Table of Contents

Introduction

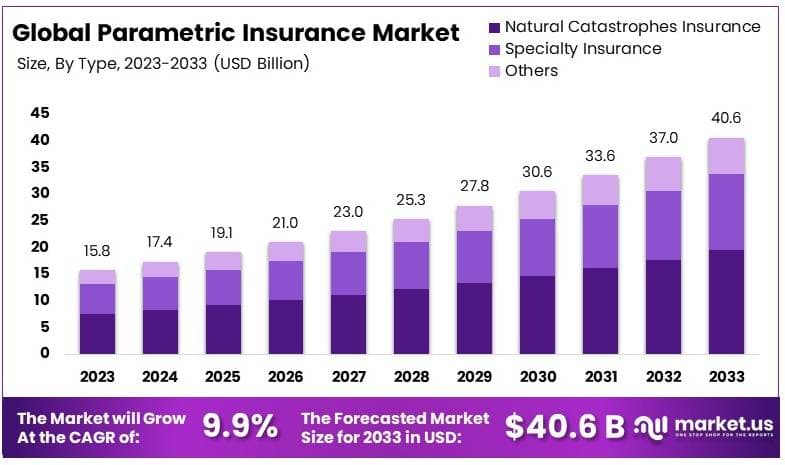

The Global Parametric Insurance Market is set to expand significantly, with its value expected to rise from USD 15.8 Billion in 2023 to USD 40.6 Billion by 2033, marking a robust CAGR of 9.9% over the forecast period from 2024 to 2033. This steady growth is driven by the increasing demand for insurance solutions that offer quick payouts based on predefined parameters, appealing to sectors exposed to risks like natural disasters and extreme weather events. In 2023, North America led the market, holding a substantial 35% share, translating to revenues of approximately USD 5.5 Billion.

Parametric insurance differs from traditional insurance as it provides payouts based on the occurrence of a predefined event, rather than covering the actual loss incurred. This type of insurance uses specific parameters, like earthquake magnitude or wind speed, to trigger payments. It simplifies claims processing, providing quick and objective payouts without the need for detailed assessments of physical damage. This efficiency makes parametric insurance particularly valuable in managing financial risks from natural disasters and other measurable events.

The primary catalysts propelling the growth of the parametric insurance market are the rising frequency of climate-related disasters and the adoption of innovative technologies. The increasing severity and frequency of natural disasters due to climate change necessitate efficient insurance solutions like parametric insurance, which offers rapid financial relief without the delays typical of traditional insurance claims processing. Advanced technologies such as IoT and AI improve the precision in monitoring and assessing risk parameters, making parametric insurance more reliable and attractive to consumers and industries alike.

The integration of cutting-edge technologies such as IoT, real-time data analytics, and blockchain is revolutionizing the parametric insurance landscape. These technologies provide continuous, accurate data that help in defining and verifying trigger conditions for insurance payouts, thus enhancing the overall efficiency and reliability of parametric insurance models. Such technological advancements are crucial in reducing basis risk and increasing the trustworthiness of parametric insurance solutions.

For instance, In June 2024, African Risk Capacity Ltd. (ARC) received a significant boost with a USD 27 million contribution from the Dutch government. This funding aims to enhance climate resilience in Africa by supporting parametric insurance initiatives. The contribution was managed through the African Development Bank’s Africa Disaster Risk Financing Program (ADRiFi) Multi-Donor Trust Fund, making the Netherlands the sixth major contributor to this initiative.

Simultaneously, IBISA, a leading climate insurtech company, secured USD 3 million in funding to expand its parametric insurance services in Asia and Africa. This investment highlights the increasing demand for affordable and accessible insurance solutions that address the challenges posed by climate change, especially in highly vulnerable communities.

Demand in the parametric insurance market is driven by the need for quick financial responses to natural disasters and other specific events. This insurance model is particularly popular in regions prone to events like hurricanes, earthquakes, and floods. The predictable and swift payout process is highly valued by businesses and governments looking to minimize economic interruptions following disasters

Opportunities in the parametric insurance market are expanding as the industry explores new applications beyond traditional weather-related risks. These include covering risks associated with cyber threats, pandemics, and non-damage business interruptions. Government initiatives promoting climate risk management and increasing global awareness are also creating new growth avenues for this market

Key Takeaways

- The Parametric Insurance Market was valued at USD 15.8 billion in 2023 and is forecasted to grow to USD 40.6 billion by 2033, with a CAGR of 9.9% over the period.

- Within the market’s type segment, Natural Catastrophes Insurance held the largest share, capturing 48% in 2023. This segment’s growth is largely fueled by the increasing risks tied to climate-related disasters.

- The Agriculture application dominated in 2023, making up 27% of the market. This focus stems from the vital need to mitigate risks in sectors heavily influenced by weather patterns and environmental conditions.

- In terms of distribution channels, Direct Sales led with a 40% share in 2023. Direct channels have become essential for providing customized parametric insurance solutions to clients.

- North America took the lead regionally, holding a 35% share in 2023. The demand for innovative and efficient risk management solutions across North America significantly supports its position in the market.

Parametric Insurance Statistics

- The Global Generative AI in Insurance Market is on a robust growth trajectory, anticipated to expand from USD 731.7 million in 2023 to an impressive USD 13,862.7 million by 2033, achieving a strong CAGR of 34.2% from 2024 to 2033. This market boom is driven by insurance providers’ increasing reliance on AI for enhanced risk assessment, fraud detection, and personalized policy offerings.

- Similarly, the AI in Auto Insurance Market is witnessing steady advancement, expected to rise from USD 281.4 million in 2023 to USD 777.7 million by 2033, with a CAGR of 10.7% over the forecast period.

- In 2023, global economic losses from natural catastrophes amounted to an estimated $380 billion, but only 31% of these losses were insured. This underscores a significant protection gap where 69% of damages remain uninsured, leaving many exposed to financial risk from natural disasters.

- A prime example was Hurricane Ian in 2022, the most costly disaster globally, with $95.5 billion in total damages, nearly half of which were uninsured. This disaster reflects a growing need for AI-driven risk solutions that can better anticipate and mitigate these economic impacts.

- Europe’s catastrophic drought in 2022—its worst in 500 years – had widespread impacts on agriculture and transportation. The Rhine River saw average barge loading capacity drop by 75% in August, severely affecting the movement of goods.

- Additionally, grain yields fell 16% below the five-year average, compounding food supply concerns. The drought further fueled wildfires across the region, which prompted health warnings throughout the EU.

Goverment Led Investments

Government-led investments in parametric insurance are increasingly recognized as pivotal in enhancing financial resilience against natural disasters and climate-related events. These investments aim to address the gaps left by traditional insurance systems, which often fail to provide quick financial relief after disasters. Governments, in collaboration with development organizations and insurance providers, are actively promoting the adoption of parametric insurance as a tool for rapid disaster recovery and economic stability.

The United Nations Development Programme (UNDP), in partnership with Generali, has emphasized the role of parametric insurance in supporting governments to prepare financially for the increasing frequency and severity of natural hazards. This approach not only facilitates faster recovery through pre-agreed payouts based on specific triggers but also encourages sustainable development practices by making funds available immediately after a disaster, thereby reducing the economic impact on vulnerable communities. These efforts are supported by creating an enabling environment through supportive regulations and policies that encourage the uptake of parametric insurance solutions.

Additionally, public-private partnerships are highlighted as essential for expanding the reach and effectiveness of parametric insurance. By collaborating with private insurers, governments can leverage expertise and resources to design insurance products that are both accessible and relevant to the needs of their populations. This cooperative approach is crucial for building a robust framework that can withstand the challenges posed by climate change and natural disasters, ensuring that communities, especially those in high-risk areas, have the necessary tools to manage and mitigate risks effectively.

Emerging Trends

- Increased Demand for Rapid Response: The frequency and severity of natural disasters, driven by climate change, have boosted the demand for insurance solutions that offer quick payouts, such as parametric insurance.

- Technology Integration: Advancements in technology, particularly IoT and AI, are being leveraged to enhance the accuracy and reliability of parametric insurance products. This helps in more accurately assessing and responding to claims based on predefined triggers.

- Focus on Climate Resilience: Parametric insurance is increasingly viewed as a crucial tool for climate adaptation and resilience, helping to manage the financial impacts of climate-related disasters. This is prompting more organizations and governments to integrate parametric solutions into their risk management strategies.

- Expansion in Coverage: There’s a broadening scope in the application of parametric insurance beyond natural disasters to include other risks like cyber threats and market volatilities, making it a versatile tool in modern risk management.

- Growing Market Acceptance: With the traditional insurance market facing limitations like high costs and coverage restrictions, parametric insurance is gaining traction as a viable alternative, offering clearer terms and faster payouts.

Top Use Cases

- Natural Disaster Response: Parametric insurance is extensively used for immediate financial assistance following natural disasters like earthquakes, hurricanes, and floods, where payouts are triggered by specific, measurable events like wind speed or seismic activity.

- Agricultural Sector Protection: In agriculture, parametric insurance mitigates financial risks caused by weather variability, such as droughts or excessive rainfall, which can significantly impact crop yields. Payouts are typically tied to predetermined weather indices.

- Renewable Energy: In the renewable energy sector, parametric insurance protects investments against environmental risks that can disrupt operations, like excessive precipitation or high wind speeds, ensuring quick recovery and minimizing downtime.

- Public Sector Resilience: Governments use parametric insurance to secure faster funds allocation in the aftermath of disasters, enhancing public resilience against economic shocks caused by catastrophic events.

- Tourism and Hospitality: For industries like tourism and hospitality, which are highly susceptible to climate impacts, parametric insurance offers a financial safety net, ensuring business continuity in the wake of adverse weather events that might deter tourist activities.

Major Challenges

- Complexity and Understanding: Parametric insurance, relying on specific parameters for payouts, is often challenging for stakeholders to fully understand compared to traditional indemnity-based models. This complexity requires enhanced education efforts to foster understanding and trust.

- Basis Risk: One of the most significant challenges is basis risk, where the parameter indexes might not perfectly align with the actual losses experienced, potentially leading to undercompensation. This risk arises due to mismatches in data accuracy, model precision, and geographical or temporal discrepancies in index measurements.

- Data Quality and Availability: Accurate and comprehensive data is crucial for designing effective parametric indexes. In regions with less developed data infrastructure, there might be a scarcity of reliable data, which can lead to poorly calibrated indexes and increased basis risk.

- Regulatory Challenges: While there is growing regulatory recognition of parametric insurance’s potential, the unique nature of these products requires new regulatory frameworks. This adaptation process can be slow, impacting the speed at which parametric insurance products can be brought to market and scaled.

- Market Penetration and Awareness: Despite its benefits, parametric insurance still faces low penetration and awareness among potential customers. The industry needs to intensify its educational and marketing efforts to highlight the advantages and specific conditions of parametric policies to a broader audience.

Attractive Opportunities

- Climate Adaptation and Resilience: As climate-related risks intensify, parametric insurance is increasingly seen as a crucial tool for adaptation. It offers fast, transparent payouts, making it suitable for managing climate and natural disaster risks. This makes it particularly valuable for sectors and regions highly exposed to climate volatility.

- Technological Integration: The integration of advanced technologies, such as AI, IoT, and satellite imagery, enhances the precision and reliability of parametric insurance products. These technologies facilitate real-time risk monitoring and the development of customized insurance solutions tailored to specific customer needs.

- Expansion into New Markets and Risks: Parametric insurance is expanding beyond traditional natural disaster coverage to include areas like cyber risks, supply chain disruptions, and non-damage business interruptions. This diversification opens up new market opportunities and attracts a wider range of customers.

- Innovation in Insurance Products: The industry is witnessing innovation in product design, including the development of microinsurance products for low-income communities and bespoke solutions for industries like agriculture, renewable energy, and tourism. These innovations are driving growth and expanding the reach of insurance coverage.

- Collaborative and Co-Reinsurance Models: The increasing scale of risks, especially from climate change, is promoting collaborative models in reinsurance. These models distribute risks more widely and allow smaller insurers to participate in the parametric insurance market, fostering a more inclusive insurance ecosystem.

Conclusion

In conclusion, The parametric insurance market is poised for significant growth, driven by the increasing prevalence of natural disasters and the integration of advanced technologies like IoT, AI, and machine learning. These technologies enhance the precision and efficiency of parametric insurance products, offering quick, reliable payouts based on predefined triggers rather than assessments of physical damage.

As climate change continues to elevate the frequency and severity of weather-related catastrophes, the demand for such efficient insurance solutions is expected to rise. Additionally, opportunities are expanding into new areas such as cyber risks and non-damage business interruptions, supported by global initiatives promoting risk management. The evolving landscape of parametric insurance promises enhanced resilience and quicker recovery from disruptive events, making it a critical component in modern risk management strategies.