edge computing in industrial automation and urban infrastructure management.

- The smart grid and retail sectors are expected to contribute 4.60% and 4.50%, respectively. Showcasing the importance of real-time operations and analytics in these areas.

- Commercial UAVs will account for the smallest share at 1.50%, pointing to niche applications in commercial drone operations.

- This distribution underscores the broad and diverse impact of edge computing across multiple industries. Facilitating more localized and efficient data processing capabilities.

(Source: Statista)

Edge Computing Use Cases in Production

- In a survey conducted in 2023 on the anticipated use cases for edge computing expected to be in production within the next three years. Respondents identified a variety of key applications across different sectors.

- Industrial IoT or operational technology functions lead the projections, with 40.7% of respondents expecting to deploy these technologies. Reflecting the growing emphasis on enhancing industrial operations through advanced connectivity and analytics.

- Physical security functions are also significant, cited by 34.3% of respondents. Indicating an increasing reliance on edge computing for real-time security operations.

- Smart building or facilities management functions are anticipated by 33.4% of participants. Underscoring the trend towards more connected and responsive infrastructure management systems.

- Close behind, 32.7% of respondents foresee the use of industry-oriented consumer IoT functions. Which highlights the expansion of IoT into consumer-centric industries. Additionally, 30% expect to implement industry-oriented robotics IoT functions. Demonstrating the role of robotics in automating and optimizing industrial processes.

- Environmental sensor functions are anticipated by 29.8% of respondents. Pointing to the importance of real-time environmental monitoring in decision-making processes. Industry-oriented augmented reality (AR) or virtual reality (VR) functions are expected to be used by 28.4% of respondents. Revealing the potential for immersive technologies in industrial applications.

- Special-purpose audio/video delivery functions are noted by 28.3% of respondents. Emphasizing the demand for high-performance streaming and media delivery at the edge.

- Finally, autonomous vehicle functions are expected by 24% of respondents. Showcasing the pivotal role of edge computing in supporting the complex data processing needs of autonomous transport systems. These anticipated use cases illustrate the diverse and expanding applications of edge computing technology in enhancing operational efficiency and enabling new capabilities across various industries.

(Source: Statista)

Deployment of Edge-enabled Internet of Things (IoT) Devices Worldwide

2020-2024

- From 2020 to 2030, the number of edge-enabled Internet of Things (IoT) devices worldwide is projected to increase significantly in both consumer and enterprise markets, as measured in millions.

- In 2020, the consumer market started with approximately 2,303 million devices, while the enterprise sector accounted for 401 million.

- By 2021, these numbers grew to 2,629 million in the consumer segment and 473 million in the enterprise segment.

- The upward trend continued, with consumer devices reaching 3,009 million and enterprise devices 554 million in 2022.

- The growth persisted into 2023, with consumer devices numbering 3,419 million and enterprise devices 638 million.

- This expansion was even more pronounced by 2024, with 3,853 million consumer devices and 721 million enterprise devices.

- In 2025, the figures reached 4,304 million for consumers and 807 million for enterprise devices.

2026-2030

- By 2026, these numbers had climbed to 4,754 million and 895 million, respectively.

- The growth trajectory maintained momentum into 2027 with 5,202 million consumer devices and 983 million enterprise devices.

- The year 2028 marked a further increase to 5,641 million consumer devices and 1,070 million in the enterprise sector.

- This growth continued steadily through 2029 and 2030, with consumer devices reaching 6,065 million and 6,469 million, respectively. While enterprise devices expanded to 1,154 million and 1,233 million.

- This decade-long trend underscores a significant expansion of IoT devices equipped with edge computing capabilities. Reflecting the growing integration of advanced technologies in both personal and professional settings.

(Source: Statista)

Key Spending Statistics

Investment in Construction

- Over the period from 2022 to 2030, global spending on data center construction is projected to rise steadily, with both co-location companies and hyperscalers contributing to the growth.

- In 2022, spending by co-location companies was estimated at $23 billion. While hyperscalers invested $9 billion.

- This spending trend is expected to increase annually, with co-location companies planning to spend $25 billion in 2023 and $27 billion in 2024. While hyperscalers are set to increase their investments to $10 billion each year over the same period.

- By 2025, investment by co-location companies is forecasted to reach $29 billion. Maintaining a steady growth trajectory through 2030, where it is expected to hit $36 billion.

- Similarly, hyperscalers’ spending, after remaining stable at $10 billion through 2025. It is anticipated to rise gradually to $11 billion in 2026 and continue growing to $13 billion by 2030.

- This consistent increase in investments underscores the growing importance of advanced data center infrastructure to support the increasing demand for cloud services and the expansion of global digital networks.

- The strategic expenditures by both co-location companies and hyperscalers highlight their commitment to enhancing the capacity and efficiency of data processing and storage facilities worldwide.

(Source: McKinsey)

Real Estate Investment and Development Prospects

- From 2018 to 2024, the European real estate market for data centers has shown a dynamic investment and development landscape.

- In 2018, investment prospects were rated at 4 out of 5, with development prospects slightly lower at 3.79, reflecting a growing but cautious expansion phase.

- In 2019, both investment and development prospects increased, reaching 4.36 and 4.11, respectively. Indicating heightened confidence and activity in the sector.

- The year 2020 saw a balanced perspective, with both investment and development prospects aligning at 4.14. Demonstrating steady market conditions despite global economic uncertainties.

- By 2021, prospects rose to 4.55 for investment and 4.45 for development. Suggesting a robust growth phase driven by increased demand for data processing infrastructure.

- However, in 2022, while investment remained stable at 4.55, development prospects peaked at 4.63, the highest in the observed period. Underscoring a particularly intense focus on building new data center capacities.

- A slight decline was noted in 2023, with investment decreasing to 4.38 and development to 4.28, reflecting a normalization after the previous year’s expansion.

- Looking ahead to 2024, investment prospects are anticipated to recover to 4.49. While development prospects are expected to decrease to 4.24 slightly. Indicating continued strong interest in data center investments, albeit with a more cautious approach toward new developments.

- This trend highlights the strategic importance of data centers in Europe’s digital economy and the cyclical nature of real estate investment and development within this key sector.

(Source: Statista)

Operational Priorities and Challenges in Edge Computing Facilities and Data Centers

- In a survey comparing operational attributes between edge computing facilities and traditional data centers. Several key differences and similarities were highlighted.

- Approximately 62% of respondents from edge computing facilities reported that the risk of an unplanned outage increased due to cost constraints, compared to 79% in traditional data centers. This indicates a more pronounced concern about cost-related risks in traditional data centers.

- Conversely, 56% of edge computing respondents noted that their company’s business model heavily relies on their facility for generating revenue and conducting e-commerce. Which is slightly less than the 67% observed in data centers.

- Availability was ranked as the highest priority over cost depreciation by 62% of those at edge computing facilities. Contrasting with 55% at data centers, suggesting a greater emphasis on availability in edge environments.

- Support from senior management in efforts to manage and prevent outages was nearly equal, with 50% endorsement in edge computing and 51% in data centers. Energy efficiency was also a close priority between the two. Value by 49% in edge computing and 51% in data centers.

- Regarding operational practices, 54% of edge computing respondents emphasized utilizing best practices in design and redundancy to maximize availability. Compared to 46% in data centers, indicating a slightly higher commitment to operational excellence in edge computing.

- Lastly, 38% of those in edge computing believed they had ample resources to address unplanned outages, compared to 43% in data centers. Showing a slight advantage in resource availability for traditional data centers. These insights reflect distinct operational dynamics and priorities between edge computing facilities and traditional data centers.

(Source: Vertiv/Ponemon Institute)

Strategies to Prevent Unplanned Outages: Edge Facilities vs. Data Centers

- In an analysis of strategies to prevent unplanned outages. Different approaches between edge facilities and data centers reveal varied preferences and practices.

- Investment in improved equipment is a priority, with 61% of edge facilities and 59% of data centers reporting such upgrades.

- Security practices show a notable difference; 51% of data centers focus on this area compared to 40% in edge facilities. Redundant infrastructure equipment is similarly emphasized more in data centers (50%) than in edge facilities (47%).

- Design and planning improvements are reported by 38% of edge facilities and 46% of data centers. Suggesting a greater emphasis on upfront planning in data centers.

- Preventative maintenance also shows a disparity, with 44% of data centers compared to 31% of edge facilities prioritizing it. Monitoring and management tools are utilized by 36% of edge facilities and 39% of data centers.

- Annual audits or assessments are more common in edge facilities (40%) than in data centers (35%). Whereas increasing the data center budget is favored by 43% of edge facilities. Significantly higher than the 34% in data centers. Hiring additional staff is seen as equally important, with both reporting 29%.

- Staff training and improved documentation are also highlighted, with edge facilities showing a slightly higher emphasis (33% and 27%, respectively) compared to data centers (27% and 25%, respectively).

- These statistics underline the diverse strategies employed by edge facilities and data centers to mitigate the risks of unplanned outages.

(Source: Vertiv/ Ponemon Institute)

Sustainability Concerns in Deploying Edge Data Center Worldwide Statistics

- In a 2023 survey assessing the impact of sustainability concerns on decision-making for deploying edge data centers globally. A varied degree of influence was reported among respondents.

- Approximately 30.5% indicated that sustainability concerns impacted their decisions to a large extent. Highlighting a significant commitment to environmentally responsible practices in their deployment strategies.

- Additionally, 40.4% of respondents said these concerns influenced their decisions to some extent. Suggesting a moderate consideration of sustainability in their operations.

- Meanwhile, 20.6% reported only a minor influence from sustainability concerns on their decision-making processes, indicating lesser prioritization.

- Conversely, a smaller group, 8.5%, stated that sustainability had no impact on their decisions regarding edge deployments. Reflecting either a lack of concern or other overriding factors in their strategic considerations.

- This spread of responses underscores the varying emphasis on sustainability within the industry as organizations balance environmental considerations with other business imperatives.

(Source: Statista)

Regulations for Edge Data Center Statistics

- Edge data centers, pivotal in the decentralization of computing resources, face an evolving landscape of regulations. Reflecting a balance between technological growth and environmental concerns.

- In the United States, recent legislative efforts focus on the environmental impact of data centers. Requiring assessments and adaptations to minimize carbon emissions and energy consumption.

- For example, Virginia has enacted laws mandating site assessments to determine the environmental impact of proposed data center projects alongside specific zoning requirements that consider proximity to national parks and historic sites.

- In Europe, the European Energy Efficiency Directive mandates data centers larger than 500 kW to report their energy use and emissions annually, effective May 2024.

- This directive is part of a broader effort to cut carbon emissions across the EU by 55% by 2030. Highlighting the increasing alignment of data infrastructure with sustainable practices.

- Furthermore, the U.S. federal government has introduced reporting mandates similar to the European model. Which is expected to affect both traditional and cryptocurrency-powered data centers.

- These regulations will require extensive reporting on energy use and environmental impact, steering the industry toward more sustainable operations.

- Overall, the regulatory environment for edge data centers is increasingly characterized by stringent reporting requirements and a strong emphasis on sustainability. Reflecting a global trend toward environmentally responsible technology deployment.

(Source: Data Center Knowledge, Data Center Dynamics, Uptime Institute Blog)

Innovations and Developments in Edge Data Center Statistics

- In the realm of IT infrastructure, edge computing has emerged as a pivotal innovation, particularly in 2023, with substantial developments enhancing business operations across multiple sectors.

- This technological advancement is primarily driven by the need for real-time data processing closer to data sources. Which significantly reduces latency and improves system reliability and security.

- Key innovations in this area include the integration of artificial intelligence (AI) and machine learning (ML) at the edge. Which facilitates more immediate data analysis and decision-making without the lag of central server communication.

- Moreover, the expansion of 5G networks enhances the capabilities of edge computing by offering faster connectivity and reduced latency. Making it ideal for IoT applications and other real-time data needs.

- The growth of edge data centers, strategically located to process data near its generation point, supports the massive influx of data from IoT devices and other digital sources. Enabling businesses to leverage actionable insights more swiftly and efficiently.

- Moreover, these centers are increasingly adopting sustainable practices, such as using renewable energy sources and implementing advanced cooling systems to reduce their environmental impact.

- Further, the trend towards edge computing continues to evolve, promising further enhancements in data processing speeds and the integration of advanced technologies to meet the ever-growing demands of digital transformation across industries.

(Sources: Data Centers, Schneider Electric Blog, Databank, Data Center Evolved)

Recent Developments

Acquisitions and Mergers:

- EdgeConneX acquires Datacenter.com: In 2023, EdgeConneX, a global provider of edge data center solutions, acquired Datacenter.com for $150 million. This acquisition allows EdgeConneX to expand its footprint in Europe and provide enhanced edge computing solutions to enterprises requiring low-latency services.

- Equinix acquires Packet for edge computing expansion: In early 2023, Equinix acquired Packet, a startup specializing in bare-metal cloud services, for $335 million. This acquisition strengthens Equinix’s position in the edge data center market by allowing it to offer hybrid cloud services and edge deployments to meet the growing demand for real-time data processing.

New Product Launches:

- Vertiv launches new edge data center solutions: In mid-2023, Vertiv introduced its new SmartCabinet™ for Edge product line, which offers pre-integrated, plug-and-play data center solutions designed for edge computing environments. This product aims to reduce deployment time by 50% and is targeted at businesses needing to support distributed IT infrastructure.

- Hewlett Packard Enterprise (HPE) debuts Edgeline 8000: In 2024, Hewlett Packard Enterprise (HPE) launched the Edgeline 8000, a rugged edge server system designed for harsh environments such as industrial and remote locations. The new system provides high-performance computing at the edge, with a 40% increase in processing power compared to previous models.

Funding:

- Vapor IO secures $100 million for edge data center expansion: In late 2023, Vapor IO, a company specializing in edge colocation services, raised $100 million in a Series C funding round. The investment will be used to build more micro data centers across the United States to support 5G and IoT applications.

- EdgePresence raises $50 million for edge infrastructure development: In early 2024, EdgePresence, a provider of modular data centers, secured $50 million to expand its edge infrastructure solutions in underserved areas. The funding will support the development of new edge data centers targeting rural and urban edge environments.

Technological Advancements:

- AI integration in edge data centers: By 2025, it is expected that 45% of edge data centers will incorporate AI and machine learning technologies to optimize data processing and improve operational efficiency, particularly in industries like autonomous vehicles, smart cities, and healthcare.

- Edge data centers powered by renewable energy: As sustainability becomes a focus, it is projected that 30% of edge data centers will use renewable energy sources such as solar and wind power by 2026, significantly reducing their environmental footprint.

Conclusion

Edge Data Center Statistics: Edge data centers are transforming data management and network architecture by enabling low-latency, high-bandwidth access near end-users, which is crucial for IoT, AI, and real-time analytics.

These centers face challenges in physical security, energy efficiency, and redundancy, requiring significant investment in equipment, planning, and security practices.

With sustainability increasingly influencing deployment strategies. The edge data center market is set for growth, driven by the need for distributed network architectures and greener technologies.

As such, these facilities are vital for a sustainable, data-driven future, balancing operational integrity with environmental concerns.

FAQs

An edge data center is a small-scale data center located close to the area where data is being generated or used. It processes data locally to reduce latency, improve speed, and enhance the overall user experience by bringing data processing closer to the endpoint devices.

Unlike traditional, centralized data centers, edge data centers are distributed geographically closer to users. This proximity reduces data travel time, leading to faster processing and response times, which are crucial for real-time applications.

Edge data centers offer several advantages, including reduced latency, improved speed, bandwidth savings, and enhanced data security by localizing data traffic and processing.

Applications that require real-time processing and low latency, such as IoT devices, autonomous vehicles, smart cities, AR/VR applications, and mobile applications, benefit significantly from edge data centers.

Edge data centers implement robust security measures that are similar to traditional data centers, including physical security, data encryption, firewalls, intrusion detection systems, and regular security audits to protect data integrity and privacy.