Table of Contents

Introduction

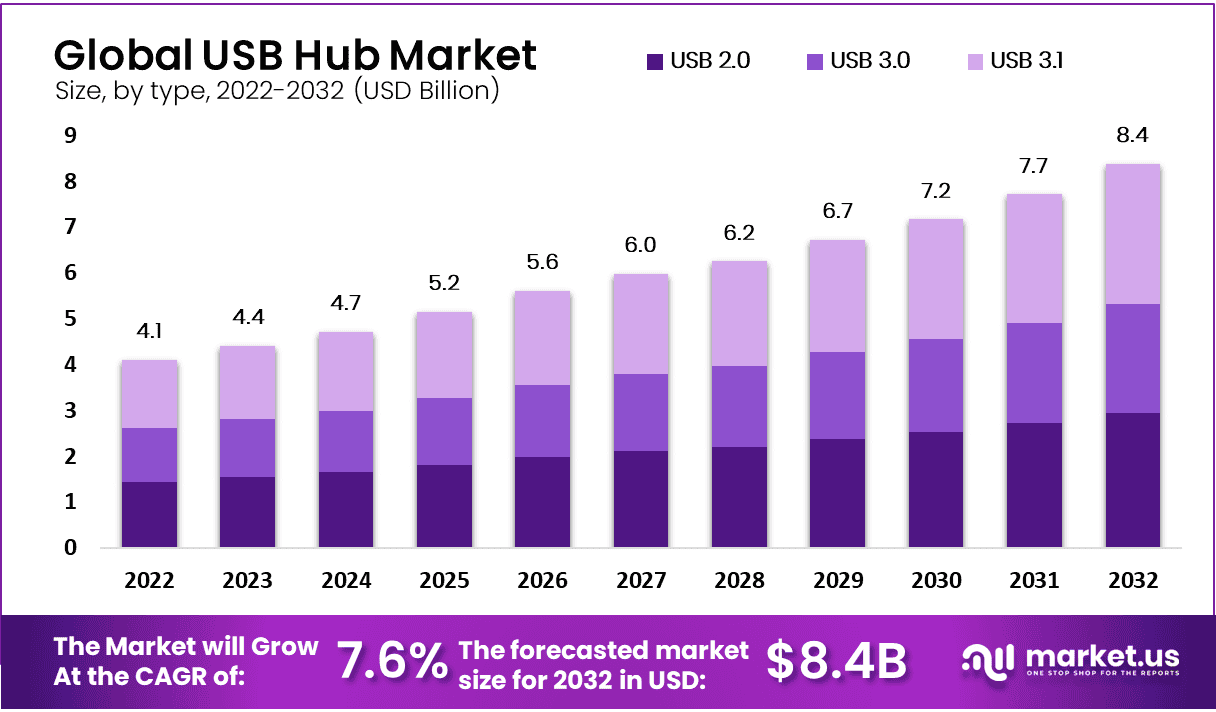

The Global USB Hub Market is projected to reach a valuation of approximately USD 8.4 billion by 2032, up from USD 4.4 billion in 2023. This represents a compound annual growth rate (CAGR) of 7.6% over the forecast period from 2023 to 2032.

A USB hub is a device that expands a single Universal Serial Bus (USB) port into multiple ports, enabling users to connect various peripherals to a computer or other host systems. These peripherals can include devices such as keyboards, mice, printers, external storage drives, and more. USB hubs are available in various configurations, including powered hubs, which supply additional power for high-energy devices, and unpowered hubs, which rely solely on the host’s power. They are critical in environments where multiple connections are necessary, such as in office setups, gaming stations, or industrial systems.

The USB hub market encompasses the production, distribution, and sale of USB hubs globally. It spans various segments, including consumer electronics, industrial applications, and automotive systems, reflecting the diverse utility of USB technology. The market is influenced by technological advancements, such as the adoption of USB 3.0, USB 3.1, and the latest USB-C standards, which offer higher data transfer speeds and power delivery capabilities. The industry serves a broad customer base, from individual consumers seeking multi-port connectivity to businesses requiring robust, scalable connection solutions.

Several factors are driving growth in the USB hub market. The proliferation of USB-enabled devices is a primary growth driver, necessitating multi-port connectivity solutions. Additionally, the rise in remote working and the demand for ergonomic and efficient home office setups have bolstered sales of USB hubs. Technological advancements, such as the integration of faster data transfer rates and improved power management in hubs, have also contributed to market expansion. Furthermore, the increasing use of USB hubs in automotive infotainment systems and industrial automation underscores their growing utility across sectors.

The demand for USB hubs is largely fueled by the rising dependency on digital devices and peripheral equipment. The consumer electronics sector remains a key demand driver, particularly with the growing adoption of USB-C hubs that cater to newer laptops, tablets, and smartphones. Enterprise demand is also robust, as organizations seek to streamline operations with efficient connectivity solutions. In the automotive sector, the integration of USB hubs for charging and connectivity purposes in vehicles is adding to demand. Similarly, the healthcare and industrial sectors are driving demand for specialized USB hubs designed for specific applications.

The USB hub market presents several lucrative opportunities. The growing adoption of USB-C technology is a significant opportunity, as it offers a universal, high-speed, and versatile solution for both data and power transfer. Additionally, emerging markets in Asia-Pacific and Latin America provide untapped growth potential due to the increasing penetration of digital devices and improving technological infrastructure.

The rise of smart homes and IoT ecosystems also creates opportunities for USB hubs to play a central role in connecting a variety of smart devices. Furthermore, the shift toward more sustainable and energy-efficient technology could spur innovation in eco-friendly USB hub solutions, aligning with global sustainability trends.

Key Takeaways

- The Global USB hub market is projected to expand from USD 4.4 billion in 2023 to USD 8.4 billion by 2032, reflecting a CAGR of 7.6%. This growth is primarily driven by the increasing need for multi-device connectivity and ongoing innovations in USB technology.

- USB 3.0 dominates the market, accounting for 58% of the total market share in 2023. It is widely preferred for its balance between high-speed data transfer capabilities and cost efficiency.

- The commercial segment holds the largest share of the USB hub market, with 53% in 2023. This is attributed to the extensive use of USB hubs in enterprise environments that require robust connectivity solutions.

- North America leads the global USB hub market, capturing 37.2% of the market share. Its dominance is driven by strong consumer electronics adoption and advanced IT infrastructure across the region.

USB Hub Statistics

- USB 4.0 delivers data transfer speeds of up to 40 Gbps, enabling high-performance use cases.

- USB 3.2 Gen 2×2 hubs offer speeds up to 20 Gbps, providing a mid-tier solution for fast data transfers.

- Modern USB-C hubs typically provide power delivery between 65W and 100W, sufficient for charging most laptops and devices.

- Over 65% of laptop users rely on at least one USB hub for additional connectivity.

- Consumers on average own 2-3 USB-powered devices that often require hub connections.

- Professional users tend to connect 4-6 devices simultaneously through USB hubs.

- Around 80% of new USB hubs offer power pass-through, enhancing charging convenience.

- Recent models achieve 15-20% greater energy efficiency compared to previous iterations.

- Slim, portable USB hubs account for approximately 60% of consumer purchases, reflecting demand for compact designs.

- Industrial-grade hubs represent about 15% of the total market, catering to specialized applications.

- HDMI output is included in roughly 75% of premium USB hubs, meeting multimedia needs.

- Ethernet ports are found in approximately 50% of business-focused hubs, ensuring reliable wired internet connections.

- Online channels contribute to over 60% of total USB hub sales, highlighting the shift towards e-commerce.

- The top five manufacturers collectively hold around 70% of the market share, demonstrating a consolidated industry landscape.

- The premium USB hub segment is experiencing an annual growth rate of 7.5%, driven by demand for advanced features.

- USB 3.0, while older, offers speeds of up to 5 Gbps, a significant improvement over USB 2.0’s 480 Mbps.

Emerging Trends

- Adoption of USB 3.0 and USB-C Technologies: There is a marked shift towards USB 3.0 and USB-C hubs, offering enhanced data transfer speeds and improved power delivery. USB 3.0 hubs accounted for 58% of the market share in 2023, reflecting their growing preference among consumers and businesses.

- Integration of Power Delivery (PD) Features: Modern USB hubs increasingly incorporate Power Delivery capabilities, enabling efficient charging of devices such as laptops, tablets, and smartphones. This integration addresses the demand for multifunctional hubs that combine data transfer with power supply, enhancing user convenience.

- Expansion in Commercial Applications: The commercial sector dominates the USB hub market, holding a 53% share in 2023. This is driven by the need for extensive connectivity solutions in enterprise environments, educational institutions, and healthcare facilities, where multiple devices require simultaneous connection and power.

- Development of Compact and Portable Designs: There is a growing trend towards compact and portable USB hubs, catering to the needs of professionals and consumers who require mobility. These designs offer multiple ports in a small form factor, facilitating easy transportation and use across various settings.

- Advancements in Wireless USB Hub Technology: The emergence of wireless USB hubs is gaining traction, providing users with the flexibility to connect devices without physical cables. This innovation supports clutter-free workspaces and enhances connectivity options, aligning with the increasing adoption of wireless technologies in personal and professional environments.

Top Use Cases

- Expansion of Connectivity in Office Environments: In modern workplaces, USB hubs facilitate the connection of multiple peripherals—such as printers, scanners, and external storage devices—to a single computer. This setup streamlines operations and reduces cable clutter, thereby improving workspace efficiency. The commercial segment dominated the USB hub market with a 53% share in 2023, underscoring their widespread adoption in office settings.

- Enhancement of Gaming Setups: Gamers utilize USB hubs to connect various devices, including controllers, headsets, and external drives, to their gaming systems. This configuration supports seamless gameplay and quick data transfers. The gaming industry has significantly contributed to the demand for USB hubs, with gaming USB hubs being in high demand.

Support for Remote Work and Home Offices: The rise of remote work has increased the need for efficient home office setups. USB hubs enable users to connect essential devices such as webcams, keyboards, and mice to laptops with limited ports, thereby enhancing productivity. The global USB hub market was valued at USD 4.4 billion in 2023, reflecting the growing demand in residential applications.

Facilitation of Creative Workspaces: Professionals in creative fields, such as digital artists and content creators, rely on USB hubs to connect devices like drawing tablets, microphones, and external hard drives. This setup allows for efficient workflow management and data storage. The integration of multiple devices through USB hubs is crucial for handling large files and complex projects. - Integration in Educational Settings: Educational institutions employ USB hubs to connect multiple devices such as projectors, interactive whiteboards, and storage devices to a single computer. This arrangement facilitates interactive learning and resource sharing. The adoption of USB hubs in educational environments supports collaborative projects and enhances teaching methodologies.

Major Challenges

- Technological Obsolescence and Compatibility Issues: Rapid advancements in USB technology, including the transition to USB 4.0, pose challenges for manufacturers and users alike. USB hubs that do not support newer standards such as Thunderbolt or USB-C risk becoming obsolete, limiting compatibility with modern devices. This creates a pressing need for continuous product innovation, often leading to higher R&D costs and reduced profitability for slower adopters.

- Price Sensitivity and Market Competition: The USB hub market is highly price-sensitive, especially in the consumer segment. Mid-range hubs dominate sales, offering an optimal balance of cost and performance. However, fierce competition among established players like Anker and Dell, as well as numerous smaller manufacturers, leads to thin profit margins. Additionally, premium hubs with advanced features often struggle to justify their higher price points in a cost-conscious market.

- Security Concerns in Data Transfer: With the proliferation of USB hubs in commercial environments, concerns over data security have intensified. Vulnerabilities such as data interception or malware spreading through USB connections present risks, particularly for sensitive industries like finance and healthcare. This issue underscores the need for enhanced security features, which can increase production costs and complicate product design.

- Supply Chain Disruptions and Component Shortages : The USB hub market has been impacted by global supply chain disruptions, particularly in sourcing semiconductor components. Delays and increased costs in manufacturing have affected production timelines and pricing strategies. Such challenges were exacerbated during the COVID-19 pandemic and continue to affect market dynamics, especially for smaller players without diversified supplier networks.

- Emergence of Alternative Technologies: The growing adoption of alternative connection standards like Thunderbolt 4 and wireless technologies is creating competition for traditional USB hubs. These alternatives offer higher speeds and more advanced functionalities, compelling users to reconsider their reliance on conventional USB hubs. For manufacturers, this shift may result in a shrinking addressable market and necessitate strategic pivots to remain competitive

Top Opportunities

- Expansion of USB-C Hubs: The growing adoption of USB-C technology, known for its reversible design and support for high-speed data transfer and power delivery, presents a substantial market opportunity. USB-C hubs are expected to grow at a significant CAGR, driven by their application in consumer electronics, automotive, and industrial sectors. This trend is amplified by the increasing integration of USB-C in devices such as smartphones, laptops, and even automobiles.

- Demand Surge in Gaming and eSports: The global gaming market, valued at over $200 billion in 2023, continues to drive the demand for high-performance peripherals, including USB hubs. Gamers require hubs with multiple ports to connect devices such as gaming keyboards, mice, external drives, and headsets. The rising popularity of eSports and high-performance gaming devices underscores a growing niche for advanced USB hubs designed for low-latency, high-speed connectivity.

- Growth in Remote Work and Online Education: The rise in remote work and virtual learning environments has increased the need for multi-port USB hubs. These hubs are essential for connecting laptops, external monitors, and other peripherals in home office setups. As hybrid work models become more prevalent, demand for USB hubs in residential settings is expected to continue growing, contributing significantly to the market’s expansion.

- Development of Multi-Port and Specialized Hubs: USB hubs offering higher port configurations (10 ports or more) and specialized hubs for specific industries (e.g., industrial-grade or gaming hubs) are gaining traction. These advanced hubs cater to both professional environments and specific consumer needs, providing tailored solutions that enhance productivity and user experience. This segment is anticipated to see strong growth due to its ability to address diverse connectivity challenges.

- Rising Adoption in Emerging Markets: The Asia-Pacific region, driven by increased digitalization and IoT adoption, is poised to be the fastest-growing market for USB hubs. As economies in this region continue to develop their IT infrastructure and consumer electronics markets, USB hub demand is expected to surge. Additionally, government initiatives promoting digital transformation will further accelerate market growth in this region.

Key Player Analysis

- Anker Innovations Co. Ltd: Anker is a leading player in the USB hub segment, known for its innovative USB-C hubs. In 2023, Anker captured a significant portion of the market with its high-performance products such as the Anker 555 USB-C Hub, featuring speeds up to 10 Gbps and 4K HDMI support. Its revenue from USB-related products contributes significantly to its annual turnover, which exceeded $1 billion in recent years.

- Texas Instruments (TI): Texas Instruments specializes in semiconductor technologies, with its USB hub solutions focusing on energy efficiency and high data transfer rates. In collaboration with Delta Electronics, TI developed a power supply unit with an 80% increase in power density. TI’s hubs are widely used in industrial applications, strengthening its position.

- Belkin International, Inc.: Belkin, a prominent name in consumer electronics, offers a range of USB hubs that prioritize design and functionality. Known for premium products, Belkin’s hubs cater to both personal and professional users. Its market share is supported by its widespread presence in retail and e-commerce platforms.

- Honeywell International: Honeywell leverages its industrial expertise to offer robust USB hub solutions. Its focus on industrial and commercial applications makes it a key player in sectors requiring durable, high-performance connectivity. Honeywell’s hubs are integral to its diversified product portfolio, contributing to its $34 billion annual revenue in 2023.

- Vaunix Technology Corp.: Vaunix is a niche player, specializing in programmable USB hubs tailored for industrial and research environments. Its products are highly valued in sectors requiring precise data transfer and control. Although smaller in scale, Vaunix’s specialized offerings carve out a distinct market segment.

Recent Developments

- In June 2024, Honeywell announced the acquisition of CAES Systems Holdings LLC for $1.9 billion in an all-cash deal. This transaction represents approximately 14 times the estimated 2024 EBITDA on a tax-adjusted basis.

- In September 2024, Grass Valley entered into a strategic partnership with ES Broadcast, aiming to strengthen their collaboration in broadcast solutions. This partnership builds on a decade of successful cooperation.

- In January 2024, Infineon launched a joint Innovation Application Center in Shenzhen with Anker Innovations. The center focuses on developing energy-efficient charging solutions to support global decarbonization efforts.

- In June 2024, Valens Semiconductor acquired Acroname to enhance its USB-focused offerings in the industrial market. This acquisition combines Valens’ USB extension chipsets with Acroname’s automation technologies.

Conclusion

The USB hub market is poised for significant growth, with projections indicating a substantial increase in market size over the coming years. This expansion is driven by the escalating demand for multi-device connectivity solutions across various sectors, including consumer electronics, commercial enterprises, and industrial applications. Technological advancements, such as the adoption of USB 3.0 and USB-C standards, are enhancing data transfer speeds and power delivery capabilities, further propelling market growth.

The rise in remote work and the proliferation of USB-enabled devices necessitate efficient connectivity solutions, thereby increasing the reliance on USB hubs. Additionally, the integration of USB hubs in automotive systems and industrial automation underscores their expanding utility across diverse industries. As the digital landscape continues to evolve, the USB hub market is expected to maintain its upward trajectory, offering ample opportunities for innovation and development.