Table of Contents

Report Overview

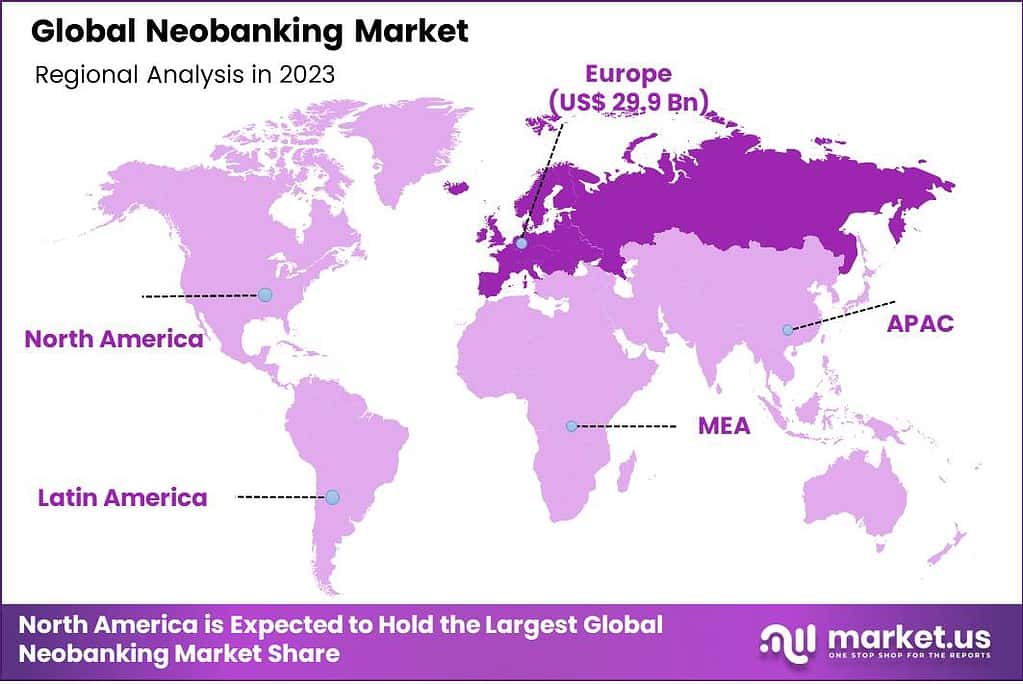

Market.us’s findings show that the global Neobanking market is projected to achieve a remarkable milestone of USD 5,382.6 billion by 2033. This growth is underpinned by a robust compound annual growth rate (CAGR) of 49% during the forecast period from 2024 to 2033. In 2023, the market was valued at USD 148.7 billion, indicating substantial potential for expansion in the coming years. Europe has emerged as a leading force in the Neobanking sector, accounting for over 30% of the market share in 2023. This dominance is attributed to the rapid adoption of digital banking solutions and favorable regulatory frameworks supporting innovation in financial technology.

Neobanking refers to digital-only banks that operate without traditional physical branch networks, offering banking services entirely online or through mobile apps. These banks are typically characterized by their user-friendly interfaces, lower cost structures, and innovative features aimed at providing a streamlined customer experience. Neobanks cater to a diverse range of customers, particularly appealing to tech-savvy individuals, those without easy access to traditional banking infrastructure, and customers seeking more intuitive and cost-effective banking solutions.

The neobanking market is expanding rapidly, driven by shifting consumer expectations and technological advancements. Neobanks are gaining traction globally, with significant growth in user bases across various demographics, especially among the unbanked, underbanked, and younger populations. They leverage modern technology to offer services such as real-time spending notifications, automated savings, and budgeting tools, all designed to enhance financial management and accessibility.

Key drivers of the neobanking market include the demand for more accessible and convenient banking services, particularly among consumers who prefer digital interactions over visiting physical branches. Technological advancements have also played a crucial role, enabling neobanks to offer enhanced features such as instant account opening, digital customer service, and integrated financial management tools. Additionally, regulatory changes in many regions have facilitated the emergence of neobanks by easing historical barriers to market entry, allowing these digital entities to compete with traditional banks.

There is a strong demand for neobanking services among various customer segments, including freelancers, expatriates, and younger consumers who value the convenience of managing finances on the go. This demand is supported by the growing acceptance of digital solutions in daily life and the broader digital transformation of financial services. The increasing popularity of mobile banking and the closure of traditional bank branches have also contributed to the rising demand for neobanking services.

Neobanks have significant opportunities to expand their market share by targeting underserved segments such as small business owners and individuals with limited access to traditional banking. The potential for global scalability, low operational costs, and the ability to offer competitive rates and fees provide neobanks with a strong platform for growth. Strategic partnerships with fintech firms and other financial institutions also offer avenues for expanding service offerings and enhancing customer value propositions.

Innovations in artificial intelligence, machine learning, and blockchain are among the key technological advancements propelling the neobanking sector forward. These technologies enable neobanks to offer personalized financial advice, improve security measures, and streamline operations. Automation and advanced data analytics also allow neobanks to offer tailored products and services, enhancing customer engagement and satisfaction.

Key Takeaways

- The Neobanking Market is projected to experience remarkable growth, reaching a massive USD 5,382.6 billion by 2033. This expansion is driven by an impressive CAGR of 49% during the forecast period.

- In 2023, the Business Account segment dominated the market, capturing over 66% of the market share. This is due to increasing demand from businesses seeking digital solutions for their banking needs.

- The Payments and Money Transfer segment led the neobanking market in 2023, with a market share of over 41%. This is driven by the growing demand for seamless, efficient payment solutions in today’s fast-paced digital economy.

- The enterprise sector was the largest adopter of neobanking services in 2023, accounting for more than 53% of the market share. Businesses are attracted by the ease of cash management, expense tracking, and the ability to handle large volumes of financial transactions digitally.

- Europe emerged as the dominant region in the neobanking space, holding over 30% of the total market share in 2023. This can be attributed to the region’s high level of digital adoption and regulatory support for fintech innovation.

Impact of AI on Neobanking

The impact of Artificial Intelligence (AI) on neobanking is profound, driving innovation and efficiency in the sector. Here are five key ways AI is transforming neobanks:

- Enhanced Customer Service: AI-powered chatbots and virtual assistants are now central to customer service in neobanks, handling inquiries and transactions with greater speed and accuracy. This automation not only improves customer experience but also reduces operational costs. For instance, some neobanks have reported that AI handles up to 98% of customer queries.

- Improved Security Measures: Neobanks leverage AI for advanced security protocols like biometric authentication, which includes fingerprint and facial recognition, significantly enhancing the safety and simplicity of user access.

- Operational Efficiency: Through robotic process automation (RPA), AI streamlines tedious tasks such as account openings and loan processing, thereby freeing up human resources for more complex tasks. This not only speeds up operations but also cuts down on errors and operational costs.

- Personalized Banking Experience: AI excels in analyzing large volumes of data to offer hyper-personalized financial services to users. By understanding individual spending habits and preferences, AI enables neobanks to tailor products and services to the needs of each customer, enhancing user satisfaction and loyalty.

- Financial Inclusion: AI models utilize alternative data (like mobile phone usage and utility bills) to assess creditworthiness, enabling neobanks to extend financial services to underserved or unbanked populations. This democratization of finance not only expands the market for neobanks but also supports economic inclusion.

Top 5 Trends and Innovations

The neobanking sector is poised for transformative growth in 2025, driven by several key trends and innovations that are reshaping the landscape of digital banking. Here are the top five trends that are expected to dominate the neobanking space:

- Enhanced Personalization Through AI and Machine Learning: Neobanks are leveraging artificial intelligence (AI) and machine learning to offer hyper-personalized banking experiences. This includes tailored financial product recommendations, personalized budget alerts, and predictive services that cater to individual customer needs.

- Adoption of Cryptocurrencies and Blockchain Technology: There is a growing integration of blockchain and cryptocurrencies within neobanks. These technologies are being utilized to offer crypto trading, custody services, and blockchain-based money transfers. This not only enhances the security and efficiency of transactions but also positions neobanks as leaders in the adoption of digital currencies.

- Expanding Financial Inclusion: Neobanks are uniquely positioned to serve the unbanked and underbanked populations, which still encompass a significant portion of the global population. By leveraging mobile technology and their digital-first models, neobanks can deliver banking services to these previously inaccessible customer segments, promoting greater financial inclusion.

- Collaboration with Traditional Banks: A notable trend is the increasing collaboration between neobanks and traditional financial institutions. These partnerships are beneficial as they combine the agility and innovative approach of neobanks with the regulatory compliance and customer base of established banks.

- Commitment to Sustainability: There is a noticeable shift towards sustainable finance within the neobanking sector. Many neobanks are incorporating eco-friendly practices and products, such as biodegradable cards and carbon offset programs. This not only helps in reducing environmental impact but also resonates with the values of socially conscious consumers.

Key Benefits for Stakeholders

- Enhanced Accessibility and Convenience: Neobanks operate on digital platforms that are accessible 24/7, eliminating the need for physical bank visits and enabling users to manage their finances more efficiently. This convenience is particularly valued in regions with high digital literacy and technological adoption, such as North America and Europe.

- Cost Efficiency: Due to their digital nature, neobanks can operate with lower overhead costs. This allows them to offer competitive pricing on financial products and services, which includes lower fees and higher interest rates for savings accounts compared to traditional banks.

- Rapid Innovation and Service Delivery: Neobanks leverage advanced technology such as AI and machine learning to rapidly develop and deploy new financial products. This agility enables them to offer innovative solutions like personalized financial management tools and responsive customer service.

- Financial Inclusion: By utilizing technology to simplify account creation and financial transactions, neobanks have the potential to extend financial services to underserved populations, including those who are unbanked or underbanked. This helps in promoting economic inclusion globally.

- Global Market Integration: Neobanks are ideally positioned to support customers with international transactions through features like multi-currency accounts and low-cost remittances. This is particularly beneficial in a globalized economy where cross-border activities are common.

Market Dynamics

Key Driver

Increasing Demand for Digital and Mobile Banking Solutions

The rise of neobanking is primarily driven by the global shift towards digitalization in the financial services sector. As traditional banking methods become less appealing to the tech-savvy and digital-first consumer base, neobanks are stepping in to fill the void with innovative, efficient, and user-friendly banking solutions accessible entirely online.

This trend is bolstered by the lower overhead costs of neobanks compared to traditional banks, allowing them to offer competitive rates and reduced fees. The increasing reliance on smartphones for daily activities further supports this trend, as neobanks offer 24/7 access to financial services through user-friendly mobile apps, enhancing convenience for users managing their finances from anywhere at any time.

Restraint

Regulatory Challenges and Customer Trust Issues

Neobanks face significant challenges in navigating the complex regulatory environments across different regions. The absence of physical branches exacerbates trust issues, particularly among customers who prefer traditional in-person banking interactions. Moreover, the fully digital nature of neobanks raises concerns over cybersecurity, with ongoing threats potentially undermining customer confidence in the security and reliability of these platforms. These factors combined make regulatory compliance and building customer trust critical hurdles that neobanks need to overcome to maintain and grow their market presence.

Opportunity

Global Expansion and Technological Collaborations

Neobanks possess a significant opportunity to expand internationally, especially into markets with less developed banking infrastructure or a high demand for digital financial services. By forming strategic partnerships and collaborations with fintech companies, traditional banks, or e-commerce platforms, neobanks can broaden their service offerings and access new customer segments. Further, the adoption of advanced technologies like blockchain and AI can enhance the security and functionality of neobanking services, making them more appealing to a broader audience.

Challenge

Intense Competition and Scalability Concerns

The neobanking sector is marked by intense competition not only from other digital banks but also from traditional financial institutions that are increasingly investing in digital banking solutions. This competition pressures neobanks to continuously innovate and differentiate their offerings. Additionally, as neobanks expand, they face challenges related to scalability and maintaining service quality. Managing these growth pains without compromising on customer satisfaction is crucial for sustaining long-term growth and success in the highly competitive neobanking landscape.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 148.7 Bn |

| Forecast Revenue (2033) | US$ 5,382.6 Bn |

| CAGR (2024-2033) | 49% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

Regional Analysis

In 2023, Europe emerged as the preeminent region in the neobanking sector, commanding over 30% of the global market share. This leadership can be primarily attributed to several key factors that have collectively fostered an environment conducive to the growth and expansion of neobanks. Firstly, the regulatory frameworks established by European authorities have significantly facilitated innovation and growth in fintech, including neobanking.

Initiatives such as the Revised Payment Services Directive (PSD2) have mandated that banks open their infrastructure to third parties, enhancing competition and enabling neobanks to offer a range of services that were traditionally the preserve of conventional banks. This regulatory support has encouraged the proliferation of neobanks across Europe, each aiming to cater to the diverse financial needs of consumers and businesses with increased efficiency and reduced costs.

Secondly, the high level of digital penetration in European countries serves as a robust foundation for the growth of digital-only banks. With a significant portion of the population having access to internet services and a proclivity for digital transactions, neobanks have found a ready and receptive market. This digital savviness among consumers has driven the adoption of neobanking platforms, as they offer user-friendly, accessible, and innovative banking solutions that align with the lifestyle and preferences of modern customers.

Moreover, the competitive landscape in Europe has pushed neobanks to continuously innovate and differentiate their offerings. This competition not only drives technological advancements but also leads to better customer service and more tailored financial products, enhancing consumer satisfaction and retention. The presence of several leading neobanks, such as Revolut, N26, and Monese, which offer multi-currency accounts, budgeting tools, and real-time transaction notifications, highlights the region’s commitment to banking innovation.

Top Key Players

- Monzo Bank Limited

- Movencorp Inc.

- WeBank

- PRETA S.A.S.

- N26 AG

- Revolut Ltd.

- Ubank

- Pockit LTD

- Starling Bank Limited

- Atom Bank PLC

- Other Key Players

Conclusion

In conclusion, the neobanking sector represents a pivotal shift in the financial services industry, driven by rapid technological advancements and changing consumer expectations. These digital-first institutions are redefining traditional banking by offering user-friendly, accessible, and cost-effective financial solutions.

The growth of the neobanking market can be attributed to its appeal to the unbanked, underbanked, and digitally savvy consumers, coupled with its ability to leverage cutting-edge technology for enhanced customer experiences and operational efficiencies. As the landscape continues to evolve, neobanks are likely to expand their offerings and increase their market share, posing a significant challenge to traditional banking models and reshaping the future of financial services.