Table of Contents

- Introduction

- Editor’s Choice

- Workflow Management System Market Statistics

- Workforce Management Applications Market Forecast

- Global Human Capital Management (HCM) Applications Market Size

- Organizations Using Workforce Management Applications

- Key Vendors Statistics

- Tools Used by IT Leaders and Managers to Assess Employee Experience Worldwide

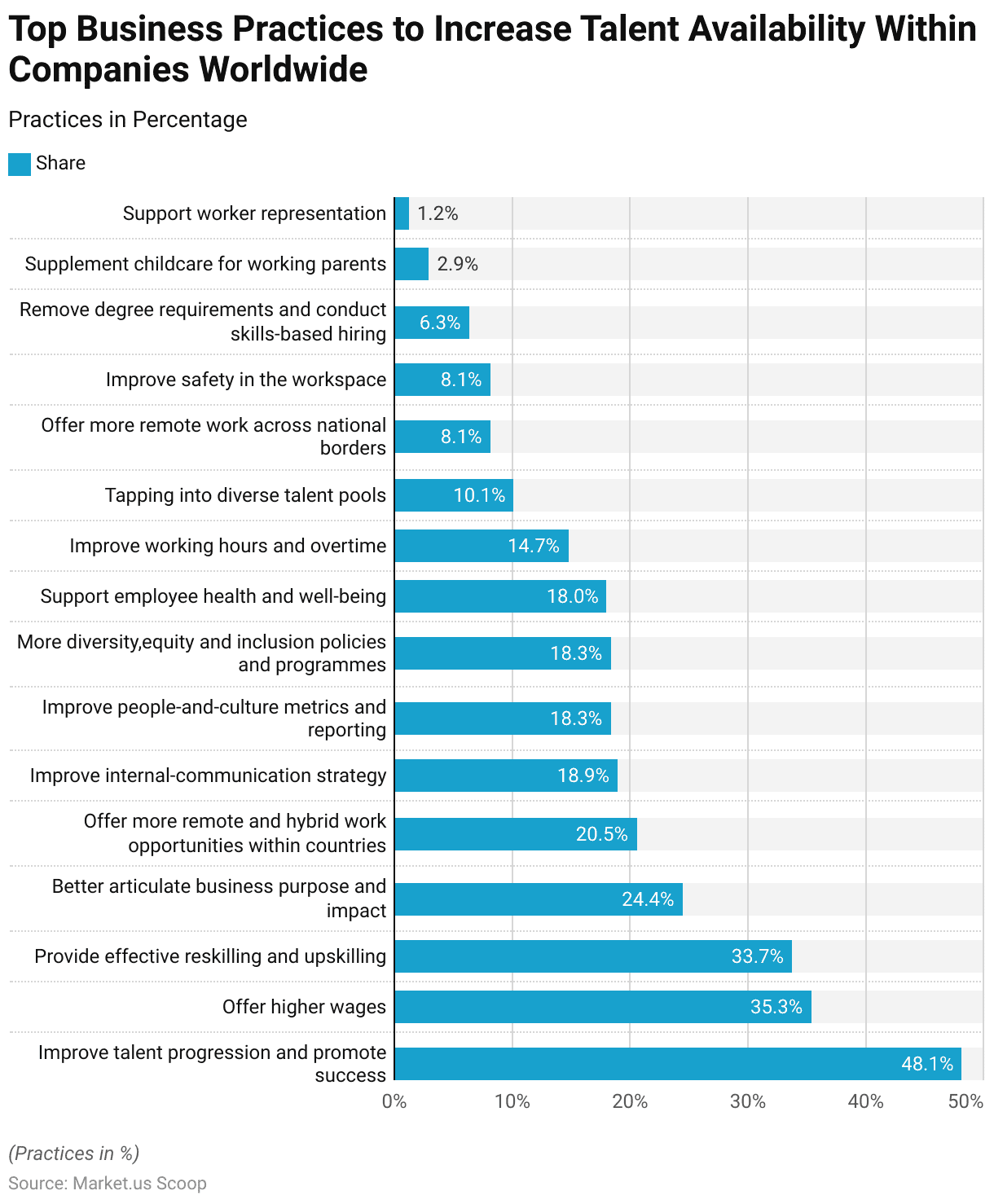

- Top Business Practices to Increase Talent Availability Within Companies Worldwide

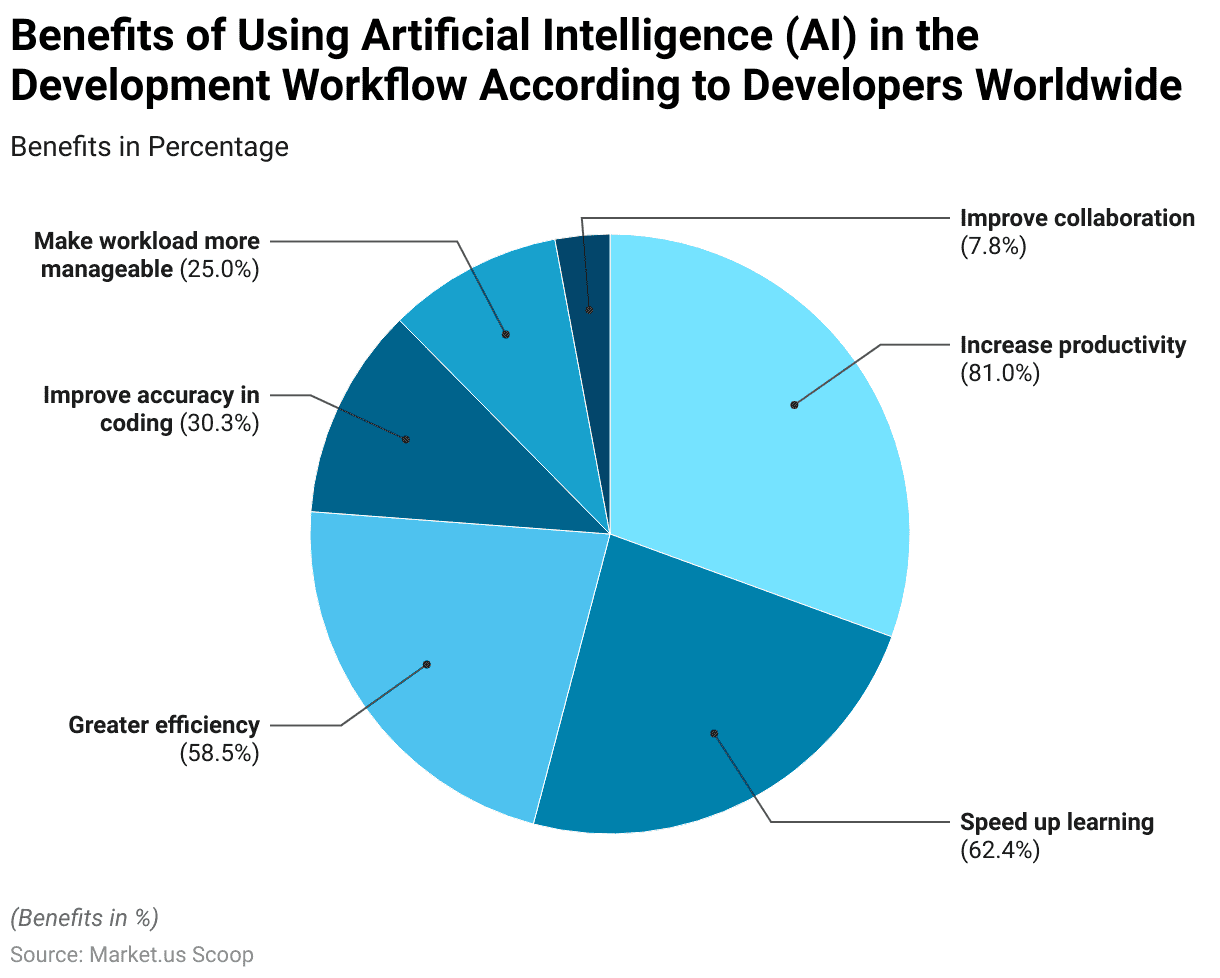

- Use of AI Tools in Workforce Management System Statistics

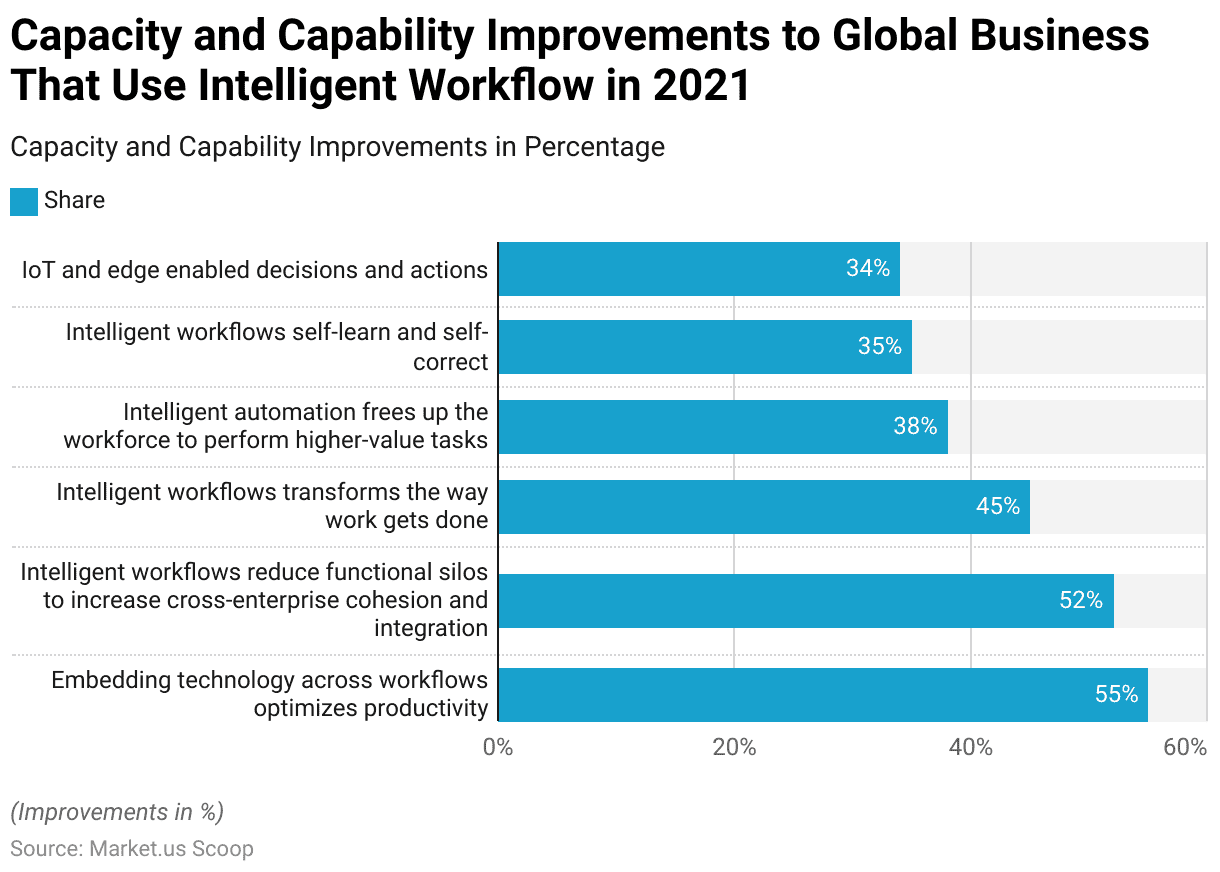

- Intelligent Workflow Improvements to Global Business Activities

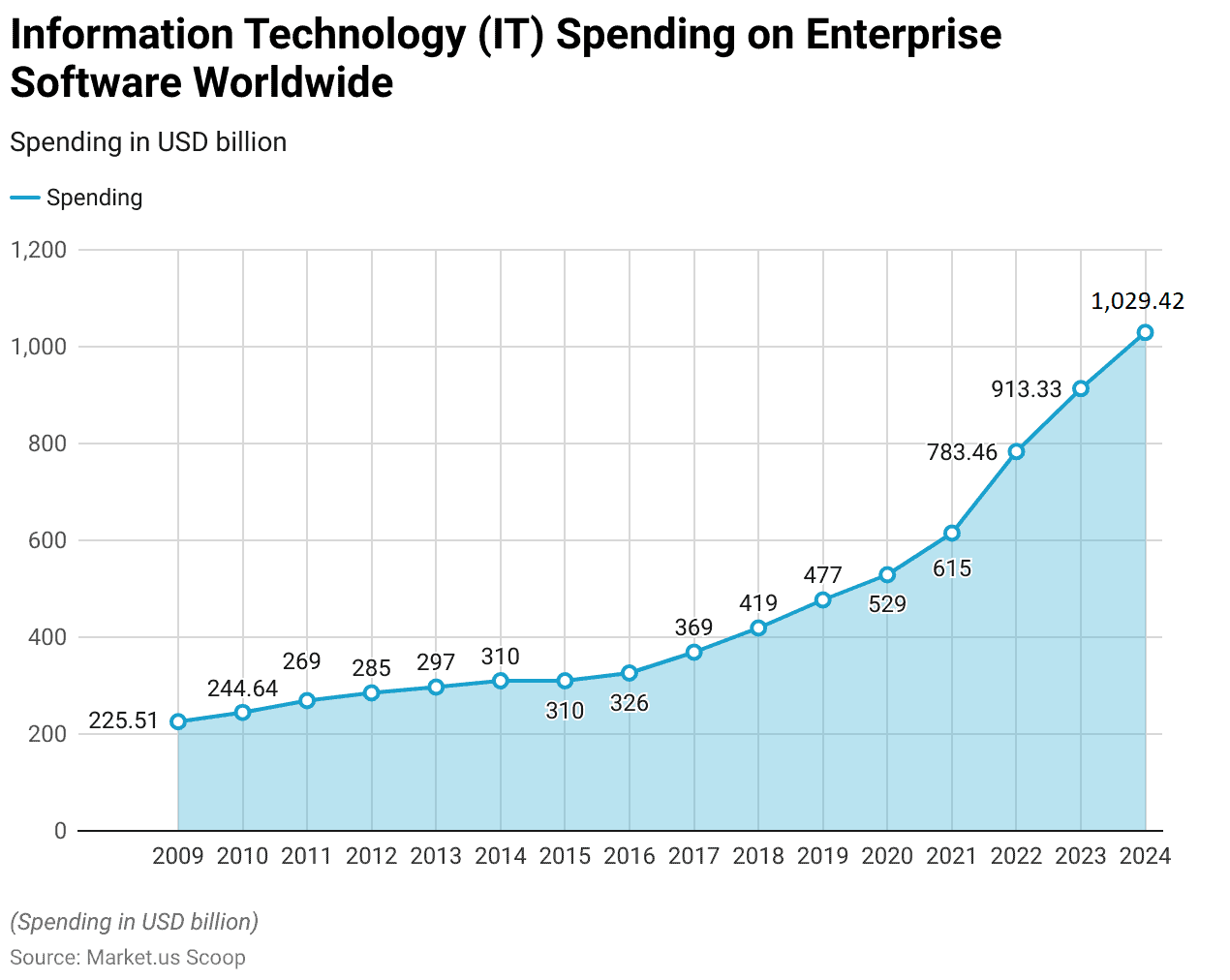

- Key Spending and Investments

- Expectations for Future Digital Workflow

- Innovations and Developments

- Regulations for Workflow Management Systems

- Recent Developments

- Conclusion

- FAQs

Introduction

Workflow Management System Statistics: A Workflow Management System (WMS) is a software solution designed to automate and streamline processes by defining, managing, and monitoring workflows within an organization.

It helps assign tasks, route them through predefined steps, and automate approvals or updates, ensuring efficiency and accountability.

Key features include task automation, real-time visibility, document management, and integration with other enterprise systems.

By reducing manual intervention, improving collaboration, and providing data-driven insights, WMS enhances productivity, ensures compliance, and supports continuous process optimization.

It is particularly valuable for organizations seeking to improve operational efficiency, reduce costs, and maintain clear oversight of task progression.

Editor’s Choice

- The global workflow management system market size reached USD 11.3 billion in 2023.

- In 2022, the global workflow management system market was predominantly dominated by cloud-based deployment, which accounted for 68.7% of the total market share.

- In 2019, time and attendance solutions were the most widely adopted workforce management applications, used by 88% of organizations to track employee hours.

- In 2014 and 2015, Kronos emerged as the leading global workforce management software vendor, with revenues increasing from USD 625 million in 2014 to USD 658 million in 2015.

- From 2018 to 2023, Salesforce consistently maintained a dominant position in the global productivity and management application market, with its market share rising from 37.9% in 2018 to 41.4% in 2021.

- In 2023, IT leaders and managers employed a variety of tools to assess employee experience globally, with surveys being the most commonly used method, reported by 57% of respondents.

- Countries like Australia enforce similar data privacy laws under the Privacy Act 1988, ensuring data protection for both public and private sector WMS.

Workflow Management System Market Statistics

Global Workflow Management System Market Size Statistics

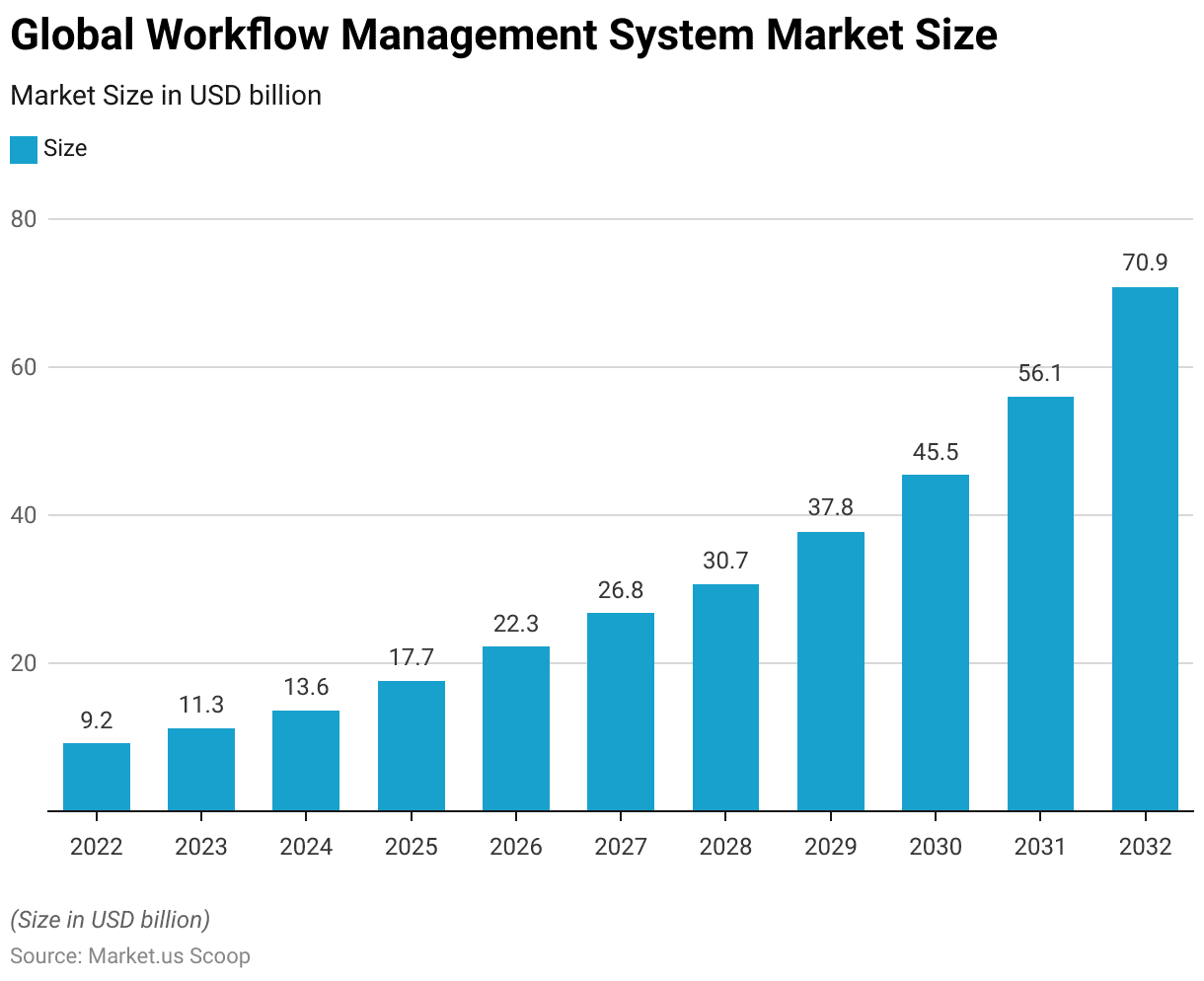

- The global workflow management system market is projected to grow significantly over the forecast period from 2022 to 2032.

- In 2022, the market size was valued at USD 9.2 billion, and this figure is expected to rise steadily, reaching USD 11.3 billion in 2023 and USD 13.6 billion in 2024.

- By 2025, the market is projected to expand further to USD 17.7 billion and continue its upward trajectory, achieving USD 22.3 billion in 2026 and USD 26.8 billion in 2027.

- The growth trend is forecast to remain robust, with the market size reaching USD 30.7 billion by 2028 and USD 37.8 billion in 2029.

- By the end of the decade in 2030, the market is anticipated to attain a valuation of USD 45.5 billion, further expanding to USD 56.1 billion in 2031.

- Ultimately, the global workflow management system market is projected to reach USD 70.9 billion by 2032, reflecting a substantial compound annual growth rate (CAGR) of 23.30% over the analysis period.

(Source: market.us)

Global Workflow Management System Market Size – By Component Statistics

2022-2027

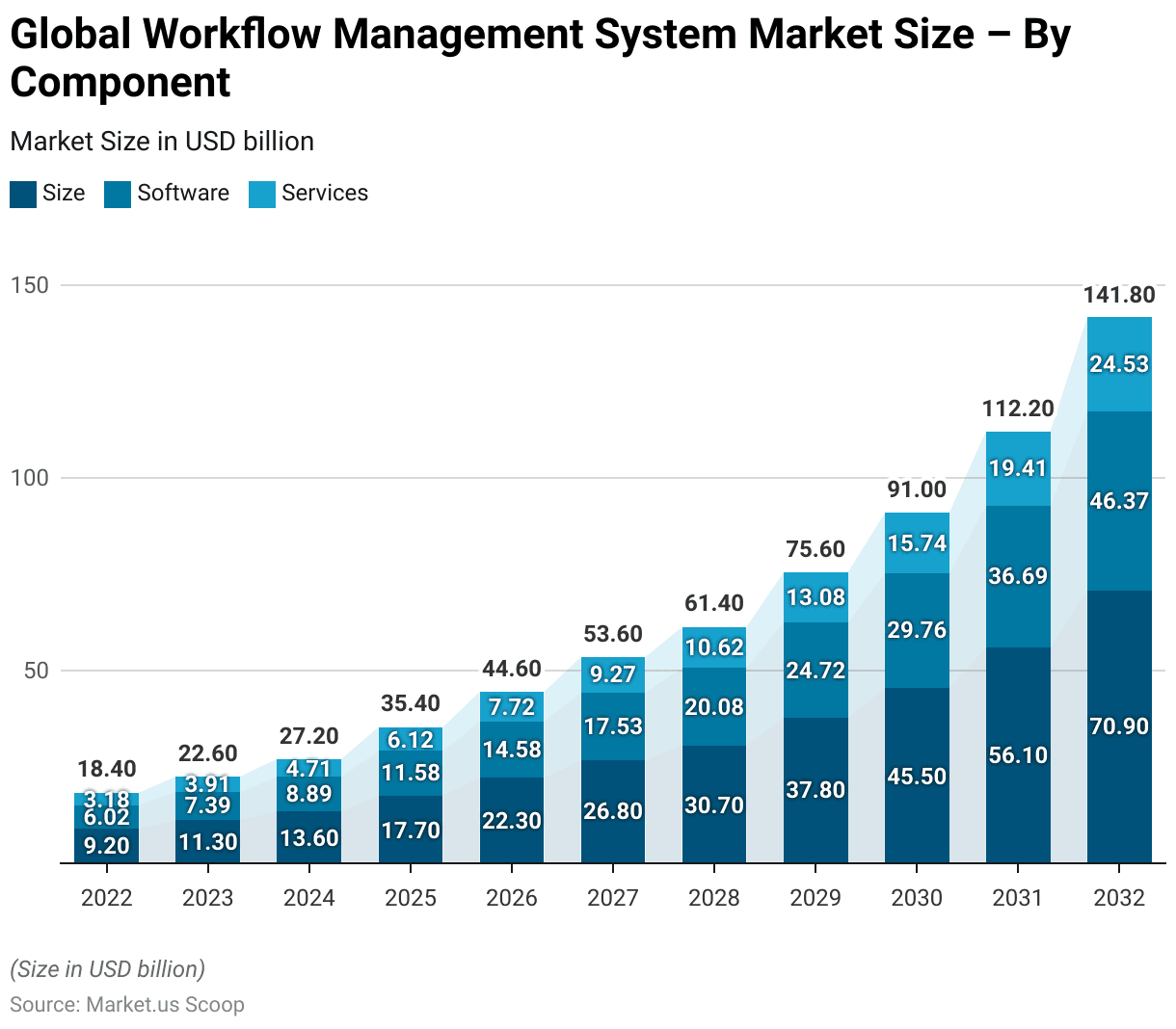

- The global workflow management system market, segmented by components into software and services, is projected to experience significant growth from 2022 to 2027.

- In 2022, the total market size was valued at USD 9.2 billion, with software accounting for USD 6.02 billion and services contributing USD 3.18 billion.

- By 2023, the market is expected to reach USD 11.3 billion, with software at USD 7.39 billion and services at USD 3.91 billion.

- The upward trend continues in 2024, with the total market valued at USD 13.6 billion, comprising USD 8.89 billion in software and USD 4.71 billion in services.

- In 2025, the market will expand further to USD 17.7 billion, with software and services contributing USD 11.58 billion and USD 6.12 billion, respectively.

- This growth persists, reaching USD 22.3 billion in 2026 (USD 14.58 billion from software and USD 7.72 billion from services) and USD 26.8 billion in 2027 (USD 17.53 billion from software and USD 9.27 billion from services).

2028-2032

- By 2028, the total market size will grow to USD 30.7 billion, with software and services accounting for USD 20.08 billion and USD 10.62 billion, respectively.

- In 2029, the market size will reach USD 37.8 billion, including USD 24.72 billion from software and USD 13.08 billion from services.

- The momentum continues into 2030, with the market reaching USD 45.5 billion, comprising USD 29.76 billion from software and USD 15.74 billion from services.

- By 2031, the total market is expected to grow to USD 56.1 billion, with software contributing USD 36.69 billion and services USD 19.41 billion.

- Finally, by 2032, the global workflow management system market is projected to reach USD 70.9 billion, with software accounting for USD 46.37 billion and services contributing USD 24.53 billion.

- This growth reflects a consistent expansion across both components, underlining the increasing adoption of workflow management systems globally.

(Source: market.us)

Workflow Management System Market Size – By Deployment Mode Statistics

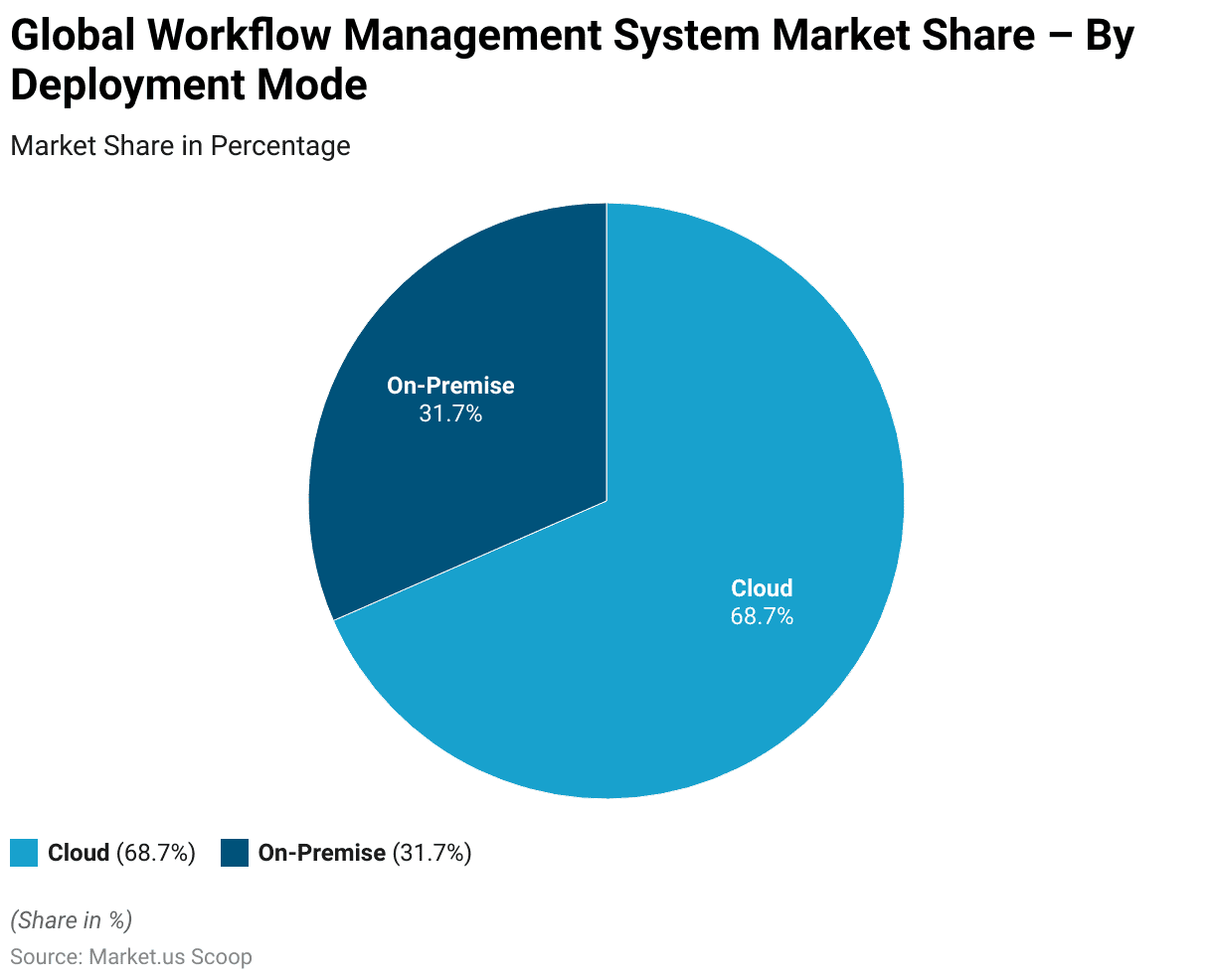

- In 2022, the global workflow management system market was predominantly dominated by cloud-based deployment, which accounted for 68.7% of the total market share.

- This indicates a strong preference for cloud solutions, driven by their scalability, cost-effectiveness, and ease of integration.

- On-premise deployment, on the other hand, constituted 31.7% of the market share, reflecting its continued relevance for organizations requiring tighter control over data and infrastructure.

- The significant adoption of cloud-based deployment highlights the ongoing shift toward digital transformation and the increasing reliance on cloud technology across various industries.

(Source: market.us)

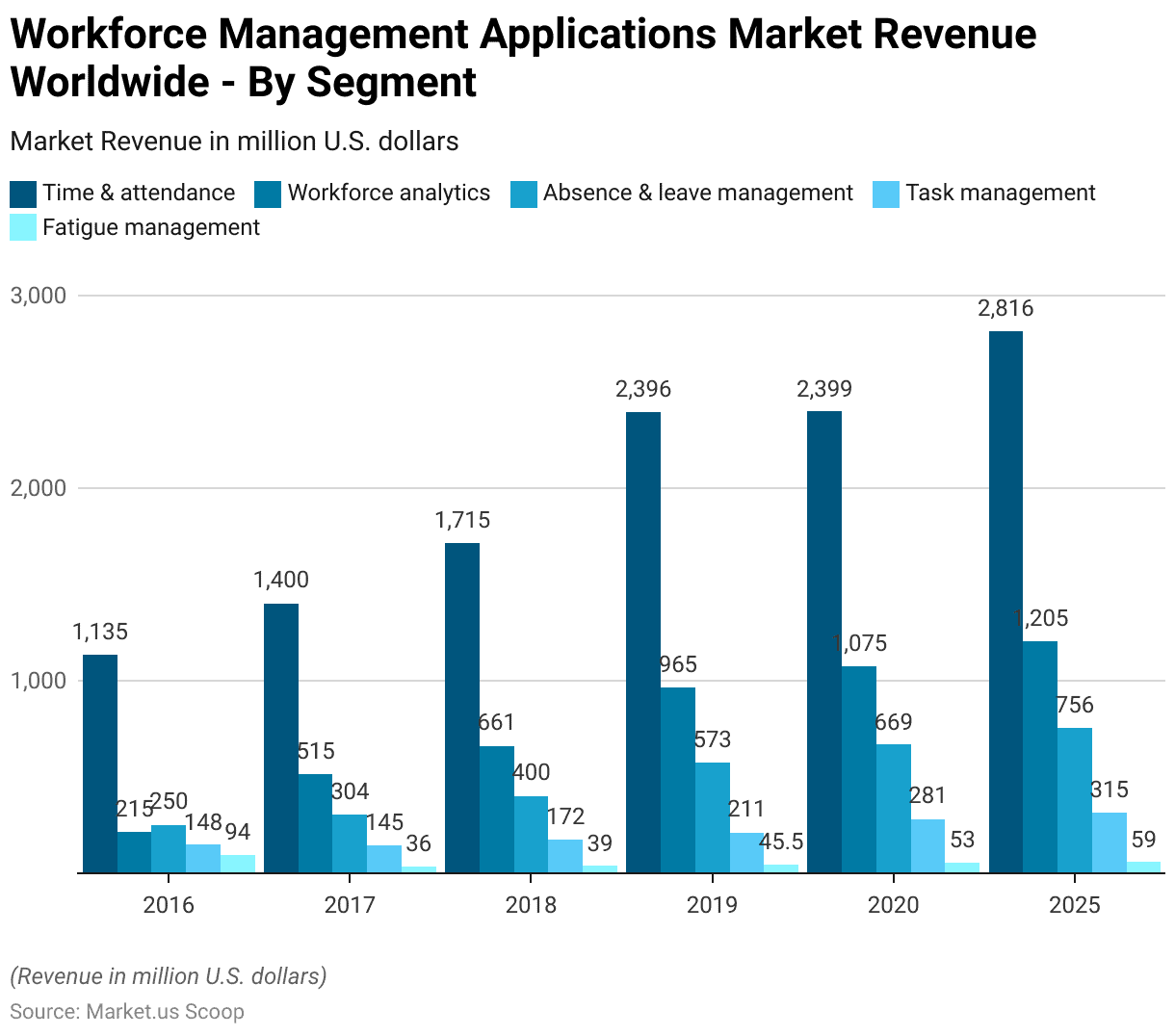

Workforce Management Applications Market Forecast

2016-2018

- The global workforce management applications market has witnessed steady growth across various segments, including time and attendance, workforce analytics, absence and leave management, task management, and fatigue management, from 2016 to 2020, with a forecast for 2025.

- In 2016, the time and attendance segment led the market with revenue of USD 1,135 million, followed by absence and leave management at USD 250 million, workforce analytics at USD 215 million, task management at USD 148 million, and fatigue management at USD 94 million.

- By 2017, revenues rose across all segments, with time and attendance reaching USD 1,400 million, workforce analytics growing significantly to USD 515 million, and absence and leave management increasing to USD 304 million.

- The growth trajectory continued in 2018, with time and attendance generating USD 1,715 million, workforce analytics USD 661 million, absence and leave management USD 400 million, task management USD 172 million, and fatigue management USD 39 million.

2019-2025

- By 2019, the market experienced a marked expansion, with time and attendance reaching USD 2,396 million, workforce analytics USD 965 million, absence and leave management USD 573 million, task management USD 211 million, and fatigue management USD 45.5 million.

- In 2020, the market maintained its upward trend, with time and attendance slightly increasing to USD 2,399 million, workforce analytics reaching USD 1,075 million, absence and leave management climbing to USD 669 million, task management growing to USD 281 million, and fatigue management rising to USD 53 million.

- By 2025, the market is projected to grow further, with time and attendance anticipated to achieve USD 2,816 million, workforce analytics USD 1,205 million, absence and leave management USD 756 million, task management USD 315 million, and fatigue management USD 59 million.

- This growth reflects the increasing adoption of workforce management solutions to enhance operational efficiency and address evolving workplace challenges.

(Source: Statista)

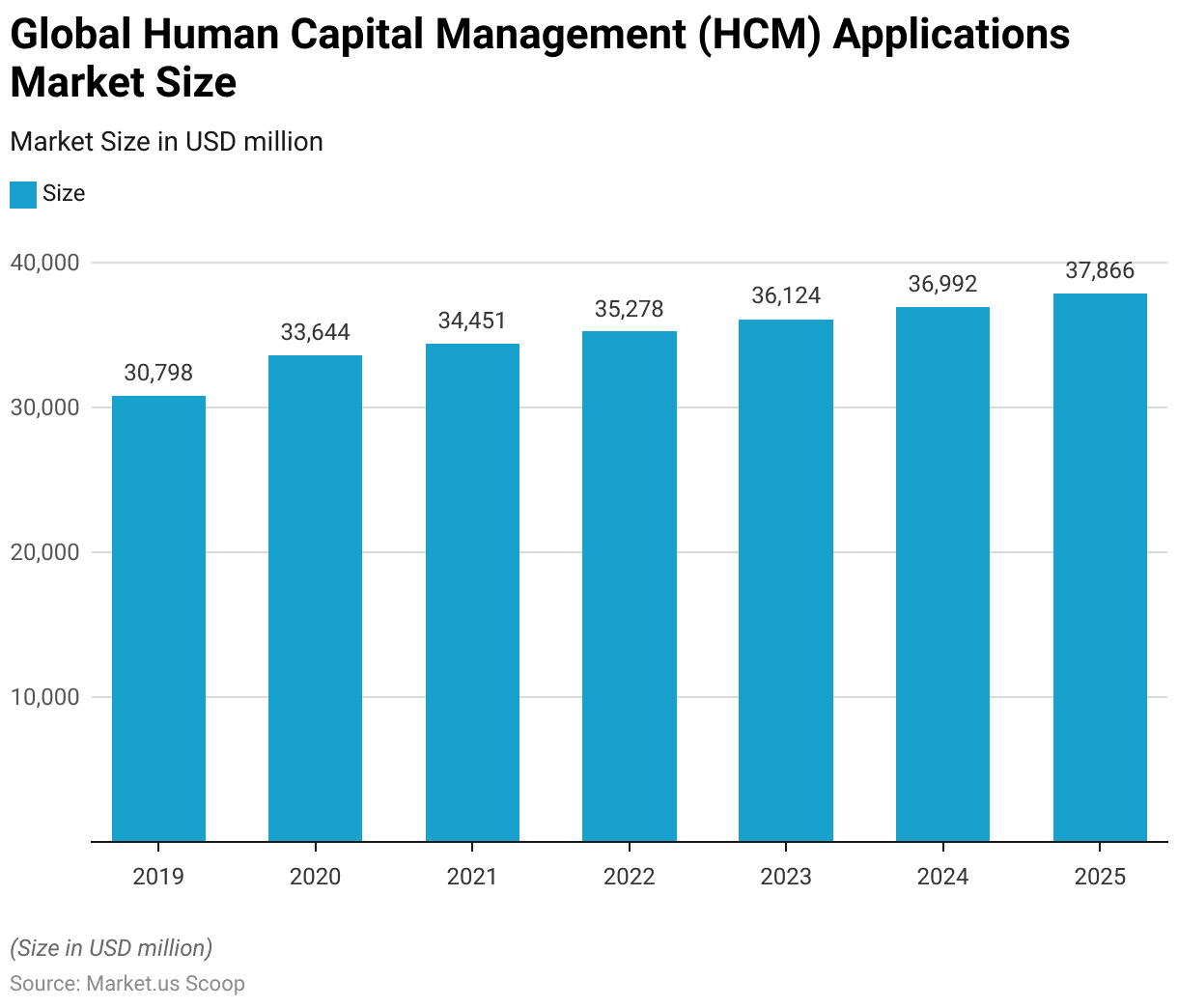

Global Human Capital Management (HCM) Applications Market Size

- The global human capital management (HCM) applications market has exhibited steady growth from 2019 to 2025, reflecting the increasing adoption of HCM solutions across industries.

- In 2019, the market size was valued at USD 30,798 million.

- This figure rose to USD 33,644 million in 2020, followed by a further increase to USD 34,451 million in 2021.

- The upward trend continued in 2022, with the market reaching USD 35,278 million, and it is projected to expand to USD 36,124 million in 2023.

- The market is forecast to maintain its growth trajectory, achieving USD 36,992 million in 2024 and reaching an estimated USD 37,866 million by 2025.

- This consistent growth underscores the growing reliance on HCM applications to streamline workforce management and enhance organizational efficiency.

(Source: Statista)

Organizations Using Workforce Management Applications

By Type

- In 2019, the global adoption of workforce management applications varied significantly across different functionalities.

- Time and attendance solutions were the most widely used, with 88% of organizations utilizing these applications to track employee hours effectively.

- Absence management followed, with 77% of respondents reporting its use, indicating its importance in managing workforce availability.

- Leave management applications were utilized by 62% of organizations, reflecting a strong focus on streamlining leave policies and approvals.

- Labor scheduling solutions were adopted by 42% of organizations, highlighting their role in optimizing staff deployment.

- Labor budgeting was the least utilized functionality, with 29% of organizations incorporating it, underscoring a lesser but growing emphasis on aligning labor costs with business goals.

- This data illustrates the varying priorities and levels of adoption of workforce management applications across organizations.

(Source: Statista)

By Organization Size

- In 2019, the adoption of workforce management applications varied across organizations of different sizes, with large organizations generally demonstrating higher usage rates.

- Among large organizations, 91% utilized time and attendance solutions, compared to 88% in mid-sized organizations and 87% in small organizations.

- Absence management was employed by 78% of large organizations and 76% of both mid-sized and small organizations.

- Leave management applications saw broader adoption in large organizations at 79%, while mid-sized and small organizations reported lower adoption rates of 62% and 58%, respectively.

- Labor scheduling tools were used by 52% of large organizations, compared to 45% in mid-sized and 40% in small organizations.

- Labor budgeting had the lowest adoption rates, with 34% of large organizations utilizing it, followed by 28% in both mid-sized and small organizations.

- These trends reflect the greater emphasis placed on comprehensive workforce management by larger organizations, likely due to their more complex operational needs.

(Source: Statista)

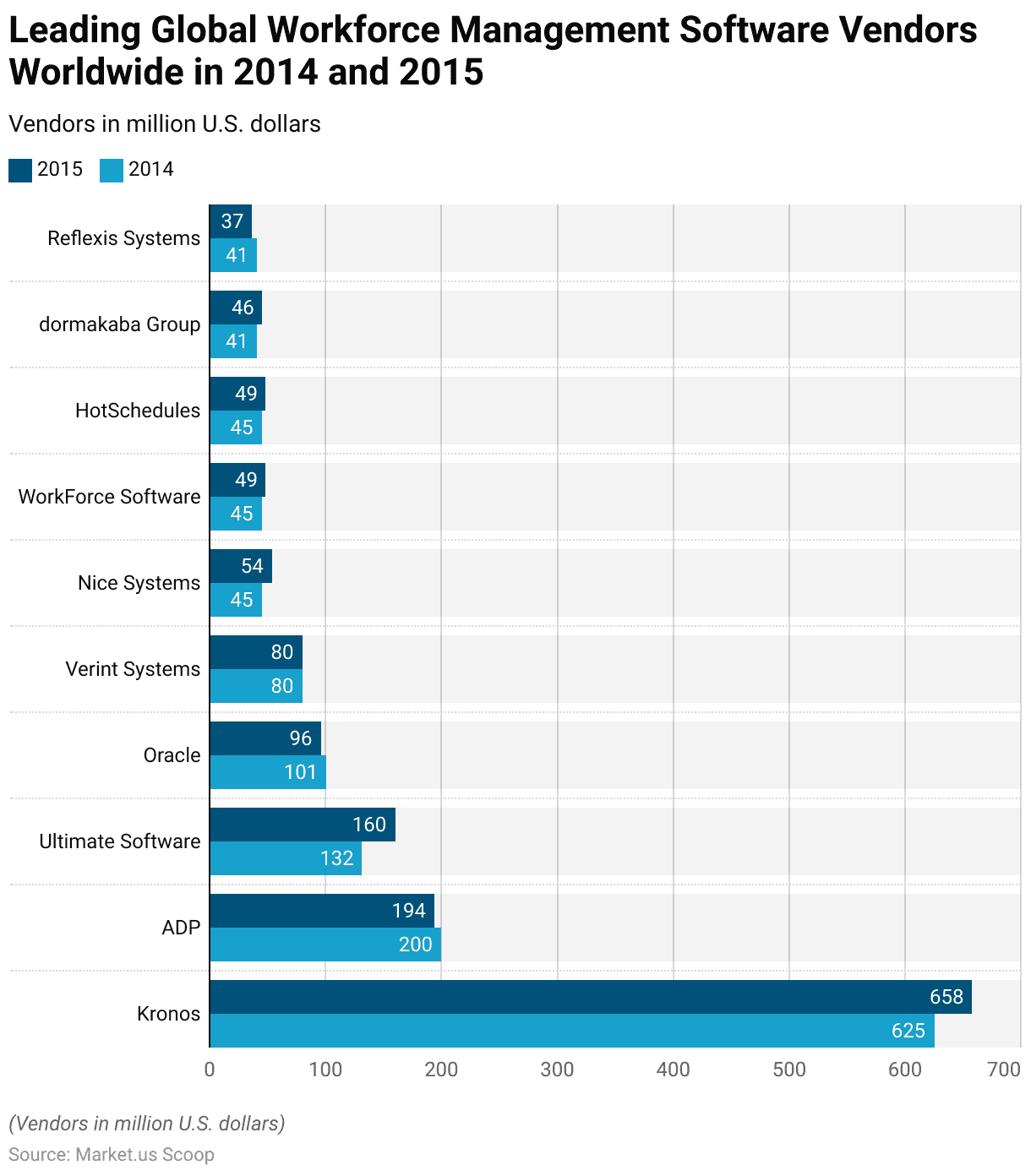

Key Vendors Statistics

Leading Global Workforce Management Software Vendors Worldwide

- In 2014 and 2015, Kronos emerged as the leading global workforce management software vendor, with revenues increasing from USD 625 million in 2014 to USD 658 million in 2015.

- ADP followed, reporting a slight decline from USD 200 million in 2014 to USD 194 million in 2015.

- Ultimate Software experienced significant growth during this period, with its revenue rising from USD 132 million in 2014 to USD 160 million in 2015.

- Oracle saw a marginal decrease in revenue, from USD 101 million in 2014 to USD 96 million in 2015.

- Verint Systems maintained consistent performance, with revenues steady at USD 80 million for both years.

- Other vendors also showed growth, including Nice Systems, which increased from USD 45 million in 2014 to USD 54 million in 2015.

- WorkForce Software and HotSchedules both grew modestly, from USD 45 million in 2014 to USD 49 million in 2015.

- Dormakaba Group’s revenue rose from USD 41 million in 2014 to USD 46 million in 2015, while Reflexis Systems saw a slight decline, with revenues dropping from USD 41 million in 2014 to USD 37 million in 2015.

- This data highlights the competitive dynamics and varying growth trajectories within the global workforce management software market during this period.

(Source: Statista)

Salesforce Productivity and Management Application Leading Vendor Share Worldwide

- From 2018 to 2023, Salesforce consistently maintained a dominant position in the global productivity and management application market, with its market share rising from 37.9% in 2018 to 41.4% in 2021.

- However, a sharp decline occurred in subsequent years, with its share dropping to 23% in 2022 and 21.7% in 2023.

- Microsoft showed steady growth during the early years, increasing from 9% in 2018 to 11.8% in 2021 before experiencing a decline to 5.7% in 2022 and recovering slightly to 5.9% in 2023.

- SAP’s market share decreased significantly over the period, from 13.2% in 2018 to 8.2% in 2021, and further to 4.6% in 2022 and 3.5% in 2023.

- Oracle also saw a steady decline, from 10.4% in 2018 to 7.4% in 2021, and then to 4.8% in 2022 and 4.4% in 2023.

- Veeva displayed growth during the earlier years, rising from 4.6% in 2018 to 7.1% in 2021, but data for 2022 and 2023 is unavailable.

- Adobe’s market share, recorded only in later years, showed a slight decline from 3.6% in 2022 to 3.4% in 2023.

- This data reflects the competitive dynamics and shifting market shares among key vendors in the productivity and management application market during this period.

(Source: Statista)

Primary Workforce Management Vendors That Always Met the Needs of Enterprises

- In 2019, Paycor emerged as the leading workforce management vendor, with 30% of respondents reporting that it consistently met the needs of enterprises.

- ADP Workforce Now followed closely, being endorsed by 24% of respondents, while Kronos Workforce Ready was preferred by 23%.

- Ceridian Dayforce and Ultimate UltiPro were also notable vendors, receiving positive feedback from 20% and 19% of respondents, respectively.

- Workday and ADP eTime were rated favorably by 17% and 16% of respondents, respectively, while WorkForce Software garnered a 14% share.

- Paycom was recognized by 13% of respondents, and Kronos Workforce Central, Infor Workbrain, and ADP Enterprise each received a 10% share.

- Oracle PeopleSoft accounted for 8% of respondents’ preferences, and SAP HCM followed with 6%.

- However, Oracle HCM Cloud received no endorsements, with 0% of respondents indicating it met their enterprise needs.

- This data highlights the competitive landscape of workforce management vendors and varying levels of satisfaction among enterprise users in 2019.

(Source: Statista)

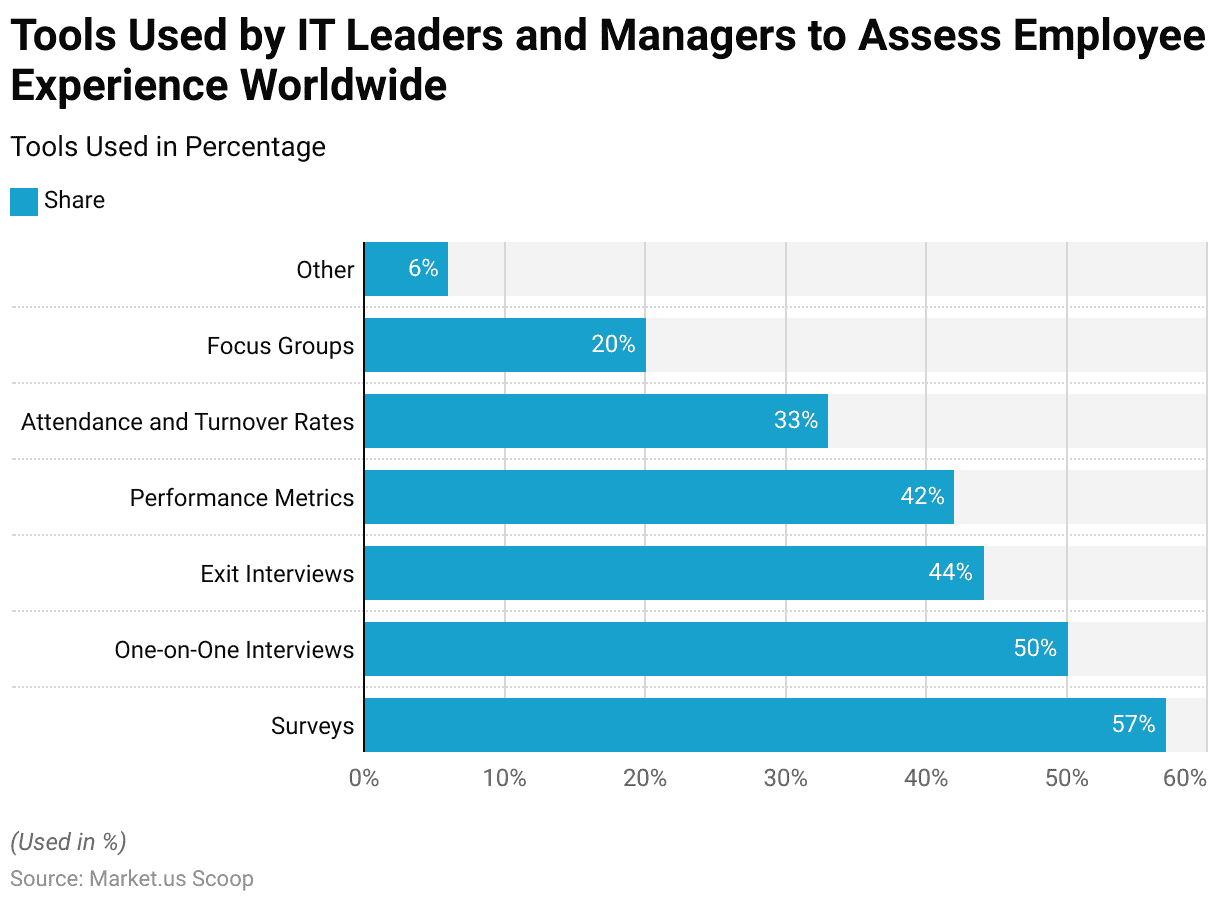

Tools Used by IT Leaders and Managers to Assess Employee Experience Worldwide

- In 2023, IT leaders and managers employed a variety of tools to assess employee experience globally, with surveys being the most commonly used method, reported by 57% of respondents.

- One-on-one interviews were utilized by 50% of respondents, emphasizing the importance of personalized feedback.

- Exit interviews were employed by 44%, providing insights into employee turnover.

- Performance metrics were also a significant tool used by 42% of respondents to evaluate employee experience indirectly through measurable outcomes.

- Attendance and turnover rates were analyzed by 33% of respondents, reflecting the use of data-driven approaches to understand employee engagement and retention.

- Focus groups were employed by 20%, enabling group discussions to gather qualitative feedback.

- Other tools were utilized by 6%, indicating a smaller share of alternative or less conventional methods.

- This data underscores the diverse strategies employed by organizations to monitor and improve employee experience in the workplace.

(Source: Statista)

Top Business Practices to Increase Talent Availability Within Companies Worldwide

- In 2023, organizations worldwide adopted various business practices to enhance talent availability within their companies.

- The most frequently reported approach, cited by 48.1% of respondents, was improving talent progression and promoting success within the organization.

- Offering higher wages followed, with 35.3% of respondents identifying it as a key strategy, while 33.7% emphasized the importance of providing effective reskilling and upskilling opportunities.

- Articulating business purpose and impact more clearly was highlighted by 24.4% as a means of attracting and retaining talent.

- Additionally, 20.5% of respondents prioritized offering more remote and hybrid work opportunities within their countries.

- Improving internal communication strategies was a focus for 18.9%, while 18.3% of organizations aimed to enhance people-and-culture metrics and implement more diversity, equity, and inclusion programs.

- Supporting employee health and well-being was a priority for 18%, while 14.7% aimed to improve working hours and overtime policies.

- Tapping into diverse talent pools was mentioned by 10.1%, and 8.1% emphasized offering remote work across national borders and improving workplace safety.

- Other strategies included removing degree requirements in favor of skills-based hiring (6.3%), supplementing childcare for working parents (2.9%), and supporting worker representation (1.2%).

- These diverse approaches reflect the multifaceted strategies companies are adopting to address talent shortages and improve workforce availability.

(Source: Statista)

Use of AI Tools in Workforce Management System Statistics

Artificial Intelligence Utilization at the Start of Work Worldwide

- In 2024, the use of AI-powered technologies as a starting point for tasks at work showed varied levels of adoption worldwide.

- Among respondents, 37% reported that they had not yet tried using AI for work-related tasks.

- Meanwhile, 29% stated they had used AI once or twice, indicating an initial exploration of its potential.

- A further 22% revealed they had utilized AI several times, reflecting a growing familiarity and acceptance of such technologies.

- Notably, 12% of respondents reported that they now use AI regularly, showcasing a segment of workers who have fully integrated AI-powered tools into their workflows. This data highlights the diverse stages of AI adoption among the global workforce.

(Source: Statista)

Most Popular Uses of AI in the Development Workflow Among Developers Worldwide

- As of 2024, developers worldwide have integrated artificial intelligence into various stages of the development workflow, with usage patterns differing across tasks.

- Writing code emerges as the most widely adopted application, with 82% of developers currently using AI for this purpose, although only 9.2% are still interested in adopting it. Searching for answers is another popular use case, with 67.5% currently utilizing AI and 17.6% expressing interest.

- Debugging and getting help are AI applications adopted by 56.7% of developers, while 25.9% remain interested in exploring it.

- Other areas, such as documenting code (40.1% currently using, 38.2% interested) and generating content for synthesizing (34.8% currently using, 33.1% interested), reflect balanced levels of adoption and interest.

- Learning about a codebase has 30.9% adoption, with 40.6% expressing interest, indicating growth potential. Testing code shows 27.2% adoption, with 46.2% interested, suggesting significant untapped potential.

- More specialized applications, such as committing and reviewing code (13.2% currently using, 40.9% interested) and project planning (12.2% currently using, 31.7% interested), reflect lower adoption rates but moderate interest.

- Predictive analytics (5.3% adoption, 39.8% interested) and deployment and monitoring (4.5% adoption, 39.6% interested) show limited current use but high levels of interest, indicating areas for future growth in AI utilization within the development workflow.

(Source: Statista)

Ability of Artificial Intelligence (AI) In Handling Complex Tasks in The Development Workflow Among Developers Worldwide

- As of 2024, developers worldwide have mixed opinions on the ability of artificial intelligence (AI) to handle complex tasks within the development workflow.

- A significant portion, 32.7% of respondents, believe AI performs “good, but not great” in managing such tasks, reflecting moderate satisfaction.

- Meanwhile, 20.8% view AI as “neither good nor bad” at handling complexity, indicating a neutral stance.

- On the negative side, 31.3% of respondents rate AI as “bad” at dealing with complex tasks, and 11.9% believe it performs “very poorly,” highlighting substantial dissatisfaction among developers.

- Only 3.3% of respondents think AI handles complex tasks “very well,” indicating that, while there is potential, AI’s capabilities in this area remain limited and in need of improvement.

- This feedback underscores the challenges and room for growth in AI’s ability to address intricate and demanding development workflows.

(Source: Statista)

Benefits of Using Artificial Intelligence (AI) in the Development Workflow According to Developers Worldwide

- As of 2024, developers worldwide recognize a range of benefits from integrating artificial intelligence (AI) into the development workflow.

- The most frequently cited benefit, identified by 81% of respondents, is an increase in productivity. AI is also seen as a tool to accelerate learning, with 62.4% of developers highlighting this advantage.

- Greater efficiency is another significant benefit reported by 58.5% of respondents. AI’s ability to improve accuracy in coding was noted by 30.3% of developers, while 25% mentioned that it helps make their workload more manageable.

- However, only 7.8% of developers saw AI as improving collaboration, suggesting that while AI offers individual workflow improvements, its impact on team dynamics may be less pronounced.

- These findings reflect the widespread optimism about AI’s potential to enhance various aspects of development processes.

(Source: Statista)

Challenges to Working with Artificial Intelligence (AI) Tools Among Developers Worldwide

- As of 2024, developers worldwide face several challenges when working with artificial intelligence (AI) tools.

- The most common concern, reported by 66.1% of respondents, is a lack of trust in the output or answers generated by AI, highlighting skepticism about the reliability of AI-generated results.

- A close second, with 64.6% of developers expressing concern, is the issue that AI tools often lack the context of the codebase, internal architecture, and company-specific knowledge, making them less effective in real-world development environments.

- Security risks also pose a challenge, with 31.9% of respondents indicating that their organizations do not have the right policies in place to mitigate these risks.

- Additionally, 29.6% of developers cited a lack of proper training and education on new AI tools as a barrier to effective use.

- The adoption of AI tools is not universal, with 25.9% noting that not everyone in their organization uses them.

- Some developers also feel that AI tools create more work rather than streamlining processes, with 12% of respondents raising this concern.

- Lastly, 11.9% identified a lack of executive buy-in as an obstacle, suggesting that leadership support is crucial for successful AI integration.

- These challenges underscore the complexities of adopting AI tools in development workflows and the need for further refinement and organizational alignment.

(Source: Statista)

Intelligent Workflow Improvements to Global Business Activities

- In 2021, businesses that implemented intelligent workflows reported a range of improvements in capacity and capability.

- The most significant benefit, cited by 55% of respondents, was that embedding technology across workflows optimized productivity.

- A further 52% highlighted that intelligent workflows reduced functional silos, thereby increasing cross-enterprise cohesion and integration.

- Additionally, 45% of respondents noted that intelligent workflows transformed the way work gets done, reflecting a shift in organizational processes.

- Intelligent automation was recognized by 38% of businesses as a means to free up the workforce for higher-value tasks, suggesting a focus on more strategic roles.

- Furthermore, 35% of respondents observed that intelligent workflows could self-learn and self-correct, improving efficiency over time.

- Finally, 34% of businesses leveraged the Internet of Things (IoT) and edge-enabled decisions and actions, indicating the role of advanced technologies in driving real-time, data-driven decision-making.

- These insights underscore the growing impact of intelligent workflows on enhancing organizational efficiency and adaptability.

(Source: Statista)

Key Spending and Investments

- From 2009 to 2024, global spending on enterprise software experienced consistent growth.

- In 2009, spending amounted to $225.51 billion, and this figure steadily increased over the following years.

- By 2010, spending rose to $244.64 billion and continued to climb, reaching $269 billion in 2011 and $285 billion in 2012.

- The upward trend persisted throughout the decade, with spending reaching $297 billion in 2013 and $310 billion in both 2014 and 2015.

- In 2016, spending increased to $326 billion, and by 2017, it had surged to $369 billion.

- The growth continued into the next decade, with spending reaching $419 billion in 2018 and $477 billion in 2019.

- In 2020, amid the global pandemic, IT spending on enterprise software accelerated, rising to $529 billion.

- By 2021, spending had reached $615 billion, and it further increased to $783.46 billion in 2022.

- In 2023, global enterprise software spending was estimated at $913.33 billion, with projections indicating a rise to $1,029.42 billion in 2024.

- This data reflects the ongoing expansion of the enterprise software market, driven by digital transformation, increased reliance on cloud services, and the growing need for advanced IT solutions across industries.

(Source: Statista)

Expectations for Future Digital Workflow

- In 2020, businesses in North America and Europe expressed strong expectations regarding the role of digital workflows and business continuity in shaping the future of work and customer interactions.

- A combined 73% of respondents (28% strongly agreeing, 45% agreeing) believed that the way organizations manage business continuity will significantly impact their ability to attract talent in the future.

- Regarding remote work, 67% of respondents (31% strongly agreeing, 36% agreeing) anticipated that employees and new hires would seek more frequent remote work opportunities than before.

- Furthermore, 66% of respondents (22% strongly agreeing, 44% agreeing) indicated that employees were demanding a greater surplus of digital alternatives.

- As for customer-facing initiatives, 64% (28% strongly agreeing, 36% agreeing) planned to develop further their digital capabilities, such as eCommerce, digital banking, and virtual events, to serve customers better.

- Additionally, 63% (19% strongly agreeing, 44% agreeing) noted that customers were increasingly seeking improved digital alternatives and interactions.

- To support workforce continuity, 61% (20% strongly agree, 41% agree) planned to upgrade their technology, including IT solutions and tools, to enhance virtual working capabilities.

- These responses reflect the growing emphasis on digital transformation, both internally for employees and externally for customers, as businesses navigate the challenges of 2020.

(Source: Statista)

Innovations and Developments

- As of 2019, business model innovation was a priority for global companies across various industries, with varying levels of emphasis.

- The automotive sector led the way, with 33% of respondents citing business model innovation as one of their top three priorities.

- Finance and insurance followed closely, with 30% of respondents indicating a strong focus on innovation in their business models.

- The materials sector also placed significant importance on this area, with 29% of respondents naming it a priority.

- Other industries with notable attention to business model innovation included consumer goods (27%), the public sector (27%), and Medtech (26%).

- Transportation and software sectors were similarly aligned, with 26% of respondents in each sector prioritizing innovation.

- The chemical and energy sectors saw 25% of companies emphasizing this area, while the durable goods and wholesale/retail industries were slightly lower at 22%.

- The telecommunications sector had 20% of respondents focusing on business model innovation, while the travel and technology sectors were less focused, with 17% and 16%, respectively.

- The industrial sector ranked lower at 14%, and the pharmaceutical industry placed the least emphasis, with only 13% of companies prioritizing innovation in their business models.

- Media companies showed the least focus, with just 5% naming business model innovation as a top priority.

- These figures highlight the varying degrees of emphasis placed on business model innovation across industries, with certain sectors, particularly those facing significant digital transformation or disruption, placing higher priority on this strategic focus.

(Source: Statista)

Regulations for Workflow Management Systems

- Workflow Management Systems (WMS) are subject to various regulations and policies that vary by region, impacting their design, implementation, and operation.

- In the United States, WMS must adhere to data protection laws such as the Health Insurance Portability and Accountability Act (HIPAA) for healthcare applications and the General Data Protection Regulation (GDPR) for any systems handling data of EU citizens.

- Additionally, industry-specific regulations, like Sarbanes-Oxley (SOX) for financial reporting or the Federal Risk and Authorization Management Program (FedRAMP) for government-related systems, impose strict security and compliance standards.

- In the European Union, GDPR remains a core framework, requiring organizations to implement secure data processing protocols, user consent management, and data retention policies.

- Meanwhile, countries like Australia enforce similar data privacy laws under the Privacy Act 1988, ensuring data protection for both public and private sector WMS.

- In Asia, jurisdictions such as Singapore adhere to the Personal Data Protection Act (PDPA), enforcing regulations on data use and sharing.

- Additionally, there are growing global trends toward introducing artificial intelligence (AI) ethics in workflow systems, with emerging legislation focused on transparency, accountability, and the prevention of biases.

- As businesses globally adopt WMS, compliance with these diverse regulations is crucial for ensuring system integrity, protecting personal data, and avoiding legal and financial risks.

(Sources: HIPAA, GDPR, Sarbanes-Oxley Act, FedRAMP, Australian Government – Office of the Australian Information Commissioner (OAIC), Personal Data Protection Act (PDPA) Singapore)

Recent Developments

Product Launches:

- In 2023, Trello, a popular task and project management tool, launched a new “Automation” feature, allowing users to automate repetitive workflow tasks.

- This feature, which integrates with tools like Slack and Google Workspace, has been well-received, with 45% of Trello users adopting it within the first quarter of release.

- The company aims to enhance user productivity by streamlining workflow automation, targeting teams and small businesses looking for cost-effective management solutions.

Acquisitions:

- Monday.com, a leading workflow management and project tracking platform, acquired Teamline, a workflow automation software company, in 2023.

- The acquisition, valued at $200 million, is expected to bolster Monday.com’s capabilities in offering more advanced automation and AI-powered workflow features.

- The merger will allow Monday.com to target larger enterprises seeking end-to-end workflow automation solutions, expanding its market share, which has already seen a 25% YoY growth in the past year.

Funding and Investments

- ProcessMaker, a low-code workflow automation platform, secured $40 million in Series B funding in 2023. The funding is aimed at expanding the platform’s capabilities, particularly in its AI-driven process automation tools.

- ProcessMaker plans to invest in increasing its presence in the healthcare and manufacturing sectors, where demand for workflow management is high.

Partnerships and Collaborations

- In 2023, Asana, a popular work management platform, entered into a strategic partnership with Salesforce to integrate Asana’s workflow management capabilities into Salesforce’s customer relationship management (CRM) system.

- This integration aims to streamline project tracking and client management for sales teams. The partnership is expected to enhance workflow efficiency for more than 150,000 Salesforce users, contributing to a 16% YoY increase in new customer acquisitions for Asana.

Consumer Adoption and Growth:

- Research from Statista reveals that 47% of companies with over 1,000 employees have adopted workflow management systems in 2023, with 50% of small and medium-sized enterprises (SMEs) also planning to implement these systems by 2025.

- Companies in the technology and finance sectors are leading adopters, accounting for 40% of the market share in workflow management system software.

Conclusion

Workflow Management System Statistics – In conclusion, the global workflow management system (WMS) market is experiencing strong growth, driven by the increasing demand for automation, digital transformation, and operational efficiency across industries.

The market is shifting toward cloud-based solutions and service-oriented models, with significant adoption expected in sectors like healthcare, finance, and retail.

While WMS offers key benefits such as enhanced productivity and reduced errors, challenges like AI integration and data security remain.

As organizations prioritize digital workflows, especially with the rise of remote work, the future of WMS will be shaped by advancements in AI and emerging technologies, playing a vital role in optimizing operations and improving business sustainability.

FAQs

A Workflow Management System (WMS) is a software application designed to help organizations manage, automate, and streamline their business processes. It facilitates the flow of tasks, information, and documents between people, systems, and processes, ensuring that the right work gets to the right person at the right time.

A WMS improves business operations by automating repetitive tasks, reducing human errors, and optimizing workflows. It enables businesses to monitor and track tasks in real time, improve collaboration across departments, and ensure consistent and efficient operations. This leads to better resource utilization, increased productivity, and cost savings.

WMS is used by businesses across various industries, including healthcare, finance, manufacturing, retail, and logistics. It is particularly beneficial for organizations that require complex, multi-step processes or need to manage large volumes of tasks and data.

For remote or hybrid teams, a WMS facilitates collaboration and ensures that tasks are assigned and tracked efficiently, regardless of location. Cloud-based WMS solutions enable team members to access workflows and update task statuses in real time, improving communication and productivity in distributed work environments.

The future of WMS is likely to see increased integration with artificial intelligence (AI), machine learning, and advanced analytics. These technologies will enable more intelligent automation, real-time decision-making, and predictive analytics. Additionally, as businesses continue to embrace digital transformation, WMS solutions will become more flexible, scalable, and capable of handling more complex workflows across industries.