Table of Contents

Report Overview

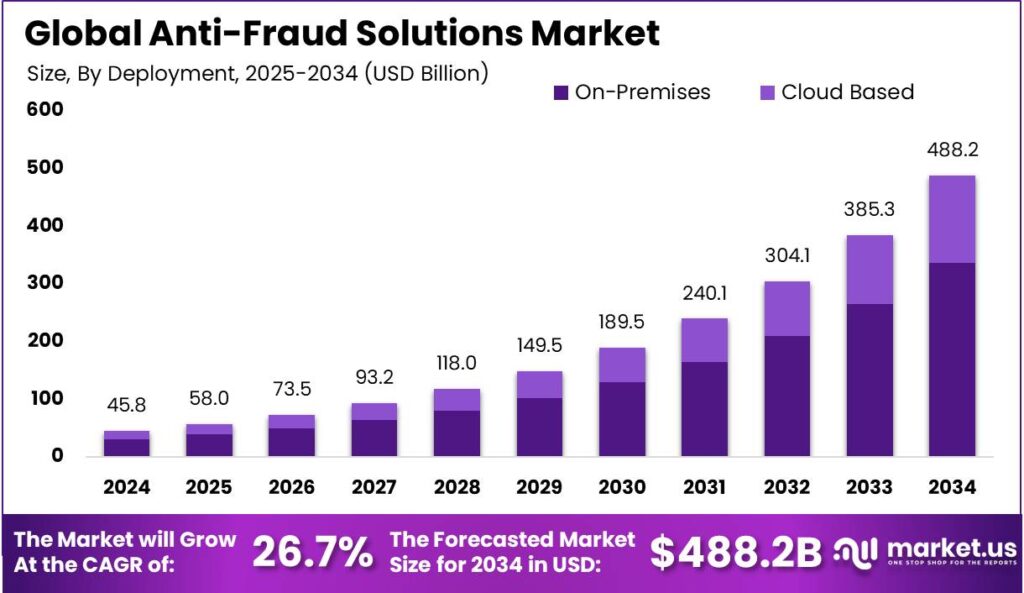

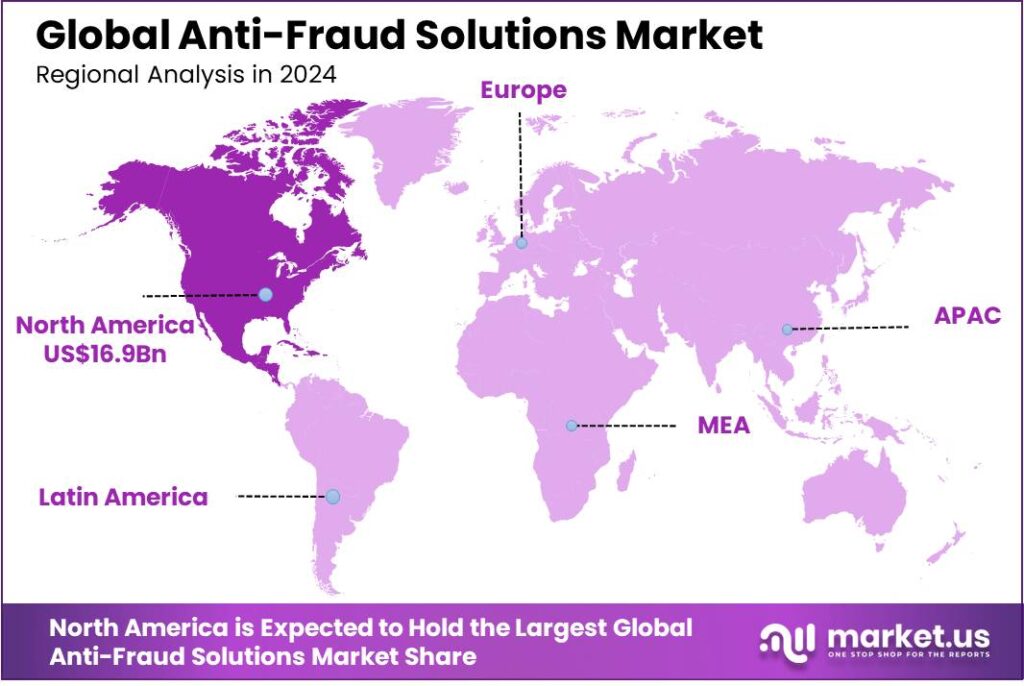

According to Market.us, The Global Anti-Fraud Solutions Market is projected to soar from USD 45.8 billion in 2024 to an impressive USD 488.2 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 26.70% throughout the forecast period from 2025 to 2034. North America currently leads the market, commanding a significant 37.1% share in 2024, with revenues nearing USD 16.9 billion. This strong regional performance underscores the growing demand for advanced anti-fraud solutions as businesses and organizations prioritize security in an increasingly digital world.

The anti-fraud solutions market is experiencing rapid growth, driven by several critical factors. As cyber-attacks become more sophisticated and online fraud increasingly widespread, organizations are compelled to adopt cutting-edge fraud prevention technologies. Additionally, the surge in digital transactions and mobile banking has expanded the opportunities for fraudsters, amplifying the need for robust security measures.

Anti-fraud solutions find critical applications across various sectors, with banking, financial services, and insurance (BFSI) being the most significant. These industries face the highest risk due to the vast amounts of sensitive financial data they handle. Healthcare and e-commerce are other key sectors where anti-fraud solutions are extensively applied, driven by the need to protect personal information and transaction data against cyber threats.

Despite the advancements, there are challenges that hinder the effectiveness of anti-fraud solutions. The continuous evolution of fraud tactics means that preventive measures must also evolve at a comparable pace. Moreover, integrating these solutions across various platforms and ensuring compatibility can be complex. There’s also the issue of false positives, where legitimate transactions are mistakenly flagged as fraudulent, potentially disrupting customer experience.

Technological innovation is at the heart of the fight against fraud. The use of big data analytics to monitor and analyze transaction patterns and detect anomalies has become more prevalent. Multi-factor authentication, which includes biometrics, has become critical in verifying identities securely. Furthermore, behavioral analytics technology is increasingly used to monitor user activities and flag unusual actions that could indicate fraud.

Key Takeaways

- The Global Anti-Fraud Solutions Market is projected to grow significantly, reaching an estimated value of USD 488.2 Billion by 2034, up from USD 45.8 Billion in 2024. This growth reflects a strong compound annual growth rate (CAGR) of 26.70% from 2025 to 2034.

- In 2024, the Solution segment dominated the market, holding a substantial share of over 64.5%.

- The On-Premises deployment model led the market in 2024, securing more than 68.9% of the total market share.

- Large Enterprises were the major adopters of anti-fraud solutions, commanding over 72.7% of the market in 2024.

- The Banking, Financial Services, and Insurance (BFSI) sector emerged as the largest end-user segment, accounting for more than 34.6% of the anti-fraud solutions market in 2024.

- North America maintained a leading position in the market, capturing over 37.1% of the market share in 2024, with revenues reaching approximately USD 16.9 billion.

Impact Of AI

- Real-Time Fraud Detection: AI can quickly spot unusual activities, like strange transactions, and flag them right away. This speed helps stop fraud before it causes harm.

- Learning from New Data: AI systems get smarter over time by learning from new information. This means they can adapt to new fraud tactics and keep up with changing methods used by fraudsters.

- Analyzing User Behavior: AI looks at how users usually behave to spot anything out of the ordinary. For example, if someone suddenly makes a big purchase in a different country, AI can notice this and raise an alert.

- Reducing False Alarms: Traditional systems might flag legitimate actions as fraud. AI is better at telling the difference between real fraud and normal behavior, which means fewer false alarms and less hassle for users.

- Handling Large Data Volumes: AI can process huge amounts of data quickly, spotting patterns and connections that humans might miss. This ability helps in identifying complex fraud schemes that involve many factors.

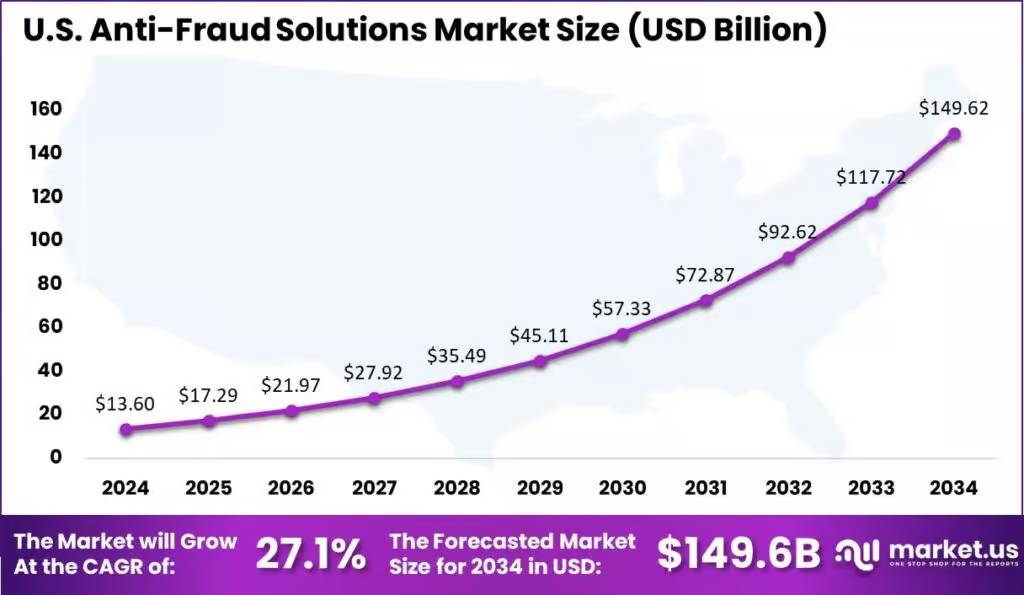

U.S. Anti-Fraud Solutions Market

In 2024, the U.S. market for anti-fraud solutions reached a significant valuation of USD 13.6 billion. This sector is experiencing rapid growth, with expectations to continue expanding at a compound annual growth rate (CAGR) of 27.1%. The increasing need for robust anti-fraud measures is driven by a combination of advancing technology and escalating cybersecurity threats.

The growth in the anti-fraud solutions market is underpinned by the relentless advancement of technology, particularly in areas such as artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies enhance the ability of businesses to detect and prevent fraudulent activities by analyzing large volumes of data to identify patterns and anomalies that are indicative of fraud. As cybercriminals become more sophisticated, the tools to counteract their efforts must evolve correspondingly, pushing demand for innovative solutions.

In 2024, North America maintained a dominant position in the global anti-fraud solutions market, securing a substantial 37.1% market share. The region generated revenues of around USD 16.9 billion, reflecting its pivotal role in the development and adoption of anti-fraud technologies.

This leadership position can be attributed to several factors, including the high concentration of technological innovation and the stringent regulatory environment that governs financial transactions and data protection in North American countries. The United States, in particular, is home to numerous tech giants and startups that are at the forefront of developing cutting-edge anti-fraud software and systems. This has not only fueled local market growth but also set trends globally in the anti-fraud technology sector.

Additionally, the increasing number of cyber-attacks and the high costs associated with data breaches have driven businesses and government entities in North America to invest heavily in anti-fraud solutions. As digital transformation continues to penetrate all aspects of business and governance, the demand for comprehensive and advanced anti-fraud strategies is expected to rise.

Key Market Segments

By Offering

- Solution

- Fraud Analytics

- Authentication

- Governance, Risk, and Compliance

- Others (Card lock and unlock, Additional liability protection, etc.)

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-Based

- On-Premises

By Enterprise Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Industry

- Banking, Financial Services and Insurance (BFSI)

- Government and Defense

- Healthcare

- IT and Telecom

- Automotive

- Retail and E-commerce

- Others (Oil & Gas, Education, etc.

Emerging Trends

- AI and Machine Learning: Banks and companies are using artificial intelligence to spot unusual activities quickly. These smart systems learn from past data to detect and prevent fraud in real-time.

- Synthetic Identity Fraud: Criminals create fake identities by mixing real and false information, making it hard to detect. To combat this, businesses are enhancing identity verification processes to ensure authenticity.

- Fraud-as-a-Service (FaaS): Some cybercriminals now offer tools and services to help others commit fraud. This makes it easier for less-skilled individuals to engage in fraudulent activities. Companies are responding by strengthening their security measures and monitoring systems.

- Deepfake Technology: With advancements in AI, fraudsters can create realistic fake videos or audio recordings to deceive individuals and organizations. To counter this, businesses are adopting advanced verification methods, including biometric checks, to confirm identities.

- Regulatory Changes: Governments are introducing stricter regulations to combat fraud, especially concerning the use of AI. Companies must stay updated with these laws to ensure compliance and protect their customers effectively.

Top Use Cases

- Real-Time Transaction Monitoring: By continuously analyzing transactions as they occur, systems can instantly detect and flag unusual behaviors, such as unexpected large purchases or rapid successive transactions, helping to prevent fraud before it causes harm.

- Identity Verification with Biometric Technology: Utilizing unique biological traits like fingerprints or facial recognition ensures that only authorized individuals can access accounts or complete transactions, significantly reducing the risk of identity theft.

- Machine Learning for Pattern Recognition: AI-driven systems learn from vast amounts of data to identify patterns associated with fraudulent behavior, enabling the detection of new and evolving fraud tactics that traditional methods might miss.

- Graph Analytics for Network Link Analysis: By examining relationships between data points, such as shared IP addresses or contact information, graph analytics can uncover complex fraud networks and detect collusion that would be difficult to identify otherwise.

- Multi-Factor Authentication (MFA): Requiring users to provide multiple forms of verification, such as a password and a fingerprint, adds an extra layer of security, making it more challenging for unauthorized users to gain access.

Market Opportunities

- Advancements in Artificial Intelligence (AI) and Machine Learning (ML): AI and ML technologies are enhancing fraud detection by analyzing patterns and predicting breaches, making anti-fraud solutions more effective and responsive to new threats.

- Integration of Behavioral Biometrics: Incorporating behavioral biometrics, such as keystroke dynamics and mouse movement analysis, strengthens authentication processes, providing unique user identification methods that are difficult for fraudsters to replicate.

- Expansion into Emerging Markets: Regions like Asia Pacific, Latin America, and the Middle East are experiencing digital growth, increasing the demand for anti-fraud solutions to protect against rising cybercrime associated with digital transactions.

- Adoption of Cloud-Based Services: As more organizations move to cloud services, there’s a growing need for scalable anti-fraud solutions that can secure data across various platforms, offering flexibility and cost-effectiveness.

- Regulatory Compliance Requirements: Stricter regulations worldwide are compelling organizations to implement comprehensive anti-fraud measures, creating opportunities for solution providers to offer tools that ensure compliance and protect against financial crimes.

Major Challenges

- Integration Complexity: Anti-fraud solutions often involve integrating multiple types of fraud detection software, which can be complex and costly. These systems need to work seamlessly together to effectively identify fraudulent activities, but achieving this integration can be technically challenging.

- False Positives: A significant challenge in fraud prevention is the high rate of false positives, where legitimate transactions are incorrectly flagged as fraudulent. This not only leads to a poor customer experience but can also be more costly than the fraud itself.

- Rapid Digital Transformation: The swift move to digital platforms since the pandemic has expanded the attack surface for fraudsters. Many businesses had to quickly adapt to online services without robust anti-fraud measures in place, leading to increased vulnerabilities.

- Evolving Fraud Techniques: Fraudsters continuously develop sophisticated methods to bypass traditional security measures, such as using synthetic identities and advanced phishing tactics. Financial institutions must constantly update their fraud detection technologies to keep up with these evolving threats. Utilizing AI and machine learning can help in identifying and adapting to new fraudulent patterns more effectively.

- Regulatory Challenges: Complying with international anti-fraud regulations can be daunting, as these rules frequently change and vary by region. Financial institutions must ensure they are not only compliant but also capable of adapting to new regulations quickly. Leveraging advanced analytics and AI can aid in maintaining compliance and enhancing the detection capabilities required by regulators.

Market Opportunities for Key Players

- Banking and Financial Services: This sector continues to dominate the demand for anti-fraud solutions due to the high volume of monetary transactions and sensitive data involved, making it a prime target for fraud. Companies are investing heavily in technologies like AI and machine learning to combat fraud effectively.

- Healthcare: There’s an accelerated growth in the healthcare sector, driven by the need to protect personal and highly sensitive data. Anti-fraud solutions here focus on combating billing fraud, fake drugs, and other scams that not only cause financial losses but also potentially endanger lives.

- Retail and E-Commerce: These industries face various fraud risks including payment fraud, return fraud, and coupon fraud. Anti-fraud technologies help verify customer transactions and enhance security, thereby increasing customer trust and satisfaction.

- Government and Public Sector: There’s an increasing implementation of anti-fraud solutions in government sectors to protect against identity theft, cyberattacks, and internal frauds, especially with the growing digitization of public services.

- Emerging Technologies and Global Expansion: The adoption of advanced technologies like behavioral biometrics, AI-driven fraud detection, and predictive analytics present significant growth opportunities. These technologies offer the ability to detect and respond to fraud in real-time, and their integration with cloud-based platforms enables organizations to scale globally while managing security risks effectively.

Conclusion

The anti-fraud solutions market has experienced significant growth in recent years, driven by the increasing frequency and sophistication of cyber threats and fraudulent activities. As businesses face mounting pressure to protect sensitive data, financial transactions, and customer trust, demand for advanced fraud prevention technologies such as machine learning, AI-based analytics, and biometric authentication is surging. Key industries, including banking, e-commerce, and insurance, are prioritizing these solutions to safeguard operations and maintain compliance with regulatory standards.

In conclusion, the anti-fraud solutions market is poised for continued expansion as organizations increasingly recognize the need for robust security measures. Innovations in fraud detection, along with growing awareness of emerging threats, will drive the market forward. However, as fraudsters adapt to new technologies, ongoing investment in advanced, adaptive security solutions will be crucial for businesses to stay ahead in the battle against fraud.