Table of Contents

Report Overview

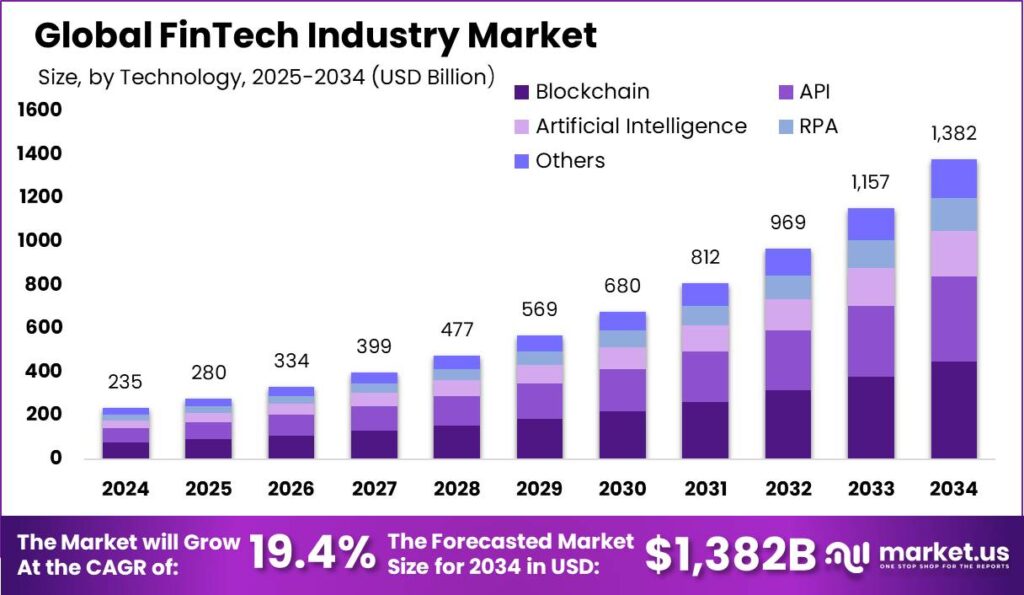

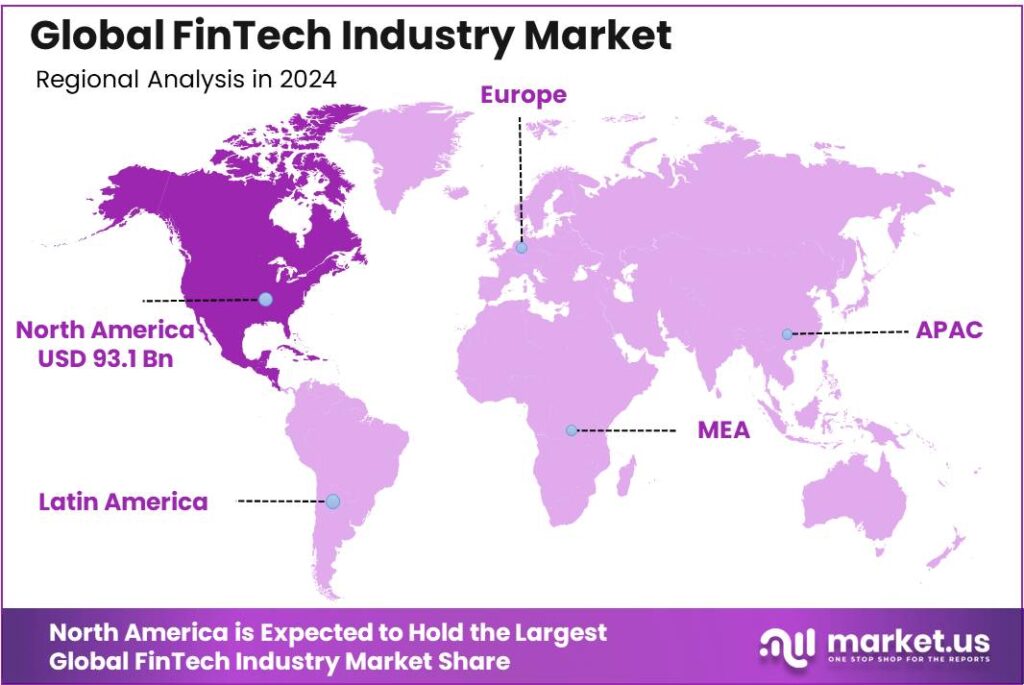

The Global FinTech Industry is set to experience tremendous growth, with its market size projected to reach approximately USD 1,382 billion by 2034, up from USD 234.6 billion in 2024. This represents a robust compound annual growth rate (CAGR) of 19.40% between 2025 and 2034. In 2024, North America led the charge, commanding a significant 39.7% share of the market, generating revenues of USD 93.1 billion.

The FinTech (Financial Technology) industry encompasses a wide range of technological innovations that aim to enhance, streamline, and disrupt traditional financial services. This rapidly evolving sector includes advancements in areas such as digital payments, lending, insurance, wealth management, and blockchain technologies. With the rise of smartphones, artificial intelligence, and data analytics, FinTech companies are reshaping how individuals and businesses access and manage financial services.

The growth of FinTech is largely driven by increasing consumer demand for seamless, digital-first banking experiences, emphasizing transparency, low fees, and high security. This shift in expectations forces FinTechs to continuously innovate. Additionally, evolving regulatory frameworks, such as regulatory sandboxes, support this growth by allowing new firms to test and refine their products in a secure, compliant environment.

Key applications of FinTech are transforming the financial services sector in several ways. Digital payments and transfers simplify transactions on a global scale, while personal finance tools assist with budgeting and investment management. Furthermore, FinTech accelerates lending and financing processes, offering quicker loan approvals and increased access to capital, especially for underserved markets.

Despite its growth, FinTech faces challenges such as cybersecurity risks, with the rise of online financial services increasing the threat of cyberattacks and the need for strong security. Regulatory compliance is also complex and costly, especially with global standards like GDPR and PSD2. Additionally, market saturation has made differentiation and customer retention more difficult as competition intensifies in the FinTech space.

The global expansion of FinTech is evident across both advanced and emerging markets, addressing gaps in traditional banking with digital solutions. As the industry grows, driven by innovation and consumer demand, substantial investments and supportive regulations continue to foster its integration into global financial systems.

Key Takeaways

- The Global FinTech Industry Market size is projected to reach USD 1,382 Billion by 2034, up from USD 234.6 Billion in 2024, growing at a CAGR of 19.40% during the forecast period from 2025 to 2034.

- In 2024, Payments held a dominant market position, capturing more than 45.6% of the market share within the FinTech industry.

- Blockchain also secured a significant share in 2024, commanding more than 32.6% of the FinTech industry market share.

- The Fraud Monitoring segment was responsible for more than 28.2% of the FinTech market in 2024, holding a dominant share.

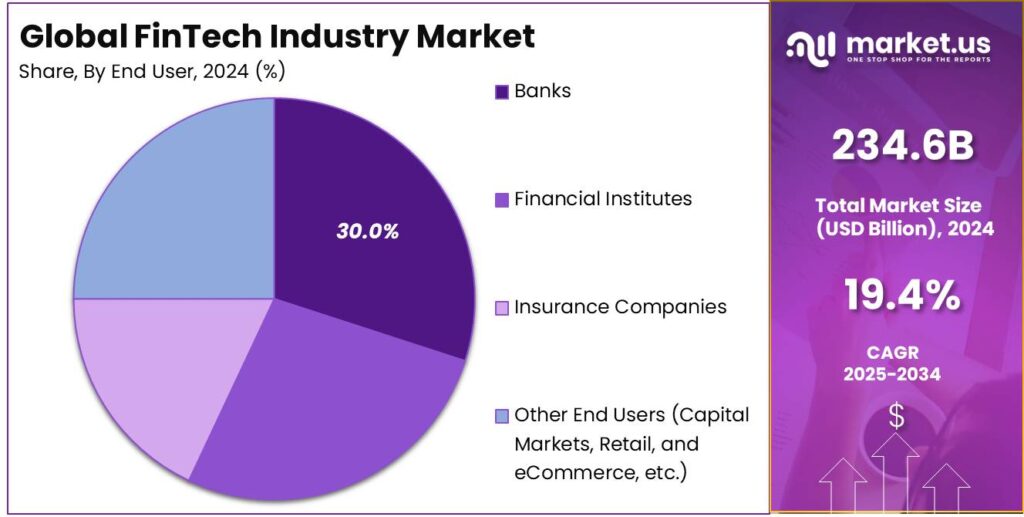

- Banks led the FinTech industry in 2024, securing more than 30.0% of the market share.

- North America was the dominant region in the FinTech industry in 2024, capturing more than 39.7% of the market share, with revenues amounting to USD 93.1 billion.

Impact Of AI

- Personalized Customer Experiences: AI helps financial companies understand their customers better. By analyzing data like spending habits and preferences, AI enables banks and financial services to offer personalized advice and products tailored to individual needs.

- Enhanced Fraud Detection: AI systems can quickly analyze large amounts of transactions to spot unusual activities, helping to detect and prevent fraud in real-time. This means safer transactions for everyone.

- Efficient Risk Assessment: When deciding on loans or credit, AI evaluates a person’s creditworthiness by examining various data points. This leads to fairer and more accurate lending decisions, benefiting both lenders and borrowers.

- Operational Efficiency: AI automates routine tasks like data entry and document processing, allowing financial institutions to operate more efficiently. This automation reduces errors and frees up human workers to focus on more complex tasks.

- Improved Investment Strategies: AI analyzes market trends and data to provide insights that help in making informed investment decisions. This assists investors in optimizing their portfolios and identifying new opportunities.

U.S. FinTech Industry Market

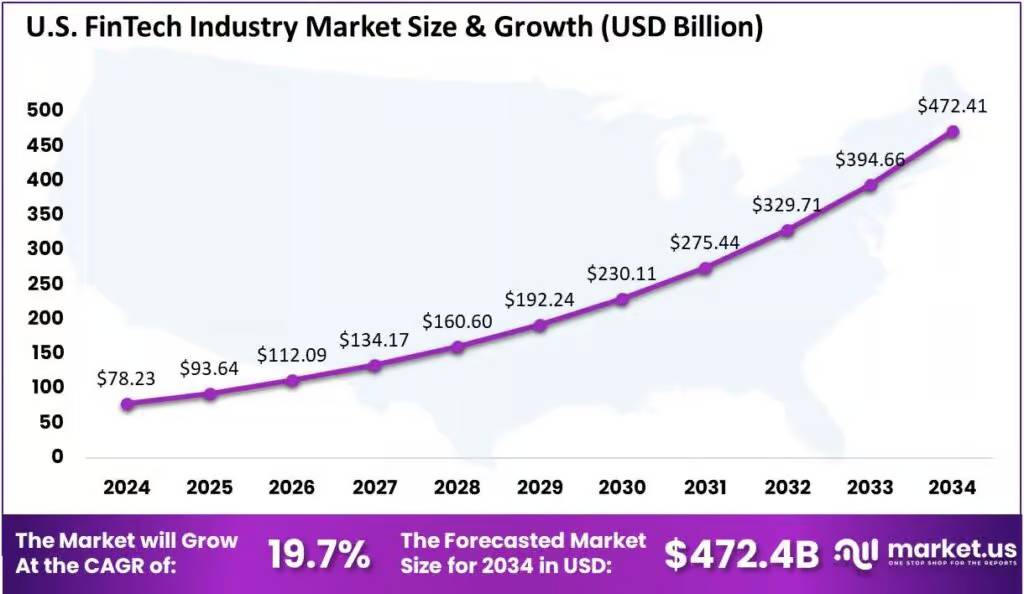

The FinTech industry in the United States has experienced substantial growth, culminating in a market size of USD 78.23 billion by the year 2024. This industry has flourished at a compound annual growth rate (CAGR) of 19.7%, a testament to its dynamic expansion and the country’s pioneering role in the FinTech space.

Several factors contribute to the United States’ leadership in the FinTech industry. The regulatory environment in the U.S. has evolved to support innovation while ensuring consumer protection. This balance fosters an ecosystem where startups can experiment and scale new financial technologies without undue burdens. The U.S. boasts a mature venture capital landscape, which provides the necessary funding and support for FinTech enterprises at various stages of their development. Access to capital is crucial for the growth and sustainability of these innovative companies.

In 2024, the FinTech industry in North America maintained a dominant stance, securing over 39.7% of the global market share. This position translated to significant revenues, totaling USD 93.1 billion, underscoring the region’s pivotal role in the financial technology landscape.

The substantial market share held by North America can be largely attributed to advanced technological infrastructure and a favorable regulatory environment that encourages innovation and growth in the FinTech sector. Additionally, the presence of numerous leading FinTech companies and startups in this region, especially in financial hubs such as New York and San Francisco, drives continual advancements and adoption of new technologies.

Moreover, the high level of digital literacy among consumers and businesses in North America contributes to the widespread acceptance and integration of FinTech services. This not only enhances operational efficiencies but also improves the overall customer experience, further fueling the growth and prominence of North America in the global FinTech market.

Market Segmentation

Type Analysis

In 2024, the payments sector continued to dominate the FinTech industry, securing over 45.6% of the market share. This strong position reflects the growing reliance on digital payment solutions across both consumer and business sectors. Factors such as the increase in online shopping, mobile payments, and the adoption of contactless payment technologies contributed to the dominance of the payments market. Furthermore, the expansion of e-commerce and the increasing need for fast, secure, and efficient transactions have driven this segment’s growth.

Technology Analysis

Blockchain technology remained a significant player in the FinTech space in 2024, capturing more than 32.6% of the market share. The decentralization and security provided by blockchain solutions have led to their increased use in various applications, including cryptocurrencies, smart contracts, and supply chain management. This technology’s ability to streamline operations and ensure transparency, security, and trust has made it highly attractive to financial institutions, businesses, and regulators alike.

Application Analysis

Fraud monitoring within the FinTech sector commanded over 28.2% of the market share in 2024. With the increasing threat of cyberattacks and financial fraud, demand for advanced fraud detection and prevention solutions surged. Artificial intelligence (AI) and machine learning (ML) technologies have played a crucial role in improving the effectiveness of fraud monitoring systems. These solutions help financial institutions identify and mitigate fraudulent activities, thus ensuring the safety and integrity of financial transactions.

End User Analysis

Banks maintained a dominant position within the FinTech industry in 2024, holding over 30.0% of the market share. This dominance reflects the integration of FinTech innovations into traditional banking services. Banks have adopted various digital banking solutions, such as mobile banking apps, online payment systems, and blockchain-based services, to enhance customer experience and streamline operations. Their significant share also stems from their role in financing and supporting emerging FinTech ventures, reinforcing their central role in the industry’s development.

Emerging Trends

- Artificial Intelligence (AI) and Machine Learning (ML) in Finance: AI and ML are transforming financial services by offering personalized banking experiences, enhancing fraud detection, and automating customer support. For instance, AI-driven platforms analyze transaction histories to provide tailored financial advice, while chatbots handle customer inquiries efficiently.

- Embedded Finance: Financial services are increasingly integrated into non-financial platforms, allowing consumers to access banking services within their everyday apps. This seamless integration simplifies transactions and enhances user experience, making financial services more convenient and accessible.

- Green Finance: There’s a growing emphasis on sustainable financial products that address environmental concerns. Tools like Mastercard’s Carbon Calculator help consumers track and offset their carbon footprint, reflecting a shift towards environmentally conscious financial solutions.

- Central Bank Digital Currencies (CBDCs): Many countries are exploring or launching their own digital currencies to enhance financial inclusion and streamline transactions. CBDCs aim to provide a secure and efficient alternative to cash, potentially revolutionizing the digital payment landscape.

- Blockchain and Decentralized Finance (DeFi): Blockchain technology is enabling decentralized financial systems, offering transparent and efficient alternatives to traditional banking. DeFi platforms facilitate peer-to-peer transactions without intermediaries, democratizing access to financial services.

Top Use Cases

- Digital Lending Platforms: These platforms connect borrowers directly with lenders, streamlining the loan process and often offering better terms than traditional banks. By utilizing technology, they can assess creditworthiness quickly, making borrowing more accessible.

- Robo-Advisors: Automated platforms that provide financial advice or investment management online with minimal human intervention. They use algorithms to create and manage a diversified portfolio tailored to individual goals and risk tolerance.

- Blockchain and Cryptocurrencies: Blockchain technology enables secure and transparent transactions, reducing the need for intermediaries. Cryptocurrencies like Bitcoin operate on blockchain, offering alternative investment opportunities and methods of transferring value.

- Insurtech Solutions: The integration of technology into the insurance sector has led to personalized policies, streamlined claims processing, and improved customer experiences. Insurtech companies leverage data analytics and digital platforms to enhance efficiency and service delivery.

- RegTech (Regulatory Technology): RegTech uses technology to help businesses comply with regulations efficiently and at a lower cost. It automates complex compliance processes, monitors transactions in real-time, and ensures adherence to legal standards, reducing the risk of fines and enhancing operational efficiency.

Major Challenges

- Data Security Concerns: With the rise of digital financial services, protecting customer data has become crucial. Cyberattacks are increasing, and breaches can lead to significant financial losses and damage trust. Implementing strong security measures like two-factor authentication and data encryption is essential to safeguard user information.

- Regulatory Compliance: Navigating the complex landscape of financial regulations is a major hurdle for fintech companies. Ensuring compliance with varying laws across regions requires substantial resources and can slow down innovation. Staying updated with regulatory changes and maintaining transparent operations are vital for success.

- Integration of Emerging Technologies: Adopting new technologies like artificial intelligence and blockchain presents both opportunities and challenges. While they can enhance services, integrating these technologies requires significant investment and expertise. Companies must balance innovation with practicality to effectively implement these tools.

- Customer Trust and Adoption: Building and maintaining customer trust is essential for fintech adoption. Concerns about data privacy, security, and the lack of personal interaction can deter potential users. Providing transparent, user-friendly services and ensuring robust security measures can help in gaining consumer confidence.

- Talent Acquisition and Retention: The rapid growth of the fintech sector has led to a high demand for skilled professionals. Finding and keeping talent with the necessary expertise is challenging and can impede a company’s ability to innovate and expand. Offering competitive benefits and fostering a dynamic work environment are strategies to attract and retain top talent.

Market Opportunities for Key Players

- Artificial Intelligence and Machine Learning: AI and ML technologies are becoming more embedded in financial services, enhancing customer service interactions and improving risk assessment and fraud detection. The use of large language models and computer vision in documentation processing is set to improve operational efficiency significantly.

- Cybersecurity and Biometrics: With the increasing sophistication of cyber threats, cybersecurity measures and biometric authentication (including multi-modal biometrics that combine facial recognition with behavioral patterns) are becoming vital for securing financial transactions and protecting sensitive data.

- Decentralized Finance (DeFi) and Open Banking: The intersection of DeFi and open banking is fostering hybrid solutions that combine the programmability of DeFi with the regulatory compliance of open banking. This trend is particularly noticeable in lending and asset tokenization.

- Buy Now, Pay Later (BNPL): The BNPL sector is expected to continue its growth with better credit assessment models and increased regulatory oversight, which will help reduce default rates and promote responsible lending practices.

- Central Bank Digital Currencies (CBDCs): CBDCs are progressing with more countries testing and expanding their digital currency initiatives. This movement is supported by advancements in payment technologies and infrastructure development by key industry players.

Recent Developments

- In a strategic move to broaden its trading offerings, eToro announced in August 2024 that it would acquire Gatsby, a fintech startup known for its focus on options and stock trading. The deal, valued at $50 million, will be settled through a combination of cash and stock.

- Envestnet, a leading wealth management technology platform, has announced a $4.5 billion take-private transaction with Bain Capital, a prominent private equity firm. The deal, which was made public on July 11, 2024, will result in Envestnet transitioning from a publicly traded company to a privately held one.

Conclusion

The FinTech industry has experienced rapid growth and transformation over the last decade, driven by advancements in technology, changing consumer preferences, and evolving regulatory landscapes. Key drivers include digital payments, blockchain, robo-advisors, and peer-to-peer lending platforms, which have disrupted traditional financial services. As financial institutions and startups continue to innovate, the industry is expanding its reach globally, with a notable rise in mobile-first solutions that cater to a wide array of financial needs, including banking, insurance, and investment management.

Looking ahead, the FinTech sector is poised for continued expansion, with emerging technologies like artificial intelligence and open banking further shaping the landscape. The industry’s growth potential is strong, although challenges such as cybersecurity risks, regulatory uncertainty, and competition from traditional players remain. However, FinTech’s ability to offer greater financial inclusion, convenience, and efficiency positions it as a key component of the global financial ecosystem for years to come.